TIDMFEVR

RNS Number : 1838Z

Fevertree Drinks PLC

13 September 2022

Fevertree Drinks plc

FY22 Interim Results to 30 June 2022

FY22 Interim Highlights

-- Strong top line performance with revenue growth of 14% year-on-year

-- Good recovery in the On-Trade channel during the first half,

with consumer demand remaining strong, especially in the US and

Southern European markets

-- As highlighted in July, pricing actions in our more

established markets and improvements in sales mix only partially

mitigated on-going industry-wide inflationary logistics and product

cost headwinds, resulting in a 670bps reduction in gross margin

-- We remain confident in the substantial long-term opportunity,

and therefore continue to invest for growth, increasing expenditure

on the brand, our people and our operations

-- The Group ended the period with a strong balance sheet,

underpinned by cash of GBP100m at period end, following payment of

the GBP50m special dividend announced in March

-- Recommending an interim dividend of 5.63 pence per share, an increase of 2% year-on-year

-- Reiterating guidance from July; FY22 revenue GBP355m -

GBP365m and EBITDA of GBP37.5m - GBP45m

GBPm H1 FY22 H1 FY21 Change

---------------------------- -------- -------- ---------

Revenue

UK 53.5 50.3 6%

US 40.1 36.2 11%

Europe Fever-Tree brand

revenue 46.5 36.7 27%

Europe total* 52.3 41.3 27%

ROW 15.0 14.0 7%

Total* 160.9 141.8 14%

Gross profit 60.1 62.5 (4)%

Gross margin 37.4% 44.1% (670)bps

Adjusted EBITDA [1] 21.9 29.2 (25)%

Adjusted EBITDA margin 13.6% 20.6% (700)bps

Diluted EPS (pence per

share) 12.08 17.44 (31)%

Dividend (pence per share) 5.63 5.52 2%

Cash 100.0 133.2 (25)%

---------------------------- -------- -------- ---------

*includes GDP's portfolio brands

Strategic highlights

-- Despite the challenging global operating environment,

Fever-Tree has continued to extend its premium market-leading

position in the UK, US, Europe and RoW

-- The Group has made significant progress on its strategic

priorities since the start of the year

o We remain the clear market leader in the UK (33% of Group

revenue), delivering revenue growth of 6% despite well-reported

industry challenges

o Positioning the brand for long term success in the US (25% of

Group revenue). US revenue was up 11% in the first half but

underlying demand is significantly higher with reported growth

impacted by Trans-Atlantic shipping challenges and a slower than

expected ramp up in local production on the East Coast of the US.

Our three-year compound annual growth rate at retail in the US is

almost three times the growth rate of the total mixer category. We

will continue to invest to capture the enormous potential we see

for our brand in this market

o Building scale and share across Europe (33% of Group revenue),

with growth of 27% driven by strong performance in Southern Europe

where the brand is seeing significant consumer pull and momentum.

Across Europe the Group drove around a third of total mixer

category growth at retail. As with the US we will continue to

invest in building our scale and potential in these markets

o Positioning the brand for the long term in large growth

markets in the RoW (9% of Group revenue), with growth of 7% but

adjusting for depletions, underlying growth is nearer 15%. Our

immediate focus is on the core markets of Australia and Canada

where the brand is performing well, but we are also focused on

wider opportunities globally as western drinking habits develop

over a longer time horizon

-- More specifically during this six-month period, we are very

pleased to report progress on the following growth initiatives:

o Successful initial trials positioning several Fever-Tree

products as premium Soft Drinks in the UK Off-Trade enabling the

Group to access a significant adjacent opportunity

o Extending into non-carbonated cocktail mixers in the US

through the acquisition of Powell & Mahoney just after period

end to accelerate the brand's entry into this notable new

category

o Important route-to-market evolution in Canada and Japan,

securing heavyweight new distribution partners reflecting the size

of the opportunity in our Rest of the World region

o Continued success with new product launches including a

Limited-Edition Passionfruit & Lime Tonic in the UK

Tim Warrillow, CEO of Fever-Tree, commented

"Fever-Tree has delivered a robust revenue performance in the

first half of 2022, with a particularly strong performance in

Europe as the On-Trade recovered. Demand has been strong in the US

and we have continued to increase our availability on shelf

enabling us to deliver a record month in August, a fantastic

achievement by the team.

Alongside driving topline growth, the business remains extremely

focused on mitigating the industry-wide cost impacts and whilst we

are still highly mindful of the extreme volatility impacting

energy-related and logistics costs, we do expect to see a gradual

decrease in our exposure over the medium term.

The strength of the Fever-Tree brand is providing exciting

opportunities to recruit new consumers and extend into significant

adjacent categories, with the opportunity in premium soft drinks in

the UK and non-carbonated cocktail mixers in the US both extremely

compelling.

The long-term opportunity for the business remains very

significant and we continue to focus on investing in our products,

marketing activities and our team. As the global leader of the

premium mixer category we remain at the centre of the

well-established trends to premiumisation and long-mixed drinks

whilst also perfectly positioned to explore these incremental

opportunities."

There will be live audio webcast on Tuesday 13(th) September

2022 at 10:00am BST. The webcast can be accessed via:

Fever-Tree FY22 Interim Results webcast

For more information please contact:

Investor queries

Ann Hyams, Director of Investor Relations I

ann.hyams@fever-tree.com I +44 (0)2045 168 106

Media queries

Oliver Winters, Director of Communications I

oliver.winters@fever-tree.com I +44 (0)770 332 9024

Nominated Advisor and Joint Broker - Numis Securities

Stuart Dickson I Hugo Rubinstein I +44 (0)20 7260 1000

Joint Broker - Investec Bank plc

David Flin I Alex Wright I +44 (0)20 7597 5970

Financial PR advisers - FGS Global

Faeth Birch +44 (0)7768 943 171;Anjali Unnikrishnan +44 (0)7826

534 233; Carolina Neri +44 (0)7502127516

Strategic update I Strong performance with On-Trade recovering

well

GBPm H1 FY22 H1 FY21 change constant

currency

change

-------------------- -------- -------- ------- ----------

Revenue

UK 53.5 50.3 6% 6%

US 40.1 36.2 11% 9%

Europe Fever-Tree

brand revenue 46.5 36.7 27% 31%

Europe total* 52.3 41.3 27% 31%

ROW 15.0 14.0 7% 5%

Total* 160.9 141.8 14% 14%

-------------------- -------- -------- ------- ----------

Fever-Tree delivered a strong top line performance in the first

half of 2022. Revenue of GBP160.9m was an increase of 14%

year-on-year and was achieved despite the Omicron variant impacting

On-Trade performance at the start of the year, alongside logistics

disruptions impacting our ability to fulfil against the strong

demand we are seeing in the US.

The wider On-Trade market rebounded particularly well in the US

and Southern Europe. In the US On-Trade sales have been

consistently ahead of pre-Covid, 2019 levels [2] , and in Europe

sales have built strongly to surpass 2019 levels, supported by the

return of the tourism industry to Southern Europe. In the UK the

On-Trade has experienced a steadier build, with pre-Covid levels

reached at the start of the second quarter(2) .

Fever-Tree has made significant strategic progress since the

start of the year. This includes the expansion into two adjacent

categories; premium soft drinks in the UK and non-carbonated

cocktail mixers in the US, both of which present significant

long-term opportunities for the brand. Alongside this, within our

core mixers we continue to launch new, innovative products

including a Limited-Edition Passionfruit & Lime Tonic in the

UK, a Blood Orange Ginger Beer in the US, as well as broadening the

distribution of our Premium Soda range across Europe to capitalise

on the growing Spritz occasion.

The Group continues to partner with a range of spirits brands

across the world, with a greater focus on the On-Trade during the

first half of the year as this channel rebuilt and events returned.

In addition, we have made two significant route-to-market changes,

transitioning to Tree of Life in Canada, and Asahi Breweries in

Japan, reflecting the size of the opportunity in those markets.

Alongside driving topline growth, the business remains extremely

focused on mitigating the industry-wide cost impacts, as well as

more specific cost headwinds, such as elevated sea freight costs,

which we will gradually decrease our exposure to through the

increasing localisation of production. We are also mindful of the

challenges facing our customers and consumers due to rising energy

costs and inflation more broadly, but believe we are well-placed

with our strong relationships and affordable premium price-point,

and therefore remain confident of delivering our plan in the second

half of the year.

Doing business in the right way, with our colleagues,

communities, and environment in mind, remains central to everything

we do at Fever-Tree. In the first six months of 2022 we have

focused on our Climate and Conservation branches of our five-branch

sustainability framework.

Having become carbon neutral in the UK last year following a

full cradle-to-grave lifecycle analysis of our greenhouse gas

emissions across, we continue to work towards, and remain committed

to, being carbon neutral globally by 2025 using science-based

emission reduction targets. A great example of how the business is

benefitting operationally, financially and in terms of carbon

reduction is through the localisation of our production in the US,

and in Australia next year. We are also making progress under our

Conservation branch, partnering with All Bar One, one of our

largest On-Trade customers in the UK, to support the rollout and

conservation of the Tiny Forests network being planted across the

UK.

UK I Increasing share and brand awareness

Fever-Tree delivered UK revenue of GBP53.5m in the first half of

the year, an increase of 6% year-on-year.

The On-Trade rebuilt steadily during the period, with

Fever-Tree's On-Trade sales increasing by c.73% year-on-year in the

first half, as we annualised lockdowns and restrictions during the

first half of 2021. The work we did to support our customers during

periods of On-Trade closure over the last two years have put us in

a strong position and we now have over 50% value share of the mixer

category in that channel, which is our highest ever share with an

increase of 3.1% compared to pre-Covid levels [3] .

The return of events this year has created more opportunities

for consumers to enjoy and trial the brand, as well as increasing

the brand's visibility. We have increased our presence with

Fever-Tree bars at a variety of events around the UK, including

Royal Ascot, The Oval and Polo in the Park, enabling us to showcase

new drinks and occasions, including a number of Spritz serves,

which have been performing particularly strongly.

Alongside mixers, the spirits category continued to perform

well, growing its On-Trade sales value by 15.6% and value share by

3.4ppts compared to 2019(3) , with premiumisation trends just as

strong and forecast to continue [4] . Fever-Tree is best placed to

capitalise on the movement to premium long mixed drinks and we are

increasingly engaging with spirits companies through co-promotions

across a number of spirit and mixer occasions, including gin &

tonic, whisky & ginger, and vodka & soda.

In the Off-Trade, the Group was lapping a very strong period of

sales in this channel last year when the On-Trade was closed,

resulting in sales decreasing by 21% compared to H1 2021. Despite

this, Fever-Tree has grown volume share within the category, is in

more UK households than any other mixer brand [5] and remains the

leading premium mixer brand at UK retail, with a rate-of-sale on

shelf seven times higher than the average rate-of-sale of other

premium mixers [6] .

Taking the entire UK mixer market into account, across both

channels, Fever-Tree remains the clear leader of the mixer

category, with c.45% value share, over twenty times the nearest

premium mixer brand, and almost 50% higher than Schweppes [7] .

The Group has continued to invest in marketing during the first

half of the year, with the launch of our new campaign "We'd say

T&G", which included our first national appearance on UK radio

stations, aiming to reach 3/4 of all adults during the summer. Our

investment behind the brand has proved hugely successful, with

Fever-Tree's prompted awareness now as high as 90% amongst spirit

and mixer drinkers, and 44% of consumers who drink spirits and

mixers claim to know the brand "very well", +5ppts year-on-year and

almost 4x higher than the next premium brand [8] .

The first half of 2022 has also seen two exciting adjacencies

being explored.

We have long understood that our products' natural ingredients,

adult flavour profiles and low-calorie options, alongside the

sophistication of our brand, means we are ideally positioned to

extend into the premium soft drink occasion. This has been

underpinned by initial trials we have conducted with a major UK

retailer over the last 12 months, which has seen a small number of

our products placed within the soft drink section of the store. The

results of this trial have been extremely encouraging with our

Ginger Beer SKU rapidly achieving the highest rate of sale for the

single serve format within the category, and the range outselling

many of the long established premium soft competitors.

While at a relatively early stage, we believe the category

presents a significant long-term adjacency for the brand. In the

near term the trial has led to wider, incremental distribution

across many of our major UK retail partners and will see the launch

of a 4x250m can format to support the roll out in the second half.

This will be followed by new flavours and extending into other

channels as we build out the opportunity in the coming years.

The second exciting opportunity has been the launch of our first

airport bar at Edinburgh airport, which opened in May. This has

provided a great way to showcase the brand and increase brand

exposure in a new setting where premium long-mixed Fever-Tree

drinks are served alongside small sharing plates. The bar has been

a big success since opening, with clear consumer demand for the

offering in that setting, demonstrating the potential for an

exciting new platform to increase the brand's visibility that we

can take to other markets globally over time.

Overall, Fever-Tree has made good progress in the UK during the

first half of 2022. We have been encouraged by the brand's

performance in the On-Trade as it recovers, as well as increasing

our volume share in the Off-Trade, and extending our brand

awareness, supported by marketing campaigns, activations and

co-promotions. We have also made important strategic steps into

exciting new adjacencies as we continue to invest for long-term

growth and remain confident about the long-term opportunity in our

home market.

US I Positioning the brand for long-term success

Fever-Tree's revenue for the first half of the year increased by

11% to GBP40.1m (up 9% at constant currency). Demand for the brand

remains strong and was significantly ahead of this result, which

was impacted by inventory restrictions towards the end of the

period caused by disruption and delays in trans-Atlantic shipping

alongside a slower than expected ramp of East Coast production.

Following steps taken to address these challenges, inventory is

recalibrating post period end and our performance is improving,

reflecting the underlying momentum as we refill pipelines with

customers and distributors.

The wider On-Trade channel in the US has rebounded quickly, with

sales surpassing pre-Covid levels from the start of the year.

Fever-Tree's On-Trade sales have also been strong, driven by new

mandates and distribution gains, including more than 1,000 new

points of distribution in Marriott Hotels, along with new accounts

at Disney and Hilton Luxury Hotels. Since the end of 2021

Fever-Tree has increased our number of On-Trade accounts by 20% and

our total points of distribution by 33% as we strengthen our

position as the premium mixer of choice in this channel.

Alongside the significant progress in the On-Trade, the brand

has continued to perform well in the Off-Trade. Our retail sales in

H1 increased by 16% year-on-year and 144% compared to 2019 [9] .

Further, our three-year growth rate (CAGR) is almost three times

the growth rate of the total mixer market and we have grown our

share by 1.6ppts(10) ensuring that we remain the clear premium

mixer market leader in retail, which remains a fast-growing

category.

The growth we are achieving in the US is being driven by our

multi-channel approach to brand-building, our strategic

innovations, and our distribution gains, alongside the supportive

macro trends to long mixed drinks. We continue to place a lot of

emphasis on marketing and investment to grow Fever-Tree's brand

awareness with both consumers and the trade. In the first half of

the year the brand has focused on a range of campaigns across

YouTube, social media, and Hulu with video content highlighting our

ingredients, provenance and "how to" mix. We also continued to

re-allocate spend back into the On-Trade with pop-up bars to

increase brand visibility and provide consumers with a fantastic

experience as they enjoy perfectly crafted cocktails using a range

of Fever-Tree mixers.

Tracking consumer drinking trends enables us to innovate in the

most impactful way, creating mixers to pair with popular,

fast-growing and premiumising spirits. The launch of our Sparkling

Pink Grapefruit mixer exemplifies this, as mixing it with either

Tequila, the fastest growing and most premium spirit, or Vodka, the

largest spirit category, creates a perfect Paloma or Spritz serve.

It's therefore no surprise that Sparkling Pink Grapefruit has been

our fastest growing new product launch, and continues to contribute

c.50% to the total sparkling grapefruit category growth(10) . The

latest exciting addition to the portfolio this month is Blood

Orange Ginger Beer, with the aim of replicating the success we've

had adding flavours to our Tonic range as a way to stimulate growth

by recruiting new consumers and prompting existing consumers to try

something new.

Alongside extending our range of carbonated mixers, we are also

extending into the significant opportunity within the

non-carbonated cocktail mixer category in the US. This segment of

the mixer market is the same size as the Tonic Water and Ginger

Beer markets combined and is growing and premiumising at pace(10) .

We believe Fever-Tree is well-placed to enter this category, given

our established credentials as the US's largest premium mixer, our

proven track-record in innovation to compliment popular spirits,

and our strong customer relationships and route to market.

Consequently, in August 2022 we acquired Powell & Mahoney, a

premium non-carbonated US cocktail mixer brand, with national

retail listings and an asset light business model with an

established production partner. We believe the acquisition will

provide Fever-Tree with the ideal platform to accelerate its entry

into this exciting adjacent category.

As demonstrated above, the Group's ambition and confidence in

the US opportunity continues to grow. We have been encouraged by

our performance in the On-Trade, our momentum in the Off-Trade, and

continue to see new opportunities for growth in this substantial

market.

Europe I Strong first half, building on a well-established

foundation

Our European business delivered a strong first half performance

with revenue for the first half increasing by 27% year-on-year (31%

at constant currency), driven by a strong return of the On-Trade in

our key European markets. The main contributors to this

outperformance have been Italy, France and Spain where increasing

retail distribution has led to market share gains alongside the

strong On-Trade rebound, as well as increasing brand awareness

driven by investment in television marketing campaigns in Spain and

Italy over the past 12 months.

The On-Trade started the year with various restrictions still in

place but accelerated in the second quarter fueled by pent-up

demand and the return of tourism. Consequently, the On-Trade made

up just over 50% of Fever-Tree's European revenues in the first

half of 2022. Both channels have seen good growth compared to

pre-Covid levels, contributing to a total sales growth of over 50%

since 2019.

Fever-Tree continues to perform strongly and drive

premiumisation across Europe. In the Off-Trade, Fever-Tree

contributed to just under a third of the total branded mixer

category value growth across Europe over the last year [10] , well

ahead of any other premium brand. We are extending our premium

leadership across our markets, with particularly strong

performances over the last three years in France and Italy, where

we've grown five times and four times faster than the market

respectively (11) .

We have continued to invest across the region with a range of

marketing activities, from traditional above-the-line campaigns to

On-Trade activations, social media campaigns, and television

adverts. A lot of the focus in our above-the-line campaigns have

been on our new, bright, eye-catching flavours, such as Rhubarb

& Raspberry which command consumer attention and make the brand

instantly visible. We have also continued our good work in the

Off-Trade during covid, with significant retail displays and

co-promotions, both of which have driven more distribution and

sales.

As the On-Trade has returned, we have been able to increase our

marketing activities in this important channel, using large

flagship accounts to increase the brand's presence with Fever-Tree

branded chairs, parasols, glassware and 'Perfect Serve' menus to

ensure the brand is being enjoyed across a range of occasions.

The business has also been investing in online and

television-based campaigns more recently, including our first ever

comprehensive digital and social media campaign in Belgium and The

Netherlands to showcase our ingredient quality and how to create

serves using our "perfect pairings". This activity has been

achieving high levels of engagement and can be used as a blueprint

for similar projects across other markets. In addition, the brand

launched its first ever television advert in Italy, a national

campaign with a 30 second advert focusing on our "3/4" message,

ingredients and quality. We have already seen a significant impact

from this campaign, with a 60% increase in our brand awareness

across the country after the advert aired in May and June [11]

.

The brand continues to make excellent progress across Europe,

with good growth in all our markets over the last three years and

an acceleration in Southern Europe in H1 2022 as the On-Trade

re-opened and tourism returned. We continue to premiumise and drive

growth in the mixer category, extending our market-leading position

and remain the only premium mixer brand with significant scale

across the region. Our strong investment behind the brand is

indicative of our confidence in the opportunity across Europe,

supported by macro trends such as the increasing popularity of long

mixed drinks and premiumisation of the spirit category.

RoW I Good progress in key markets with significant route to

market evolutions

Fever-Tree delivered revenue of GBP15.0 million in our Rest of

the World region in the first half of the year, a 7% increase

compared to H1 2021 (5% at constant currency). We were lapping some

strong comparators from last year but our underlying growth across

the region was slightly stronger, at c.15% when we look at

depletions.

In Australia, Fever-Tree grew by 53% in the Off-Trade over the

last year and is driving all of the growth and premiumisation in

the mixer category. The Tonic category is doing particularly well

as Gin & Tonic continues to lead the growth of long mixed

drinks, especially at the premium end, and Fever-Tree Tonics are

growing four times faster than the wider Tonic category [12] . We

continue to win new shelf space, with more than 2,000 additional

points of distribution secured in Coles in the first half of the

year and our new can format enhancing sales through the recruitment

of new consumers to the brand. As well as increasing the brand's

presence on shelf, we continue to activate the brand in the

On-Trade. Our latest Gin & Tonic Festival was held in Brisbane

after the success of the event in Sydney last year, extending the

brand's presence across the country with consumers and the

trade.

In Canada, consumers are increasingly drinking and premiumising

their long-mixed drinks as both spirit and mixer categories

continue to premiumise. Fever-Tree is helping to drive the growth

and premiumisation of the mixer category, increasing our sales at

over five times the rate of the total mixer category over the last

three years. This growth has come across all key mixer categories,

with Ginger Beer doing particularly well in the first half of 2022

and new launches in the Soda & Sparkling category adding to our

growth as we expand our portfolio into Spritz occasions. As well as

expanding into new categories, Fever-Tree continues to hold

approximately a third of the market share in the Tonic category and

has grown to c.28% of the Ginger Beer category, an increase of

6ppts in the last year [13] .

As we look to the long-term opportunity in Canada, we have also

made a significant step-change in our route-to-market this year by

transitioning to a new much more powerful distributor, Tree of

Life. With over 70 years of experience in the Canadian market, Tree

of Life are well-positioned to support our growth ambitions in the

market, with their strong sales team, broad, multi-channel

coverage, and comprehensive geographic reach.

In Asia we have also made an important change to our

route-to-market. The brand has agreed to take on Asahi Breweries as

our new distribution partner in Japan, with a three-year exclusive

deal starting in January 2023, this move is reflective of Asahi's

belief in the significant future opportunity of the premium mixer

and adult soft drink category and we are excited about working with

a company of their size and influence to go after the opportunity

in this potentially valuable market.

The Group continues to grow strongly in this region, where we

see substantial growth opportunities in a number of markets. We

have extended our premium market-leading position in Australia and

Canada and continue to take steps to position us for longer term

opportunities across markets as the long-mixed drink trend gathers

momentum globally.

Operational review

The Group continues to expand its global production network,

with ten sites currently providing capacity and flexibility as we

scale globally, with further expansion expected in 2023. While this

has diversified our production volumes away from our core UK

bottler, as we build volumes through regional production networks

we will recapture economies of scale and be in a strong position to

drive improvements in costs per unit. In addition, increasingly

localising our US and Australian production over the next two years

will reduce our exposure to sea freight costs, as well as reducing

our carbon footprint.

The level of disruption and uncertainty remains high, with rapid

shifts in the operational and cost backdrop. Specifically, labour

shortages at our East Coast bottler in the US have impacted our

ramp up, resulting in greater production volumes required from the

UK, and has increased our exposure to sea freight costs in the

short-term. We are working closely with our US bottling partner,

who have reinforced their senior management team in recent weeks

and we have co-authored a detailed operational plan focussed on

recruitment, training and additional shift patterns in order to

increase daily output levels over the remainder of the year.

In addition, glass availability will be restricted across our

suppliers in the second half of the year, which will limit our

opportunity to deliver revenue upside despite the strong demand

we're seeing across our markets. We are working with our suppliers

to secure our 2023 glass requirements against a backdrop of

inflationary cost pressure, driven predominantly by the currently

elevated gas pricing.

Financial review

The Group has continued to make strategic progress in the first

half of 2022, whilst navigating the on-going logistics disruption

and intensifying cost headwinds prevalent across the industry.

Revenue of GBP160.9m (H1 2021: GBP141.8m), with growth of 14%

(14% at constant currency) was a strong performance, with the

On-Trade showing promising signs of recovery and demand remaining

strong, especially in our growth markets.

The Group generated an adjusted EBITDA of GBP22.0m (H1 2021:

GBP29.2m), a 24.7% decrease year-on-year. As anticipated, gross

margins have been impacted by inflationary cost pressures and

continued exposure to elevated Trans-Atlantic freight costs, which

were only partially off-set by an improved channel and regional

mix, and pricing actions taken in our more established markets.

Despite these impacts we continue to invest behind the brand, our

team and our operations as we remain focused on the significant

opportunity ahead. Operating expenditure has been maintained at

23.7% of Group revenue (H1 2021: 23.5%) and as a result, the

impacts on gross margin have translated to a reduction in EBITDA

margin to 13.6% (H1 2021: 20.6%).

Whilst working capital improved, the reduction in EBITDA margin

drove a lower level of operating cash flow conversion, which

alongside the payment of the GBP50m special dividend announced at

the 2021 full year results in March, has resulted in a reduction in

cash held to GBP100.0m (H1 2021: GBP133.2m). The balance sheet

remains strong and the Board is recommending an interim of dividend

of 5.63pence per share, an increase of 2% year-on-year.

GBPm H1 FY22 H1 FY21 Change

-------- --------

Revenue 160.9 141.8 14%

------------------- -------- -------- ---------

Gross profit 60.1 62.5 (4)%

------------------- -------- -------- ---------

Gross margin 37.4% 44.1% (670)bps

------------------- -------- -------- ---------

Adjusted EBITDA 22.0 29.2 (25)%

------------------- -------- -------- ---------

Adjusted EBITDA

margin 13.6% 20.6% (700)bps

------------------- -------- -------- ---------

Operating profit 17.4 25.3 (31)%

------------------- -------- -------- ---------

Profit before tax 17.6 25.3 (30)%

------------------- -------- -------- ---------

Cash 100.0 133.2 (25)%

------------------- -------- -------- ---------

Gross margin

Gross margin of 37.4% represents a reduction from the 44.1%

gross margin reported in the first half of 2021. The main factors

impacting gross margin were:

-- Inflationary cost increases impacting underlying product

costs and logistics costs across regions.

-- Further increases in the underlying cost of sea freight, with

on-going exposure to Trans-Atlantic freight costs as UK-produced

stock is required to underpin US growth until East Coast production

increases to the required levels.

-- Whilst both pricing actions in our established regions and

changes in channel and regional mix drove margin improvement, this

was not sufficient to off-set the impact of the inflationary

headwinds in the first half.

As previously guided, we expect inflationary cost pressures to

have an increased impact in the second half of the year. Whilst

disruption and uncertainty remain elevated across categories, the

most notable impacts are expected to relate to the cost of glass

bottles, where a sustained elevation in gas price is being passed

through by suppliers against a backdrop of limited glass

availability across the Group's suppliers in the UK and Europe.

Alongside this, a slower ramp up of the East Coast bottling line

than planned has necessitated an increased level of UK production

for the US, and a continued exposure to elevated Trans-Atlantic

freight costs in the second half, where underlying charges on key

routes are up c. 50% since the beginning of the year.

Our team is extremely focused on navigating the current

challenges we are facing. In the short term, we are working closely

with our network of suppliers to secure our 2023 requirements, and

with our US bottling partner to ensure the East coast production

line is ramping up to required levels in order to reduce our

exposure to Trans-Atlantic shipping charges in 2023.

We continue to invest in the operational capabilities that will

underpin the growth opportunity. We have made experienced new hires

in our global supply chain team and are working on a substantial

program of activities to mitigate near term inflation, and

crucially, to also set the business up for longer term profitable

growth. These actions can be broadly grouped into four key

areas:

1. Expanding our production footprint: establishing capacity

closer to our key growth markets to minimise transport costs,

optimise our inventory holdings and facilitate quicker reactions to

market dynamics, with a focus on establishing US canning and

Australian bottling during 2023.

2. Optimising our existing footprint: working closely with our

current partners to drive efficiency and effectiveness as we manage

our increasing complexity.

3. Procurement: leveraging our global scale, widening and

on-shoring our supplier base, such as sourcing glass locally in the

US, and ensuring our contracts are calibrated for both the current

disruptive environment and our longer term growth as we scale

through our regionalised production footprint.

4. Technology: underpinning all of the above is a wide-ranging

programme to embed technology across our global operations that

will give us best in class ways of working, data and insights to

manage near term disruption, as well as underpinning our future

growth.

Operating expenditure

Underlying operating expenses increased by 14.5% in the first

half of the year to GBP38.2m (H1 2021: GBP33.3m) and remained

broadly consistent with the prior year at 23.7% of Group revenue

(H1 2021: 23.5%)

We continue to invest behind the brand, including a radio

advertising campaign in the UK and first national television

advertising in Italy, where we are seeing strong growth. Our

marketing spend in the first half of the year was 10.2% of

Fever-Tree brand revenue (H1 2021: 9.9%) and we expect it to remain

at this level for the remainder of the year. Staff costs and other

overheads increased by 13.8% and remained consistent at 13.9% of

Group revenue in the first half of the year (H1 2021: 13.9%).

The Group generated an adjusted EBITDA of GBP22.0m, a 24.7%

decrease on the first half of 2021 (H1 2021: GBP29.2m). The

dilution in gross margin, due mainly to inflationary cost pressures

and continued exposure to elevated Trans-Atlantic freight charges,

coupled with maintained levels of underlying operating expenditure

as a proportion of revenue, has resulted in a retraction in

adjusted EBITDA margin to 13.6% (H1 2021: 20.6%).

Depreciation reduced marginally to GBP1.6m (H1 2021: GBP1.8m)

whilst amortisation remained flat at GBP0.8m (H1 2021: GBP0.8m).

Share based payments increased to GBP2.2m (H1 2021: GBP1.3m). As a

result of these movements, the 24.7% decrease in adjusted EBITDA

translates to a 31.2% decrease in operating profit to GBP17.4m (H1

2021: GBP25.3m).

Tax

The effective tax rate in the first half of 2022 was 19.8% (H1

2021: 19.5%) and was in line with expectations.

Earnings per share

The basic earnings per share for the period are 12.10 pence (H1

2021: 17.47 pence) and the diluted earnings per share for the

period are 12.08 pence (H1 2021: 17.44 pence), a decrease of

30.7%.

In order to compare earnings per share period on period,

earnings have been adjusted to exclude amortisation and the UK

statutory tax rates have been applied (disregarding other tax

adjusting items). On this basis, normalised earnings per share for

the first half of 2022 are 12.87 pence (2021: 18.14 pence), a

decrease of 29.1%.

Balance sheet and working capital

Working capital increased marginally to GBP76.3m (H1 2021:

GBP73.8), improving to 23.1% of last twelve months' revenue (H1

2021: 25.5%). Period end receivables increased at a slower rate

than revenue growth and recoverability has remained strong, with a

comparable ageing profile year on year. Whilst inventory levels

increased in line with revenue, period end inventory is more

weighted to goods in-transit to the US compared to goods in

warehouse, reflecting the inventory pinch points experienced in the

US towards the end of the period as UK-produced goods were held on

vessels unable to enter congested US ports.

Whilst working capital has improved, the reduction in EBITDA

margin has resulted in cash generated from operations reducing to

6% of adjusted EBITDA (H1 2021: 22%). We expect working capital to

further reduce in the second half of the year and drive improvement

in operating cash flow conversion.

Cash and Dividend

The Group's cash position reduced in the first half of the year

as a result of paying the special dividend announced at the 2021

full year results in March, alongside a reduction in operating cash

flow conversion. The Group continues to retain a strong cash

position of GBP100.0m, and this not only underpins our confidence

in navigating the challenging operating environment but also allows

us to continue to focus on making the correct strategic choices for

the long-term health of the Fever-Tree brand and success of the

business.

As a reflection of our confidence in the financial strength of

the Group the Directors are pleased to declare an interim dividend

of 5.63 pence per share, 2% ahead of the 2021 interim dividend. The

dividend will be paid on 21 October 2022, to shareholders on the

register on 30 September 2022.

Post period event

In August the Group completed the acquisition of Powell &

Mahoney LLC ("P&M"), a premium non-carbonated cocktail mixer

company based in the US for a deal value of $5.9m. P&M operate

an outsourced business model, and the Group will inherit a strong

relationship with a local US bottler alongside a well-established

footprint of listings within US retail. The acquisition will

provide the platform for the Group to accelerate its entry into the

non-carbonated cocktail mixer category in the US, with exciting

Fever-Tree innovation to announce in due course.

FY22 Outlook and Guidance

Fever-Tree remains committed to investing in the substantial

future opportunity for the brand across our regions, enabled by the

Group's strong balance sheet and conviction in our ability to

deliver long-term sustainable growth.

We continue to operate within an exceptionally challenging

environment and our team remains focused on balancing the

mitigation of on-going cost challenges whilst prioritising

continuity of supply. Uncertainty and the risk of disruption

remains elevated, whilst wider inflationary cost pressures,

especially with respect to underlying energy pricing, will continue

to impact our business as well as impacting our suppliers,

production partners, customers and consumers.

Whilst we acknowledge this elevated uncertainty, our performance

has remained in line with the revised guidance provided in July,

and so are reiterating our revenue guidance range of GBP355 million

to GBP365 million for the full year, with a gross profit margin in

a range of 33% to 35%, and an EBITDA range of c. GBP37.5 million to

GBP45 million.

Consolidated statement of comprehensive income

For the six months ended 30 June 2022

Notes Unaudited 6 Unaudited 6 Audited

months to 30 months to 30 year to

June 2022 June 2021 31 December

GBPm GBPm 2021

GBPm

Revenue 2 160.9 141.8 311.1

Cost of sales (100.8) (79.3) (180.2)

============== ============== =============

Gross profit 60.1 62.5 130.9

Administrative expenses (42.7) (37.2) (75.3)

Adjusted EBITDA 1 22.0 29.2 63.0

Depreciation (1.6) (1.8) (3.2)

Amortisation (0.8) (0.8) (1.5)

Share based payment charges (2.2) (1.3) (2.7)

================================ ====== ============== ============== =============

Operating profit 17.4 25.3 55.6

Finance costs

Finance income 0.3 0.1 0.3

Finance expense (0.1) (0.1) (0.3)

Profit before tax 17.6 25.3 55.6

Tax expense (3.5) (4.9) (11.0)

============== ============== =============

Profit for the year /

period 14.1 20.4 44.6

Items that may be reclassified

to profit or loss

Foreign currency translation (0.1) - -

difference of foreign

operations

Effective portion of

cash flow hedges (1.6) (0.6) (1.3)

Related Tax 0.3 - 0.3

============== ============== =============

(1.4) (0.6) (1.0)

Comprehensive income

attributable to equity

holders of the parent

company 12.7 19.8 43.6

Earnings per share for

profit attributable to

the owners of the parent

during the year

Basic (pence) 4 12.10 17.47 38.29

Diluted (pence) 4 12.08 17.44 38.19

Consolidated statement of financial position

30 June 2022

Unaudited Unaudited Audited

30 June 2022 30 June 2021 31 December

GBPm GBPm 2021

GBPm

Non-current assets

Property, plant & equipment 9.2 9.9 9.6

Intangible assets 48.4 48.0 47.7

Deferred tax asset 3.0 3.0 2.8

Other financial assets - - -

============== ============== =============

Total non-current assets 60.6 60.9 60.1

============== ============== =============

Current assets

Inventories 53.3 47.8 36.2

Trade and other receivables 77.5 70.7 70.3

Derivative financial

instruments - - 0.9

Corporation tax asset 3.1 - 2.4

Cash and cash equivalents 100.0 133.2 166.2

============== ============== =============

Total current assets 233.9 251.7 276.0

============== ============== =============

Total assets 294.5 312.6 336.1

============== ============== =============

Current liabilities

Trade and other payables (54.4) (44.7) (49.4)

Loans and other borrowing (0.1) (0.1) (0.1)

Derivative financial

instruments (1.1) (0.4) -

Corporation tax liability - (3.2) (0.6)

Lease liabilities (0.7) (0.9) (0.7)

============== ============== =============

Total current liabilities (56.3) (49.3) (50.8)

============== ============== =============

Non-current liabilities

Deferred tax liability (1.6) (1.1) (1.6)

Lease liabilities (1.9) (0.7) (2.1)

============== ============== =============

Total non-current liabilities (3.5) (1.8) (3.7)

============== ============== =============

Total liabilities (59.8) (51.1) (54.5)

============== ============== =============

Net assets 234.7 261.5 281.6

============== ============== =============

Equity attributable to

equity holders of the

company

Share capital 0.3 0.3 0.3

Share premium 54.8 54.8 54.8

Capital Redemption Reserve 0.1 0.1 0.1

Cash Flow Hedge Reserve (1.1) 0.2 (0.2)

Translation Reserve (0.3) (0.2) (0.2)

Retained earnings 180.9 206.3 226.8

Total equity 234.7 261.5 281.6

============== ============== =============

Consolidated statement of cash flows

For the six months ended 30 June 2022

Unaudited 6 Unaudited Audited year

months to 30 6 months to to 31 December

June 2022 30 June 2021 2021

GBPm GBPm GBPm

Operating activities

Profit before tax 17.6 25.3 55.6

Finance expense 0.1 0.1 0.3

Finance income (0.3) (0.1) (0.3)

Depreciation of property,

plant & equipment 1.6 1.8 3.2

Amortisation of intangible

assets 0.8 0.8 1.5

Share based payments 2.2 1.3 2.7

Impairment loses on receivables

and inventories 0.1 - 3.8

Gain on disposal of fixed

asset - - 0.1

============== ============== ================

22.1 29.2 66.9

(Increase)/ Decrease in trade

and other receivables (10.2) (12.0) (14.6)

(Increase)/ Decrease in inventories (19.6) (9.3) 0.5

Increase/ (Decrease) in trade

and other payables 6.0 (1.4) 7.7

Increase/(decrease) in derivative

asset/liability 3.2 - (2.8)

(20.6) (22.7) (9.2)

Cash generated from operations 1.5 6.5 57.7

============== ============== ================

Income tax paid (5.5) (2.4) (10.9)

Net cash flows from operating

activities (4.0) 4.1 46.8

============== ============== ================

Investing activities

Purchase of property, plant

and equipment (1.1) (2.5) (3.6)

Interest received 0.3 0.1 0.3

Investment in intangible

assets (1.2) - (1.0)

Acquisition of subsidiary, - - -

net of cash acquired

============== ============== ================

Net cash used in investing

activities (2.0) (2.4) (4.3)

============== ============== ================

Financing activities

Interest paid (0.1) (0.1) (0.2)

Dividends paid (62.2) (11.9) (18.4)

Repayment of loan - - (0.1)

Payment of lease liabilities (0.4) (0.2) (0.6)

Net cash used in financing

activities (62.7) (12.2) (19.3)

============== ============== ================

Net increase/ (decrease)

in cash and cash equivalents (68.7) (10.5) 23.2

Cash and cash equivalents

at beginning of period 166.2 143.1 143.1

Effect of movement in exchange

rates on cash held 2.5 0.6 (0.1)

============== ============== ================

Cash and cash equivalents

at end of period 100.0 133.2 166.2

============== ============== ================

Notes to the consolidated financial information

For the six months ended 30 June 2022

1. Basis of preparation and accounting policies

The principal accounting policies adopted in the preparation of

the interim financial information are unchanged from those applied

in the Group's financial statements for the year ended 31 December

2021 which had been prepared in accordance with International

Accounting Standards in conformity with the requirements of the

Companies Act 2006. The accounting policies applied herein are

consistent with those expected to be applied in the financial

statements for the year ended 31 December 2022.

This report is not prepared in accordance with IAS 34. The

financial information does not constitute statutory accounts within

the meaning of section 435 of the Companies Act 2006. Statutory

accounts for Fevertree Drinks plc for the year ended 31 December

2021 have been delivered to the Registrar of Companies. The

auditor's report on those accounts was unqualified, did not draw

attention to any matters by way of emphasis and did not contain a

statement under Section 498 (2) or (3) of the Companies Act

2006.

Adjusted EBITDA has been calculated consistently with the method

applied in the financial statements for the year ended 31 December

2021. Operating profit is adjusted for a number of non-cash items,

including amortisation, depreciation, and the share-based payment

charge which recognises the fair value of share options granted.

The intention is for Adjusted EBITDA to provide a comparable,

year-on-year indicator of underlying trading and operational

performance. Adjusted EBITDA is an appropriate measure since it

represents to users a normalised, comparable operating profit,

excluding the effects of the accounting estimates and non-cash

items mentioned above. The definition for adjusted EBITDA as

defined above is consistent with the definition applied in previous

years. This measure is not defined in the International Financial

Reporting Standards. Since this is an indicator specific to the

Group's operational structure, it may not be comparable to adjusted

metrics used by other companies.

The impact of COVID-19 and the ongoing instability in Ukraine

has also been reflected in the Directors' assessment of the going

concern basis of preparation for the Group financial statements.

This has been considered by modelling the impact on the Group's

cashflow for the period to the end of December 2023. In completing

this exercise, the Directors established there were no plausible

scenarios that would result in the Group no longer continuing as a

going concern.

The Directors have therefore concluded that the Group has

adequate resources to continue in operational existence for at

least the 12 months following the publication of the interim

financial statements, that it is appropriate to continue to adopt

the going concern basis of preparation in the financial statements,

that there is not a material uncertainty in relation to going

concern and that there is no significant judgement involved in

making that assessment. This strong financial position has

underpinned the Directors' decision to pay an interim dividend of

5.63 p ence per share.

Notes to the consolidated financial information

For the six months ended 30 June 2022

2. Revenue by region

Unaudited Unaudited Audited

6 months to 6 months to year to 31

30 June 2022 30 June 2021 December

GBPm GBPm 2021

GBPm

United Kingdom 53.5 50.3 118.3

United States of America 40.1 36.2 77.9

Europe 52.3 41.3 88.2

Rest of the World 15.0 14.0 26.7

============== ============== ============

Group 160.9 141.8 311.1

============== ============== ============

3. Dividend

The interim dividend of 5.63 pence per share will be paid on 21

October 2022 to shareholders on the register on 30 September

2022.

4. Earnings per share

Unaudited 6 Unaudited Audited

months to 30 6 months to year to

June 2022 30 June 2021 31 December

GBPm GBPm 2021

GBPm

Profit

Profit used to calculate

basic and diluted EPS 14.1 20.4 44.6

============== ============== =============

Number of shares

Weighted average number

of shares for the purpose

of basic earnings per share 116,551,449 116,525,784 116,536,876

Weighted average number

of employee share options

outstanding 214,120 231,674 302,357

Weighted average number

of shares for the purpose

of diluted earnings per share 116,765,569 116,757,458 116,839,233

Basic earnings per share

(pence) 12.10 17.47 38.29

============== ============== =============

Diluted earnings per share

(pence) 12.08 17.44 38.19

============== ============== =============

Notes to the consolidated financial information

For the six months ended 30 June 2022

4. Earnings per share (continued)

Normalised EPS Unaudited 6 Unaudited Audited

months to 30 6 months to year to

June 2022 30 June 2021 31 December

GBPm GBPm 2021

GBPm

Profit

Reported profit before tax 17.6 25.3 55.6

============== ============== =============

Add back:

Amortisation 0.8 0.8 1.5

============== ============== =============

Adjusted profit before tax 18.4 26.1 57.1

Tax - assume standard rate

(19%) (3.5) (5.0) (10.8)

============== ============== =============

Normalised earnings 15.0 21.1 46.3

============== ============== =============

Number of shares 116,551,449 116,525,784 116,536,876

Normalised earnings per

share (pence) 12.87 18.14 39.70

============== ============== =============

Normalised EPS is an Alternative Performance Measure in which

earnings have been adjusted to exclude amortisation and the UK

statutory tax rates have been applied (disregarding other tax

adjusting items).

5. Events after the reporting period

On 1 August, the Group acquired 100% of the share capital of

Powell & Mahoney LLC ("P&M"), a premium non-carbonated

cocktail mixer company based in the US. The total consideration for

the acquisition comprises $0.7m cash, and c.$5.2m additional

funding to settle existing debt within P&M at the acquisition

date.

Initial acquisition accounting under IFRS 3 is on-going and will

be disclosed in the Group's financial statements for the year-ended

31 December 2022.

[1] Adjusted EBITDA is earnings before interest, tax,

depreciation, amortisation, share based payment charges and finance

costs

[2] CGA

[3] CGA

[4] IWSR

[5] Kantar 52 wks to 12/06/22

[6] IRI YTD 10/07.22 (Other premium brands: Schweppes 1783;

Fentimans; London Essence; Merchant's Heart; Double Dutch)

[7] CGA & IRI 13 weeks to 16/06/2022

[8] Savanta Brand Tracking 2021

[9] Nielsen

[10] Nielsen and IRI data top 10 European markets

[11] Attest survey

[12] Woolworth & Coles scan data

[13] Nielsen 52 weeks to June 2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UUUKRUKUKAAR

(END) Dow Jones Newswires

September 13, 2022 02:01 ET (06:01 GMT)

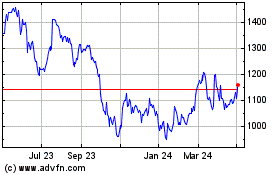

Fevertree Drinks (LSE:FEVR)

Historical Stock Chart

From Mar 2024 to Apr 2024

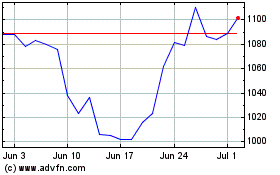

Fevertree Drinks (LSE:FEVR)

Historical Stock Chart

From Apr 2023 to Apr 2024