TIDMGABI TIDMGABC

RNS Number : 4541Z

GCP Asset Backed Income Fund Ltd

25 January 2022

25 January 2022

GCP Asset Backed Income Fund Limited

(the "Company" or "GCP Asset Backed")

LEI: 213800FBBZCQMP73A815

Net Asset Value and Investment Update

GCP Asset Backed, which invests in asset backed loans, announces

that, as at 31 December 2021, the unaudited net asset value ("NAV")

per ordinary share of the Company (including current period

revenue) is 99.29 pence per share.

NAV

The NAV performance for the 3 month period is a positive

movement of 0.35 pence per share after the payment of dividends, an

increase of 0.35 per cent.

The positive NAV performance for the period was driven by a

combination of excess earnings in the period and upwards

revaluation of an asset finance loan by the Valuation Agent.

Portfolio Update

The only portfolio assets that remain categorised as high risk

are the loan to a co-living group (the "Co-living Group") and the

two community facility loans, representing an aggregate 6.98% of

the total portfolio value.

The portfolio continues to rotate well with GBP44.7m repaid and

GBP46.9m deployed in the period. The Investment Manager continues

to target loans to borrowers it already knows, in sectors that have

performed well for the Company and which offer attractive,

risk-adjusted returns.

Co-living

There have been no material movements in the position of the

Co-living Group loan since the announcement on 22 December

2021.

We are not proposing any change to the holding value of the

Co-living Group loan, in line with the decision to only recognise

movements on the receipt of funds. The value of the loan therefore

continues to be held in line with the initial NAV write-down on 13

September 2021.

Community Facilities

The Company has provided loans to two community facilities.

These facilities house a variety of small businesses including

bars, food outlets, co-working and studio space.

A sale process for the two community assets was commenced over

the summer of 2021 with the appointment of a preferred bidder

occurring at the end of September. This initial preferred bidder

was unable to complete the bid within the given timescale and,

therefore, a second party was appointed as preferred bidder and the

assets transferred to new ownership in the period.

The Investment Manager is working closely with the new owner and

significant wins have already been achieved on the two assets,

including reaching agreement to turn the large garden area at the

Hackney site into a bar and terrace and the drawing up of plans to

convert the basement at the Peckham site into studios, for which

there is currently a waiting list of potential tenants.

Both assets continue to be impacted by the Omicron variant and

the UK Government having imposed "Plan B" coronavirus

restrictions.

CHP and ROC Engines

This loan defaulted in March 2019 and was sold in April 2021. As

reported in the NAV announcement of 15 July 2021, GBP1.1m of this

loan was held in escrow following the sale and subject to potential

warranty claims, with GBP1m due to be released in December 2021 and

GBP0.1m due to be released in March 2023. We are pleased to report

that the full GBP1.1m was released back to the Company in December

2021.

There remains a further small amount of money due under the sale

documentation and the Company still retains security over a further

engine on a separate site. This site is expected to be awarded

planning permission this quarter and has a significant renewable

heat incentive tariff linked to it. No value has been ascribed in

the NAV to this engine or any additional funds due pursuant to the

sale, but the Investment Manager will continue to monitor these

assets closely.

Dividends

On 3 November 2021, the Company declared a quarterly dividend in

respect of the period from 1 July 2021 to 30 September 2021 of

1.575p per share, which was paid on 10 December 2021.

Outlook

The Investment Manager remains focussed on recovering value from

the Co-living Group. However, it remains highly encouraged by the

continued strong level of repayments that are being experienced

across the balance of the portfolio. These repayments continue to

be matched by a strong pipeline of opportunities in sectors that

the Investment Manager finds attractive.

The Investment Manager will be holding a webinar on 28 January

2022 at 10am to provide more detail on the portfolio. For any

investor interested in joining, please e-mail

zoe.french@graviscapital.com .

For further information, please contact:

Gravis Capital Management Ltd +44 (0)20 3405 8500

David Conlon

Joanne Fisk

Investec Bank plc +44 (0)20 7597 4000

Helen Goldsmith

Denis Flanagan

Neil Brierley

Buchanan/Quill +44 (0)20 7466 5000

Helen Tarbet

Sarah Gibbons-Cook

Henry Wilson

Notes to Editors

GCP Asset Backed is a closed ended investment company traded on

the Main Market of the London Stock Exchange. Its investment

objective is to generate attractive risk-adjusted returns primarily

through regular, growing distributions and modest capital

appreciation over the long term.

The Group seeks to meet its investment objective by making

investments in a diversified portfolio of predominantly UK based

asset backed loans which have contracted, predictable medium to

long term cash flows and/or physical assets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVKZGZMGDKGZZZ

(END) Dow Jones Newswires

January 25, 2022 02:00 ET (07:00 GMT)

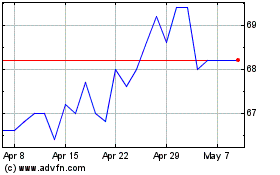

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From Mar 2024 to Apr 2024

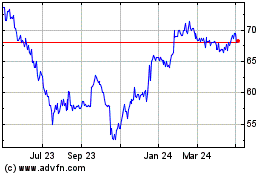

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From Apr 2023 to Apr 2024