TIDMGABI TIDMGABC

RNS Number : 0597A

GCP Asset Backed Income Fund Ltd

21 September 2022

GCP Asset Backed Income Fund Limited

(the "Company" or "GCP Asset Backed")

LEI: 213800FBBZCQMP73A815

Half-yearly report and unaudited interim condensed financial

statements for the period ended 30 June 2022

The Directors of the Company are pleased to announce the

Company's interim results for the period ended 30 June 2022. The

full unaudited half-yearly report and unaudited condensed financial

statements can be accessed via the Company's website at

www.gcpassetbacked.com.

For further information, please contact:

Gravis Capital Management Limited +44 (0) 20 3405 8500

David Conlon

Joanne Fisk

Investec Bank plc +44 (0)20 7597 4000

Helen Goldsmith

Denis Flanagan

Neil Brierley

Buchanan/Quill +44 (0)20 7466 5000

Helen Tarbet

Sarah Gibbons-Cook

Henry Wilson

ABOUT THE COMPANY

GCP Asset Backed Income Fund Limited is a listed investment

company which focuses predominantly on investments in UK asset

backed loans.

The Company seeks to provide shareholders with attractive

risk-adjusted returns through regular, growing distributions and

modest capital appreciation over the long term.

The Group is currently invested in a diversified portfolio of

asset backed loans across the social infrastructure, property,

energy and infrastructure, and asset finance sectors, located

predominantly in the UK.

The Company is a closed-ended investment company incorporated in

Jersey. The Company has a premium listing on the Official List of

the FCA with its shares admitted to trading on the Premium Segment

of the Main Market of the LSE since 23 October 2015.

At 30 June 2022, its market capitalisation was GBP421.4 million.

The Company is a constituent of the FTSE All - Share Index.

AT A GLANCE - 30 JUNE 2022

HY20 HY21 HY22

----------------------------- ------ ------ -------

Market capitalisation GBPm 389.8 450.8 421.4

Value of investments(1) GBPm 429.5 476.5 427.7

Dividends for the period p 3.10 3.15 3.16(2)

Share price p 88.30 102.50 95.80

NAV per share p 100.83 102.71 98.45

Profit for the period GBPm 6.9 16.1 10.2

----------------------------- ------ ------ -------

HIGHLIGHTS FOR THE PERIOD

- Dividends of 3.16(2) pence per share declared for the period,

in line with the increased dividend target(3) of 6.325 pence per

share for the year.

- Total shareholder return(4) for the period of 2.0% (30 June

2021: 16.0%) and an annualised total shareholder return since

IPO(4) of 5.2%.

- Profit for the period of GBP10.2 million (30 June 2021:

GBP16.1 million) reflecting the impact of the decrease in fair

value of the Group's Co - living loan. Excluding the fair value

decrease, profit for the period would have been GBP15.6 million (30

June 2021: GBP18.7 million).

- NAV per share of 98.45(5) pence at 30 June 2022.

- Loans of GBP25.9 million advanced and repayments of GBP42.7

million received in the period.

- Exposure to a diversified, partially inflation and/or interest

rate protected portfolio of 59 asset backed loans with a third

party valuation of GBP423.6(6) million at 30 June 2022.

- Post period end, the Group advanced GBP23.7 million secured

against four projects and received repayments totalling GBP11.1

million.

1. Includes the valuation of the Subsidiary, refer to note 8 for

further information.

2. Total dividend of 3.1625 pence includes a quarterly dividend

of 1.58125 pence per share for the quarter to 30 June 2022, which

was declared post period end.

3. Information in relation to dividends set out above is for

illustrative purposes only and is not intended to be, and should

not be taken as, a profit forecast or estimate.

4. Alternative performance measure - refer below for definitions

and calculation methodology.

5. Does not include a provision for the dividend in respect of

the quarter to 30 June 2022, which was declared and paid post

period end.

6. Valuation of the loan portfolio held by the Subsidiary. The

Company makes its investments through its wholly owned Subsidiary.

Refer to note 1 for further information.

INVESTMENT OBJECTIVES AND KPIS

The Company's purpose as a closed - ended investment company is

to meet its investment objective, which is to generate attractive

risk - adjusted returns through regular, growing distributions and

modest capital appreciation over the long term.

ATTRACTIVE RISK ADJUSTED REGULAR, GROWING DISTRIBUTIONS CAPITAL APPRECIATION

RETURNS

---------------------------- ------------------------------ ------------------------------

To provide shareholders To provide shareholders To achieve modest appreciation

with returns that are with regular, growing in shareholder value

attractive with regard dividend distributions. over the long term.

to the level of risk

taken.

KEY PERFORMANCE INDICATORS

---------------------------- ------------------------------ ------------------------------

The Group is exposed The Company is paying The Company's shares

to a diversified, partially dividends at the increased closed at 95.80 pence

inflation and/or interest target(3) rate set for per share at the period

rate protected portfolio 2022 of 6.325 pence per end and have traded at

of loans secured against share. Dividends totalling an average discount(2)

contracted medium to 3.16(4) pence per share to NAV for the period

long-term cash flows were declared for the of 1.1%.

and/or physical assets. period.

---------------------------- ------------------------------ ------------------------------

59 3.16p(4) 95.80p

Number of investments Dividends in respect Share price at 30 June

at 30 June 2022 of the period to 30 June 2022

2022

---------------------------- ------------------------------ ------------------------------

7.4%(1) 49% 2.7%

Weighted average annualised Portfolio by value with Discount(2) to NAV at

yield(2) of investment inflation and/or interest 30 June 2022

portfolio rate protection mechanisms

---------------------------- ------------------------------ ------------------------------

Further information on Company performance can be found

below.

1. Including the Company's Co-living loan which is held at net

realisable value. Excluding this loan, the weighted average

annualised yield(2) is 7.85%.

2. Alternative performance measure - refer below for definitions

and calculation methodology.

3. Information in relation to dividends set out above is for

illustrative purposes only and is not intended to be, and should

not be taken as, a profit forecast or estimate.

4. Total dividend of 3.1625 pence includes a quarterly dividend

of 1.58125 pence per share for the quarter to 30 June 2022, which

was declared post period end.

PORTFOLIO AT A GLANCE

A portfolio of 59 asset backed loans with an average life of

five years which are partially inflation and/or interest rate

protected. The loans fall within the following sectors and are

secured predominantly against assets and cash flows in the UK:

PROPERTY

- 19 loans within sector

- GBP176.3m

- 42%

SOCIAL INFRASTRUCTURE

- 22 loans within sector

- GBP166.0m

- 39%

ENERGY AND INFRASTRUCTURE

- 8 loans within sector

- GBP26.8m

- 6%

ASSET FINANCE

- 10 loans within sector

- GBP54.5

- 13%

SENIOR RANKING SECURITY

73%

WEIGHTED AVERAGE ANNUALISED YIELD(1)

7.4%(2)

INFLATION AND/OR INTEREST RATE PROTECTION MECHANISMS

49%

1. Alternative performance measure - refer below for definitions

and calculation methodology.

2. Including the Company's Co-living loan which is held at net

realisable value. Excluding this loan, the weighted average

annualised yield(1) is 7.85%.

CHAIRMAN'S INTERIM STATEMENT

The first half of 2022 has seen major changes in the

macro-economic environment which bring both challenges and

opportunities.

Introduction

The first half of 2022 has seen major changes in the macro -

economic environment which bring both challenges and opportunities

for the Company. Whilst we have seen a reduction in the value of

the Co-living group loan, the rest of the portfolio continues to

perform well and has mitigants in place to manage the macro -

economic impacts of inflation and interest rate rises, which are

described in more detail below.

It has been positive to see the remaining UK Covid-19

restrictions lifted in the period. However, the start of 2022 has

brought new challenges, with global business activity restarting

post-pandemic and the conflict in Ukraine affecting the

macro-economic environment, principally through increases in energy

prices. Throughout the period, the portfolio has shown resilience,

with 95% of the loans continuing to perform as expected.

Investment activity

At the period end, the Company's portfolio comprised 59 loans,

offering diversification through exposure to 22 asset classes

including property development, social housing and infrastructure.

86% of the portfolio is secured against physical assets with the

balance secured against contracted cash flows.

During the period, the Group advanced GBP25.9 million secured

against 19 projects, with a further GBP23.7 million invested post

period end. The Group continues to target and invest into key

sectors with both new and existing borrowers who have demonstrated

strong governance and stewardship of their businesses, with a

strong pipeline of investment opportunities.

In the period, GBP42.7 million in repayments have been received,

including repayment of the Company's final investment in the

battery storage sector as well as repayments of football finance

positions and student accommodation projects.

As the Company matures, it is expected that the rate at which

principal is repaid will continue to increase. The Company factors

in this return of principal when considering its funding needs,

ensuring it utilises its RCF where necessary to mitigate against

the impact of cash drag.

Portfolio update

The work-out process for the Co-living group loan is ongoing.

Since the year end, there has been a decrease in the valuation of

the Co-living group loan, resulting in a reduction in the NAV of

1.22 pence per share. This was driven by developments in the sales

process for the assets. Whilst this is disappointing, we are

confident that the process will be completed satisfactorily and

remain committed to realising value for the Company. The Investment

Manager has provided further information below.

The multi-use community facility projects which were impacted by

the pandemic continue to be held at a discount to par of GBP1.2

million. These assets were operated under new management in the

period and have seen improvement in performance. Further

information is provided below.

No other reductions in valuation have been proposed in the

period, with the remaining loans in the portfolio performing

well.

Excluding the impact of the write-down on the Co-living group

loan, the NAV at 30 June 2022 would have increased by 0.38 pence

per share over the period. The increase was driven by excess income

and principal indexation on a number of care home loans with

inbuilt inflation protection mechanisms.

Financial performance

In the period, the Company's portfolio generated total income of

GBP13.4 million with profit for the period of GBP10.2 million,

decreasing from GBP16.1 million in the prior period due to the

decrease in fair value of the Co-living loan as detailed above.

Earnings of 2.32 pence per share on an IFRS basis were

generated, which includes the write-down of the Co-living loan and

changes to discount rates. Adjusted EPS(1) was 3.54 pence per

share, compared to the dividend of 3.16(2) pence for the

period.

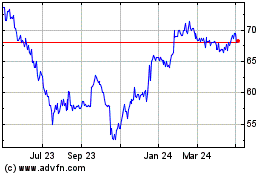

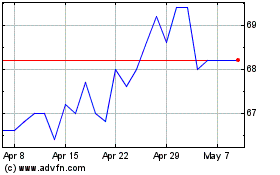

NAV and share price performance

At the period end, the net assets of the Company were GBP433.0

million. The NAV per share decreased from 99.29 pence at 31

December 2021 to 98.45(3) pence at 30 June 2022.

The Company's shares have traded at a discount(1) since the

outset of the Covid-19 pandemic impacted financial markets, with an

average discount(1) of 1.1% to NAV in the period. Since IPO, the

shares have traded at an average discount(1) to NAV of 0.4%. At 30

June 2022, the shares were trading at 95.80 pence, representing a

2.7% discount(1) to NAV.

The Board and Investment Manager have continued to release

detailed portfolio information in shareholder communications, host

regular webinars and meet with shareholders on an individual basis

through the period. The Board continues to monitor the discount and

will look to implement share buybacks where this would offer value

to shareholders.

On 15 September 2022, the closing share price was 94.00 pence

with the shares trading at a 4.5% discount(1) to NAV.

Investment pipeline

The Investment Manager continues to see good opportunities for

investment in line with the investment strategy of the Company and

the principles which have guided investment since IPO. The current

pipeline includes further investment in residential property

development, nurseries and CNG stations which are providing

essential services and infrastructure to local communities.

Dividend policy

The Company set a dividend target(4) of 6.325 pence per share

for 2022. The Directors are pleased to confirm that the Company is

on track to meet this target(4) , with dividends totalling 3.16(2)

pence per share being declared in respect of the period.

Market overview and outlook

The period has seen a reduction in the uncertainties presented

by the Covid-19 pandemic, with all remaining restrictions in the UK

lifted on 1 April 2022. Whilst the portfolio has been impacted by

the Covid-19 pandemic, it remains resilient, with only three of the

59 loans not meeting their principal or interest payment

obligations. The majority of the portfolio has performed well, with

borrower management teams navigating the challenges of the pandemic

to ensure their businesses continue to provide important

infrastructure and services such as childcare, accommodation for

students, new homes, CNG fuel and care for elderly and vulnerable

people.

Across the global economy, challenges in returning to pre -

pandemic levels of activity alongside the conflict in Ukraine and

increased geopolitical instability have impacted supply chains,

employment and energy prices, which in turn has led to a rise in

the rate of inflation not seen in the UK for decades.

The portfolio includes a large proportion of loans with

contractual mechanisms which offer protection against inflation

and/or interest rates. It has a weighted average loan life of five

years, allowing for reinvestment at prevailing rates; further

detail is provided below. We believe that these features mean that

the Company has mitigants in place to operate in an inflationary

environment. Equally, the increases in base rates and reduction in

available capital from traditional lending sources may present an

opportunity for the Company as an alternative lender, to invest in

sectors and assets which would previously have been able to access

cheaper capital.

The Investment Manager continues to see good opportunities for

investment into new projects and is focused on delivering the

current pipeline to ensure efficient deployment of repaid

capital.

ESG

The Company published its first ESG policy in January 2022,

which can be found on the website. The policy details how ESG

issues are considered throughout the Company's operations and used

to guide decisions, processes and policies wherever possible with

the aim of operating a sustainable business model that does not

detrimentally impact the environment and provides benefits to

society.

In the period, incentive schemes have been implemented which

reduce fees charged to borrowers subject to the successful delivery

of ESG projects. To date, this has included scholarship nursery

places, co-living rooms for refugees fleeing the conflict in

Ukraine and sponsored studio space in East London.

The Board is also pleased to announce that Joanna Dentskevich

has been appointed as 'ESG representative', being the Director

responsible for implementation of ESG policy.

Governance and compliance

The Board recognises the importance of a strong corporate

governance culture and continues to maintain principles of good

corporate governance as set out in the AIC Code.

Principal risks and uncertainties

Following a detailed review of the principal risks and

uncertainties detailed in the Company's 2021 annual report, the

Directors now consider, in light of the current inflationary

environment, there to be a new principal risk focusing on the

macro-economic environment and a longer period of economic

uncertainty. The Directors also concluded that there had been an

increase in the residual risk of the principal risk pertaining to

credit risk. The remaining risks and uncertainties remain unchanged

since publication.

The principal risks and uncertainties are expected to remain

relevant to the Company for the next six months of its financial

year. The principal risk categories include (but are not limited

to) credit risk, economic risk, key resource risk, regulatory risk

and execution risk.

Further details can be found below and on pages 52 to 56 of the

2021 annual report.

Going concern statement

The Directors have made an assessment of the Company's ability

to continue as a going concern and are satisfied that the Company

has adequate resources to continue in operational existence for a

period of at least twelve months from the date on which the

half-yearly report and unaudited interim condensed financial

statements are approved.

The Directors are not aware of any material uncertainties that

may cast significant doubt on the Company's ability to continue as

a going concern, having taken into account the liquidity of the

Group's investment portfolio and the Company's financial position

in respect of its cash flows, borrowing facilities and investment

commitments (of which there are none of significance). Therefore,

the financial statements have been prepared on a going concern

basis.

On behalf of the Board

Alex Ohlsson

Chairman

20 September 2022

For more information, refer to the Investment Manager's report

below.

1. Alternative performance measure - refer below for definitions

and calculation methodology.

2. Total dividend of 3.1625 pence includes a quarterly dividend

of 1.58125 pence per share for the quarter to 30 June 2022, which

was declared post period end.

3. Does not include a provision for the dividend in respect of

the quarter to 30 June 2022, which was declared and paid post

period end.

4. The dividend target set out above is a target only and not a

profit forecast or estimate and there can be no assurance that it

will be met.

INVESTMENT MANAGER'S REPORT

The Company's investment objective is to generate attractive

risk-adjusted returns through regular, growing distributions and

modest capital appreciation over the long term.

3.16p(1)

Dividends declared for the period

2.0%

Total shareholder return(2) for the period

The Investment Manager

Gravis Capital Management Limited provides discretionary

investment management and risk management services to the Group

which includes investment identification, investment due diligence

and structuring, investment monitoring, the management and

reporting of the existing loan portfolio and financial reporting

support. Investment decisions are made on behalf of the Group by

the Investment Manager's investment committee, with an update

provided to the Board on a quarterly basis and additional updates

when significant events have occurred. The Board has overall

responsibility for the Group's activities, including the review of

investment activity, performance, control and supervision of the

Investment Manager.

The Investment Manager also provides advice regarding the

Company's equity and debt funding requirements. The Investment

Manager is the AIFM to the Company. The basis of the remuneration

of the Investment Manager is set out in note 15 to the unaudited

interim condensed financial statements.

Summary investment policy

The Company makes investments(3) in a diversified portfolio of

senior and subordinated debt instruments which are secured against,

or comprise, contracted, predictable medium to long-term cash flows

and/or physical assets.

The Company's investments will typically be unquoted and will

include, but not be limited to, senior loans, subordinated loans,

mezzanine loans, bridge loans and other debt instruments. The

Company may also make limited investments in equities,

equity-related derivative instruments such as warrants, controlling

equity positions (directly or indirectly) and/or directly in

physical assets.

The Company will at all times invest and manage its assets in a

manner which is consistent with the objective of spreading

investment risk. This will include diversification by asset type,

counterparty, locality and revenue source.

The Company's investment objective, other policies and

restrictions are set out in its 2021 annual report and financial

statements, which is available on the Company's website. There have

been no changes since publication.

Asset backed lending overview

Asset backed lending is an approach to structuring investments

used to fund infrastructure, industrial or commercial projects,

asset financing and equipment leases. Asset backed lending relies

on the following to create security against which investment can be

provided:

- the intrinsic value of physical assets; and/or

- the value of long-term, contracted cash flows generated from

the sale of goods and/or services produced by an asset.

Asset backed lending is typically provided to a Project Company,

a corporate entity established with the specific purpose of owning,

developing and operating an asset. Financing is provided to the

Project Company with recourse solely to the shares held in, and

assets held by, that Project Company.

Cash generation to service loans and other financing relies on

the monetisation of the goods and/or services the Project Company's

assets provides. Lenders implement a security structure that allows

them to take control of the Project Company and its assets to

optimise the monetisation of goods and/or services associated with

such assets if the Project Company has difficulties complying with

its financing terms.

Typically, an asset backed lending structure involves a number

of counterparties, who enter into contractual relationships with

the Project Company that apportion value and risk through providing

services (e.g. operations and maintenance) associated with the

development, ownership and/or operations of an asset. In

structuring an asset backed loan, the Project Company will seek to

ensure risks (and associated value) are apportioned to those

counterparties best able to manage them. This ensures the effective

pricing and management of risks inherent in the asset. Further, it

also means the residual risks (and potential rewards) being taken

by the Project Company are well understood by the parties providing

finance to such company.

The benefits associated with asset backed debt investments

Investment in asset backed loans offers relatively secure and

predictable returns to their lenders when compared with general

corporate or unsecured lending. Mainstream lenders operating in the

market often restrict their lending to certain asset types, sectors

or loan sizes, particularly in times of economic uncertainty. Where

borrowers may not have access to mainstream financing for reasons

other than the creditworthiness of the relevant proposition, such

as loan size, tenure, structure or an understanding of the

underlying cash flows and/or asset, attractive rates are available

for those willing to commit the resource, innovation and time to

understanding and identifying a solution for a specific borrower's

requirements.

A loan secured against a specific asset (within a Project

Company established specifically for that asset) is capable of

analysis broadly by reference to a set of known variables such

as:

- how an asset generates cash flow;

- its current value;

- expected future value;

- the competence of its service providers; and

- the availability of alternative parties in the event of a

failure by one or more service providers.

The need to fully understand the risks associated with a given

asset and structure arrangements with experienced service providers

to effectively manage those risks requires specialist skills and

resources. For this reason, the Company's target market remains

underserviced by mainstream lenders, therefore offering an

attractive risk-adjusted return for parties with relevant

experience and access to the required resources.

1. Total dividend of 3.1625 pence includes a quarterly dividend

of 1.58125 pence per share for the quarter to 30 June 2022, which

was declared post period end.

2. Alternative performance measure - refer below for definitions

and calculation methodology.

3. The Company makes its investments through its wholly owned

Subsidiary. Refer to note 1 for further information.

INVESTMENT PORTFOLIO

Portfolio performance

The portfolio performed well in the period, showing resilience,

with 95% of the loans continuing to perform as expected.

Investments that have performed well include loans to a

children's nursery group which accounted for 6.4% of the portfolio

at the period end. The group provides high-quality childcare in

specially designed settings and has grown from two to 17 sites,

with the support of the Company. In the period, the group completed

a significant equity raise which will allow it to continue

developing new sites. The Investment Manager is working with the

group on new development projects and hopes to provide additional

funding in due course. Elsewhere in the portfolio, the five care

homes supported by the Company continue to perform well. These

homes are modern, purpose-built care homes offering first-rate care

to elderly and vulnerable people in regions with an undersupply of

care provision. One site is currently under construction and

expected to open in 2023. The remaining sites are all operational

and currently at 90% occupancy. The Company's total exposure across

the operational assets is at an LTV(1) of 63%, yielding an average

of 8.4% and amortising over the term of the loans. The Investment

Manager believes these loans provide good risk-adjusted returns

with exposure to profitable assets and strong asset backing.

Co-living update

The Co-living loan defaulted in May 2021 and was placed into

administration by the Lender Consortium in September 2021 after a

transaction to buy the Co-living group failed. The Investment

Manager continues to work on the realisation of the Co-living

group's assets with a number of assets now transacted, including

the Canary Wharf asset, which exchanged post period end and is

expected to complete in October 2022.

In the period, a further write-down of this loan was taken,

principally as a result of issues that arose during the due

diligence process on the Canary Wharf and Old Oak assets. The

Investment Manager believes there are mitigants to these positions

and is continuing to work on these to ensure further recovery is

made on this loan.

The loan has been challenging to work-out as the Company was

lending at a group level as part of a syndicate. This means that

agreement must be reached with asset level lenders and

co-investors, all of whom have different drivers and objectives.

Due to these complications, the significant adviser fees incurred

have had a material impact on the recovery made against this

loan.

The assets themselves have performed well through the period and

continue to do so. The Old Oak asset has moved to c.97% occupancy

post period end, with the average weekly rate and projected

bookings at its highest ever level, with a significant shift to

tenants taking out six to twelve month agreements. We therefore

continue to remain positive about the sector and note that no asset

level lenders have suffered any losses.

As previously noted, we do not believe any read-across should be

made from the position on this loan to the rest of the portfolio,

where the Company lends at the asset level. The Investment Manager

has been working hard to maximise the recovery available to the

Company and has sought to take on board the lessons learned from

this loan.

Portfolio updates

The multi-use community facilities were operated under new

ownership during the period. These consist of studios, co-working

space, bars, food outlets and events space across two sites in

London. Collectively, the assets comprise 1.6% of the portfolio.

The assets were adversely impacted by the Covid-19 pandemic as

restrictions on hospitality and public spaces prevented the sites

from operating. As restrictions have lifted, consumer confidence

has grown and both sites have seen improvements in footfall.

The percentage of the portfolio invested in overseas projects

decreased in the period from 22% at December 2021 to 17% at June

2022. This was primarily driven by repayments of loans to student

accommodation assets and football broadcasting contracts outside of

the UK. The Investment Manager is not targeting a significant

increase in overseas exposure but believes that careful selection

of projects which offer risk-adjusted returns and additional

diversification is positive for the portfolio.

Exposure to assets under construction has increased from 13% to

17% of the portfolio in the period. All of the construction

projects are under fixed price contracts with experienced

contractors and the Investment Manager employs third party

specialist advisers to monitor the projects and report on key

milestones. The projects are all proceeding materially on time and

budget with a number anticipated to complete in the coming

months.

The Investment Manager believes that pressures on the

construction sector from both supply chain challenges and inflation

will make fixed price construction contracts harder to access and

therefore restrict traditional lending from banks to the sector.

This could present interesting funding opportunities for the

Company to support larger developments.

Pipeline projects are largely new projects with existing

borrowers and into sectors with which the Investment Manager is

very familiar. The Investment Manager believes that a consistent

approach to asset selection and seeking strong asset backing, good

management teams and in sectors where there is structural demand

will continue to build a resilient and well-performing

portfolio.

1. Alternative performance measure - refer below for definitions

and calculation methodology.

Inflation

Inflation has continued to increase in the period, with CPI

increasing by 9.4% in the twelve months to June 2022. This has

primarily been driven by the return to pre-pandemic activity levels

and the increase in energy prices due to the ongoing conflict in

Ukraine.

An inflationary environment will impact on how borrower

companies operate but can equally present opportunities for new

investment. At publication date, the Bank of England has increased

base rates to 1.75% with further increases anticipated over the

next twelve months. Whilst the Investment Manager has not yet seen

the increased rates positively impacting the pipeline, further

increases in interest rates could see the Company's lending rates

become more competitive in sectors which were previously able to

access cheaper financing.

As can be seen below, 49% of the portfolio benefits from partial

inflation protection by one of the mechanisms set out below and a

further 44% consists of loans with a duration of under three years,

allowing for reinvestment of loans at prevailing rates, with the

remainder of the loans with a duration of over three years. The

Investment Manager believes that, together, these characteristics

provide mitigation against an inflationary environment. The impact

of these protections is already flowing through, with principal

indexation on the care home loans contributing a 0.31 pence per

share uplift in NAV in the period.

Portfolio characteristics

- Inflation protection mechanisms 49%:

- Principal indexation 20%

- Direct rate linkage 18%

- Profit sharing 11%

- Fixed rate, over 3 years remaining 7%

- Fixed rate, under 3 years remaining 44%

Inflation protection mechanisms

There are a number of mechanisms in place within the portfolio

which offer different forms of inflation protection on the

loans.

The mechanics of these protections are explained in more detail

in the adjacent table. The portfolio characteristics above shows

the percentage of the portfolio benefiting from each mechanism.

Given the scale of inflation being reported, when applying these

mechanisms, the Investment Manager will take into account the

borrower's ability to pass on inflationary costs through their

business model and retains discretion on how increases to rates or

loans are applied.

The Investment Manager believes that these mechanisms will

support the Company in the current inflationary environment and

going forward.

Type of protection How does it work? Portfolio investments

---------------------- ---------------------------------------- ---------------------------

Direct rate linkage The interest rate charged for - Buy-to-let mortgages

the loan is directly linked to - Management fee contracts

the base rate. Increases in the - Nurseries

rate (usually above an agreed

threshold) result in a direct

increase to the loan interest

rate.

---------------------- ---------------------------------------- ---------------------------

Principal indexation When RPI, CPI or interest rates - Care homes

rise above an agreed strike price, - Bridging and development

the loan principal outstanding loans

is increased following a formula, - Social housing

which is normally 50% of the

difference between the current

interest rate or inflation and

the agreed base rate.

Typically, this is used on longer-dated

assets with inflation linked

income models or bridging loans.

---------------------- ---------------------------------------- ---------------------------

Profit sharing Share warrants and profit-sharing - Renewable investments

mechanisms are in place on certain - Residential property

loans. These options allow the

Company to share in profits generated

by borrowers e.g. where they

are able to increase lending

rates on bridging loans.

---------------------- ---------------------------------------- ---------------------------

Fixed rate, under Maintaining a portfolio which - Bridging loans

three years remaining regularly repays and requires - Football financing

reinvestment means that the Company - Development loans

is able to reinvest at prevailing

rates and reflect current market

dynamics.

The weighted average life of

the portfolio is five years.

---------------------- ---------------------------------------- ---------------------------

TOP TEN INVESTMENTS BY VALUE

Key

1. Sector type

2. % of portfolio by value

3. Asset class

4. Multi/single asset exposure

1. Bridging Co 1

1. Property

2. 5.9%

3. Residential property

4. Multi asset

2. Development Fin Co 6

1. Property

2. 5.0%

3. Residential property

4. Multi asset

3. Student Accom 2

1. Social infrastructure

2. 4.7%

3. Student accommodation

4. Multi asset

4. Property Co 2

1. Social infrastructure

2. 4.1%

3. Social housing

4. Multi asset

5. Contract Income 3

1. Asset finance

2. 3.6%

3. Contract income

4. Single asset

6. Care Homes Co 3

1. Social infrastructure

2. 3.5%

3. Care home

4. Single asset

7. Property Co 7

1. Property

2. 3.5%

3. Residential property

4. Multi asset

8. Property Co

1. Social infrastructure

2. 3.5%

3. Social housing

4. Multi asset

9. Co-living Co 3

1. Property

2. 3.2%

3. Co-living

4. Multi asset

10. Care Homes Co 2

1. Social infrastructure

2. 3.1%

3. Care home

4. Single asset

Further information on the portfolio can be found on the

Company's website.

Investment portfolio

At 30 June 2022, the Group was exposed to a diversified

portfolio of 59 asset backed investments with a fair value of

GBP423.6(1) million, of which 73% benefit from senior security and

49% from partial inflation and/or interest rate protection. The

weighted average annualised yield(2) on the Group's investments was

7.4%(3) , with a weighted average expected term of five years.

The key metrics above, principally yield and inflation and/or

interest rate protection, are in line with the same period last

year, demonstrating that the Company is continuing to deploy

capital efficiently at rates that are value accretive to

shareholders.

The portfolio is primarily backed by assets in the UK,

representing 83% of such security, with the remainder of the assets

located in Europe, the USA, Australia and Hong Kong.

The Company has minimal currency exposure (which is hedged) with

all investments either denominated in Pound Sterling or exposure

hedged to Pound Sterling using rolling forward contracts. Post

period end, the Company advanced a further GBP3.2 million secured

against international projects.

PORTFOLIO ANALYSIS

SECTOR TYPE

Property | 42%

Social infrastructure | 39%

Asset finance | 13%

Energy and infrastructure | 6%

SECURITY RANKING

Senior | 73%

Mezzanine | 27%

INTEREST RATE PROFILE

<7% | 26%

7-8% | 38%

>8% | 36%

TERM PROFILE

<5 yrs | 72%

5-10 yrs | 7%

>10 yrs | 21%

LOCATION

UK | 83%

Europe | 8%

Rest of world | 9%

1. Valuation of the loan portfolio held by the Subsidiary.

2. Alternative performance measure - refer below for definitions

and calculation methodology.

3. Including the Co-living loan which is held at net realisable

value. Excluding this loan, the weighted average annualised

yield(2) is 7.85%.

New investments

During the period, the Group made investments totalling GBP25.9

million.

Investments have been made in a number of attractive asset

classes over the period, including football finance, new build

residential property developments and construction of a

purpose-built care home.

Repayments in the period have included the final battery storage

project which the Company was invested in, resulting in a final IRR

of 9.1%. In addition, the Company has received repayment on the

first football finance position and a partial repayment of an

overseas student accommodation project.

The Investment Manager continues to see a strong pipeline of

attractive asset backed financing opportunities.

INVESTMENTS AND REPAYMENTS DURING THE PERIOD(1)

SECTOR AVERAGE SECURITY STATUS INVESTMENTS REPAYMENTS

TERM

--------------------- ------- ------------------- ------------------------ --------------- --------------

Asset finance 5 years Senior Operational GBP2.1 million GBP2.4 million

Energy and 2 years Senior Operational/Construction GBP0.7 million GBP5.4 million

infrastructure

Property(2) 1 year Senior/Subordinated Operational/Construction GBP10.2 million GBP8.6 million

Social infrastructure 8 years Senior/Subordinated Operational/Construction GBP12.9 million GBP26.3

million

--------------------- ------- ------------------- ------------------------ --------------- --------------

Total GBP25.9 GBP42.7

million million

--------------------- ------- ------------------- ------------------------ --------------- --------------

INVESTMENTS AND REPAYMENTS POST PERIOD(1)

SECTOR AVERAGE SECURITY STATUS INVESTMENTS REPAYMENTS

TERM

--------------- ------- ------------------- ------------------------ --------------- --------------

Asset finance 2 years Senior Operational GBP3.2 million GBP2.3 million

Energy and - - - - GBP0.4 million

infrastructure

Property 1 year Senior/Subordinated Operational/Construction GBP20.5 million GBP8.4 million

--------------- ------- ------------------- ------------------------ --------------- --------------

Total GBP23.7 GBP11.1

million million

--------------- ------- ------------------- ------------------------ --------------- --------------

1. The Company makes its investments through its wholly owned

Subsidiary. Refer to note 1 for further information.

2. Includes development projects that were subject to review by

the Board under the Company's investment approval process, refer to

below.

RISKS AND VIABILITY

Update on principal risks and uncertainties

The Board considers the principal uncertainties faced by the

Company during the year to be as detailed below.

UNCERTAINTY 1: Covid-19

Since early 2020, there has been a period of rapid regulatory,

economic and societal change to manage the spread of Covid-19,

which has presented challenges for operational businesses. In the

period, all remaining Covid-19 restrictions in the UK were

lifted.

Travel restrictions for Australia have remained in place during

the period, although these have now been lifted post period end.

Student accommodation projects have seen the impact of these

restrictions with reduced occupancy as universities continue to

offer hybrid learning. However, as these restrictions have now been

lifted, we expect improved occupancy moving into the next academic

year.

At the time of writing, the likelihood of new Covid-19

regulations being introduced is very low, with little political

appetite to return to such restrictions. However, businesses

continue to experience issues around staffing, illness and supply

chain management being attributed to the lasting impact of the

pandemic.

To date, the impact on the Company's portfolio has been limited

to the operation of the Co-living group and the Company's

investments in multi-use community facilities. Positively,

operational performance of both the community facility assets has

improved in the period.

Covid-19 remains a principal uncertainty for the Company and the

Board continues to monitor its impact on the Company's

portfolio.

UNCERTAINTY 2: BREXIT

Significant uncertainty around the economic relationship between

the UK and the EU continues. Following the expiry of the transition

period on 31 December 2020, the terms on which the UK will interact

with the EU continue to be negotiated.

Post period end, following the resignation of Boris Johnson, Liz

Truss won the Conservative party leadership contest and became

prime minister of the UK. We are not anticipating any major change

to the current Brexit position noting that Ms Truss' position

remained consistent with the previous administration during her

campaign to become prime minister.

Brexit legislation is having an impact on supply chain and

staffing, particularly for projects under construction or reliant

on a migrant workforce. Therefore, the Board believes that Brexit

should remain a principal uncertainty for the Company.

UNCERTAINTY 3: CONFLICT IN UKRAINE

As noted in the 2021 annual report of the Company, the Board

considers the ongoing conflict in Ukraine to be a principal

uncertainty for the Company.

Although the Company is predominantly invested in the UK with no

investments in Ukraine, Russia, or Belarus, or borrowers being

impacted by sanctions imposed due to the war, the Company's

borrowers are exposed to the increases in energy prices now being

experienced worldwide as a result of the conflict.

To date, the impact has been limited with the assets in the

portfolio absorbing increases in their budgets. However, the Board

is aware that the rise in energy costs will be a concern for all

businesses within the portfolio impacting their operating costs and

profitability.

The Board continues to monitor the wider impact of the conflict

on geopolitical relationships and volatility in the energy

market.

In the period, one of the residual risk profiles of the

principal risks included in the Company's 2021 annual report and

financial statements has increased, with the residual risk profile

of all other principal risks remaining stable. In addition, the

Board has identified a new principal risk, which is set out

below.

CATEGORY 1: CREDIT RISK

----------------------------------------------- --------------------------------- -----------------------------

CHANGE IN RESIDUAL

RISK IMPACT HOW THE RISK IS MANAGED RISK OVER THE PERIOD

--------------------- ------------------------ --------------------------------- -----------------------------

Borrower default, The success of The Investment Manager Increase

loan non-performance the Group is dependent continuously monitors During the period,

and collateral upon borrowers the actual performance inflation has driven

risks fulfilling their of projects and their increases in operational

Borrowers to payment obligations borrowers, taking action costs for borrowers

whom the Group when they fall where appropriate, and particularly with

has provided due. Failure of reports on performance regard to energy

loans default the Group to receive of the Group's portfolio prices. The subsequent

or become insolvent. payments or to to the Board each quarter. impact on supply

recover part or chain costs for construction

all amounts owed projects and salary

together with potential costs has impacted

additional costs on revenue lines

incurred from the for businesses. Where

renegotiation and/or borrowers are not

restructuring of able to pass these

loans can result costs on, this could

in substantial impact on their ability

irrecoverable costs to service their

being incurred. debt.

This could have

a material adverse To date, none of

effect on the NAV the Group's borrowers

of the Company have missed interest

and its ability or principal payments

to meet its stated as a result of cost

target returns inflation. However,

and dividend. this continues to

be an area of focus

for the Investment

Manager. Over the

next year, inflation

and energy costs

increases are expected

to present further

challenges.

CATEGORY 2: ECONOMIC RISK

----------------------------------------------- --------------------------------- -----------------------------

CHANGE IN RESIDUAL

RISK IMPACT HOW THE RISK IS MANAGED RISK OVER THE PERIOD

--------------------- ------------------------ --------------------------------- -----------------------------

Macro-economic Continued high The portfolio has partial New

The Company inflation, increases inflation protection,

invests in in energy prices, in particular on longer-dated

a variety of increases in interest loans, through a number

sectors and rates and geopolitical of different mechanisms

geographies uncertainty could including direct rate

which could have a material linkage, profit sharing

be impacted adverse effect and principal indexation.

in different on (i) the underlying These are described

ways by changes Project Companies in more detail above.

in interest e.g. by reducing In addition, the weighted

rates, inflation the value of underlying average loan life of

and the geopolitical assets or stressing the portfolio is five

environment. cash flow where years, allowing for

revenue does not reinvestment of the

keep pace with loans at prevailing

rising costs and rates.

(ii) the ability

of the Company The diversification

to meet the investment of the portfolio across

objective. 22 asset classes and

multiple geographies

also offers additional

protection in a changing

environment.

The Investment Manager

is continuing to see

opportunities for reinvestment

in attractive sectors

and at appropriate risk-adjusted

rates. It is monitoring

changes in inflation

and interest rates closely.

--------------------- ------------------------ --------------------------------- -----------------------------

Going concern and viability

The Investment Manager has carried out a going concern and

viability review. This analysed the scenarios and estimates used in

the viability assessment included in the 2021 annual report and

noted no significant variances. The analysis considered the equity

financing, debt financing and investment portfolio of the Company,

and which has been reviewed by the Board.

The Board remains of the view that none of the challenges

identified impact the going concern or viability of the

Company.

COMPANY PERFORMANCE

The Company has increased its dividend target for the year and

continues to deliver regular income to shareholders.

HY22 HY21 Relevance to strategy

------------------------------------------------ --------- -------- -----------------------------------------------

Dividends for the period 3.16p(1) 3.15p The dividend reflects the Company's aim to

deliver regular, growing dividends and is a key

element of total return.

------------------------------------------------ --------- -------- -----------------------------------------------

Basic earnings per share 2.32p 3.67p Basic EPS represents the earnings generated by

the Group's investment portfolio in line with

the investment strategy.

------------------------------------------------ --------- -------- -----------------------------------------------

Annualised total shareholder return since IPO(2) 5.2% 6.2% Total return measures the delivery of the

Company's strategy, to provide shareholders

with

attractive total returns in the longer term.

------------------------------------------------ --------- -------- -----------------------------------------------

Dividend yield(2) 6.6%(3) 6.1% The dividend yield measures the Company's

ability to deliver on its investment strategy

of

generating regular, growing dividends.

------------------------------------------------ --------- -------- -----------------------------------------------

Profit for the period GBP10.2m GBP16.1m Profit for the period measures the Company's

ability to deliver attractive risk-adjusted

returns

from its investment portfolio.

------------------------------------------------ --------- -------- -----------------------------------------------

NAV per ordinary share 98.45p(4) 102.71p The NAV per share measures the Company's aim to

deliver modest capital appreciation over the

long term.

------------------------------------------------ --------- -------- -----------------------------------------------

1. Total dividend of 3.15625 pence includes a quarterly dividend

of 1.58125 pence per share for the quarter to 30 June 2022, which

was declared post period end.

2. Alternative performance measure - refer below for definitions

and calculation methodology.

3. Total dividend declared for the period annualised, relative

to the closing share price at the period end, expressed as a

percentage.

4. Does not include a provision for the dividend in respect of

the quarter to 30 June 2022, which was declared and paid post

period end.

FINANCIAL REVIEW

The Company generated total income of GBP10.2 million, declared

dividends of 3.16(1) pence per share and delivered a total

shareholder return(2) of 2.0% for the period.

Financial performance

The Company has prepared its half-yearly report and unaudited

interim condensed financial statements in accordance with IAS 34

Interim Financial Reporting.

In the period, the Company's portfolio generated total income of

GBP13.4 million (30 June 2021: GBP19.4 million). Profit for the

period was GBP10.2 million (30 June 2021: GBP16.1 million), with

basic EPS of 2.32 pence (30 June 2021: 3.67 pence). Adjusted EPS(2)

for the period was 3.54 pence per share, which excludes the unwind

of changes in discount rates in relation to the Covid-19 pandemic

and the write-down on the Co-living loan.

The dividend for the period of 3.16(1) pence was paid as 1.58125

pence per share for the quarter to 31 March 2022 with a further

dividend of 1.58125 pence per share for the quarter to 30 June

2022, declared post period end, on 22 July 2022.

Ongoing charges

The Company's ongoing charges percentage(2) for the period,

calculated in accordance with the AIC methodology, was 1.2%

annualised (30 June 2021: 1.2% annualised).

Investment valuation

The weighted average discount rate(2) across the portfolio at 30

June 2022 was 7.62%. The valuation of investments is sensitive to

changes in discount rates applied. A sensitivity analysis detailing

the impact of a change in discount rates is given in note 14.3.

The Valuation Agent carries out a fair market valuation of the

Group's investments on behalf of the Board on a semi-annual basis.

Any assets which may be subject to discount rate changes are valued

on a quarterly basis. The valuation principles used by the

Valuation Agent are based on a discounted cash flow methodology

(excluding the Co-living loan); refer to note 14.3 for further

information. A fair value for each asset acquired by the Group is

calculated by applying a discount rate (determined by the Valuation

Agent) to the cash flow expected to arise from each asset.

Cash position

The Company received interest payments of GBP15.7 million (30

June 2021: GBP17.2 million) and capital repayments of GBP42.7

million (30 June 2021: GBP37.6 million) in the period, in line with

expectations. The Company paid cash dividends of GBP13.9 million

(30 June 2021: GBP13.9 million) and a further GBP7.0 million post

period end. Total cash reserves at the period end were GBP8.6

million (30 June 2021: GBP9.5 million).

Borrowings

The Company continues to utilise its RCF with RBSI for an amount

of GBP50 million, which expires in August 2023. At the period end

GBP1.9 million was drawn (31 December 2021: GBP19.9 million). The

Company uses the RCF to ensure it effectively utilises its cash

resources to reduce any cash drag which impacts dividend

coverage.

Conflicts of interest

In the period, GBP1.5 million was advanced under existing

facilities to finance development projects in the USA and

Australia. Post period end, the Group committed GBP18.6 million to

finance a residential development project in the USA.

The directors of the Investment Manager directly or indirectly

own an equity interest in these development projects. In accordance

with the Company's investment approval process, the investments

were reviewed and approved by the Board.

GCP Infra

Where there is any overlap for a potential investment with GCP

Infra, GCP Infra has a right of first refusal over such investment.

During the period, no investments were offered to GCP Infra under

its right of first refusal. To date, no investments offered to GCP

Infra have been accepted.

1. Total dividend of 3.1625 pence includes a quarterly dividend

of 1.58125 pence per share for the quarter to 30 June 2022, which

was declared post period end.

2. Alternative performance measure - refer below for definitions

and calculation methodology.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

Under the terms of the DTRs of the FCA, the Directors are

responsible for preparing the half-yearly report and unaudited

interim condensed financial statements in accordance with

applicable regulations.

The Directors confirm to the best of their knowledge that:

- the unaudited interim condensed financial statements have been

prepared in accordance with IAS 34 Interim Financial Reporting;

- the Chairman's interim statement and the Investment Manager's

report constitute the Company's interim management report, which

includes a fair review of the information required by DTR 4.2.7R

(indication of important events during the first six months and

description of principal risks and uncertainties for the remaining

six months of the year);

- the unaudited interim condensed financial statements include a

fair review of the information required by DTR 4.2.8R (disclosure

of related parties' transactions and changes therein); and

- the half-yearly report and unaudited interim condensed

financial statements for the period ended 30 June 2022 give a true

and fair view of the assets, liabilities, financial position and

return of the Company.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in Jersey governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

On behalf of the Board

Alex Ohlsson

Chairman

20 September 2022

INDEPENT REVIEW REPORT

To GCP Asset Backed Income Fund Limited

Report on the unaudited interim condensed financial

statements

Our conclusion

We have reviewed GCP Asset Backed Income Fund Limited's

unaudited interim condensed financial statements (the "interim

financial statements") in the half-yearly report and unaudited

interim condensed financial statements of GCP Asset Backed Income

Fund Limited for the six month period ended 30 June 2022. Based on

our review, nothing has come to our attention that causes us to

believe that the interim financial statements are not prepared, in

all material respects, in accordance with International Accounting

Standard 34, 'Interim Financial Reporting', and the Disclosure

Guidance and Transparency Rules sourcebook of the United Kingdom's

Financial Conduct Authority.

What we have reviewed

The interim financial statements comprise:

- the unaudited interim condensed statement of financial

position as at 30 June 2022;

- the unaudited interim condensed statement of comprehensive

income for the period then ended;

- the unaudited interim condensed statement of cash flows for

the period then ended;

- the unaudited interim condensed statement of changes in equity

for the period then ended; and

- the explanatory notes to the interim financial statements.

The interim financial statements included in the half-yearly

report and unaudited interim condensed financial statements have

been prepared in accordance with International Accounting Standard

34, 'Interim Financial Reporting', and the Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial

Conduct Authority.

Responsibilities for the interim financial statements and the

review

Our responsibilities and those of the Directors

The half-yearly report and unaudited interim condensed financial

statements, including the interim financial statements, is the

responsibility of, and has been approved by, the Directors. The

Directors are responsible for preparing the half-yearly report and

unaudited interim condensed financial statements in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', and the Disclosure Guidance and Transparency Rules

sourcebook of the United Kingdom's Financial Conduct Authority.

Our responsibility is to express a conclusion on the interim

financial statements in the half-yearly report and unaudited

interim condensed financial statements based on our review. This

report, including the conclusion, has been prepared for and only

for the Company for the purpose of complying with the Disclosure

Guidance and Transparency Rules sourcebook of the United Kingdom's

Financial Conduct Authority and for no other purpose. We do not, in

giving this conclusion, accept or assume responsibility for any

other purpose or to any other person to whom this report is shown

or into whose hands it may come save where expressly agreed by our

prior consent in writing.

What a review of interim financial statements involves

We conducted our review in accordance with International

Standard on Review Engagements 2410, 'Review of Interim Financial

Information Performed by the Independent Auditor of the Entity'

issued by the International Auditing and Assurance Standards Board.

A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing and,

consequently, does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

We have read the other information contained in the half-yearly

report and unaudited interim condensed financial statements and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the interim

financial statements.

PricewaterhouseCoopers CI LLP

Chartered Accountants

Jersey, Channel Islands

20 September 2022

UNAUDITED INTERIM CONDENSED STATEMENT OF COMPREHENSIVE

INCOME

For the period ended 30 June 2022

Period Period

ended ended

30 June 30 June

2022 2021

Notes GBP'000 GBP'000

--------------------------------------------------------------------------------------------- ----- ------- -------

Income

Loan interest realised 3 15,731 17,231

Net loss on financial assets at fair value through profit or loss 3 (2,459) (1,225)

Net (loss)/gain on derivative financial instruments 3 (558) 773

--------------------------------------------------------------------------------------------- ----- ------- -------

Net changes in fair value of financial assets and financial liabilities at fair value through

profit or loss 12,714 16,779

Other income 3 722 2,634

--------------------------------------------------------------------------------------------- ----- ------- -------

Total income 13,436 19,413

--------------------------------------------------------------------------------------------- ----- ------- -------

Expenses

Investment management fees 15 (1,907) (1,972)

Operating expenses (808) (787)

Directors' remuneration 15 (104) (100)

--------------------------------------------------------------------------------------------- ----- ------- -------

Total expenses (2,819) (2,859)

--------------------------------------------------------------------------------------------- ----- ------- -------

Total operating profit before finance costs 10,617 16,554

--------------------------------------------------------------------------------------------- ----- ------- -------

Finance costs

Finance expenses 4 (430) (426)

--------------------------------------------------------------------------------------------- ----- ------- -------

Total profit and comprehensive income 10,187 16,128

--------------------------------------------------------------------------------------------- ----- ------- -------

Basic and diluted earnings per share (pence) 7 2.32 3.67

--------------------------------------------------------------------------------------------- ----- ------- -------

All items in the above statement are derived from continuing

operations.

The notes below form an integral part of the financial

statements.

UNAUDITED INTERIM CONDENSED STATEMENT OF FINANCIAL POSITION

As at 30 June 2022

(Audited)

As at As at

30 June 31 December

2022 2021

Notes GBP'000 GBP'000

------------------------------------------------------ ----- ----------- -----------

Assets

Cash and cash equivalents 10 8,603 10,108

Derivative financial instruments 14 - 492

Other receivables and prepayments 9 35 128

Financial assets at fair value through profit or loss 8 427,705 446,989

------------------------------------------------------ ----- ----------- -----------

Total assets 436,343 457,717

------------------------------------------------------ ----- ----------- -----------

Liabilities

Derivative financial instruments 14 (229) -

Other payables and accrued expenses 12 (1,440) (1,445)

Revolving credit facilities 11 (1,643) (19,546)

------------------------------------------------------ ----- ----------- -----------

Total liabilities (3,312) (20,991)

------------------------------------------------------ ----- ----------- -----------

Net assets 433,031 436,726

------------------------------------------------------ ----- ----------- -----------

Equity

Share capital 13 442,607 442,607

Retained losses (9,576) (5,881)

------------------------------------------------------ ----- ----------- -----------

Total equity 433,031 436,726

------------------------------------------------------ ----- ----------- -----------

Ordinary shares in issue (excluding treasury shares) 13 439,833,518 439,833,518

------------------------------------------------------ ----- ----------- -----------

NAV per ordinary share (pence per share) 98.45 99.29

------------------------------------------------------ ----- ----------- -----------

The unaudited interim condensed financial statements were

approved and authorised for issue by the Board of Directors on

20 September 2022 and signed on its behalf by:

Alex Ohlsson

Chairman

Colin Huelin FCA

Director

The notes below form an integral part of the financial

statements.

UNAUDITED INTERIM CONDENSED STATEMENT OF CHANGES IN EQUITY

For the period ended 30 June 2022

Share Retained Total

capital losses equity

Notes GBP'000 GBP'000 GBP'000

----------------------------------------------------- ----- ------- -------- --------

Balance as at 1 January 2022 442,607 (5,881) 436,726

Total profit and comprehensive income for the period - 10,187 10,187

Dividends paid 6 - (13,882) (13,882)

----------------------------------------------------- ----- ------- -------- --------

Balance as at 30 June 2022 442,607 (9,576) 433,031

----------------------------------------------------- ----- ------- -------- --------

UNAUDITED INTERIM CONDENSED STATEMENT OF CHANGES IN EQUITY

For the period ended 30 June 2021

Share Retained Total

capital earnings equity

Notes GBP'000 GBP'000 GBP'000

----------------------------------------------------- ----- ------- -------- --------

Balance as at 1 January 2021 442,900 6,862 449,762

Total profit and comprehensive income for the period - 16,128 16,128

Share repurchases 13 (293) - (293)

Dividends paid 6 - (13,860) (13,860)

----------------------------------------------------- ----- ------- -------- --------

Balance as at 30 June 2021 442,607 9,130 451,737

----------------------------------------------------- ----- ------- -------- --------

The notes below form an integral part of the financial

statements.

UNAUDITED INTERIM CONDENSED STATEMENT OF CASH FLOWS

For the period ended 30 June 2022

Period Period

ended ended

30 June 30 June

2022 2021

Notes GBP'000 GBP'000

------------------------------------------------------------------------------------------- ----- -------- --------

Cash flows from operating activities

Total operating profit before finance costs 10,617 16,554

Adjustments for:

Net changes in fair value of financial assets and financial liabilities at fair value

through

profit or loss 3 (12,714) (16,779)

Realised gains on derivative instruments 3 163 892

Increase/(decrease) in other payables and accrued expenses 11 (120)

Decrease/(increase) in other receivables and prepayments 93 (2,163)

------------------------------------------------------------------------------------------- ----- -------- --------

Total (1,830) (1,616)

------------------------------------------------------------------------------------------- ----- -------- --------

Loan interest realised 3 15,731 17,231

Investment in Subsidiary 8 (25,896) (69,433)

Capital repayments from Subsidiary 8 42,721 37,624

------------------------------------------------------------------------------------------- ----- -------- --------

Net cash flow generated from/(used in) operating activities 30,726 (16,194)

------------------------------------------------------------------------------------------- ----- -------- --------

Cash flows from financing activities

Proceeds from revolving credit facilities 11 11,500 34,150

Repayment of revolving credit facilities 11 (29,500) (4,000)

Share repurchases 13 - (293)

Finance costs paid (349) (342)

Dividends paid 6 (13,882) (13,860)

------------------------------------------------------------------------------------------- ----- -------- --------

Net cash flow (used in)/generated from financing activities (32,231) 15,655

------------------------------------------------------------------------------------------- ----- -------- --------

Net decrease in cash and cash equivalents (1,505) (539)

Cash and cash equivalents at beginning of the period 10,108 9,994

------------------------------------------------------------------------------------------- ----- -------- --------

Cash and cash equivalents at end of the period 8,603 9,455

------------------------------------------------------------------------------------------- ----- -------- --------

Net cash flow used in operating activities includes:

Loan interest realised 3 15,731 17,231

------------------------------------------------------------------------------------------- ----- -------- --------

The notes below form an integral part of the financial

statements.

NOTES TO THE UNAUDITED INTERIM CONDENSED FINANCIAL

STATEMENTS

For the period ended 30 June 2022

1. General information

The Company is a public closed-ended investment company

incorporated on 7 September 2015 and domiciled in Jersey, with

registration number 119412. The Company is governed by the

provisions of the Jersey Company Law and the CIF Law.

The ordinary and C shares (when in issue) of the Company are

admitted to the Official List of the FCA and are traded on the

Premium Segment of the Main Market of the LSE.

The Company makes its investments through its wholly owned

Subsidiary, by subscribing for the Secured Loan Notes issued by the

Subsidiary. The Subsidiary subsequently on - lends the funds to

borrowers.

At 30 June 2022, the Company had one wholly owned Subsidiary,

GABI UK, (31 December 2021: one) incorporated in England and Wales

on 23 October 2015 (registration number 9838893). GABI UK had two

subsidiaries (31 December 2021: two): GABI Housing (registration

number 10497254) incorporated in England and Wales on 25 November

2016 and GABI GS (registration number 10546087) incorporated in

England and Wales on 4 January 2017. The Company, GABI UK, GABI

Housing (including its subsidiary, GABI Blyth (dissolved on 7 June

2022)) and GABI GS comprises the Group. The registered office

address for GABI UK, GABI Housing, GABI Blyth (prior to its

dissolution) and GABI GS is 24 Savile Row, London W1S 2ES.

GABI GS holds shares as security for loans issued to underlying

borrowers, where required. Its purpose is to isolate any potential

liabilities that may arise from holding shares as security from the

Company.

GABI Housing invests in five properties and the social income

stream that is derived from these properties through letting them

to specialist housing associations.

The Company, through its Subsidiary, seeks to meet its

investment objective through a diversified portfolio of investments

which are secured against, or comprise, contracted, predictable

medium to long-term cash flows and/or physical assets.

The Group's investments are predominantly in the form of medium

to long-term fixed or floating rate loans which are secured against

cash flows and/or physical assets which are predominantly UK

based.

The Group's investments are typically unquoted and include, but

are not limited to, senior loans, subordinated loans, mezzanine

loans, bridge loans and other debt instruments. The Group may also

make limited investments in equities, equity-related derivative

instruments such as warrants, controlling equity positions

(directly or indirectly) and/or directly in physical assets.

The Group at all times invests and manages its assets in a

manner which is consistent with the objective of spreading

investment risk.

Where possible, investments are structured to benefit from

partial inflation and/or interest rate protection.

2. Significant accounting policies

The principal accounting policies applied in the preparation of

these unaudited interim condensed financial statements are set out

below. In the current period, the Company has applied amendments to

IFRS. These include annual improvements to IFRS, changes in

standards, legislative and regulatory amendments, changes in

disclosure and presentation requirements. The adoption of these has