TIDMEME

RNS Number : 9287V

Empyrean Energy PLC

16 December 2021

This announcement contains inside information

Empyrean Energy PLC / Index: AIM / Epic: EME / Sector: Oil &

Gas

16 December 2021

Empyrean Energy PLC ("Empyrean" or the "Company")

Empyrean raises GBP7.623 million (US$10.14m) to fully fund Jade

prospect drilling

Empyrean Energy plc ("Empyrean" or the "Company"), the oil and

gas development company with interests in China, Indonesia and the

United States, advises that it has secured funding totalling

GBP7.623 million through an equity placing and convertible loan

note issue, the proceeds of which will complete the Company's

funding requirements (on a dry hole basis) for the drilling of the

Jade prospect at the Company's 100% owned Block 29/11 permit,

offshore China, which is scheduled to be drilled in late December

2021.

Pursuant to an equity placing, the Company has issued 60,383,334

new ordinary shares in the Company (the "New Ordinary Shares") at a

price of 6.0p per New Ordinary Share (the "Placing Price") to raise

GBP3.623 million (before costs) (the "Placing"). The Placing is

being completed under the Company's existing authorities and is not

subject to the approval of shareholders.

In conjunction with the Placing, the Company has entered into a

Convertible Loan Note Agreement with a Melbourne-based investment

fund (the "Lender"), pursuant to which the Company has issued a

convertible loan note to the Lender and has received gross proceeds

of GBP4.0 million (the "Convertible Note"). The Convertible Note

has a maturity date of 16 December 2022 and the Lender can elect to

convert all or part of the principal amount of the Convertible Note

into fully paid ordinary shares in the Company at any time prior to

maturity at a conversion price of 8.0p per share. The Convertible

Note bears interest at a rate of 10% per annum and is secured by a

senior first ranking charge over the Company, including it's 8.5%

interest in the Duyung PSC and Mako Gas Field.

A condition of the Convertible Note was that the Company secure

commitments for a minimum of GBP3.0 million through an equity

placement in conjunction with the Convertible Note, which it has

now successfully achieved. The Company has accepted

over-subscriptions above the GBP3.0 million threshold that will be

used to partly fund testing of any oil column encountered whilst

drilling, though further funding will be required should the

Company encounter an oil column that requires testing. The Company

has a number of alternatives for that further funding under

consideration.

Significantly, the combined funds raised through the Placing and

Convertible Note now complete the funding requirements (on a dry

hole basis) for the drilling of the Jade Prospect. As announced in

November 2021, Empyrean executed an Integrated Drilling Contract

("IDC") with China Oilfield Services Limited ("COSL") which

confirmed a substantially reduced turnkey quote for the drilling of

the Jade prospect of US$12.38 million on a dry hole basis, an

approximate 34% saving on the initial quote. On a success basis,

testing of any oil column has been quoted at an additional US$7.4

million. Immediately following the Placing and Convertible Note

issue, the Company will have GBP10.68m (approx US$14.2m) cash on

hand.

Following the Placing, the Company's enlarged issued share

capital will comprise 637,320,780 ordinary shares of 0.2p each (the

"Shares"), each with voting rights. This figure may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, securities of the Company under the

Financial Conduct Authority's Disclosure and Transparency

Rules.

The Placing Price represents a 16.67% discount to the price of

the Company's shares as at close of business on 15 December 2021

(7.20p), a 16.13% discount to the 7-day volume weighted average

price ('VWAP') and a 15.44% discount to the 30-day VWAP of the

Company's shares. The conversion price of the Convertible Note (8p)

represents a 11.11% premium to the price of the Company's shares as

at close of business on 15 December 2021, a 11.83% premium to the

7-day volume weighted average price ('VWAP') and a 12.75% premium

to the 30-day VWAP of the Company's shares

The majority of the subscribers to the Placing were

institutional and high net worth investors, including both new

investors and existing shareholders, and also clients of First

Equity Limited in the United Kingdom and both Petra Capital and Max

Capital in Australia. Petra Capital in Australia were the corporate

advisor to the Convertible Note.

Funds raised from the proceeds of the Placing and Convertible

Note will primarily be used for final drilling preparation

activities and the drilling of the Jade prospect, and for the

Company's general working capital requirements.

The 2021 drilling campaign is targeting a world class

conventional oil target in the Jade prospect, to which Gaffney

Cline assigned a Geological Chance of Success ("GCoS") of 32%.

Subsequent to this independent assessment, the Company has

completed a gas cloud study and post stack seismic inversion study

that further mitigate risk. As a result, the Company's internal

assessment of the GCoS for the Jade prospect now stands at 41%. The

Jade prospect has a Gaffney Cline audited mean in place potential

of 225 MMbbl and a P10 in place upside of 395 MMbbl. The drilling

of the Jade prospect is the first of the three identified prospects

within Block 29/11, which also contains the Topaz and Pearl

prospects. The combined audited mean in place potential of all

three prospects is 884 MMbbl and a P10 in place upside of 1,588

MMbbl.

COSL has currently assigned the NH8 drill rig to drill the Jade

prospect. The Company engaged COSL back in October to complete a

required well site survey over the Jade drill location. The well

site survey requires 5 days of suitable sea conditions, including

swells less than 1.2m, in order to complete this survey. Sea

conditions have not allowed this survey to proceed as at today's

date. The Company and COSL will complete this survey as soon as sea

conditions allow, and the survey vessel is fully equipped and on

standby to mobilise immediately should weather conditions allow.

The well site survey is critical to 2 of 8 essential permits

required to drill. A total of 5 permit applications have already

been made and are expected to be granted in the coming weeks. The

last permit relates to the oil spill response plan which is

currently nearing completion and expected to be lodged within the

coming week. As these permits are granted, the Company will provide

updates by way of announcement.

It is expected that the Jade prospect will take approximately 26

days to reach total depth, with the testing of any oil column

encountered expected to take a further 14 days. The Jade prospect

is targeting a potentially world class conventional carbonate

reservoir, with discoveries nearby producing sweet light oil in the

38-41 api range. Four recent nearby discoveries exhibit gas clouds

on 3D seismic in the overburden rocks above the reservoir and seal.

This feature is not exhibited in nearby dry wells. Empyrean's Jade

and Topaz prospects both exhibit gas clouds on 3D seismic similar

to nearby discoveries. Any discovery at the Jade prospect will

significantly further de-risk the 'double the size of Jade' target

at the Topaz prospect.

Empyrean has a 100% working interest in Jade during the

exploration phase of the project. Empyrean's partner in the

project, China National Offshore Oil Corporation ('CNOOC"), has the

right to assume a 51% interest in the project during the

development of any discovery. Exploration costs are recovered at an

accelerated rate from first production. Development costs are also

recovered from first production along with 9% interest.

Application will be made for the New Ordinary Shares to be

admitted to trading on AIM. Admission is expected to take place on

22 December 2021. The New Ordinary Shares will rank pari passu with

existing shares in issue.

Cyber Fraud Incident

The Company recently made a payment totalling US$1.98 million to

China Oilfield Services Limited ("COSL"), representing a 10%

deposit (US$1.23m) on the dry hole cost component of the Integrated

Drilling Contract ("IDC") signed with COSL plus mobilisation costs

(US$0.75m); however, the Company has been informed that this

payment has not been received by COSL and appears to have been

redirected to an unknown third party as a result of a sophisticated

cyber fraud perpetrated against COSL and the Company.

The Company is currently working with its bank, the recipient

bank and the police authorities in three jurisdictions and can

confirm that the recipient bank account has been frozen and that

recovery actions have commenced. It is not known at this stage

whether the full funds will be recovered. The Company has notified

and opened case files with the police in the UK, Singapore and the

Federal Police in Australia and criminal investigations have duly

commenced. The Company has notified its insurers and has also taken

action to ensure the integrity of its own IT systems.

While these investigations take their course, the Company has

held proactive discussions with COSL, with both parties agreeing in

good faith to continue with drilling preparation activities without

delay.

Despite this incident, Empyrean is fully funded to drill the

Jade Prospect and will continue to work cooperatively to ensure

that activities remain on track. Further updates will be provided

as the criminal investigations progress. It is anticipated that

this will take several months to complete.

The information contained in this announcement has been reviewed

by Empyrean's Executive Technical director, Gaz Bisht, who has over

31 years' experience as a hydrocarbon geologist and

geoscientist.

Tom Kelly, CEO of Empyrean, commented on the Placing:

"We are extremely pleased to successfully raise the necessary

funding to complete our drill preparation activities and drill the

exciting Jade Prospect in China, which remains on target to

commence shortly after weather conditions allow us to complete the

well site survey.

Drilling the large Jade prospect will be the culmination of over

five years of systematic, thorough and dedicated hard work by our

technical team led by Gaz Bisht. Gaz has overseen this project

since its inception, through acquiring 3D data and the excellent

additional and thorough pre-drill exploration. We are now getting

ready to drill, and this conventional light oil 395 million barrel

in place target has been given a 32% geological chance of success

by Gaffney Cline. Empyrean ranks that chance at 41%. It is now time

to let the drill bit do the talking. We have high hopes for both

the Jade and Topaz prospects and in addition we have a great

methane gas discovery at Mako in Indonesia to focus on in the

future.

I'd like to extend special thanks to the Lender and its team,

whom we welcome as a note holder and future shareholder, and to all

new and existing shareholders who supported this raising and to

those who have supported the Company throughout the build up to

this potentially transformational point in the Company's history.

I'd also like to again commend our partners CNOOC on their

co-operative approach and assistance throughout this process. We

now look forward to updating shareholders on the final drilling

preparation activities, including the well site survey, and the

announcement of the spud date for the hugely exciting Jade

Prospect."

**ENDS**

For further information:

Empyrean Energy plc

Tom Kelly Tel: +61 6 146 5325

Cenkos Securities plc (Nominated

Advisor and Broker)

Neil McDonald Tel: +44 (0) 131 220 9771

Pete Lynch Tel: +44 (0) 131 220 9772

First Equity Limited (Joint Broker)

Jason Robertson Tel: +44 (0) 20 7330 1883

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEEADAKFELFFFA

(END) Dow Jones Newswires

December 16, 2021 08:07 ET (13:07 GMT)

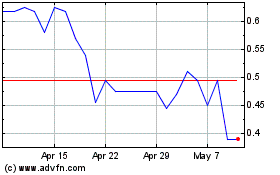

Empyrean Energy (LSE:EME)

Historical Stock Chart

From Mar 2024 to Apr 2024

Empyrean Energy (LSE:EME)

Historical Stock Chart

From Apr 2023 to Apr 2024