TIDMGABI TIDMGABC

RNS Number : 1352N

GCP Asset Backed Income Fund Ltd

28 September 2021

GCP Asset Backed Income Fund Limited

Half-yearly report and unaudited interim condensed financial

statements for the period ended 30 June 2021

The Directors of the Company are pleased to announce the

Company's interim results for the period ended 30 June 2021. The

full unaudited half-yearly report and unaudited condensed financial

statements can be accessed via the Company's website at

https://www.graviscapital.com/funds/gcp-asset-backed/literature

For further information, please contact:

Gravis Capital Management Limited +44 (0) 20 3405 8500

David Conlon

Joanne Fisk

Investec Bank plc +44 (0)20 7597 4000

Helen Goldsmith

Denis Flanagan

Neil Brierley

Buchanan/Quill +44 (0)20 7466 5000

Helen Tarbet

Sarah Gibbons-Cook

Henry Wilson

ABOUT THE COMPANY

GCP Asset Backed Income Fund Limited is a listed investment

company which focuses predominantly on investments in UK asset

backed loans.

The Company seeks to provide shareholders with attractive

risk-adjusted returns through regular, growing distributions and

modest capital appreciation over the long term.

The Group is currently invested in a diversified portfolio of

asset backed loans across the social infrastructure, property,

energy and infrastructure and asset finance sectors, located

predominantly in the UK.

The Company is a closed-ended investment company incorporated in

Jersey. The Company has a premium listing on the Official List of

the FCA with its shares admitted to trading on the Premium Segment

of the Main Market of the LSE since 23 October 2015.

At 30 June 2021, its market capitalisation was GBP450.8 million.

The Company is a constituent of the FTSE All--Share Index.

AT A GLANCE - 30 JUNE 2021

HY19 HY20 HY21

--------------------------- ------ ------ ---------

Market capitalisation GBPm 471.7 389.8 450.8

--------------------------- ------ ------ ---------

Value of investments GBPm 421.1 429.5 476.5

--------------------------- ------ ------ ---------

Dividends for the period p 3.10 3.10 3.15(1)

--------------------------- ------ ------ ---------

Ordinary share price p 107.00 88.30 102.50

--------------------------- ------ ------ ---------

NAV per ordinary share p 102.31 100.83 102.71(2)

--------------------------- ------ ------ ---------

Profit for the period GBPm 13.2 6.9 16.1

--------------------------- ------ ------ ---------

HIGHLIGHTS FOR THE PERIOD

-- Dividends of 3.15(1) pence per share declared for the period.

-- Total shareholder return(3) for the period of 16.0% (prior

period: -16.0%) and an annualised total shareholder return since

IPO(3) of 6.2%.

-- Profit for the period of GBP16.1 million, increased from

GBP6.9 million in the prior period where discount rate adjustments

impacted valuations due to the Covid-19 pandemic. Early repayment

fee income of GBP2.4 million was received in the period.

-- NAV per ordinary share of 102.71(2) pence at 30 June 2021.

-- Loans of GBP69.4 million advanced and repayments of GBP37.6 million received in the period.

-- Exposure to a diversified, partially inflation and/or

interest rate protected portfolio of 54 asset backed loans with a

third party valuation of GBP473.5 million at 30 June 2021.

-- Post period end, the Group advanced GBP16.3 million secured

against 17 projects and received repayments totalling GBP33.8

million. Further, the fair value of the Group's co--living loan

decreased with an estimated consequent reduction in the NAV of 3.69

pence per share.

1. Includes a quarterly dividend of 1.575 pence per share for

the quarter to 30 June 2021, which was declared and paid post

period end.

2. Does not include a provision for the dividend in respect of

the quarter to 30 June 2021, which was declared and paid post

period end.

3. Alternative performance measure - refer to below for definitions and calculation methodology.

INVESTMENT OBJECTIVES AND KPIs

The Company's purpose as a closed--ended investment company is

to meet its investment objective, which is to generate attractive

risk--adjusted returns through regular, growing distributions and

modest capital appreciation over the long term.

ATTRACTIVE RISK ADJUSTED REGULAR, GROWING DISTRIBUTIONS CAPITAL APPRECIATION

RETURNS

---------------------------- ------------------------------ ------------------------------

To provide shareholders To provide shareholders To achieve modest appreciation

with returns that are with regular, growing in shareholder value

attractive with regard dividend distributions. over the long term.

to the level of risk

taken.

KEY PERFORMANCE INDICATORS

---------------------------- ------------------------------ ------------------------------

The Group is exposed The Company is paying The Company's ordinary

to a diversified, partially dividends at the target(2) shares closed at 102.50

inflation and/or interest rate set for 2021. The pence per share at the

rate protected portfolio Company has declared period end and have traded

of loans secured against dividends totalling 3.15(3) at an average discount(1)

contracted medium to pence per ordinary share to NAV for the period

long-term cash flows for the period. of 6.4%.

and/or physical assets.

54 3.15p (3) 102.50p

Number of investments Dividends in respect Ordinary share price

at 30 June 2021 of the period to 30 June at 30 June 2021

2021

7.8% 44% 0.2%

Weighted average annualised Percentage of portfolio Discount(1) to NAV at

yield(1) on investment by value with inflation 30 June 2021

portfolio and/or interest rate

protection

---------------------------- ------------------------------ ------------------------------

Further information on Company performance can be found

below.

1. Alternative performance measure - refer to below for definitions and calculation methodology.

2. Information in relation to dividends set out above is for

illustrative purposes only and is not intended to be, and should

not be taken as, a profit forecast or estimate.

3. Includes a quarterly dividend of 1.575 pence per share for

the quarter to 30 June 2021, which was declared and paid post

period end.

PORTFOLIO AT A GLANCE

A portfolio of 54 asset backed loans with an average life of

five years which are partially inflation and/or interest rate

protected. The loans fall within the following sectors and are

secured predominantly against assets and cash flows in the UK:

PROPERTY

-- 17 loans within sector

-- GBP212.1m

-- 45%

ASSET FINANCE

-- 9 loans within sector

-- GBP61.3m

-- 13%

ENERGY AND INFRASTRUCTURE

-- 8 loans within sector

-- GBP44.9m

-- 9%

SOCIAL INFRASTRUCTURE

-- 20 loans within sector

-- GBP155.2m

-- 33%

SENIOR RANKING SECURITY

70%

WEIGHTED AVERAGE ANNUALISED YIELD(1)

7.8%

INFLATION AND/OR INTEREST RATE PROTECTION

44%

1. Refer to alternative performance measure below for definitions and calculation methodology.

CHAIRMAN'S INTERIM STATEMENT

This period of change has brought both challenges and

opportunities for the Company. Whilst some sectors have seen

disruption, there have been opportunities for new investment which

match the strong levels of repayment.

Introduction

The past 18 months have presented significant challenges for all

of us and the Company is no exception. The Covid-19 pandemic

continues to create significant uncertainty, notwithstanding the

vaccination programmes and other measures under way in the

countries in which the Group invests. We continue to strive to

actively manage our portfolio of loans to protect capital value and

produce attractive total returns for our shareholders.

Overall, the first half of the year has been largely positive

for the Company. All but one of our 54 investments continued to

perform in the period, all expected payments of interest have been

made(1) and excess principal repayments received with several loans

repaying early. These early repayments continue to have a positive

impact for the Company, with GBP2.4 million of repayment fees being

received in the period.

As set out below, our co--living loan, which had been flagged as

being impacted by the Covid-19 pandemic, had liquidity issues in

the period. As a result, the co-living group appointed a large

investment bank to run a sales process, which unfortunately post

period end failed to produce a satisfactory result for the lenders.

Subsequent to the period end and to maximise recovery, the

consortium of lenders formed a credit bid vehicle backed by highly

experienced developers and operators of student accommodation and

co-living assets.

The Investment Manager and Board are disappointed with the

estimated consequent reduction in NAV of 3.69 pence per share.

However, we believe this estimate to be conservative and will

collectively work hard to recover additional value for the Group.

We remain satisfied that the unique characteristics of this loan

within the Group's portfolio of loans means there is no

read--across to our other loans, which, as these results highlight

continue to perform.

In light of the continued uncertainties caused by the Covid-19

pandemic, the Board, Investment Manager and Valuation Agent have

continued to be prudent with regard to the discount rates applied

to a number of loans, reflecting the perceived market risk of

assets in those sectors. Notwithstanding this, during the period 14

loans had their risk premium reduced due to the strong performance

of the underlying assets. Over the period, four loans (including

the co-living loan) had their market risk premium increased. The

net impact of these adjustments was a negative impact of 0.46 pence

per share in the period.

The Company generated earnings of 3.67 pence per share on an

IFRS basis, which includes the adjustment to discount rates as

detailed above. EPS excluding these discount rate adjustments

(adjusted EPS(2) ) was 4.13 pence per share, which more than fully

covered the dividend of 3.15 pence for the period.

1. As previously reported by the Company, the CHP loan was in

default and, as such, no payments were expected until the sale

completed in April 2021.

2. Alternative performance measure - refer to below for definitions and calculation methodology.

Covid-19 impact

The Investment Manager has been closely monitoring the

performance of investments and the impact that the Covid-19

pandemic continues to have on the portfolio. At the period end, the

Group's investments were categorised into the following broad

headline risk bands:

COVID-19 VALUATION % OF VALUATION % OF

IMPACT ON AT 30 JUNE PORTFOLIO AT 30 JUNE PORTFOLIO

BORROWER DESCRIPTION 2021 30 JUNE 2021 2020 30 JUNE 2020

----------- ------------------------------------- ------------------- ------------- --------------- -------------

Significant impact on how the

business of the borrower operates,

increases in costs or reductions

in revenues. Expected disruption to

the business model in the medium

High term. GBP38.2 million(1) 8.1% GBP37.2 million 8.7%

----------- ------------------------------------- ------------------- ------------- --------------- -------------

Some impact on how the business of

the borrower operates, some

increases in costs or reductions

in revenues. Limited expected

disruption to the business model in GBP172.9 GBP257.1

Medium the medium term. million 36.5% million 60.1%

----------- ------------------------------------- ------------------- ------------- --------------- -------------

No major impact to the way the

business of the borrower operates,

with revenue and costs remaining

in line with previous periods. No

expected disruption to the business GBP262.4 GBP133.6

Low model in the long term. million 55.4% million 31.2%

----------- ------------------------------------- ------------------- ------------- --------------- -------------

The 'high' impact investments detailed in the table on risk and

viability below comprise co-living assets and two operational

multi-use community facilities, all of which have a public-facing

element and continue to be exposed to a greater impact from the

Covid-19 pandemic.

Co-living loan

In May 2021, our loan to a co-living developer and operator

breached a liquidity covenant, leading to the co-living group

appointing a large investment bank to run a sales process. This was

considered the optimal process for the lenders due to the upcoming

working capital requirements of the co--living group, principally

as a result of their large development pipeline. Initial offers

were received at the end of June 2021, which informed the increased

discount rate adjustment at this time, and the fair value.

A preferred bidder was appointed at the end of July on the same

price point as the initial bids. Unfortunately the preferred bidder

was unable to agree a business plan with certain of the co--living

group's senior funders and co--investors. This led to them

withdrawing from the process. The lending consortium considered a

number of other bids for the co-living group. It was determined

that the most deliverable recovery arose through a credit bid,

targeting six of the co-living group's most attractive assets.

The bid was formulated with a group that is highly experienced

in the development and operation of student accommodation and

co-living assets. The assumed recovery under the proposed

transaction has been based solely on a conservative view of the

sales value of these assets. No recoveries from the other assets

within the co-living group are reflected in the Company's

determination of its net asset value.

These events have resulted in an estimated consequent reduction

in NAV of 3.69 pence per share. The impact will be reflected in the

forthcoming 30 September 2021 NAV and is disclosed as a post

balance sheet event below.

This is clearly a very disappointing result for the whole lender

consortium, considering the security package and asset backed

structure in place. The structure of this loan was unique in the

portfolio and therefore, whilst we intend to take a note of lessons

learned from this transaction, we do not believe that the impact

should be read-across to other mezzanine positions in the

portfolio. The remainder of the Company's portfolio continues to

perform as expected. The Investment Manager has provided further

information below.

1. Following events which occurred post period end, the fair

value of the co-living loan has decreased. Refer to note 16.

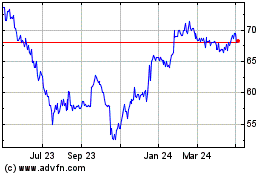

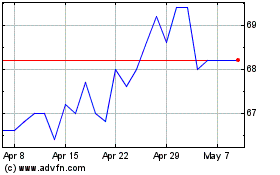

NAV and share price performance

At the period end, the net assets of the Company were GBP451.7

million. The NAV per ordinary share increased from 102.18 pence at

31 December 2020 to 102.71 pence(1) at 30 June 2021.

The Company's ordinary shares have traded at a discount(2) since

the outset of the Covid-19 pandemic impacted financial markets,

with an average discount(2) of 6.4% to NAV in the period. Since

IPO, the shares have traded at an average premium(2) to NAV of

1.1%. At 30 June 2021, the shares were trading at 102.50 pence,

representing a 0.2% discount(2) to NAV.

The Board sought to manage the discount(2) over the period

through a number of methods, including releasing more detailed

portfolio information in shareholder communications, hosting

quarterly webinars and meeting shareholders on an individual basis.

The Board also approved the repurchase of shares as the share price

discount(2) to NAV offered value to shareholders. A total of

325,000 shares were bought back in the period at an average price

of 90.22 pence per share.

On 24 September 2021, the closing share price per ordinary share

was 98.40 pence with the shares trading at a 4.2% discount(2) to

NAV.

Investments

During the period, the Group advanced GBP69.4 million secured

against 25 projects. The Group continues to target and invest into

key sectors with existing borrowers who have demonstrated strong

governance and stewardship of their businesses.

A total of GBP37.6 million of principal was repaid in the

period. As the Company matures, it is expected that the rate at

which principal is repaid will continue to increase. The Company

factors this return of principal when considering its funding

needs, ensuring it utilises its RCF where necessary to mitigate

against the impact of cash drag.

Post period end, a further GBP16.3 million was advanced and

GBP33.8 million was repaid.

Credit facility

Post period end, the Company extended its RCF with RBSI which is

now due to mature in August 2023, with all commercial terms

remaining the same as the previous GBP50 million facility.

Dividend policy

The Company set a dividend target(3) of 6.30 pence per share for

2021. The Directors are pleased to confirm that the Company is on

track to meet this target(3) , with dividends totalling 3.15(4)

pence per ordinary share being declared in respect of the

period.

Market overview and outlook

As noted in the 2020 annual report, the Covid-19 pandemic

continues to present significant uncertainties and challenges for

underlying borrowers and the global economy.

The biggest impact has been felt in the portfolio by assets with

public-facing elements (being the co-living and multi-use community

facility assets) which have been directly impacted by lockdown

regulations restricting hospitality and travel sectors from

operating. Certain additional conditions impacting travel remain in

place and there continues to be speculation over whether lockdowns

will be reintroduced later in the year, giving continued

uncertainty to these asset operators.

Whilst we have not been immune to the difficulties presented by

the pandemic, we believe that the portfolio is in a good position,

with the Investment Manager working hard to recover additional

value in the co-living loan.

Across the portfolio, 44% of the loans have inflation or

interest rate protection in place. Typically, we will look to

ensure there is protection on loans with a longer tenor and where

the cash flows of the underlying business are exposed to inflation

risk.

The Investment Manager continues to see opportunities for

investment in a variety of sectors which remain underserved by

mainstream lenders and has a strong pipeline to deploy funds

returned through repayments.

Taking lessons learned over the five and a half years since the

launch of the Company, the Investment Manager remains focused on

identifying and executing transactions which will enhance the

portfolio and deliver shareholder returns.

ESG

ESG and responsible investing are key priorities for the Board

this year and during the period the Directors have been developing

a policy to ensure ESG issues are considered throughout the Company

and to help guide decisions, processes and policies wherever

possible with the aim of operating a sustainable business model not

detrimentally impacting the environment and providing benefits to

society.

It is intended that the policy will use the framework of the PRI

principles, to which our Investment Manager is a signatory, and

will ensure alignment across the Company, its investments and its

service providers.

The Board looks forward to sharing the policy with shareholders

prior to the year end.

Governance and compliance

The Board recognises the importance of a strong corporate

governance culture and continues to maintain principles of good

corporate governance as set out in the AIC Code.

Principal risks and uncertainties

The Directors consider that the principal risks and

uncertainties facing the Company, in particular the uncertainties

relating to the impact of Brexit and the Covid-19 pandemic, remain

unchanged since the publication of the Company's 2020 annual

report. The principal risks and uncertainties are expected to

remain relevant to the Company for the next six months of its

financial year. The principal risks include (but are not limited

to) credit risk, economic risk, key resource risk, regulatory risk

and execution risk.

Further details can be found below and on pages 44 to 49 of the

2020 annual report.

Going concern statement

The Directors have made an assessment of the Company's ability

to continue as a going concern and are satisfied that the Company

has adequate resources to continue in operational existence for a

period of at least twelve months from the date on which the

half-yearly report and unaudited interim condensed financial

statements are approved.

In making the assessment, the Directors have considered the

continued likely impacts of the ongoing Covid-19 pandemic on the

Company, operations and the investment portfolio.

The Directors, Investment Manager, Administrator and other

service providers have put in place contingency plans to minimise

disruption. Furthermore, the Directors are not aware of any

material uncertainties that may cast significant doubt on the

Company's ability to continue as a going concern, having taken into

account the liquidity of the Group's investment portfolio and the

Company's financial position in respect of its cash flows,

borrowing facilities and investment commitments (of which there are

none of significance). Therefore, the financial statements have

been prepared on a going concern basis.

On behalf of the Board

Alex Ohlsson

Chairman

27 September 2021

For more information, please refer to the Investment Manager's

report below.

1. Does not include a provision for the dividend in respect of

the quarter to 30 June 2021, which was declared and paid post

period end.

2. Alternative performance measure - refer to below for definitions and calculation methodology.

3. The dividend target set out above is a target only and not a

profit forecast or estimate and there can be no assurance that it

will be met.

4. Includes a quarterly dividend of 1.575 pence per share for

the quarter to 30 June 2021, which was declared and paid post

period end.

INVESTMENT MANAGER'S REPORT

The Company's investment objective is to generate attractive

risk-adjusted returns through regular, growing distributions and

modest capital appreciation over the long term.

3.15p(1)

Dividends declared for the period

16.0%

Total shareholder return(2) for the period

The Investment Manager

Gravis Capital Management Limited provides discretionary

investment management and risk management services to the Group

which includes investment identification, investment due diligence

and structuring, investment monitoring, the management and

reporting of the existing loan portfolio and financial reporting

support. Investment decisions are made on behalf of the Group by

the Investment Manager's investment committee, with an update

provided to the Board on a quarterly basis and additional updates

when significant events have occurred. The Board has overall

responsibility for the Group's activities, including the review of

investment activity, performance, control and supervision of the

Investment Manager.

The Investment Manager also provides advice regarding the

Company's equity and debt funding requirements. The Investment

Manager is the AIFM to the Company. The basis of the remuneration

of the Investment Manager is set out in note 15 to the unaudited

interim condensed financial statements.

Summary investment policy

The Company makes investments(3) in a diversified portfolio of

senior and subordinated debt instruments which are secured against,

or comprise, contracted, predictable medium to long-term cash flows

and/or physical assets.

The Company's investments will typically be unquoted and will

include, but not be limited to, senior loans, subordinated loans,

mezzanine loans, bridge loans and other debt instruments. The

Company may also make limited investments in equities,

equity-related derivative instruments such as warrants, controlling

equity positions (directly or indirectly) and/or directly in

physical assets.

The Company will at all times invest and manage its assets in a

manner which is consistent with the objective of spreading

investment risk. This will include diversification by asset type,

counterparty, locality and revenue source.

At the AGM in May 2021, the Company's shareholders approved an

amendment to the Company's investment policy to increase the

maximum overseas exposure from 20% to 30% of gross assets. The

Company's investment objective, other policies and restrictions are

set out in its 2020 annual report and financial statements, which

is available on the Company's website.

Asset backed lending overview

Asset backed lending is an approach to structuring investments

used to fund infrastructure, industrial or commercial projects,

asset financing and equipment leases. Asset backed lending relies

on the following to create security against which investment can be

provided:

-- the intrinsic value of physical assets; and/or

-- the value of long-term, contracted cash flows generated from

the sale of goods and/or services produced by an asset.

Asset backed lending is typically provided to a Project Company,

a corporate entity established with the specific purpose of owning,

developing and operating an asset. Financing is provided to the

Project Company with recourse solely to the shares held in, and

assets held by, that Project Company.

Cash generation to service loans and other financing relies on

the monetisation of the goods and/or services the Project Company's

assets provides. Lenders implement a security structure that allows

them to take control of the Project Company and its assets to

optimise the monetisation of goods and/or services associated with

such assets if the Project Company has difficulties complying with

its financing terms.

Typically, an asset backed lending structure involves a number

of counterparties, who enter into contractual relationships with

the Project Company that apportion value and risk through providing

services (e.g. operations and maintenance) associated with the

development, ownership and/or operations of an asset. In

structuring an asset backed loan, the Project Company will seek to

ensure risks (and associated value) are apportioned to those

counterparties best able to manage them. This ensures the effective

pricing and management of risks inherent in the asset. Further, it

also means the residual risks (and potential rewards) being taken

by the Project Company are well understood by the parties providing

finance to such company.

The benefits associated with asset backed debt investments

Investment in asset backed loans offers relatively secure and

predictable returns to their lenders when compared with general

corporate or unsecured lending. Further, the reduction since 2007

in the availability of mainstream debt (primarily from banks) has

created the potential for more attractive pricing on debt

investments, particularly where such investments have been

originated and structured to accommodate the borrowers' specific

requirements. In particular, where borrowers may not have access to

mainstream financing for reasons other than the creditworthiness of

the relevant proposition, such as loan size, tenure, structure or

an understanding of the underlying cash flows and/or asset,

attractive rates are available for those willing to commit the

resource, innovation and time to understanding and identifying a

solution for a specific borrower's requirements.

A loan secured against a specific asset (within a Project

Company established specifically for that asset) is capable of

analysis broadly by reference to a set of known variables such

as:

-- how an asset generates cash flow;

-- its current value;

-- expected future value;

-- the competence of its service providers; and

-- the availability of alternative parties in the event of a

failure by one or more service providers.

The need to fully understand the risks associated with a given

asset and structure arrangements with experienced service providers

to effectively manage those risks requires specialist skills and

resources. For this reason, the Company's target market remains

underserviced by mainstream lenders, therefore offering an

attractive risk--adjusted return for parties with relevant

experience and access to the required resources.

1. Includes a quarterly dividend of 1.575 pence per share for

the quarter to 30 June 2021, which was declared and paid post

period end.

2. Alternative performance measure - refer to below for definitions and calculation methodology.

3. The Company makes its investments through its wholly owned

Subsidiary. Refer to note 1 for further information.

INVESTMENT PORTFOLIO

Portfolio performance

We are pleased to report that despite the ongoing economic

disruption caused by the Covid-19 pandemic impacting the co-living

group and the multi-use community facilities, the portfolio

performed in line with the Investment Manager's expectations during

the first half of the financial year, with all expected interest

and principal payments received(1) . The limited impact of the

Covid-19 pandemic on the Company's cash flows over the period

illustrates both the highly cash--generative nature of the

portfolio as well as the strong performance of the portfolio's

underlying loans.

During the period, the portfolio experienced a number of

positive developments. Firstly, there was a positive resolution to

the CHP loan. This loan defaulted in March 2019 and we worked with

a number of different parties to achieve a sale of the asset, which

closed in the period. The sale resulted in an immediate repayment

of GBP1.1 million, with a further GBP1.1 million held in escrow

subject to any potential warranty claims, which together represent

slightly more than the fair value after it was revalued

downwards.

The GBP1.1 million held in escrow is expected to be released in

two tranches in December 2021 and March 2023. We are not

anticipating any successful warranty claims but given the time

elapsed since default, a small reduction in fair value is being

retained against the loan.

Secondly, at the AGM in May 2021, the Company's shareholders

approved an amendment to the Company's investment policy to

increase the maximum overseas exposure from 20% to 30% of gross

assets. The Investment Manager made two further investments in

overseas assets and additional drawdowns under committed

projects.

The Company ended the period with an overseas exposure of 20% of

gross assets. The Investment Manager aims to grow the overseas

exposure slowly, where investments present good risk

diversification and return.

In the portfolio, the co-living group and the multi-use

community facilities have been most heavily impacted by the

Covid-19 pandemic and have encountered further difficulties over

the period.

The co-living group provides a mixture of long stay and short

stay accommodation. The loan represents 6.9% of the portfolio by

value. As announced in the Company's updates on 13 and 15 September

2021, there was a subsequent deterioration of bid levels for the

group and it was decided that a credit bid would offer the best

route for the lender consortium. This resulted in an estimated

consequent reduction in the NAV of 3.69 pence per share.

The lender consortium has proposed to fund an acquisition

vehicle with the intention of completing a credit bid for six of

the co--living group's assets, to be operated by an experienced

operator. Given the complexity of the group and the immediate

funding needs of the underlying projects, we believe this structure

offers the best path to realising value in the assets. We will

continue to work with the other lenders in the consortium to

complete this transaction and hope to recover additional value from

other assets in the co--living group, which remain subject to

security. We remain confident that the circumstances and

structuring of this loan, which led to losses for the whole lender

consortium, are unique to this asset and do not reflect the quality

of protections in the Company's portfolio.

The multi-use community facilities host food outlets, community

spaces, artist studios, bars, and event and co-working areas. The

facilities represent a combined 1.1% of the portfolio by value.

These assets have faced significant challenges through the multiple

lockdowns and are also experiencing liquidity issues at the group

level. Therefore, we are engaged with the borrower in an ongoing

sales process. At the time of writing, three bidders are actively

engaged in the process and undergoing due diligence on the

group.

The Company's dividend continues to be fully covered on an

adjusted EPS(2) basis. The total dividend was 117% covered by EPS

of 3.67 pence and 131% covered by an adjusted EPS(2) of 4.13

pence.

Exposure to assets under construction has increased from 12% at

the year end to 13% of the portfolio. Where assets are in

construction, the Investment Manager employs third party advisers

to monitor progress against key milestones. The Investment Manager

is pleased to report that the remaining assets under construction

are proceeding materially on time and budget.

Property continues to represent the largest sector for the

Company, making up 45% of the portfolio, across residential

property, co--living and buy-to-let mortgages. In the period, there

was significant regulatory change with the expiry of the stamp duty

holiday relief. Nevertheless, we are pleased to see continued

resilience in the UK residential property market with average house

prices rising over the year.

The low average LTV(1) of c.65% against the property assets

continues to provide significant security against market

downturns.

The Investment Manager continues to see many positives across

the Company's diversified portfolio, which continues to generate

positive returns for shareholders, whilst recognising the

challenges posed by a small number of assets.

1. As previously reported by the Company, the CHP loan was in

default and, as such, no payments were expected until the sale

completed in April 2021.

2. Alternative performance measure - refer to below for definitions and calculation methodology.

PORTFOLIO ANALYSIS

Sector type

Property 45%

Social infrastructure 33%

Asset finance 13%

Energy and infrastructure 9%

Security ranking

Senior 70%

Mezzanine 30%

Term profile

<5 yrs 75%

5-10 yrs 9%

>10 yrs 16%

Interest rate profile

<7% 23%

7-8% 41%

>8% 36%

Location

UK 80%

Europe 12%

Rest of world 8%

1. Alternative performance measure - refer to below for definitions and calculation methodology.

TOP TEN INVESTMENTS BY VALUE

Key

1 Sector type

2 % of portfolio by value

3 Asset class

4 Multi/single asset exposure

1. Development Fin Co 6

1 Property

2 8.6%

3 Residential property

4 Multi asset

2. Co-living Co 3(1)

1 Property

2 6.9%

3 Co-living

4 Multi asset

3. Infrastructure 1

1 Energy and infrastructure

2 5.3%

3 Infrastructure

4 Multi asset

4. Student Accom 3

1 Social infrastructure

2 5.0%

3 Student accommodation

4 Single asset

5. Bridging Co 2

1 Property

2 4.8%

3 Residential property

4 Multi asset

6. Bridging Co 1

1 Property

2 4.6%

3 Residential property

4 Multi asset

7. Student Accom 2

1 Social infrastructure

2 4.2%

3 Student accommodation

4 Single asset

8. Property Co 2

1 Social infrastructure

2 3.7%

3 Social housing

4 Multi asset

9. Contract Income 3

1 Asset finance

2 3.2%

3 Contract income

4 Single asset

10. Property Co 7

1 Property

2 3.1%

3 Residential property

4 Multi asset

Further information on the portfolio can be found on the

Company's website.

1. Following events which occurred post period end, the fair

value of the co-living loan has decreased. Refer to note 16.

Investment portfolio and new investments

At 30 June 2021, the Group was exposed to a diversified

portfolio of 54 asset backed investments with a fair value of

GBP473.5 million, of which 70% benefit from senior security and 44%

from partial inflation and/or interest rate protection. The

weighted average annualised yield(1) on the Group's investments was

7.8%, with a weighted average expected term of five years.

The key metrics above, principally yield and inflation and/or

interest rate protection, are in line with the same period last

year, demonstrating that the Company is continuing to deploy

capital efficiently at rates that are value accretive to

shareholders.

The portfolio is primarily backed by assets in the UK,

representing 80% of such security, with the remainder of the

Group's security provided by assets located in Europe, the USA,

Australia and Hong Kong. The Company has minimal currency exposure

(which is hedged) with 99% of investments either denominated in

Pound Sterling or exposure hedged to Pound Sterling using rolling

forward contracts. Post period end, the Company advanced a further

GBP3.0 million secured against international projects.

During the period, the Group made investments totalling GBP69.4

million.

Investments have been made in a number of attractive asset

classes over the period including football finance, infrastructure

assets and new-build residential property developments. In

addition, the impact of Covid-19 has opened up growth opportunities

for some borrowers. In the period we have made further investments

in new nursery projects and an additional CNG development station,

allowing both of these borrowers to expand their businesses and

providing additional security.

The Investment Manager continues to see a strong pipeline of

attractive asset backed financing opportunities to deploy its

remaining capital, including amounts available under the RCF.

INVESTMENTS AND REPAYMENTS DURING THE PERIOD(2)

SECTOR AVERAGE TERM SECURITY STATUS INVESTMENTS REPAYMENTS

----------------------- ------------ ------------------- ------------------------ --------------- ---------------

Asset finance 5 years Senior Operational GBP17.1 million GBP1.3 million

----------------------- ------------ ------------------- ------------------------ --------------- ---------------

Energy and

infrastructure 6 years Senior Operational GBP27.7 million GBP19.8 million

----------------------- ------------ ------------------- ------------------------ --------------- ---------------

Property(3) 2 years Senior/Subordinated Operational GBP15.6 million GBP16.1 million

----------------------- ------------ ------------------- ------------------------ --------------- ---------------

Social infrastructure 8 years Senior/Subordinated Operational/Construction GBP9.0 million GBP0.4 million

----------------------- ------------ ------------------- ------------------------ --------------- ---------------

Total GBP69.4 million GBP37.6 million

----------------------- ------------ ------------------- ------------------------ --------------- ---------------

INVESTMENTS AND REPAYMENTS POST PERIOD(2)

SECTOR AVERAGE TERM SECURITY STATUS INVESTMENTS REPAYMENTS

------------------------- ------------ ------------ ----------- --------------- ---------------

Asset finance 6 years Senior Operational GBP3.0 million -

------------------------- ------------ ------------ ----------- --------------- ---------------

Energy and infrastructure - - - - GBP14.7 million

------------------------- ------------ ------------ ----------- --------------- ---------------

Property 2 years Subordinated Operational GBP10.5 million GBP19.1 million

------------------------- ------------ ------------ ----------- --------------- ---------------

Social infrastructure 10 years Senior Operational GBP2.8 million -

------------------------- ------------ ------------ ----------- --------------- ---------------

Total GBP16.3 million GBP33.8 million

------------------------- ------------ ------------ ----------- --------------- ---------------

1. Alternative performance measure - refer to below for definitions and calculation methodology.

2. The Company makes its investments through its wholly owned

Subsidiary. Refer to note 1 for further information.

3. Includes development projects that were subject to review by

the Board under the Company's investment approval process, refer

below.

RISKS AND VIABILITY

Covid-19 impact

The Covid-19 pandemic continues to present a number of

challenges to the Company, albeit that the principal risks and

uncertainties faced by the Company remain unchanged from December

2020.

Whilst the UK has resumed unrestricted economic activity since

July, other investment jurisdictions including Australia have

recently seen increased restrictions resulting from rising cases

and low vaccination rates. The situation is being closely

monitored, with a particular focus on the impact of travel

restrictions on the occupancy of operation student accommodation

assets.

The Board, on advice from its Valuation Agent and Investment

Manager, has continued to quantify any increase in risk through the

discount rate applied to the loans in the portfolio. When assessing

changes to discount rates, the Board, on advice from its Valuation

Agent and Investment Manager, takes account of the movements in

pricing of risk across the market as a whole, such as those caused

by the uncertainties associated with the Covid-19 pandemic.

It also considers an asset-specific approach which takes into

account a number of other variables that can impact the discount

rate, such as:

-- the underlying loan structure (senior or mezzanine);

-- the operational stage (construction or operational);

-- risk rating factors, such as each project's revenue and cost

drivers which could impact the debt service loan cover ratios;

and

-- the value of the underlying security structure.

The table on below sets out a summary of the risk rating factors

and discount rate movements for each asset class experiencing a

'high, medium or low' impact from the Covid-19 pandemic, as set out

above.

It should be noted that whilst this prudent approach to value

adjustment has been taken in respect of the portfolio, the

principal amount of debt owed by the underlying borrowers has not

changed.

In the event of non-payment of interest by a borrower,

outstanding amounts would be added to the principal owed and

therefore become recoverable in final repayments or against any

enforcement proceeds, taking into account the value of the

underlying security structure for each loan.

Changes to discount rates result in a revaluation of

investments, which is reflected through fair value movements in the

statement of comprehensive income. Where discount rate changes

result in a downward revaluation, as the loans approach their

maturity dates, income recognised in future years will be higher

than the interest accrued on the loan due to a phenomenon known as

'pull-to-par' where loans converge on their par value at maturity.

This phenomenon leads to an increase in the Company's dividend

cover ratio(1) on an earnings basis (under IFRS). The opposite

effect is noted on any loans which have been revalued upward. The

Board and the Investment Manager consider this aspect when

evaluating and declaring dividends.

The discount rate adjustments set out below had a 0.46 pence per

share impact on the earnings and NAV of the Company.

1. Alternative performance measure - refer to below for definitions and calculation methodology.

COVID-19 AVERAGE %

IMPACT ON % OF IMPACTED 30 JUNE 2021 RISK DISCOUNT

BORROWER PORTFOLIO ASSET CLASS GBP'000 RATING FACTORS RATE CHANGE

------------ ----------- --------------------- ------------ ----------------------------- ------------

High 8.1% Co-living 32,827(1) Occupancy levels and LTV 4.00%

Multi-use community

facilities 5,377 Regulatory risk and occupancy 9.00%

------------ ----------- --------------------- ------------ ----------------------------- ------------

Total 38,204

------------ ----------- --------------------- ------------ ----------------------------- ------------

Occupancy, operating costs

Medium 36.5% Student accommodation 22,310 and construction timetables 1.25%

Residential

property 131,359 Default rates and LTV 0.15%

Occupancy and operating

Nurseries 18,157 costs 0.25%

CHP 1,028 N/A N/A

------------ ----------- --------------------- ------------ ----------------------------- ------------

Total 172,854

------------ ----------- --------------------- ------------ ----------------------------- ------------

Various asset

Low 55.4% classes 262,485 Multiple factors

------------ ----------- --------------------- ------------ ----------------------------- ------------

Total 262,485

------------ ----------- --------------------- ------------ ----------------------------- ------------

Valuation of portfolio 473,543

------------------------- --------------------- ------------ ----------------------------- ------------

1. Following events which occurred post period end, the fair

value of the co-living loan has decreased. Refer to note 16.

Update on principal risks and uncertainties

In light of the ongoing impact of the Covid-19 pandemic and

Brexit, the Board is providing the update below on the

uncertainties impacting the Company and their impact on the

Company's principal risks for those risks where residual risk has

changed since the year end.

UNCERTAINTY 1: COVID-19

The Board has continued to monitor and assess the impact of the

Covid-19 pandemic on the Company's portfolio.

As noted above, the co-living group and the multi-use community

facilities have experienced direct impact through restrictions on

their ability to operate due to UK Government legislation. Post

period end, the majority of regulations impacting on operations of

business in the UK were relaxed, allowing for increased

activity.

The key risk to the portfolio remains any future waves of

infections and the reintroduction of restrictions on the operations

of businesses in the portfolio, as currently seen in Australia. It

is important to note, however, that Australia's vaccination

programme is ongoing, which should assist in limiting any future

restrictions going forward.

The Board is aware of the ongoing impact of Covid-19 on staffing

and supply chain management. To date, there has been no impact on

the portfolio but this is an area of increased focus for the

Company which will be monitored over the coming months.

The Covid-19 pandemic is an ongoing uncertainty which the Board

continues to closely monitor.

UNCERTAINTY 2: BREXIT

As noted in the 2020 annual report, the Board considers Brexit

to be a principal uncertainty for the Company.

Whilst the UK officially left the EU on 31 January 2020 and

began a transition period that ended on 31 December 2020, there

remains considerable uncertainty around the future relationship

between the UK and the EU.

The Board continues to monitor the impact of Brexit on the

portfolio's reliance on the EU for materials and/or labour, in

particular for projects under construction in the UK. However, to

date, no impact has been seen on the Company caused by Brexit or

associated regulatory and political changes.

The Board will continue to monitor the potential macro-economic

and political impacts of Brexit in the coming months to assess

whether Brexit will continue to be an uncertainty for the

Company.

In the period, none of the residual risk profiles of the

principal risks of the Company have increased, including as a

result of the

Covid-19 pandemic (as set out above and below) with the residual

risk profile of one principal risk decreasing in the period and

the rest remaining stable.

RISK 1: REGULATORY RISK

HOW THE CHANGE IN THE RESIDUAL

RISK IMPACT RISK IS MANAGED RISK IN THE PERIOD

----------------------- ---------------------- -------------------------- --------------------------

Changes in laws, Any change in the The Company has Decreased

regulation and/or laws, regulations a comprehensive In the period,

policy and/or Government compliance monitoring the stamp duty

The Company, its policy affecting programme relevant holiday relief

operations and the Company or to its operations introduced by the

the underlying the underlying that ensures compliance UK Government in

Project Companies Project Companies with developments July 2020 was phased

are subject to may have a material and change in legislation out, resulting

laws and regulations adverse effect and regulation in an initial fall

enacted by national on the ability in the Channel in UK house prices.

and local Governments. of the Company Islands and the However, this was

to successfully UK, including monitoring outweighed by the

pursue the investment the impact of Brexit significant increases

policy and meet in the jurisdictions in house prices

its investment in which the Group over the last year

objective, which invests. The programme and therefore did

therefore may impact also monitors compliance not have a material

the value of the with listing and impact on the Company.

Company. FCA marketing rules. Regulatory risk

as a result of

changing policy

to manage the Covid-19

pandemic continues.

However, there

is more certainty

than in earlier

periods as the

UK Government looks

to reduce restrictions

and regulation.

The Investment

Manager will continue

to monitor the

impact of any changes

in policy across

the portfolio.

As noted above,

the continued uncertainty

around Brexit also

poses risks to

the underlying

borrower businesses,

particularly where

those businesses

rely on migrant

labour or imported

materials from

the EU. To date,

no impact has been

seen as a result

of changing regulation

due to Brexit.

The Investment

Manager will continue

to monitor the

impact of any changes

in policy on these

borrowers.

----------------------- ---------------------- -------------------------- --------------------------

Going concern and viability

In addition to the analysis set out above which informed changes

to the discount rates of the assets, the Investment Manager has

carried out a going concern and viability review. This analysed the

impact of the Covid-19 pandemic on the equity financing, debt

financing and investment portfolio of the Company, and which has

been reviewed by the Board.

Following events which occurred post period end, the fair value

of the co-living loan has decreased with an estimated consequent

reduction in the NAV of 3.69 pence per share. The co-living loan

had unique characteristics which means there is no read-across to

other loans in the Group's portfolio, which continue to perform as

expected.

As such, the Board remains of the view that none of the

challenges identified impact the going concern or viability of the

Company.

COMPANY PERFORMANCE

The Company continues to deliver regular income to

shareholders.

HY21 HY20 Relevance to strategy

------------------- ---------- ------- ------------------------------------------------

Dividends declared 3.15p 3.10p The dividend reflects the Company's

in respect of ability to deliver regular, sustainable,

the period long-term dividends and is a key element

of total return.

------------------- ---------- ------- ------------------------------------------------

Basic earnings 3.67p(1) 1.56p Basic EPS represents the earnings generated

per share by the Group's investment portfolio

in line with the investment strategy.

------------------- ---------- ------- ------------------------------------------------

Annualised total 6.2% 3.4% Total return measures the delivery of

shareholder return the Company's strategy, to provide shareholders

since IPO(2) with attractive total returns in the

longer term.

------------------- ---------- ------- ------------------------------------------------

Dividend yield(2) 6.1%(3) 7.3% The dividend yield measures the Company's

ability to deliver on its investment

strategy of generating regular, sustainable,

long--term dividends.

------------------- ---------- ------- ------------------------------------------------

Profit for the GBP16.1m GBP6.9m Profit for the period measures the Company's

period ability to deliver attractive risk--adjusted

returns from its investment portfolio.

------------------- ---------- ------- ------------------------------------------------

NAV per ordinary 102.71p(4) 100.83p Growth in NAV per share measures the

share Company's ability to deliver modest

capital appreciation over the long term.

------------------- ---------- ------- ------------------------------------------------

1. Includes an unrealised loss of 0.46 pence per share in

respect of discount rate adjustments to reflect the uncertainties

associated with the Covid-19 pandemic.

2. Alternative performance measure - refer to below for definitions and calculation methodology.

3. Total dividend declared for the period annualised, relative

to the closing share price at the period end, expressed as a

percentage.

4. Does not include a provision for the dividend in respect of

the quarter to 30 June 2021, which was declared and paid post

period end.

FINANCIAL REVIEW

The Company generated total income of GBP19.4 million, declared

dividends of 3.15 pence per share and delivered a total shareholder

return(1) of 16.0% for the period.

Financial performance

The Company has prepared its half-yearly report and unaudited

interim condensed financial statements in accordance with IAS 34

Interim Financial Reporting.

In the period, the Company's portfolio generated total income of

GBP19.4 million. Profit for the period was GBP16.1 million, with

basic EPS of 3.67 pence. Adjusted EPS(1) for the period was 4.13

pence per share, which excludes changes in discount rates.

The dividend for the period was paid as 1.575 pence per share

for the quarter to 31 March 2021 with a further dividend of 1.575

pence per share for the quarter to 30 June 2021, declared post

period end, on 22 July 2021.

Ongoing charges

The Company's ongoing charges percentage for the period,

calculated in accordance with the AIC methodology, was 1.2%

annualised (30 June 2020: 1.2% annualised).

Investment valuation

The weighted average discount rate(1) across the portfolio at 30

June 2021 was 8.6%. The valuation of investments is sensitive to

changes in discount rates applied. A sensitivity analysis detailing

the impact of a change in discount rates is given in note 14.3.

The Valuation Agent carries out a fair market valuation of the

Group's investments on behalf of the Board on a semi-annual basis.

Any assets which may be subject to discount rate changes are valued

on a quarterly basis. The valuation principles used by the

Valuation Agent are based on a discounted cash flow methodology. A

fair value for each asset acquired by the Group is calculated by

applying a discount rate (determined by the Valuation Agent) to the

cash flow expected to arise from each asset.

At the period end, the valuation of investments includes an

adjustment to discount rates to reflect the uncertainties

associated with the Covid-19 pandemic. These adjustments were first

applied in March 2020 and contributed to an overall discount rate

increase of 106 basis points across the portfolio. Since that date,

the Board and the Valuation Agent have been able to take a more

asset-specific approach in determining discount rates. This

resulted in an overall decrease to the weighted average discount

rate [1] of 13 basis points in the period, excluding the previously

defaulted CHP loan. The decrease reflects tightened spreads and

positive performance across the Company's property investments.

Changes to discount rates by asset class are presented in the

table above.

Cash position

The Company received interest payments of GBP17.2 million and

capital repayments of GBP37.6 million in the period, in line with

expectations. The Company paid cash dividends of GBP13.9 million

during the period and a further GBP6.9 million post period end.

Total cash reserves at the period end were GBP9.5 million.

Borrowings

During the period, the Company had access to an RCF with RBSI

for an amount of GBP50 million, which matured in August 2021. Post

period end, a 24 month extension option was exercised and, as a

result, the facility will now expire in August 2023. All commercial

terms remain the same as the previous GBP50 million facility.

Conflicts of interest

In the period, GBP1.0 million was drawn under existing

facilities to finance student accommodation development projects in

the UK and the USA. The directors of the Investment Manager

directly or indirectly own an equity interest in these development

projects. In accordance with the Company's investment approval

process, the investments were reviewed and approved by the

Board.

GCP Infra

Where there is any overlap for a potential investment with GCP

Infra, GCP Infra has a right of first refusal over such investment.

During the period, no investments were offered to GCP Infra under

its right of first refusal. To date, no investments offered to GCP

Infra have been accepted.

1. Alternative performance measure - refer to below for definitions and calculation methodology.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

Under the terms of the DTRs of the FCA, the Directors are

responsible for preparing the half-yearly report and unaudited

interim condensed financial statements in accordance with

applicable regulations.

The Directors confirm to the best of their knowledge that:

-- the unaudited interim condensed financial statements have

been prepared in accordance with IAS 34 Interim Financial

Reporting;

-- the Chairman's interim statement and the Investment Manager's

report constitute the Company's interim management report, which

includes a fair review of the information required by DTR 4.2.7R

(indication of important events during the first six months and

description of principal risks and uncertainties for the remaining

six months of the year);

-- the unaudited interim condensed financial statements include

a fair review of the information required by DTR 4.2.8R (disclosure

of related parties' transactions and changes therein); and

-- the half-yearly report and unaudited interim condensed

financial statements for the period ended 30 June 2021 give a true

and fair view of the assets, liabilities, financial position and

return of the Company.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in Jersey governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

On behalf of the Board

Alex Ohlsson

Chairman

Colin Huelin

Director

27 September 2021

INDEPENT REVIEW REPORT

To GCP Asset Backed Income Fund Limited

Report on the review of the unaudited interim condensed

financial statements

Our conclusion

We have reviewed GCP Asset Backed Income Fund Limited's

unaudited interim condensed financial statements (the "interim

financial statements") in the half-yearly report and unaudited

interim condensed financial statements of GCP Asset Backed Income

Fund Limited (the "Company") for the six month period ended 30 June

2021. Based on our review, nothing has come to our attention that

causes us to believe that the interim financial statements are not

prepared, in all material respects, in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', and the Disclosure Guidance and Transparency Rules

sourcebook of the United Kingdom's Financial Conduct Authority.

What we have reviewed

The interim financial statements comprise:

-- the unaudited interim condensed statement of financial position as at 30 June 2021;

-- the unaudited interim condensed statement of comprehensive income for the period then ended;

-- the unaudited interim condensed statement of cash flows for the period then ended;

-- the unaudited interim condensed statement of changes in

equity for the period then ended; and

-- the explanatory notes to the interim financial statements.

The interim financial statements included in the half-yearly

report and unaudited interim condensed financial statements have

been prepared in accordance with International Accounting Standard

34, 'Interim Financial Reporting', and the Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial

Conduct Authority.

As disclosed in note 2 to the interim financial statements, the

financial reporting framework that has been applied in the

preparation of the full annual financial statements of the Company

is the Companies (Jersey) Law 1991 and International Financial

Reporting Standards (IFRSs).

Responsibilities for the interim financial statements and the

review

Our responsibilities and those of the Directors

The half-yearly report and unaudited interim condensed financial

statements, including the interim financial statements, is the

responsibility of, and has been approved by, the Directors. The

Directors are responsible for preparing the half-yearly report and

unaudited interim condensed financial statements in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', and the Disclosure Guidance and Transparency Rules

sourcebook of the United Kingdom's Financial Conduct Authority.

Our responsibility is to express a conclusion on the interim

financial statements in the half-yearly report and unaudited

interim condensed financial statements based on our review. This

report, including the conclusion, has been prepared for and only

for the Company for the purpose of complying with the Disclosure

Guidance and Transparency Rules sourcebook of the United Kingdom's

Financial Conduct Authority and for no other purpose. We do not, in

giving this conclusion, accept or assume responsibility for any

other purpose or to any other person to whom this report is shown

or into whose hands it may come save where expressly agreed by our

prior consent in writing.

What a review of interim financial statements involves

We conducted our review in accordance with International

Standard on Review Engagements 2410, 'Review of Interim Financial

Information Performed by the Independent Auditor of the Entity'

issued by the International Auditing and Assurance Standards Board.

A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing and,

consequently, does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

We have read the other information contained in the half-yearly

report and unaudited interim condensed financial statements and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the interim

financial statements.

PricewaterhouseCoopers CI LLP

Chartered Accountants

Jersey, Channel Islands

27 September 2021

UNAUDITED INTERIM CONDENSED STATEMENT OF COMPREHENSIVE

INCOME

For the period ended 30 June 2021

Period ended Period ended

30 June 2021 30 June 2020

Notes GBP'000 GBP'000

----------------------------------------------------------------------------------- ----- ------------ ------------

Income

Loan interest realised 3 17,231 17,889

Net unrealised loss on financial assets at fair value through profit or loss 3 (1,225) (9,382)

Net gain/(loss) on derivative financial instruments 3 773 (382)

----------------------------------------------------------------------------------- ----- ------------ ------------

Net changes in fair value of financial assets and financial liabilities at fair

value through

profit or loss 16,779 8,125

----------------------------------------------------------------------------------- ----- ------------ ------------

Fee income 3 2,634 1,806

Deposit interest income - 5

----------------------------------------------------------------------------------- ----- ------------ ------------

Total income 19,413 9,936

----------------------------------------------------------------------------------- ----- ------------ ------------

Expenses

Investment management fees (1,972) (1,905)

Operating expenses (787) (657)

Directors' remuneration (100) (101)

----------------------------------------------------------------------------------- ----- ------------ ------------

Total expenses (2,859) (2,663)

----------------------------------------------------------------------------------- ----- ------------ ------------

Total operating profit before finance costs 16,554 7,273

----------------------------------------------------------------------------------- ----- ------------ ------------

Finance costs

Finance expenses 4 (426) (372)

----------------------------------------------------------------------------------- ----- ------------ ------------

Total profit and comprehensive income 16,128 6,901

----------------------------------------------------------------------------------- ----- ------------ ------------

Basic and diluted earnings per share (pence) 7 3.67 1.56

----------------------------------------------------------------------------------- ----- ------------ ------------

All items in the above statement are derived from continuing

operations.

The notes below form an integral part of the financial

statements.

UNAUDITED INTERIM CONDENSED STATEMENT OF FINANCIAL POSITION

As at 30 June 2021

(Audited)

As at

As at 31 December

30 June 2021 2020

Notes GBP'000 GBP'000

------------------------------------------------------ ----- ------------ -----------

Assets

Financial assets at fair value through profit or loss 8 476,546 445,962

Other receivables and prepayments 9 2,271 108

Derivative financial instruments 14 80 158

Cash and cash equivalents 10 9,455 9,994

------------------------------------------------------ ----- ------------ -----------

Total assets 488,352 456,222

------------------------------------------------------ ----- ------------ -----------

Liabilities

Other payables and accrued expenses 12 (1,458) (1,604)

Derivative financial instruments 14 (41) -

Revolving credit facilities 11 (35,116) (4,856)

------------------------------------------------------ ----- ------------ -----------

Total liabilities (36,615) (6,460)

------------------------------------------------------ ----- ------------ -----------

Net assets 451,737 449,762

------------------------------------------------------ ----- ------------ -----------

Equity

Share capital 13 442,607 442,900

Retained earnings 9,130 6,862

------------------------------------------------------ ----- ------------ -----------

Total equity 451,737 449,762

------------------------------------------------------ ----- ------------ -----------

Ordinary shares in issue (excluding treasury shares) 13 439,833,518 440,158,518

------------------------------------------------------ ----- ------------ -----------

NAV per ordinary share (pence per share) 102.71 102.18

------------------------------------------------------ ----- ------------ -----------

The unaudited interim condensed financial statements were

approved and authorised for issue by the Board of Directors on 27

September 2021 and signed on its behalf by:

Alex Ohlsson

Chairman

Colin Huelin

Director

The notes below form an integral part of the financial

statements.

UNAUDITED INTERIM CONDENSED STATEMENT OF CHANGES IN EQUITY

For the period ended 30 June 2021

Share Retained Total

capital earnings equity

Notes GBP'000 GBP'000 GBP'000

----------------------------------------------------- ----- ------- -------- --------

Balance as at 1 January 2021 442,900 6,862 449,762

Total profit and comprehensive income for the period - 16,128 16,128

Share repurchases 13 (293) - (293)

Dividends paid 6 - (13,860) (13,860)

----------------------------------------------------- ----- ------- -------- --------

Balance as at 30 June 2021 442,607 9,130 451,737

----------------------------------------------------- ----- ------- -------- --------

UNAUDITED INTERIM CONDENSED STATEMENT OF CHANGES IN EQUITY

For the period ended 30 June 2020

Share Retained Total

capital earnings equity

Notes GBP'000 GBP'000 GBP'000

----------------------------------------------------- ----- ------- -------- --------

Balance as at 1 January 2020 443,915 7,931 451,846

Total profit and comprehensive income for the period - 6,901 6,901

Equity shares issued 13 518 - 518

Share issue costs (20) - (20)

Share repurchases 13 (386) - (386)

Dividends paid 6 - (13,687) (13,687)

----------------------------------------------------- ----- ------- -------- --------

Balance as at 30 June 2020 444,027 1,145 445,172

----------------------------------------------------- ----- ------- -------- --------

The notes below form an integral part of the financial

statements.

UNAUDITED INTERIM CONDENSED STATEMENT OF CASH FLOWS

For the period ended 30 June 2021

Period ended Period ended

30 June 2021 30 June 2020

Notes GBP'000 GBP'000

----------------------------------------------------------------------------------- ----- ------------ ------------

Cash flows from operating activities

Total operating profit before finance costs 16,554 7,273

Adjustments for:

Net changes in fair value of financial assets and financial liabilities at fair

value through

profit or loss 3 (16,779) (8,125)

Realised gains/(losses) on derivative instruments 892 (375)

Decrease in other payables and accrued expenses (120) (49)

(Increase)/decrease in other receivables and prepayments (2,163) 32

----------------------------------------------------------------------------------- ----- ------------ ------------

Total (1,616) (1,244)

----------------------------------------------------------------------------------- ----- ------------ ------------

Interest received from Subsidiary 3 17,231 17,889

Investment in Subsidiary 8 (69,433) (49,520)

Capital repayments from Subsidiary 8 37,624 64,533

----------------------------------------------------------------------------------- ----- ------------ ------------

Net cash flow (used in)/generated from operating activities (16,194) 31,658

----------------------------------------------------------------------------------- ----- ------------ ------------

Cash flows from financing activities

Proceeds from revolving credit facilities 11 34,150 11,399

Repayment of revolving credit facilities 11 (4,000) (20,875)

Share issue costs - (20)

Share repurchases 13 (293) (386)

Finance costs paid (342) (269)

Dividends paid 6 (13,860) (13,169)

----------------------------------------------------------------------------------- ----- ------------ ------------

Net cash flow generated from/(used in) financing activities 15,655 (23,320)

----------------------------------------------------------------------------------- ----- ------------ ------------

Net (decrease)/increase in cash and cash equivalents (539) 8,338

Cash and cash equivalents at beginning of the period 9,994 8,687

----------------------------------------------------------------------------------- ----- ------------ ------------

Cash and cash equivalents at end of the period 9,455 17,025

----------------------------------------------------------------------------------- ----- ------------ ------------

Net cash flow used in operating activities includes:

Interest received from bank deposits - 5

Interest received from Subsidiary 3 17,231 17,889

----------------------------------------------------------------------------------- ----- ------------ ------------

Non-cash items:

Purchase of financial assets: indexation (24) (304)

Interest received from Subsidiary 24 304

Scrip dividend 6 - (518)

Equity issue in respect of scrip dividend - 518

----------------------------------------------------------------------------------- ----- ------------ ------------

The notes below form an integral part of the financial

statements.

NOTES TO THE UNAUDITED INTERIM CONDENSED FINANCIAL

STATEMENTS

For the period ended 30 June 2021

1. General information