TIDMGAL

RNS Number : 3106N

Galantas Gold Corporation

31 May 2022

GALANTAS GOLD CORPORATION

TSXV & AIM: Symbol GAL

GALANTAS REPORT FINANCIAL RESULTS FOR THE QUARTERED MARCH 31,

2022

May 31, 2022: Galantas Gold Corporation (the 'Company') is

pleased to announce its unaudited financial results for the Quarter

ended March 31, 2022.

Financial Highlights

Highlights of the first quarter 2022 results, which are

expressed in Canadian Dollars, are summarized below:

All figures denominated in Canadian Dollars (CDN$)

Quarter Ended

March 31

2022 2021

Revenue $ 0 $ 0

Cost and expenses of operations $ (46,639) $ (46,148)

Loss before the undernoted $ (46,639) $ (46,148)

Depreciation $ (130,531) $ (72,065)

General administrative expenses $ (1,171,170) $ (505,097)

Foreign exchange (loss) gain $ (67,472) $ (16,653)

Net (Loss) for the quarter $ (1,415,812) $ (639,963)

Working Capital Deficit $ (1,850,980) $ (8,532,943)

Cash loss from operating activities before changes in non-cash working capital $ (577,604) $ (296,161)

Cash at March 31, 2022 $ 2,417,152 $ 487,193

Sales revenue for the quarter ended March 31, 2022 amounted to $

Nil compared to revenue of $ Nil for the quarter ended March 31,

2021. Shipments of concentrate commenced during the third quarter

of 2019. Concentrate sales provisional revenues totalled US$

219,000 for the first quarter of 2022 compared to US $ 567,000 for

the first quarter of 2021. Until the mine commences commercial

production, the net proceeds from concentrate sales are being

offset against development assets.

The Net Loss for the quarter ended March 31, 2022 amounted to $

1,415,812 (2021: $639,963) and the cash outflow from operating

activities before changes in non-cash working capital for the

quarter ended March 31, 2022 amounted to $577,604 (2021:

$296,161).

The Company had a cash balance of $2,417,152 at March 31, 2022

compared to $ 487,193 at March 31, 2021. The working capital

deficit at March 31, 2022 amounted to $ 1,850,980 compared to a

working capital deficit of $8,532,943 at March 31, 2021.

Safety is a high priority for the Company and we continue to

invest in safety-related training and infrastructure. The zero lost

time accident rate since the start of underground operations

continues. Environmental monitoring demonstrates a high level of

regulatory compliance.

The detailed results and Management Discussion and Analysis

(MD&A) are available on www.sedar.com and www.galantas.com and

the highlights in this release should be read in conjunction with

the detailed results and MD&A. The MD&A provides an

analysis of comparisons with previous periods, trends affecting the

business and risk factors.

http://www.rns-pdf.londonstockexchange.com/rns/3106N_1-2022-5-30.pdf

Qualified Person

The financial components of this disclosure have been reviewed

by Alan Buckley (Chief Financial Officer) and the production and

permitting components by Brendan Morris (COO), qualified persons

under the meaning of NI. 43-101. The information is based upon

local production and financial data prepared under their

supervision.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS: This press

release contains forward-looking statements within the meaning of

the United States Private Securities Litigation Reform Act of 1995

and applicable Canadian securities laws, including revenues and

cost estimates, for the Omagh Gold project. Forward-looking

statements are based on estimates and assumptions made by Galantas

in light of its experience and perception of historical trends,

current conditions and expected future developments, as well as

other factors that Galantas believes are appropriate in the

circumstances. Many factors could cause Galantas' actual results,

the performance or achievements to differ materially from those

expressed or implied by the forward looking statements or strategy,

including: gold price volatility; discrepancies between actual and

estimated production, actual and estimated metallurgical recoveries

and throughputs; mining operational risk, geological uncertainties;

regulatory restrictions, including environmental regulatory

restrictions and liability; risks of sovereign involvement;

speculative nature of gold exploration; dilution; competition; loss

of or availability of key employees; additional funding

requirements; uncertainties regarding planning and other permitting

issues; and defective title to mineral claims or property. These

factors and others that could affect Galantas's forward-looking

statements are discussed in greater detail in the section entitled

"Risk Factors" in Galantas' Management Discussion & Analysis of

the financial statements of Galantas and elsewhere in documents

filed from time to time with the Canadian provincial securities

regulators and other regulatory authorities. These factors should

be considered carefully, and persons reviewing this press release

should not place undue reliance on forward-looking statements.

Galantas has no intention and undertakes no obligation to update or

revise any forward-looking statements in this press release, except

as required by law.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

Enquiries

Galantas Gold Corporation

Mario Stifano - CEO

Email: info@galantas.com

Website: www.galantas.com

Telephone: 001 416 453 8433

Grant Thornton UK LLP (Nomad)

Philip Secrett, Harrison Clarke, George Grainger, Samuel

Littler:

Telephone: +44(0)20 7383 5100

Panmure Gordon & Co (AIM Broker & Corporate Adviser)

Hugh Rich, John Prior:

Telephone: +44(0)20 7886 2500

GALANTAS GOLD CORPORATION

Condensed Interim Consolidated Financial Statements

(Expressed in Canadian Dollars)

(Unaudited)

Three Months Ended March 31, 2022

NOTICE TO READER

The accompanying unaudited condensed interim consolidated

financial statements of Galantas Gold Corporation (the "Company")

have been prepared by and are the responsibility of management. The

unaudited condensed interim consolidated financial statements have

not been reviewed by the Company's auditors.

Galantas Gold Corporation

Condensed Interim Consolidated Statements of Financial

Position

(Expressed in Canadian Dollars)

(Unaudited)

As at As at

March 31, December 31,

2022 2021

------------------------------------------------------------ ----------- ------------

ASSETS

Current assets

Cash and cash equivalents $ 2,417,152 $ 1,069,751

Accounts receivable and prepaid expenses (note 4) 731,709 1,279,935

Inventories (note 5) 13,626 108,788

------------------------------------------------------------- ----------- ------------

Total current assets 3,162,487 2,458,474

Non-current assets

Property, plant and equipment (note 6) 27,300,093 25,688,836

Long-term deposit (note 8) 492,510 513,960

Exploration and evaluation assets (note 7) 1,934,312 1,574,183

------------------------------------------------------------- ----------- ------------

Total non-current assets 29,726,915 27,776,979

------------------------------------------------------------- ----------- ------------

Total assets $ 32,889,402 $ 30,235,453

--------------------------------------------------------- ----------- ------------

EQUITY AND LIABILITIES

Current liabilities

Accounts payable and other liabilities (notes 9 and 17) $ 3,026,740 $ 3,013,999

Due to related parties (note 15) 1,440,977 124,317

Leases (note 11) 545,750 416,040

------------------------------------------------------------- ----------- ------------

Total current liabilities 5,013,467 3,554,356

Non-current liabilities

Non-current portion of financing facilities (note 10) 4,199,285 4,247,488

Due to related parties (note 15) 2,462,530 2,444,376

Decommissioning liability (note 8) 575,462 600,525

------------------------------------------------------------- ----------- ------------

Total non-current liabilities 7,237,277 7,292,389

------------------------------------------------------------- ----------- ------------

Total liabilities 12,250,744 10,846,745

------------------------------------------------------------- ----------- ------------

Equity

Share capital (note 12(a)(b)) 61,876,670 57,783,570

Reserves 14,008,031 15,435,369

Deficit (55,246,043) (53,830,231)

------------------------------------------------------------- ----------- ------------

Total equity 20,638,658 19,388,708

------------------------------------------------------------- ----------- ------------

Total equity and liabilities $ 32,889,402 $ 30,235,453

--------------------------------------------------------- ----------- ------------

The notes to the unaudited condensed interim consolidated

financial statements are an integral part of these statements.

Going concern (note 1)

Incorporation and nature of operations (note 2)

Contingency (note 17)

Event after the reporting period (note 18)

Galantas Gold Corporation

Condensed Interim Consolidated Statements of Loss

(Expressed in Canadian Dollars)

(Unaudited)

Three Months Ended

March 31,

2022 2021

---------------------------------------------------------------------------- ---------- ----------

Revenues

Sales of concentrate (note 14) $ - $ -

Cost and expenses of operations

Cost of sales 46,639 46,148

Depreciation (note 6) 130,531 72,065

----------------------------------------------------------------------------- ---------- ----------

177,170 118,213

---------------------------------------------------------------------------- ---------- ----------

Loss before general administrative and other expenses (177,170) (118,213)

----------------------------------------------------------------------------- ---------- ----------

General administrative expenses

Management and administration wages (note 15) 117,640 144,083

Other operating expenses 78,788 32,580

Accounting and corporate 152,979 15,184

Legal and audit 63,640 49,173

Stock-based compensation (note 12(d)) 350,539 4,631

Shareholder communication and investor relations 135,787 59,853

Transfer agent 4,015 2,861

Director fees (note 15) 35,000 8,500

General office 21,187 3,569

Accretion expenses (notes 8, 10 and 15) 120,487 104,560

Loan interest and bank charges less deposit interest (notes 10 and 15) 91,108 80,103

----------------------------------------------------------------------------- ---------- ----------

1,171,170 505,097

Other expenses

Foreign exchange loss 67,472 16,653

----------------------------------------------------------------------------- ---------- ----------

67,472 16,653

---------------------------------------------------------------------------- ---------- ----------

Net loss for the period $ (1,415,812) $ (639,963)

------------------------------------------------------------------------- ---------- ----------

Basic and diluted net loss per share (note 13) $ (0.02) $ (0.01)

------------------------------------------------------------------------- ---------- ----------

Weighted average number of common shares outstanding - basic and diluted 78,556,743 46,565,537

----------------------------------------------------------------------------- ---------- ----------

The notes to the unaudited condensed interim consolidated

financial statements are an integral part of these statements.

Galantas Gold Corporation

Condensed Interim Consolidated Statements of Comprehensive

Loss

(Expressed in Canadian Dollars)

(Unaudited)

Three Months Ended

March 31,

2022 2021

------------------------------------------------------------------ ---------- --------

Net loss for the period $ (1,415,812) $(639,963)

Other comprehensive loss

Items that will be reclassified subsequently to profit or loss

Exchange differences on translating foreign operations (870,977) (96,925)

------------------------------------------------------------------- ---------- --------

Total comprehensive loss $ (2,286,789) $(736,888)

--------------------------------------------------------------- ---------- --------

The notes to the unaudited condensed interim consolidated

financial statements are an integral part of these statements.

Galantas Gold Corporation

Condensed Interim Consolidated Statements of Cash Flows

(Expressed in Canadian Dollars)

(Unaudited)

Three Months Ended

March 31,

2022 2021

---------------------------------------------------------------------------- ---------- --------

Operating activities

Net loss for the period $ (1,415,812) $(639,963)

Adjustment for:

Depreciation (note 6) 130,531 72,065

Stock-based compensation (note 12(d)) 350,539 4,631

Accrued interest (notes 10 and 15) 171,614 78,874

Foreign exchange loss 93,714 79,672

Accretion expenses (notes 8, 10 and 15) 91,810 104,560

Non-cash working capital items:

Accounts receivable and prepaid expenses 567,842 260,990

Inventories 95,585 48,145

Accounts payable and other liabilities (82,217) 19,284

Due to related parties (129,249) 91,762

----------------------------------------------------------------------------- ---------- --------

Net cash and cash equivalents (used in) provided by operating activities (125,643) 120,020

----------------------------------------------------------------------------- ---------- --------

Investing activities

Net purchase of property, plant and equipment (2,458,074) (172,550)

Exploration and evaluation assets (425,831) (47,366)

Lease payments (note 11) (137,145) -

----------------------------------------------------------------------------- ---------- --------

Net cash and cash equivalents used in investing activities (3,021,050) (219,916)

----------------------------------------------------------------------------- ---------- --------

Financing activities

Proceeds from exercise of warrants 3,135,200 -

Advances from related parties 1,380,477 -

Repayment of financing facilities - (23,802)

----------------------------------------------------------------------------- ---------- --------

Net cash and cash equivalents provided by (used in) financing activities 4,515,677 (23,802)

----------------------------------------------------------------------------- ---------- --------

Net change in cash and cash equivalents 1,368,984 (123,698)

Effect of exchange rate changes on cash held in foreign currencies (21,583) (1,203)

Cash and cash equivalents, beginning of period 1,069,751 612,094

Cash and cash equivalents, end of period $ 2,417,152 $ 487,193

------------------------------------------------------------------------- ---------- --------

Cash $ 2,417,152 $ 487,193

Cash equivalents - -

------------------------------------------------------------------------- ---------- --------

Cash and cash equivalents $ 2,417,152 $ 487,193

------------------------------------------------------------------------- ---------- --------

The notes to the unaudited condensed interim consolidated

financial statements are an integral part of these statements.

Galantas Gold Corporation

Condensed Interim Consolidated Statements of Changes in

Equity

(Expressed in Canadian Dollars)

(Unaudited) Reserves

--------------------------------------

Equity

settled Foreign

share-based currency

translation

Share Warrants payments

capital reserve reserve reserve Deficit Total

------------------ ---------- --------- ----------- ----------- ----------- ----------

Balance, December

31, 2020 $ 52,933,594 $ 340,000 $ 8,381,382 $ 1,012,739 $(48,545,800) $14,121,915

Stock-based

compensation (note

12(d)) - - 4,631 - - 4,631

Exchange differences

on translating

foreign operations - - - (96,925) - (96,925)

Net loss for the

period - - - - (639,963) (639,963)

---------------------- ---------- --------- ----------- ----------- ----------- ----------

Balance, March 31,

2021 $ 52,933,594 $ 340,000 $ 8,386,013 $ 915,814 $(49,185,763) $13,389,658

------------------ ---------- --------- ----------- ----------- ----------- ----------

Balance, December

31, 2021 $ 57,783,570 $4,130,200 $ 10,417,260 $ 887,909 $(53,830,231) $19,388,708

------------------ ---------- --------- ----------- ----------- ----------- ----------

Warrants issued (note

15(a)(ii)) - 51,000 - - - 51,000

Stock-based

compensation (note

12(d)) - - 350,539 - - 350,539

Exercise of warrants 4,093,100 (957,900) - - - 3,135,200

Exchange differences

on translating

foreign operations - - - (870,977) - (870,977)

Net loss for the

period - - - - (1,415,812) (1,415,812)

---------------------- ---------- --------- ----------- ----------- ----------- ----------

Balance, March 31,

2022 $ 61,876,670 $3,223,300 $ 10,767,799 $ 16,932 $(55,246,043) $20,638,658

------------------ ---------- --------- ----------- ----------- ----------- ----------

The notes to the unaudited condensed interim consolidated

financial statements are an integral part of these statements.

Galantas Gold Corporation

Notes to Condensed Interim Consolidated Financial Statements

Three Months Ended March 31, 2022

(Expressed in Canadian Dollars)

(Unaudited)

-------------------------------------------------------------

1. Going Concern

These unaudited condensed interim consolidated financial

statements have been prepared on a going concern basis which

contemplates that Galantas Gold Corporation (the "Company") will be

able to realize assets and discharge liabilities in the normal

course of business. In assessing whether the going concern

assumption is appropriate, management takes into account all

available information about the future, which is at least, but is

not limited to, twelve months from the end of the reporting period.

Management is aware, in making its assessment, of uncertainties

related to events or conditions that may cast doubt on the

Company's ability to continue as a going concern. The Company's

future viability depends on the consolidated results of the

Company's wholly-owned subsidiary Cavanacaw Corporation

("Cavanacaw"). Cavanacaw has a 100% shareholding in both Flintridge

Resources Limited ("Flintridge") who are engaged in the

acquisition, exploration and development of gold properties, mainly

in Omagh, Northern Ireland and Omagh Minerals Limited ("Omagh") who

are engaged in the exploration of gold properties, mainly in the

Republic of Ireland. The Omagh mine has an open pit mine, which was

in production until 2013 when production was suspended and is

reported as property, plant and equipment and as an underground

mine which having established technical feasibility and commercial

viability in December 2018 has resulted in associated exploration

and evaluation assets being reclassified as an intangible

development asset and reported as property, plant and

equipment.

The going concern assumption is dependent upon forecast cash

flows being met and further financing currently being negotiated.

The management's assumptions in relation to future levels of

production, gold prices and mine operating and capital costs are

crucial to forecast cash flows being achieved. Should production be

significantly delayed, revenues fall short of expectations or

operating costs and capital costs increase significantly, there may

be insufficient cash flows to sustain day to day operations without

seeking further finance.

Negotiations with current finance providers to extend short-term

loans have progressed positively and the maturity dates for both

the G&F Phelps Ltd. ("G&F Phelps") and Ocean Partners UK

Ltd. ("Ocean Partners") loans have now been extended to December

31, 2023 (see notes 10 and 15). During the year ended December 31,

2021, the Company raised gross proceeds of $8M through the issuance

of shares to new and current investors to meet the financial

requirements of the Company for the foreseeable future. During the

three months ended March 31, 2022, the Company raised gross

proceeds of $3M through the exercise of warrants. Based on the

financial projections prepared, the directors believe it's

appropriate to prepare the unaudited condensed interim consolidated

financial statements on the going concern basis.

As at March 31, 2022, the Company had a deficit of $55,246,043

(December 31, 2021 - $53,830,231). Comprehensive loss for the three

months ended March 31, 2022 was $2,286,789 (three months ended

March 31, 2021 - $736,888). These conditions raise material

uncertainties which may cast significant doubt as to whether the

Company will be able to continue as a going concern. However,

management is confident that it will continue as a going concern.

However, this is subject to a number of factors including market

conditions.

These unaudited condensed interim consolidated financial

statements do not reflect adjustments to the carrying values of

assets and liabilities, the reported expenses and financial

position classifications used that would be necessary if the going

concern assumption was not appropriate. These adjustments could be

material.

2. Incorporation and Nature of Operations

The Company was formed on September 20, 1996 under the name

Montemor Resources Inc. on the amalgamation of 1169479 Ontario Inc.

and Consolidated Deer Creek Resources Limited. The name was changed

to European Gold Resources Inc. by articles of amendment dated July

25, 1997. On May 5, 2004, the Company changed its name from

European Gold Resources Inc. to Galantas Gold Corporation. The

Company was incorporated to explore for and develop mineral

resource properties, principally in Europe. In 1997, it purchased

all of the shares of Omagh which owns a mineral property in

Northern Ireland, including a delineated gold deposit. Omagh

obtained full planning and environmental consents necessary to

bring its property into production.

The Company entered into an agreement on April 17, 2000,

approved by shareholders on June 26, 2000, whereby Cavanacaw, a

private Ontario corporation, acquired Omagh. Cavanacaw has

established an open pit mine to extract the Company's gold deposit

near Omagh, Northern Ireland. Cavanacaw also has developed a

premium jewellery business founded on the gold produced under the

name Galántas Irish Gold Limited ("Galántas"). As at July 1, 2007,

the Company's Omagh mine began production and in 2013 production

was suspended. On April 1, 2014, Galántas amalgamated its jewelry

business with Omagh.

On April 8, 2014, Cavanacaw acquired Flintridge. Following a

strategic review of its business by the Company during 2014 certain

assets owned by Omagh were acquired by Flintridge.

On April 17, 2020, the Company completed a share consolidation

of its share capital on the basis of ten existing common shares for

one new common share consolidation.

The Company's operations include the consolidated results of

Cavanacaw, and its wholly-owned subsidiaries Omagh, Galántas and

Flintridge.

The Company's common shares are listed on the TSX Venture

Exchange ("TSXV") and London Stock Exchange AIM under the symbol

GAL. On September 1, 2021, the Company's common shares started

trading under the symbol GALKF on the OTCQX in the United States.

The primary office is located at The Canadian Venture Building, 82

Richmond Street East, Toronto, Ontario, Canada, M5C 1P1.

In March 2020, the World Health Organization declared

coronavirus (COVID-19) a global pandemic. This contagious disease

outbreak, which has continued to spread, has adversely affected

workforces, economies, and financial markets globally, leading to

an economic downturn. It is not possible for the Company to predict

the duration or magnitude of the adverse results of the outbreak

and its effects on the Company's business or ability to raise

funds.

3. Basis of Preparation

Statement of compliance

The Company applies International Financial Reporting Standards

("IFRS") as issued by the International Accounting Standards Board

and interpretations issued by the International Financial Reporting

Interpretations Committee ("IFRIC"). These unaudited condensed

interim consolidated financial statements have been prepared in

accordance with International Accounting Standard 34 - Interim

Financial Reporting. Accordingly, they do not include all of the

information required for full annual financial statements.

The policies applied in these unaudited condensed interim

consolidated financial statements are based on IFRS issued and

outstanding as of May 30, 2022 the date the Board of Directors

approved the statements. The same accounting policies and methods

of computation are followed in these unaudited condensed interim

consolidated financial statements as compared with the most recent

annual consolidated financial statements as at and for the year

ended December 31, 2021. Any subsequent changes to IFRS that are

given effect in the Company's annual consolidated financial

statements for the year ending December 31, 2022 could result in

restatement of these unaudited condensed interim consolidated

financial statements.

4. Accounts Receivable and Prepaid Expenses

As at As at

March 31, December 31,

2022 2021

-------------------------------------------------- --------- ------------

Sales tax receivable - Canada $ 9,181 $ 4,471

Valued added tax receivable - Northern Ireland 257,653 239,774

Accounts receivable 293,503 594,071

Prepaid expenses 171,372 281,207

Other debtors - 160,412

--------------------------------------------------- --------- ------------

$ 731,709 $ 1,279,935

-------------------------------------------------- --------- ------------

Prepaid expenses includes advances for consumables and for

construction of the passing bays in the Omagh mine.

The following is an aged analysis of receivables:

As at As at

March 31, December 31,

2022 2021

----------------------------- --------- ------------

Less than 3 months $ 538,614 $ 884,550

3 to 12 months 13,432 105,526

More than 12 months 8,291 8,652

------------------------------ --------- ------------

Total accounts receivable $ 560,337 $ 998,728

-------------------------- --------- ------------

5. Inventories

As at As at

March 31, December 31,

2022 2021

--------------------------- --------- ------------

Concentrate inventories $ 13,626 $ 108,788

------------------------ --------- ------------

6. Property, Plant and Equipment

Freehold Plant and

land and machinery Motor Office Development Assets under

Cost buildings (i) vehicles equipment assets (ii) construction Total

------------- --------- --------- -------- --------- ----------- ------------ ----------

Balance,

December 31,

2020 $2,398,171 $6,951,208 $ 162,571 $ 191,422 $ 19,345,676 $ - $29,049,048

Additions - 1,263,168 38,975 27,973 4,898,703 556,273 6,785,092

Disposals - (6,289) - - - - (6,289)

Cash receipts

from

concentrate

sales - - - - (1,412,329) - (1,412,329)

Foreign

exchange

adjustment (34,357) (99,099) (2,329) (2,742) (270,376) - (408,903)

------------- --------- --------- -------- --------- ----------- ------------ ----------

Balance,

December 31,

2021 2,363,814 8,108,988 199,217 216,653 22,561,674 556,273 34,006,619

Additions - 415,434 - 1,212 2,354,523 - 2,771,169

Disposals - - - - - (29,499) (29,499)

Foreign

exchange

adjustment (98,652) (337,016) (8,315) (9,042) (874,573) (22,242) (1,349,840)

------------- --------- --------- -------- --------- ----------- ------------ ----------

Balance,

March 31,

2022 $2,265,162 $8,187,406 $ 190,902 $ 208,823 $ 24,041,624 $ 504,532 $35,398,449

------------- --------- --------- -------- --------- ----------- ------------ ----------

Freehold Plant

land and and Motor Office Development Assets under

Accumulated

depreciation buildings machinery vehicles equipment assets construction Total

------------- --------- --------- -------- --------- ----------- ------------ ----------

Balance,

December 31,

2020 $1,986,461 $5,648,586 $ 130,107 $ 125,791 $ - $ - $ 7,890,945

Depreciation 6,347 507,731 19,776 13,992 - - 547,846

Disposals - (4,801) - - - - (4,801)

Foreign

exchange

adjustment (28,499) (83,818) (1,995) (1,895) - - (116,207)

------------- --------- --------- -------- --------- ----------- ------------ ----------

Balance,

December 31,

2021 1,964,309 6,067,698 147,888 137,888 - - 8,317,783

Depreciation 1,250 122,656 3,650 2,975 - - 130,531

Foreign

exchange

adjustment (82,021) (255,791) (6,293) (5,853) - - (349,958)

------------- --------- --------- -------- --------- ----------- ------------ ----------

Balance,

March 31,

2022 $1,883,538 $5,934,563 $ 145,245 $ 135,010 $ - $ - $ 8,098,356

------------- --------- --------- -------- --------- ----------- ------------ ----------

Freehold Plant

land and and Motor Office Development Assets under

Carrying

value buildings machinery vehicles equipment assets construction Total

------------- --------- --------- -------- --------- ----------- ------------ ----------

Balance,

December 31,

2021 $ 399,505 $2,041,290 $ 51,329 $ 78,765 $ 22,561,674 $ 556,273 $25,688,836

------------- --------- --------- -------- --------- ----------- ------------ ----------

Balance,

March 31,

2022 $ 381,624 $2,252,843 $ 45,657 $ 73,813 $ 24,041,624 $ 504,532 $27,300,093

------------- --------- --------- -------- --------- ----------- ------------ ----------

(i) Right-of-use assets of $680,520 is included in additions of

the plant and machinery for the year ended December 31, 2021.

Right-of-use assets of $283,596 is included in additions of the

plant and machinery for the three months ended March 31, 2022.

(i) Development assets are expenditures for the underground

mining operations in Omagh.

7. Exploration and Evaluation Assets

Exploration

and

evaluation

Cost assets

---------------------------- -----------

Balance, December 31, 2020 $ 750,741

Additions 834,193

Foreign exchange adjustment (10,751)

---------------------------- -----------

Balance, December 31, 2021 1,574,183

Additions 425,831

Foreign exchange adjustment (65,702)

---------------------------- -----------

Balance, March 31, 2022 $ 1,934,312

---------------------------- -----------

Carrying value

---------------------------- -----------

Balance, December 31, 2021 $ 1,574,183

---------------------------- -----------

Balance, March 31, 2022 $ 1,934,312

---------------------------- -----------

8. Decommissioning Liability

The Company's decommissioning liability is a result of mining

activities at the Omagh mine in Northern Ireland. The Company

estimated its decommissioning liability at March 31, 2022 based on

a risk-free discount rate of 1% (December 31, 2021 - 1%) and an

inflation rate of 1.50% (December 31, 2021 - 1.50%). The expected

undiscounted future obligations allowing for inflation are GBP

330,000 and based on management's best estimate the decommissioning

is expected to occur over the next 5 to 10 years. On March 31,

2022, the estimated fair value of the liability is $575,462

(December 31, 2021 - $600,525). Changes in the provision during the

three months ended March 31, 2022 are as follows:

As at As at

March 31, December 31,

2022 2021

-------------------------------------------------- --------- ------------

Decommissioning liability, beginning of period $ 600,525 $ 598,275

Accretion 2,681 10,892

Foreign exchange (27,744) (8,642)

--------------------------------------------------- --------- ------------

Decommissioning liability, end of period $ 575,462 $ 600,525

----------------------------------------------- --------- ------------

As required by the Crown in Northern Ireland, the Company is

required to provide a bond for reclamation related to the Omagh

mine in the amount of GBP 300,000 (December 31, 2021 - GBP

300,000), of which GBP 300,000 was funded as of March 31, 2022 (GBP

300,000 was funded as of December 31, 2021) and reported as

long-term deposit of $492,510 (December 31, 2021 - $513,960).

9. Accounts Payable and Other Liabilities

Accounts payable and other liabilities of the Company are

principally comprised of amounts outstanding for purchases relating

to exploration costs on exploration and evaluation assets, general

operating activities and professional fees activities.

As at As at

March 31, December 31,

2022 2021

------------------------------------------------ --------- ------------

Accounts payable $ 1,760,640 $ 1,463,316

Accrued liabilities 1,266,100 1,550,683

------------------------------------------------- --------- ------------

Total accounts payable and other liabilities $ 3,026,740 $ 3,013,999

--------------------------------------------- --------- ------------

The following is an aged analysis of the accounts payable and

other liabilities:

As at As at

March 31, December 31,

2022 2021

------------------------------------------------ --------- ------------

Less than 3 months $ 2,292,383 $ 2,246,440

3 to 12 months 93,132 98,415

More than 24 months 641,225 669,144

------------------------------------------------- --------- ------------

Total accounts payable and other liabilities $ 3,026,740 $ 3,013,999

--------------------------------------------- --------- ------------

10. Financing Facilities

Amounts payable on the Company's financial facilities are as

follow:

As at As at

March 31, December 31,

2022 2021

-------------------------------------------------------------- --------- ------------

Ocean Partners

Financing facilities, beginning of period $ - $ 2,186,272

Repayment of financing facilities - (23,802)

Accretion - 126,949

Interest - 86,820

Foreign exchange adjustment - 200,898

Financing facility reallocated to due to related parties - (2,577,137)

--------------------------------------------------------------- --------- ------------

- -

----------------------------------------------------------- --------- ------------

G&F Phelps

Financing facility reallocated from due to related parties 4,247,488 4,578,039

Less bonus warrants issued - (670,000)

Accretion 64,839 151,290

Interest 85,874 164,197

Foreign exchange adjustment (198,916) 23,962

--------------------------------------------------------------- --------- ------------

4,199,285 4,247,488

-------------------------------------------------------------- --------- ------------

Financing facilities - non-current portion $ 4,199,285 $ 4,247,488

----------------------------------------------------------- --------- ------------

11. Leases

Balance, December 31, 2020 $ -

Addition (i) 680,520

Interest expense 36,706

Lease payments (297,450)

Foreign exchange (3,736)

------------------------------- --------

Balance, December 31, 2021 416,040

Addition (ii) 283,596

Interest expense 13,513

Lease payments (137,145)

Foreign exchange (30,254)

------------------------------- --------

Balance, March 31, 2022 $ 545,750

--------------------------- --------

(i) During the year ended 2021, the Company entered into lease

agreements in respect to rent of equipments which will expire

between February 2022 to July 2022.

(ii) During the three months ended 2022, the Company entered

into lease agreements in respect to rent of equipments which will

expire June 2022.

12. Share Capital and Reserves

a) Authorized share capital

At March 31, 2022, the authorized share capital consisted of an

unlimited number of common and preference shares issuable in

Series.

The common shares do not have a par value. All issued shares are

fully paid.

No preference shares have been issued. The preference shares do

not have a par value.

b) Common shares issued

At March 31, 2022, the issued share capital amounted to

$61,876,670. The continuity of issued share capital for the periods

presented is as follows:

Number of

common

shares Amount

---------------------------------------------- ---------- ----------

Balance, December 31, 2020 and March 31, 2021 46,565,537 $52,933,594

----------------------------------------------- ---------- ----------

Balance, December 31, 2021 74,683,801 $57,783,570

Exercise of warrants 7,838,000 4,093,100

----------------------------------------------- ---------- ----------

Balance, March 31, 2022 82,521,801 $61,876,670

----------------------------------------------- ---------- ----------

c) Warrant reserve

The following table shows the continuity of warrants for the

periods presented:

Weighted

average

Number of exercise

warrants price

---------------------------------------------- ---------- --------

Balance, December 31, 2020 and March 31, 2021 1,700,000 $ 0.33

----------------------------------------------- ---------- --------

Balance, December 31, 2021 28,691,598 $ 0.39

Issued (notes 15(a)(ii)) 250,000 0.50

Exercised (7,838,000) 0.40

----------------------------------------------- ---------- --------

Balance, March 31, 2022 21,103,598 $ 0.39

----------------------------------------------- ---------- --------

The following table reflects the actual warrants issued and

outstanding as of March 31, 2022:

Grant date Exercise

Number fair value price

Expiry date of warrants ($) ($)

------------------ ----------- ---------- --------

February 3, 2023 250,000 51,000 0.50

May 14, 2023 18,453,598 2,258,947 0.40

December 31, 2023 2,400,000 913,353 0.33

------------------- ----------- ---------- --------

21,103,598 3,223,300 0.39

------------------ ----------- ---------- --------

d) Stock options

The following table shows the continuity of stock options for

the periods presented:

Weighted

average

Number of exercise

options price

---------------------------------------------- --------- --------

Balance, December 31, 2020 and March 31, 2021 570,000 $ 1.16

----------------------------------------------- --------- --------

Balance, December 31, 2021 4,885,000 $ 0.88

Expired (255,000) 1.35

Cancelled (205,000) 0.96

----------------------------------------------- --------- --------

Balance, March 31, 2022 4,425,000 $ 0.85

----------------------------------------------- --------- --------

The portion of the estimated fair value of options granted in

the prior years and vested during the three months ended March 31,

2022, amounted to $350,539 (three months ended March 31, 2021 -

$4,631).

The following table reflects the actual stock options issued and

outstanding as of March 31, 2022:

Weighted average Number of

remaining Number of options Number of

Exercise contractual options vested options

Expiry date price ($) life (years) outstanding (exercisable) unvested

------------------ --------- ---------------- ----------- ------------- ---------

April 19, 2023 1.10 1.05 25,000 25,000 -

February 13, 2024 0.90 1.87 85,000 85,000 -

June 27, 2024 0.90 2.24 100,000 100,000 -

May 19, 2026 0.86 4.14 3,770,000 1,256,667 2,513,333

June 21, 2026 0.73 4.23 425,000 141,667 283,333

August 27, 2026 0.86 4.41 20,000 6,667 13,333

------------------ --------- ---------------- ----------- ------------- ---------

0.85 4.04 4,425,000 1,615,001 2,809,999

------------------ --------- ---------------- ----------- ------------- ---------

13. Net Loss per Common Share

The calculation of basic and diluted loss per share for the

three months ended March 31, 2022 was based on the loss

attributable to common shareholders of $1,415,812 (three months

ended March 31, 2021 - $639,963) and the weighted average number of

common shares outstanding of 78,556,743 (three months ended March

31, 2021 - 46,565,537) for basic and diluted loss per share.

Diluted loss did not include the effect of 21,103,598 warrants

(three months ended March 31, 2021 - 1,700,000) and 4,425,000

options (three months ended March 31, 2021 - 570,000) for the three

months ended March 31, 2022, as they are anti-dilutive.

14. Revenues

Shipments of concentrate under the off-take arrangements

commenced during the second quarter of 2019. Concentrate sales

provisional revenues during the three months ended March 31, 2022

totaled approximately US$219,000 (three months ended March 31, 2021

- US$567,000). However, until the mine reaches the commencement of

commercial production, the net proceeds from concentrate sales will

be offset against Development assets.

15. Related Party Disclosures

Related parties include the Board of Directors, close family

members, other key management individuals and enterprises that are

controlled by these individuals as well as certain persons

performing similar functions.

Related party transactions conducted in the normal course of

operations are measured at the exchange amount and approved by the

Board of Directors in strict adherence to conflict of interest laws

and regulations.

(a) The Company entered into the following transactions with

related parties:

Three Months Ended

March 31,

2022 2021

---------------------------------------- --------- --------

Interest on related party loans (i) $ 74,695 $ 78,876

-------------------------------- ---- --------- --------

(i) Refer to note 10(i)(ii).

(ii) On February 3, 2022, the Company announced the closing of

the loan agreement for US$1.06 million with Ocean Partners. Ocean

Partners and the Company have a common director. Terms of the loan

agreement are:

-- The loan matures on July 31, 2022 (the "Maturity Date").

-- The loan will bear interest at an annual rate of 10%

compounded monthly payable upon repayment of the loan.

-- US$20,000 structuring fee has been paid to Ocean Partners.

-- US$40,000 consulting fee will be paid to Ocean Partners, to

be invoiced separately by Ocean Partners.

-- 250,000 warrants have been granted to Ocean Partners, which

will be exercisable for a period of 12 months at an exercise price

of $0.50. The bonus warrants are subject to a hold period under

applicable securities laws and the rules of the TSXV, expiring on

June 4, 2022. The fair value of the 250,000 warrants was valued at

$51,000 using the following Black-Scholes option pricing model with

the following assumptions: expected dividend yield - 0%, expected

volatility - 107%, risk-free interest rate - 1.22% and an expected

average life of 1 year.

-- US$40,000 extension fee will be paid to Ocean Partners if the

Company elects to extend the loan for a further six months from the

Maturity Date.

Proceeds from the loan will be used for further development of

the Omagh mine in Northern Ireland and working capital.

As at March 31, 2022, financial liabilities due to the Lender

and recorded as due to related parties on the unaudited condensed

interim consolidated statement of financial position is $3,826,322

(December 31, 2021 - $2,444,376).

March 31, December 31,

2022 2021

------------------------------------------------------------ ---------- ------------

Balance, beginning of period $ 2,444,376 $ -

Financing facility reallocated to due to related parties - 2,577,137

Loan received 1,380,477 -

Less bonus warrants (51,000) (251,000)

Repayment (5,979) -

Accretion 24,290 57,338

Interest 72,227 27,506

Foreign exchange adjustment (38,069) 33,395

------------------------------------------------------------- ---------- ------------

Balance, end of period 3,826,322 2,444,376

Less current balance (1,363,792) -

------------------------------------------------------------- ---------- ------------

Due to related parties - non-current balance $ 2,462,530 $ 2,444,376

--------------------------------------------------------- ---------- ------------

(b) Remuneration of officer and directors of the Company was as

follows:

Three Months Ended

March 31,

2022 2021

----------------------------- --------- --------

Salaries and benefits (1) $ 107,583 $ 117,606

Stock-based compensation 250,310 2,258

------------------------------ --------- --------

$ 357,893 $ 119,864

----------------------------- --------- --------

(1) Salaries and benefits include director fees. As at March 31,

2022, due to directors for fees amounted to $55,500 (December 31,

2021 - $102,917) and due to officers, mainly for salaries and

benefits accrued amounted to $21,685 (December 31, 2021 - $21,400),

and is included with due to related parties.

(c) As at March 31, 2022, Ross Beaty owns 3,744,747 common

shares of the Company or approximately 4.54% of the outstanding

common shares. Premier Miton owns 4,848,243 common shares of the

Company or approximately 5.88%. Melquart owns, directly and

indirectly, 24,273,528 common shares of the Company or

approximately 29.41% of the outstanding common shares of the

Company. Eric Sprott owns 8,833,333 common shares of the Company or

approximately 10.70%. Mike Gentile owns 5,600,000 common shares of

the Company or approximately 6.79%. The remaining 42.68% of the

shares are widely held, which includes various small holdings which

are owned by directors of the Company. These holdings can change at

anytime at the discretion of the owner.

The Company is not aware of any arrangements that may at a

subsequent date result in a change in control of the Company.

16. Segment Disclosure

The Company has determined that it has one reportable segment.

The Company's operations are substantially all related to its

investment in Cavanacaw and its subsidiaries, Omagh and Flintridge.

Substantially all of the Company's revenues, costs and assets of

the business that support these operations are derived or located

in Northern Ireland. Segmented information on a geographic basis is

as follows:

March 31, 2022 United Kingdom Canada Total

------------------- -------------- --------- ----------

Current assets $ 1,029,940 $2,132,547 $ 3,162,487

Non-current assets $ 29,600,351 $ 126,564 $29,726,915

Revenues $ - $ - $ -

------------------- -------------- --------- ----------

December 31, 2021 United Kingdom Canada Total

------------------- -------------- --------- ----------

Current assets $ 1,379,742 $1,078,732 $ 2,458,474

Non-current assets $ 27,714,667 $ 62,312 $27,776,979

Revenues $ - $ - $ -

------------------- -------------- --------- ----------

17. Contingency

During the year ended December 31, 2010, the Company's

subsidiary Omagh received a payment demand from Her Majesty's

Revenue and Customs ("HMRC") in the amount of $499,553 (GBP

304,290) in connection with an aggregate levy arising from the

removal of waste rock from the mine site during 2008 and early

2009. Omagh believed this claim to be without merit. An appeal was

lodged with the Tax Tribunals Service and the hearing started at

the beginning of March 2017 and following a number of adjournments

was completed in August 2018. During the year ended December 31,

2019, the Tax Tribunals Service issued their judgement dismissing

the appeal by Omagh in respect of the assessments. A provision has

now been included in the unaudited condensed interim consolidated

financial statements in respect of the aggregates levy plus

interest and penalty.

There is a contingent liability in respect of potential

additional interest which may be applied in respect of the

aggregates levy dispute. Omagh is unable to make a reliable

estimate of the amount of the potential additional interest that

may be applied by HMRC.

18. Event After the Reporting Period

On May 3, 2022, the Company granted 1,742,500 stock options to

directors, officers, employees and consultants of the Company to

purchase common shares at $0.60 per share until May 3, 2027. The

options will vest as to one third immediately and one third on each

of May 3, 2023 and May 3, 2024.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFDZGFKNGLGZZM

(END) Dow Jones Newswires

May 31, 2022 02:00 ET (06:00 GMT)

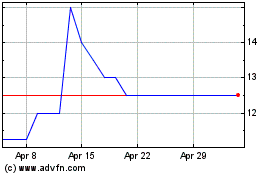

Galantas Gold (LSE:GAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Galantas Gold (LSE:GAL)

Historical Stock Chart

From Apr 2023 to Apr 2024