TIDMFEVR

RNS Number : 8946E

Fevertree Drinks PLC

16 March 2022

Fevertree Drinks plc

FY21 Preliminary Results to 31 December 2021

FY21 Highlights

-- Fever-Tree delivered revenue growth of 23% (26% at constant

currency), growing strongly across all markets, extending its

position as the leading global premium mixer brand

-- The Off-Trade performed well, and remained ahead of 2019

levels, even as the On-Trade re-opened, with consumers increasingly

enjoying long mixed drinks at home and premiumising their

serves

-- Fever-Tree maintained its number one position in the UK

retail mixer category, with 39.8% value share ([1])

-- Significant Off-Trade momentum in the US, with the brand

growing to become the number one Ginger Beer brand at retail in the

US, as well as finishing the year as the number one Tonic brand at

retail[2]

-- Good performance across Fever-Tree's European markets, driven

by strong Off-Trade sales, a positive return of the On-Trade and

importer restocking as the region recovered from On-Trade

restrictions

-- Unprecedented global supply chain disruption impacted our

gross margin, with a reduction in Adjusted EBITDA margin to

20.2%

-- Significant progress and investment across our sustainability

initiatives with all our products sold in the UK now carbon

neutral

-- The Group continued to invest for long-term growth:

o Successful launches of the new Premium Soda range in the UK

On-Trade, Sparkling Lime & Yuzu in the US, and Rhubarb &

Raspberry Tonic across Europe after its successful launch in the

UK

o Focused on a range of marketing opportunities, including TV

adverts in the UK and Spain, pop-up bars in London, New York and

Texas, prominent retail displays, and multi-channel

co-promotions

o Began commissioning of our second US bottling line, on the

East Coast, which will ramp up to full production during H1

FY22

Financial highlights

GBPm FY21 FY20 Change

------------------------------- ------ ------ ---------

Revenue

UK 118.3 103.3 15%

US 77.9 58.5 33%

Europe (Fever-Tree brand

revenue) 78.6 59.0 33%

Europe total revenue 88.2 65.3 35%

ROW 26.7 25.0 6%

Total 311.1 252.1 23%

Gross profit 130.9 116.3 12%

Gross margin 42.1% 46.2% (410)bps

Adjusted EBITDA[3] 63.0 57.0 11%

Adjusted EBITDA margin 20.2% 22.6% (240)bps

Diluted EPS (pence per share) 38.19 35.76 7%

Dividend (pence per share) 15.99 15.68 2%

Net cash 166.2 143.1 16%

------------------------------- ------ ------ ---------

-- Net cash increased to GBP166 million; growth of 16% year-on-year.

-- Proposed full year dividend of 15.99 pence per share, an increase of 2% year-on-year,

-- Recommending a special dividend of 42.90 pence per share,

reflecting our financial strength, ongoing cash generation, as well

as our confidence in the continued execution of our strategy.

FY22 Guidance

Fever-Tree is performing well in the Off-Trade across our key

regions, gaining share within the mixer categories and driving

growth of the premium segment. This is supported by the increased

popularity of drinking premium long mixed drinks at home, which

both retailers and spirits companies are investing behind. As a

result, we expect Off-Trade demand to remain at higher levels than

pre-pandemic and are well placed to benefit from this sustained

shift in consumer behaviour. The On-Trade has continued to recover

since the start of the year, and we look forward to a full year of

trading through this channel for the first time in over two years.

Consequently, we expect to deliver revenue growth of between

c.14%-17%, to GBP355 million - GBP365 million in FY22.

As highlighted in January, there remains a global backdrop of

inflationary pressures against which we are employing a range of

mitigating actions. However, commodity prices have increased

dramatically in recent weeks because of the terrible events

unfolding in Ukraine and this has created significant uncertainty

in relation to input costs. As a result, we now expect to deliver

an EBITDA range of between GBP63 million and GBP66 million for

FY22.

Notwithstanding these near-term cost headwinds, the long-term

opportunity looks even more significant than it did a few years ago

following the acceleration of supportive consumer trends, and the

Group is using its strong balance sheet to remain focused on

realising this opportunity with our fantastic team and unrivalled

global brand strength.

Tim Warrillow, Co-Founder and CEO of Fever-Tree, commented

" Our fantastic team has delivered a great set of results with

impressive revenue growth in all our key markets during another

year of uncertainty and disruption. Our growing momentum reflects

the brand's increasing presence and popularity around the world,

nowhere more so than the US where we finished the year as the No.1

Tonic Water brand by value at US retail. This is a significant

achievement and matches the position we have held in the UK, as

well as several European markets, for a number of years.

Whilst the tragic situation in Ukraine has resulted in

significant uncertainty in relation to our input costs in the short

term, the long-term global opportunity for Fever-Tree remains

substantial and we are as confident as ever in the brand's ability

to capitalise on this. We are excited by the growing interest in

the long-mixed drink category from retailers, spirits brands and

consumers, especially given the increasing focus on premium

segments, which places Fever-Tree, as the largest global premium

mixer brand, at the centre of these trends. "

There will be live audio webcast on Wednesday 16(th) March 2022

at 10:00am GMT. The webcast can be accessed via:

https://www.sunipapictures.com/fever-tree/

For more information please contact:

Investor queries

Ann Hyams, Director of Investor Relations I ann.hyams@fever-tree.com I +44 (0)7435 828 138

Media queries

Oliver Winters, Director of Communications I

oliver.winters@fever-tree.com I +44 (0)770 332 9024

Nominated Advisor and Joint Broker - Numis Securities

Garry Levin I Matt Lewis I Hugo Rubinstein I +44 (0)20 7260

1000

Joint Broker - Investec Bank plc

David Flin I Alex Wright I +44 (0)20 7597 5970

Financial PR advisers - Finsbury

Faeth Birch +44 (0)7768 943 171; Anjali Unnikrishnan +44 (0)

7826 534 233; Amanda Healy +44 (0)7795 051 635

Group performance I Good progress during 2021

The Group performed well throughout another unprecedented year,

simultaneously making strategic progress towards our long-term

opportunity, as well as delivering a strong set of results for the

financial year. The strength of our team, the brand, and our key

relationships with customers and suppliers has ensured that we

further extended our clear position as the global leading premium

mixer brand. We were delighted to be voted "Number One Top Selling

Mixer" and "Number One Top Trending Mixer" for the eighth year

running by Drinks International as we continue to lead the

category.

At the same time, it's been exciting to see the acceleration of

the trends that have been supporting the brand's growth for many

years; namely, the outperformance of spirits relative to wine and

beer, the increased popularity of long mixed drinks, and the

premiumisation of both the spirit and mixer categories around the

World.

The Group delivered revenue of GBP311.1m, representing a strong

increase of 23% year-on-year and almost a 20% increase compared to

2019, the last pre-pandemic financial year. This was an extremely

good performance in the context of continued widespread On-Trade

closures across our markets in the first half of 2021. When the

On-Trade re-opened it recovered strongly, and Fever-Tree maintained

or grew its market leading premium mixer position across the UK,

US, and Europe, alongside a continuation of robust Off-Trade

trading, which has remained well above pre-pandemic levels.

The well-publicised logistics challenges which affected the

whole industry during 2021 impacted our margins for the full year,

with gross margin reducing to 42.1%. Rest assured managing our cost

base is core to our operating model especially considering the

current inflationary pressures and supply chain disruption impacts

on our margins but also to ensure that we are operating

efficiently. We do though believe that it is important to balance

our efforts by investing for growth in capabilities, our brand

portfolio, NPD and our supply chain, especially in critical markets

like the US. As a result, we have continued to invest, with

operating expenses at 21.9% of revenue, resulting in an EBITDA of

GBP63.0m, a 10% increase year-on-year, but a slight reduction in

margins, to 20.2%, as guided. Profit before tax was GBP55.6m, an 8%

increase compared to 2020, and we ended the year with a strong

balance sheet and net cash of GBP166.2m, an increase of 16%

year-on-year.

COVID-19 update

A gradual return to normality in many of our regions throughout

the second half of the year was interrupted in the final few weeks

in December by the spread of new Covid variants, reminding us that

the pandemic is not yet behind us. However, I remain confident in

the brand's strong position, with our asset light, outsourced

business model continuing to provide the business with the

flexibility to react quickly to changing channel dynamics and

consumer demand, as well as the resilience to withstand the ongoing

challenges.

In many ways, remote working has enabled our teams across the

globe to work more closely and connect more frequently, sharing

greater insights, learnings, and data across the workforce. We also

continued to support our workforce and local communities across our

regions, especially in the first half of the year when lockdowns

were at their most stringent.

Strategic update I Strong performance driven by proactive

actions

Revenue, GBPm FY21 FY20 Change Constant Currency

------------------------- ----- ----- ------ -----------------

UK 118.3 103.3 15%

US 77.9 58.5 33% 41%

Europe (Fever-Tree brand

revenue) 78.6 59.0 33%

Europe total revenue* 88.2 65.3 35% 40%

ROW 26.7 25.0 6%

Total 311.1 252.1 23%

========================= ===== ===== ====== =================

*includes GDP portfolio brand revenue

UK I Good Off-Trade performance and On-Trade rebuilding

The Fever-Tree brand further strengthened its position in the

UK, growing revenues by 15% year-on-year despite the continuation

of tough On-Trade restrictions. We have maintained our

market-leading position in the Off-Trade, finishing the year with

39.8%[4] value share of the mixer market at retail, far ahead of

all other premium brands combined with a value share of 2.1%(5) .

Our strong execution, brand strength and customer loyalty also

enabled us to extend our leading share in the On-Trade to 50.9%[5]

as it re-opened during the second half of the year.

In another uncertain year, the On-Trade remained closed or under

significant restrictions until July. During the period of closures

our team continued to engage with, and offer support to the

On-Trade, putting us in a strong position as the channel re-opened.

This reopening was characterised by an initial release of pent-up

demand during the summer months, before a more gradual recovery

throughout the second half of the year, building as consumers

became more confident and normal working patterns started to

resume. By the end of November, sales were around 90% of 2019

levels(7) , before the spread of the Omicron variant impacted

consumer behaviour and led to slower sales during the Christmas

period. Consequently, On-Trade revenue increased by 59% compared to

2020 but remained at 62% of 2019 levels across the year as a

whole.

The brand was able to re-invigorate its presence and marketing

in the On-Trade during the summer, with activations across the

South Coast of the UK placing particular focus on promoting the

Spritz occasion using our new Premium Soda range. Alongside this we

established a fantastic summer bar in the heart of Covent Garden

from June to October, along with more specific activations at major

sporting events such as Royal Ascot and The Oval.

The Spritz occasion is especially popular with younger

consumers, who have initially returned more quickly and in higher

numbers to the On-Trade than older age groups. Fever-Tree's range

of Premium Sodas performed well, with the offer of simple two

ingredient cocktails, easy execution and trade-up opportunities

resonating with our pub and bar accounts.

While we are mindful of the continued uncertainty surrounding

the On-Trade, our brand strength, our well-established and deep

relationships with the trade and our unrivalled range of products

means we are well placed to continue to build on this market

leading position as the channel continues to recover.

The Off-Trade has continued to perform above expectations as the

popularity of enjoying long mixed drinks at home has been sustained

even as the On-Trade has re-opened. The Off-Trade was characterised

by particularly strong demand in the first quarter, when the

On-Trade was completely closed and encouragingly, as the On-Trade

recovered in the second half, we maintained double digit growth in

the Off-Trade compared to pre-pandemic levels. Across the year,

Fever-Tree's Off-Trade sales increased by 20% compared to 2019, but

were broadly in-line with 2020 when we experienced more prolonged

periods of lockdown. Crucially, our UK household penetration has

increased to 15.4%[6] since 2019 which means the brand is in more

people's fridges than ever before.

The spirits category also performed well at retail during the

year, continuing to grow ahead of wine and beer compared to

pre-COVID levels, with premium and flavoured spirits stand-out

performers. This not only supported the growing popularity of our

new Soda range, but also underpinned significant progress for our

Gingers range which performed well from an increasing distribution

base, with an 87% sales increase compared to pre-COVID.

The Group has continued to innovate and pioneer the category,

capturing the latest consumer trends, and building on our premium

mixer credentials. We launched a new Limited-Edition Damson &

Sloe Berry Tonic for Autumn / Winter, combining seasonal flavours

with a rich purple colour to great effect. The product was not only

designed to capitalise on consumer trends towards flavoured tonics

and eye-catching liquids, but as a limited edition, also served to

excite the category and bring incremental value through additional

sales.

Overall, I'm pleased with the progress the brand has made in the

UK during the year. We have been encouraged by our performance as

the On-Trade re-opens, as well as the sustained strength of our

Off-Trade sales. We have maintained or increased our value share

and number one position in the Off-Trade and On-Trade respectively

and continue to invest to drive our brand awareness and excite the

category with new products.

Notwithstanding the on-going uncertainty around On-Trade

trading, every action we took last year, from not furloughing any

of our team, to focusing spend on the Off-Trade while the On-Trade

was closed which included a repetition of our successful national

television advertising campaign, to launching new flavours and

formats, has continued to pay dividends as we start to enter a new

normal. Importantly, our confidence in the long-term opportunity

only increases as we see both spirit and mixer categories

continuing to grow and premiumise, and consequently more consumers

enjoying premium long mixed drinks both at home and in pubs, bars

and restaurants. Fever-Tree is uniquely placed to drive growth

under these supportive market trends, with our enviable category

leadership position, our broad and innovative portfolio, and the

strength of our relationships with suppliers and customers.

US I Fever-Tree growing strongly, outperforming the mixer

category in the Off-Trade

Fever-Tree had another strong performance in the US, with

revenue growth ahead of expectations at 33% to GBP77.9m (41% on a

constant currency basis). We have seen continued growth in both

premium spirits and premium mixers in the US, and our market

leading position and strong momentum gives us great confidence in

the opportunity for Fever-Tree within the market.

Our On-Trade sales in the US were initially affected by closures

and restrictions which varied by State in length and extent,

resulting in challenging conditions in this channel during the

first half of the year. We saw strong initial sales as States

re-opened and it was clear that consumers were excited to get back

out to bars and restaurants.

We have also continued to secure new distribution in the

On-Trade, with notable new agreements with Hilton Luxury Hotels, as

well as multiple other restaurant, bar and casino accounts across

the country. Our focus on high quality On-Trade accounts,

successful introduction of new products, and relationships with our

On-Trade customers, as well as our strong partnership with Southern

Glazer's Wines and Spirits ("SGWS"), ensured that our monthly

On-Trade sales started to surpass pre-COVID levels as early as

April and remained strong for the rest of the year.

Alongside the positive re-opening of the On-Trade, Fever-Tree

has maintained its outperformance in the Off-Trade, with value

growth of 24% compared to 2020, and 97% compared to 2019[7]. Within

the portfolio we have seen strong growth across our full range of

mixers, targeting multiple drinks occasions, from the mule (Ginger

Beer) to tonics (Tonic Water) and spritzes (Soda &

Sparkling).

Fever-Tree remains the largest premium mixer brand in the US and

continues to be the number one value contributor to the total

Ginger Beer and Tonic Water markets at retail. We had several

significant achievements this year, growing to become the number

one Ginger Beer and the number one Tonic brand by value in the US,

surpassing Goslings and Schweppes respectively. These milestones

are a fantastic demonstration of the growing strength of the brand

and our important role in driving long mixed drinking trends in the

US.

Our success during the year has been based on our growing

rate-of-sale, far ahead of other mixer brands, which has

incentivised our retail customers to give us more shelf space,

increasing our distribution and depth within each account. Our new

Sparkling products, Pink Grapefruit and Lime & Yuzu have helped

to drive this growth, as well as the introduction of our can format

in more flavours than ever before.

We continue to place a lot of emphasis on marketing and

investment to grow Fever-Tree's brand awareness with both consumers

and the trade, focusing on the Off-Trade and digital execution in

the first half of 2021, whilst also re-allocating spend back into

the On-Trade as the channel re-opened. We have focused on creating

"Fever-Tree perfect serve menus", as well as providing custom

signage, menu boards and other products such as outdoor parasols

and furniture to the On-Trade, and we were excited to open a new

pop-up bar in Texas, following the success of our original pop-up

bar which remains in Bryant Park, New York. Both locations give the

brand excellent visibility and enable us to provide consumers with

a fantastic experience as they enjoy perfectly crafted cocktails

using a range of Fever-Tree mixers.

We continued to put a great emphasis on collaborating with

spirits partners, using the power of co-promotions to drive

different serves, and have been featured in a number of

multi-channel campaigns during the year. This included a

co-promotion with Grey Goose, which promoted the Spritz serve over

the summer months using our new Sodas, and a Whiskey Ginger

co-promotion with Jim Beam which aimed to encourage a generation of

new consumers to "Take a break from beer" and enjoy a lower ABV,

lower sugar serve.

We believe some of the uplift in at-home consumption during

lockdowns will remain as consumers have enjoyed experimenting with

long mixed drinks at home. This is helping to drive the

acceleration of premiumisation trends we have been seeing for a

number of years as consumers have purchased more premium drinks at

home over the last 18 months and are now less willing to compromise

when they go back to the On-Trade. Encouragingly, consumers have

been increasingly choosing spirits over wine and beer, with vodka

and tequila gaining share ahead of other categories. This is

particularly pleasing to see as our two new Sparkling launches,

Pink Grapefruit and Lime & Yuzu have been specifically created

to mix with these two spirits.

In summary, Fever-Tree's strong performance, innovation directed

at specific US consumer habits, focus on influential co-promotional

campaigns, and growing rate-of-sale, along with the increasing

interest in premium long mixed drinks is enabling us to increase

our presence across the grocery, liquor and On-Trade channels. We

are extending our market-leading position, with further marketing

activations, growing presence and greater consumer awareness

ensuring that we will continue this strong momentum into 2022 and

beyond.

Europe I Extending market leadership across the region

Total European revenue increased by 35% to GBP88.2m (40% on a

constant currency basis), including GBP9.6m of GDP portfolio brand

revenue. This strong performance was ahead of expectation and

driven by Fever-Tree's increasing value across the region, a strong

Off-Trade performance, a positive rebuild in the On-Trade, and some

importer restocking during the first half of the year.

The On-Trade was materially impacted by closures during the

first half of the year, with vaccine rollouts and consequent

recovery taking slightly longer than the UK and US. However, the

impetus to capture the final weeks of the summer tourist season,

especially across Southern Europe, led to a very positive end to

the Summer with record months in a number of markets.

Fever-Tree continues to drive growth of the premium mixer

category at retail in Europe, gaining share and contributing to

about a third of the total category's growth during the year, well

ahead of any other premium brand, and second only to Schweppes. We

now hold 15.3% of the retail branded mixer value share, a 3.6%

increase compared to 2019[8].

Most pleasingly, our focus on category management has helped to

build a distinct mixer category for the first time in European

retail, enabling retailers to place more emphasis on how visible it

is, how it's marketed to consumers and the resources that are

allocated to the space. We are therefore encouraged about the whole

category's growth, as well as Fever-Tree's role in driving this at

the premium end, which should ensure the Off-Trade continues its

strong performance even as the On-Trade gets back to pre-COVID

levels.

This year we launched our Rhubarb & Raspberry Tonic across

key European markets, with very promising initial sales growth. The

flavour has already become one of our most popular Tonic flavours

across the region, leveraging the trend towards bright, pink and

sweeter mixers. We are also particularly excited about our

Mediterranean Tonic and our Ginger Beer mixers, the former of which

is now our most popular Tonic across a number of European markets,

and the latter is growing strongly to extend our range beyond

Tonics to other popular serves.

Co-promotions remain a focus of our marketing strategy and this

year we have moved from a more local, to a regional approach,

driving consistent initiatives across multiple markets, whilst

continuing to adapt to local preferences. A great example of this

is various co-promotions in over ten countries we have executed

with the Aperitivo brand Lillet, where we have focused on consumer

trends towards earlier and lighter drinking occasions, as well as

giving us the opportunity to provide for occasions beyond the

G&T.

In addition, we have invested in broader marketing activities,

such as our first television campaign in Spain, delivering our

"3/4" message and focusing on the quality of our ingredients, which

significantly increased our prompted awareness in Catalunya, the

main region the campaign was focused on. We have also introduced

new flavours and formats, such as our Rhubarb & Raspberry

Tonic, and a new 750ml glass bottle in Germany, aligning to German

consumers' purchasing preferences.

Our progress in the Off-Trade along with the promising recovery

of the On-Trade gives us confidence in the opportunity across

Europe. The Off-Trade has been less impacted by the re-opening of

the On-Trade than anticipated, with a strong net positive sales

impact as both channels gain in strength. The mixer category is

growing at pace and Fever-Tree has continued to extend its

market-leading position, remaining the only premium mixer brand

with significant scale across the region. There are a number of

markets that offer real potential, and we continue to invest, build

meaningful relationships in the trade and with spirit partners, and

drive the growth of the premium segment.

RoW I Supportive trends and strategic progress driving

growth

We have made good progress in our Rest of the World region with

revenue growth of 6% to GBP26.7m, against tough comparators from

the second half of last year.

In Australia, spirits are taking share of throat from beer and

wine and the category continues to premiumise which, in turn, is

driving demand for premium mixers. Fever-Tree remains the clear

leader in premium mixers, contributing more to the total mixer

category growth at grocery than any other brand[9], with especially

strong sales in Tonics. A fantastic demonstration of how the brand

has been driving the premiumisation of the mixer category is that

since our launch of larger format (500ml) Tonics in Woolworths (in

December 2020), the average selling price of large format Tonics

has grown by almost 30%. Fever-Tree has also gained national

distribution with Premium Sodas and Gingers as we seek to be the

premium mixer of choice across Australia's most popular and

trending drinks serves, and this has helped to drive our strong

value growth of 52% in grocery during 2021.

In Canada, the mixer market continues to premiumise, with the

premium segment outpacing the mainstream segment to reach 10% of

the total mixer category. Fever-Tree remained not only the largest

premium mixer brand by value at Canadian retail, but also largest

Tonic brand by value, ahead of Schweppes, with 32% share. In

addition, Ginger Beer performed incredibly well, growing by almost

40%[10] through new distribution with key retailers and expansion

into our can format. Diversifying our range of mixers is a core

part of our strategy for long-term success and this year we

introduced our Sparkling Pink Grapefruit which has been our most

successful new flavour launch in the Canadian market, capitalising

on the popularity of the Paloma and Spritz Occasions. We look

forward with confidence in this market as we continue to gain

share, innovate, expand our distribution, and increase our

rate-of-sale.

Asia remains a region with long-term potential for Fever-Tree.

We have entered three new markets this year and continue to

re-evaluate our distribution partners across the region to ensure

we are with the right partner for the next stage of our

development. We have also extended our pan-Asia deal with Accor,

the largest hotel group in the region, for three years, remaining

their preferred premium mixer partner across Asia, as well as

continuing to develop our relationships with the international and

local spirits companies, including Bacardi, Campari and Diageo.

Operational Review

Our team have continued to work very closely with our partners

throughout our supply chain to help mitigate against the impacts of

the global pandemic, including the increased level of supply chain

disruption that impacted the entire industry this year.

Disruption was widespread, impacting global shipping

availability, lead times and pricing, as well as HGV driver

availability and costs in key markets. Consequently, we maintained

higher stock levels of key ingredients and our team focused on

preserving continuity of supply, most notably by increasing

shipments to the US and building local inventory in the first half

of the year, but also working with our main UK logistics partner to

manage driver availability during peak periods. Whilst these

actions have resulted in increased cost and impacted our margins,

they have ensured that we have continued to supply our customers

globally throughout this on-going period of disruption,

underpinning the strong revenue growth we are reporting.

The Group worked with our production partner in the US to

successfully commission and ramp up production on our new line on

the West Coast of the US. In addition, we began commissioning a new

line on the East Coast at the end of the period and will be ramping

up production there over the first half of 2022. These are exciting

strategic developments for the Group, adding further capacity and

flexibility to our network and setting us up to realise our

substantial ambition in the US market with local bottling

capability.

With both US bottling lines in place, we operate across seven

bottling sites and three canning sites globally. This increasingly

local production network will underpin our growth ambitions in both

Europe and the US, will mitigate some of our exposure to elevated

logistics costs, and will help to reduce the carbon emissions

associated with our supply chain operations.

The long-term opportunity

Fever-Tree's long-term strategy remains unchanged and continues

to be underpinned by strong global trends towards premium long

mixed drinking, with the brand's excellent track record against the

competition making us best placed to execute against this. Both the

popularity of long mixed drinks and the premiumisation of the

spirit and mixer categories have accelerated over the last two

years, increasing our confidence in the future growth potential for

Fever-Tree.

The value of the global spirits market has been growing over the

last five years and premium spirits, which deliver authenticity,

engagement and quality for consumers, have been driving this

growth. The value of the most premium segments within Fever-Tree's

top 15 markets have grown by more than 50% over the last five years

and now comprise approximately 40% of the category, compared to

just under a third in 2015, significantly outperforming the

standard and value segments[11].

The advent of the well-crafted premium mixer, pioneered and led

by Fever-Tree, allows these premium spirits to be consumed simply,

in a long refreshing manner that is suited to today's consumer, and

across a wider range of occasions both at home and in the

On-Trade.

Consequently, the mixer categories across all our key markets

are growing and premiumising. In the UK, Europe and the US the

mixer categories have all grown by over 10% CAGR over the last two

to three years, with the premium segments once again outpacing

mainstream.

Our excitement stems from the fact that Fever-Tree not only sits

at the heart of this fast-growing global movement to premium long

mixed drinks but is the primary driver of growth of mixer

categories across the world which is resulting in the premium long

mixed drink becoming increasingly important to the serve strategies

of major spirits brands, especially in the US.

During the pandemic the trend to long mixed drinks has

accelerated in the Off-Trade as consumers enjoyed long mixed drinks

at home as a form of entertainment and a treat at the end of the

working day, with much of this elevated demand remaining even as

the On-Trade reopened across the world. Consequently, we believe

that not only will the elevated Off-Trade demand be sustained to

some extent, but also that the higher level of adoption of premium

spirits and mixers in the Off-Trade will encourage premiumisation

in the On-Trade as consumers have become accustomed to high quality

long mixed drinks.

What is unique is that Fever-Tree sits at the heart of these

global trends, in an unrivalled position. We have the first mover

advantage, track record against competition, international

footprint, tools, range, global brand recognition and relationships

to continue to benefit from and drive this trend forward.

Fever-Tree Team

This year has been characterised by a lower level of recruitment

than we undertook in 2020. We have focused on consolidating the

hires made in the last two years, ensuring we have the appropriate

internal structures to drive continued success, and integrate the

GDP team into the Group. The prevalence of virtual working over the

last two years has provided us with more opportunities to connect

our teams across every one of our regions, which has been even more

important as we grow and become a more global business. Despite our

pace of growth, we remain entrepreneurial at heart and work hard to

ensure we have a culture that enables all our team, regardless of

location, department or level feel they can make a real difference

to the business.

Sustainability

The last 12 months has seen the Group build on the progress and

framework established at the beginning of 2021, making real strides

forward in several key areas. Most notably perhaps was the

announcement in October that all our mixers sold in the UK are now

carbon neutral from 2021 onwards alongside a global ambition to

achieve carbon neutrality across all regions by 2025. While the way

we operate helps to keep our own emissions low, we are holding

ourselves to account for the emissions generated through our entire

supply chain. We will continue to challenge ourselves and our

partners to take steps to mitigate and reduce the carbon footprint

of our drinks, reflecting our commitment to making a positive

change in this important area.

Further initiatives have included becoming a founding partner of

Tesco's Loop trial to promote and trial reusable packaging. From

the very beginning, we have taken pride in using infinitely

recyclable glass bottles and aluminium cans for our drinks, and

continue to investigate ever more sustainable packaging solutions,

including refillable options, hence our investment in this

initiative with one of our major customers.

Perhaps most pleasing has been the engagement we have seen both

internally and externally as we have begun to roll out our

sustainability roadmap. Our employees have led from the front,

whether it be establishing keeper teams to help with the

maintenance and monitoring of the Fever-Tree Tiny Forest in

Hammersmith, West London, offering volunteering and mentoring

through our partners Future Frontiers and Key 4 Life or fundraising

throughout the year for our Charitable partner Malaria No More UK

to support the ongoing fight against Malaria, our teams across the

globe have been at the heart of our strategy.

Alongside this, we have been focused on ensuring we continue to

provide the best environment and culture for our employees to

thrive. This has included conducting our first employee wide

engagement survey in conjunction with "Best Companies" which

resulted in Fever-Tree being accredited as an "Outstanding" firm to

work for, establishing a Group wide Diversity and Inclusivity

committee to build on our D&I framework as well as providing a

forum for our employees to share their experience and

learnings.

Summary & Outlook

2021 has been a year of notable success, as well as significant

external challenges, and I am proud of how the business has

navigated the volatile environment to deliver a strong set of

results. We end the year with increased confidence in the

opportunity ahead and our ability to delivery against it across the

world.

Our performance in the Off-Trade remained strong, even as the

On-Trade re-opened, exceeding our expectations across all our

regions. There has never been more excitement around enjoying long

mixed drinks at home. These trends along with our growing brand

strength and awareness enabled us to drive value share gains in all

our key markets, including the UK, US, Europe, Australia and

Canada.

The On-Trade also came back strongly as restrictions were

lifted, responding to high levels of pent-up demand around the

world. The support we committed to our On-Trade partners meant we

were well positioned to benefit from a positive re-opening and

therefore saw strong growth and distribution gains during the

second half of the year. Not only did we end the year with over 50%

market share in the UK On-Trade, but we also saw record months of

trading across Europe and the US, giving us confidence in our

long-term growth plans across our mature and growth regions.

During the pandemic, the strong and secure financial position of

the Group has enabled us to remain focused on the long-term

opportunity, continue to invest and make strategic progress. We

made a number of significant launches, including our Premium Sodas

in the UK On-Trade as well as our Lime & Soda in the US, and

our Rhubarb & Raspberry Tonic across Europe, all of which are

performing ahead of our expectations. In addition, we added to our

local US production, commissioning a second bottling line at the

end of the year on the East Coast.

The Group remains well-placed financially with a cash position

at year end of GBP166.2m and our asset light, outsourced business

model continues to ensure we have a low fixed cost base and the

flexibility to manage any future challenges. We are of course

mindful of the impact that the uncertainty and instability of the

last two years has had on our gross margins. Our focus remains on

driving growth and ensuring we are equipped to manage the scale and

complexity of a global business. This requires us to invest in our

processes, systems and to move to local production partners at the

appropriate point whilst also investing ahead of demand in key

markets. We are continuing to develop our global production

footprint and can look forward with confidence to opportunities to

capture economies of scale, optimise local inventory holdings and

reduce our exposure to global sea freight over the coming

years.

We are mindful of the terrible events unfolding in Ukraine and

related geopolitical uncertainty and will continue to monitor any

future impacts this may have on our business. Alongside this, there

remains a global backdrop of inflationary pressure against which we

are employing a range of mitigating actions to offset some of the

ongoing significant cost headwinds.

Despite this, we continue to be excited by the global growth of

spirits, trends to long mixed drinks and increasing popularity of

premium serves, all of which have accelerated during the last two

years. In addition, new supportive trends such as mixology at home,

along with our ever-increasing brand awareness and range of mixers

to cater to more consumer occasions makes us increasingly confident

in the opportunity ahead for the Group.

Finance review

The Group capitalised on strong Off-Trade momentum and its

commitment since the start of the pandemic to continue to invest in

the brand and product innovation to deliver revenue of GBP311.1m

(2020: GBP252.1m), achieving growth of 23% despite the on-going

On-Trade restrictions, disruption and uncertainty caused by

COVID-19.

Performance in the Off-Trade was consistently strong across

regions, with the brand gaining market share in our key growth

markets, whilst On-Trade performance was encouraging despite being

impacted by restrictions in the first half of 2021 and towards the

end of the year.

We have continued to make good strategic progress, with

successful new product launches and continued investment in

marketing, sustainability and our people. As a result of our

strategic focus and our initiatives throughout the pandemic we have

strong momentum in a number of exciting growth markets, including

the US, Canada, Australia as well as across our European markets,

further positioning us as a truly global brand and the clear leader

of the premium mixer opportunity.

As was the case across the industry, the Group was impacted

throughout 2021 by considerable disruption to global logistics

networks, most notably through the availability and pricing of sea

freight and HGV drivers across our regions, which negatively

impacted gross margin. Despite the increased level of logistics

costs, we continued to invest for the long-term, and as a result,

the adjusted EBITDA margin reduced to 20.2% (2020: 22.6%). As we

move into 2022 conditions remain challenging, with continued

disruption and significant headwinds in product and logistics

costs, but we are working to mitigate the impact of these increases

and as usual remain focussed on driving margin improvement over the

medium term alongside our strong top line growth.

The Group generated an adjusted EBITDA of GBP63.0m (2020:

GBP57.0m), returning to growth with an increase of 10.3% on 2020.

Operating cash flow conversion remained strong at 91.7% (2020:

95.8%) and we end the year with an improved cash position of

GBP166.2m (2020: GBP143.1m). As a reflection of our confidence in

the financial strength of the Group, the Board is recommending a

final dividend of 10.47 pence per share, an increase of 2%

year-on-year, as well as a special dividend of 42.90 pence per

share.

Gross Margin

Gross margin of 42.1% represents a reduction from the 46.2%

gross margin reported in 2020. Whilst there were marginal impacts

from net foreign currency headwinds and the impact of consolidating

a full year of GDP portfolio brand revenue, the most significant

impact on gross margin was the increase in logistics costs.

The disruption to global logistics networks had multiple impacts

on gross margin, including increased UK logistics costs driven by

shortages of HGV drivers and significantly increased Trans-Atlantic

freight charges for the shipping of product to the US. In order to

mitigate the impact of uncertainty of sea freight availability we

took the decision to build inventory in the US in the first half of

the year. This successfully ensured continued product availability

in the US, however, it also resulted in elevated storage charges

and, at the end of the year, we were required to book a GBP1.3m

provision against inventory approaching its expiry date. The unsold

inventory largely related to a narrow range of new product lines

which were shipped to the US early in 2021 ahead of expected new

distribution in both the Off and On-Trade channels which was

subsequently delayed until later in the year due to the on-going

impact of COVID-19.

Disruption and uncertainty are on-going as we proceed into 2022,

and we anticipate significant headwinds in both logistics and

product costs. Against this backdrop we are focused on mitigating

actions, with the ramping up of local production on the East Coast

of the US, alongside a fully functioning West Coast production

line, essential in reducing our exposure to elevated Trans-Atlantic

freight costs, as well as allowing for lower inventory holdings in

the US. We are also working on a number of initiatives, including

transitioning to new warehousing locations in the US closer to our

bottling lines as well as multiple other projects across the Group

all of which are aimed at driving improvements in gross margin over

the medium term.

Operating expenditure

Despite the on-going impact of COVID-19 on our On-Trade revenue,

and the impact of global logistics disruption on our gross margin,

we continued to focus on the significant opportunity ahead for the

Group and invest in the brand, our people and our capabilities.

This led to underlying operating expenses[12] increasing by 14.6%

to GBP67.9m (2020: GBP59.3m), reducing to 21.9% of Group revenue

(2020: 23.5%).

We invested in TV advertising campaigns in the UK and Spain,

upweighted digital marketing spend across regions and executed

strong On-Trade activations across the summer period. Premium

spirit brands are more engaged than ever in seeking co-promotional

opportunities to drive serves resulting in multiple significant

campaigns across our key markets. Total marketing spend from the

Group remained strong at 9.3% of Fever-Tree brand revenue (2020:

9.9%).

Staff costs and other overheads increased to GBP38.7m (2020:

GBP34.1m). Following a significant increase in headcount in 2020 we

recruited less this year, consolidating the team and continuing to

integrate the GDP staff and operations following the acquisition in

July 2020. We will continue to build the team in 2022, to invest

ahead and underpin the increasing scale, scope and complexity of

the business. Whilst we will necessarily increase our headcount, we

intend to remain a lean organisation, and preserve the

entrepreneurial culture and operational agility that has served the

Group so well to date.

Whilst underlying operating expenses reduced as a percentage of

revenue to 21.9%, this was not sufficient to offset the decrease in

gross margin and as a result, the adjusted EBITDA margin reduced to

20.2% (2020: 22.6%). Despite this reduction in margin, due to the

strong revenue performance adjusted EBITDA returned to growth in

2021, increasing by 10.3% to GBP63.0m (2020: GBP57.0m)

Amortisation charges increased to GBP1.5m (2020: GBP1.1m)

following a full year of amortisation of the intangible asset

created on acquisition of GDP in July 2020. Depreciation charges

also increased to GBP3.2m (2020: GBP2.7m), largely driven by the

reusable packaging system in Germany, including the launch of a new

750ml glass bottle format. Finally, share based payment charges

increased to GBP2.7m (2020: GBP1.9m).

As a result of the increases in amortisation, depreciation and

share based payment charges, the 10.3% increase in adjusted EBITDA

translates to a 8.3% increase in operating profit to GBP55.6m

(2020: GBP51.3m) and profit before tax of GBP55.6m (2020:

GBP51.6m), an increase of 7.7%.

Tax

The effective tax rate in 2021 increased to 19.7% (2020: 19.1%),

driven by an adjustment to deferred tax in relation to future UK

corporation tax rate changes.

Earnings Per Share

The basic earnings per share for the year are 38.29 pence (2020:

35.86 pence) and the diluted earnings per share for the year are

38.19 pence (2020: 35.76 pence).

In order to compare earnings per share year on year, earnings

have been adjusted to exclude amortisation and the UK statutory tax

rates have been applied (disregarding other tax adjusting items).

On this basis, normalised earnings per share for 2021 are 39.70

pence per share and for 2020 were 36.72 pence per share, an

increase of 8.1%.

Working Capital

We began 2021 with elevated levels of inventory as we sought to

mitigate the impact of on-going COVID-related disruption alongside

the UK's exit from the EU. Whilst we were able to navigate the

latter with minimal disruption, supply chain uncertainty

contributed to the decision to build inventory further in the first

half of 2021, notably in the US. During the second half we reduced

inventory levels in the US as West Coast production ramped up and

as we approached commissioning of an East Coast bottling line. As a

result, year-end inventory levels were GBP36.2m, a reduction of

GBP2.5m from 2020 (2020: GBP38.7m).

Trade and other receivables increased in line with revenue

growth to GBP70.3m (2019: GBP56.0m). Our strong relationships,

proactive engagement with customers and appropriate levels of

credit insurance position us well to continue to manage the

on-going credit risk. However, we recognise that the current

external environment contributes to an elevated level of credit

risk and consequently increased our credit loss provision at year

end to GBP3.1m (2020: GBP1.2m). The movement in trade and other

receivables was partially offset by an increase in trade and other

payables to GBP49.4m (2020: GBP42.4m).

As a result of the above movements, there was only a marginal

increase in working capital of GBP4.7m to GBP57.1m (2020: GBP52.4m)

and therefore working capital improved to 18.3% of revenue (2020:

20.8%), which resulted in cash generated from operations of 91.7%

(2020: 95.8%).

Capital Expenditure

Due to the structure of the Group's business model, capital

expenditure requirements remain low, with additions of GBP5.8m in

the year (2020: GBP2.5m). The additions in the year included

continued investment in reusable packaging in Germany, reflecting

the growth in that market.

Cash Position

The Group continues to retain a strong cash position, with cash

at year end increasing by 16% to GBP166.2m (2020: GBP143.1m). This

platform provides a significant competitive advantage over many of

our premium mixer competitors globally and has allowed the Group to

remain focused on driving strategic progress over the last two

years despite the disruptions caused by COVID-19.

The Group's Capital Allocation Framework remains unchanged. We

intend to retain sufficient cash to allow for investment against

the opportunity ahead and primarily foresee this investment taking

the form of operational expenditure, including upweighted marketing

spend across our growth regions at the appropriate stage, whilst we

also intend to retain sufficient cash reserves to allow us to take

advantage of opportunities to upweight and accelerate investment as

they arise.

Whilst not a priority or essential component of the Group's

plans, we also remain vigilant with regards to M&A

opportunities that would further assist with the delivery of our

strategy, as demonstrated by the acquisition of GDP in 2020. Where

the Board considers there to be surplus cash held on the Balance

Sheet it will consider additional distribution to shareholders.

Dividend

The Group remains committed to a progressive dividend policy and

as such, the Board is recommending a final dividend of 10.47 pence

per share in respect of 2021 (2020: 10.27 pence per share). If

approved, this would bring the sum of the interim and final

ordinary dividend in respect of 2021 to 15.99 pence per share

(2020: 15.68 pence per share).

In addition to this, reflecting the strong year end cash

position, on-going cash generation and confidence in the execution

of the 2022 plan and beyond, the Board considers it appropriate to

recommend a special dividend of 42.90 pence per share. If approved,

this would bring the total dividend for 2021 to 58.89 pence per

share (2020: 15.68 pence per share).

If approved by shareholders at the AGM on 19 May 2022 the final

dividend will be paid on 27 May 2022 to shareholders on the

register on 7 April 2022.

Performance Indicators

The Group monitors its performance through a number of key

indicators. These are formulated at Board meetings and reviewed at

both an operational and Board level.

Progress against these key indicators was closely monitored

during the year. Due to the on-going disruption caused by the

pandemic during 2021, targeted performance was adjusted accordingly

as the year progressed. Group revenue growth was strong and ahead

of expectations, whilst the gross margin and adjusted EBITDA margin

were both down year on year and behind the Board's

expectations.

Revenue growth %

Group revenue growth was +23.4% in 2021 (2020: -3.2%).

Gross margin %

The Group achieved a gross margin of 42.1% in 2021 (2020:

46.2%).

Adjusted EBITDA margin %

The Group achieved an adjusted EBITDA margin of 20.2% in 2021

(2020: 22.6%).

Fevertree Drinks plc

Consolidated statement of profit or loss and other comprehensive

income

For the year ended 31 December 2021

2021 2020

GBPm GBPm

Revenue 311.1 252.1

Cost of sales (180.2) (135.8)

Gross profit 130.9 116.3

Administrative expenses (75.3) (65.0)

Adjusted EBITDA 63.0 57.0

Depreciation (3.2) (2.7)

Amortisation (1.5) (1.1)

Share based payment charges (2.7) (1.9)

Operating profit 55.6 51.3

Finance income 0.3 0.5

Finance expense (0.3) (0.2)

Profit before tax 55.6 51.6

Tax expense (11.0) (9.9)

Profit for the year 44.6 41.7

Items that may be reclassified

to profit or loss

Foreign currency translation

difference of foreign operations - (0.2)

Effective portion of cash flow

hedges (1.3) 0.6

Related tax 0.3 -

-------- --------

Total other comprehensive income (1.0) 0.4

-------- --------

Total comprehensive income

for the year 43.6 42.1

-------- --------

Earnings per share

Basic (pence) 38.29 35.86

Diluted (pence) 38.19 35.76

Fevertree Drinks plc

Consolidated statement of financial position

At 31 December 2021

2021 2020

GBPm GBPm

Non-current assets

Property, plant and equipment 9.6 7.5

Intangible assets 47.7 48.8

Deferred tax asset 2.8 1.9

Total non-current assets 60.1 58.2

------- -------

Current assets

Inventories 36.2 38.7

Trade and other receivables 70.3 56.0

Derivative financial instruments 0.9 1.3

Corporation tax asset 2.4 1.1

Cash and cash equivalents 166.2 143.1

Total current assets 276.0 240.2

------- -------

Total assets 336.1 298.4

------- -------

Current liabilities

Trade and other payables (49.4) (42.4)

Loans and borrowings (0.1) (0.1)

Lease liabilities (0.7) (0.7)

Corporation tax liability (0.6) -

------- -------

Total current liabilities (50.8) (43.2)

------- -------

Non-current liabilities

Lease liabilities (2.1) (1.1)

Deferred tax liability (1.6) (1.5)

Total non-current liabilities (3.7) (2.6)

------- -------

Total liabilities (54.5) (45.8)

------- -------

Net assets 281.6 252.6

------- -------

Equity attributable to equity

holders of the company

Share capital 0.3 0.3

Share premium 54.8 54.8

Capital redemption reserve 0.1 0.1

Cash flow hedge reserve (0.2) 0.8

Translation reserve (0.2) (0.2)

Retained earnings 226.8 196.8

------- -------

Total equity 281.6 252.6

------- -------

Fevertree Drinks plc

Consolidated statement of cash flows

For the year ended 31 December 2021

2021 2020

GBPm GBPm

Operating activities

Profit before tax 55.6 51.6

Finance expense 0.3 0.2

Finance income (0.3) (0.5)

Depreciation 3.2 2.7

Amortisation of intangible assets 1.5 1.1

Share based payments 2.7 1.9

Impairment losses on receivables and inventories 3.8 -

Gain on disposal of fixed asset 0.1 -

66.9 57.0

Decrease/(Increase) in trade and other

receivables (14.6) 4.0

Decrease/(Increase) in inventories 0.5 (17.2)

(Decrease)/Increase in trade and other

payables 7.7 10.8

(Decrease)/Increase in derivative asset/liability (2.8) -

------- -------

(9.2) (2.4)

Cash generated from operations 57.7 54.6

------- -------

Income taxes paid (10.9) (16.5)

Net cash flows from operating activities 46.8 38.1

------- -------

Investing activities

Purchase of property, plant and equipment (3.6) (2.6)

Interest received 0.3 0.5

Investment in intangible assets (1.0) -

Acquisition of subsidiary, net of cash

acquired - (1.7)

Net cash used in investing activities (4.3) (3.8)

------- -------

Financing activities

Interest paid (0.2) (0.2)

Dividends paid (18.4) (17.8)

Repayment of loan (0.1) (0.9)

Payment of lease liabilities (0.6) (0.7)

Net cash used in financing activities (19.3) (19.6)

------- -------

Net increase in cash and cash equivalents 23.2 14.7

------- -------

Cash and cash equivalents at beginning

of period 143.1 128.3

Effect of movements in exchange rates

on cash held (0.1) 0.1

Cash and cash equivalents at end of period 166.2 143.1

------- -------

1. Basis of Preparation

The financial information contained in this results announcement

has been prepared on the basis of the accounting policies set out

in the statutory financial statements for the year ended 31

December 2020. Whilst the financial information included in this

announcement has been computed in accordance with the recognition

and measurement requirements of UK adopted international accounting

standards, this announcement does not itself contain sufficient

disclosures to comply with UK adopted international accounting

standards.

The financial information set out above does not constitute the

company's statutory accounts for 2021 or 2020. Statutory accounts

for the years ended 31 December 2021 and 31 December 2020 have been

reported on by the Independent Auditor. The Independent Auditor's

Report on the Annual Report and Financial Statements for 2021 and

2020 was unqualified, did not draw attention to any matters by way

of emphasis, and did not contain a statement under 498(2) or 498(3)

of the Companies Act 2006. Statutory accounts for the year ended 31

December 2020 have been filed with the Registrar of Companies. The

statutory accounts for the year ended 31 December 2021 will be

delivered to the Registrar in due course.

2. Revenue

An analysis of turnover by geographical market is given

below:

2021 2020

GBPm GBPm

United Kingdom 118.3 103.3

United States of America 77.9 58.5

Europe 88.2 65.3

Rest of the World 26.7 25.0

311.1 252.1

====== ======

3. Earnings per share

2021 2020

GBPm GBPm

Profit

Profit used in calculating basic and diluted

EPS 44.6 41.7

Number of shares

Weighted average number of shares for the

purpose of

basic earnings per share 116,536,876 116,277,921

Weighted average number of dilutive employee

share options outstanding 302,357 335,590

------------ ------------

Weighted average number of shares for the

purpose of

diluted earnings per share 116,839,233 116,613,511

------------ ------------

Basic earnings per share (pence) 38.29 35.86

------------ ------------

Diluted earnings per share (pence) 38.19 35.76

------------ ------------

4. Dividends

In the financial year ended 31 December 2021 dividends were paid

with a value of GBP18,399,903 (being GBP11,966,441 at 10.27 pence

per share in respect of the year ended 31 December 2020, and

GBP6,433,462 at 5.52 pence per share in respect of the six months

ended 30 June 2021). The Directors are proposing a final dividend

of 10.47 pence per share and a special dividend of 42.90 pence per

share, totalling GBP62,202,735 for 2021. This dividend has not been

accrued in the consolidated statement of financial position.

[1] IRI 13 weeks to 26 December 2021

[2] Nielsen

[3] Adjusted EBITDA is earnings before interest, tax,

depreciation, amortisation, share based payment charges and finance

costs

[4] IRI 13 weeks to 26/12/2021

[5] CGA 13 weeks to 01/01/2022

[6] Kantar 52 week penetration to 26/12/2021

[7] Nielsen

[8] Nielsen & IRI

[9] Woolworths & Coles scan data 2021

[10] Nielsen 12 weeks to 01/01/2022

[11] IWSR 2020 - Fever-Tree top 15 markets: UK, US, Australia,

Austria, Benelux, Canada, Denmark, France, Germany, Italy,

Netherlands, Portugal, Spain, Sweden, Switzerland

[12] Underlying operating expenses is defined as Administrative

expenses (GBP75.3m) less Depreciation (GBP3.2m), Amortisation

(GBP1.5m) and Share based payments expenditure (GBP2.7m)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FFFVIVIIELIF

(END) Dow Jones Newswires

March 16, 2022 03:00 ET (07:00 GMT)

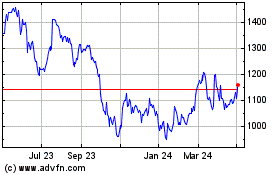

Fevertree Drinks (LSE:FEVR)

Historical Stock Chart

From Mar 2024 to Apr 2024

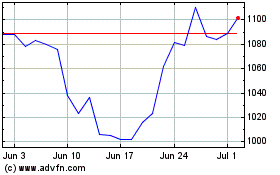

Fevertree Drinks (LSE:FEVR)

Historical Stock Chart

From Apr 2023 to Apr 2024