TIDMEJFI TIDMEJFZ

RNS Number : 0492H

EJF Investments Ltd

04 April 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES,

ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA (OTHER THAN THE

REPUBLIC OF IRELAND), AUSTRALIA, CANADA, SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE IT IS UNLAWFUL TO DO SO.

THIS ANNOUNCEMENT IS AN ADVERTISEMENT FOR THE PURPOSES OF THE

PROSPECTUS REGULATION RULES OF THE UNITED KINGDOM'S FINANCIAL

CONDUCT AUTHORITY AND NOT A PROSPECTUS. NEITHER THIS ANNOUNCEMENT

NOR ANYTHING CONTAINED HEREIN SHALL FORM THE BASIS OF, OR BE RELIED

UPON IN CONNECTION WITH, ANY OFFER OR COMMITMENT WHATEOEVER IN ANY

JURISDICTION. INVESTORS SHOULD NOT SUBSCRIBE FOR OR PURCHASE ANY

SECURITIES REFERRED TO IN THIS ADVERTISMENT EXCEPT ON THE BASIS OF

THE INFORMATION CONTAINED IN THE PROSPECTUS TO BE PUBLISHED BY THE

COMPANY IN DUE COURSE. COPIES OF THE PROSPECTUS WILL, FOLLOWING

PUBLICATION, BE AVAILABLE FROM THE COMPANY'S WEBSITE ( WWW.EJFI.COM

), SUBJECT TO APPLICABLE SECURITIES LAWS.

For persons that are resident of, or are present in, the United

Kingdom, this announcement is directed exclusively at persons who

are "qualified investors" within the meaning of article 2(e) of

Regulation (EU) 2017/1129, as it forms part of UK law by virtue of

the European Union (Withdrawal) Act 2018, who are also persons who

are "investment professionals" as defined in Article 19 of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 and/or in Article 14(5) of the Financial Services and Markets

Act 2000 (Promotion of Collective Investment Schemes) (Exemptions)

Order 2001, and any other persons to whom such communications may

lawfully be made under such statutory instruments (all such persons

together being referred to as "relevant persons"). This

announcement must not be acted on or relied on in the United

Kingdom, by persons who are not relevant person. Any investment

activity to which this announcement relates is available only to

relevant persons in the United Kingdom and will be engaged in only

with such persons.

Persons distributing this announcement must satisfy themselves

that it is lawful to do so. The Company assumes no responsibility

in the event there is a violation by any person of such

restrictions.

This announcement may not be published, distributed or

transmitted by any means or media, directly or indirectly, in whole

or in part, in or into the United States. This announcement does

not constitute an offer to sell, or a solicitation of an offer to

buy, securities in the United States. The securities mentioned

herein have not been, and will not be, registered under the US

Securities Act of 1933, as amended, and will not be offered to the

public in the United States. The Company has not been, and will not

be, registered under the US Investment Company Act of 1940, as

amended.

4 April 2022

EJF Investments Ltd

Rollover Offer and launch of ZDP Placing Programme

The Board of EJF Investments Ltd ("EJFI" or the "Company") is

pleased to announce that further to the information provided in the

Company's Annual Report published on 30 March 2022, it expects to

shortly publish a prospectus (the "Prospectus") containing details

of a rollover offer (the "Rollover Offer") to convert existing 2022

ZDP shares into new 2025 ZDP shares ("New 2025 Rollover ZDP

Shares") as well as a placing programme of up to 70 million new

ordinary shares (the "New Ordinary Shares") and/or C Shares (the

"New C Shares") and up to 25 million new 2025 ZDP shares in the

Company (the "New 2025 Placing ZDP Shares") (the "Placing

Programme" and, together with the Rollover Offer, the "Proposals").

The Rollover Offer is not being made to persons in the United

States or to US Persons except in limited circumstances.

Once published, a copy of the Prospectus will be submitted to

the National Storage Mechanism and will be made available for

inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism and be made

available on the Company's website: https://www.ejfi.com/ .

Terms used and not defined in this announcement bear the meaning

given to them in the Prospectus expected to be published today.

Background to the Proposals

The Company currently has two series of ZDP Shares in issue.

These are due for redemption on 30 November 2022 and 18 June 2025,

respectively. The aggregate redemption sum payable on the

redemption of the 2022 ZDP Shares is approximately GBP19.84 million

which is due on 30 November 2022. The Rollover Offer will enable

2022 ZDP Shareholders to remain invested in the Company at a higher

Gross Redemption Yield than the current Gross Redemption Yield of

the 2022 ZDP Shares. The Directors believe that there would be

minimal, if any, dilutive effects to 2025 ZDP Shareholders, and

those 2022 ZDP Shareholders who elect to convert (by way of

re-designation) their 2022 ZDP Shares could benefit from a larger

liquidity base and shareholder profile.

The Placing Programme is being undertaken to enable the Company

to raise capital on an ongoing basis should conditions allow.

The Rollover Offer

Under the Rollover Offer, 2022 ZDP Shareholders as at the

Rollover Record Date will be given the opportunity to convert (by

way of re-designation) some or all of their 2022 ZDP Shares into

New 2025 Rollover ZDP Shares. The Rollover Offer is not being made

to persons in the United States or to US Persons except in limited

circumstances. The Rollover Value attributed to each 2022 ZDP Share

as at the Rollover Date will be the Accrued Capital Entitlement of

each 2022 ZDP Share of 128.18p. The 2022 ZDP Shares will therefore

be converted to New 2025 Rollover ZDP Shares at the New 2025 ZDP

Share Rollover Price of 116.81p per 2025 ZDP Share (which will be

higher than the Accrued Capital Entitlement of the 2025 ZDP Shares

as at the Rollover Date). This will result in each 2022 ZDP Share

being converted (by way of re-designation) into 1.09735 New 2025

Rollover ZDP Shares.

The New 2025 Rollover ZDP Shares will rank pari passu with the

Existing 2025 ZDP Shares in all aspects. The New 2025 Rollover ZDP

Shares will have the same 2025 ZDP Final Capital Entitlement and

2025 ZDP Repayment Date as the Existing 2025 ZDP Shares, namely

140p per New 2025 Rollover ZDP Share on 18 June 2025. The New 2025

Rollover ZDP Shares will have a New 2025 ZDP Gross Redemption Yield

of 6.0 per cent. per annum to maturity, which is higher than the

2022 ZDP Gross Redemption Yield of 5.75 per cent. per annum, but

lower than the 2025 ZDP Gross Redemption Yield on the Existing 2025

ZDP Shares of 7.0 per cent per annum (due to the New 2025 ZDP Share

Rollover Price being set at above the Accrued Capital Entitlement

of the Existing 2025 ZDP Shares as at the Rollover Date).

The Latest time and date for receipt of Forms of Election and

TTE Instructions in connection with the Rollover Offer is 1:00 p.m.

on 3 May 2022 and the results of the Rollover Offer are expected to

be announced on 4 May 2022. Assuming that the Rollover Offer

Conditions are satisfied, Admission of the New 2025 Rollover ZDP

Shares arising upon conversion of the 2022 ZDP Shares pursuant to

the Rollover Offer is expected to occur on 10 May 2022.

The Rollover Offer is conditional on:

The Rollover Offer is conditional on: (i) valid elections being

received in respect of New 2025 Rollover ZDP Shares with a minimum

value, in aggregate, of GBP5 million; (ii) the ZDP Cover for the

2022 ZDP Shares and the ZDP Cover for the 2025 ZDP Shares being not

less than 3.5x; (iii) the passing of any required resolutions which

include an ordinary resolution of Ordinary Shareholders to

authorise the terms of the Rollover Offer; and (iv) Rollover

Admission.

The Company reserves the right to bring forward the 2022 ZDP

Repayment Date for the 2022 ZDP Shares that are not rolled over

pursuant to the Rollover Offer to an earlier repayment date to be

confirmed by the Company via an RIS announcement (the "Company's

Discretionary 2022 ZDP Early Redemption Date"). Following

completion of the Rollover Offer, all of the remaining 2022 ZDP

Shareholders will be entitled to receive the full 2022 ZDP Final

Capital Entitlement, namely 132.25p per 2022 ZDP Share, in respect

of all remaining 2022 ZDP Shares in their holding on the Company's

Discretionary 2022 ZDP Early Redemption Date, to the extent the

Company elects to bring forward the 2022 ZDP Redemption Date. The

Company's Discretionary 2022 ZDP Early Redemption Date is

conditional upon the passing of any required Resolutions, which

includes an ordinary resolution of Ordinary Shareholders to

authorise the Company's Discretionary 2022 ZDP Early Redemption

Date.

The Company's Discretionary 2022 ZDP Early Redemption Date is

conditional upon the passing of any required Resolutions, which

includes an ordinary resolution of Ordinary Shareholders to

authorise the Company's Discretionary 2022 ZDP Early Redemption

Date.

The Placing Programme

From the date of this Prospectus, the Company's Directors may

implement the Placing Programme. The maximum number of New Ordinary

Shares and/or New C Shares and New 2025 Placing ZDP Shares which

will be issued under the Placing Programme is 70 million and 25

million, respectively. The Placing Programme is flexible and may

have a number of closing dates. The Placing Programme will open on

4 April 2022 and the latest date for issuing New Ordinary Shares,

New C Shares and/or New 2025 Placing ZDP Shares under the Placing

Programme will be 3 April 2023. The Company's Directors reserve the

right to close the Placing Programme at any time prior to 3 April

2023.

Each allotment and issue of New Ordinary Shares, New C Shares

and/or New 2025 Placing ZDP Shares pursuant to the Placing

Programme will be conditional on: (i) the applicable Placing Price

being determined by the Company and the Manager (in consultation

with Liberum) (to the extent that New Ordinary Shares or New 2025

Placing ZDP Shares are issued); (ii) a special resolution of

Ordinary Shareholders to authorise (a) the Placing Programme, and

(b) the disapplication of pre-emption rights in respect of the

Ordinary Shares; (iii) for a Placing of New 2025 Placing ZDP Shares

only: (a) the ZDP Cover of the 2022 ZDP Shares and the 2025 ZDP

Shares not being less than 3.5x, and (b) the Minimum Cover Amount

in respect of the New 2025 Placing ZDP Shares being met following

completion of the Placing; (iv) the Placing Agreement becoming

otherwise unconditional in respect of that Placing, and not being

terminated in accordance with its terms before the relevant Placing

Admission of New Ordinary Shares, New C Shares and/or New 2025

Placing ZDP Shares becomes effective; (v) Admission of the New

Ordinary Shares, New C Shares and/or New 2025 Placing ZDP Shares to

be issued pursuant to the relevant Placing; and (vi) a valid

supplementary prospectus being published by the Company if such is

required pursuant to Article 23 of the UK Prospectus

Regulation.

Expected Timetable

Rollover Offer

Prospectus published 4 April 2022

Publication of Shareholder Circular 5 April 2022

Latest time and date for receipt of 1:00 p.m. on 3 May 2022

Forms of Election and TTE Instructions

in connection with the Rollover Offer

Rollover Record Date 6:00 p.m. on 3 May 2022

Announcement of the results of the Rollover 4 May 2022

Offer

EGM 5 May 2022

Admission and dealings in the 2025 ZDP 8:00 a.m. on 10 May

Shares pursuant to the Rollover Offer 2022

CREST accounts credited in respect of 10 May 2022

Depositary Interests in respect of 2025

ZDP Shares issued in uncertificated

form pursuant to the Rollover Offer

Share certificates in respect of 2025 Within 10 Business Days

ZDP Shares issued pursuant to the rollover of Rollover Admission

Offer in certificated form despatched

by post

Placing Programme

Prospectus published 4 April 2022

Placing Programme opens 4 April 2022

Publication of the Placing Price in As soon as reasonably

respect of each Placing practicable following

the closing of each

Placing

Admission and dealings in Ordinary Shares 8.00 a.m. on each day

commence on the London Stock Exchange on which New Ordinary

Shares, New C Shares

and/or New 2025 Placing

ZDP Shares are issued

pursuant to a Placing

Crediting of CREST stock accounts in 8.00 a.m. on each day

respect of the Ordinary Shares on which New Ordinary

Shares, New C Shares

and/or New 2025 Placing

ZDP Shares are issued

pursuant to a Placing

Share certificates despatched (where Approximately one week

applicable) following Placing Admission

of the New Ordinary

Shares, New C Shares

and/or New 2025 Placing

ZDP Shares

Last date for Shares to be issued pursuant 3 April 2023

to the Placing Programme

Each of the times and dates set out above is subject to change

without further notice. References to times are to London time

unless otherwise stated.

ENQUIRIES

For the Investment Manager

EJF Investments Manager LLC

Peter Stage / Matt Gill

pstage@ejfcap.com / mgill@ejfcap.com

+44 203 752 6775 / +44 203 752 6771 / +44 203 752 6774

For the Company Secretary and Administrator

BNP Paribas Securities Services S.C.A Jersey Branch

jersey.bp2s.ejf.cosec@bnpparibas.com

+44 1534 709 198 / +44 1534 813 996

For the Broker

Liberum Capital Limited

Darren Vickers / Owen Matthews / Lydia Zychowska

+44 203 100 2222

About EJF Investments Limited

EJFI is a registered closed-ended limited liability company

incorporated in Jersey under the Companies (Jersey) Law 1991, as

amended, on 20 October 2016 with registered number 122353. The

Company is regulated by the Jersey Financial Services Commission

(the "JFSC"). The JFSC is protected by both the Collective

Investment Funds (Jersey) Law 1988 and the Financial Services

(Jersey) Law 1998, as amended, against liability arising from the

discharge of its functions under such laws.

LEI: 549300XZYEQCLA1ZAT25

Investor information & warnings

The latest available information on the Company can be accessed

via its website at www.ejfi.com .

This communication has been issued by, and is the sole

responsibility of, the Company and is for information purposes

only. It is not, and is not intended to be an invitation,

inducement, offer or solicitation to deal in the shares of the

Company. The price and value of shares in the Company and the

income from them may go down as well as up and investors may not

get back the full amount invested on disposal of shares in the

Company. An investment in the Company should be considered only as

part of a balanced portfolio of which it should not form a

disproportionate part. Prospective investors are advised to seek

expert legal, financial, tax and other professional advice before

making any investment decision.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAXLFEDDAEFA

(END) Dow Jones Newswires

April 04, 2022 02:00 ET (06:00 GMT)

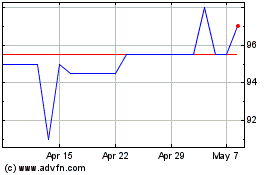

Ejf Investments (LSE:EJFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ejf Investments (LSE:EJFI)

Historical Stock Chart

From Apr 2023 to Apr 2024