TIDMFGP

FIRSTGROUP PLC

PROPOSED TER OFFER

* Proposed tender offer to return up to £500 million to shareholders at 105

pence per share

* Premium of 9.2 per cent. to the closing price on 26 October

* Tender Offer subject to shareholder approval; circular to be published

today

* Irrevocable undertaking from Coast Capital Management to support the

resolutions and tender its full holdings

* Tender proceeds expected to be despatched to Shareholders in December

FirstGroup plc ("FirstGroup" or the "Company") announces the proposed return of

up to £500 million to its shareholders (the "Shareholders") by way of a tender

offer at 105 pence per share (the "Tender Offer", which is summarised below).

On 22 July 2021, FirstGroup completed the disposal of its First Student and

First Transit businesses to EQT Infrastructure (the "Transaction") for net

disposal proceeds of $3,123 million (the "Net Disposal Proceeds"). On the same

date, FirstGroup announced its intention to increase the proposed return of

value to £500 million from £365 million previously (the "Return of Value").

Following consultation with Shareholders, the Board has decided that the

appropriate first step is to conduct the Return of Value by way of the Tender

Offer. Shareholders are therefore being invited to tender some or all of their

Ordinary Shares for purchase on the terms and subject to the Conditions set out

in the Circular to be published today.

Shareholders may decide not to participate fully or partially in the Tender

Offer for a number of reasons, including their view of the potential for the

value of the Company to increase in the future. If the full £500 million is not

returned to Shareholders through the Tender Offer, the Board intends to

undertake a second phase of the Return of Value to return any remaining surplus

cash following completion of the Tender Offer to Shareholders. If required, it

is expected that this second phase would take place by way of a share buyback

of up to approximately £50 million, with any meaningful surplus above this

amount being returned by way of a special dividend (with accompanying

consolidation and sub-division of the Company's share capital (the "Share

Consolidation")).

In addition to the Return of Value, the Board reiterates its commitment to

keeping the balance sheet position of the Group under review and will consider

the prospects for making further additional distributions to Shareholders in

due course, following crystallisation of the First Transit Earnout of up to

$240 million (fair valued in the Group's recent full year results at $140

million (£102 million) for accounting purposes), realisation of value from the

sale of the properties retained and consideration deferred in the recent sale

of Greyhound Lines Inc. to FlixMobility GmbH, and the potential release of

monies from pension escrow (of up to £117 million). The Board also notes the

capacity to increase gearing over time, as end market conditions and hence

business performance improves.

Commenting, David Martin, FirstGroup Executive Chairman said:

"I am very pleased to announce the launch of the proposed Tender Offer. This

marks the culmination of our portfolio rationalisation strategy, as announced

in December 2019, which has refocused the Group on its leading UK public

transport businesses. In doing so, we have created a cash generative company

with a well-capitalised balance sheet, a focused strategy and attractive growth

prospects in our markets. The policy backdrop in the UK has never been more

supportive and public transport has a critical role to play in helping

communities and economies build back better and more sustainably. The premium

for the Tender Offer reflects our confidence in our future prospects, as well

as the substantial further sums expected to be realised by the Group over time

from the disposals completed this year."

Key elements of the Tender Offer

* £500 million is available to be returned to Qualifying Shareholders via the

purchase of up to 476,190,476 Ordinary Shares (representing up to

approximately 38.9 per cent. of the Issued Ordinary Share Capital).

* The Tender Price will be 105 pence per Ordinary Share, a premium of 9.2 per

cent. to the closing price of 96.15 pence per Ordinary Share on 26 October

2021.

* The Tender Offer is conditional on, among other things, the approval of

Shareholders, which will be sought at a general meeting of the Company to

be held at 11 a.m. on 18 November 2021 (the "General Meeting").

+ The Company will also seek authority to undertake the second phase of

the Return of Value at the General Meeting.

* The Tender Offer will open on 28 October 2021 and will close at 1.00 p.m.

on 29 November 2021.

* Proceeds are expected to be despatched to Shareholders who successfully

tender Ordinary Shares in December 2021.

Coast Capital Management participation in the Tender Offer

Coast Capital Management currently controls, in aggregate, 156,749,809 Ordinary

Shares, representing approximately 12.82 per cent. of the Issued Ordinary Share

Capital as at the Latest Practicable Date. Coast Capital Management will

participate in the Tender Offer in full, and has irrevocably undertaken to vote

in favour of the Resolutions and to tender, in aggregate, 156,749,809 Ordinary

Shares under the Tender Offer at the Tender Price.

Benefits of the Tender Offer

The benefits of the Tender Offer for Shareholders as a whole are that:

* it is available to all Qualifying Shareholders regardless of the size of

their holdings;

* it means Qualifying Shareholders who participate will receive, for Ordinary

Shares successfully tendered, a Tender Price that represents a premium of

9.2 per cent. to the closing price of 96.15 pence per Ordinary Share on 26

October 2021;

* it provides Qualifying Shareholders who wish to reduce their holdings of

Ordinary Shares with an opportunity to do so at a market-driven price with

an appropriate premium; and

* it permits Shareholders who wish to retain their current investment in

FirstGroup and their Ordinary Shares to do so and no Shareholder is

required to participate in the Tender Offer.

The Company intends to cancel all of the Ordinary Shares acquired in connection

with the Tender Offer. As a result, the Tender Offer should have a positive

impact on the Group's earnings per share (assuming earnings stay the same).

Current trading update

On 21 October 2021, FirstGroup announced the sale of Greyhound Lines, Inc. (the

US Greyhound operating business) to a wholly-owned subsidiary of FlixMobility

GmbH ("FlixMobility"), completing the Company's stated strategy to focus on its

leading UK public transport businesses. The sale was not subject to any closing

conditions and completed on the same day. The announcement noted that the sale

resulted in cash consideration to the Group of $172m (comprising $140m paid

initially, with $32m in unconditional deferred consideration to be paid in

instalments over eighteen months from the sale), that certain Greyhound

properties have been retained by FirstGroup (initially being leased back to

Greyhound at market rates but expected to be sold over the next three to five

years) and that FirstGroup retains certain legacy Greyhound net liabilities

(including pension, self-insurance, finance leases settled at closing of the

sale, grant receivables, liability buyout premia and certain other items).

On 21 October 2021, the Group also stated that "trading in the Group's

continuing businesses year to date has been in line and there is no change to

management's expectations" for the continuing Group for the current financial

year, and that following the Greyhound transaction "and with certain First Bus

capital expenditure payments now falling after the period end and better than

expected working capital flows, the Group estimates that adjusted net debt1 at

the end of the current financial year will be c.£ 80-90m lower than previously

expected, in the range of £10-20m."

There has been no significant change to the current trading of the Group since

these announcements were made.

Further information

A shareholder circular (the "Circular") containing the full terms and

conditions of the Tender Offer and instructions to Qualifying Shareholders on

how to tender their Ordinary Shares should they wish to do so, and convening

the General Meeting, is expected to be published today. The Circular will be

available on the Company's website at www.firstgroupplc.com/tenderoffer and

copies of the Circular will also be submitted to the National Storage Mechanism

and be available for inspection at www.morningstar.co.uk/nsm.

This summary should be read in conjunction with the full text of this

announcement and the Circular.

Contacts at FirstGroup:

Faisal Tabbah, Head of Investor Relations

Stuart Butchers, Group Head of Communications

Tel: +44 (0) 20 7725 3354

corporate.comms@firstgroup.co.uk

Contacts at Brunswick PR:

Andrew Porter / Simone Selzer, Tel: +44 (0) 20 7404 5959

Advisers:

Goldman Sachs International

Eduard van Wyk, Bertie Whitehead, Anna Reynolds

J.P. Morgan Cazenove

Charles Harman, Richard Perelman, Poppy Barrett-Fish

Notes

1 'Adjusted net debt' excludes First Rail ring-fenced cash and IFRS 16 lease

liabilities from net debt, as defined in the FY21 results.

Legal Entity Identifier (LEI): 549300DEJZCPWA4HKM93. Classification as per DTR

6 Annex 1R: 2.2. This announcement contains inside information. The person

responsible for arranging the release of this announcement on behalf of

FirstGroup is David Isenegger, Group General Counsel and Company Secretary.

FirstGroup plc (LSE: FGP.L) is a leading private sector provider of public

transport services. With £4.3 billion in revenue and around 30,000 employees,

our UK divisions transported nearly 700,000 passengers a day in the 52 weeks to

27 March 2021. First Bus is the second largest regional bus operator in the UK,

serving two-thirds of the UK's 15 largest conurbations with a fleet of c.5,000

buses. First Rail is the UK's largest rail operator, with many years of

experience running long-distance, commuter, regional and sleeper rail services.

We operate a fleet of c.3,750 rail vehicles on four contracted operations

(Avanti, GWR, SWR, TPE) and two open access routes (Hull Trains and Lumo, our

new East Coast service launching later in 2021). We create solutions that

reduce complexity, making travel smoother and life easier. Our businesses are

at the heart of our communities and the essential services we provide are

critical to delivering wider economic, social and environmental goals. We are

formally committed to operating a zero-emission First Bus fleet by 2035 and to

cease purchasing further diesel buses after 2022; and First Rail will help

support the UK Government's goal to remove all diesel-only trains from service

by 2040. Visit our website at www.firstgroupplc.com and follow us

@firstgroupplc on Twitter.

FIRSTGROUP PLC

PROPOSED TER OFFER TO RETURN UP TO £500 MILLION TO SHAREHOLDERS

FirstGroup PLC ("FirstGroup" or the "Company") announces the proposed return of

up to £500 million to its shareholders (the "Shareholders") by way of a tender

offer.

1. BACKGROUND TO AND BENEFITS OF THE TER OFFER

Background to the Tender Offer

On 21 July 2021, FirstGroup completed the disposal of First Student and First

Transit to EQT Infrastructure (the "Transaction"). As announced on 22 July

2021, the net disposal proceeds from the Transaction were $3,123 million (the "

Net Disposal Proceeds"), an increase of $58 million over the base amount

previously announced by the Company due to the final adjustments for working

capital and debt and debt-like items as described in the circular in relation

to the Transaction published by the Company on 10 May 2021 (the "Transaction

Circular"). On the same date, FirstGroup announced its intention to increase

the proposed return of value to £500 million (equivalent to approximately 41

pence per share at the time of announcement) from £365 million (the "Return of

Value"). Such increase is due to the increase in Net Disposal Proceeds (as set

out above), the increased clarity for First Rail resulting from agreement of

South Western Railway and TransPennine Express National Rail Contracts and

final rail franchise termination sums, and a more positive cashflow outlook for

the Group than had been previously anticipated.

As well as enabling the Return of Value, the Transaction allows the Group to

make a £337 million contribution to the UK DB Pension Schemes (of which up to £

117 million will be held in escrow and may be released back to the Group on

conclusion of subsequent triennial valuations from 2024 onwards, depending on

scheme performance) and to address other longstanding liabilities including

those relating to the Greyhound business ("Greyhound")) while ensuring the

business is appropriately capitalised to continue investing for the future.

Following consultation with Shareholders, the Board has decided that the

appropriate first step is to conduct the Return of Value by way of a Tender

Offer. Shareholders are therefore being invited to tender some or all of their

Ordinary Shares for purchase on the terms and subject to the Conditions set out

in the Circular.

Shareholders may decide not to participate fully or partially in the Tender

Offer for a number of reasons, including their view of the potential for the

value of the Company to increase in the future. If the full £500 million is not

returned to Shareholders through the Tender Offer, the Board intends to

undertake a second phase of the Return of Value to return any remaining surplus

cash following completion of the Tender to Shareholders. This second phase of

the Return of Value will be influenced by the size of any amount that has not

been returned via the Tender Offer. In such circumstances, if there is

sufficient surplus, the Board intends to return approximately £50 million of it

by way of a share buyback, with any meaningful surplus above this amount being

returned by way of a Special Dividend (with accompanying Share Consolidation).

The role of the Share Consolidation is to seek to ensure that the price per

Ordinary Share remains materially unaffected by any Special Dividend, all other

things being considered.

Why is FirstGroup pursuing the Tender Offer?

In line with the Company's announcements of its intention to return up to £500

million of cash to Shareholders, the Board has considered the different ways of

returning these funds, and has consulted with Shareholders on the different

methods which are typically used to do so. Following that consideration and

consultation, the Board concluded that a Tender Offer made at an appropriate

premium to the price per share of Ordinary Shares, is the best way to return a

significant amount of capital to Shareholders in a short space of time, taking

account of the relative costs, complexity and timeframes of the various

possible methods, as well as the likely tax treatment for Shareholders. The

Board recognises that the Tender Offer may not return the full £500 million so

has set out a clear route to effectively return any amount not returned via the

Tender Offer.

Benefits of the Tender Offer for Shareholders

The benefits of the Tender Offer for Shareholders as a whole are that:

* it is available to all Qualifying Shareholders regardless of the size of

their holdings;

* it means Qualifying Shareholders who participate will receive, for Ordinary

Shares successfully tendered, a Tender Price that represents a premium of

12.4 per cent. to the closing price of 93.4 pence per Ordinary Share on the

Latest Practicable Date (being 25 October 2021) and a premium of 16.9 per

cent. to the volume weighted average price per Ordinary Share over the one

month to the Latest Practicable Date;

* it provides Qualifying Shareholders who wish to reduce their holdings of

Ordinary Shares with an opportunity to do so at a market-driven price with

an appropriate premium; and

* it permits Shareholders who wish to retain their current investment in

FirstGroup and their Ordinary Shares to do so and no Shareholder is

required to participate in the Tender Offer.

The Tender Offer will reduce the number of Ordinary Shares in issue, and so

should, assuming earnings stay the same, have a positive impact on the Group's

earnings per share (as the Company intends to cancel all of the Ordinary Shares

acquired in connection with the Tender Offer).

Coast Capital Management currently controls, in aggregate, 156,749,809 Ordinary

Shares, representing approximately 12.82 per cent. of the Issued Ordinary Share

Capital as at the Latest Practicable Date. Coast Capital Management intends to

participate in the Tender Offer in full, and has irrevocably undertaken to vote

in favour of the Resolutions and to tender, in aggregate, 156,749,809 Ordinary

Shares under the Tender Offer at the Tender Price. Further details of this

irrevocable undertaking are set out in the Circular.

General Meeting to approve the Tender Offer and the potential further phase of

the Return of Value

The Tender Offer will require the approval of Shareholders at a general meeting

of the Company, which will be held at Queen Elizabeth II Centre, Broad

Sanctuary, Westminster, London, SW1P 3EE on 18 November 2021 at 11:00am.

There is no guarantee that the Tender Offer will return the full sum of £500

million to Qualifying Shareholders. If the full £500 million is not returned

through the Tender Offer, if there is sufficient surplus, the Board intends to

return approximately £50 million of the surplus by way of a share buyback, with

any meaningful surplus above this amount being returned by way of a special

dividend (the "Special Dividend") (with accompanying Share Consolidation). The

Company is therefore also taking the opportunity at the General Meeting to

consider certain matters in addition to the Tender Offer Resolution which would

require Shareholder approval if, to complete the Return of Value, the New

Buyback Authority were to be used or a Special Dividend were to be paid,

including:

* a resolution authorising the Company to purchase up to a maximum of

122,281,244 Ordinary Shares, representing approximately 10 per cent. of the

Issued Ordinary Share Capital as at the Latest Practicable Date, which

would be used to return to Shareholders approximately £50 million of the

Net Disposal Proceeds not returned through the Tender Offer (the "New

Buyback Authority"). This New Buyback Authority would replace the Existing

Buyback Authority which was approved at the Company's AGM on 13 September

2021; and

* a resolution authorising the Board to effect a consolidation and

sub-division of the Company's share capital (the "Share Consolidation"),

which may be appropriate if a Special Dividend is paid to ensure that the

market price per New Ordinary Share immediately after the payment of the

Special Dividend would be approximately equal to the market price per

Ordinary Share immediately before such payment.

By requesting these authorities now, the Board is seeking to ensure that the

Company will be able to act quickly and without the delay and cost of convening

a further general meeting if the Board does subsequently decide to return a

portion of the £500 million not returned by the Tender Offer by way of a

repurchase of Ordinary Shares and, if applicable, payment of a Special Dividend

(with accompanying Share Consolidation). Further information about the New

Buyback Authority and the Share Consolidation is set out in the Circular.

It is noted that there is no guarantee that, if the full £500 million is not

returned through the Tender Offer, any repurchase of Ordinary Shares or Special

Dividend for any surplus not returned will be paid, as such matters will be

subject to the determination of the Board at the relevant time, including an

assessment of prevailing equity market conditions, the capital needs of the

Group, the sufficiency of distributable reserves and other factors, and the

Board reserves the right to pursue alternative uses of the available funds,

including for alternative share buybacks or dividends, or investment purposes.

2. THE TER OFFER

Overview of the Tender Offer

It is proposed that up to 476,190,476 Ordinary Shares (representing

approximately 38.9 per cent. of the Issued Ordinary Share Capital as at the

Latest Practicable Date) be purchased under the Tender Offer, for a maximum

aggregate cash consideration of £500 million.

Full details of the Tender Offer, including the terms and conditions on which

it is made, are set out in Part IV (Details of the Tender Offer) of the

Circular and in the Tender Form. Shareholders do not have to tender any

Ordinary Shares.

All Qualifying Shareholders who are on the Register at 6.00 p.m. on 29 November

2021 are entitled, but not required, to tender some or all of their Ordinary

Shares for purchase by Goldman Sachs, acting as principal, pursuant to the

requirements set out in the Circular.

Tenders will only be accepted at the Tender Price. The Tender Price represents

a premium of 12.4 per cent. to the closing price of 93.4 pence per Ordinary

Share on the Latest Practicable Date and represents a premium of 16.9 per cent.

to the volume weighted average price per Ordinary Share over the one month to

the Latest Practicable Date.

Subject to satisfaction of the Conditions to the Tender Offer, Ordinary Shares

which are successfully tendered under the Tender Offer will be purchased at a

price of 105 pence per Ordinary Share.

The Issued Ordinary Share Capital on the Latest Practicable Date was

1,222,969,677. If the Tender Offer is implemented in full, this will result in

the purchase of 476,190,476 Ordinary Shares (representing approximately 38.9

per cent. of the Issued Ordinary Share Capital of FirstGroup on the Latest

Practicable Date). The Issued Ordinary Share Capital of FirstGroup following

the cancellation of the Ordinary Shares (after FirstGroup has acquired all

validly tendered and purchased Ordinary Shares from Goldman Sachs) will be

746,621,972, assuming no further options are exercised for newly issued shares

in the interim. Shareholders should note that the Issued Ordinary Share Capital

numbers referred to in this paragraph take no account of any further dilution

which may be caused by the Share Plans, which is explained in further detail in

the Circular.

The Tender Offer is to be effected by Goldman Sachs (acting as principal and

not as agent, nominee or trustee) purchasing Ordinary Shares from Shareholders.

Goldman Sachs, in turn, has the right to require the Company to purchase from

it, and can be required by the Company to sell to it, such Ordinary Shares at

the Tender Price under an option agreement (the "Option Agreement"), details of

which are set out in the Circular. All Ordinary Shares purchased by the

Company from Goldman Sachs pursuant to the Option Agreement will be cancelled.

Options available to Shareholders in respect of the Tender Offer

Qualifying Shareholders are not obliged to tender any Ordinary Shares if they

do not wish to do so. If no action is taken by Qualifying Shareholders, there

will be no change to the number of Ordinary Shares that they hold and they will

receive no cash as a result of the Tender Offer.

Each Qualifying Shareholder who wishes to participate in the Tender Offer is

entitled to submit a tender to sell some or all of their Ordinary Shares.

The total number of Ordinary Shares tendered by any Qualifying Shareholder

should not exceed the total number of Ordinary Shares registered in the name of

that Qualifying Shareholder at the Record Date. For example, a Qualifying

Shareholder may decide to tender 50 per cent. of their Ordinary Shares, but if

a Qualifying Shareholder returned a tender purporting to offer for sale more

than 100 per cent. of their Ordinary Shares, they would be deemed to have

tendered only the number of Ordinary Shares actually owned by that Shareholder

on the Record Date, with the tender in respect of any additional shares being

deemed invalid.

Once made, any tender of Ordinary Shares will be irrevocable.

The Tender Offer will open on 28 October 2021 (unless such date is altered by

the Company in accordance with the Tender Offer). The Tender Offer will close

at 1.00 p.m. on 29 November 2021 and tenders received after that time will not

be accepted (unless the Closing Date is extended by the Company in accordance

with the Tender Offer).

Shareholders should note that the Tender Offer is conditional on, among other

things, the passing at the General Meeting of the Tender Offer Resolution as

set out in the Notice of General Meeting.

Number of Ordinary Shares that will be purchased pursuant to the Tender Offer

All Shareholders who tender Ordinary Shares will receive the Tender Price,

subject, where applicable, to the scaling-down arrangements set out in the

Circular. Accordingly, where scaling-down applies there is no guarantee that

all of the Ordinary Shares which are tendered by Qualifying Shareholders will

be accepted for purchase.

If more than 476,190,476 Ordinary Shares are validly tendered by Shareholders,

acceptances of validly tendered Ordinary Shares will be scaled-down to

determine the extent to which individual tenders are accepted.

These scaling-down arrangements are set out in full in the Circular and should

be read in full.

Guaranteed Entitlement

The Guaranteed Entitlement is only relevant if the Tender Offer is

oversubscribed. Tenders in respect of approximately 38.9 per cent. of each

holding of Ordinary Shares of every Qualifying Shareholder on the Record Date

will be accepted in full at the Tender Price and will not be scaled down. This

percentage is known as the "Guaranteed Entitlement". Qualifying Shareholders

may tender Ordinary Shares in excess of their Guaranteed Entitlement. However,

if the Tender Offer is oversubscribed, the tender of such excess Ordinary

Shares will only be successful to the extent that other Shareholders have

tendered less than their Guaranteed Entitlement.

These Guaranteed Entitlement arrangements are set out in full in the Circular

and should be read in full.

Circumstances in which the Tender Offer may not proceed

There is no guarantee that the Tender Offer will take place. The Tender Offer

is conditional on the passing of the Tender Offer Resolution set out in the

Notice of General Meeting. The Tender Offer is also conditional on other

matters, including:

* receipt of valid tenders in respect of at least 12,228,124 Ordinary Shares

(representing approximately 1 per cent. of the Issued Ordinary Share

Capital as at the Latest Practicable Date) by 1.00 p.m. on the Closing Date

and there continuing to be valid tenders in respect of at least such number

of Ordinary Shares; and

* the Tender Offer not having been terminated in accordance with its terms

and the Company having confirmed to Goldman Sachs that it will not exercise

its right to require Goldman Sachs not to proceed with the Tender Offer.

The Board has reserved the right, at any time prior to the Tender Offer

becoming unconditional, to require Goldman Sachs not to proceed with the Tender

Offer if the Board concludes that the implementation of the Tender Offer is no

longer in the best interests of the Company and/or Shareholders as a whole. The

Board has also reserved the right, at any time prior to the announcement of the

results of the Tender Offer, with the prior consent of Goldman Sachs, to revise

the aggregate value of the Tender Offer, or to extend the period during which

the Tender Offer is open, based on market conditions and/or other factors,

subject to compliance with applicable legal and regulatory requirements.

If the Tender Offer does not occur, the Group will have on its balance sheet

the £500 million of cash that is proposed to be returned pursuant to the Return

of Value. Holding this amount of cash means that the Group is likely to receive

a reduced return on capital while the Board considers how best to deploy or

return these funds to Shareholders. The Board is of the opinion that, subject

to any value-creating alternatives, this cash is surplus to the requirements of

the Group and that it would be in the best interests of the Company and

Shareholders as a whole not to retain this cash on the Group's balance sheet

but to return it to Shareholders by other means, such as a special dividend,

for example.

Results announcement and Unconditional Date

As set out in the timetable below, it is expected that the results of the

Tender Offer will be announced on 2 December 2021, at which time the Tender

Offer is expected to become unconditional subject to the Conditions described

in the Circular having been satisfied. Until such time as the Tender Offer

becomes unconditional, the Tender Offer will be subject to the Conditions

described in the Circular. Settlement is then expected to take place as set out

in the timetable below.

Full terms and conditions of the Tender Offer

Full details of the Tender Offer, including the terms and conditions on which

it is made and some questions and answers related to the Return of Value are

set out in the Circular.

3. EXPECTED TIMETABLE

Tender Offer opens 28 October 2021

Latest time and date for receipt of Forms of Proxy 11:00 a.m. on 16 November

for the General Meeting 2021

General Meeting 11:00a.m. on 18 November

2021

Latest time and date for receipt of Tender Forms and 1.00 p.m. on 29 November

share certificates or other documents of title for 2021

tendered certificated Ordinary Shares (i.e. close of

the Tender Offer)

Latest time and date for settlement of TTE 1.00 p.m. on 29 November

Instructions for tendered uncertificated Ordinary 2021

Shares (i.e. close of the Tender Offer)

Record Date for the Tender Offer 6.00 p.m. on 29 November

2021

Announcement of the results of the Tender Offer 2 December 2021

Unconditional Date for the Tender Offer and purchase 2 December 2021

of Ordinary Shares under the Tender Offer

CREST accounts credited for revised uncertificated 7 December 2021

shareholdings of Ordinary Shares (or, in the case of

unsuccessful tenders, for entire holdings of

Ordinary Shares)

CREST accounts credited in respect of Tender Offer 7 December 2021

proceeds for uncertificated Ordinary Shares

Cheques despatched in respect of Tender Offer 16 December 2021

proceeds for certificated Ordinary Shares

Return of share certificates in respect of 16 December 2021

unsuccessful tenders of certificated Ordinary Shares

Despatch of balance share certificates in respect of 16 December 2021

unsold Ordinary Shares in certificated form

Each of the times and dates in the table set out above is indicative only and

may be subject to change by FirstGroup, in which event details of the new times

and dates will be notified to Shareholders by announcement through a Regulatory

Information Service.

All references to times in the timetable above are to London times.

4. DIVIDS

It is not expected that the Tender Offer will have any impact on FirstGroup's

intention in respect of dividends as stated in the financial policy framework

set out in the Transaction Circular and in the results announcement of 27 July

2021, which is to commence payment of a regular dividend during the financial

year ending March 2023. The Group is targeting the annual dividend amount to be

around three times covered by a new Rail-adjusted Profit After Tax measure,

assuming normalisation of trading conditions post-pandemic.

In addition to the Return of Value, the Board reiterates its commitment to

keeping the balance sheet position of the ongoing Group under review and will

consider the prospects for making further additional distributions to

Shareholders in due course, following crystallisation of the First Transit

Earnout (as defined in the Transaction Circular and fair valued in the Group's

recent full year results at $140 million for accounting purposes), realisation

of value from the sale of the properties retained and consideration deferred in

the recent sale of Greyhound Lines Inc. to FlixMobility GmbH, and the potential

release of monies from pension escrow (of up to £117 million). The Board also

notes the capacity to increase gearing over time, as end market conditions and

hence business performance improves.

5. IRREVOCABLE UNDERTAKING

The Company has received an irrevocable undertaking from Coast Capital

Management, in its capacity as a controller of Ordinary Shares in the Company

and, as such, a major shareholder in the Company, to support the Tender Offer.

Pursuant to that irrevocable undertaking Coast Capital Management has committed

to validly tender, or to procure the valid tender of, 156,749,809 Ordinary

Shares (representing approximately 12.82 per cent of the total issued share

capital of the Company) in accordance with the procedure specified in the

Circular. The Ordinary Shares which are the subject of the undertaking will be

tendered as soon as possible and in any event within ten days of the

publication of the Circular. Coast Capital Management has also undertaken to

vote in favour of the Resolutions and not to sell, or otherwise dispose of, the

Ordinary Shares which are the subject of the undertaking or to acquire any

additional Ordinary Shares or interest in the Company.

6. TAKEOVER CODE

Rule 9 of the Takeover Code applies to any person who acquires an interest in

shares which, when taken together with shares in which persons acting in

concert with him are interested, carry 30 per cent. or more of the voting

rights of a company which is subject to the Takeover Code. Any such person is

required to make a general offer to all shareholders of that company to acquire

their shares in cash at not less than the highest price paid by such person, or

by any person acting in concert with him, for any interest in shares within the

12 months prior to the offer. Such an offer under Rule 9 of the Takeover Code

must also be made where any person who, together with persons acting in concert

with him, holds not less than 30 per cent. but not more than 50 per cent. of

the voting rights in the company and such person, or any person acting in

concert with him, acquires an interest in any other shares which increase the

percentage of shares carrying voting rights in which he is interested.

When a company purchases its own voting shares, any resulting increase in the

percentage of voting rights held by a shareholder, or group of shareholders

acting in concert, will be treated as an acquisition for the purpose of Rule 9.

Goldman Sachs may purchase, as principal and not as agent, nominee or trustee,

Ordinary Shares under the Tender Offer, which could result in Goldman Sachs

owning 30 per cent. or more of the Issued Ordinary Share Capital. It is also

possible that entities within the group of which Goldman Sachs is part hold or

come to hold other interests in the Issued Ordinary Share Capital and that, in

certain cases, those interests could be subject to aggregation with any

Ordinary Shares acquired under the Tender Offer for the purposes of Rule 9 of

the Takeover Code. As such, it is possible that the aggregated holdings of

Goldman Sachs and persons in concert with it could result in a requirement to

make a general offer under Rule 9.

Goldman Sachs has indicated its intention that, shortly after the purchase of

Ordinary Shares under the Tender Offer, it will sell all those Ordinary Shares

to the Company for cancellation. Accordingly, a waiver has been obtained from

the Panel on Takeovers and Mergers in respect of the application of Rule 9 to

the purchase by Goldman Sachs of Ordinary Shares under the Tender Offer.

7. FINANCIAL ADVICE

The Board has received financial advice from Goldman Sachs and J.P. Morgan in

relation to the Return of Value. In providing their financial advice, Goldman

Sachs and J.P. Morgan have relied upon the Board's commercial assessments of

the Return of Value.

8. RECOMMATION

The Board considers the Return of Value and the Resolutions to be in the best

interests of Shareholders as a whole. Accordingly, the Board recommends that

Shareholders vote in favour of the Resolutions to be proposed at the General

Meeting, as the Directors intend to do for their respective individual

beneficial holdings of, in aggregate, 751,483 Ordinary Shares, representing

approximately 0.06 per cent. of the Issued Ordinary Share Capital as at the

Latest Practicable Date.

The Board makes no recommendation to Shareholders in relation to participation

in the Tender Offer itself. Whether or not Shareholders decide to tender all

or any of their Ordinary Shares will depend on, among other things, their view

of FirstGroup's prospects and their own individual circumstances, including

their tax position. Shareholders need to take their own decision and are

recommended to consult their duly authorised independent advisers.

9. DIRECTORS' INTENTIONS

Each of the Directors has confirmed that they do not intend to tender through

the Tender Offer any of their current individual beneficial holding of Ordinary

Shares.

DEFINITIONS

The following definitions apply throughout this announcement unless the context

requires otherwise:

AGM annual general meeting;

Board or Directors the board of directors of FirstGroup;

Business Day a day other than a Saturday or Sunday or

public holiday in England and Wales on which

banks are open in London for general

commercial business;

certificated or in certificated recorded on the Register as being held in

form certificated form (that is, not in CREST);

CERTS the US Department of the Treasury's

Coronavirus Economic Relief for Transportation

Services scheme;

Closing Date the latest time and date at which the Tender

Offer shall close;

Coast Capital Management Coast Capital Management LP;

Company or FirstGroup FirstGroup PLC, a public limited company

incorporated in Scotland with registered

number SC157176, whose registered office is at

395 King Street, Aberdeen, AB24 5RP;

Conditions has the meaning given to that term in

paragraph 2.1 of Part IV (Details of the

Tender Offer) of the Circular;

CREST the paperless settlement procedure operated by

Euroclear enabling system securities to be

evidenced otherwise than by certificates and

transferred otherwise than by written

instrument;

CREST Manual the rules governing the operation of CREST as

published by Euroclear and as amended from

time to time;

CREST Member a person who has been admitted by Euroclear as

a system-member (as defined in the CREST

Regulations);

CREST Participant a person who is, in relation to CREST, a

system participant (as defined in the CREST

Regulations);

CREST Regulations the Uncertificated Securities Regulations 2001

(SI 2001/3755), as amended from time to time;

Disclosure Guidance and the disclosure guidance and transparency rules

Transparency Rules made under Part VI of FSMA (and contained in

the FCA's publication of the same name), as

amended from time to time;

Equiniti Equiniti Limited, a limited company

incorporated in England and Wales with

registered number 6226088, whose registered

office is at Aspect House, Spencer Road,

Lancing, West Sussex, BN99 6DA;

Euroclear Euroclear UK & Ireland Limited, the operator

of CREST;

Existing Buyback Authority the general authority to buy back up to a

maximum of 122,246,788 Ordinary Shares,

representing approximately 10 per cent. of the

Issued Ordinary Share Capital, that was

approved by Shareholders at the Company's AGM

held on 13 September 2021;

Financial Advisers J.P. Morgan and Goldman Sachs together;

Form of Proxy the form of proxy enclosed with the Circular

(where applicable) for use by Shareholders in

connection with the General Meeting;

FSMA Financial Services and Markets Act 2000, as

amended from time to time;

General Meeting the General Meeting of the Company to be held

at Queen Elizabeth II Centre, Broad Sanctuary,

Westminster, London, SW1P 3EE on 18 November

2021 at 11:00am;

Goldman Sachs Goldman Sachs International;

Group FirstGroup together with its subsidiaries and

subsidiary undertakings;

Guaranteed Entitlement has the meaning given to that term under

"Guaranteed Entitlement" at section 2 (The

Tender Offer) of this announcement;

Issued Ordinary Share Capital the Company's issued ordinary share capital,

excluding any treasury shares from time to

time;

J.P. Morgan or J.P. Morgan J.P. Morgan Securities plc;

Cazenove

Latest Practicable Date 25 October 2021, being the latest practicable

date prior to the publication of the Circular;

Listing Rules the listing rules made under Part VI of FSMA

(and contained in the FCA's publication of the

same name), as amended from time to time;

London Stock Exchange London Stock Exchange plc;

Main Market the main market for listed securities

maintained by the London Stock Exchange;

Market Abuse Regulation Regulation (EU) No. 596/2014 of the European

Parliament and of the Council of 16 April 2014

on market abuse, and any implementing

legislation, in each case as it forms part of

retained EU law as defined in the European

Union (Withdrawal) Act 2018;

Member Account ID the identification code or number attached to

any member account in CREST;

Net Disposal Proceeds has the meaning given to that term under

"Background to the Offer" in section 1

(Background to And Benefits Of The Tender

Offer) of this announcement;

New Buyback Authority the authority to buy back up to a maximum of

122,281,244 Ordinary Shares, representing

approximately 10 per cent. of the Issued

Ordinary Share Capital as at the Latest

Practicable Date, for which approval will be

sought for at the General Meeting;

New Ordinary Shares Ordinary Shares owned by Shareholders

following any Share Consolidation, such

Shareholders owning the same proportion of the

Company as they did immediately prior to the

Share Consolidation taking effect (subject to

the treatment of fractional entitlements) but

holding a smaller number of new Ordinary

Shares than the number of Ordinary Shares held

immediately prior to the Share Consolidation;

Notice of General Meeting the notice of the General Meeting which is set

out at the end of the Circular;

Option Agreement has the meaning given to that term under

"Options available to Shareholders in respect

of the Tender Offer" at section 2 (The Tender

Offer) of this announcement, details of which

are set out at paragraph 6 of Part VII

(Additional Information) of the Circular;

Ordinary Shares ordinary shares with a nominal value of 5

pence each in the capital of FirstGroup (or,

where the context requires, with such other

nominal value as an ordinary share in the

Company may have following any Share

Consolidation);

Overseas Shareholder a Shareholder who is resident in, or a citizen

of, a jurisdiction outside the United Kingdom;

Participant ID the identification code or membership number

used in CREST to identify a particular CREST

Member or other CREST Participant;

Qualifying Shareholders Shareholders other than those with a

registered address in any of the Restricted

Jurisdictions;

Record Date 6.00 p.m. on 29 November 2021 or such other

time and date as may be determined by the

Company in its sole discretion in the event

that the Closing Date is altered in accordance

with paragraph 2.22 of Part IV (Details of

the Tender Offer) of the Circular;

Register the register of members of FirstGroup;

Regulatory Information Service or one of the regulatory information services

RIS authorised by the FCA to receive, process and

disseminate regulatory information from listed

companies;

Resolutions the resolutions to be proposed at the General

Meeting, as set out in the Notice of General

Meeting;

Restricted Jurisdictions Australia and New Zealand;

Return of Value has the meaning given to that term under

"Background to the Offer" in section 1

(Background To And Benefits Of The Tender

Offer) of this announcement;

Share Consolidation has the meaning given to that term under

"General Meeting to approve the Tender Offer

and the potential further phase of the Return

of Value" in section 1 (Background To And

Benefits Of The Tender Offer) of this

announcement;

Shareholders holders of Ordinary Shares from time to time;

Special Dividend has the meaning given to that term under

"General Meeting to approve the Tender Offer

and the potential further phase of the Return

of Value" in section 1 (Background To And

Benefits Of The Tender Offer) of this

announcement;

subsidiary has the meaning given to that term in section

1159 of the Companies Act 2006;

subsidiary undertaking has the meaning given to that term in section

1162 of the Companies Act 2006;

Takeover Code the City Code on Takeovers and Mergers;

Tender Form the tender form issued with the Circular to

Qualifying Shareholders who hold their

Ordinary Shares in certificated form;

Tender Offer the invitation by Goldman Sachs to

Shareholders to tender Ordinary Shares for

purchase by Goldman Sachs on the terms and

subject to the conditions set out in the

Circular and also, in the case of certificated

Ordinary Shares only, the Tender Form (and,

where the context so requires, the associated

repurchase of such Ordinary Shares by the

Company from Goldman Sachs);

Tender Offer Resolution the resolution which seeks shareholder

approval for the Tender Offer under the

requirements of the Listing Rules;

Tender Price 105 pence, being the price per Ordinary Share

at which Ordinary Shares will be purchased

pursuant to the Tender Offer;

Transaction has the meaning given to that term under

"Background to the Offer" in section 1

(Background To And Benefits Of The Tender

Offer) of this announcement;

Transaction Circular has the meaning given to that term under

"Background to the Offer" in section 1

(Background To And Benefits Of The Tender

Offer) of this announcement;

TTE Instruction a transfer to escrow instruction (as defined

by the CREST Manual);

UK DB Pension Schemes the First UK Bus Pension Scheme and the

FirstGroup Pension Scheme;

UK or United Kingdom the United Kingdom of Great Britain and

Northern Ireland;

uncertificated or in recorded on the Register as being held in

uncertificated form uncertificated form in CREST and title to

which, by virtue of the CREST Regulations, may

be transferred by means of CREST;

Unconditional Date the date on and time at which the Tender Offer

becomes unconditional, which is expected to be

on 2 December 2021;

US or United States the United States of America, its territories

and possessions, any state of the United

States of America, the District of Columbia

and all other areas subject to its

jurisdiction;

US Exchange Act the US Securities Exchange Act of 1934, as

amended from time to time; and

US Shareholder a Shareholder who, for US federal income tax

purposes, is a beneficial owner of Ordinary

Shares and who is: (i) an individual that is a

citizen or resident of the United States, (ii)

a corporation, or other entity taxable as a

corporation, created or organized in or under

the laws of the United States, any state

therein or the District of Columbia, or (iii)

an estate or trust the income of which is

subject to US federal income taxation

regardless of its source.

IMPORTANT STATEMENT

This announcement does not constitute or form part of an offer or invitation,

or a solicitation of any offer or invitation, to purchase any Ordinary Shares

or other securities.

The full terms and conditions of the Tender Offer will be set out in the

Circular, which Shareholders are advised to read in full. Any response to the

Tender Offer should be made only on the basis of the information in the

Circular.

J.P. Morgan Securities plc (which conducts its U.K. investment banking

activities as J.P. Morgan Cazenove) ("J.P. Morgan"), which is authorised by the

Prudential Regulation Authority and regulated by the Financial Conduct

Authority and the Prudential Regulation Authority in the United Kingdom, is

acting as lead joint sponsor, joint financial adviser and joint corporate

broker exclusively for FirstGroup and for no one else in connection with the

Return of Value and will not be responsible to anyone other than FirstGroup for

providing the protections afforded to clients of J.P. Morgan or for providing

advice in relation to the matters described in this announcement.

Goldman Sachs International ("Goldman Sachs"), which is authorised by the

Prudential Regulation Authority and regulated by the Financial Conduct

Authority and the Prudential Regulation Authority in the United Kingdom, is

acting as joint sponsor, joint financial adviser and joint corporate broker

exclusively for FirstGroup and for no one else in connection with the Return of

Value and will not be responsible to anyone other than FirstGroup for providing

the protections afforded to clients of Goldman Sachs or for providing advice in

relation to the matters described in this announcement.

Apart from the responsibilities and liabilities, if any, which may be imposed

on J.P. Morgan and Goldman Sachs (the "Financial Advisers") under FSMA or the

regulatory regime established thereunder: (i) neither of the Financial Advisers

or any persons associated or affiliated with either of them accepts any

responsibility whatsoever or makes any warranty or representation, express or

implied, in relation to the contents of this announcement, including its

accuracy, completeness or verification or for any other statement made or

purported to be made by, or on behalf of it, FirstGroup or the Directors, in

connection with FirstGroup and/or the Tender Offer; and (ii) each of the

Financial Advisers accordingly disclaims, to the fullest extent permitted by

law, all and any liability whatsoever, whether arising in tort, contract or

otherwise (save as referred to above) which they might otherwise be found to

have in respect of this announcement or any such statement.

Cautionary statement regarding forward-looking statements

This announcement includes statements that are, or may be deemed to be,

forward-looking statements. These forward-looking statements can be identified

by the use of forward-looking terminology, including the terms anticipates,

believes, could, estimates, expects, intends, may, plans, projects, should or

will, or, in each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives, goals, future

events or intentions. By their nature, forward-looking statements involve risk

and uncertainty because they relate to future events and circumstances.

Forward-looking statements may, and often do, differ materially from actual

results. Any forward-looking statements in this announcement reflect

FirstGroup's current view with respect to future events and are subject to

risks relating to future events and other risks, uncertainties and assumptions

relating to the Group and its operations, results of operations and growth

strategy. Other than in accordance with its legal or regulatory obligations

(including under the Listing Rules, the Disclosure Guidance and Transparency

Rules, the Market Abuse Regulation and the rules of the London Stock Exchange),

FirstGroup is not under any obligation and FirstGroup expressly disclaims any

intention or obligation (to the maximum extent permitted by law) to update or

revise any forward-looking statements, whether as a result of new information,

future events or otherwise.

Overseas Shareholders

The availability of the Tender Offer to Shareholders who are not resident in

the United Kingdom may be affected by the laws of the relevant jurisdiction in

which they are located. Shareholders who are not resident in the United Kingdom

should read paragraph 6 of Part IV (Details of the Tender Offer) of the

Circular and should inform themselves about, and observe, any applicable legal

or regulatory requirements. In addition, the attention of Shareholders who are

resident in the United States is drawn to the section for US Shareholders

below.

The Tender Offer is not being made, directly or indirectly, in or into, or by

use of the mails of, or by any means or instrumentality (including, without

limitation, facsimile transmission, telex, telephone and e-mail) of interstate

or foreign commerce of, or any facilities of a national securities exchange of,

any Restricted Jurisdiction and the Tender Offer cannot be accepted by any such

use, means, instrumentality or facility or from within any Restricted

Jurisdiction. Accordingly, unless otherwise determined by the Company and

permitted by applicable law and regulation, neither the Circular nor the Tender

Form nor any related document is being, nor may it be, directly or indirectly,

mailed, transmitted or otherwise forwarded, distributed, or sent in, into or

from any Restricted Jurisdiction, and persons receiving the Circular, the

Tender Form and/or any related document (including, without limitation,

trustees, nominees or custodians) must not mail or otherwise forward,

distribute or send it in, into or from such Restricted Jurisdiction, as to do

so may invalidate any purported acceptance of the Tender Offer. Any person

(including, without limitation, trustees, nominees or custodians) who would or

otherwise intends to, or who may have a contractual or legal obligation to,

forward the Circular, the Tender Form and/or any related document to any

jurisdiction outside the United Kingdom, should seek appropriate advice before

taking any action.

U.S. Shareholders

The Tender Offer is not subject to the disclosure and other procedural

requirements of Rule 13e-4 or Regulation 14D under the US Securities Exchange

Act of 1934 (the "US Exchange Act"). The Tender Offer will be made in the US in

accordance with the requirements of Regulation 14E under the US Exchange Act to

the extent applicable. Certain provisions of Regulation 14E under the US

Exchange Act are not applicable to the Tender Offer by virtue of Rule 14d-1(d)

under the US Exchange Act. Goldman Sachs will act as US dealer manager with

respect to the Tender Offer in the United States to the extent required. US

Shareholders should note that the Ordinary Shares are not listed on a US

securities exchange and the Company is not subject to the periodic reporting

requirements of the US Exchange Act and is not required to, and does not, file

any reports with the US Securities and Exchange Commission thereunder.

It may be difficult for US Shareholders to enforce certain rights and claims

arising in connection with the Tender Offer under US federal securities laws

since the Company is located outside the US and most of its officers and

directors may reside outside the US. It may not be possible to sue a non-US

company or its officers or directors in a non-US court for violations of US

federal securities laws. It also may not be possible to compel a non-US company

or its affiliates to subject themselves to a US court's judgment.

The receipt of cash pursuant to the Tender Offer by a Shareholder who is a US

person will be a taxable transaction for US federal income tax purposes. The

Circular sets out a guide to certain US tax consequences of the Tender Offer

for Shareholders under current US law. However, each such Shareholder should

consult and seek individual advice from an appropriate professional adviser.

To the extent permitted by applicable law and in accordance with normal UK

practice, the Company, Goldman Sachs or any of their respective affiliates, may

make certain purchases of, or arrangements to purchase, Ordinary Shares outside

the United States during the period in which the Tender Offer remains open for

participation, including sales and purchases of Ordinary Shares effected by

Goldman Sachs acting as market maker in the Ordinary Shares. These purchases,

or other arrangements, may occur outside the United States either in the open

market at prevailing prices or in private transactions at negotiated prices. In

order to be excepted from the requirements of Rule 14e-5 under the US Exchange

Act by virtue of Rule 14e-5(b)(12) thereunder, such purchases, or arrangements

to purchase, must comply with applicable English law and regulation, including

the Listing Rules, and the relevant provisions of the US Exchange Act. Any

information about such purchases will be disclosed as required in the UK and

the US and, if required, will be reported via a Regulatory Information Service

and will be available on the London Stock Exchange website at http://

www.londonstockexchange.com.

While the Tender Offer is being made available to Shareholders in the US, the

right to tender Ordinary Shares is not being made available in any jurisdiction

in the US in which the making of the Tender Offer or the right to tender such

Ordinary Shares would not be in compliance with the laws of such jurisdiction.

This announcement has not been approved, disapproved or otherwise recommended

by the US Securities and Exchange Commission or any US state securities

commission and such authorities have not confirmed the accuracy or determined

the adequacy of this announcement. Any representation to the contrary is a

criminal offence in the US.

END

(END) Dow Jones Newswires

October 27, 2021 02:00 ET (06:00 GMT)

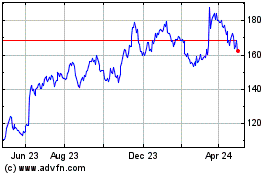

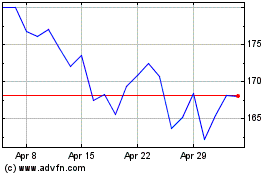

Firstgroup (LSE:FGP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Firstgroup (LSE:FGP)

Historical Stock Chart

From Apr 2023 to Apr 2024