TIDMGABI TIDMGABC

RNS Number : 2868F

GCP Asset Backed Income Fund Ltd

15 July 2021

15 July 2021

GCP Asset Backed Income Fund Limited

(the "Company" or "GCP Asset Backed")

LEI: 213800FBBZCQMP73A815

Net Asset Value and Investment Update

GCP Asset Backed, which invests in asset backed loans, announces

that, as at 30 June 2021, the unaudited net asset value ("NAV") per

ordinary share of the Company (including current period revenue) is

102.71 pence.

NAV

The NAV performance for the 3 month period is a positive

movement of 0.22 pence per share after the payment of dividends, a

rise of 0.21 per cent.

The Company's investments continued to perform in the period to

30 June 2021, with all principal and interest payments received as

expected(1) . The performance in this period means that all

expected interest and principal payments have been received in

their entirety since the onset of the COVID-19 pandemic in early

2020.

The Board, after due consideration to advice from the

independent Valuation Agent and recommendations from the Investment

Manager, has determined to continue with its prudent approach to

discount rate movements to reflect continued uncertainties related

to the COVID-19 pandemic on several loans. During the period a

number of discount rate adjustments have been made, which are

detailed below.

(1) As previously reported by the Company the CHP and ROC loan

referred to below remains in default and no interest payments are

expected on this loan.

Portfolio Update

We continue to allocate our loans into three categories on a

high-level basis. In line with previous updates, the portfolio as a

whole continues to move towards a lower risk rating, with discount

rates being adjusted to reflect this risk reduction.

Impact Commentary % of Portfolio % of Portfolio Movement (as

June 21 March 21 % of portfolio)

-------------------------- --------------- --------------- -----------------

No major impact

to the way the business

operates, with revenue

and costs remaining

in line with previous

quarters.

No expected long

term impact as a

result of change

Low in the medium term. 55.4% 56.5% (1.1)%

-------------------------- --------------- --------------- -----------------

Some impact on how

the business operates,

some increased costs

or reduction in

revenues.

Limited expected

disruption to markets

Medium in the medium term. 36.5% 34.7% 1.8%

-------------------------- --------------- --------------- -----------------

Significant impact

on how the business

operates, increases

in costs or reductions

in revenues.

Expected disruption

to the business

model in the medium

High term. 8.1% 8.8% (0.7%)

-------------------------- --------------- --------------- -----------------

The Investment Manager will be holding a webinar on 27 July 2021

at 10am to provide more detail on the portfolio. For any investor

interested in joining, please e-mail zoe.french@graviscapital.com

.

Sector update

Co-living - Discount Rate increased from 31 March 2020 by

250bps

The borrower, which provides a mixture of long stay and short

stay accommodation, has a facility in place with a security package

comprising 10 operational assets, 5 assets in construction and 12

sites in pre-development.

GABI is a minority lender as part of a syndicate of lenders to

the borrower. The borrower undertook a strategic review of its

funding position and determined that the long-term viability of the

borrower group would be better met via a sale. A sales process was

kicked off in the period and several bids were received for the

borrower group, with bidders now at the second round stage.

The discount rate on the loan has been increased to reflect the

offers received for the group and the expected buyout price on the

debt.

Community Facility - Discount Rate unchanged from 31 March

2020

The Group has provided loans to two community facilities. These

facilities house a variety of small businesses including bars, food

outlets, co-working and studio space.

Despite both facilities now being open, they continue to be

impacted by the UK Government's restrictions on dining and

drinking. These restrictions continue to limit capacity at both

venues, as only table service is allowed in groups of up to six.

Serving customers in this way increases overheads as additional

serving, front of house and cleaning staff are all required.

Despite these restrictions, both facilities have operated well in

the period, taking advantage of the UEFA European 2020 Championship

to significantly increase both footfall and income.

One site made interest payments as planned, whilst the newer

site continued to capitalise interest. Both sites are experiencing

strong interest in their remaining units, including a significant

events operator who is interested in leasing the event space at the

new site for a period of 10 years.

We remain hopeful that the easing of restrictions will allow

these businesses to thrive. Continuing the prudent approach to

adjustments, we have held the current provisions until we see the

impact of the movement out of lockdown.

CHP and ROC Engines - Discount Rate unchanged from 30 June

2020

This loan defaulted in March 2019, since which time we have been

working to achieve a sale of the asset. We are pleased to report

that the asset was sold to an investment bank in the period. This

resulted in an immediate repayment of GBP1.08m, with a further

GBP1.1m held in escrow subject to any potential warranty claims.

The first GBP1m is expected to be released in December 2021 and the

final GBP0.1m in March 2023. We remain confident that there are

unlikely to be any claims against these warranties, as the SPV has

sat dormant and within our control since it defaulted.

There is one ROC engine which sat outside the sale. This is in a

separate SPV, over which we have full security. The developers were

awarded a Renewable Heat Incentive tariff in the period and are now

looking to build out the facility, targeting financial close

towards the beginning of quarter four. We have not ascribed any

value to this engine in the current NAV and will update this in

September, depending on whether financial close is likely to be

achieved or whether we will need to sell the engine.

The valuation of the asset was slightly increased in the period

in line with the current expected recovery of the warranty amounts.

This asset has been moved from high to medium risk in the

period.

Nurseries - Discount Rate unchanged from 31 March 2021

The Group has lent to 11 nurseries, all of which are now

operational. The group lent against one additional nursery in the

period.

The borrower group continues to perform and occupancy remains

high. We remain excited about the borrower who is fast building a

reputation as one of the premium nursery brands in London.

Bridging/Development and Buy to Let Loans - Discount Rate

reduced by average of 2bps

The Group has lent to several parties which provide specialist

property loans secured against residential property. The loans are

at a low loan-to-value ratio (less than 65 per cent) and typically

have secondary protection in place, including personal guarantees.

This book of loans has continued to perform strongly throughout the

period, though an average 15bps discount rate adjustment remains

across the loans. This is to provide some caution against

fluctuations in property prices as a result of the ending of the

stamp duty holiday and furlough schemes provided by the UK

Government.

The Group has also provided a warehousing line for a buy-to-let

mortgage portfolio, which was refinanced in the period through a

securitisation of the book. This is the third time our warehousing

line has been securitised and on each occasion the spreads achieved

have tightened. The funds returned are moved into bridging loans as

the warehousing line builds back up, ensuring there is no cash drag

on behalf of the Fund. As a result of the continued high

performance, the 15bps discount rate adjustment on the buy to let

portfolio has been removed.

Student accommodation - Various rates

The Group has four remaining loans secured against student

accommodation projects.

In the period we increased the discount rate against our

Australian student accommodation loan by 100bps. This rate was

increased due to the continued lockdown of the country and

therefore the difficulty in attracting foreign students. The three

main buildings we have funded have all completed construction,

though they are all currently mothballed. The equity holders remain

highly supportive and have injected additional equity to cover the

running of the assets through to 2022. We are also in discussions

with the equity holders regarding a small prepayment on the

loan.

We have decreased the provision on our Dublin loan by 100bps as

a result of the strong advanced bookings that are being seen for

September.

Overall we remain highly supportive of our student accommodation

loans and we are seeing significant interest from large

institutions in the high quality and well located assets we have

funded.

General

The portfolio continues to rotate well with GBP35.7m repaid and

GBP54m deployed against five new loans in the period. We continue

to see strong performance in existing loans with notable increases

in the occupancy of our care homes and the continued strong

performance of property loans being a highlight in the period.

During the period, shareholders voted to allow the Company to

increase its overseas exposure from 20% to 30%, at the period end

the total overseas exposure was 20%.

Dividends

On 29 April 2021, the Company declared a quarterly dividend in

respect of the period from 1 January 2021 to 31 March 2021 of

1.575p per share, which was paid on 14 June 2021.

Outlook

We continue to remain encouraged by the overall performance and

strong cash generation of the portfolio. As the country looks to

lift remaining coronavirus restrictions, we remain hopeful that the

high risk loans we have highlighted will be able to recover.

For further information, please contact:

Gravis Capital Management Ltd +44 (0)20 3405 8500

David Conlon

Joanne Fisk

Investec Bank plc +44 (0)20 7597 4000

Helen Goldsmith

Denis Flanagan

Neil Brierley

Buchanan/Quill +44 (0)20 7466 5000

Helen Tarbet

Sarah Gibbons-Cook

Henry Wilson

Notes to Editors

GCP Asset Backed is a closed ended investment company traded on

the Main Market of the London Stock Exchange. Its investment

objective is to generate attractive risk-adjusted returns primarily

through regular, growing distributions and modest capital

appreciation over the long term.

The Group seeks to meet its investment objective by making

investments in a diversified portfolio of predominantly UK based

asset back loans which have contracted, predictable medium to long

term cash flows and/or physical assets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVFZGMNLDLGMZM

(END) Dow Jones Newswires

July 15, 2021 02:00 ET (06:00 GMT)

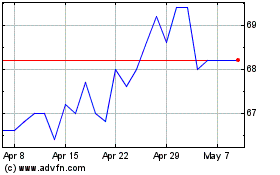

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From Mar 2024 to Apr 2024

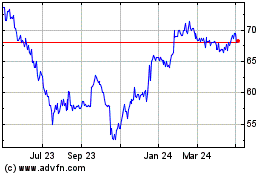

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From Apr 2023 to Apr 2024