Fulcrum Utility Services Ltd Market Update (7125S)

18 November 2021 - 1:09AM

UK Regulatory

TIDMFCRM

RNS Number : 7125S

Fulcrum Utility Services Ltd

17 November 2021

17 November 2021

FULCRUM UTILITY SERVICES LIMITED

("Fulcrum", the "Company" or "the Group")

Market Update

H1 trading in line with expectations; resilience to turbulence

in energy market

The Board notes the recent share price movement and turbulence

in the energy market and provides an update on the Group's

activities. The Company expects to publish its interim results on 2

December 2021 .

Highlights

-- Good progress in the first half of the year, with H1 trading in line with management expectations;

-- Revenues for the six months to 30 September 2021 increased by approximately 47% on the previous year to GBP28.6

million (H1 2020: GBP19.5 million), demonstrating a strong recovery following COVID's impact;

-- Adjusted EBITDA* of GBP1.0 million (H1 2020: loss of GBP1.0 million) in line with management expectations;

-- Order book growth of 44% up GBP24.8 million to GBP80.9 million as at 30 September 2021 (31 March 2021: GBP56.1

million), driven by securing a variety of significant new contract wins;

-- Successful completion of tranche three of the domestic gas assets transfer to ESP for a total consideration of

GBP3.8 million, with GBP3.7 million of this received in cash on 1 June 2021;

-- Net debt of GBP3.3 million (31 March 2021: GBP1.5 million) with headroom of GBP5.5 million on the Group's

Revolving Credit Facility at 30 September 2021; and

-- The business continues to demonstrate resilience within a volatile energy market.

*Adjusted EBITDA from continuing operations is operating profit

/ (loss) excluding the impact of exceptional items, other gains,

depreciation, amortisation and equity-settled share-based payment

charges.

Group operations remain insulated from current energy market

volatility

The Group notes the recent volatility in the UK energy market,

which has resulted in the failure of a number of energy suppliers

and Supplier of Last Resort requirements being enacted.

The Board is pleased to report that its multi-utility

contracting operations across the housing, Industrial &

Commercial, including EV connections, and utility ownership and

maintenance sectors have, to date, been unaffected by the current

energy crisis. The Board is confident that, currently, the Group's

smart metering business model, order book and delivery pipeline is

robust and resilient to the turbulence being felt in the energy

market.

Furthermore, the Board believes that although conditions for

energy suppliers are currently uncertain, the strong Government

stimulus and increasing regulatory framework are key market drivers

for the Group's smart metering business and, as such, it sees

significant and strategic growth opportunities for the Group in

this arena across all aspects of meter life.

Terry Dugdale, CEO, said:

"I am pleased with the Group's performance in the period and,

against the backdrop of ongoing turbulence in the energy market, I

am pleased with the resilience that we have shown which, I believe,

demonstrates the strength of our business model and diverse

operations.

With a growing and healthy order book, robust business model and

specialist energy infrastructure capabilities, we are well

positioned to capitalise on the many and significant opportunities

presented by the UK's transition to a net-zero future, and I am

excited by the Group's future growth prospects."

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

Enquiries:

Fulcrum Utility Services Limited +44 (0)114 280

Terry Dugdale, Chief Executive Officer 4150

Cenkos Securities plc (Nominated adviser and broker)

Camilla Hume / Callum Davidson (Nomad) / Michael +44 (0)20 7397

Johnson (Sales) 8900

Notes to Editors:

Fulcrum is a multi-utility infrastructure and services provider.

The Group operates nationally with its head office in Sheffield,

UK. It designs, builds, owns and maintains utility infrastructure

and offers smart meter exchange programmes.

https://investors.fulcrum.co.uk/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFDFLWEFSESF

(END) Dow Jones Newswires

November 17, 2021 09:09 ET (14:09 GMT)

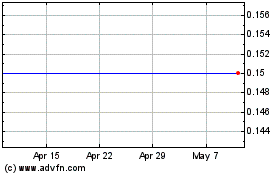

Fulcrum Utility Services... (LSE:FCRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

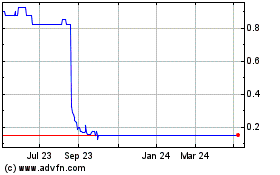

Fulcrum Utility Services... (LSE:FCRM)

Historical Stock Chart

From Apr 2023 to Apr 2024