FirstGroup PLC Sale of Greyhound Lines, Inc.

21 October 2021 - 5:00PM

UK Regulatory

TIDMFGP

FIRSTGROUP PLC

SALE OF GREYHOUND LINES, INC.

FirstGroup plc ('FirstGroup' or the 'Group') announces the sale of Greyhound

Lines, Inc. to a wholly-owned subsidiary of FlixMobility GmbH ('FlixMobility')

(the 'Transaction'), completing its stated strategy to focus on its leading UK

public transport businesses.

* The Transaction results in cash consideration to the Group of $172m,

comprising $140m paid initially, with $32m in unconditional deferred

consideration paid in instalments over eighteen months

* Greyhound properties with an estimated net market value of c.$176m will be

retained by FirstGroup; they will initially be leased back to Greyhound at

market rates but are expected to be sold over the next three to five years

* FirstGroup also retains certain legacy Greyhound net liabilities, including

pension, self-insurance, and finance leases settled at closing, which in

total were valued at $320m as at 27 March 2021, as well as grant

receivables, buyout premia and other items estimated at a net cost of

c.$47m, against which the Group had retained $197m of proceeds from the

sale of First Student and First Transit earlier in the year

* The $140m of Greyhound initial cash proceeds will be retained by the Group

to support the close-out of these legacy liabilities and related net costs,

with the balance of the property proceeds and deferred consideration

resulting in c.$178m (c.£128m) in net value for the Group being realised

over time

* The Transaction is not subject to any closing conditions and will complete

today

Commenting, David Martin, FirstGroup Executive Chairman said:

"Greyhound is an iconic business which has been at the heart of North American

life for more than a century, through its unique national network which

connects communities across the continent. We are proud of the significant

developments we made to Greyhound's business model during FirstGroup's

ownership, including the introduction of express point-to-point routes,

real-time pricing and yield management and a transformed customer offering and

experience.

"This transaction realises an appropriate value for Greyhound's operations and

ensures Greyhound's legacy liabilities are suitably managed. Today's agreement

regarding Greyhound's future completes the Group's portfolio rationalisation

strategy which has refocused FirstGroup on its leading UK public transport

businesses with a strong platform to create sustainable value going forward.

"I want to thank the management and employees of Greyhound, who have remained

steadfastly dedicated to providing the best possible service for their

customers despite the challenges of the pandemic. I am confident their

commitment to high standards of service for customers will be sustained and the

business will continue to strengthen and develop in future under its new

ownership."

Jochen Engert, Founder and Chief Executive Officer of FlixMobility, said:

"The continuous expansion of our network through partnerships and acquisitions

has always been an integral part of our growth strategy to build our global

presence. The acquisition of Greyhound is a major step forward and strengthens

FlixBus´ leading position in the US. The FlixBus and Greyhound teams share a

common vision to make smart, affordable and sustainable mobility accessible to

all."

Background to and reasons for the Transaction

FirstGroup has previously set out its objective to rationalise the Group's

portfolio of businesses in light of the limited synergies between its UK and

North American divisions, and today's Transaction follows the sale of the

Group's other North American businesses, First Student and First Transit, to

EQT Infrastructure in July 2021. The Transaction provides clarity for

Greyhound's customers, employees and stakeholders and we believe that its new

owners are well placed to support the continued development of Greyhound going

forward.

Effects on FirstGroup

In the near term, FirstGroup intends to use the initial cash proceeds of the

Transaction together with the remaining cash set aside from the sale of First

Student and First Transit to accelerate the de-risking of the Greyhound

self-insurance liabilities and settle the finance leases, with discharge of the

remaining pension liabilities to follow in due course. The $32m in deferred

unconditional consideration, property value of $176m and CARES/ARP grant

collections are expected to be realised over time, resulting in c.$178m (c.£

128m) in net value for the Group, which may be considered for potential

supplementary returns to shareholders or for other opportunities in future.

The Group expects to record a gain on disposal in the current year accounts as

a result of today's Transaction, with further profits on sales of the property

portfolio to be realised in future.

Following today's announcement and with certain First Bus capital expenditure

payments now falling after the period end and better than expected working

capital flows, the Group estimates that adjusted net debt1 at the end of the

current financial year will be c.£80-90m lower than previously expected, in the

range of £10-20m.

Trading in the Group's continuing businesses year to date has been in line and

there is no change to management's expectations for the current financial year

as outlined in the full year results announcement on 27 July 2021. FirstGroup

intends to publish results for the first half of the financial year on Thursday

9 December 2021.

Information regarding Greyhound

Greyhound is the only nationwide operator of scheduled intercity coach services

across the United States, as well as operations into Canada and Mexico. Its

iconic brand has been a mainstay of the North American transportation landscape

for more than a hundred years. Greyhound's fleet of 1,300 vehicles and 2,400

employees provide services connecting 1,750 destinations across North America.

For the 52 weeks to 27 March 2021, Greyhound Lines, Inc. reported revenue of

$422.6m (£323.0m), EBITDA of $37.4m (£27.3m) and an adjusted operating profit

of $1.8m (£1.3m)2. The gross assets the subject of the Transaction as at 27

March 2021 were $193.8m (£141.5m).

Information regarding FlixMobility

FlixMobility is mobility provider, offering new alternatives for convenient,

affordable and environmentally friendly travel via the FlixBus and FlixTrain

brands. With a unique approach and innovative technology, the company has

quickly established Europe's largest long-distance bus network and launched the

first green long-distance trains in 2018 as well as a pilot project for

all-electric buses in Germany, the US and France. Since 2013, FlixMobility has

changed the way hundreds of millions of people have travelled throughout Europe

and created tens of thousands of new jobs in the mobility industry. In 2018,

FlixMobility launched FlixBus USA to bring this new travel alternative to the

United States.

Further Transaction details

Greyhound assets and liabilities inside the Transaction perimeter

FirstGroup has reached agreement with Neptune Holding Inc. (the 'Buyer'), a

corporation 100% controlled by FlixMobility, to sell Greyhound Lines, Inc., the

US Greyhound operating business (including its vehicle fleet, trademarks, and

certain other assets and liabilities) for an enterprise value on a debt-free /

cash-free basis of c.$46m plus unconditional deferred consideration of $32m

with an interest rate of 5% per annum. A further $1.5m may also become payable

contingent on specific agreement of a particular property lease.

Greyhound has now received both tranches of cash grants under the US Department

of the Treasury's Coronavirus Economic Relief for Transportation Services

('CERTS') scheme, totalling $108m, or c.$7m higher than initially anticipated,

which will be retained by Greyhound Lines Inc. and spent on its operations in

accordance with the terms of the grant. Recognising its resulting cash balance

and c.$14m in debt and debt-like items being assumed by the Buyer, the cash

proceeds received by the Group from the Buyer at closing as a result of the

Transaction is $140m, with the $32m in unconditional deferred consideration (to

be received in regular instalments from the Buyer over the next 18 months or

sooner) resulting in consideration payable of $172m.

Greyhound property assets and legacy liabilities outside the Transaction

perimeter

Greyhound-related property holdings in the US (the 'Retained Properties') with

an aggregate estimated net market value of c.$176m are not part of the

Transaction with the Buyer and will be retained by FirstGroup. The Buyer has

entered into lease agreements to use the Retained Properties as part of

Greyhound's future operations at market rental levels. The majority of these

are subject to a three-year lease term, with the remainder subject to a

six-month initial term followed by six-month rolling terms. FirstGroup intends

to monetise all of the Retained Properties over time to further optimise net

proceeds.

As previously indicated, Greyhound also remains eligible to receive further

funding awards from other US federal schemes such as the CARES Act and the

American Rescue Plan ('ARP'), and, to the extent that further recoveries are

made under these schemes which relate to losses incurred while Greyhound was

under the Group's ownership during the pandemic, the Buyer will pay equivalent

amounts to FirstGroup.

In addition to the Retained Properties, FirstGroup will also retain certain

other Greyhound liabilities, including Greyhound's self-insurance reserve

liabilities up to the date of closing (valued at $151m as at 27 March 2021),

the Greyhound defined benefit pensions schemes (valued at $144m as at 27 March

2021), finance leases (valued at $25m as at 27 March 2021 that have been

settled on closing) and certain environmental and other liabilities and costs.

Greyhound is currently in the process of completing the closure of its

activities in Canada and these do not form part of the Transaction; as such the

Group retains all the assets and liabilities relating to this business

(including its defined benefit pension scheme, legacy insurance liabilities and

real estate). As noted at the full year results, $197m of the First Student and

First Transit sale proceeds was set aside to de-risk these liabilities, and

since then the Group has made an initial payment of c.$102m into the Greyhound

pension schemes in the US and Canada to begin that process.

FirstGroup has a strong track record of actively managing Greyhound's property

holdings for value, such as the sale of three Greyhound properties for gross

proceeds of $137m and a profit on sale of c.$100m announced in December 2020.

FirstGroup has realised aggregate proceeds of Greyhound-related property of

$400m over the last 10 years through 30 property transactions of $1m or more in

value.

Contacts at FirstGroup:

Faisal Tabbah, Head of Investor Relations

Stuart Butchers, Group Head of Communications

Tel: +44 (0) 20 7725 3354

corporate.comms@firstgroup.co.uk

Contacts at Brunswick PR:

Andrew Porter / Simone Selzer, Tel: +44 (0) 20 7404 5959

Contacts at Goldman Sachs International:

Sole Financial Advisor and Joint Corporate Broker

Eduard van Wyk and Bertie Whitehead, Tel: +44 (0) 20 7774 1000

Further notes

$m

Enterprise value of Greyhound Lines, Inc., on debt- and cash-free basis 46

payable at closing

Unconditional deferred consideration for Greyhound Lines, Inc. payable 32

over 18 months

Enterprise value of Greyhound Lines, Inc. on debt- and cash-free basis3 78

Estimated net position to be realised over time:

Enterprise value of Greyhound Lines, Inc., on debt- and cash-free basis 46

payable at closing (from above)

Cash on Greyhound Lines. Inc. balance sheet 108

Debt and debt-like items on balance sheet transferred to Buyer (14)

Net cash proceeds payable at closing for Greyhound Lines, Inc. 140

Unconditional deferred consideration for Greyhound Lines, Inc. payable 32

over 18 months (from above)

Net cash proceeds payable for Greyhound Lines, Inc.3 172

Estimated market value of Retained Properties, to be realised over 176

three-to-five years

Cash proceeds plus estimated realisable market value of Retained 348

Properties3

Total net legacy liabilities initially retained as at 27 March 2021:

- Self-insurance provision (151)

- Pension deficit (144)

- Finance leases settled at closing (25)

- Other estimated net liabilities (CARES/ARP receivables, Canada, (47)

buyout premia/deal costs, environmental, etc)

- Proceeds from sale of First Student and First Transit set aside to 197

manage Greyhound liabilities

Estimated net cost to discharge retained net liabilities (170)

Estimated net position to be realised over time, following property 178

sales, discharge of legacy liabilities3 etc

1 'Adjusted net debt' excludes First Rail ring-fenced cash and IFRS 16 lease

liabilities from net debt, as defined in the FY21 results.

2 'Adjusted operating profit' is stated before gain on disposal of

properties, strategy costs, self-insurance provision charge and certain other

items. 'EBITDA' is earnings before interest, tax, depreciation and

amortisation, calculated as adjusted operating profit less capital grant

amortisation plus depreciation.

3 Excludes a further $1.5m in consideration which may become payable

contingent on specific agreement of a particular property lease.

All '$' or 'USD' amounts are United States dollars.

Goldman Sachs International is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct Authority and the Prudential

Regulation Authority. Goldman Sachs International is acting exclusively for

FirstGroup and no one else in connection with the Transaction and will not

regard any other person (whether or not a recipient of this announcement) as a

client in relation to the Transaction and will not be responsible to anyone

other than FirstGroup for providing the protections afforded to Goldman Sachs

International's clients nor for giving advice in relation to the Transaction or

any other arrangement referred to in this announcement.

FirstGroup plc (LSE: FGP.L) is a leading private sector provider of public

transport services. With £4.3 billion in revenue and around 30,000 employees,

our UK divisions transported nearly 700,000 passengers a day in the 52 weeks to

27 March 2021. First Bus is the second largest regional bus operator in the UK,

serving two-thirds of the UK's 15 largest conurbations with a fleet of c.5,000

buses. First Rail is the UK's largest rail operator, with many years of

experience running long-distance, commuter, regional and sleeper rail services.

We operate a fleet of c.3,750 rail vehicles on four contracted operations

(Avanti, GWR, SWR, TPE) and two open access routes (Hull Trains and Lumo, our

new East Coast service launching later in 2021). We create solutions that

reduce complexity, making travel smoother and life easier. Our businesses are

at the heart of our communities and the essential services we provide are

critical to delivering wider economic, social and environmental goals. We are

formally committed to operating a zero-emission First Bus fleet by 2035 and to

cease purchasing further diesel buses after 2022; and First Rail will help

support the UK Government's goal to remove all diesel-only trains from service

by 2040. Visit our website at www.firstgroupplc.com and follow us

@firstgroupplc on Twitter.

Legal Entity Identifier (LEI): 549300DEJZCPWA4HKM93. Classification as per DTR

6 Annex 1R: 2.2. This announcement contains inside information. The person

responsible for arranging the release of this announcement on behalf of

FirstGroup is David Isenegger, Group General Counsel and Company Secretary.

END

(END) Dow Jones Newswires

October 21, 2021 02:00 ET (06:00 GMT)

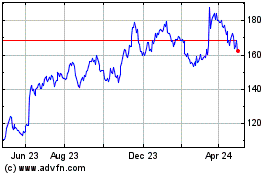

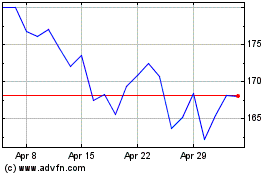

Firstgroup (LSE:FGP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Firstgroup (LSE:FGP)

Historical Stock Chart

From Apr 2023 to Apr 2024