TIDMGACA

RNS Number : 2977D

General Accident PLC

02 March 2022

2 March 2022

GENERAL ACCIDENT PLC

2021 ANNUAL REPORT AND FINANCIAL STATEMENTS

On 2 March 2022, General Accident plc (the "Company") released

its 2021 Preliminary Results Announcement for the year ended 31

December 2021. The Company announces it has today issued the 2021

Annual Report and Financial Statements.

The document is available to view on the Company's website at

https://www.aviva.com/investors/reports/ and copies have been

submitted to the National Storage Mechanism and will shortly be

available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

Printed copies of the 2021 Annual Report and Financial

Statements can be requested free of charge by shareholders by

contacting the Company's Registrar, Computershare Investor Services

PLC, on 0371 495 0105 or at AvivaSHARES@computershare.co.uk, or by

writing to the Group Company Secretary, Aviva plc, St Helen's, 1

Undershaft, London EC3P 3DQ.

Enquiries:

Kirsty Cooper, Group General Counsel and Company Secretary

Telephone - 020 7662 6646

Roy Tooley, Head of Secretariat - Corporate

Telephone - +44 (0)7800 699781

Information required under Disclosure & Transparency Rule

6.3

This announcement should be read in conjunction with the

Company's preliminary results announcement issued on 2 March 2022.

Together these constitute the material required by DTR 6.3 to be

communicated to the media in full unedited text through a

Regulatory Information Service. This material is not a substitute

for reading the Company's 2021 Annual report and financial

statements. Page and note references in the text below refer to

page numbers and notes in the 2021 Annual report and financial

statements.

Statement of directors' responsibilities in respect of the

financial statements

The directors are responsible for preparing the strategic

report, directors' report and the financial statements in

accordance with applicable law and regulations.

Company law requires the directors to prepare financial

statements for each financial year. Under that law the directors

have prepared the financial statements in accordance with

UK-adopted international accounting standards. Under company law,

directors must not approve the financial statements unless they are

satisfied that they give a true and fair view of the state of

affairs of the Company and of the profit or loss of the Company for

that period. In preparing the financial statements, the directors

are required to:

- select suitable accounting policies and then apply them consistently;

- state whether applicable UK-adopted international accounting

standards have been followed, subject to any material departures

disclosed and explained in the financial statements;

- make judgements and accounting estimates that are reasonable and prudent; and

- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The directors are responsible for safeguarding the assets of the

company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements comply with the Companies Act 2006.

The directors are responsible for the maintenance and integrity

of the company's financial statements published on the ultimate

parent company's website. Legislation in the United Kingdom

governing the preparation and dissemination of financial statements

may differ from legislation in other jurisdictions.

Directors' confirmations

Each of the directors, whose names and functions are listed in

Directors and officers confirm that, to the best of their

knowledge:

- the company financial statements, which have been prepared in

accordance with UK-adopted international accounting standards, give

a true and fair view of the assets, liabilities, financial position

and profit of the company; and

- the Strategic report includes a fair review of the development

and performance of the business and the position of the company,

together with a description of the principal risks and

uncertainties that it faces.

Corporate governance

The Company is a wholly-owned subsidiary of Aviva plc, a company

with a premium listing on the London Stock Exchange, and as such is

subject to Aviva plc's system of risk management, internal control

and financial reporting. Aviva plc is subject to the UK Corporate

Governance Code. The Aviva plc Annual Report and Accounts set out

details of how the Aviva Group has applied the principles and

complied with the provisions of the UK Corporate Governance Code

during 2021. Further information on the Code can be found on the

Financial Reporting Council's website, www.frc.org.uk .

13. Risk management

(a) Risk management framework

The Company operates a risk management framework that forms an

integral part of the management and Board processes and

decision-making framework, aligned to the Group's risk management

framework.

The Company's risk management approach is aimed at actively

identifying, measuring, managing, monitoring and reporting

significant existing and emerging risks. Risks are managed

considering the significance of the risk to the business and its

internal and external stakeholders.

To promote a consistent and rigorous approach to risk management

across all businesses, the Group has a set of risk policies and

business standards which set out the risk strategy, appetite,

framework and minimum requirements for the Group's worldwide

operations, including the Company.

For the purposes of risk identification and measurement, and

aligned to the Company's risk policies, risks are usually grouped

by risk type: credit, market, liquidity and operational risk. Risks

falling within these types may affect a number of metrics including

those relating to statement of financial position strength,

liquidity and profit.

The directors recognise the critical importance of having

efficient and effective risk management systems in place and

acknowledge that they are responsible for the Company's framework

of internal control and of reviewing its effectiveness. The

framework is designed to manage rather than eliminate the risk of

failure to achieve the Company's objectives and can only provide

reasonable assurance against misstatement or loss. The directors of

the Company are satisfied that their adherence to this Group

framework provides an adequate means of managing risk in the

Company.

Further information on the types and management of specific risk

types is given in sections (b) to (f) below.

(b) Credit risk

Credit risk is the risk of financial loss as a result of the

default or failure of third parties to meet their payment

obligations to the Company, or variations in market values as a

result of changes in expectation related to these risks.

The credit quality of receivables and other financial assets is

monitored by the Company, and provisions are made for expected

credit losses. Expected credit losses on material receivables and

other assets are calculated with reference to the Company's

historical experience of losses, along with an analysis of payment

terms. Short term financial assets (where all amounts are

receivable within 12 months from the reporting date) do not

generally attract an expected credit loss charge, unless there is

objective evidence that losses are likely to arise.

The Company makes use of the simplified approach when

calculating expected credit losses on trade receivables which don't

include a significant financing component, and therefore calculates

expected credit losses over the lifetime of the instrument in

question. As at the reporting date, no lifetime expected credit

losses have been recognised in relation to receivables.

The Company has not purchased or originated any credit-impaired

financial assets as at the reporting date.

The Company's financial assets primarily comprise loans and

receivables due from its parent, Aviva plc, which has an external

issuer credit rating of A (issuer credit ratings represent an

issuer's ability to meet its overall financial commitments as they

fall due), and as such the credit risk arising from the

counterparty failing to meet all or part of their obligations is

considered remote. There are no material expected credit losses

recognised in relation to loans due from Aviva plc.

In addition, the loan amounting to GBP9,484 million (2020:

GBP9,529 million) is secured by a legal charge against the ordinary

share capital of Aviva Group Holdings Limited. Due to the nature of

the financial assets, and the fact that the loans are intended to

be held until settled, by the issuer (on maturity or earlier if

redeemed before maturity), and not traded, the Company is not

exposed to the risk of changes to the market value caused by

changing perceptions of the credit worthiness of Aviva plc.

Expected credit losses at 31 December 2021 were GBPnil (2020:

GBPnil).

(c) Market risk

Market risk is the risk of an adverse financial impact resulting

directly or indirectly from fluctuations in interest rates,

inflation, foreign currency exchange rates, equity prices and

property values. At the statement of financial position date, the

Company did not have any material exposure to currency exchange

rates, equity prices or property values.

Interest rate risk arises from the inter-company loans

receivable (see note 8). The net asset value of the Company's

financial resources is not materially affected by fluctuations in

interest rates. In January 2021, the loan due from the Company's

parent (see note 14(a)) was reset at a fixed interest rate until it

matures on 31 December 2022, consequently the Company's interest

income and profits are no longer sensitive to changes in interest

rates up to the date the loan matures.

(d) Liquidity risk

Liquidity risk is the risk of not being able to make payments as

they become due because there are insufficient assets in cash

form.

The Company does not hold any assets in cash form. Cash

settlements of its dividend obligations to holders of preference

shares, which are discretionary and subject to director resolution,

pass through an intercompany account.

(e) Operational risk

Operational risk is the risk of a direct or indirect loss,

arising from inadequate or failed internal processes, people and

systems, or external events, including changes in the regulatory

environment.

Given its limited activities, the key operational risks to the

Company are inadequate governance and lack of sufficiently robust

financial controls. The risks are mitigated by the Company's

implementation of the Group's risk management policies and

framework and compliance with the Group's Financial Reporting

Control Framework.

(f) Capital management

The Company's capital risk is determined with reference to the

requirements of the Company's stakeholders. In managing capital,

the Company seeks to maintain sufficient, but not excessive,

financial strength to support the payment of preference dividends

and the requirements of other stakeholders. The sources of capital

used by the Company are equity shareholders' funds and preference

shares. At 31 December 2021 the Company had GBP13,932 million

(2020: GBP13,932 million) of total capital employed.

14. Related party transactions

T he Company had the following transactions with related

parties, which include parent companies, subsidiaries, and fellow

Group companies in the normal course of business.

(a) Loans due from parent company

On 14 December 2017, the Company provided a loan to Aviva plc,

its parent company, of GBP9,990 million with a maturity date of 31

December 2022. For 2020 and 2019, the loan has accrued interest at

65 basis points above 3 month LIBOR (and in the event that the

LIBOR rate is less than zero, the rate shall be deemed to be zero).

From January 2021, as a result of LIBOR being abolished, this loan

was reset at a fixed interest rate. This rate was set as follows;

5- year

Gilt (-0.105% as of 1 January 2021) + Basis adjustment 0.15% +

0.65% floor. The principal loan has a maturity date of 31 December

2022, however it is the intention of both parties that this

facility will be renewed in full upon maturity and has been

presented within over 5 years maturity in the table below.

As at the statement of financial position date, the loan balance

outstanding was GBP9,484 million (2020: GBP9,529 million). This

facility has been secured against the ordinary share capital of

Aviva Group Holdings Limited. The loan agreement also includes a

penalty interest charge of 1% above the interest rate if any

amounts payable under the loan agreement remain outstanding. As at

31 December 2021, no amounts remain outstanding.

The maturity analysis of the related party loans receivable is

as follows:

2021 2020

GBPm GBPm

1-5 years - 9,529

Over 5 years 9,484 -

9,484 9,529

----------------------- ------------------------------------

Effective interest rate 0.70% 1.25%

----------------------- ------------------------------------

The interest received on these loans shown in the income

statement is GBP66 million (2020: GBP120 million). See note 1.

(b) Other transactions

(i) Services provided to related parties

Services

provided

to related

parties 2021 2020

---------- --------------------------------------------- ---------------------------------- ----------------------------------------------------------------- -------------------------------------------

Expenses incurred Receivable Expenses incurred Receivable

in the year at year end in the year at year end

GBP'000 GBPm GBPm GBPm

Immediate

parent 40 4,448 - 4,403

40 4,448 - 4,403

--------------------------------------------- ---------------------------------- ---------------------------------------------------------------------------- -------------------------------------------

The related parties' receivables are not secured and no

guarantees were received in respect thereof. The receivables will

be settled in accordance with normal credit terms.

(ii) Audit fees

Expenses incurred in the year represents audit fees. There were

no non-audit fees paid to the Company's auditors during the year

(2020: GBPnil). Audit fees as described in note 4 are borne by the

Company's ultimate parent, Aviva plc.

(iii) Dividends paid

Dividends paid relates to an intercompany transaction of GBP45

million (2020: GBP101 million) with the Company's parent, Aviva

plc. Preference dividends of GBP21 million (2020: GBP21 million)

were approved on behalf of the Company by its parent, Aviva plc.

Refer to note 6.

(c) Key management compensation

Key management, which comprises the directors of the Company,

are not remunerated directly for their services as directors of the

Company and the amount of time spent performing their duties is

incidental to their role across the Group. All such costs are borne

by Aviva plc and are not recharged to the Company. See note 3 for

details of directors' remuneration.

(d) Ultimate parent entity

The ultimate parent entity and controlling party is Aviva plc, a

public limited Group incorporated and domiciled in the United

Kingdom. This is the parent undertaking of the smallest and largest

Group to consolidate these financial statements. Copies of Aviva

plc consolidated financial statements are available on application

to the Group Company Secretary, Aviva plc, St Helen's, 1

Undershaft, London EC3P 3DQ, and on the Aviva plc website at

www.aviva.com .

15. Subsequent events

There are no subsequent events to report.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSSSFEDFEESEFD

(END) Dow Jones Newswires

March 02, 2022 03:01 ET (08:01 GMT)

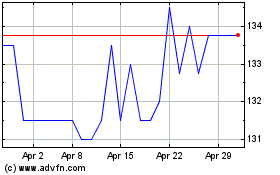

Gen.acc.8se.pf (LSE:GACA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gen.acc.8se.pf (LSE:GACA)

Historical Stock Chart

From Apr 2023 to Apr 2024