TIDMFA.

RNS Number : 1789Z

FireAngel Safety Technology Group

19 May 2021

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION STIPULATED UNDER THE

MARKET ABUSE REGULATION (EU) NO. 596/2014 ("MAR") AND THE RETAINED

UK LAW VERSION OF MAR PURSUANT TO THE MARKET ABUSE (AMENDMENT) (EU

EXIT) REGULATIONS 2019 (SI 2019/310) ("UK MAR"). UPON THE

PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION

SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE

PUBLIC DOMAIN.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, NEW ZEALAND, THE REPUBLIC OF

SOUTH AFRICA, JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH

RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS MADE FOR INFORMATION PURPOSES ONLY

AND DOES NOT CONSTITUTE AN OFFER TO SELL OR ISSUE OR SOLICITATION

TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE SHARES IN FIREANGEL

SAFETY TECHNOLOGY GROUP PLC IN ANY JURISDICTION IN WHICH ANY SUCH

OFFER OR SOLICITATION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS NOT AN OFFER OF SECURITIES FOR SALE IN THE

UNITED STATES. THE SECURITIES DISCUSSED HEREIN HAVE NOT BEEN AND

WILL NOT BE REGISTERED UNDER THE US SECURITIES ACT OF 1933, AS

AMENDED (THE "US SECURITIES ACT") AND MAY NOT BE OFFERED OR SOLD IN

THE UNITED STATES ABSENT REGISTRATION OR AN EXEMPTION FROM

REGISTRATION UNDER THE US SECURITIES ACT. NO PUBLIC OFFERING OF THE

SECURITIES DISCUSSED HEREIN IS BEING MADE IN THE UNITED STATES.

19 May 2021

FireAngel Safety Technology Group plc

('FireAngel', the 'Company' or the 'Group')

Result of Open Offer and Conditional Placing

Directors' Dealings

and

Total Voting Rights

Result of Open Offer and Conditional Placing

Further to its announcement of 30 April 2021 (the

'Announcement'), FireAngel Safety Technology Group plc (AIM: FA.),

a leading developer and supplier of home safety products ,

announces the result of the Open Offer to Qualifying

Shareholders.

Valid acceptances have been received from Qualifying

Shareholders in respect of 23,656,538 Open Offer Shares. This

represents approximately 61.7 per cent. of the Open Offer Shares

available under the Open Offer which, at the Issue Price, has

raised approximately GBP4.26 million.

As detailed in the Announcement, under the terms of the Placing

Agreement the number of Conditional Placing Shares will be scaled

back to 14,694,627 New Ordinary Shares, which, at the Issue Price,

has raised approximately GBP2.65 million for the Company.

A further 16,093,279 Firm Placing Shares are to be issued,

which, at the Issue Price, has raised approximately GBP2.9 million

for the Company.

Subject to the admission to trading on AIM of the 54,444,444 New

Ordinary Shares ('Admission'), the Company will have raised a total

of approximately GBP9.8 million (before expenses) as a result of

the Fundraising.

Admission and Total Voting Rights

It is expected that Admission will become effective and that

dealings in the New Ordinary Shares will commence at 8.00 a.m. on

20 May 2021. The New Ordinary Shares will rank pari passu with the

Existing Ordinary Shares. Following Admission, the Company's issued

share capital will comprise 181,003,289 Ordinary Shares carrying

voting rights. This figure may be used by Shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interests in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Directors' Dealings

Further to the Announcement, due to the clawback of Conditional

Placing Shares under the Open Offer, each of Zoe Fox (Chief

Financial Officer), Jon Kempster (Non-Executive Director), Glenn

Collinson (Non-Executive Director) and Graham Whitworth

(Non-Executive Director) and his wife will be issued with 31,417,

31,417, 62,832 and 94,239 Placing Shares respectively in respect of

their subscriptions in the Placing.

In addition, John Conoley (Executive Chairman) and his wife

subscribed in full for their Open Offer Entitlements and for Excess

Open Offer Entitlements being, in aggregate, 181,211 Open Offer

Shares.

As a result, the Directors' resulting shareholdings immediately

following Admission are detailed below:

Director Current % of Existing Placing Shareholding % of Enlarged

shareholding Ordinary or Open on Admission Share Capital

Shares Offer

Shares

John Conoley* 424,355 0.34% 181,211 605,566 0.33%

Zoe Fox - - 31,417 31,417 0.02%

Jon Kempster - - 31,417 31,417 0.02%

Glenn Collinson - - 62,832 62,832 0.03%

Graham Whitworth* 3,636,542 2.87% 94,239 3,730,781 2.06%

Simon Herrick - - - - -

*and his wife

Capitalised terms in this announcement have the same meaning as

given in the Announcement.

For further information, please contact:

FireAngel Safety Technology Group plc 024 7771 7700

John Conoley, Executive Chairman

Zoe Fox, Chief Financial Officer

companysecretary@fireangeltech.com

Shore Capital (Nominated adviser and

joint broker) 020 7408 4050

Tom Griffiths/David Coaten

N+1 Singer (Joint broker)

Rick Thompson/Alex Bond 020 7496 3000

Houston (Financial PR) 0204 529 0549

Kate Hoare/Laura Stewart

Notes to Editors

About FireAngel Safety Technology Group plc

FireAngel's mission is to protect and save lives by making

innovative, leading-edge home safety products which are simple and

accessible. FireAngel is one of the market leaders in the European

home safety products market.

FireAngel's principal products are connected smoke alarms, CO

alarms, heat alarms and accessories. The Company has an extensive

portfolio of patented intellectual property in Europe, the US and

other selected territories. Products are sold under FireAngel's

leading brands of FireAngel, FireAngel Pro, FireAngel Specification

and AngelEye.

For further product information, please visit:

www.fireangeltech.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIGPUWAAUPGGPB

(END) Dow Jones Newswires

May 19, 2021 09:05 ET (13:05 GMT)

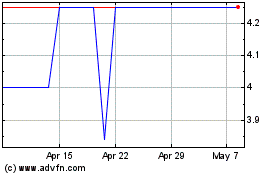

Fireangel Safety Technol... (LSE:FA.)

Historical Stock Chart

From Mar 2024 to Apr 2024

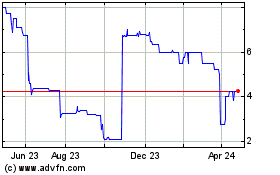

Fireangel Safety Technol... (LSE:FA.)

Historical Stock Chart

From Apr 2023 to Apr 2024