TIDMFSF

RNS Number : 9503J

Foresight Sustain. Forestry Co PLC

03 May 2022

3 May 2022

Foresight Sustainable Forestry Company Plc

("FSF" or "the Company")

31 March 2022 Net Asset Value ("NAV") and Portfolio Update

Foresight Sustainable Forestry Company Plc, an investment

company that invests in UK forestry and afforestation assets,

announces that as at 31 March 2022 its unaudited Net Asset Value

("NAV") was GBP135.5 million (post IPO: GBP127.6 million),

resulting in a NAV per Ordinary Share of 104.2 pence, up 6.1 pence

from 98.1 pence immediately following the Company's IPO in November

2021.

Summary of NAV key drivers:

FSF saw gains across its portfolio of GBP7.9m (6.2%) over the

period from the first day of trading on 24 November 2021 to the

period end on 31 March 2022. The related valuations were performed

on a property-by-property basis by an independent third-party in

accordance with the Royal Institute of Chartered Surveyors ("RICS")

Red Book Fair Value methodology.

Within the portfolio, the afforestation assets delivered a gain

to FSF of 18% during the period, with demand for afforestation and

the associated voluntary carbon credits particularly strong. In

addition, several afforestation properties achieved key development

milestones in the period, including Banc Farm, which completed

planting activities, and Mountmill Burn, which commenced planting

activities. The established forestry aspect of the portfolio saw a

gain of 2% with notably few comparable transactions within the UK

for mature assets during the period, partly as a result of the

impact of Storm Arwen.

Following the revaluation, FSF's split of afforestation assets

(by value) has increased by 3% to 36% of the total portfolio,

moving FSF materially closer to its stated target of 40-50%

afforestation. The remaining 64% of value is in established

forestry assets.

Portfolio Update

Completion of planting at Banc Farm

At the end of March 2022, FSF completed planting at Banc Farm,

with no material deviations to the expected number of trees planted

at c.229,300. This is a key development milestone for the asset and

driver of capital appreciation for FSF. In addition to the

forecasted production of over 48,000 tonnes of sustainable timber

on a c.35-year rotation, this project is forecast to increase the

baseline biodiversity net gain of the site (according to DEFRA's

Metric 3.0) by 60% over the next five years and sequester 21,218

tonnes of additional CO (2) . Banc Farm will now undergo an

independent verification to confirm the number of voluntary carbon

units that are accredited to it.

Pipeline and deployment update

Following the expansion of FSF's mapping activity, the Company

has identified over 4,500 properties that meet its afforestation

criteria, covering an area in excess of 860,000 hectares. This

activity has driven a material boost to the pipeline of future

investments and provides confidence in FSF's ability to originate

attractive, off-market afforestation properties going forward.

FSF is currently in the process of transacting twelve individual

off-market afforestation properties under exclusivity, extending

over 2,700 hectares, for an aggregated consideration (excluding

transaction taxes and adviser costs) of over GBP18 million,

demonstrating FSF's continued ability to convert its pipeline into

live, executable deals.

Additionally, FSF is pleased to have entered into an option

agreement, valid until 31 December 2022, with Foresight Inheritance

Tax Fund ("FITF") for an additional eight forestry properties

covering more than 3,000 hectares, with a combined value of GBP27.6

million as of 30 September 2021. Afforestation assets represent

c.19% of these properties by value.

FSF has deployed 91% of IPO proceeds. It is estimated that FSF

has GBP4.1m available for further afforestation investments until

the IPO proceeds will be considered fully invested.

Richard Davidson, Chairman of Foresight Sustainable Forestry

Company, commented:

"We are delighted that FSF, the London Stock Exchange's first

natural capital investment vehicle, has delivered such a strong

first NAV update which illustrates how capital appreciation is

achieved by acquiring and developing afforestation sites, while

also directly contributing to the twin fights against climate

change and biodiversity loss.

We are proud to have successfully completed planting at Banc

Farm, one of Wales's largest planting schemes this season and

Foresight's first to reach this milestone. The development of our

afforestation pipeline, together with the opportunity to execute on

the option agreement over another eight forestry sites, gives FSF

an attractive pipeline of assets that positions us well to deploy

the small remaining IPO proceeds and deliver future growth for our

investors."

Looking forward, we intend to build on our good performance to

date, adding scale and leveraging the favourable macro tailwinds

applicable to UK forestry to continue to deliver strong investor

returns."

About the Company

Foresight Sustainable Forestry Company Plc ("the Company") is an

externally managed investment company investing in a diversified

portfolio of UK forestry and afforestation assets. Targeting a net

total return of more than CPI +5%, the Company provides investors

with the opportunity for real returns and capital appreciation

driven by the prevailing global imbalance between supply and demand

for timber; the inflation-protection qualities of UK land

freeholds; and biological tree growth of 3% to 4% not correlated to

financial markets. It also offers outstanding sustainability and

ESG attributes and access to carbon units related to carbon

sequestration from new afforestation planting. The Company targets

value creation as the afforestation projects successfully achieve

development milestones in the process of converting open ground

into established commercial forest and woodland areas. The Company

is seeking to make a direct contribution in the fight against

climate change through forestry and afforestation carbon

sequestration initiatives and to preserve and proactively enhance

natural capital and biodiversity across its portfolio. It is

managed by Foresight Group LLP. https://fsfc.foresightgroup.eu/

For further information, please contact:

Foresight Sustainable Forestry Company Plc

Robert Guest

Richard Kelly

fsfc@foresightgroup.eu +44 20 3667 8100

Jefferies International Limited

Neil Winward

Will Soutar +44 20 7029 8000

Citigate Dewe Rogerson

Toby Moore (toby.moore@citigatedewerogerson.com) +44 7768 981763

Jos Bieneman (jos.bieneman@citigatedewerogerson.com) +44 7834 336650

This announcement does not constitute, and may not be construed

as, an offer to sell or an invitation to purchase investments of

any description, or the provision of investment advice by any

party. No information set out in this announcement is intended to

form the basis of any contract of sale, investment decision or any

decision to purchase securities in the Company.

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"anticipates", "expects", "intends", "may", "will", "targeting" or

"should" or, in each case, their negative or other variations or

comparable terminology. All statements other than statements of

historical facts included in this announcement, including, without

limitation, those regarding the Company's financial position,

strategy, plans, proposed acquisitions and objectives, are

forward-looking statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVPPUCPCUPPGQB

(END) Dow Jones Newswires

May 03, 2022 02:01 ET (06:01 GMT)

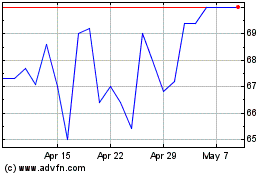

Foresight Sustainable Fo... (LSE:FSF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Foresight Sustainable Fo... (LSE:FSF)

Historical Stock Chart

From Apr 2023 to Apr 2024