FirstGroup PLC Total Voting Rights

03 December 2021 - 2:37AM

UK Regulatory

TIDMFGP

FIRSTGROUP PLC

Announcement of Acquisition of Shares and Total Voting Rights

2 December 2021

THE INFORMATION CONTAINED IN THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION IN OR INTO AUSTRALIA OR NEW ZEALAND

PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THIS ANNOUNCEMENT

FIRSTGROUP PLC

Acquisition of Shares and Total Voting Rights

Further to its announcement of the results of its Tender Offer earlier today,

FirstGroup plc (the "Company") confirms that, under the terms of the Option

Agreement, it has acquired from Goldman Sachs 476,190,476 Ordinary Shares in

the Company at the Tender Price of 105 pence per Ordinary Share, representing a

total cost of £499,999,999.80. The Ordinary Shares acquired by the Company are

today being cancelled. The Ordinary Shares were originally purchased by Goldman

Sachs pursuant to the Tender Offer at the Tender Price.

In accordance with Paragraph 5.6.1 of the FCA's Disclosure Guidance and

Transparency Rules, the Company notifies the market of the following:

* The 476,190,476 Ordinary Shares acquired by the Company from Goldman Sachs

represented approximately 38.9% of the voting rights attributable to the

Ordinary Shares immediately prior to such acquisition.

* Following completion of the Tender Offer and the cancellation of

476,190,476 Ordinary Shares, the Issued Ordinary Share Capital consists of

746,664,464 Ordinary Shares with voting rights. Each of these Ordinary

Shares carries one vote. The total number of voting rights, therefore, is

746,664,464. The ordinary shares have a nominal value of 5 pence each.

This figure may be used by Shareholders as the denominator for the calculations

by which they will determine if they are required to notify their interest in,

or a change to their interest in, the Company under the FCA's Disclosure

Guidance and Transparency Rules.

Capitalised terms used in this announcement have the meanings given to them in

the announcement of the Company dated 27 October 2021 in respect of the Tender

Offer.

Contacts at FirstGroup:

Faisal Tabbah, Head of Investor Relations

Stuart Butchers, Group Head of Communications

corporate.comms@firstgroup.com

+44 (0) 20 7725 3354

Contacts at Brunswick PR:

Andrew Porter / Simone Selzer, Tel: +44 (0) 20 7404 5959

Legal Entity Identifier (LEI): 549300DEJZCPWA4HKM93. Classification as per DTR

6 Annex 1R: 2.5.

IMPORTANT NOTICE

This announcement does not constitute or form part of an offer or invitation,

or a solicitation of any offer or invitation, to purchase any Ordinary Shares

or other securities.

The full terms and conditions of the Tender Offer are set out in the Circular,

which Shareholders were advised to read in full.

J.P. Morgan Securities plc (which conducts its U.K. investment banking

activities as J.P. Morgan Cazenove) ("J.P. Morgan"), which is authorised by the

Prudential Regulation Authority and regulated by the Financial Conduct

Authority and the Prudential Regulation Authority in the United Kingdom, is

acting as lead joint sponsor, joint financial adviser and joint corporate

broker exclusively for FirstGroup and for no one else in connection with the

Return of Value and will not be responsible to anyone other than FirstGroup for

providing the protections afforded to clients of J.P. Morgan or for providing

advice in relation to the matters described in this announcement.

Goldman Sachs International ("Goldman Sachs"), which is authorised by the

Prudential Regulation Authority and regulated by the Financial Conduct

Authority and the Prudential Regulation Authority in the United Kingdom, is

acting as joint sponsor, joint financial adviser and joint corporate broker

exclusively for FirstGroup and for no one else in connection with the Return of

Value and will not be responsible to anyone other than FirstGroup for providing

the protections afforded to clients of Goldman Sachs or for providing advice in

relation to the matters described in this announcement.

Apart from the responsibilities and liabilities, if any, which may be imposed

on J.P. Morgan and Goldman Sachs (the "Financial Advisers") under FSMA or the

regulatory regime established thereunder: (i) neither of the Financial Advisers

or any persons associated or affiliated with either of them accepts any

responsibility whatsoever or makes any warranty or representation, express or

implied, in relation to the contents of this announcement, including its

accuracy, completeness or verification or for any other statement made or

purported to be made by, or on behalf of it, FirstGroup or the Directors, in

connection with FirstGroup and/or the Tender Offer; and (ii) each of the

Financial Advisers accordingly disclaims, to the fullest extent permitted by

law, all and any liability whatsoever, whether arising in tort, contract or

otherwise (save as referred to above) which they might otherwise be found to

have in respect of this announcement or any such statement.

Cautionary statement regarding forward-looking statements

This announcement includes statements that are, or may be deemed to be,

forward-looking statements. These forward-looking statements can be identified

by the use of forward-looking terminology, including the terms anticipates,

believes, could, estimates, expects, intends, may, plans, projects, should or

will, or, in each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives, goals, future

events or intentions. By their nature, forward-looking statements involve risk

and uncertainty because they relate to future events and circumstances.

Forward-looking statements may, and often do, differ materially from actual

results. Any forward-looking statements in this announcement reflect

FirstGroup's current view with respect to future events and are subject to

risks relating to future events and other risks, uncertainties and assumptions

relating to the Group and its operations, results of operations and growth

strategy. Other than in accordance with its legal or regulatory obligations

(including under the Listing Rules, the Disclosure Guidance and Transparency

Rules, the Market Abuse Regulation and the rules of the London Stock Exchange),

FirstGroup is not under any obligation and FirstGroup expressly disclaims any

intention or obligation (to the maximum extent permitted by law) to update or

revise any forward-looking statements, whether as a result of new information,

future events or otherwise.

END

(END) Dow Jones Newswires

December 02, 2021 10:37 ET (15:37 GMT)

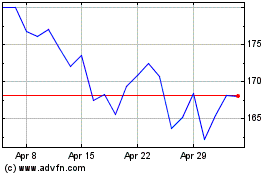

Firstgroup (LSE:FGP)

Historical Stock Chart

From Mar 2024 to Apr 2024

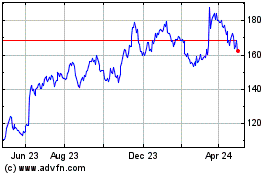

Firstgroup (LSE:FGP)

Historical Stock Chart

From Apr 2023 to Apr 2024