TIDMGAL

RNS Number : 6869T

Galantas Gold Corporation

21 March 2023

GALANTAS GOLD ANNOUNCES UPSIZE TO NON-BROKERED PRIVATE PLACEMENT

FINANCING AND TERMS OF SHARES-FOR-DEBT TRANSACTION

Not for distribution to United States news wire services or for

dissemination in the

United States

March 21, 2023, TORONTO, CANADA - Galantas Gold Corporation

(TSX-V & AIM: GAL; OTCQX: GALKF) ("Galantas" or the " Company")

is pleased to announce that, in order to accommodate additional

interest in its previously announced non-brokered private placement

(as amended, the "Offering"), the Offering will be upsized to up to

7,638,888 units of the Company ("Units") at a price of C$0.36 per

Unit for aggregate gross proceeds of up to approximately C$2.75

million.

Each Unit will consist of one common share of the Company (a

"Common Share") and one Common Share purchase warrant (a

"Warrant"), with each Warrant entitling the holder thereof to

purchase one Common Share at a price of C$0.55 per share for a

period of 60 months from the closing date.

The net proceeds of the Offering are expected to be used for

exploration, including follow-up drilling targeting the high-grade

dilation zones to depth at the Joshua Vein and the recently

identified Kerr Vein target, development at Galantas' gold project

in Northern Ireland, as well as exploration at the recently

announced gold-rich volcanogenic massive sulphide project in

Scotland, and for general working capital purposes.

Certain persons may be eligible to receive finder's fees,

payable in cash, representing up to 7% of the proceeds generated by

such finders, in connection with the Offering. In addition, the

Company may also issue to certain finders non-transferable

compensation warrants (the "Finder's Warrants") to purchase that

number of Common Shares as is equal to 7% of the number of Units

sold to subscribers identified by such finders pursuant to the

Offering, with each Finder's Warrant entitling the holder thereof

to purchase one Common Share at a price of C$0.36 per share for a

period of 24 months from the closing date.

In addition to the foregoing, the Company has received strong

support from stakeholders and also announces the terms of a

proposed shares-for-debt transaction (the "Debt Settlement") with

several arm's length creditors of the Company to settle

approximately C$299,020 of indebtedness through the issuance of an

aggregate of 830,611 Units at a deemed price of C$0.36 per Unit on

the same terms as the Units issued under the Offering.

Closing of the Offering and the Debt Settlement is expected to

occur on or about March 27, 2023, and remain subject to certain

closing conditions including, but not limited to, the receipt of

all necessary approvals, including the conditional acceptance of

the TSX Venture Exchange. The securities issued pursuant to the

Offering and the Debt Settlement will be subject to a four-month

hold period under applicable Canadian securities laws.

The securities offered have not been, nor will they be,

registered under the United States Securities Act of 1933, as

amended, or any state securities law, and may not be offered or

sold in the United States absent registration or an exemption from

such registration requirements. This news release shall not

constitute an offer to sell or the solicitation of an offer to buy

nor shall there be any sale of the securities in any state in which

such offer, solicitation or sale would be unlawful.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

About Galantas Gold Corporation

Galantas Gold Corporation is a Canadian public company that

trades on the TSX Venture Exchange and the London Stock Exchange

AIM market, both under the symbol GAL. It also trades on the OTCQX

Exchange under the symbol GALKF. The Company's strategy is to

create shareholder value by operating and expanding gold production

and resources at the Omagh Project in Northern Ireland.

Enquiries

Galantas Gold Corporation

Mario Stifano: Chief Executive Officer

Email: info@galantas.com

Website: www.galantas.com

Telephone: +44(0)28 8224 1100

Grant Thornton UK LLP (AIM Nomad)

Philip Secrett, Harrison Clarke, George Grainger, Samuel

Littler

Telephone: +44(0)20 7383 5100

SP Angel Corporate Finance LLP (AIM Broker)

David Hignell, Charlie Bouverat (Corporate Finance)

Grant Barker (Sales & Broking)

Telephone: +44(0)20 3470 0470

Forward-Looking Statements

This news release contains forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995 and applicable Canadian securities laws, including, but

not limited to, the terms of the Offering and the Debt Settlement,

the use of proceeds of the Offering, the timing and ability of the

Company to close the Offering and the Debt Settlement, the timing

and ability of the Company to receive necessary regulatory

approvals, and the plans, operations and prospects of the Company.

Forward-looking statements are based on estimates and assumptions

made by Galantas in light of its experience and perception of

historical trends, current conditions and expected future

developments, as well as other factors that Galantas believes are

appropriate in the circumstances. Many factors could cause

Galantas' actual results, the performance or achievements to differ

materially from those expressed or implied by the forward looking

statements or strategy, including: gold price volatility;

discrepancies between actual and estimated production, actual and

estimated metallurgical recoveries and throughputs; mining

operational risk, geological uncertainties; regulatory

restrictions, including environmental regulatory restrictions and

liability; risks of sovereign involvement; speculative nature of

gold exploration; dilution; competition; loss of or availability of

key employees; additional funding requirements; uncertainties

regarding planning and other permitting issues; and defective title

to mineral claims or property. These factors and others that could

affect Galantas' forward-looking statements are discussed in

greater detail in the section entitled "Risk Factors" in Galantas'

Management Discussion & Analysis of the financial statements of

Galantas and elsewhere in documents filed from time to time with

the Canadian provincial securities regulators and other regulatory

authorities. These factors should be considered carefully, and

persons reviewing this news release should not place undue reliance

on forward-looking statements. Galantas has no intention and

undertakes no obligation to update or revise any forward-looking

statements in this news release, except as required by law.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEPPUPCWUPWUQG

(END) Dow Jones Newswires

March 21, 2023 03:00 ET (07:00 GMT)

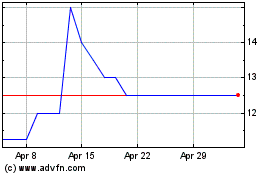

Galantas Gold (LSE:GAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Galantas Gold (LSE:GAL)

Historical Stock Chart

From Apr 2023 to Apr 2024