Franchise Brands PLC Q3 Trading Update (1992Q)

26 October 2021 - 5:00PM

UK Regulatory

TIDMFRAN

RNS Number : 1992Q

Franchise Brands PLC

26 October 2021

26 October 2021

FRANCHISE BRANDS PLC

("Franchise Brands", the "Group" or the "Company")

Q3 Trading Update

Record Metro Rod system sales, up 32%, leading to strong Q3

profits

Board c onfident of meeting consensus market expectations for

2021

Franchise Brands plc (AIM: FRAN), a multi-brand franchise

business, provides the following trading update for the three

months to 30 September 2021 ("Q3").

The Group has continued to perform strongly during Q3, with

adjusted EBITDA for the quarter and year-to-date reaching a record

level. This strong performance has been driven by the outstanding

growth of our Metro Rod franchisees, who have increased system

sales for the quarter by 32% year-on-year. Willow Pumps has been

slower to recover from the reduced Covid-related volumes of 2020,

particularly in the supply and installation part of the business

which is reliant on the house-building sector. The B2C division

continues to perform well with 52 new recruits year-to-date, which

is ahead of 2020 and in line with 2019. T he Board is therefore

confident of meeting current consensus market expectations* for the

year to 31 December 2021 (which had been upgraded in July) and

reconfirms the Group's strategic financial target of run-rate

turnover of GBP100m and adjusted EBITDA of GBP15m by the end of

2023.

The digital transformation at Metro Rod and Metro Plumb

continues at pace. Our integrated technology platform, the core

elements of which are the "Vision" works management system and the

"Connect" customer portal, is being optimised with a series of

upgrades to further enhance functionality. The next stage is to

develop an improved engineer interface and scheduling capability to

further improve productivity, which is important in the current

tight labour market. It is our ambition to develop a common

technology platform across all our businesses that will enhance the

end-to-end customer experience and improve the efficiency and

productivity of our business and those of our customers and

franchisees.

We continue to seek opportunities to utilise our considerable

balance sheet strength to complement our organic growth through

earnings-enhancing acquisitions that will either expand or enhance

our B2B division, leverage our existing B2C infrastructure, or

identify a franchise business of scale that would create a third

division of the Group.

Stephen Hemsley, Executive Chairman, commented:

"I am pleased with our Q3 performance which demonstrates the

strength of our organic strategy and look forward to Q4 and the

full year result with confidence. The progress we are making with

our digital platform is already beginning to transform our existing

businesses and will provide a scaleable technology platform to

support the accelerated development of businesses we will acquire

in the future. We will therefore continue to invest significant

resources in this area.

"We continue to review a number of acquisition opportunities but

remain patient and will only move forward where we are confident

that an opportunity will provide a good return for our

shareholders, in a reasonable timescale, and with an acceptable

risk."

*Consensus market expectations for the financial year ending 31

December 2021 are currently as follows:

-- Revenue GBP58.2m

-- Adjusted EBITDA GBP8.4m

-- Adjusted EPS 5.43p

-- Dividend 1.50p

Enquiries:

Franchise Brands plc + 44 (0) 1625 813231

Stephen Hemsley, Executive Chairman

Chris Dent, Chief Financial Officer

Julia Choudhury, Corporate Development Director

Allenby Capital Limited (Nominated Adviser

and Joint Broker) +44 (0) 20 3328 5656

Jeremy Porter / Liz Kirchner (Corporate

Finance)

Amrit Nahal (Sales & Corporate Broking)

Dowgate Capital Limited (Joint Broker) +44 (0) 20 3903 7715

James Serjeant / Colin Climie / Nicholas

Chambers

MHP Communications (Financial PR) +44 (0) 20 3128 8100

Katie Hunt +44 (0) 7884 494112

franchisebrands@mhpc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPGUWUUPGGRA

(END) Dow Jones Newswires

October 26, 2021 02:00 ET (06:00 GMT)

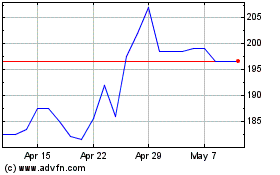

Franchise Brands (LSE:FRAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Franchise Brands (LSE:FRAN)

Historical Stock Chart

From Apr 2023 to Apr 2024