Ferro-Alloy Resources Limited First sale of ferro-molybdenum (8586R)

10 November 2021 - 6:00PM

UK Regulatory

TIDMFAR

RNS Number : 8586R

Ferro-Alloy Resources Limited

10 November 2021

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which is part of UK law

by virtue of the European Union (Withdrawal) Act 2018

10 November 2021

Ferro-Alloy Resources Limited ('FAR' or the 'Company' or the

'Group')

First sale of ferro-molybdenum and completion of testing of

ferro-vanadium

Ferro-Alloy Resources Limited (LSE:FAR), the vanadium producer

and developer of the large Balasausqandiq vanadium deposit in

Southern Kazakhstan, is pleased to announce it has made its first

commercial sale of ferro-molybdenum and has completed testing of

the production of ferro-vanadium.

As announced on 22 September 2021, the Company had started

conversion of its calcium molybdate product into the higher value

ferro-molybdenum. FAR are now pleased to announce that the first

commercial contract for sale has been signed.

The Company is now recovering around 4.5 tonnes per month of

ferro-molybdenum as a by-product from its recovery of vanadium from

bought-in concentrates and this is expected to grow as throughput

of the plant increases. The molybdenum is initially recovered as

calcium molybdate which was previously sold at a discount to

prevailing molybdenum prices, but this is now being converted and

sold as ferro-molybdenum, avoiding the discount.

In addition, the Company is pleased to announce that testing of

the production of ferro-vanadium using a similar process to

ferro-molybdenum has been successfully completed, allowing the

Company to choose in future whether to sell its vanadium production

as vanadium pentoxide or ferro-vanadium, depending on which is the

most profitable taking account of pricing and costs. Ferro-vanadium

typically sells for some US$3-$4 per kilogramme more than for the

same quantity of vanadium in vanadium pentoxide, roughly reflecting

conversion costs, but the ability to make ferro-vanadium opens up a

wider range of customers and, in particular, customers in

Kazakhstan which minimise transport costs and provide other fiscal

advantages.

The Company's full range of products available for sale now

consist of:

-- Ammonium metavanadate (AMV)

-- Vanadium pentoxide

-- Ferro-vanadium

-- Ferro-molybdenum

-- Nickel concentrates

Nick Bridgen, CEO, commented : "These are two important steps

towards maximising the value we get from our exiting operation, and

further demonstrates our growing technical expertise.

"With vanadium prices at a relatively high and stable level, and

with our growing production, our existing operations now fulfil

their objective of providing cash flows to support our feasibility

study and ongoing development of the Balasausqandiq deposit."

For further information, visit www.ferro-alloy.com or contact:

Ferro-Alloy Resources Nick Bridgen (CEO) info@ferro-alloy.com

Limited

+44 207 408 4090

Shore Capital Jerry Keen/Toby Gibbs

(Corporate Broker) +44 (0)203 005

VSA Capital Andrew Monk/Simon Barton 5000

St Brides Partners

Limited

(Financial PR & IR

Adviser) Catherine Leftley +44 207 236 1177

About Ferro Alloy Resources Limited:

The Company's operations are all located at the Balasausqandiq

deposit in Kyzylordinskaya Oblast in the South of Kazakhstan.

Currently the Company has two main business activities:

a) the high grade Balasausqandiq vanadium project (the

"Project"); and

b) an existing vanadium concentrate processing operation (the

"Existing Operation")

Balasausqandiq is a very large deposit, with vanadium as the

principal product together with several by-products. Owing to the

nature of the ore, the capital and operating costs of development

are very much lower than for other vanadium projects.

A reserve on the JORC 2012 basis has been estimated only for the

first ore-body (of five) which amounts to 23 million tonnes, not

including the small amounts of near-surface oxidised material which

is in the Inferred resource category. In the system of reserve

estimation used in Kazakhstan the reserves are estimated to be over

70m tonnes in ore-bodies 1 to 5 but this does not include the full

depth of ore-bodies 2 to 5.

There is an existing concentrate processing operation at the

site of the Balasausqandiq deposit. The production facilities were

originally created from a 15,000 tonnes per year pilot plant which

was then adapted to treat concentrates and expanded. Further

expansion is being undertaken which is expected to result in

annualised production capacity of around 1,500 tonnes of contained

vanadium pentoxide plus significant by-product molybdenum.

The strategy of the Company is to develop both the Project and

the Existing Operation in parallel. Although they are located on

the same site and use some of the same infrastructure, they are

separate operations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISFZMGMNLMGMZM

(END) Dow Jones Newswires

November 10, 2021 02:00 ET (07:00 GMT)

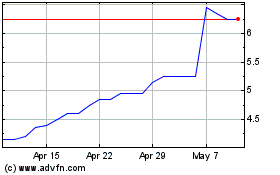

Ferro-alloy Resources (LSE:FAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ferro-alloy Resources (LSE:FAR)

Historical Stock Chart

From Apr 2023 to Apr 2024