Fintel PLC Director/PDMR Dealing (0164P)

14 October 2021 - 5:00PM

UK Regulatory

TIDMFNTL

RNS Number : 0164P

Fintel PLC

14 October 2021

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR. Upon the

publication of this announcement via the Regulatory Information

Service, this inside information is now considered to be in the

public domain.

Fintel plc

(the "Company" or "Fintel")

Director / PDMR Dealing

Fintel plc, the leading independent provider of fintech and

support services to the UK's retail financial services sector, has

been notified that three trusts whose beneficial owner is Kenneth

"Ken" Davy, Non-Executive Interim Chairman, namely "Kenneth Ernest

Davy Number 2 (Children's) Settlement 1997", "Jennifer Davy

Discretionary Settlement 1997" and "Jennifer Davy Number 2

(Children's) Settlement 1997", have sold 895,422, 895,422 and

895,408 ordinary shares of 1 pence each in the Company ("Ordinary

Shares"), respectively, at a price of 220 pence per share.

Ken Davy has informed the Company that he does not intend to

dispose of any further interest he has in any Ordinary Shares for a

period of six months from today.

Following these sales, Mr. Davy's beneficial interest is

26,137,774 Ordinary Shares, representing approximately 28.60% of

the Company's issued share capital.

The notification below, made in accordance with the requirements

of the EU Market Abuse Regulation, provides further detail:

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them.

1 Details of the person discharging managerial responsibilities/person

closely associated

a) Name 1. Kenneth Ernest Davy Number 2

(Children's) Settlement 1997

2. Jennifer Davy Discretionary Settlement

1997

3. Jennifer Davy Number 2 (Children's)

Settlement 1997

================================ ================================================

2 Reason for the notification

==================================================================================

a) Position/status 1. Person closely associated with

Person Discharging Managerial Responsibilities

(Kenneth Davy, Non-Executive Interim

Chairman (PDMR))

2. Person closely associated with

Person Discharging Managerial Responsibilities

(Kenneth Davy, Non-Executive Interim

Chairman (PDMR))

3. Person closely associated with

Person Discharging Managerial Responsibilities

(Kenneth Davy, Non-Executive Interim

Chairman (PDMR))

================================ ================================================

b) Initial notification/Amendment Initial notification

================================ ================================================

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

==================================================================================

a) Name Fintel plc

================================ ================================================

b) LEI 213800DXP1VY21GCTH04

================================ ================================================

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

==================================================================================

a) Description of the financial Ordinary shares of 1 pence each

instrument, type of instrument

ISIN: GB00BG1THS43

Identification Code

================================ ================================================

b) Nature of the transaction 1. Sale of Ordinary Shares

2. Sale of Ordinary Shares

3. Sale of Ordinary Shares

================================ ================================================

c) Price(s) and volume(s) Price No. of shares

1. 220 pence 895,422

---------- --------------

2. 220 pence 895,422

---------- --------------

3. 220 pence 895,408

---------- --------------

================================ ================================================

d) Aggregated information Price: 220 pence

No of shares: 2,686,252

================================ ================================================

e) Date of transaction 1. 13 October 2021

2. 13 October 2021

3. 13 October 2021

================================ ================================================

f) Place of transaction 1. London Stock Exchange, AIM

2. London Stock Exchange, AIM

3. London Stock Exchange, AIM

================================ ================================================

For further information please contact:

Fintel via Instinctif Partners

Matt Timmins (Joint Chief Executive

Officer)

Zeus Capital (Nominated Adviser

and Joint Broker) +44 (0) 20 3829 5000

Martin Green

Dan Bate

Pippa Hamnett

Investec Bank (Joint Broker) +44 (0) 20 7597 5095

Bruce Garrow

David Anderson

Harry Hargreaves

Instinctif Partners (Financial +44 78 3767 4600 / fintel@instinctif.com

PR)

George Peele

Mark Walter

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHUOOKRAKURAAA

(END) Dow Jones Newswires

October 14, 2021 02:00 ET (06:00 GMT)

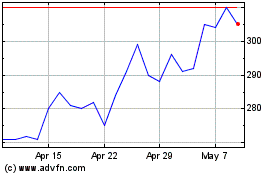

Fintel (LSE:FNTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

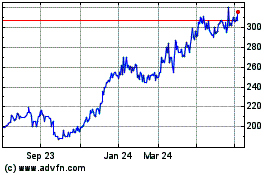

Fintel (LSE:FNTL)

Historical Stock Chart

From Apr 2023 to Apr 2024