TIDMGABI TIDMGABC

RNS Number : 8892S

GCP Asset Backed Income Fund Ltd

19 July 2022

19 July 2022

GCP Asset Backed Income Fund Limited

(the "Company" or "GCP Asset Backed")

LEI: 213800FBBZCQMP73A815

Net asset value and investment update

GCP Asset Backed, which invests in asset backed loans, announces

that, at 30 June 2022, the unaudited net asset value ("NAV") per

ordinary share of the Company (including current period revenue) is

98.45 pence per share.

NAV

The NAV performance for the 3 month period is a negative

movement of 0.91 pence per share after the payment of dividends, a

decrease of 0.92% per cent.

The negative NAV performance for the period was driven by

valuation adjustments to the Company's loan to the co-living group

(the "Co-living Group Loan") as described below.

Portfolio update

The Company currently has exposure to 59 loans across 22

sectors. Overall, the portfolio continues to perform well, and the

Investment Manager remains satisfied with the mix and quality of

investments within the portfolio.

The Company continues to experience repayment of capital, with a

further GBP9.5 million of principal returned in the period. Its

first football finance loan repaid in full, with the Company

receiving additional prepayment fees. The Investment Manager

believes that this is an attractive sector and, whilst not

currently looking to increase the Company's overall exposure, the

Investment Manager is looking to complete follow-on transactions as

funds are repaid.

The Company's remaining battery storage project repaid in full

in the period, generating additional income through prepayment

fees. Battery storage has been a strong sector for the Company,

with all loans repaying early and benefiting from fee uplifts.

The only assets in the portfolio that are categorised as high

risk are the Co-living Group Loan and the two community facility

loans, as described below.

The Co-living Group Loan

At 30 June 2022, given the continuing uncertainty surrounding

the realisation value of the Co-living Group Loan, the Directors,

having taken advice from the Company's valuation agent and

Investment Manager, have considered a range of values, resulting in

an impact ranging from a low of negative 1.53 pence per share to a

high of positive 0.25 pence per share on the NAV of the Company.

Consistent with the Board's historical preference for prudence, the

Directors have decided to value the Co-living Group Loan at 30 June

2022 at the lower end of this valuation range, resulting in a

negative NAV movement of 1.21 pence per share.

This decision was based upon a number of developments in the

period which have altered the valuation range from what was

previously considered a prudent position. The Investment Manager is

working to resolve a number of these positions in a way which

mitigates the impact to the Company.

Community facilities

The Company has provided loans to two community facilities,

which house a variety of small businesses including bars, food

outlets, co-working, studios and workshop space.

The first community facility remains near fully occupied and

work is underway to further enhance the building, including letting

the unused basement.

The second community facility has performed well in the period.

The opening of the outside garden space at this facility, as noted

at the end of the last quarter, has had a positive impact on the

site. Further spaces are looking to be activated with discussions

advancing on the last remaining units to be let.

The Investment Manager remains confident that these are strong

assets with borrowers which should be well placed to repay their

respective loans. We anticipate that the adjustments taken against

these loans will be kept in place until the assets are fully

stabilised and able to demonstrate a period of sustained

performance.

The Investment Manager continues to work closely with the

management team to support improvements at these assets.

Dividends

On 29 April 2022, the Company announced an increased quarterly

dividend in line with its new dividend target for the year of

6.325p. It declared a quarterly dividend in respect of the period

from 1 January 2022 to 31 March 2022 of 1.58125p per share, which

was paid on 14 June 2022.

Outlook

Market volatility and economic uncertainty are continuing to

increase as a result of high inflation, interest rate concerns and

the impact of the Russian invasion of Ukraine on energy prices and

supply chains. Whilst we note the impact that this is having on the

Company's share price, the Investment Manager is pleased to report

that the portfolio as a whole remains resilient. The Investment

Manager continues to focus on lending in known sectors and

borrowers, based on their performance during the pandemic and

throughout the life of the Company. The Investment Manager believes

that the continued repayments and deployment into new and

attractive sectors demonstrates the robustness of the

portfolio.

The Investment Manager continues to liaise with the Company's

borrowers on a regular basis to assess the impact of inflation,

power prices and staffing on their businesses, noting that a number

of borrowers may benefit from an inflationary environment given the

nature of their business models.

The Investment Manager continues to apply its measured approach

to investing and is aiming to resolve the workout process of the

Co-living Group Loan in a manner which will maximise recovery for

the Company.

The Investment Manager will be holding a webinar on Wednesday 27

July 2022 at 10.00am to provide more detail on the portfolio. For

any investor interested in joining, please e-mail

zoe.french@graviscapital.com .

For further information, please contact:

Gravis Capital Management Ltd +44 (0)20 3405 8500

David Conlon

Joanne Fisk

Investec Bank plc +44 (0)20 7597 4000

Helen Goldsmith

Denis Flanagan

Neil Brierley

Buchanan/Quill +44 (0)20 7466 5000

Helen Tarbet

Sarah Gibbons-Cook

Henry Wilson

Notes to Editors

GCP Asset Backed is a closed ended investment company traded on

the Main Market of the London Stock Exchange. Its investment

objective is to generate attractive risk-adjusted returns primarily

through regular, growing distributions and modest capital

appreciation over the long term.

The Group seeks to meet its investment objective by making

investments in a diversified portfolio of predominantly UK based

asset backed loans which are secured against contracted,

predictable medium to long term cash flows and/or physical

assets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVDZGMNGRNGZZZ

(END) Dow Jones Newswires

July 19, 2022 02:00 ET (06:00 GMT)

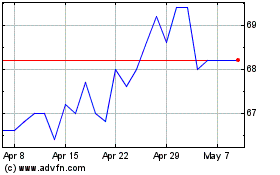

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From Mar 2024 to Apr 2024

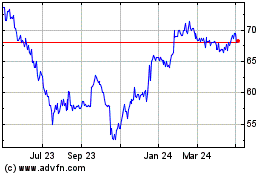

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From Apr 2023 to Apr 2024