TIDMFSG

RNS Number : 1260O

Foresight Group Holdings Limited

06 October 2021

6 October 2021

Foresight Group Holdings Limited

Trading Update for the six months to 30 September 2021

Foresight Group Holdings Limited ("Foresight"), a listed

infrastructure and private equity manager group, provides a trading

update for the six months to 30 September 2021.

Highlights

-- Strong growth in Assets under Management ("AUM") with estimated

AUM of GBP8.1 billion and Funds under Management ("FUM")

of GBP6.0 billion at 30 September 2021, equating to an annualized

growth rate of 25% and 34% respectively in the period

-- Retail net inflows during the six-month period were back

to similar levels seen in the six-month period pre-pandemic,

which gives the Board further confidence for the outlook

for FY2022

-- Strong capital deployment across our core business areas

of infrastructure and private equity with GBP295 million

deployed during the period compared with GBP206 million for

the same six-month period last year

-- Successful final close of Foresight Energy Infrastructure

Partners ("FEIP"), with total commitments of EUR 851 million

secured, 70% ahead of original target

-- Listing of Foresight's sustainable forestry business scheduled

for November 2021 with progress being made on several other

new fund launches

-- Group Revenue and Core EBITDA expectations for the full year

to 31 March 2022 are unchanged

Bernard Fairman, Executive Chairman of Foresight Group Holdings

Limited, commented:

"The last six months have continued to build on the positive

momentum we have seen since Foresight's listing in February. We

have experienced substantial growth in FUM as a result of strong

retail net inflows plus further institutional fund closes and

together with the near-term pipeline of new fund launches and

deployment, this gives the Board confidence in achieving the

Group's full year FY2022 targets.

The current volatility in power pricing in the UK and beyond has

provided some positive momentum for Foresight's balanced portfolio

of infrastructure assets. More broadly it highlights the need for

further acceleration of the transition to a reliable, resilient and

low carbon energy system, a space in which Foresight has

established itself as a leader. Foresight owns and operates c.

GBP4.0 billion of electricity generating assets. Much of the

production is either fixed price income from renewable obligation

certificates or sold forward at fixed prices. However, c. 15% is

benefitting from the near quadrupling of electricity prices with a

further c. 25% likely to similarly benefit as their fixes expire

during the next two years, should electricity prices remain

elevated. Electricity generating assets are valued using third

party power curves which continue to maintain that electricity will

revert to its long-term average of GBP40-GBP50 per megawatt hour

after about a year. The current market dynamics provide potential

significant upside to these curves, which would benefit Foresight

over the medium term.

At the upcoming COP26 event, we expect world leaders to announce

new targets aimed at tackling climate change. These targets should

provide even more impetus to our strategy and business model and

will further underpin Foresight's considerable growth

potential."

Trading update

Foresight reports estimated AUM at 30 September 2021 of GBP8.1

billion (31 March 2021: GBP7.2 billion), an annualized increase of

25% in the six-month period, achieved purely through organic

growth.

Net inflows totalled c. GBP0.8 billion, with strong retail

inflows, especially from the tax-based products, accompanied by

closes from several institutional funds. Prospects for future

institutional fundraising also remain positive with several funds

expected to announce further fund raises during the second half of

FY2022.

Operational margins remain robust with Revenue and Core EBITDA

in line with Group expectations. Recurring revenues at 30 September

2021 remain in line with the target range of 85%-90%.

Fund updates

During the period, we closed FEIP, our fund aimed at backing

second generation green energy investments, at a level that was 70%

ahead of our original target. The EUR 851 million raised is further

evidence of Foresight's enhanced international profile and of

increasing investor appetite to back innovations that will

accelerate the shift to a decarbonised world.

Within private equity, we announced the first close of our

Foresight Regional Investment III LP fund at GBP65 million. The

Fund is cornerstoned by the Greater Manchester Pension Fund, with

strong support from Clwyd and Merseyside Pension Funds.

In terms of the new areas of development beyond green energy

that we outlined at IPO, the planned listing of our sustainable

forestry assets later this year combines our expertise in providing

sustainable investment opportunities and attractive returns - it is

very much a fund of its time.

Strong capital deployment

Our investment teams have continued to deploy capital into new

and existing investments. In total, GBP295 million was deployed

during the six months to 30 September 2021, with the Infrastructure

team deploying capital into 25 projects globally and the Private

Equity team deploying capital into 26 UK businesses across a wide

variety of sectors.

Interim Results announcement

Foresights' Interim Results to 30 September 2021 are scheduled

to be released on 9 December 2021. Details of the results

presentation to analysts will be announced in due course.

Interim Dividend Timetable

As indicated in the IPO prospectus, the Board intends to pay one

third of the total dividend payment for the year as an interim

dividend, with two thirds being paid by way of a final

dividend.

The expected timetable in relation to the Interim Dividend is as

follows:

Ex-Dividend 10 March 2022

Date

Record Date 11 March 2022

Payment Date 25 March 2022

Please note that figures contained in this announcement are

unaudited and subject to change.

About Foresight Group

Foresight Group was founded in 1984 and is a leading

infrastructure and private equity investment manager. With a

long-established focus on ESG and sustainability-led strategies, it

aims to provide attractive returns to its institutional and private

investors from hard-to-access private markets. Foresight Group

manages over 300 infrastructure assets with a focus on solar and

onshore wind assets, bioenergy and waste, as well as renewable

energy enabling projects, energy efficiency management solutions,

social and core infrastructure projects and sustainable forestry

assets. Its private equity team manages eight regionally focused

investment funds across the UK, supporting over 120 SMEs. Foresight

Group operates from 12 offices across six countries in Europe and

Australia with AUM of c. GBP8.1 billion as at 30 September 2021.

Foresight Group Holdings Limited listed on the Main Market of the

London Stock Exchange in February 2021.

https://www.fsg-investors.com/

Enquiries:

Foresight Group

Jo Nicolle IR@foresightgroup.eu / +44 7790 804 263

Citigate Dewe Rogerson (Public relations adviser to Foresight

Group)

Caroline Merrell caroline.merrell@citigatedewerogerson.com

/ +44 7852 210 329

Toby Moore toby.moore@citigatedewerogerson.com /

+44 7768 981 763

Corporate Brokers

Jefferies +44 (0) 20 7029 8000

Paul Nicholls

Graham Davidson

Lee Morton

Max Jones

Numis +44 (0) 20 7260 1000

Stephen Westgate

Charlie Farquhar

Laura White

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUPGPUUUPGGBA

(END) Dow Jones Newswires

October 06, 2021 02:00 ET (06:00 GMT)

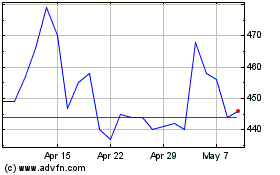

Foresight (LSE:FSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Foresight (LSE:FSG)

Historical Stock Chart

From Apr 2023 to Apr 2024