TIDMFEN

RNS Number : 2455N

Frenkel Topping Group PLC

28 September 2021

THIS ANNOUNCEMENT, INCLUDING THE INFORMATION CONTAINED HEREIN,

IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, CANADA, JAPAN, AUSTRALIA, THE REPUBLIC OF SOUTH

AFRICA OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION.

PLEASE SEE THE IMPORTANT NOTICES AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND SHALL NOT

CONSTITUTE AN OFFER TO SELL OR ISSUE OR THE SOLICITATION OF AN

OFFER TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY NEW ORDINARY

SHARES OF FRENKEL TOPPING GROUP PLC IN THE UNITED STATES, CANADA,

JAPAN, AUSTRALIA, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION NO. 596/2014 ("MAR"). UPON

THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS

NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN

Frenkel Topping Group plc

("Frenkel Topping", the "Company" or the "Group")

Result of Treasury Share Sale

Frenkel Topping Group plc (AIM: FEN), a specialist financial and

professional services firm operating within the personal injury and

clinical negligence marketplace, is pleased to announce that

further to its announcement earlier today in relation to the

proposed sale of Treasury Shares (the "Launch Announcement"), it

has successfully completed the sale of 3,105,708 ordinary shares of

0.5p each in the capital of the Company ("Ordinary Shares"),

previously held in treasury. The ("Treasury Share Sale") took place

through an accelerated bookbuilding process managed by finnCap

Ltd.

The Company has raised, in aggregate, GBP2.3 million (before

expenses) through the Treasury Share Sale of 3,105,708 Ordinary

Shares at a price of 73 pence per Share ("Issue Price").

Related party transaction

North Atlantic Smaller Companies Investment Trust plc ("NASCIT")

is subscribing for 1,500,000 Treasury Shares in the Treasury Share

Sale at the Issue Price. The subscription by NASCIT constitutes a

related party transaction for the purposes of the AIM Rules by

virtue of NASCIT being a substantial shareholder of the Company and

Christopher Mills, CEO of NASCIT, being a Non-Executive Director of

the Company. The Independent Directors (being all Directors save

for Christopher Mills) consider, having consulted with the

Company's nominated adviser, finnCap, that the terms upon which

NASCIT is participating in the Treasury Share Sale are fair and

reasonable insofar as the Company's shareholders are concerned.

Following the subscription, Christopher Mills, via NASCIT, is

interested in 26,500,000 Ordinary Shares of the Company,

representing approximately 23.42 per cent. of the Company's issued

share capital.

Total Voting Rights

Following the Treasury Share Sale, the total number of Ordinary

Shares in issue will be 113,157,349 with no shares held in treasury

therefore the total number of voting rights in the Company will be

113,157,349. This figure may be used by Shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Capitalised terms unless otherwise defined shall carry the same

meaning as set out in the Launch Announcement.

For further information:

Frenkel Topping Group plc www.frenkeltoppinggroup.co.uk

Richard Fraser, Chief Executive Officer Tel: 0161 886 8000

finnCap Ltd (Nominated Advisor & Tel: 020 7220 0500

Broker)

Carl Holmes/James Thompson/Milesh

Hindocha (Corporate Finance)

Richard Chambers (ECM)

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name

Harwood Capital LLP as investment

manager to NASCIT

--------------------------------------- ------------------------------------------------

2 Reason for the notification

-----------------------------------------------------------------------------------------

a) Position/status Harwood Capital LLP and NASCIT are

PCAs of Christopher Mills, Non-Executive

Director of Frenkel Topping plc

--------------------------------------- ------------------------------------------------

b) Initial notification Initial Notification

/Amendment

--------------------------------------- ------------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------------------------

a) Name Frenkel Topping Group plc

--------------------------------------- ------------------------------------------------

b) LEI 213800I5L3K7AT7A4R20

--------------------------------------- ------------------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-----------------------------------------------------------------------------------------

a) Description of the Ordinary shares of GBP0.05 each

financial instrument,

type of instrument

Identification code GB00B01YXQ71

b) Nature of the transaction Share purchase

--------------------------------------- ------------------------------------------------

c) Price(s) and volume(s)

---------------------- ---------------------

Price(s) Volume(s)

---------------------- ---------------------

GBP0.73 1,500,000

------------------------------------------------------------------- ---------------------

d) Aggregated information

- Aggregated volume 1,500,000

- Price GBP1,095,000

e) Date of the transaction 28/09/2021

--------------------------------------- ------------------------------------------------

f) Place of the transaction London Stock Exchange

--------------------------------------- ------------------------------------------------

About Frenkel Topping Group:

The financial services firm consists of Frenkel Topping Limited,

Ascencia Investment Management, Obiter Wealth Management, Equatas

Accountants, Forth Associates, A & M Bacon Limited and Partners

in Costs Limited.

The group of companies specialises in providing financial advice

and asset protection services to clients at times of financial

vulnerability, with particular expertise in the field of personal

injury and clinical negligence.

With more than 30 years' experience in the industry, Frenkel

Topping has earned a reputation for commercial astuteness

underpinned by a strong moral obligation to its clients, employees

and wider society, with a continued focus on its Environmental,

Social and Governance (ESG) impact.

Through its core business, Frenkel Topping Limited, the firm

supports litigators pre-settlement in achieving maximum damages, by

providing expert witness services, and post-settlement to achieve

the best long-term financial outcomes for clients after injury. It

boasts a client retention rate of 99%.

The Group's discretionary fund manager, Ascencia, provides

financial portfolios for clients in unique circumstances. In recent

years Ascencia has diversified its portfolios to include a

Sharia-law-compliant portfolio and a number of ESG portfolios in

response to increased interest in socially responsible investing

(SRI).

Obiter provides a generalist wealth management service -

including advice on Savings and Investments; Tax planning; Life

Insurance; Critical Illness and Income protection; Endowment advice

and Keyman Insurance, with a particular specialism in financial

advice on pensions and pension sharing orders for the clients of

divorce and family lawyers. Obiter applies the same core principles

of honesty, transparency, responsibility and reliability to

individuals, regardless of background or situation.

In 2019, Frenkel Topping launched its accountancy arm, Equatas,

to assist clients with tax planning and move closer to providing a

full end-to-end service under the Group brand, improving the

experience for clients and maintaining the Group's standards

throughout the client journey.

In 2020 Frenkel Topping acquired Forth Associates, a specialist

forensic accounting services business which assists in financial

and legal disputes. The acquisition makes Frenkel Topping the

largest independent provider of financial expert witness reports to

the claimant marketplace.

Earlier in 2021 Frenkel Topping acquired A & M Bacon Limited

a leading costs specialist in local government and Court of

Protection, and Partners in Costs Limited who specialise in civil

litigation claims, including personal injury (ranging from

catastrophic injury to clinical negligence), professional

negligence, commercial claims and court of protection costs.

Later in 2021, costs consultants, Bidwell Henderson. joined the

Frenkel Topping Group of businesses. One of the UK's largest

professional legal services companies specialising in both legal

aid and inter partes law costs drafting, legal cashiering and costs

training services, Bidwell Henderson are the go-to legal aid costs

agency for drafting cost case plans where significant high-costs

are involved in large scale and complex legal cases.

For more information visit: www.frenkeltoppinggroup.co.uk

Important Notice:

MEMBERS OF THE GENERAL PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN

THE TREASURY SALE. THIS ANNOUNCEMENT AND ANY OFFER OF SECURITIES TO

WHICH IT RELATES ARE ONLY ADDRESSED TO AND DIRECTED AT (1) IN ANY

MEMBER STATE OF THE EUROPEAN ECONOMIC AREA, PERSONS WHO ARE

QUALIFIED INVESTORS WITHIN THE MEANING OF ARTICLE 2(1)(E) OF EU

DIRECTIVE 2003/71/EC AND ANY RELEVANT IMPLEMENTING MEASURES (THE

"PROSPECTUS DIRECTIVE"); AND (2) IN THE UNITED KINGDOM, PERSONS WHO

(I) HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS

WHO FALL WITHIN ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS

ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 (AS AMENDED) (THE

"ORDER"); OR (II) FALL WITHIN ARTICLE 49(2)(A) TO (D) OF THE ORDER

OR (III) ARE PERSONS TO WHOM AN OFFER OF THE TREASURY SHARES MAY

OTHERWISE LAWFULLY BE MADE (ALL SUCH PERSONS REFERRED TO IN (1)

AND, (2) TOGETHER BEING REFERRED TO AS "RELEVANT PERSONS"). THE

INFORMATION REGARDING THE TREASURY SALESET OUT IN THIS ANNOUNCEMENT

MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT

PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS

ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND WILL

BE ENGAGED IN ONLY WITH RELEVANT PERSONS.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND SHALL NOT

CONSTITUTE AN OFFER TO SELL OR ISSUE OR THE SOLICITATION OF AN

OFFER TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY NEW ORDINARY

SHARES OF FRENKEL TOPPING GROUP PLC IN THE UNITED STATES, CANADA,

JAPAN, AUSTRALIA, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL

The Treasury Shares have not been, and will not be, registered

under the US Securities Act of 1933, as amended (the "Securities

Act"), or under the securities laws of any State or other

jurisdiction of the United States, and, absent registration, may

not be offered or sold in the United States (as defined in

Regulation S under the Securities Act) except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and the securities

laws of any relevant State or other jurisdiction of the United

States. There will be no public offering of the Treasury Shares in

the United States or elsewhere.

The Treasury Shares have not been approved or disapproved by the

US Securities and Exchange Commission, any state securities

commission or other regulatory authority in the United States, nor

have any of the foregoing authorities passed upon or endorsed the

merits of the Treasury Sale or the accuracy or adequacy of this

announcement. Any representation to the contrary is a criminal

offence in the United States.

No prospectus or offering document has been or will be prepared

in connection with the Treasury Sale. Any investment decision to

buy securities in the Treasury Sale must be made solely on the

basis of publicly available information. Such information is not

the responsibility of and has not been independently verified by

the Company or finnCap or any of their respective affiliates.

Neither this announcement nor any copy of it may be taken,

transmitted or distributed, directly or indirectly, in or into or

from the United States (including its territories and possessions,

any State of the United States and the District of Columbia),

Australia, Canada, the Republic of South Africa or Japan. Any

failure to comply with this restriction may constitute a violation

of US, Australian, Canadian, South African or Japanese securities

laws.

The distribution of this announcement and the offering or sale

of the Treasury Shares in certain jurisdictions may be restricted

by law. No action has been taken by the Company, finnCap or any of

their respective affiliates that would, or which is intended to,

permit a public offer of the Treasury Shares in any jurisdiction,

or possession or distribution of this announcement or any other

offering or publicity material relating to the Treasury Shares, in

any jurisdiction where action for that purpose is required. Persons

into whose possession this announcement comes are required by the

Company and finnCap to inform themselves about and to observe any

applicable restrictions.

No reliance may be placed, for any purposes whatsoever, on the

information contained in this announcement or on its completeness

and this announcement should not be considered a recommendation by

the Company or finnCap or any of their respective affiliates in

relation to any purchase of or subscription for securities of the

Company. No representation or warranty, express or implied, is

given by or on behalf of the Company, finnCap or any of their

respective directors, partners, officers, employees, advisers or

any other persons as to the accuracy, fairness or sufficiency of

the information or opinions contained in this announcement and none

of the information contained in this announcement has been

independently verified. Save in the case of fraud, no liability is

accepted for any errors, omissions or inaccuracies in such

information or opinions.

finnCap, which is authorised and regulated by the Financial

Conduct Authority in the United Kingdom, is acting only for the

Company in connection with the Treasury Sale and will not be

responsible to anyone other than the Company for providing the

protections offered to the clients of finnCap, nor for providing

advice in relation to the Treasury Sale or any matters referred to

in this announcement, and apart from the responsibilities and

liabilities (if any) imposed on finnCap by Financial Services and

Markets Act 2000 ("FSMA"), any liability therefore is expressly

disclaimed. Any other person in receipt of this announcement should

seek their own independent legal, investment and tax advice as they

see fit.

References to time in this announcement are to London time,

unless otherwise stated. All times and dates in this announcement

may be subject to amendment.

Certain statements in this announcement are forward-looking

statements. By their nature, forward-looking statements involve a

number of risks, uncertainties and assumptions that could cause

actual results or events to differ materially from those expressed

or implied by the forward-looking statements. These risks,

uncertainties and assumptions could adversely affect the outcome

and financial consequences of the plans and events described

herein. No one undertakes any obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise. Readers should not place

any undue reliance on forward-looking statements which speak only

as of the date of this announcement. Statements contained in this

announcement regarding past trends or events should not be taken as

representation that such trends or events will continue in the

future.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPUAPBUPGGGR

(END) Dow Jones Newswires

September 28, 2021 07:44 ET (11:44 GMT)

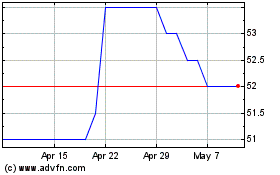

Frenkel Topping (LSE:FEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Frenkel Topping (LSE:FEN)

Historical Stock Chart

From Apr 2023 to Apr 2024