TIDMFSG

RNS Number : 7159H

Foresight Group Holdings Limited

08 April 2022

LEI: 213800NNT42FFIZB1T09

08 April 2022

FY22 Trading Update

Continuing to deliver on our growth strategy

Foresight Group Holdings Limited ("Foresight", "Foresight

Group", "the Group"), a leading infrastructure and private equity

manager, today provides an update on its performance for the

financial year ended 31 March 2022 ("FY22").

Financial Highlights[1]

-- Strong growth in AUM to GBP8.7 billion, up 21% on the prior year

and meeting our ambitious target, with FUM increasing 27% to GBP6.5

billion. This increase was achieved through wholly organic growth

-- Both Revenue and Core EBITDA (pre share-based payments) are anticipated

to be in line with or slightly ahead of our expectations, with

operational margins remaining robust

-- Total net inflows and performance of GBP1.5 billion for FY22,

an increase of 57% on the prior year (FY21: GBP0.9 billion) with

positive inflows in every quarter. Further disclosure on inflows

and performance will be provided in the Group's FY22 results

Operational Highlights(1)

Infrastructure

-- Continued to invest in core asset classes including Forestry and

Fibre networks, while expanding into adjacent assets such as Geothermal

Energy, Pumped Hydro, and Interconnectors. This has been largely

achieved through further investment in development platforms which

involve moderate initial deployments but provide substantial opportunities

for further future deployments

-- FY22 deployment figures reflect this, with 41 transactions at

a total value of GBP484 million coupled with substantial future

deployment rights of GBP427 million giving a total of GBP911 million

(FY21: 46 transactions, GBP595 million deployed, future deployment

rights2 GBP47 million)

Private Equity

-- Deployed GBP81 million across 53 equity transactions as SME entrepreneurs

and owner-managers were able to focus on their corporate strategies

as the uncertainties created by COVID-19 ease (FY21: GBP59 million

deployed, across 41 equity transactions)

-- Considerably grew our presence in secured lending, investing GBP47

million (FY21: GBP13 million)

-- As announced in January, strong performance by the Group's first

North-West fund (FRIF) exceeded expectations, generating performance

fees in FY22

Foresight Capital Management ("FCM")

-- Expanded the OEIC offering in Q4 FY22 with the launch of the FP

Foresight Sustainable Future Themes Fund. This fund aims to deliver

growth by investing in the shares of listed companies that operate

across five core themes, underpinned by sustainable development

and decarbonisation

-- At 31 March 2022, FCM had GBP1.6 billion of AUM, with net inflows

and performance of GBP455 million in the 12 month period. This

includes GBP72 million of net inflows and performance in Q4 FY22,

which we view as a strong performance given the challenging market

backdrop

-- The Group has recently offset its scope 1, 2, and 3 emissions

using verified carbon credits from ClimateCare, a step on the

Group's journey to becoming Net-Zero by 2050 or before

-- Agreed an innovative new collaboration with the Eden Project,

with launch scheduled by the end of June 2022 when further details

will be announced

Bernard Fairman, Executive Chairman of Foresight Group Holdings

Limited, commented:

"Foresight Group's first full year as a listed company has been

extremely successful. We set out a clear strategy and ambitious

targets at IPO and I am delighted that we are delivering as

promised.

"Additionally, we are actively engaged in a number of

strategically compelling M&A opportunities.

"Progress towards a low-carbon power system and a sustainable

society more broadly is accelerating. This transition will impact

multiple sectors, including energy itself but also industry,

transport, agriculture and the way we value and use our land. We

expect to see an increased appreciation of the natural capital

services provided by forests, soil and oceans - in particular their

ability to facilitate carbon sequestration and the reestablishment

of biodiversity.

"Underpinned by strong business fundamentals and proven

expertise as a sustainability-led investor, Foresight is well

positioned to benefit from long term structural trends and macro

conditions favouring both sustainable infrastructure and UK

regional private equity investment. In short, the outlook for the

Group through this year and beyond remains very positive."

FY22 Results Announcement

Foresight's Full Year Results to 31 March 2022 are scheduled to

be released on Tuesday 12 July 2022, with a presentation for

analysts on the same day. Details on how to attend the presentation

will be available on https://www.fsg-investors.com/ in due

course.

Please note that all figures contained in this announcement are

unaudited and subject to change.

Enquiries:

Foresight Group Investors Citigate Dewe Rogerson

Caroline Merrell / Toby

Liz Scorer Moore

+44 (0) 7852 210329

/ +44 (0) 7768 981763

+44 (0) 7966 966956 caroline.merrell@citigatedewerogerson.com

ir@foresightgroup.eu /

toby.moore@citigatedewerogerson.com

About Foresight Group Holdings Limited

Foresight Group was founded in 1984 and is a leading

infrastructure and private equity investment manager, operating

from 12 offices across six countries in Europe and Australia with

AUM of GBP8.7 billion as of 31 March 2022. With a long-established

focus on ESG and sustainability-led strategies, it aims to provide

attractive returns to its institutional and private investors from

hard-to-access private markets.

Foresight Group manages over 300 infrastructure assets with a

focus on solar and onshore wind assets, bioenergy and waste, as

well as renewable energy enabling projects, energy efficiency

management solutions, social and core infrastructure projects and

sustainable forestry assets. Its private equity team manages eight

regionally focused investment funds across the UK, supporting over

120 SMEs. Foresight Capital Management manages four strategies

across six investment vehicles with an AUM of over GBP1.6 billion.

It has made over 270 clean energy investments to date.

Foresight Group listed on the Main Market of the London Stock

Exchange in February 2021. https://www.fsg-investors.com/

Disclaimer - Forward-looking statements

This statement, prepared by Foresight Group Holdings Limited

(the "Company"), may contain forward-looking statements about the

Company and its subsidiaries (the "Group"). Such forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "projects",

"estimates", "plans", "anticipates", "targets", "aims",

"continues", "expects", "intends", "hopes", "may", "will", "would",

"could" or "should" or, in each case, their negative or other

various or comparable terminology. Forward-looking statements

involve known and unknown risks, uncertainties, assumptions and

other factors which are beyond the Company's control and are based

on the Company's beliefs and expectations about future events as of

the date the statements are made. If the assumptions on which the

Group bases its forward-looking statements change, actual results

may differ from those expressed in such statements. There are a

number of factors that could cause actual results and developments

to differ materially from those expressed or implied by these

forward-looking statements, including those set out under

"Principal Risks" in the Company's annual report for the financial

year ended 31 March 2021. The annual report can be found on the

Company's website ( www.fsg-investors.com ). Forward-looking

statements speak only as of the date they are made. Except as

required by applicable law and regulation, the Company undertakes

no obligation to update these forward-looking statements. Nothing

in this statement should be construed as a profit forecast.

[1] Net inflows are calculated on FUM

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAKLXESSAEFA

(END) Dow Jones Newswires

April 08, 2022 02:00 ET (06:00 GMT)

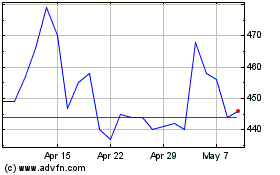

Foresight (LSE:FSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Foresight (LSE:FSG)

Historical Stock Chart

From Apr 2023 to Apr 2024