TIDMFCRM

RNS Number : 3424U

Fulcrum Utility Services Ltd

01 August 2022

1 August 2022

FULCRUM UTILITY SERVICES LIMITED

("Fulcrum" or "the Group")

Final results for the year ended 31 March 2022 ("FY22")

Headlines:

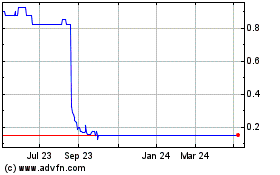

-- Revenue up 31.2% to GBP61.8 million (2021: GBP47.1 million)

-- Adjusted EBITDA(1) of GBP0.5 million (2021: GBP0.1 million)

-- Loss before tax of GBP14.2 million (2021: GBP11.5 million)(2)

-- Cash outflow from operating activities of GBP7.6 million (2021: GBP2.4 million)

-- Adjusted earnings per share of (1.4)p (2021: (0.9)p) and

basic earnings per share of (5.2)p (2021: (4.6)p)

-- Net cash of GBP11.2 million as at 31 March 2022 (2021: GBP1.5 million net debt)

-- Debt facility headroom of GBP10 million as at 31 March 2022 (2021: GBP4.3 million)

-- Net assets of GBP45.9 million (2021: GBP35.4 million)

(1) Adjusted EBITDA is operating loss excluding the impact of

exceptional items, other net gains, depreciation, amortisation and

equity-settled share-based payment charges.

(2) Includes GBP10.6 million of exceptional items (2021: GBP8.5

million), including GBP5.6 million for onerous contracts (2021:

GBPnil)

Commenting on the full year results, Antony Collins, Chief

Executive Officer, said:

"I was delighted to have the opportunity to join the Group in

January 2022. Whilst, as with most businesses, Fulcrum is not

without challenges, I strongly believe the business has the

essential capabilities to be successful in an exciting and growing

marketplace.

"Despite the significant challenges presented to the Group this

year, including the impact of the UK's energy crisis and wider,

very difficult trading conditions, I am confident that Fulcrum can

grow and be successful in several exciting and growing markets. At

the same time, the new executive team is identifying improvement

opportunities and ensuring optimal performance to deliver

long-term, sustainable growth for the benefit of all

shareholders.

"The Group's medium to long-term growth also remains underpinned

by strong market drivers and government stimulus. These, I believe,

position Fulcrum well to benefit from the UK's transition to a low

carbon economy and a net-zero future."

This announcement contains inside information.

Enquiries:

Fulcrum Utility Services Limited +44 (0)114 280

Antony Collins, Chief Executive Officer 4150

Cenkos Securities plc (Nominated adviser and broker)

Camilla Hume / Callum Davidson (Nomad) / Michael +44 (0)20 7397

Johnson (Sales) 8900

Notes to Editors:

Fulcrum is a multi-utility infrastructure and services provider.

The Group operates nationally with its head office in Sheffield,

UK. It designs, builds, owns, and maintains utility infrastructure

and offers smart meter exchange programmes.

https://investors.fulcrum.co.uk/

Chair's statement

As has been widely reported, FY22 was a challenging year for the

UK's energy infrastructure sector and Fulcrum has not been immune

to this. Whilst the Group initially experienced a strong recovery

from the impact of Covid-19 and positive progress was made in the

first half of the year, the impact of difficult market conditions

is reflected in the Group's overall performance for the full

year.

Results

It was pleasing that Fulcrum's first half financial performance

was in line with management's expectations, and significantly ahead

of the first half of the prior year. The Group also secured a

strong succession of its largest ever contract wins.

Notwithstanding this positive start to the year, with the

Group's diverse business operations initially helping to insulate

it from the energy crisis, the sustained turbulence in the energy

market, coupled with wider market issues of supply chain pressure

and cost inflation in materials and labour, along with exceptional

costs, significantly affected the Group's profitability in the

final quarter of the year.

Revenue for the year ended 31 March 2022 was slightly ahead of

market expectations at GBP61.8 million, representing year-on-year

growth of 31.2%, with adjusted EBITDA for the same period at GBP0.5

million. Adjusted EBITDA is operating loss of GBP13.7 million,

excluding the impact of exceptional items of GBP10.6 million

(including GBP5.6 million for onerous contracts), other net gains

of GBP0.3 million, depreciation and amortisation of GBP3.3 million

and an equity-settled share-based payment charge of GBP0.6

million.

I would like to express my personal thanks to all of our people

for their hard work, efforts and resilience in what has been

another year of difficult market conditions.

Impact of the UK's energy crisis and challenging trading

conditions

Since the Group's successful fundraise in December 2021, the UK

energy market has continued to experience considerable turbulence.

Predominantly, this affected the performance and profitability of

the Group's meter exchange operations.

Wider market issues of supply chain pressure and cost inflation

in materials and labour also weighed on the profitability of the

Group's multi-utility contracting operations, especially in its

major electrical and multi-utility projects, which are inherently

complex and longer term in nature.

The Board expects that whilst the challenges in the energy

market and the difficult market conditions continue, the Group's

order book will also soften, and this is reflected in the order

book value of GBP48 million(1) as at 31 March 2022. We have put

appropriate actions and controls in place to mitigate risk and

protect the business whilst the UK's energy crisis and challenging

market conditions prevail.

(1) Orderbook value excluding metering's onerous contracts

A refocus on our core strategy

The Group has refocused its attention on its core multi-utility

contracting and asset ownership growth strategy and the Board has

put in place a new executive team to execute it.

The Board believes that there is a significant opportunity for

the Group to grow its multi-utility contracting operations across

the housing and industrial & commercial, including electric

vehicle connections, sectors. The Board further believes that the

Group's essential and niche capabilities position it well for

future growth and that this belief is underpinned by the long-term

strategic tailwinds of the UK's utility and energy infrastructure

needs now, and for its net-zero future.

The Group's network of utility assets, valued in excess of GBP36

million as at 31 March 2022, continue to generate recurring income

and provide attractive and predictable long-term returns. The Board

continues to believe that additional asset ownership presents a

significant growth opportunity for the Group.

To support the execution of our asset growth strategy, Fulcrum

announced on 15 December 2021 that it had raised gross proceeds of

GBP20.05 million by way of a conditional placing and subsequently

raised gross proceeds of approximately GBP1.2 million through an

open offer. The Board is grateful for the continued support of

existing investors. We are mindful that, whilst presenting risks,

the current instability in the energy market produces opportunities

for the Group to acquire additional asset portfolios at attractive

valuations and as such the Board is continuing to identify and

review potential asset acquisition opportunities.

At the same time, the Board is mindful of maintaining balance

sheet strength, and supporting the Group's liquidity remains a

priority. As such, the Group became debt free in the year, and all

planned tranches of the asset sale to ESP were also successfully

delivered.

Changes to our team

The Board appointed Antony Collins as CEO in January 2022.

Antony has a strong background in business turnaround and his focus

has been to improve business operations and refocus the Group on

its core utility infrastructure and asset ownership growth strategy

and, since joining Fulcrum, he has put in place a strong and

experienced executive team to lead the Group. Stuart Crossman

joined the Group in January 2022 as COO and is a Chartered Engineer

with over 40 years in multi-utilities and has vast experience in

asset management, operational performance and health and safety and

Jonathan Jager joined the Group as CFO in February 2022. Jonathan

is a highly experienced CFO with over 20 years' experience of

developing high performing finance functions within the energy

sector.

The new team is focused on executing the Group's core

multi-utility and utility asset growth strategy and the Board is

pleased to report that business improvements are being delivered

that will both protect the business in the current market climate

and support the Group's long-term, sustainable growth.

ESG and sustainability

We are committed to using our capabilities to support the UK's

net-zero revolution, and to also reduce the impact of the Group's

operations on climate change. Fulcrum remains on its journey to be

carbon neutral by 2030.

Dividend

Considering the full year performance and the continuing

turbulence in the Group's core markets, the Board will not be

recommending the payment of a dividend in respect of the financial

year ended 31 March 2022 but will continue to keep its dividend

policy under review.

Outlook

Despite the current difficult trading conditions and the UK's

energy crisis, market fundamentals, supported by government

stimulus that underpins the UK's transition to a low carbon

economy, remain strong and, the Board believes, continue to provide

significant and strategic growth opportunities for the Group across

the diverse sectors it operates in.

Whilst the Board is mindful of the ongoing volatility in the UK

energy market, we are confident that the Group remains well

positioned to successfully grow in the long term. Fulcrum has the

essential experience and

capabilities needed to support the expansion of the UK's energy

infrastructure, which is needed now, and to achieve our net-zero

future. The Board remains excited by the opportunities this

presents.

Jennifer Babington

Non-executive Chair

1 August 2022

Chief Executive Officer's statement

2022 review

I was delighted to have the opportunity to join the Group in

January 2022. Whilst, as with most businesses, Fulcrum is not

without challenges, I strongly believe the business has the

essential capabilities to be successful in an exciting and growing

marketplace.

In the year under review, the Group began to recover from the

impact of Covid-19 and, in line with its stated growth strategy,

secured several of its largest ever contracts.

However, the sustained effects of the UK's energy crisis and

wider market issues of supply chain pressure and cost inflation

presented significant challenges to the Group's operations. This

affected the profitability of the

Group's multi-utility contracting business and its meter

exchange operations, particularly in the final quarter of the

year.

Since joining the business, my immediate priority has been to

protect and improve margins and refocus the Group on its core

utility infrastructure and asset ownership growth strategy. To

support me in doing this, the Board and I also appointed a new,

highly experienced, executive team to lead the Group.

Acting quickly to protect the business, the executive team has

identified contracts where performance and profitability were

materially affected by adverse market conditions and agreed to

mutually terminate them to protect the business by mitigating their

impact on the Group and its performance.

Delivering growth in core markets

In line with the Board's strategy, the new executive team is

actively reviewing the Group's activities to ensure it performs

optimally, identifying opportunities to improve profitability, and

ensuring Fulcrum remains focused on delivering its core strategy

and achieving sustainable growth for the benefit of all

shareholders.

Despite the challenges presented by the current difficult

trading conditions, Fulcrum has, I believe, the essential

capabilities required to be successful and achieve long-term growth

in what are exciting and growing markets.

In terms of its core multi-utility contracting and asset

ownership growth strategy:

1. The Group is well established and has a diverse multi-utility

contracting business. It operates across a variety of sectors,

nationally, and is one of only a few businesses that can deliver

all sizes and complexity of utility infrastructure, including high

voltage electrical infrastructure, designed, and delivered through

the Group's Dunamis business. The limited market share that the

Group has in each of these markets presents a sizeable opportunity

for growth.

2. The Group's network of utility assets, valued in excess of

GBP36 million as at 31 March 2022, continues to generate recurring

income and provide attractive and predictable long-term returns.

Additional asset ownership presents a significant growth

opportunity for the Group and, whilst presenting risks, the current

instability in the energy market produces opportunities to acquire

additional asset portfolios at attractive valuations.

To underpin the execution of our core growth strategy, in

December 2021 gross proceeds of GBP20.05 million were raised by way

of conditional placing and gross proceeds of approximately GBP1.2

million were through an open offer. We also successfully completed

the planned tranches of the asset sale to ESP for a total

consideration of GBP6.7 million in the year.

Progress on asset growth strategy

Further to the successful fundraise, the Group is pleased to

confirm that, in line with its asset growth strategy, it acquired

an Industrial & Commercial gas meter asset portfolio on 29 July

2022.

This acquisition, at a consideration of GBP0.6 million, follows

a due diligence process and provides the Group with additional

assets that generate recurring income and provide attractive and

predictable returns. The Group also continues to search for, and

review, potential additional asset acquisition opportunities and is

at varying stages of discussion and due diligence with several

prospects.

Financial performance and results

Total revenue increased year on year by GBP14.7 million to

GBP61.8 million (2021: GBP47.1 million) as the business recovered

well from the impacts of Covid-19. Infrastructure revenues were 33%

higher than the previous year at GBP57.6 million (2021: GBP43.4

million). Utility asset ownership revenues were 14% higher than the

previous year at GBP4.2 million (2021: GBP3.7 million).

The Group incurred an operating loss of GBP13.7 million for the

year (2021: GBP11.2 million). This loss includes exceptional costs

of GBP10.6 million (2021: GBP8.5 million), depreciation and

amortisation of GBP3.3 million (2021: GBP3.7 million), a

share-based payment charge of GBP0.6 million (2021: GBP0.4 million)

offset by other net gains of GBP0.3 million (2021: GBP1.4 million).

Exceptional costs include the income statement impact of the

impairment of our utility asset portfolio of GBP1.9 million (2021:

GBP1.9 million) as a result of an independent, external valuation

of those assets at year end, GBP2.3 million impairment of

intangible assets (2021: GBP4.9 million) and GBP5.6 million of

onerous contracts (2021: GBPnil) related to losses from the Group's

smart meter exchange and management contracts with energy suppliers

and the loss for a complex, high voltage infrastructure project.

Other net gains of GBP0.3 million (2021: GBP1.4 million) relate to

the profit on sale of utility assets to ESP and related enhanced

payments from ESP as the Group met certain trigger points in

respect of new domestic connection wins.

Adjusted EBITDA(1) for the year increased to GBP0.5 million from

GBP0.1 million in the prior year. Adjusted EBITDA was affected by a

dilution of the gross margin, particularly as cost of materials

were impacted by significant inflationary effects, and the impact

of the turbulent energy sector making trading conditions more

challenging in the second half of the year and predominantly in the

last quarter of the year. However, mobilisation on larger projects

improved as expected as customers regained confidence post

Covid-19, resulting in increasing revenues in the year, whilst

fixed operational costs continued. Administrative expenses

(excluding exceptional items) reduced by 5%, as the business

applied greater cost controls on discretionary spending.

(1) Adjusted EBITDA is operating loss excluding the impact of

exceptional items, other net gains, depreciation, amortisation, and

equity-settled share-based payment charges

Liquidity and net cash

The Group's trading performance for the year has resulted in a

cash outflow from operating activities of GBP7.6 million (2021:

GBP2.4 million). The Group places a high priority on cash

generation and the active management of working capital. As at 31

March 2022, the Group had net cash of GBP11.2 million (2021: GBP1.5

million net debt).

Net cash inflow from investing activities was GBP1.4 million

(2021: GBP3.8 million outflow), benefiting from GBP7 million of net

receipts (GBP6.5 million received for planned tranche sales and an

enhanced payment milestone of GBP0.6 million) from the disposal of

utility assets (2021: GBP5 million), partly offset by investment in

utility and other assets of GBP5.6 million (2021: GBP8

million).

Net cash inflow from financing activities of GBP13.4 million

(2021: GBP5.7 million outflow) was predominantly due to the

successful share issue that raised a net GBP20.6 million, less the

net repayment of the Revolving Credit Facility (RCF) totalling

GBP5.7 million, and GBP1.4 million in lease and interest payments

(2021: GBP1.2 million). Net cash outflow from exceptional items was

GBP1.6 million (2021: GBP1.2 million). The cash proceeds from

further asset sales, along with our prudent financial discipline,

will enable Fulcrum to maintain a strong balance sheet and will

support the generation of cash in the future.

Reserves and net assets

Net assets increased by GBP10.5 million during the year to

GBP45.9 million (2021: GBP35.4 million), primarily resulting from

increasing contract assets to GBP20.2 million (2021: GBP15.6

million) and an improved cash balance of GBP11.2 million (2021:

GBP3.9 million). The Group received a net revaluation gain on the

utility asset portfolio of GBP1.9 million (2021: GBP3.8 million net

impairment). Net assets per share at 31 March 2022 were 11.5p per

share (2021: 15.9p).

As at 31 March 2022, the issued share capital of the Company was

399,313,458 ordinary shares (2021: 222,117,945) with a nominal

value of GBP339,313 (2021: GBP222,118). At the end of the year, the

Group operated one Save As You Earn (SAYE) scheme.

Housing

The Group designs, installs and delivers new electricity, gas,

water and fibre connections to provide a complete multi-utility

service for homebuilders across mainland UK. Fulcrum is a

well-established brand in the housing market and works with various

UK housebuilders of all sizes, with the Group's expertise and

credibility offering added value and reassurance for

developers.

The Group's multi-utility infrastructure expertise has become

increasingly vital to homebuilders of all sizes, as we offer advice

and support on how to ensure new utility infrastructure is designed

and installed to meet emerging needs, like EV charging, powering

energy generating infrastructure such as heat pumps, and meeting

regulatory requirements, like the Future Homes Standard. The

essential support we provide to homebuilders saw Fulcrum win the

"Highly Commended" title in the Subcontractor/Service Provider of

the Year category at the Housebuilder Awards 2021.

We selectively tender on new opportunities in line with our

margin strategy and, in the year, secured a healthy flow of new

contract wins, including some of the Group's largest ever new

housing developments. Adversely, these larger sites were the most

affected by the ongoing difficult trading conditions of supply

chain pressure and cost inflation in materials and labour, by being

inherently more complex and more long-term in nature.

Mid to long-term market drivers remain strong in the housing

sector. The UK's current undersupply of housing remains well

documented and bridging the housing gap is supported by strong

government incentives. This presents substantial potential growth

opportunities for the Group.

Industrial and commercial (I&C) including electric vehicle

(EV) and high voltage (HV) connections

The Group provides multi-utility infrastructure for all sizes

and complexities of I&C and EV projects. The Group's ability to

design and build I&C multi-utility and EV charging

infrastructure of all sizes and complexities, particularly niche

high voltage (132kV) electricity infrastructure, delivered through

the Group's Dunamis business, is an important differentiator for

the Group. Fulcrum also selectively adopts and owns I&C gas and

electricity utility assets in line with our asset growth

strategy.

The Group used its capabilities to secure a variety of major

multi-utility and EV charging infrastructure projects in the

period, supporting projects of national significance. These were

selectively tendered on in line with the Group's margin strategy

but, like the large housing contracts secured, these were most

severely impacted by supply chain pressure and cost inflation by

being significantly complex, and longer-term contracts. As part of

our ongoing business improvement review, we identified a materially

loss-making complex, high voltage infrastructure project which has

been provided for within exceptional items in cost of sales.

The I&C market, including EV connections, presents some

hugely exciting opportunities for the Group and medium to long-term

market growth drivers are very strong. Electricity is a key enabler

in decarbonising the economy cost effectively by 2050, and demand

for electrical infrastructure to power the EV charging network,

renewable energy generating equipment and battery storage

infrastructure, essential to transition to net zero, is expected to

grow rapidly.

This increased need for more electrical infrastructure is

essential to transition to net zero, and Fulcrum remains one of a

limited number of businesses in the UK with the essential

capabilities required to facilitate this.

Maintenance and ownership

The Group's ability to adopt, own and maintain the UK's

essential utility infrastructure is fundamental to our growth

strategy.

The utility assets we own continue to provide a healthy

recurring income and deliver attractive and predictable long-term

returns, and we continued to adopt additional I&C utility

assets in the year, adding them to our income generating

portfolio.

Additional utility asset ownership presents a significant growth

opportunity for the Group and, whilst we are cognisant that the

current market conditions present risk, the current instability in

the market also presents opportunities to acquire asset portfolios

at attractive valuations. Additionally, the current and future

proceeds from the asset sale agreement with ESP provide the Group

with additional financial strength that underpins our asset

ownership growth ambitions and the execution of our strategy.

Our high voltage electrical maintenance capabilities, delivered

though our Maintech Power business, are niche, and will be

essential to maintain the additional electrical and renewable

energy generating infrastructure the UK needs to achieve net

zero.

Smart metering

The UK's energy crisis has presented considerable challenges for

our smart metering operations in the year, affecting the

performance and profitability of the Group's various smart meter

exchange and management contracts.

The sustained volatility and turbulence in the market affected

the performance and profitability of the Group's smart meter

exchange and management contracts with energy suppliers. The

contracts were deeply impacted in the second half of the year,

primarily resulting from the insolvency of several of the Group's

other, smaller energy supplier customers and one of the Group's

labour-only sub-contractors.

After the year end, we agreed to mutually terminate contracts

affected by the UK energy crisis to protect the business by

mitigating their impact on the Group and its performance.

Delivering contracts safely

Maintaining the highest standards of health and safety remains

our highest priority. A safety-first strategy is in place to ensure

zero harm and, although this is well embedded into our culture and

operations, we are never complacent and are committed to continuous

improvement in health and safety performance.

Antony Collins

Chief Executive Officer

1 August 2022

Consolidated statement of comprehensive income

for the year ended 31 March 2022

Year ended Year ended

31 March 31 March

2022 2021

Notes GBP'000 GBP'000

Revenue 61,846 47,054

Cost of sales -- underlying (50,149) (35,211)

Cost of sales -- exceptional items 4 (5,422) (2,050)

Total cost of sales (55,571) (37,261)

Gross profit 6,275 9,793

Administrative expenses -- underlying (15,094) (15,912)

Administrative expenses -- exceptional items 4 (5,202) (6,400)

Total administrative expenses (20,296) (22,312)

Other net gains 5 330 1,353

Operating loss 6 (13,691) (11,166)

Net finance expense (496) (293)

Loss before taxation (14,187) (11,459)

Taxation 7 765 1,178

Loss for the year attributable to equity holders of the parent (13,422) (10,281)

Other comprehensive income

Items that will never be reclassified to profit or loss:

Revaluation of utility assets 10 4,252 1,569

Surplus arising on utility assets internally adopted in the year 10 57 338

Impairment of previously revalued utility assets (477) (3,548)

Deferred tax on items that will never be reclassified to profit or loss (1,083) 560

Total comprehensive expense for the year (10,673) (11,362)

Loss per share attributable to the owners of the business

Basic 9 (5.2)p (4.6)p

Diluted 9 (5.1)p (4.5)p

Adjusted EBITDA is the basis that the Board uses to measure and

monitor the Group's financial performance as it is a more accurate

reflection of the commercial reality of the Group's business.

Further details of Alternative Performance Measures are included in

note 3.

Operating loss (13,691) (11,166)

Equity-settled share-based payment charge 639 436

Other net gains 5 (330) (1,353)

Exceptional items within operating loss 4 10,624 8,450

Depreciation and amortisation 10, 12, 13 3,257 3,739

Adjusted EBITDA 499 106

Surplus arising on sale of domestic utility assets and enhanced payments 5 330 1,353

Adjusted EBITDA including sale of domestic utility assets and enhanced payments 829 1,459

Consolidated statement of changes in equity

for the year ended 31 March 2022

Share Share Revaluation Merger Retained Total

capital premium reserve Restated(1) reserve earnings Restated(1) equity

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 March 2020 222 389 11,549 11,347 22,800 46,307

Total comprehensive income

for the year

Loss for the year -- -- -- -- (10,281) (10,281)

Revaluation surplus on

external valuation of

utility assets -- -- 1,569 -- -- 1,569

Surplus arising on utility

assets internally adopted

in the year 10 -- -- 338 -- -- 338

Disposal of previously

revalued assets 5 -- -- (574) -- 574 --

Depreciation on previously

revalued assets -- -- (342) -- 342 --

Exceptional items -- fixed

asset impairment -- -- (3,548) -- -- (3,548)

Deferred tax in respect of

items that will never be

reclassified to profit

and loss -- -- 560 -- -- 560

Transactions with equity

shareholders

Equity-settled share-based

payment credit -- -- -- -- 436 436

Balance at 31 March 2021 222 389 9,552 11,347 13,871 35,381

Restatement of opening

balances(1) -- -- (671) -- 671 --

-------------------------- ----- -------- -------- -------------------- -------- --------------------- --------

Balance at 31 March 2021

(restated) (1) 222 389 8,881 11,347 14,542 35,381

Total comprehensive income

for the year

Loss for the year -- -- -- -- (13,422) (13,422)

Revaluation surplus on

external valuation of

utility assets 10 -- -- 4,252 -- -- 4,252

Surplus arising on utility

assets internally adopted

in the year 10 -- -- 57 -- -- 57

Disposal of previously

revalued assets 5 -- -- (1,445) -- 1,445 --

Depreciation on previously

revalued assets -- -- (179) -- 179 --

Additional costs allocated

to previously revalued

assets -- -- (37) -- -- (37)

Exceptional items -- fixed

asset impairment -- -- (477) -- -- (477)

Deferred tax in respect of

items that will never be

reclassed to profit and

loss -- -- (1,083) -- -- (1,083)

Transactions with equity

shareholders

Equity-settled share-based

payment credit -- -- -- -- 639 639

Issue of new shares net of

transaction costs 177 20,388 -- -- -- 20,565

Balance at 31 March 2022 399 20,777 9,969 11,347 3,383 45,875

(1) The revaluation reserve and retained earnings have been

restated to reallocate fair value gains and losses between these

reserves in relation to disposals of utility assets in previous

years. As such, the balance sheet as at 31 March 2021 has been

restated. There is no impact on net assets.

Consolidated balance sheet

as at 31 March 2022

31 March 31 March

2022 2021 Restated(1)

Notes GBP'000 GBP'000

Non-current assets

Property, plant and equipment 10 37,151 37,314

Intangible assets 12 15,597 18,907

Right-of-use assets 13 2,323 3,081

Deferred tax assets 7 3,495 2,710

58,566 62,012

Current assets

Contract assets 20,177 15,640

Inventories 433 438

Trade and other receivables 9,620 6,550

Cash and cash equivalents 16 11,176 3,934

41,406 26,562

Total assets 99,972 88,574

Current liabilities

Trade and other payables (15,825) (12,669)

Contract liabilities (25,272) (27,098)

Current lease liability 13 (802) (996)

Current provisions 17 (3,035) (54)

(44,934) (40,817)

Non-current liabilities

Non-current lease liability 13 (1,873) (2,382)

Borrowings 15 -- (5,483)

Non-current provisions 17 (1,296) --

Deferred tax liabilities 7 (5,994) (4,511)

(9,163) (12,376)

Total liabilities (54,097) (53,193)

Net assets 45,875 35,381

Equity

Share capital 14 399 222

Share premium 20,777 389

Revaluation reserve 9,969 8,881

Merger reserve 11,347 11,347

Retained earnings 3,383 14,542

Total equity 45,875 35,381

(1)The balance sheet has been restated to reflect a reallocation

between the revaluation reserve and retained earnings. There is no

impact on net assets.

The financial statements were approved by the Board of Directors

on 1 August 2022 and were signed on its behalf by:

Jennifer Babington

Non-executive Chair

Company number FC030006

Consolidated cash flow statement

for the year ended 31 March 2022

Year ended Year ended

31 March 31 March

2022 2021

Notes GBP'000 GBP'000

Cash flows from operating activities

Loss for the year after tax (13,422) (10,281)

Tax credit 7 (765) (1,178)

Loss for the year before tax (14,187) (11,459)

Adjustments for:

Depreciation 10, 13 1,832 1,919

Amortisation of intangible assets 12 1,425 1,820

Exceptional items -- fixed asset impairment 4 1,920 1,857

Exceptional items -- intangible asset impairment 4, 12 2,309 4,935

Net finance expense 496 293

Equity-settled share-based payment charge 639 436

Loss/(profit) on disposal of utility assets 5 75 (873)

Gain on IFRS 16 lease modification 13 (16) --

Additional consideration receivable from previous utility asset sales 5 (259) --

Increase in contract assets (4,537) (3,361)

Increase in trade and other receivables (3,154) (201)

Decrease in inventories 5 8

Increase in trade and other payables 3,370 2,995

Decrease in contract liabilities (1,826) (807)

Increase/(decrease) in provisions 17 4,277 (4)

Cash outflow from operating activities (7,631) (2,442)

Tax repaid/(paid) 12 (108)

Net cash outflow from operating activities (7,619) (2,550)

Cash flows from investing activities

Acquisition of external utility assets (2,468) (3,958)

Utility assets internally adopted (2,475) (3,503)

Acquisition of plant and equipment 10 (242) (87)

Acquisition of intangibles 12 (424) (140)

Proceeds on disposal of utility assets 5 6,487 4,578

Receipt of deferred consideration on disposal of utility assets 642 670

Costs paid in relation to disposal of subsidiary -- (1,245)

Costs paid in relation to disposal of utility assets (141) (102)

Proceeds on disposal of assets -- other -- 9

Additional consideration received from previous utility asset sales 49 --

Net cash inflow/(outflow) from investing activities 1,428 (3,778)

Cash flows from financing activities

Proceeds from issue of ordinary shares 14 21,263 --

Share issue transaction costs (698) --

Borrowings received 15 5,250 5,700

Borrowings repaid 15 (10,950) (10,000)

Prepaid arrangement fees (11) (247)

Interest paid and banking charges (non-IFRS 16) (297) (153)

IFRS 16 -- principal payments 13 (1,022) (861)

IFRS 16 -- deposit payments -- (11)

IFRS 16 -- interest payments 13 (121) (139)

IFRS 16 -- proceeds received on disposal of leased vehicle 13 19 --

---------------------------------------------------------------------- ------ ---------- ----------

Net cash inflow/(outflow) from financing activities 13,433 (5,711)

Increase/(decrease) in net cash and cash equivalents 7,242 (12,039)

Cash and cash equivalents at the beginning of the year 3,934 15,973

Cash and cash equivalents at the end of the year 16 11,176 3,934

1. Accounting policies

The principal accounting policies adopted in the preparation of

these financial statements are set out below.

Basis of preparation

The financial information set out in this preliminary

announcement has been derived from the Group's consolidated

financial statements for the years ended 31 March 2022 and 31 March

2021. The audited financial information included in this

preliminary results announcement for the year ended 31 March 2022

and audited information for the year ended 31 March 2021 does not

comprise statutory accounts within the meaning of section 434

Companies Act 2006. The information has been extracted from the

audited non statutory financial statements for the year ended 31

March 2022 which will be delivered to the Registrar of Companies in

due course. Non statutory financial statements for the year ended

31 March 2021 were approved by the Board of directors and have been

delivered to the Registrar of Companies. The report of the

independent auditors for the year ended 31 March 2022 and 2021

respectively on these financial statements were unqualified.

Whilst the financial information included in this preliminary

announcement has been prepared on the basis of the requirements of

International Financial Reporting Standards as adopted by the

United Kingdom, this announcement does not itself contain

sufficient information to comply with IFRS.

The financial statements have been prepared on the historical

cost basis except for the revaluation of certain non-current

assets. Historical cost is generally based on the fair value of the

consideration given in exchange for assets.

Going concern

At 31 March 2022 the Group had net assets of GBP45.9 million

(2021: GBP35.4 million), net current liabilities of GBP3.5 million

(2021: GBP14.3 million), cash of GBP11.2 million (2021: GBP3.9

million) and borrowings of GBPnil (2021: GBP5.5 million) as set out

in the consolidated balance sheet. In the year ended 31 March 2022,

the Group suffered a loss after tax of GBP13.4 million (2021:

GBP10.3 million) and had net cash inflows of GBP7.2 million (2021:

net cash outflows of GBP12.0 million) after investing GBP4.9

million in utility assets (2021: GBP7.5 million) and repaying a net

GBP5.7 million of borrowings (2021: GBPnil).

These financial statements are prepared on the basis that the

Group is a going concern. In forming its opinion as to going

concern, the Board has prepared cash flow forecasts based upon its

assumptions with particular consideration of the key risks and

uncertainties, as well as taking into account available borrowing

facilities. The going concern period assessed is until 30 September

2023 which has been selected as it can be projected with a good

degree of expected accuracy.

The Group successfully completed a share placing in December

2021 generating gross proceeds of GBP21.3 million to help fund the

Group's continued growth strategy. Consequently the Group re-paid

its Revolving Credit Facility (RCF) in full on 1 January 2022. The

RCF of GBP10 million remains available up to 30 November 2022,

although the Group currently has no plans to utilise this facility.

This facility includes two financial covenants; ratio of total debt

to EBITDA and ratio of the market value of pipeline assets to total

debt. The forecasts, as approved by the Board, satisfy these

financial covenants with reasonable levels of headroom.

The forecasts prepared reflect a cautious view on continued

sector growth and include a range of sensitivities including a

severe but plausible scenario together with mitigating actions.

Changes to the principal assumptions included a reduction in EBITDA

of approximately 40%. Even under the downside scenario, the Group

continues to project sufficient cash reserves, continues to operate

with headroom on borrowing facilities and associated covenants, and

has additional mitigation measures within management's control, for

example accelerating cash receipts and reducing operating costs,

that could be deployed to create further cash. To further test the

sensitivity, the Group also considered a more severe downside

scenario that reflected even further deterioration in operational

and commercial performance. Under this scenario, the Group forecast

a cash low point in the second half of 2023, but the management

team are confident that it has various immediate mitigating levers

that would avoid, and sufficiently alleviate, this position.

Based on these considerations, together with the Directors'

knowledge and experience of the markets in which the Group

operates, the Directors considered it appropriate to adopt the

going concern basis of accounting in the preparation of the Group's

financial statements.

Adoption of new and revised International Financial Reporting

Standards (IFRSs) and IFRIC interpretations

The Group has applied the following standards and amendments for

the first time for its annual reporting period commencing 1 April

2021:

-- Amendments to IAS 1 "Presentation of Financial Statements";

-- Amendments to IFRS 3 "Business Combinations";

-- Amendments to IFRS Practice Statement 2 "Making Materiality Judgements";

-- Amendments to IAS 8 "Accounting Policies, Changes in Accounting Estimates and Errors"; and

-- Amendments to IAS 12 "Income Taxes".

Their adoption has not had any material impact on the

disclosures or on the amounts reported. Certain new accounting

standards and interpretations have been published that are not

mandatory for 31 March 2022 reporting periods and have not been

early adopted by the Group. These standards are not expected to

have a material impact on the entity in the current or future

reporting periods and on foreseeable future transactions.

2. Operating segments

The Board has been identified as the chief operating

decision-maker (CODM) as defined under IFRS 8 "Operating Segments".

The Directors consider there to be two operating segments,

Infrastructure: Design and Build and Utility assets: Own and

Operate. Fulcrum's Infrastructure: Design and Build segment

provides utility infrastructure and connections services. Utility

assets: Own and Operate comprises both the ownership of gas,

electrical and meter assets and the safe and efficient conveyance

of gas and electricity through its transportation networks. Gas

transportation services are provided under the iGT licence granted

from Ofgem in June 2007 and electricity services are provided under

the iDNO licence granted from Ofgem in November 2017.

The information provided to the Board includes management

accounts comprising operating result before exceptional items for

each segment and other financial and non-financial information used

to manage the business on a consolidated basis.

Year ended 31 March

Year ended 31 March 2022 2021

----------------------------------- -----------------------------------

Utility Infrastructure: Utility

Infrastructure: assets: Design assets:

Design and Own and Total and Own and Total

Build Operate Group Build Operate Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------------- --------------- -------- -------- --------------- -------- --------

Reportable segment revenue 57,631 4,215 61,846 43,400 3,654 47,054

Adjusted EBITDA* (1,557) 2,056 499 (969) 1,075 106

Other net gains 146 184 330 480 873 1,353

Share-based payment charge (639) - (639) (436) - (436)

Depreciation and amortisation (2,606) (651) (3,257) (2,979) (760) (3,739)

-------------------------------------------- --------------- -------- -------- --------------- -------- --------

Reportable segment operating (loss)/profit

before exceptional items (4,656) 1,589 (3,067) (3,904) 1,188 (2,716)

Cost of sales - exceptional items (3,502) (1,920) (5,422) - (2,050) (2,050)

Administrative expenses - exceptional items (5,202) - (5,202) (6,400) - (6,400)

-------------------------------------------- --------------- -------- -------- --------------- -------- --------

Reporting segment operating loss (13,360) (331) (13,691) (10,304) (862) (11,166)

Net finance expense (107) (389) (496) (171) (122) (293)

-------------------------------------------- --------------- -------- -------- --------------- -------- --------

Loss before tax (13,467) (720) (14,187) (10,475) (984) (11,459)

-------------------------------------------- --------------- -------- -------- --------------- -------- --------

* Adjusted EBITDA is operating loss excluding the impact of

exceptional items, other net gains, depreciation, amortisation and

equity-settled share-based payment charges. Full reconciliation of

Alternative Performance Measures (APMs) is provided in note 3.

The Group derives all of its revenue from the UK and all of the

Group's customers are based in the UK. The Group's revenue is

derived from contracts with customers.

3. Alternative Performance Measures

The Group uses Alternative Performance Measures (APMs), as

listed below, to present users of the accounts with a clear view of

what the Group considers to be the results of its underlying,

sustainable business operations, thereby enabling consistent

year-on-year comparisons and making it easier for users of the

accounts to identify trends.

Alternative Performance

Measure Definition

----------------------- ------------------------------------------------------------------------------------------

Operating loss excluding exceptional items, other net gains, amortisation and depreciation

Adjusted EBITDA and equity-settled share-based payments.

Adjusted loss Loss before taxation excluding amortisation of acquired intangibles and exceptional items

before taxation included within cost of sales and administrative expenses.

Net assets per

share Net assets divided by the number of shares in issue at the financial reporting date.

----------------------- ------------------------------------------------------------------------------------------

A reconciliation of these Alternative Performance Measures has

been disclosed in the tables below:

(a) Reconciliation of operating loss to "adjusted EBITDA"

31 March 31 March

2022 2021

GBP'000 GBP'000

---------------------------------------- -------- --------

Operating loss (13,691) (11,166)

Adjusted for:

Exceptional items within operating loss 10,624 8,450

Other net gains (330) (1,353)

Amortisation and depreciation 3,257 3,739

Equity-settled share-based payments 639 436

---------------------------------------- -------- --------

Adjusted EBITDA 499 106

---------------------------------------- -------- --------

(b) Reconciliation of loss before tax to "adjusted loss before

tax"

31 March 31 March

2022 2021

GBP'000 GBP'000

------------------------------------------------------ -------- --------

Loss before tax (14,187) (11,459)

Adjusted for:

Exceptional items included in cost of sales 5,422 2,050

Exceptional items included in administrative expenses 5,202 6,400

Amortisation of acquired intangibles 1,248 1,356

------------------------------------------------------ -------- --------

Adjusted loss before tax (2,315) (1,653)

------------------------------------------------------ -------- --------

(c) Net assets per share

31 March 31 March

2022 2021

GBP'000 GBP'000

------------------------------------- -------- --------

Net assets at the end of the year 45,875 35,381

Issued shares at the end of the year 399,313 222,118

Net assets per share 11.5p 15.9p

------------------------------------- -------- --------

4. Exceptional items

Year Year

ended ended

31 March 31 March

2022 2021

GBP'000 GBP'000

------------------------------------------------------ --------- ---------

Exceptional items included in cost of sales 5,422 2,050

Exceptional items included in administrative expenses 5,202 6,400

------------------------------------------------------ --------- ---------

10,624 8,450

------------------------------------------------------ --------- ---------

(a) Exceptional items included in cost of sales

Year Year

ended ended

31 March 31 March

2022 2021

GBP'000 GBP'000

--------------------------------- --------- ---------

Fixed asset impairment 1,920 1,857

Remedial works to utility assets - 193

Onerous contracts 3,502 -

--------------------------------- --------- ---------

5,422 2,050

--------------------------------- --------- ---------

Fixed asset impairment relates to the impairment of utility

assets not previously revalued upwards. Onerous contracts costs

relate to losses from the Group's smart meter exchange and

management contracts with energy suppliers and the loss for a

complex, high voltage infrastructure project.

(b) Exceptional items included in administrative expenses

Year Year

ended ended

31 March 31 March

2022 2021

GBP'000 GBP'000

-------------------------------- --------- ---------

Restructuring costs 575 569

One-off legal and adviser costs 242 896

Intangible asset impairment 2,309 4,935

Onerous contracts 2,076 -

-------------------------------- --------- ---------

5,202 6,400

-------------------------------- --------- ---------

Restructuring costs relate to employee exit and severance costs.

Intangible asset impairment relates to the impairment of goodwill

and software and development costs. Onerous contracts costs relate

to losses from the Group's smart meter exchange and management

contracts with energy suppliers.

Net cash outflows in the year ended 31 March 2022 for

exceptional items in cost of sales and administrative expenses were

GBP1.6 million (2021: GBP1.2 million).

5. Other net gains

Included within other net gains are the following amounts:

Year Year

ended ended

31 March 31 March

2022 2021

GBP'000 GBP'000

------------------------------------------------------- --------- ---------

(Loss)/profit on disposal of assets (75) 873

Additional consideration receivable from utility asset

sales in previous years 259 -

Enhanced payments received 146 480

------------------------------------------------------- --------- ---------

330 1,353

------------------------------------------------------- --------- ---------

Additional consideration receivable from utility asset sales in

previous years is amounts due to the Group for utility assets sold

in previous years that were non-metered when sold and became

metered in the year ended 31 March 2022.

Enhanced payments are amounts receivable by the Group when the

number of domestic connections introduced by the Group to a third

party reaches certain pre-agreed thresholds.

The loss on disposal of assets represents the loss arising on

sale of certain of the Group's utility assets to a third party. The

Group has entered into an agreement with the third party to sell

part of its utility assets portfolio in structured tranches.

Year

Year ended ended

31 March 31 March

2022 2021

GBP'000 GBP'000

-------------------------------------------------- ---------- ---------

Consideration - proceeds received 6,487 4,578

Consideration - retention receivable 201 142

-------------------------------------------------- ---------- ---------

Total consideration 6,688 4,720

Net book value of assets sold (including the

effect of previous revaluations) (6,580) (3,712)

Legal and other costs relating to the transaction (173) (102)

Discounting of retention consideration due

in more than one year (10) (33)

-------------------------------------------------- ---------- ---------

(Loss)/profit on disposal of assets (75) 873

-------------------------------------------------- ---------- ---------

Some of the disposed utility assets had previously been revalued

in accordance with the Group policy. Upon disposal, this gave rise

to a transfer between the revaluation reserve and retained earnings

of GBP1,445,000 (2021: GBP574,000).

6. Operating loss

Included in operating loss are the following charges:

Year Year

ended ended

31 March 31 March

2022 2021

GBP'000 GBP'000

---------------------------------------------- --------- ---------

Amortisation of intangible assets 1,425 1,820

Depreciation of property, plant and equipment 838 1,027

Depreciation of right-of-use asset 994 892

---------------------------------------------- --------- ---------

7. Taxation

Year Year

ended ended

31 March 31 March

2022 2021

GBP'000 GBP'000

----------------- --------- ---------

Current tax (380) (130)

Deferred tax (385) (1,048)

----------------- --------- ---------

Total tax credit (765) (1,178)

----------------- --------- ---------

At Budget 2020, the government announced that the corporation

tax main rate (for all profits except ring-fence profits) for the

years starting 1 April 2021 and 2022 would be 19%. At Spring Budget

2021, the government announced that the corporation tax main rate

would rise to 25% for companies with profits over GBP250,000

together with the introduction of a small profits rate of 19% with

effect from 1 April 2023. The increase in the tax rate to 25% is

considered to be substantively enacted, and accordingly the

deferred tax balances expected to unwind after 1 April 2023 have

been calculated using the 25% tax rate.

The Group has GBP12.5 million (31 March 2021: GBP12.1 million)

of tax losses for which deferred tax assets of GBP3.1 million (31

March 2021: GBP2.3 million) have been recognised. The deferred tax

asset is expected to be recovered over five years. The Group also

has unrecognised tax losses of GBP9.7 million (31 March 2021:

GBP3.0 million) for which no deferred tax asset has been recognised

as there is insufficient certainty over whether those losses will

reverse.

Reconciliation of effective tax rate

Year Year

ended ended

31 March 31 March

2022 2021

GBP'000 GBP'000

------------------------------------------------------- --------- ---------

Loss before taxation (14,187) (11,459)

------------------------------------------------------- --------- ---------

Tax using the UK corporation tax rate of 19.0% (2021:

19.0%) 2,696 2,177

Non-taxable items (501) (614)

Effect of change in rate of corporation tax 255 -

Tax deductions for share options exercised (121) (83)

Adjustment to tax charge in respect of previous year's

corporation tax 380 130

Adjustment to tax charge in respect of previous year's

deferred tax (382) 148

Utilisation of previously unrecognised losses - 345

Release of previously recognised losses (1,262) (579)

Chargeable gains arising (300) (346)

------------------------------------------------------- --------- ---------

Total tax credit 765 1,178

------------------------------------------------------- --------- ---------

Movement in deferred tax balances

31 March 2022 31 March 2021

----------------------------- -----------------------------

Deferred Deferred Deferred Deferred

tax assets tax liabilities tax assets tax liabilities

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------- ----------- ---------------- ----------- ----------------

At the beginning of the year 2,710 (4,511) 1,784 (5,193)

Recognised in profit or loss

Adjustment in respect of previous years (388) 6 106 42

Tax losses (utilised)/recognised 1,721 - 1,055 -

Effect of change in rate of corporation tax 831 (576) - -

Origination/reversal of other timing differences (117) 170 45 379

Reclassification between assets and liabilities - - 299 (299)

Release of previously recognised losses (1,262) - (579) -

Recognised in other comprehensive income

Effect of change in rate of corporation tax - (798) - -

Revaluation of property, plant and equipment - (285) - 560

------------------------------------------------- ----------- ---------------- ----------- ----------------

At the end of the year 3,495 (5,994) 2,710 (4,511)

------------------------------------------------- ----------- ---------------- ----------- ----------------

8. Dividends

No dividends were paid in the year ended 31 March 2022 or 31

March 2021.

No interim dividends were declared and no final dividends are

proposed relating to the year ended 31 March 2022.

9. Earnings per share (EPS)

Basic earnings per share

The calculation of basic and diluted earnings per share has been

based on the following result attributable to ordinary shareholders

and weighted average number of ordinary shares outstanding:

Year Year

ended ended

31 March 31 March

2022 2021

GBP'000 GBP'000

------------------------------------------------------- --------- ---------

Loss for the year used for calculation of basic EPS (13,422) (10,281)

Exceptional items included in cost of sales 5,422 2,050

Exceptional items included in administrative expenses 5,202 6,400

Remove tax relief on exceptional items (2,019) (1,606)

Amortisation of intangibles 1,248 1,356

------------------------------------------------------- --------- ---------

Loss for the year used for calculation of adjusted EPS (3,569) (2,081)

------------------------------------------------------- --------- ---------

Number of shares

31 March 31 March

2022 2021

Number Number

of shares of shares

('000) ( ' 000)

----------------------------------------------------------- ---------- ----------

Weighted average number of ordinary shares for the purpose

of basic EPS 260,169 222,118

Effect of potentially dilutive ordinary shares 1,739 7,434

----------------------------------------------------------- ---------- ----------

Weighted average number of ordinary shares for the purpose

of diluted EPS 261,908 229,552

----------------------------------------------------------- ---------- ----------

EPS

Basic (5.2)p (4.6)p

Diluted basic (5.1)p (4.5)p

----------------------------------------------------------- ---------- ----------

Adjusted basic (1.4)p (0.9)p

Adjusted diluted basic (1.4)p (0.9)p

----------------------------------------------------------- ---------- ----------

10. Property, plant and equipment

(a) Reconciliation of carrying amount

Fixtures

Utility and Computer

assets fittings equipment Total

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- -------- --------- ---------- --------

Cost

At 31 March 2020 66,588 1,065 1,276 68,929

Externally acquired assets 3,485 19 68 3,572

Internally adopted assets 3,170 - - 3,170

Surplus arising on internally adopted

assets 338 - - 338

Revaluation 1,659 - - 1,659

Disposals (3,860) (15) - (3,875)

-------------------------------------- -------- --------- ---------- --------

At 31 March 2021 71,380 1,069 1,344 73,793

Externally acquired assets 2,677 22 220 2,919

Internally adopted assets 2,424 - - 2,424

Surplus arising on internally adopted

assets 57 - - 57

Revaluation 4,252 - - 4,252

Disposals (6,663) - - (6,663)

-------------------------------------- -------- --------- ---------- --------

At 31 March 2022 74,127 1,091 1,564 76,782

-------------------------------------- -------- --------- ---------- --------

Accumulated depreciation

At 31 March 2020 (28,271) (717) (1,121) (30,109)

Depreciation charge for the year (735) (143) (149) (1,027)

Impairment from external revaluation (5,495) - - (5,495)

Disposals 148 4 - 152

-------------------------------------- -------- --------- ---------- --------

At 31 March 2021 (34,353) (856) (1,270) (36,479)

Depreciation charge for the year (613) (80) (145) (838)

Impairment from external revaluation (2,397) - - (2,397)

Disposals 83 - - 83

-------------------------------------- -------- --------- ---------- --------

At 31 March 2022 (37,280) (936) (1,415) (39,631)

-------------------------------------- -------- --------- ---------- --------

Net book value

At 31 March 2022 36,847 155 149 37,151

-------------------------------------- -------- --------- ---------- --------

At 31 March 2021 37,027 213 74 37,314

-------------------------------------- -------- --------- ---------- --------

At 31 March 2020 33,562 348 155 38,820

-------------------------------------- -------- --------- ---------- --------

Utility assets include GBP0.4 million (2021: GBP0.4 million) of

meter assets valued at cost less depreciation to date.

Internally adopted assets are stated at the full cost of

construction of GBP3.7 million (2021: GBP8.8 million) less the

deficit arising on internally adopted assets of GBP1.3 million

(2021: GBP5.6 million).

Disposals include utility assets with a net book value of

GBP6,580,000 that were disposed of as part of Tranches 3 and 4 of

the utility assets sale as disclosed in note 5.

(b) Measurement of fair values

The fair value of utility assets was determined by external,

independent specialist valuers, having appropriate recognised

professional qualifications and experience in the assets being

valued. The valuation established the fair value of the assets at

31 March 2022. The key assumptions used in the valuation model

include current market prices, useful economic lives of the assets

and income generated by the assets discounted using a weighted

average cost of capital. The valuation technique used is classified

as a Level 3 fair value (based on unobservable inputs) under IFRS

13.

The value in use assessment is sensitive to changes in the key

assumptions used. Sensitivity analysis has been performed, with a

0.6% increase in the discount rate leading to a GBP1.0 million

reduction in the revaluation gain and a 0.6% reduction in the

discount rate leading to a GBP0.9 million increase in the

revaluation gain.

The utility assets and utility assets under construction are the

only financial assets that are held at fair value in the financial

statements.

(c) Impairment loss

Following the valuation of the utility assets estate, a net

revaluation gain of GBP1.9 million (2021: GBP3.8 million net

impairment charge) was recorded. A revaluation gain of GBP4.3

million (2021: GBP1.6 million) was recognised in the revaluation

reserve, with an impairment of GBP0.5 million (2021: GBP3.5

million) offset against the revaluation reserve and a GBP1.9

million impairment charge (2021: GBP1.9 million) included within

exceptional items in cost of sales in the consolidated statement of

comprehensive income.

11. Capital commitments

The Group has entered into contracts to purchase property, plant

and equipment in the form of utility assets from external parties.

At 31 March 2022 the balance was GBP5.5 million (2021: GBP9.6

million).

12. Intangible assets

Brand Software

and and

customer development

Goodwill relationships costs Total

Reconciliation of carrying amount GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- -------- -------------- ------------ --------

Cost

At 31 March 2020 14,251 12,607 4,675 31,533

Additions - - 140 140

---------------------------------------- -------- -------------- ------------ --------

At 31 March 2021 14,251 12,607 4,815 31,673

Additions - - 424 424

---------------------------------------- -------- -------------- ------------ --------

At 31 March 2022 14,251 12,607 5,239 32,097

---------------------------------------- -------- -------------- ------------ --------

Accumulated amortisation and impairment

At 31 March 2020 - (2,918) (3,093) (6,011)

Amortisation for the year - (1,356) (464) (1,820)

Impairment (4,494) (218) (223) (4,935)

---------------------------------------- -------- -------------- ------------ --------

At 31 March 2021 (4,494) (4,492) (3,780) (12,766)

Amortisation for the year - (1,248) (177) (1,425)

Impairment (2,149) - (160) (2,309)

---------------------------------------- -------- -------------- ------------ --------

At 31 March 2022 (6,643) (5,740) (4,117) (16,500)

---------------------------------------- -------- -------------- ------------ --------

Net book value

At 31 March 2022 7,608 6,867 1,122 15,597

---------------------------------------- -------- -------------- ------------ --------

At 31 March 2021 9,757 8,115 1,035 18,907

---------------------------------------- -------- -------------- ------------ --------

At 31 March 2020 14,251 9,689 1,582 25,522

---------------------------------------- -------- -------------- ------------ --------

(a) Amortisation

The amortisation of brand, customer relationships and software

(including development costs) is included in administrative

expenses.

(b) Impairment testing

The Group tests goodwill annually for impairment or more

frequently if there are indications that goodwill may be impaired.

The Group tests other intangible assets for impairment when there

is an indication that the assets might be impaired.

Given a number of internal and external factors, management

believes that indications for possible impairment exist for the

brands and customer relationships. Accordingly, an impairment test

has been carried out in relation to both goodwill and the brands

and customer relationships. Where an impairment is indicated,

goodwill would be impaired first, followed by the brands and

customer relationships on a pro-rata basis.

Goodwill and the brands and customer relationships are tested

for impairment by comparing the carrying amount of each CGU with

the recoverable amount. The recoverable amount is the higher of

fair value less costs to sell and the value in use.

Goodwill brought forward at the start of the year relates to the

acquisition of Fulcrum Group Holdings Limited on 8 July 2010 and

the acquisition of The Dunamis Group Limited on 5 February 2018.

The carrying amount of the goodwill is allocated across

cash-generating units (CGUs). The goodwill held by the Group

relates to either the Fulcrum Infrastructure Services CGU or

Dunamis, which has two CGUs. The brands and customer relationships

also relate to the same CGUs.

In the impairment tests, the recoverable amounts are determined

based on value in use calculations which require assumptions. The

fair value measurement was categorised as a Level 3 fair value

based on the inputs in the valuation technique used.

The recoverable amounts of the CGUs have been determined from

value in use calculations which have been predicated on discounted

cash flow projections from financial plans approved by the Board.

The values assigned to the key assumptions represent management's

assessment of future trends in the relevant industries and have

been based on historical data from both external and internal

sources, together with the Group's views on the future achievable

growth and the impact of committed cash flows. Cash flows beyond

this are extrapolated using the estimated long-term growth rates as

summarised in the following paragraph.

The pre-tax cash flows that these projections produced were

discounted at pre-tax discount rates based on the Group's beta

adjusted cost of capital reflecting management's assessment of

specific risks related to each cash-generating unit. Pre-tax

discount rates of between 8.1% and 9.8% (2021: between 7.6% and

9.4%) have been used in the impairment calculations which the

Directors believe fairly reflect the risks inherent in each of the

CGUs. The terminal cash flows are extrapolated in perpetuity using

a growth rate of 2.0% (2021: 2.0%). This is not considered to be

higher than the long-term industry growth rate.

Following the review, the carrying value of the intangible

assets exceeded the associated value in use for one of the Dunamis

CGUs. Consequently, an impairment of GBP2.1 million was made to the

carrying value of goodwill. No impairment was recognised for the

Fulcrum CGU.

A segment-level summary of the acquired intangible assets

allocation is presented below:

Fulcrum Dunamis Total

GBP'000 GBP'000 GBP'000

---------------------------------- -------- -------- --------

Goodwill 2,225 5,383 7,608

Brands and customer relationships - 6,867 6,867

---------------------------------- -------- -------- --------

The value in use assessment is sensitive to changes in the key

assumptions used. Sensitivity analysis has been performed on the

individual CGUs with a 1.0% increase in the discount rate and a

1.0% reduction in the long-term growth rate.

Based on this analysis, the reasonably possible downside

scenario to the discount rate would increase the impairment by

GBP0.9 million, and the change to the long-term growth rate would

increase the impairment by GBP0.7 million.

An impairment charge of GBP0.2 million (2021: GBPnil) has been

recognised for software used in the delivery of contracts deemed to

be onerous during the year ended 31 March 2022.

13. Leases

The Group has leases for land and buildings and plant and

machinery. Leases for land and buildings relate mainly to office

properties and depots, whilst the plant and machinery leases are

predominantly motor vehicles. With the exception of short-term

leases and leases of low value underlying assets, each lease is

reflected on the balance sheet as a right-of-use asset and a lease

liability.

Leases of property range from a period of three to ten years,

and leases of motor vehicles are for three or four years. Lease

payments are generally fixed. The use of extension and termination

options within leases gives the Group flexibility and such options

are exercised when they align with the Group's strategy and where

economic benefits of exercising such options exceed the expected

overall costs.

31 March 31 March

2022 2021

Right-of-use assets GBP'000 GBP'000

-------------------- -------- --------

Land and buildings 1,254 1,500

Plant and machinery 1,069 1,581

-------------------- -------- --------

Total 2,323 3,081

-------------------- -------- --------

31 March 31 March

2022 2021

GBP'000 GBP'000

--------------------------------- -------- --------

Additions to right-of-use assets 255 1,252

--------------------------------- -------- --------

Additions to right-of-use assets include new leases and

extensions to existing lease agreements.

31 March 31 March

2022 2021

Depreciation on right-of-use assets GBP'000 GBP'000

------------------------------------ -------- --------

Land and buildings 291 247

Plant and machinery 703 645

------------------------------------ -------- --------

Total 994 892

------------------------------------ -------- --------

Land and buildings Plant and machinery

-------------------- ---------------------

31 March 31 March 31 March 31 March

2022 2021 2022 2021

Maturity of lease liabilities GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ --------- --------- ---------- ---------

Less than one year 298 310 504 686

Between one and five years 1,123 1,191 605 946

In more than five years 145 245 - -

------------------------------ --------- --------- ---------- ---------

Total 1,566 1,746 1,109 1,632

------------------------------ --------- --------- ---------- ---------

31 March 31 March

2022 2021

Other impact on profit and loss GBP'000 GBP'000

------------------------------------------- -------- --------

Finance costs on leases (121) (139)

Expense on short-term and low value leases (490) (637)

Gain on lease modification 16 -

------------------------------------------- -------- --------

Total (595) (776)

------------------------------------------- -------- --------

31 March 31 March

2022 2021

Cash flows in respect of leases GBP'000 GBP'000

--------------------------------------------------- -------- --------

IFRS 16 - principal payments (1,022) (861)

IFRS 16 - interest payments (121) (139)

Cash outflows relating to short-term and low value

leases (490) (637)

Proceeds received on disposal of leased vehicle 19 -

--------------------------------------------------- -------- --------

Total (1,614) (1,637)

--------------------------------------------------- -------- --------

During the year ended 31 March 2022, the Group disposed of a

leased vehicle for proceeds of GBP19,000. This resulted in a gain

on lease modification in the statement of comprehensive income of

GBP16,000. No leases were disposed of or modified in the year ended

31 March 2021.

14. Share capital

31 March 31 March

2022 2021

GBP'000 GBP'000

--------------------------------------------------- -------- --------

Authorised

500,000,000 ordinary shares of GBP0.001 each 500 500

--------------------------------------------------- -------- --------

Allotted, issued and fully paid

399,313,458 (2021: 222,117,945) ordinary shares of

GBP0.001 each 399 222

--------------------------------------------------- -------- --------

Ordinary shareholders are entitled to dividends as declared.

During the year ended 31 March 2022, 177,195,513 new ordinary

shares were issued. The shares issued had a nominal value of

GBP0.001 each and were issued at GBP0.12 each. No new ordinary

shares were issued during the year ended 31 March 2021.

15. Interest-bearing loans and borrowings

On 1 December 2020, the Group entered into a two year Revolving

Credit Facility agreement with Lloyds Banking Group for GBP10

million. This facility supports the financing, construction and

acquisition of pipeline assets. During the year ended 31 March

2022, net repayments of GBP5.7 million were made by the Group. At

31 March 2022, GBP10 million of this facility remained available

for future drawdowns.

(a) Changes in liabilities arising from financing activities

31 March 31 March

2022 2021

GBP'000 GBP'000

------------------------------------------- -------- --------

At the beginning of the year 5,483 10,000

Repaid in year (10,950) (10,000)

New borrowings 5,250 5,700

Capitalised borrowing fees (11) (260)

Amortisation of capitalised borrowing fees 134 43

------------------------------------------- -------- --------

At the end of the year (94) 5,483

------------------------------------------- -------- --------

As no borrowings are outstanding as at 31 March 2022, the

capitalised borrowing fees have been included within trade and

other receivables.

(b) Terms and repayment schedule

Year 31 March 31 March

Nominal of 2022 2021

Currency interest rate maturity GBP'000 GBP'000

----------------------------------- --------- ---------------- ---------- -------- --------

Bank of England

Two year Revolving Credit Facility base rate

agreement GBP + 3.5% 2022 - 5,700

----------------------------------- --------- ---------------- ---------- -------- --------

The Group has complied with the financial covenants (asset

cover, leverage and EBITDA covenants) relating to the above

facilities.

16. Reconciliation to net cash/(debt)

31 March 31 March

2022 2021

GBP'000 GBP'000

-------------------------- -------- --------

Cash and cash equivalents 11,176 3,934