TIDMFARN

RNS Number : 6496N

Faron Pharmaceuticals Oy

01 October 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH

AFRICA, SINGAPORE, HONG KONG OR ANY OTHER JURISDICTION IN WHICH

SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE EU REGULATION 596/2014 ("MAR") AND ARTICLE 7 OF

MAR AS INCORPORATED INTO UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN

UNION (WITHDRAWAL) ACT 2018 ("UK MAR").

THIS ANNOUNCEMENT IS ONLY DIRECTED AT PERSONS IN THE UNITED

KINGDOM THAT ARE QUALIFIED INVESTORS WITHIN THE MEANING OF ARTICLE

2(E) OF REGULATION 2017/1129/EU AS INCORPORATED INTO UK DOMESTIC

LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 THAT ARE

ALSO (I) INVESTMENT PROFESSIONALS FALLING WITHIN ARTICLE 19(5) OF

THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION)

ORDER 2005 (THE "ORDER") AND/OR (II) HIGH NET WORTH ENTITIES, AND

OTHER PERSONS TO WHOM IT MAY LAWFULLY BE COMMUNICATED, FALLING

WITHIN ARTICLE 49(2)(A) TO (E) OF THE ORDER (EACH SUCH PERSON BEING

REFERRED TO AS A "RELEVANT PERSON"). ACCORDINGLY, THIS ANNOUNCEMENT

AND ITS CONTENTS MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO

ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO

WHICH THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT

PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. PERSONS

INTO WHOSE POSSESSION THIS ANNOUNCEMENT COMES ARE REQUIRED TO

INFORM THEMSELVES ABOUT AND TO OBSERVE ANY SUCH RESTRICTIONS.

Faron Pharmaceuticals Ltd

("Faron" or the "Company")

Results of Placing and Issue Price

Capitalised terms used in this announcement have the meanings

given to them in the announcement made on 30 September 2021

regarding the proposed issue and placing of new ordinary shares in

the Company (the "Launch Announcement"), unless the context

provides otherwise.

Company announcement, 1 October 2021 at 7:00 a.m. BST / 9:00

a.m. EEST

Inside information

TURKU, FINLAND / BOSTON, MA - Faron Pharmaceuticals Ltd (First

North: FARON, AIM: FARN), the clinical stage biopharmaceutical

company, announces today that the Bookbuild, announced on 30

September 2021, is now closed. The Placing comprises the issue of

2,763,158 Placing Shares at an Issue Price of EUR 3.80 per Placing

Share, which represents a 9.4 % discount to the volume weighted

average price on 30 September 2021 on NASDAQ Helsinki First North

Growth.

The Placing Shares to be issued amount to approximately 5.5 % of

the issued shares and votes in the Company, immediately prior to

the Placing. The Company raised aggregate gross proceeds of EUR

10.5 million in the Placing. The Placing was supported by existing

shareholders as well as new investors. The European Investment

Council (EIC) Fund, which had given a pre-commitment, was among the

largest investors. With these proceeds and the current level of

activities the Company has sufficient working capital until Q3

2022.

" We are extremely pleased with the results of this Placing and

the interest we received from investors, including a second

significant investment from the European Investment Council Fund,"

said Toni Hänninen, Chief Financial Officer of Faron. "These funds

raised strengthen our balance sheet and will allow us to continue

accelerating our bexmarilimab and Traumakine development

programs."

"We are extremely pleased to continue supporting Faron with this

second share subscription in Faron Pharmaceuticals," commented José

Fernando Figueiredo, member of the EIC Fund Investment Committee.

"This follow-on investment witnesses the EIC Fund commitment in

accelerating the clinical development of the treatments for medical

conditions."

Use of Proceeds

The primary reason for conducting the Placing was to accelerate

and expand the clinical development of the Company's main drug

candidates, bexmarilimab and Traumakine(R) (intravenous interferon

beta-1a). Some proceeds will also be used for the manufacturing

processes of both drug candidates, and to strengthen the Company's

balance sheet.

The Placing Shares will confer a right to dividends and other

shareholder rights from their registration with the trade register

kept by the Finnish Patent and Registration Office (the "Trade

Register") which is expected to be on or about 1 October 2021 (the

"Registration"). Following the Registration, the Placing Shares

will subsequently be entered in the book-entry system maintained by

Euroclear Finland Oy and registered in the book-entry accounts of

each investor. Trading in the Placing Shares is expected to

commence on NASDAQ First North Growth and the AIM market of the

London Stock Exchange latest on or about 5 October 2021.

Following issue and Registration of the Placing Shares, the

number of shares in the Company will be 53,221,032 ordinary shares

with voting rights attached. The Company has no shares in treasury;

therefore, the total number of voting rights in Faron will be

53,221,032 (the "New Number of Shares and Votes"). This figure may

be used by shareholders as the denominator for the calculations by

which they will determine whether they are required to notify an

interest in, or a change to their interest in, the New Number of

Shares and Votes of the Company.

Related party transaction

Timo Syrjälä, an existing shareholder in the Company, has

subscribed for 1,312,000 Placing Shares in aggregate (subscribed

for through Acme Investments SPF Sarl ("Acme"), an entity wholly

owned by Mr Syrjälä), for an aggregate subscription value of EUR

5.0 million at the Issue Price. Following the Placing, Mr Syrjälä's

total holding in the Company's shares, which includes his indirect

holding through Acme, will be 8,873,402 shares, representing 16.7 %

of the New Number of Shares and Votes. Mr Syrjälä is a "Substantial

Shareholder" in the Company for the purposes of the AIM Rules for

Companies (the "AIM Rules"). His subscription for Placing Shares

pursuant to the Placing is a related party transaction for the

purposes of the AIM Rules. The Directors of the Company, all of

whom are independent of Mr Syrjälä, having consulted with Cairn

Financial Advisers LLP, the Company's nominated adviser for the

purposes of the AIM Rules, consider the terms of the participation

by Mr Syrjälä in the Placing to be fair and reasonable insofar as

shareholders are concerned.

The information contained within this notice constitutes inside

information stipulated under the Market Abuse Regulation (EU) No.

596/2014.

For more information please contact:

Faron Pharmaceuticals Ltd

Dr Markku Jalkanen, Chief Executive Officer

investor.relations@faron.com

Swedbank AB (publ), Finnish Branch, Financial Adviser

Mika Karikoski (Corporate Finance)

Phone: +358 (0)40 741 6959

Cairn Financial Advisers LLP, Nomad

Sandy Jamieson, Jo Turner

Phone: + 44 207 213 0880

Sisu Partners Oy, Certified Adviser on Nasdaq First North

Juha Karttunen

Phone: +358 40 555 4727

Jukka Järvelä

Phone: +358 50 553 8990

Peel Hunt LLP, Broker

Christopher Golden, James Steel

Phone: +44 (0) 20 7418 8900

Consilium Strategic Communications

Mary-Jane Elliott, David Daley, Lindsey Neville

Phone: +44 (0)20 3709 5700

faron@consilium-comms.com

Stern Investor Relations

Julie Seidel

Phone: +1 (212) 362-1200

julie.seidel@sternir.com

About Faron Pharmaceuticals Ltd.

Faron (AIM: FARN, First North: FARON) is a clinical stage

biopharmaceutical company developing novel treatments for medical

conditions with significant unmet needs caused by dysfunction of

our immune system. The Company currently has a pipeline based on

the receptors involved in regulation of immune response in

oncology, organ damage and bone marrow regeneration. Bexmarilimab,

a novel anti-Clever-1 humanized antibody, is its investigative

precision immunotherapy with the potential to provide permanent

immune stimulation for difficult-to-treat cancers through targeting

myeloid function. Currently in Phase I/II clinical development as a

potential therapy for patients with untreatable solid tumors,

bexmarilimab has potential as a single-agent therapy or in

combination with other standard treatments including immune

checkpoint molecules. Traumakine is an investigational intravenous

(IV) interferon beta-1a therapy for the treatment of acute

respiratory distress syndrome (ARDS) and other ischemic or

hyperinflammatory conditions. Traumakine is currently being

evaluated in global trials as a potential treatment for

hospitalized patients with COVID-19 and with the 59th Medical Wing

of the US Air Force and the US Department of Defense for the

prevention of multiple organ dysfunction syndrome (MODS) after

ischemia-reperfusion injury caused by a major trauma. Faron is

based in Turku, Finland. Further information is available at

www.faron.com.

About the European Innovation Council Fund

Established in June 2020, the European Innovation Council Fund

(EIC Fund) is a breakthrough initiative of the European Commission

to make direct equity and quasi-equity investments (between

EUR500.000 and EUR15 million) in European high impact and deep tech

start-ups and scale ups. With a long-term perspective, the EIC Fund

invests in companies from any sector, across all EU member states

as well as in associated countries.

The EIC Fund aims to fill a critical financing gap and its main

purpose is to support companies in the development and

commercialization of disruptive technologies. This is achieved by

crowding-in market players, and further sharing risk by building a

large network of capital providers and strategic partners suitable

for co-investments and follow-on funding.

IMPORTANT INFORMATION

Market Abuse Regulation

Market soundings, as defined in Regulation (EU) No 596/2014

("MAR"), were taken in respect of the proposed Placing with the

result that certain persons became aware of inside information, as

permitted by MAR. That inside information in relation to the

Placing is set out in this announcement and has been disclosed as

soon as possible in accordance with paragraph 7 of article 17 of

MAR. Therefore, those persons that received inside information in

such market sounding are no longer in possession of inside

information relating to the Company and its securities.

This announcement contains inside information for the purposes

of Article 7 of MAR and Article 7 of UK MAR.

MiFID II

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the Placing Shares have been subject to a product approval process,

which has determined that the Placing Shares are: (i) compatible

with an end target market of: (a) retail investors, (b) investors

who meet the criteria of professional clients and (c) eligible

counterparties (each as defined in MiFID II); and (ii) eligible for

distribution through all distribution channels as are permitted by

MiFID II (the "Target Market Assessment"). Notwithstanding the

Target Market Assessment, distributors should note that: the price

of the Placing Shares may decline and investors could lose all or

part of their investment; the Placing Shares offer no guaranteed

income and no capital protection; and an investment in the Placing

Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other adviser) are

capable of evaluating the merits and risks of such an investment

and who have sufficient resources to be able to bear any losses

that may result therefrom. The Target Market Assessment is without

prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the offer.

Caution regarding forward-looking statements

Certain statements in this announcement are, or may be deemed to

be, forward-looking statements. Forward-looking statements are

identified by their use of terms and phrases such as "believe",

"could", "should", "expect", "envisage", "estimate", "intend",

"may", "plan", "potentially", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward-looking statements reflect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

A number of factors could cause actual results to differ

materially from the results and expectations discussed in the

forward-looking statements, many of which are beyond the control of

the Company. In addition, other factors which could cause actual

results to differ materially include the ability of the Company to

successfully licence its programmes, risks associated with

vulnerability to general economic and business conditions,

competition, environmental and other regulatory changes, actions by

governmental authorities, the availability of capital markets or

other sources of funding, reliance on key personnel, uninsured and

underinsured losses and other factors. Although any forward-looking

statements contained in this announcement are based upon what the

Directors believe to be reasonable assumptions, the Company cannot

assure investors that actual results will be consistent with such

forward-looking statements. Accordingly, readers are cautioned not

to place undue reliance on forward-looking statements. Subject to

any continuing obligations under applicable law or any relevant AIM

Rule requirements, in providing this information the Company does

not undertake any obligation to publicly update or revise any of

the forward-looking statements or to advise of any change in

events, conditions or circumstances on which any such statement is

based.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROILMMTTMTTJTAB

(END) Dow Jones Newswires

October 01, 2021 02:00 ET (06:00 GMT)

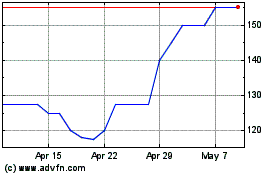

Faron Pharmaceuticals Oy (LSE:FARN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Faron Pharmaceuticals Oy (LSE:FARN)

Historical Stock Chart

From Apr 2023 to Apr 2024