TIDMFAR

RNS Number : 1281N

Ferro-Alloy Resources Limited

28 September 2021

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which is part of UK law

by virtue of the European Union (Withdrawal) Act 2018

28 September 2021

Ferro-Alloy Resources Limited ('FAR' or the 'Company' or the

'Group')

Interim Results for the six months ended 30 June 2021

Ferro-Alloy Resources Limited (LSE:FAR), the vanadium producer

and developer of the large Balasausqandiq vanadium deposit in

Southern Kazakhstan, announces its unaudited interim results for

the six months ended 30 June 2021 .

Highlights:

-- Improved financial results from existing vanadium processing

operations reflecting higher realised prices offset by lower

production due to Covid-19 related impacts that have now been

largely resolved:

o Vanadium pentoxide prices rose 63% from US$5.2/lb in January

2021 to US$8.5/lb over the period;

o Prices for molybdic oxide and ferro-molybdenum grew 109% and

83% respectively

-- Enhanced financial position to support new Balasausqandiq

vanadium project development with US$8.2m in cash as at 30 June

2021 (2020: US$0.7m)

o Strategic Investment led by Vision Blue Resources Limited,

with US$10.1m invested to date

-- Significant incremental operational progress achieved to

support increased production and enhanced product mix at existing

operation:

o Test programme with Fraunhofer ICT institute launched on

Company's products for electrolyte production

-- Board strengthened with the appointment of Sir Mick Davis,

former Xstrata CEO, as Chairman and Peet Nienaber, former head of

Xstrata Alloys, as a Non-Executive Director

For further information, visit www.ferro-alloy.com or contact:

Ferro-Alloy Resources Nick Bridgen (CEO) info@ferro-alloy.com

Limited

+44 207 408 4090

Shore Capital Jerry Keen/Toby Gibbs

(Corporate Broker) +44 (0)203 005

VSA Capital Andrew Monk/Simon Barton 5000

St Brides Partners

Limited

(Financial PR & IR

Adviser) Catherine Leftley +44 207 236 1177

Summary

During the period we continued to successfully deliver on our

strategy of expanding our existing operations while progressing

plans for the rapid development of the transformative

Balasausqandiq vanadium project in parallel.

The expansion of production capacity to around 1,500 tonnes of

saleable vanadium product per year is proceeding as planned. Some

significant infrastructure upgrades have been completed and others

are continuing and we have completed the installation of equipment

to increase production capacity, convert AMV into vanadium

pentoxide and produce ferro-molybdenum. We expect to achieve the

first sales of ferro-molybdenum, vanadium pentoxide and possibly

ferro-vanadium in the second half of the current year, providing

enhanced revenues.

We have also worked with the Vision Blue team during the period

to refine and expand the Bankable Feasibility Study on the large

scale, low cost Balasausqandiq Project which has the potential to

become the lowest cost producer of vanadium globally. As part of

this process, a drilling programme has been developed to confirm

sufficient reserves on a JORC Indicated basis to feed both Phase 1

and Phase 2 of the planned operations. The results of the Bankable

Feasibility Study are expected during the last quarter of 2022.

The prices of vanadium pentoxide, molybdic oxide and

ferro-molybdenum rose by 63%, 109% and 83% respectively in the

period, underlining our confidence in the long-term prospects for

the Company's products.

The investment climate in Kazakhstan continues to further

improve with the country receiving US$3.9 billion in foreign direct

investment last year driven by growing investment in mining,

transport, financial services, telecommunications and energy.

Balasausqandiq feasibility study

Development of the large Balasausqandiq vanadium deposit

continues in parallel with the Company's Existing Operations.

The Company has expanded the scope of the feasibility study to

include both Phase 1 (1 million tonnes per year of ore treated) and

Stage 2 (a total of 4 million tonnes of ore per year). This

expanded feasibility study is fully funded, including a drilling

programme that has been developed to confirm that reserves on a

JORC Indicated basis are sufficient to feed the expanded Phase 2

production. Drilling is expected to commence in November 2021 and

to be completed in the first half of 2022. The current contract is

for 13,900 metres but with the potential to increase up to 20,000

metres.

The Company has supplied SGS (Lakefield) with 600 kg of sample

for technological testing. The work is supported by

Coffey/Tetratech Group with the purpose of proving the technology

that was developed by the Company at its pilot plant operations. A

further 450 kg of samples for variability testing have been

selected and are being prepared for despatch.

Existing Operations

New products

Until late in 2020, the Group's only vanadium product was

ammonium metavanadate (AMV), an internationally traded product from

which vanadium pentoxide is made by heating to dissociate the

ammonia for collection and recycling. AMV is usually sold at a

discount from published vanadium pentoxide prices. Conversion of

this AMV to vanadium pentoxide has now commenced, improving the

Company's ability to obtain more favourable prices in future.

During the period under review we started the conversion of our

calcium molybdate by-product into ferro-molybdenum, a higher value

product, using the alumothermic process, with production of up to

five tonnes of ferro-molybdenum expected each month depending on

the type and molybdenum grade of the raw-materials treated.

The Company is now selling 100% of its residues from operations

as low-grade nickel concentrates meaning no waste products from

operations are retained on site.

Electrolyte for vanadium flow-batteries (VFBs)

After the end of the period, the Company signed an agreement

with Fraunhofer ICT Institute in Germany, which carries out

investigations on various vanadium electrolyte compositions and

battery performance, to explore the Company's product's suitability

for industrial electrolyte production for vanadium flow-batteries.

Samples have been shipped and work has commenced.

In addition, in September 2020, we reported that the Company's

specialists had developed a new process for the production of

electrolyte for VFBs directly from ammonium metavanadate, a more

economical process. A Kazakhstan patent for the technology has

recently been received.

Powerline

Connection to the high-voltage line was completed on schedule

and on budget in June 2021. A delay by the suppliers of the

automated control and metering system required by the line's owners

has pushed back the planned switching-on into October.

Infrastructure

A new laboratory with upgraded equipment has been built adjacent

to the process plant which will help to meet customer requirements.

The Company has also constructed a new warehouse for vanadium

concentrates and finished goods.

Production

During the period ended 30 June 2021, production of vanadium

pentoxide (V2O5) amounted to 88.2 tonnes, 9% below the

corresponding period in 2020. The decline was caused by

interruptions in the supply of vanadium concentrates caused by

Covid-19 restrictions and a worldwide shortage of containers. From

June 2021, supplies have started flowing normally and more than

usual stocks have now been received to allow production to return

to normal. 25.3 tonnes of calcium molybdate was produced in the

period, compared with none in the first half of 2020 as production

only started in the second half of 2020.

Production of Change from Production of

Quarter (2021) Vanadium Pentoxide 2020 Molybdic Oxide

(tonnes of vanadium (tonnes of molybdic

pentoxide contained oxide contained

in AMV*) in calcium molybdate)

Q1 57.4 +20% 21.9

--------------------- ------------ -----------------------

Q2 30.8 -37% 3.2

--------------------- ------------ -----------------------

H1 2021 88.2 -9% 25.3

--------------------- ------------ -----------------------

* AMV: ammonium metavanadate

Outlook for the Existing Operation

Raw-materials supplies have returned to normal pre-covid levels,

and consequently production in H2 is expected to be substantially

higher than H1. Some bottlenecks have been experienced during the

ramp-up of production which started in June and July 2021 and these

are being addressed with a programme of improvements that are

expected to unfold over the next three months.

Looking further ahead, the Company is procuring an electric arc

furnace which can further double production capacity. This furnace

will be used to produce ferro-vanadium directly from raw-material

concentrates without first producing vanadium pentoxide, and it

will also be used for the production of by-product ferro-nickel, a

higher value product than the low grade concentrate currently being

sold.

Revenues during H2 2021 are expected to increase not only by the

expected ramp-up of throughput but also by the sales of the new

products, ferro-molybdenum, vanadium pentoxide, nickel concentrate

and possibly ferro-vanadium as described above.

Corporate

Further to the Subscription Agreement signed in March 2021 with

Vision Blue Resources, a total of US$10.1m has been invested to

date, made up of US$4.2m of Convertible Loan Notes and the

remainder as equity. The Convertible Loan Notes will be converted

into equity at the price originally agreed in March 2021 of 9 pence

per share when to do so will not trigger the requirement for the

Company to issue a new prospectus.

The proceeds of the funding package will be used to complete the

expansion of the existing processing facilities and complete the

Balasausqandiq feasibility study.

Under the terms of the investment agreement, Vision Blue

Resources have options to invest a further US$2.5m at 9 pence per

share, US$10m at 25 pence per share and US$20m at 78 pence per

share at various milestones.

This strategic relationship with Vision Blue Resources included

the appointment of Sir Mick Davis as Chairman, and subsequently Mr.

Peet Nienaber as a Non-Executive Director. The experience,

knowledge and contacts of both individuals will continue to play an

important role as the Company develops.

Since the start of 2021 the Company has raised US$475,829 from

the issue of 242 bonds, with 58 issued in February and a further

184 issued on 12 March 2021. All the bonds have been issued on the

Astana Stock Exchange ("AIX") with a nominal value of US$2,000

each, have a coupon of 5.8% payable twice-yearly, are unsecured and

are repayable on 17 March 2023.

Product prices

In 2021 the published price for vanadium pentoxide rose from

US$5.2/lb in January 2021 to US$8.5/lb over the period and is

currently around US$8.8/lb.

Prices for molybdic oxide and ferro-molybdenum grew strongly

during first half of 2021. Molybdic oxide increased from US$9.25/lb

at the beginning of 2021 to US$20.00 now. Ferro-molybdenum followed

a similar trend with an increase from US$22.9/kg in the beginning

of 2021 up to US$44 now.

COVID-19

Although the major effects of Covid-19 on the delivery of

raw-materials appear to be over, some minor disruptions are

continuing. Quarantine requirements and transport restrictions

continue to be imposed periodically and restrictions on foreigners

coming to Kazakhstan are continuing, making it difficult to bring

international specialists to site for the commissioning of new

equipment or other studies.

The Company requires all employees arriving on site to have

either a PCR test or a vaccination passport. By the beginning of

September 2021, 95% of the site workforce had been vaccinated and

no cases of illness have been detected.

The level of cases in Kazakhstan reduced in recent weeks to

around 2,000 cases per day. According to official sources, the

current level of vaccination is around 7.3 million people out of a

population of 19 million, or around 38%.

Earnings and cash flow

The Group generated total revenues of US$1.5m for the period

compared to US$1.1m for the first six months of 2020, reflecting

the higher market prices. However, the delayed delivery of vanadium

concentrates has curtailed production.

The cost of sales reduced to US$1.5m from US$1.9m for the first

six months of 2020, reflecting primarily the cost of concentrate

that was treated during the first half of 2020 comparing to new

concentrate costs in the first half of 2021.

Administrative expenses amounted to US$0.8m, (H1 2020:

US$0.8m).

The Group made a reduced net loss before and after tax of US$1.

1 m (H1 2020: loss of US$1.7m) reflecting the greater gross income

received during the first half of 2021 (US$0.056) compared with a

gross loss in the first half of 2020 (US$0.8m).

Net cash outflows from operating activities totalled US$1.3m,

(H1 2020: cash outflow US$0.7m). Investment activities and capital

expenditure increased significantly, with net cash outflows from

investing activities totalling US$1.6m (H1 2020: US$0.074m).

Investment was made mainly in the Balasausqandiq feasibility study.

Net cash inflows from financing activities totalled US$ 10.1 m (H1

2020: US$0.7m) being the proceeds, net of commissions, from equity

and convertible loan notes raised with Vision Blue Resources and

bonds issues.

Balance sheet review

Non-current assets totalled US$6.4m at 30 June 2021 (2020:

US$5.1m), reflecting investment in the feasibility study and

investment into completion of the construction of the high-voltage

line.

Current assets excluding cash balances totalled US$1.6m compared

with US$0.9m at 31 December 2020. Higher trade and other

receivables and prepayments were offset by lower inventory

levels.

The Group had cash of US$8.2m at 30 June 2021 (2020:

US$0.7m).

Description of principal risks, uncertainties and how they are

managed

(a) Current processing operations:

Current processing operations make up a small part of the

Group's expected future value but provide useful cash flows in the

near term and allow the group to gain valuable experience of the

vanadium industry. The principal risk of this operation is the

price of its product, vanadium. The price of vanadium pentoxide is

volatile and rose from historic lows at the beginning of 2016 to a

near-record high of nearly US$30/lb near the end of 2018.

Currently, the price of vanadium pentoxide is at around US$8.8/lb

which is a little less than the inflation-adjusted ten-year average

to date. Most forecasters anticipate that vanadium will be in

deficit in the short to medium term, resulting in some recovery in

current prices, and will return to the long-run marginal cost of

production in the longer term which may be substantially higher.

The Company acquires raw materials at a cost that is related to the

price of vanadium so there is a natural hedge but there is a risk

of changes in vanadium prices between the time of acquisition of

the raw materials and sale of the product which cannot be entirely

avoided.

The processing operation is also dependent on the continuing

availability of raw materials which are subject to competition from

other processors. The Company is mitigating this risk by

positioning itself to treat a wide variety of potential

raw-materials and maintaining low treatment costs, whilst

extracting the maximum value from by-product constituents.

The level of profitability of the current processing operation

is also dependent on production levels being sufficient to generate

profits to cover fixed overheads. The level of production could be

impacted by unanticipated production difficulties, power outages

and raw-material delivery limitations. The Company aims to keep a

stockpile of raw-materials and has installed a larger capacity

generator to maintain production during outages.

The Company is currently carrying out various expansion projects

which will lower the average cost of production and as part of this

project, has connected to a larger capacity and more reliable power

supply which is expected to start delivering power shortly. A

substantial part of this expansion has already been completed .

There remains a risk that the Covid-19 crisis worsens in

Kazakhstan. This could cause further disruption to supply-lines,

staffing and subcontractors as has already occurred, but it is also

possible that a case might arise on site requiring a temporary

shutdown of operations. In addition, Covid-19 may impact the

availability of finance or the terms which are available. Whilst it

is not possible to guard against this, the Company continues to

take all recommended precautions, including a very high level of

vaccination amongst employees, and will aim to maintain higher than

normal stores of essential supplies on site. In terms of funding,

cash flows are monitored on a continuous basis to enable the

Company to take proactive measures to safeguard liquidity.

(b) Financing risk :

The Company is in stronger financing position relative to the

prior year. In March of 2021 the Company signed an investment

agreement with Vision Blue Resources. Under the terms of this

agreement, investment of US$10.1m has already been made which is

expected to be sufficient to finance the completion of the

expansion of the existing plant and the feasibility study.

(c) Climate change risk :

Although no specific risks to the Company's operations have been

identified, the Company's operations could be subject to extreme

weather conditions and the prices of its products may be subject to

changes in the world's economy caused by climate change. Kazakhstan

is planning to publish a document entitled "A concept of low carbon

development by 2050" which is not yet publicly available.

(d) Risks associated with the developing nature of the Kazakh economy:

According to the World Bank Kazakhstan has transitioned from

lower-middle-income to upper-middle-income status in less than two

decades. Kazakhstan's regulatory environment has similarly

developed, and the Company believes that the period of rapid change

and high risk is coming to an end. Nevertheless, the economic and

social regulatory environment continues to develop and there remain

some areas where regulatory risk is greater than in developed

economies.

(e) Balasausqandiq project:

The Balasausqandiq project is a much larger contributor to the

Group's value than current operations and its value is primarily

dependent on long term vanadium prices.

The Project is also dependent on raising finance to meet capital

costs anticipated to amount to in excess of US$100m for the first

phase. Raising this money will be dependent on the successful

outcome of the western bankable feasibility study which is ongoing.

The favourable financial and other characteristics of the Project

determined by studies so far completed give the directors

confidence that the outcome of the study will be successful.

Initial discussions with the providers of finance, including with

the Development Bank of Kazakhstan for which our project has passed

through initial screening, have been encouraging.

Responsibility statements

Directors' Responsibility Statement

We confirm that to the best of our knowledge:

a) the Condensed set of Interim Financial Statements has been

prepared in accordance with IAS 34 'Interim Financial

Reporting';

b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year);

c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein); and

d) the condensed set of interim financial statements, which has

been prepared in accordance with the applicable set of accounting

standards, gives a true and fair view of the assets, liabilities,

financial position and profit or loss of the issuer, or the

undertakings included in the consolidation as a whole as required

by DTR 4.2.4R.

This Half Yearly Report has been approved by the Board and

signed on its behalf by:

James Turian

Director

27.09.2021

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2021 30 June 2020

Note $000 $000

------------- -------------------------

Revenue from customers (pricing

at shipment) 2 1,520 1,172

Other revenue (adjustments

to price after delivery and

fair value changes) 2 27 (44)

Total revenue 2 1,547 1,12 8

Cost of sales 3 (1,491) (1,903)

------------- -------------------------

Gross income 56 (775 )

Other income 8 -

Administrative expenses 4 (849) (766)

Distribution expenses (218) ( 55 )

Other expenses (2) (2)

------------- -------------------------

Loss from operating activities (1,005) (1, 5 98 )

------------- -------------------------

Net finance costs 6 (78) (1 11 )

------------- -------------------------

Loss before income tax (1,083) (1,709)

============= =========================

Income tax - (1)

Loss for the period (1,083) (1,710)

Other comprehensive income

(loss)

Items that may be reclassified

subsequently to profit or

loss

Exchange differences arising

on translation of foreign

operations 145 (275)

------------- -------------------------

Total comprehensive (loss)

income for the period (938) (1,985)

============= =========================

Loss per share (basic and

diluted), US$ 14 (0.003) (0.005)

------------- -------------------------

These consolidated financial statements were approved by

directors on 31 August 2021 and signed by:

_____________________________

James Turian

Director

Unaudited

31 December

3 0 June 2021 2020

Note $000 $000

--------------- ------------

ASSETS

Non-current assets

Property, plant and equipment 7 2,705 2,8 0 0

Exploration and evaluation

assets 8 1,158 813

Intangible assets 9 21 21

Prepayments 12 2,489 1,467

Total non-current assets 6,373 5,101

--------------- ------------

Current assets

Inventories 10 480 694

Trade and other receivables 1 1 68 5 205

Prepayments 12 393 52

Cash and cash equivalents 13 8,158 707

Total current assets 9,716 1,658

--------------- ------------

Total assets 16,089 6,759

=============== ============

EQUITY AND LIABILITIES

Equity

Share capital 14 41,252 35,606

Convertible loan notes 14 4,019 -

Additional paid-in capital 397 397

Foreign currency translation

reserve (3,3 1 7) (3,462)

Accumulated losses (29,644) (28,56 1 )

--------------- ------------

Total equity 12,707 3,980

--------------- ------------

Non-current liabilities

Loans and borrowings 15 896 412

Provisions 46 47

Total non-current liabilities 942 459

--------------- ------------

Current liabilities

Loans and borrowings 15 523 524

Trade and other payables 16 1,917 1,736

Payables at FVTPL 17 - 60

--------------- ------------

Total current liabilities 2,440 2,320

--------------- ------------

Total liabilities 3,382 2,77 9

--------------- ------------

Total equity and liabilities 16,089 6,759

=============== ============

Additional Foreign currency

Share Convertible paid in capital translation Accumulated

capital loan notes $000 reserve losses Total

$000 $000 $000 $000 $000

-------- ----------- ---------------- ---------------- ------------------ --------

Balance at 1

January 2020 33,965 - 397 (2,934) (24,617) 6,811

( 1 ,710

Loss for the year - - - - (1,710) )

Other comprehensive

expense

Exchange

differences

arising on

translation

of foreign

operations - - - (275) - (275)

-------- ----------- ---------------- ---------------- ------------------ --------

Total comprehensive

income (loss) for

the

year - - - (275) (1,710) (1,985)

-------- ----------- ---------------- ---------------- ------------------ --------

Transactions with

owners, recorded

directly

in equity

Shares issued, net

of issue costs 410 - - - - 410

Balance at 30 June (26,32 7

2020 34,375 - 397 (3,209) ) 5,236

======== =========== ================ ================ ================== ========

Balance at 1

January 2021 35,606 - 397 (3,462) (28,561) 3,980

Loss for the year - - - - (1,083) (1,083 )

Other comprehensive

income

Exchange

differences

arising on

translation

of foreign

operations - - - 1 45 - 1 45

-------- ----------- ---------------- ---------------- ------------------ --------

Total comprehensive

income (loss) for

the

year - - - 1 45 (1,083) (9 3 8)

-------- ----------- ---------------- ---------------- ------------------ --------

Transactions with

owners, recorded

directly

in equity

Shares issued, net

of issue costs

(note

14) 5,646 - - - - 5,646

Convertible loan

notes - 4,019 4,019

Balance at 30 June

2021 41,252 4,019 397 (3,3 1 7) (29,644) 12,707

======== =========== ================ ================ ================== ========

Condensed unaudited Consolidated Statement of Changes in

Equity

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2021 30 June 2020

$000 $000

------------- -------------

Cash flows from operating activities

Loss for the period (1,083) (1,710)

Adjustments for:

Depreciation and amortisation 3, 4 207 244

Income tax - 1

Net finance costs 6 78 1 11

Cash from operating activities before changes

in working capital (798) (1,354)

Change in inventories 205 1,073

Change in trade and other receivables (519) ( 430 )

Change in prepayments (341) (508)

Change in trade and other payables 214 534

Change in payables at FVTPL (60) (3)

------------- -------------

Net cash from operating activities (1,299) (687)

------------- -------------

Cash flows from investing activities

Acquisition of property, plant and equipment 7 (1,229) ( 74 )

Acquisition of exploration and evaluation

assets 8 (320) -

Acquisition of intangible assets 9 (1) -

Net cash used in investing activities (1,550) (74)

------------- -------------

Cash flows from financing activities

Proceeds from issue of share capital 14 5,900 442

Transaction costs on shares subscription 14 (254) ( 32 )

Proceeds from issue of convertible loan

notes 14 4,019 -

Proceeds from borrowings 15 476 300

Interests paid 15 (30) -

Net cash from financing activities 10,111 710

------------- -------------

Net increase in cash and cash equivalents 7,262 (5 1 )

Cash and cash equivalents at the beginning

of year 13 707 648

------------- -------------

Effect of movements in exchange rates on

cash and cash equivalents 189 (171)

------------- -------------

Cash and cash equivalents at the end of

the period 8,158 426

============= =============

Unaudited notes to the Financial Statements for the 6 months period ended 30 June 2021

1 Basis of preparation

These Condensed Unaudited Financial Statements have been

prepared in accordance with IAS34 Interim Financial Reporting. The

same accounting policies and basis of preparation have been

followed as in the annual financial statements of the Group which

were published on 28 June 2021.

The consolidated financial statements are prepared in accordance

with IFRS on a going concern basis.

The Directors have reviewed the Group's cash flow forecasts for

a period of at least 12 months from the date of approval of the

financial statements, together with sensitivities and mitigating

actions. In addition, the Directors have given specific

consideration to the continued risks and uncertainties associated

with the COVID-19 pandemic and considered reverse stress test

scenarios to assess the potential impact on liquidity in line with

recent guidance.

On 8 February and 12 March 2021 the Company issued the bonds for

consideration totalling US$476 thousand with a three-year maturity

term, bearing interest of 7.0%, payable twice-yearly. In June 2021

one investor that has purchased 50 bonds with early redemption date

has decided to hold the bonds until end of the period. As a result

there are currently 206 bonds issued that have early redemption

option. None of the investors that purchased bonds in June 2020

have exercised their rights for early redemption . Out of 206 bonds

with early redemption option, 155 bonds for the total amount of

US$310 thousand have early redemption right in September 2021. The

Directors have reviewed the scenario of investor exercising their

rights and took this into consideration.

The Company signed an investment agreement with Vision Blue

Resources and their co-investors on 15 March 2021. In pursuit of

this agreement, the Company issued 24,741,021 ordinary shares for

cash at a price of 9 pence per share to raise US$3.1m to finance

the further expansion of the existing process plant and completion

of the bankable feasibility study. The Initial Investment by Vision

Blue has been completed in June 2021 bringing total investment to

US$3.1m. Further investments of US$7m have been made in June 2021

with a target to accelerate expanded bankable feasibility study

with added Stage 2 of Balasausqandiq project.

A further US$2.5m may be invested at Vision Blue's option two

months after the feasibility study for the development of Phase 1

of the Balasausqandiq project is released.

These funds are expected to l be sufficient to bring the

existing processing factory to the level of 1500 tonnes of V2O5

production per year, generating forecast cash flow of up to US$10m

per year. In addition, the investments will be used for finalising

the Western Bankable Feasibility Study. Although the remaining

funds to be invested remains at the option of Vision Blue Resources

and therefore cannot be guaranteed, in view of the current share

price which is substantially in excess of the agreed exercise

price, the Directors are confident that the further investments

will be made.

The agreement also provides for further investments at higher

share prices to be made at the option of Vision Blue Resources to

finance the construction of the Phase 1 project, but these further

options are likely to come beyond the time under consideration for

current Going Concern purposes.

The current cash position and forecast operational cash flow in

the base case scenario shows that the Company is in stable

financing position. There is further potential for volatility in

commodity prices, supply chain disruption, mine site workforce

rotations and travel to the mine site if the pandemic escalates. In

case of a reduction in vanadium pentoxide prices from current

levels to US$3.4/lb and calcium molybdate prices to US$8.86/lb

additional funding would be required in July 2022. Under this

scenario the company will consider various financing options such

as issuing bonds or further equity.

After review of these forecasts and scenarios the Directors have

a reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future based

on the recent funds raised and operational cash flow generation of

the processing operations, at forecast prices. In the event of

further impacts from COVID-19 the Directors anticipate being able

to raise funds if required given the value contained in the Group's

assets and the expansion plans. Accordingly, the Directors continue

to adopt the going concern basis in preparing the consolidated

financial statements.

Use of estimates and judgments

Preparing the financial statements requires management to make

judgements, estimates and assumptions that affect the application

of accounting policies and the reported amounts of assets and

liabilities, income and expenses. Actual results may differ from

these estimates.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimates are revised and in any future periods

affected.

Carrying value of processing operations

Given the remaining low in vanadium pentoxide prices in the

period, the Directors have tested the processing operations

PP&E for impairment at 30 June 2020. In doing, so, net present

value cash flow forecasts were prepared using the fair value less

cost to develop method which required estimates including vanadium

pentoxide prices, production including the impact of ongoing and

planned expansion together with costs and discount rate. Key

estimates included:

-- Production volumes of 48 tonnes per month of vanadium

pentoxide from pyrometallurgical line and 86 tonnes per month of

vanadium pentoxide from electrometallurgical line from 2022 with

flat production thereafter.

-- Average prices of US$9.5/lb in 2021 and thereafter,

reflecting management estimates having consideration of market

commentary less a discount, and lower than the US$7.50/lb used by

the Company as a long-term assumption for other planning

purposes.

-- Further capital development costs of US$7.6m.

-- Discount rate of 10% post tax in real terms.

Based on the key assumptions set out above, the recoverable

amount of PP&E (US$48m) exceeds its carrying amount (US$2.7m)

by US$46m and therefore PP&E were not impaired.

Fair value of trade receivables and payables classified at fair

value less profit and loss (note 11, 16 and 17)

The consideration receivable in respect of certain AMV and

calcium molybdate sales for which performance obligations have been

satisfied at the end of the period and for which the Group has

received prepayment under the terms of the sale agreements, remain

subject to pricing adjustments with reference to market prices in

the month following arrival at the port of final destination. Under

the Group's accounting policies, the fair value of the

consideration is determined and the remaining receivable is

adjusted to reflect fair value, or, if the final estimated

consideration is lower than the amounts received prior to the end

of the period, a payable at FVTPL is recorded. In the absence of

forward market prices for the commodity, management estimated the

forward price based on: a) spot market prices for vanadium

pentoxide at 30 June 2021 less applicable deductions for AMV and

calcium molybdate; b) foreign exchange rates; c) risk free rates

and d) carry costs when material.

As at 30 June 2021 the Group recorded trade receivables of

US$0.346m (2020: US$Nil). As at 30 June 2021 the Group recognised a

payable at FVTPL of US$Nil (2020: US$0.056m).

These Condensed Unaudited Financial Statements have not been

audited or reviewed by the Group Auditor.

2 Revenue

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2021 30 June 2020

$000 $000

------------- -------------

Revenue from sales of vanadium

products 1,436 1,170

Revenue from sales of molybdate

calcium 74

Sales of gravel and waste rock 10 2

Total revenue from customers under

IFRS 15 1,520 1,172

------------- -------------

Other revenue - change in fair

value of customer contract 27 (44)

============= =============

Total revenue 1,547 1,128

============= =============

Products

Under certain sales contracts the single performance obligation

is the delivery of products to the designated delivery point at

which point possession, title and risk transfers to the buyer.

Typically, the buyer makes an initial provisional payment based on

volumes and quantities assessed by the Company and market spot

prices at the date of shipment. The final payment is received once

the product has reached its final destination with adjustments for

quality / quantity and pricing based on the historical average

market prices during a quotation period and an adjusting payment or

receipt will be made to the initially received revenue. Where the

final payment for a shipment made prior to the end of an accounting

period has not been determined before the end of that period, the

revenue is recognised based on the spot price that prevails at the

end of the accounting period.

Other revenue related to the change in the fair value of amounts

receivable and payable under the sales contracts between the date

of initial recognition and the period end resulting from market

prices are recorded as Other Revenue.

3 Cost of sales

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2021 30 June 2020

$000 $000

------------- -------------

Materials 977 1,261

Wages, salaries and related taxes 258 340

Depreciation 19 4 231

Electricity 43 67

Other 19 4

------------- -------------

1,491 1,903

============= =============

4 Administrative expenses

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2021 30 June 2020

$000 $000

------------- -------------

Wages, salaries and related taxes 449 437

Professional services 155 211

Listing & reorganisation expenses 44 6

Audit 4 3

Materials 45 25

Depreciation and amortization 13 13

Insurance 20 -

Bank fees 42 5

Business trip expenses 9 10

Security 7 7

Communication and information services 5 4

Other 56 43

------------- -------------

849 766

============= =============

5 Personnel costs

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2021 30 June 2020

$000 $000

------------- -------------

Wages, salaries and related taxes 758 624

-------------

758 624

============= =============

During 6m 2021 personnel costs of US$232 thousand (2020: US$180

thousand) have been charged to cost of sales, US$448 thousand

(2020: US$437 thousand) to administrative expenses and US$78

thousand (2020: US$7 thousand) were charged to cost of inventories

which were not yet sold as at the end of the 6 months period.

6 Finance costs

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2021 30 June 2020

$000 $000

------------- -------------

Net foreign exchange (income) costs 41 101

Interest expense on financial liabilities

(bonds) 37 10

Net finance costs/(income) 78 111

============= =============

7 Property, plant and equipment

Land and Plant and Construction

buildings equipment Vehicles Computers Other in progress Total

$000 $000 $000 $000 $000 $000 $000

---------- ---------- -------- --------- ----- ------------ -------

Cost

Balance at 1 January 2020 1,687 2,014 587 39 104 1,445 5,876

Additions - 28 10 1 5 255 299

Foreign currency translation

difference (158) (189) (56) (4) (10) (140) (557)

---------- ---------- -------- --------- ----- ------------ -------

Balance at 31 December 2020 1,529 1,853 541 3 6 99 1,560 5,618

========== ========== ======== ========= ===== ============ =======

Balance at 1 January 2021 1,529 1,853 541 36 99 1,560 5,618

Additions - 4 - 2 10 158 174

Transfers 495 743 7 - - (1,245) -

Disposals - - (22) - - - (22)

Foreign currency translation

difference (30) (38) (8) (1) (2) (16) (95)

---------- ---------- -------- --------- ----- ------------ -------

Balance at 30 June 2021 1,994 2,562 518 3 7 107 457 5,675

========== ========== ======== ========= ===== ============ =======

Depreciation

Balance at 1 January 2020 639 1 , 645 330 17 39 - 2 , 670

Depreciation for the period 51 294 42 7 12 - 4 0 6

Foreign currency translation

difference (61) (160) (3 2 ) (2) (3) - (258)

---------- ---------- -------- --------- ----- ------------ -------

Balance at 31 December 2020 629 1 , 779 34 0 22 48 - 2 , 818

========== ========== ======== ========= ===== ============ =======

Balance at 1 January 2021 629 1 , 779 340 22 48 - 2 , 818

Depreciation for the period 37 161 17 3 5 - 223

Disposals - - (22) - - - (22)

Foreign currency translation

difference (11) (31) (5) - (1) - (48)

---------- ---------- -------- --------- ----- ------------ -------

Balance at 30 June 2021 655 1 , 909 33 0 25 52 - 2 , 971

========== ========== ======== ========= ===== ============ =======

Carrying amounts

At 1 January 2020 1,048 369 2 57 22 65 1,445 3,2 06

========== ========== ======== ========= ===== ============ =======

At 31 December 2020 900 74 201 14 51 1,560 2,800

========== ========== ======== ========= ===== ============ =======

At 30 June 2021 1,339 653 188 12 55 457 2,705

========== ========== ======== ========= ===== ============ =======

During 2021, depreciation expense of US$193 thousand (2020:

US$380 thousand) has been charged to cost of sales, excluding cost

of finished goods that were not sold at year-end, US$12,000 (2020:

US$25,000) - to administrative expenses, and US$17,000 has been

charged to cost of finished goods that were not sold at the end of

the period (2020: US$1,000). Construction in progress relates to

upgrades to the processing plant associated with the expansion of

the facility.

8 Exploration and evaluation assets

The Group's exploration and evaluation assets relate to

Balasausqandiq deposit. During the 6 months period ended 30 June

2021 the Group capitalised the expenses for the feasibility study

as exploration and evaluation assets (in 2020: nil). As at 30 June

2021, the carrying value of exploration and evaluation assets was

US$0.865 m (at 30 June 2020: US$0. 56 m).

Unaudited

Unaudited six-month

six-month period ended

period ended 30 June

30 June 2021 2020

$000 $000

------------- -------------

Balance at 1 January 813 59

Additions (feasibility study) 320 -

Foreign currency translation difference 26 (3)

Balance at 30 June 1,158 56

============= =============

9 Intangible assets

Mineral Computer

rights Patents software Total

$000 $000 $000 $000

-------- -------- ---------- -------

Cost

Balance at 1 January

2020 100 34 3 137

Additions - 1 - 1

Foreign currency translation

difference (9) (3) - ( 1 2)

-------- -------- ---------- -------

Balance at 31 December

2020 9 1 32 3 126

======== ======== ========== =======

Balance at 1 January

2021 91 32 3 126

Additions - 1 - 1

Foreign currency translation

difference (9) (3) - ( 1 2)

-------- -------- ---------- -------

Balance at 30 June

2021 9 1 32 3 126

======== ======== ========== =======

Amortisation

Balance at 1 January

2020 100 10 3 1 1 3

Amortisation for the

year - 1 - 1

Foreign currency translation

difference (9) - - (9)

-------- -------- ---------- -------

Balance at 31 December

2020 9 1 11 3 1 05

======== ======== ========== =======

Balance at 1 January

2021 91 11 3 105

Amortisation for the

year - 1 - 1

Foreign currency translation

difference (9) - - (9)

-------- -------- ---------- -------

Balance at 30 June

2021 9 1 11 3 1 05

======== ======== ========== =======

Carrying amounts

At 1 January 2020 - 24 - 2 4

======== ======== ========== =======

At 31 December 2020 - 2 1 - 21

======== ======== ========== =======

At 30 June 2021 - 21 - 21

======== ======== ========== =======

During the six months ended 30 June 2021 and 2020, amortisation

of intangible assets was charged to administrative expenses.

10 Inventories

Unaudited

31 December

30 June 2021 2020

$000 $000

-------------- -----------

Raw materials and consumables 389 434

Finished goods 83 75

Work in progress 8 185

480 694

============== ===========

During the six months ended 30 June 2021, inventories expensed

to profit and loss amounted to US$994,000 (six months period ended

30 June 2020: US$1,286,000).

11 Trade and other receivables

Unaudited 31 December

Current 30 June 2021 2020

$000 $000

------------- -----------

Trade receivables from third

parties 346 18

Due from employees 24 10

VAT receivable 345 205

Other receivables 6 8

------------- -----------

721 241

Expected credit loss provision

for receivables (36) (36)

-------------

685 205

============= ===========

12 Prepayments

Unaudited

31 December

30 June 2021 2020

$000 $000

-------------- -----------

Non-current

Prepayments for equipment 2,489 1,467

2,489 1,467

============== ===========

Current

Prepayments for goods and services 393 52

-------------- -----------

393 52

============== ===========

The prepayments for equipment are related mainly to high-voltage

powerline connection. For more details see Report on

production.

The current prepayments are related mainly to purchase of raw

materials for processing.

13 Cash and cash equivalents

Unaudited

31 December

30 June 2021 2020

$000 $000

-------------- -----------

Cash at current bank accounts 8,143 688

Cash at bank deposits 14 14

Petty cash 1 5

Cash and cash equivalents 8,158 707

============== ===========

14 Equity

(a) Share capital

Number of shares unless otherwise stated Ordinary shares

Unaudited 31 December

30 June 2021 2020

------------- -----------

Par value -

Outstanding at beginning of

year 330,589,052 312,978,848

Shares issued 47,087,747 17,610,204

-------------

Outstanding at end of period 377,676,799 330,589,052

============= ===========

Ordinary shares

All shares rank equally. The holders of ordinary shares are

entitled to receive dividends as declared from time to time and are

entitled to one vote per share at meetings of the Company.

During six months ended at 30 June 2021 the Company issued

47,087,747 ordinary shares of no par value by way of a direct

subscription into the Company for cash at price 9 pence per share,

raising a total of GBP4,238,000 (US$5,900,000 minus US$254,000 of

commission ).

Convertible loan notes

Convertible loan notes are considered as equity as the

conditions that are set out in the Convertible Loan Note agreement

provide for conversion into equity in all circumstances except

certain conditions that the Directors of the Company do not

consider probable. In particular, the conditions required to be

fulfilled before conversion takes place include an obligation on

the Company to receive certain Consents from the regulatory

authorities which have already been received, and avoidance of the

possibility of triggering a requirement for the issue of a

prospectus which will automatically be achieved upon the effluxion

of time provided no further shares are issued. The directors do not

envisage any circumstances under which they would need to issue

further shares prior to the final date of conversion on 4 January

2022.

Reserves

Share capital: Value of shares issued less costs of

issuance.

Convertible loan notes: Further investment rights at issue

price.

Additional paid in capital: Amounts due to shareholders which

were waived.

Foreign currency translation reserve: Foreign currency

differences on retranslation of results from functional to

presentational currency and foreign exchange movements on

intercompany balances considered to represent net investments which

are permanent as equity.

Accumulated losses: Cumulative net losses.

(b) Dividends

N o dividends were declared for the year ended 30 June 2021.

(c) (Loss) earnings per share (basic and diluted)

The calculation of basic and diluted (loss) / earnings per share

has been based on the following loss attributable to ordinary

shareholders and weighted-average number of ordinary shares

outstanding. There are no convertible bonds and convertible

preferred stock, so basic and diluted losses are the same.

(i) Loss attributable to ordinary shareholders (basic and diluted)

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2021 30 June 2020

$000 $000

------------- -------------

Loss for the year, attributable

to owners of the Company (1,083) (1,710)

------------- -------------

Loss attributable to ordinary shareholders (1,083) (1,710)

============= =============

(ii) Weighted-average number of ordinary shares (basic and diluted)

Unaudited Unaudited

six-month six-month

period ended period ended

Shares 30 June 2021 30 June 2020

------------- -------------

Issued ordinary shares at 1 January

(after subdivision) 330,589,052 312,978,848

Effect of shares issued (weighted) 4,531,663 1,265,811

Weighted-average number of ordinary

shares at

30 June 335,120,715 314,244,659

============= =============

Earnings (loss) per share of common

stock attributable to the Company

(basic and diluted) (0.003) (0.005)

------------- -------------

15 Loans and borrowings

In 2021 the Company issued unsecured corporate bonds with

effective interest rates of 7.0%. Investors have subscribed for a

total of 242 of the Company's bonds with a nominal value of

US$2,000 each but are issued at a premium or discount to achieve

the effective interest rates agreed. The bonds are unsecured, have

a three-year term, and bear the coupon rate of 5.8%, paid

twice-yearly. The bonds have been listed on AIX with identifier

FAR.0323 and ISIN number KZX000000336. Some of the investors (that

own 206 bonds) have the right to receive early repayment after a

minimum period of 12 months from the purchase date.

Unaudited

31 December

30 June 2021 2020

$000 $000

-------------- -----------

Non-current liabilities

Bonds payable 896 412

-------------- -----------

896 412

============== ===========

Current liabilities

Bonds payable (early repayment

rights) 512 512

Interest payable 11 12

--- ---

523 524

=== ===

Terms and conditions of outstanding bonds in 6 months period

ended at 30 June 2021 were as follows:

Effective

interest Nominal Actual Coupon Coupon

US$ Currency rate amount amount rate paid Interest

--------- --------- ------- ------- ------ ------ --------

Bonds payable US$ 7.5% 506 503 5.8% 15 15

Bonds payable US$ 7.0% 886 876 5.8% 15 21

Bonds payable US$ 5.8% 20 21 5.8% - 1

------- ------

1,412 1,400 30 37

======= ======= ====== ========

During 6 months period ended at 30 June 2021 the Group sold

bonds to subscribers and received cash from subscribers in the

total amount of US$475,830 (2020: US$924,000).

Details of tranches of the bonds

Actual Earliest

Bond price Number Nominal Actual repayment Maturity

Tranche date denomination per bond of bonds amount amount date date

------------- ------------- --------- --------- ------- ------- ---------- ----------

08.02.2021 2,000 1,999 58 116,000 115,940 17.03.2023 17.03.2023

17.03.2021 2,000 1,956 52 104,000 101,708 17.03.2023 17.03.2023

17.03.2021 2,000 1,956 30 60,000 58,678 01.10.2021 17.03.2023

17.03.2021 2,000 1,956 102 204,000 199,504 09.10.2021 17.03.2023

Total 484,000 475,830

======= =======

Non-cash transactions from financing activities are shown in the

reconciliation of liabilities from financing transactions

overleaf.

Loans and borrowings Unaudited

six-month

period

ended 2020

30 June

2021 $000

$000

------------ -------

At 1 January 936 -

Cash flows:

-Interest paid (30) (19)

-Proceeds from loans and borrowings 476 924

------------ -------

Total 1.382 905

Non-cash flows

* Interest accruing in period 37 33

* Bond discount/premium - (2)

At 30 June/31 December 1,419 936

============ =======

16 Trade and other payables

Unaudited

31 December

30 June 2021 2020

$000 $000

-------------- -----------

Trade payables 1,016 1,035

Debt to directors/key management

(Note 20) 745 522

Debt to employees 65 57

Other taxes 91 122

1,917 1,736

============== ===========

17 Payables at FVPL

Unaudited

31 December

30 June 2021 2020

$000 $000

-------------- -----------

Payables at FVPL - 60

- 60

============== ===========

18 Contingencies

(a) Insurance

The insurance industry in the Kazakhstan is in a developing

state and many forms of insurance protection common in other parts

of the world are not yet generally or economically available. The

Group does not have full coverage for its plant facilities,

business interruption, or third party liability in respect of

property or environmental damage arising from accidents on Group

property or relating to Group operations. There is a risk that the

loss or destruction of certain assets could have a material adverse

effect on the Group 's operations and financial position.

(b) Taxation contingencies

The taxation system in Kazakhstan is relatively new and is

characterised by frequent changes in legislation, official

pronouncements and court decisions which are often unclear,

contradictory and subject to varying interpretations by different

tax authorities. Taxes are subject to review and investigation by

various levels of authorities which have the authority to impose

severe fines, penalties and interest charges. A tax year generally

remains open for review by the tax authorities for five subsequent

calendar years but under certain circumstances a tax year may

remain open longer.

These circumstances may create tax risks in Kazakhstan that are

more significant than in other countries. Management believes that

it has provided adequately for tax liabilities based on its

interpretations of applicable tax legislation, official

pronouncements, and court decisions. However, the interpretations

of the relevant authorities could differ and the effect on these

consolidated financial statements, if the authorities were

successful in enforcing their interpretations, could be

significant.

There are no tax claims or disputes at present.

19 Segment reporting

The Group's operations are split into three segments based on

the nature of operations: processing, subsoil operations (being

operations related to exploration and mining) and corporate segment

for the purposes of IFRS 8 Operating Segments. The Group's assets

are primarily concentrated in the Republic of Kazakhstan and the

Group's revenues are derived from operations in, and connected

with, the Republic of Kazakhstan.

Unaudited six-month

period ended 30 June

2021

Processing Subsoil Corporate Total

$000 $000 $000 $000

---------- ------- --------- -------

Revenue 1,547 - - 1,547

Cost of sales (1,491) - - (1,491)

Other income 8 - - 8

Administrative expenses (247) (25) (576) (849)

Distribution & other

expenses (220) - - (220)

Finance costs ( 8 ) - (70) ( 78 )

Profit before tax (411) (25) (646 ) (1,083)

========== ======= ========= =======

Unaudited six-month

period ended 30 June

2020

Processing Subsoil Corporate Total

$000 $000 $000 $000

---------- ------- --------- -------

Revenue 1,128 - - 1,128

Cost of sales (1,903) - - (1,903)

Administrative expenses (176) (49) (540) (765)

Distribution & other

expenses (57) - - (57)

Finance costs (19) - (92) (111)

---------- ------- --------- -------

(1, 709

Profit before tax (1,027) (49) (632) )

========== ======= ========= =======

Included in revenue arising from processing are revenues of

US$1,5m (2019: US$1.1m) which arose from sales to one of the

largest Group customer and one new customer. No other single

customer contributes 10 per cent or more to the Group's

revenue.

The sales to two largest customers were (in US$) during the

first half 2021:

Sideralloys SA (Switzerland) 0.5m (39%) (2020: nil)

MTALX (UK) 0.6 (43%) (2020: nil)

20 Related party transactions

Transactions with management and close family members

Management remuneration

Key management personnel received the following remuneration

during the year, which is included in personnel costs (see Note

9):

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2021 30 June 2020

$000 $000

------------- -------------

Wages, salaries and related

taxes 200 209

------------- -------------

Refer to note 16 amount of wages and salaries that are

outstanding at 30 June 2021 equal to US$0.7m.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEWFMWEFSEDU

(END) Dow Jones Newswires

September 28, 2021 01:59 ET (05:59 GMT)

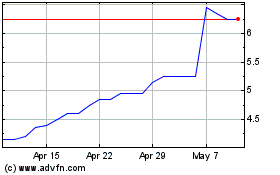

Ferro-alloy Resources (LSE:FAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ferro-alloy Resources (LSE:FAR)

Historical Stock Chart

From Apr 2023 to Apr 2024