TIDMGAL

RNS Number : 8959A

Galantas Gold Corporation

30 May 2023

GALANTAS GOLD CORPORATION

TSXV & AIM: Symbol GAL

GALANTAS REPORT FINANCIAL RESULTS FOR THE QUARTERED MARCH 31,

2023

May 30, 2023: Galantas Gold Corporation (the 'Company') is

pleased to announce its unaudited financial results for the Quarter

ended March 31, 2023.

Financial Highlights

Highlights of the first quarter 2023 results, which are

expressed in Canadian Dollars, are summarized below:

All figures denominated in Canadian Dollars (CDN$)

Quarter Ended

March 31

2023 2022

Revenue $ 0 $ 0

Cost and expenses of operations $ (50,215) $ (46,639)

Loss before the undernoted $ (50,215) $ (46,639)

Depreciation $ (126,105) $ (130,531)

General administrative expenses $ (1,242,764) $ (1,171,170)

Foreign exchange gain (loss) $ 25,470 $ (67,472)

Net (Loss) for the quarter $ (1,3 93,614) $ (1 ,415,812)

Working Capital Deficit $ (11,074,990) $ (1,850,980)

Cash loss from operating activities before changes in non-cash working capital $ (475,530) $ (577,604)

Cash at March 31, 2023 $ 2,516,822 $ 2,417,152

Sales revenue for the quarter ended March 31, 2023 amounted to $

Nil compared to revenue of $ Nil for the quarter ended March 31,

2022. Shipments of concentrate commenced during the third quarter

of 2019. Concentrate sales provisional revenues totalled US$

255,000 for the first quarter of 2023 compared to US $ 219,000 for

the first quarter of 2022. Until the mine commences commercial

production, the net proceeds from concentrate sales are being

offset against development assets.

The Net Loss for the quarter ended March 31, 2023 amounted to $

1,393,614 (2021: $ 1,415,812) and the cash outflow from operating

activities before changes in non-cash working capital for the

quarter ended March 31, 2023 amounted to $475,530 (2022:

$577,604).

The Company had a cash balance of $2,516,822 at March 31, 2023

compared to $ 2,417,152 at March 31, 2022. The working capital

deficit at March 31, 2023 amounted to $ 11,074,990 compared to a

working capital deficit of $ 1,850,980 at March 31, 2022. The

increase results from a recategorization of loans from non current

to current.

Safety is a high priority for the Company and we continue to

invest in safety-related training and infrastructure. The zero lost

time accident rate since the start of underground operations

continues. Environmental monitoring demonstrates a high level of

regulatory compliance.

The detailed results and Management Discussion and Analysis

(MD&A) are available on www.sedar.com and www.galantas.com and

the highlights in this release should be read in conjunction with

the detailed results and MD&A. The MD&A provides an

analysis of comparisons with previous periods, trends affecting the

business and risk factors.

Click on, or paste the following link into your web browser, to

view the associated PDF document.

http://www.rns-pdf.londonstockexchange.com/rns/8959A_1-2023-5-29.pdf

Qualified Person

The financial components of this disclosure have been reviewed

by Alan Buckley (Chief Financial Officer) and the production and

permitting components by Brendan Morris (COO), qualified persons

under the meaning of NI. 43-101. The information is based upon

local production and financial data prepared under their

supervision.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS: This press

release contains forward-looking statements within the meaning of

the United States Private Securities Litigation Reform Act of 1995

and applicable Canadian securities laws, including revenues and

cost estimates, for the Omagh Gold project. Forward-looking

statements are based on estimates and assumptions made by Galantas

in light of its experience and perception of historical trends,

current conditions and expected future developments, as well as

other factors that Galantas believes are appropriate in the

circumstances. Many factors could cause Galantas' actual results,

the performance or achievements to differ materially from those

expressed or implied by the forward looking statements or strategy,

including: gold price volatility; discrepancies between actual and

estimated production, actual and estimated metallurgical recoveries

and throughputs; mining operational risk, geological uncertainties;

regulatory restrictions, including environmental regulatory

restrictions and liability; risks of sovereign involvement;

speculative nature of gold exploration; dilution; competition; loss

of or availability of key employees; additional funding

requirements; uncertainties regarding planning and other permitting

issues; and defective title to mineral claims or property. These

factors and others that could affect Galantas' forward-looking

statements are discussed in greater detail in the section entitled

"Risk Factors" in Galantas' Management Discussion & Analysis of

the financial statements of Galantas and elsewhere in documents

filed from time to time with the Canadian provincial securities

regulators and other regulatory authorities. These factors should

be considered carefully, and persons reviewing this press release

should not place undue reliance on forward-looking statements.

Galantas has no intention and undertakes no obligation to update or

revise any forward-looking statements in this press release, except

as required by law.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

Enquiries

Galantas Gold Corporation

Mario Stifano - CEO

Email: info@galantas.com

Website: www.galantas.com

Telephone: 001 416 453 8433

Grant Thornton UK LLP (Nomad)

Philip Secrett, Harrison Clarke, George Grainger, Samuel

Littler:

Telephone: +44(0)20 7383 5100

SP Angel Corporate Finance LLP (AIM Broker)

David Hignell, Charlie Bouverat (Corporate Finance)

Grant Barker (Sales and Broking)

Telephone: +44(0)20 3470 0470

GALANTAS GOLD CORPORATION

Condensed Interim Consolidated Financial Statements

(Expressed in Canadian Dollars)

(Unaudited)

Three Months Ended March 31, 2023

NOTICE TO READER

The accompanying unaudited condensed interim consolidated

financial statements of Galantas Gold Corporation (the "Company")

have been prepared by and are the responsibility of management. The

unaudited condensed interim consolidated financial statements have

not been reviewed by the Company's auditors.

Galantas Gold Corporation

Condensed Interim Consolidated Statements of Financial

Position

(Expressed in Canadian Dollars)

(Unaudited)

As at As at

March 31, December 31,

2023 2022

------------------------------------------------------------ ----------- ------------

ASSETS

Current assets

Cash and cash equivalents $ 2,516,822 $ 1,038,643

Accounts receivable and prepaid expenses (note 4) 1,570,518 1,810,993

Inventories (note 5) 80,285 83,242

------------------------------------------------------------- ----------- ------------

Total current assets 4,167,625 2,932,878

Non-current assets

Property, plant and equipment (note 6) 25,910,707 24,255,849

Long-term deposit (note 8) 501,780 489,660

Exploration and evaluation assets (note 7) 3,660,664 2,665,313

------------------------------------------------------------- ----------- ------------

Total non-current assets 30,073,151 27,410,822

------------------------------------------------------------- ----------- ------------

Total assets $ 34,240,776 $ 30,343,700

--------------------------------------------------------- ----------- ------------

EQUITY AND LIABILITIES

Current liabilities

Accounts payable and other liabilities (notes 9 and 16) $ 4,608,751 $ 4,052,041

Current portion of financing facilities (note 10) 5,252,499 4,836,267

Due to related parties (note 14) 5,381,365 5,072,534

------------------------------------------------------------- ----------- ------------

Total current liabilities 15,242,615 13,960,842

Non-current liabilities

Non-current portion of financing facilities (note 10) 571,910 -

Decommissioning liability (note 8) 599,498 582,441

Other liability (note 14) 1,021,819 1,085,426

------------------------------------------------------------- ----------- ------------

Total non-current liabilities 2,193,227 1,667,867

------------------------------------------------------------- ----------- ------------

Total liabilities 17,435,842 15,628,709

------------------------------------------------------------- ----------- ------------

Equity

Share capital (note 11(a)(b)) 71,104,535 69,664,056

Reserves 17,558,183 15,515,105

Deficit (71,857,784) (70,464,170)

------------------------------------------------------------- ----------- ------------

Total equity 16,804,934 14,714,991

------------------------------------------------------------- ----------- ------------

Total equity and liabilities $ 34,240,776 $ 30,343,700

--------------------------------------------------------- ----------- ------------

The notes to the unaudited condensed interim consolidated

financial statements are an integral part of these statements.

Going concern (note 1)

Incorporation and nature of operations (note 2)

Contingency (note 16)

Events after the reporting period (note 17)

Galantas Gold Corporation

Condensed Interim Consolidated Statements of Loss

(Expressed in Canadian Dollars)

(Unaudited)

Three Months Ended

March 31,

2023 2022

------------------------------------------------------------------------------ ----------- ----------

Revenues

Sales of concentrate (note 13) $ - $ -

Cost and expenses of operations

Cost of sales 50,215 46,639

Depreciation (note 6) 126,105 130,531

------------------------------------------------------------------------------- ----------- ----------

176,320 177,170

------------------------------------------------------------------------------ ----------- ----------

Loss before general administrative and other expenses (176,320) (177,170)

------------------------------------------------------------------------------- ----------- ----------

General administrative expenses

Management and administration wages (note 14) 124,198 117,640

Other operating expenses 94,763 78,788

Accounting and corporate 146,611 152,979

Legal and audit 43,393 63,640

Stock-based compensation (note 11(d)) 183,723 350,539

Shareholder communication and investor relations 162,595 135,787

Transfer agent 6,345 4,015

Director fees (note 14) 35,000 35,000

General office 41,946 21,187

Accretion expenses (notes 8, 10 and 14) 111,132 120,487

Loan interest and bank charges less deposit interest (notes 10 and 14) 293,058 91,108

------------------------------------------------------------------------------- ----------- ----------

1,242,764 1,171,170

Other expenses

Foreign exchange gain (loss) (25,470) 67,472

------------------------------------------------------------------------------- ----------- ----------

(25,470) 67,472

------------------------------------------------------------------------------ ----------- ----------

Net loss for the period $ (1,393,614) $(1,415,812)

--------------------------------------------------------------------------- ----------- ----------

Basic and diluted net loss per share (note 12) $ (0.01) $ (0.02)

--------------------------------------------------------------------------- ----------- ----------

Weighted average number of common shares outstanding - basic and diluted 103,893,399 78,556,743

------------------------------------------------------------------------------- ----------- ----------

The notes to the unaudited condensed interim consolidated

financial statements are an integral part of these statements.

Galantas Gold Corporation

Condensed Interim Consolidated Statements of Comprehensive

Loss

(Expressed in Canadian Dollars)

(Unaudited)

Three Months Ended

March 31,

2023 2022

------------------------------------------------------------------ ---------- ----------

Net loss for the period $ (1,393,614) $(1,415,812)

Other comprehensive income (loss)

Items that will be reclassified subsequently to profit or loss

Exchange differences on translating foreign operations 453,574 (870,977)

------------------------------------------------------------------- ---------- ----------

Total comprehensive loss $ (940,040) $(2,286,789)

--------------------------------------------------------------- ---------- ----------

The notes to the unaudited condensed interim consolidated

financial statements are an integral part of these statements.

Galantas Gold Corporation

Condensed Interim Consolidated Statements of Cash Flows

(Expressed in Canadian Dollars)

(Unaudited)

Three Months Ended

March 31,

2023 2022

---------------------------------------------------------------------------- ---------- ----------

Operating activities

Net loss for the period $ (1,393,614) $(1,415,812)

Adjustment for:

Depreciation (note 6) 126,105 130,531

Stock-based compensation (note 11(d)) 183,723 350,539

Accrued interest (notes 10 and 14) 395,054 171,614

Foreign exchange loss 102,070 93,714

Accretion expenses (notes 8, 10 and 14) 111,132 91,810

Non-cash working capital items:

Accounts receivable and prepaid expenses 251,144 567,842

Inventories 4,896 95,585

Accounts payable and other liabilities 461,212 (82,217)

Due to related parties - (129,249)

----------------------------------------------------------------------------- ---------- ----------

Net cash and cash equivalents provided by (used in) operating activities 241,722 (125,643)

----------------------------------------------------------------------------- ---------- ----------

Investing activities

Net purchase of property, plant and equipment (1,187,334) (2,458,074)

Exploration and evaluation assets (921,853) (425,831)

Lease payments - (137,145)

----------------------------------------------------------------------------- ---------- ----------

Net cash and cash equivalents used in investing activities (2,109,187) (3,021,050)

----------------------------------------------------------------------------- ---------- ----------

Financing activities

Proceeds of private placements (note 11(b)(i)) 2,963,142 -

Share issue costs (204,993) -

Proceeds from exercise of warrants 5,600 3,135,200

Advances from related parties - 1,380,477

Repayments to related parties (6,500) -

Proceeds from financing facilities (note 10) 580,392 -

----------------------------------------------------------------------------- ---------- ----------

Net cash and cash equivalents provided by financing activities 3,337,641 4,515,677

----------------------------------------------------------------------------- ---------- ----------

Net change in cash and cash equivalents 1,470,176 1,368,984

Effect of exchange rate changes on cash held in foreign currencies 8,003 (21,583)

Cash and cash equivalents, beginning of period 1,038,643 1,069,751

----------------------------------------------------------------------------- ---------- ----------

Cash and cash equivalents, end of period $ 2,516,822 $ 2,417,152

------------------------------------------------------------------------- ---------- ----------

Cash $ 2,516,822 $ 2,417,152

Cash equivalents - -

------------------------------------------------------------------------- ---------- ----------

Cash and cash equivalents $ 2,516,822 $ 2,417,152

------------------------------------------------------------------------- ---------- ----------

The notes to the unaudited condensed interim consolidated

financial statements are an integral part of these statements.

Galantas Gold Corporation

Condensed Interim Consolidated Statements of Changes in

Equity

(Expressed in Canadian Dollars)

(Unaudited)

Reserves

--------------------------------------

Equity

settled Foreign

share-based currency

Share Warrants payments translation

capital reserve reserve reserve Deficit Total

---------------------- ---------- --------- ----------- ----------- ----------- ----------

Balance, December 31,

2021 $ 57,783,570 $4,130,200 $ 10,417,260 $ 887,909 $(53,830,231) $19,388,708

Warrants issued - 51,000 - - - 51,000

Stock-based

compensation (note

11(d)) - - 350,539 - - 350,539

Exercise of warrants 4,093,100 (957,900) - - - 3,135,200

Exchange differences

on translating

foreign operations - - - (870,977) - (870,977)

Net loss for the

period - - - - (1,415,812) (1,415,812)

-------------------------- ---------- --------- ----------- ----------- ----------- ----------

Balance, March 31,

2022 $ 61,876,670 $3,223,300 $ 10,767,799 $ 16,932 $(55,246,043) $20,638,658

---------------------- ---------- --------- ----------- ----------- ----------- ----------

Balance, December 31,

2022 $ 69,664,056 $3,903,004 $ 11,887,678 $ (275,577) $(70,464,170) $14,714,991

Shares issued in

private placement

(note 11(b)(i)) 2,963,142 - - - - 2,963,142

Warrants issued

(note 11(b)(i)) (1,284,806) 1,284,806 - - - -

Warrants issued

(notes 10(i) and

14(a)(iv)) - 82,511 - - - 82,511

Share issue costs

(note 11(b)(i)) (245,168) 40,175 - - - (204,993)

Stock-based

compensation (note

11(d)) - - 183,723 - - 183,723

Exercise of warrants 7,311 (1,711) - - - 5,600

Warrants expired - (51,000) 51,000 - - -

Exchange differences

on translating

foreign operations - - - 453,574 - 453,574

Net loss for the

period - - - - (1,393,614) (1,393,614)

-------------------------- ---------- --------- ----------- ----------- ----------- ----------

Balance, March 31,

2023 $ 71,104,535 $5,257,785 $ 12,122,401 $ 177,997 $(71,857,784) $16,804,934

---------------------- ---------- --------- ----------- ----------- ----------- ----------

The notes to the unaudited condensed interim consolidated

financial statements are an integral part of these statements.

Galantas Gold Corporation

Notes to Condensed Interim Consolidated Financial Statements

Three Months Ended March 31, 2023

(Expressed in Canadian Dollars)

(Unaudited)

-------------------------------------------------------------

1. Going Concern

These unaudited condensed interim consolidated financial

statements have been prepared on a going concern basis which

contemplates that Galantas Gold Corporation (the "Company") will be

able to realize assets and discharge liabilities in the normal

course of business. In assessing whether the going concern

assumption is appropriate, management takes into account all

available information about the future, which is at least, but is

not limited to, twelve months from the end of the reporting period.

Management is aware, in making its assessment, of uncertainties

related to events or conditions that may cast doubt on the

Company's ability to continue as a going concern. The Company's

future viability depends on the consolidated results of the

Company's wholly-owned subsidiary Cavanacaw Corporation

("Cavanacaw"). Cavanacaw has a 100% shareholding in both Flintridge

Resources Limited ("Flintridge") who are engaged in the

acquisition, exploration and development of gold properties, mainly

in Omagh, Northern Ireland and Omagh Minerals Limited ("Omagh") who

are engaged in the exploration of gold properties, mainly in the

Republic of Ireland. The Omagh mine has an open pit mine, which was

in production until 2013 when production was suspended and is

reported as property, plant and equipment and as an underground

mine which having established technical feasibility and commercial

viability in December 2018 has resulted in associated exploration

and evaluation assets being reclassified as an intangible

development asset and reported as property, plant and

equipment.

The going concern assumption is dependent upon forecast cash

flows being met and further financing currently being negotiated.

The management's assumptions in relation to future levels of

production, gold prices and mine operating and capital costs are

crucial to forecast cash flows being achieved. Should production be

significantly delayed, revenues fall short of expectations or

operating costs and capital costs increase significantly, there may

be insufficient cash flows to sustain day to day operations without

seeking further finance.

Negotiations with current finance providers to extend short-term

loans have commenced, are progressing positively and the maturity

dates for both the G&F Phelps Ltd. ("G&F Phelps") and Ocean

Partners UK Ltd. ("Ocean Partners") loans are expected to be

extended beyond March 31, 2023 (see notes 10 and 14).

During the year ended December 31, 2022, the Company raised

gross proceeds of $11M through the issuance of shares to investors

and the exercise of warrants to meet the financial requirements of

the Company for the foreseeable future. During the three months

ended March 31, 2023, the Company raised gross proceeds of $3M

through the issuance of shares to investors. Based on the financial

projections prepared, the directors believe it's appropriate to

prepare the unaudited condensed interim consolidated financial

statements on the going concern basis.

As at March 31, 2023, the Company had a deficit of $71,857,784

(December 31, 2022 - $70,464,170). Comprehensive loss for the three

months ended March 31, 2023 was $940,040 (three months ended March

31, 2022 - $2,286,789). These conditions raise material

uncertainties which may cast significant doubt as to whether the

Company will be able to continue as a going concern. However,

management believes that it will continue as a going concern.

However, this is subject to a number of factors including market

conditions. These unaudited condensed interim consolidated

financial statements do not reflect adjustments to the carrying

values of assets and liabilities, the reported expenses and

financial position classifications used that would be necessary if

the going concern assumption was not appropriate. These adjustments

could be material.

2. Incorporation and Nature of Operations

The Company was formed on September 20, 1996 under the name

Montemor Resources Inc. on the amalgamation of 1169479 Ontario Inc.

and Consolidated Deer Creek Resources Limited. The name was changed

to European Gold Resources Inc. by articles of amendment dated July

25, 1997. On May 5, 2004, the Company changed its name from

European Gold Resources Inc. to Galantas Gold Corporation. The

Company was incorporated to explore for and develop mineral

resource properties, principally in Europe. In 1997, it purchased

all of the shares of Omagh which owns a mineral property in

Northern Ireland, including a delineated gold deposit. Omagh

obtained full planning and environmental consents necessary to

bring its property into production.

The Company entered into an agreement on April 17, 2000,

approved by shareholders on June 26, 2000, whereby Cavanacaw, a

private Ontario corporation, acquired Omagh. Cavanacaw has

established an open pit mine to extract the Company's gold deposit

near Omagh, Northern Ireland. Cavanacaw also has developed a

premium jewellery business founded on the gold produced under the

name Galántas Irish Gold Limited ("Galántas"). As at July 1, 2007,

the Company's Omagh mine began production and in 2013 production

was suspended. On April 1, 2014, Galántas amalgamated its jewelry

business with Omagh.

On April 8, 2014, Cavanacaw acquired Flintridge. Following a

strategic review of its business by the Company during 2014 certain

assets owned by Omagh were acquired by Flintridge.

The Company's operations include the consolidated results of

Cavanacaw, and its wholly-owned subsidiaries Omagh, Galántas and

Flintridge.

The Company's common shares are listed on the TSX Venture

Exchange ("TSXV") and London Stock Exchange AIM under the symbol

GAL. On September 1, 2021, the Company's common shares started

trading under the symbol GALKF on the OTCQX in the United States.

The primary office is located at The Canadian Venture Building, 82

Richmond Street East, Toronto, Ontario, Canada, M5C 1P1.

3. Basis of Preparation

Statement of compliance

The Company applies International Financial Reporting Standards

("IFRS") as issued by the International Accounting Standards Board

and interpretations issued by the International Financial Reporting

Interpretations Committee ("IFRIC"). These unaudited condensed

interim consolidated financial statements have been prepared in

accordance with International Accounting Standard 34 - Interim

Financial Reporting. Accordingly, they do not include all of the

information required for full annual financial statements.

The policies applied in these unaudited condensed interim

consolidated financial statements are based on IFRS issued and

outstanding as of May 29, 2023 the date the Board of Directors

approved the statements. The same accounting policies and methods

of computation are followed in these unaudited condensed interim

consolidated financial statements as compared with the most recent

annual consolidated financial statements as at and for the year

ended December 31, 2022. Any subsequent changes to IFRS that are

given effect in the Company's annual consolidated financial

statements for the year ending December 31, 2023 could result in

restatement of these unaudited condensed interim consolidated

financial statements.

4. Accounts Receivable and Prepaid Expenses

As at As at

March 31, December 31,

2023 2022

-------------------------------------------------- --------- ------------

Sales tax receivable - Canada $ 38,583 $ 22,971

Valued added tax receivable - Northern Ireland 136,290 281,308

Accounts receivable 154,510 116,374

Prepaid expenses 1,241,135 1,390,340

--------------------------------------------------- --------- ------------

$ 1,570,518 $ 1,810,993

-------------------------------------------------- --------- ------------

Prepaid expenses includes advances for consumables and for

construction of the passing bays in the Omagh mine. Prepaid

expenses includes also $1,000,000 pursuant to services agreement

for the underground development at the Omagh Gold Project.

The following is an aged analysis of receivables:

As at As at

March 31, December 31,

2023 2022

----------------------------- --------- ------------

Less than 3 months $ 210,130 $ 343,381

3 to 12 months 65,392 51,868

More than 12 months 53,861 25,404

------------------------------ --------- ------------

Total accounts receivable $ 329,383 $ 420,653

-------------------------- --------- ------------

5. Inventories

As at As at

March 31, December 31,

2023 2022

--------------------------- --------- ------------

Concentrate inventories $ 80,285 $ 83,242

------------------------ --------- ------------

6. Property, Plant and Equipment

Freehold Plant

land and and Motor Office Development Assets under

machinery

Cost buildings (i) vehicles equipment assets (ii) construction Total

------------- --------- --------- -------- --------- ----------- ------------ -----------

Balance,

December 31,

2021 $2,363,814 $8,108,988 $ 199,217 $ 216,653 $ 22,561,674 $ 556,273 $ 34,006,619

Additions - 464,632 45,599 9,619 11,008,120 - 11,527,970

Disposals - - (14,531) - - - (14,531)

Transfer - 529,972 - - - (529,972) -

Cash receipts

from

concentrate

sales - - - - (823,475) - (823,475)

Impairment - - - - (10,124,920) - (10,124,920)

Foreign

exchange

adjustment (111,761) (381,794) (9,419) (10,243) (1,219,359) (26,301) (1,758,877)

------------- --------- --------- -------- --------- ----------- ------------ -----------

Balance,

December 31,

2022 2,252,053 8,721,798 220,866 216,029 21,402,040 - 32,812,786

Additions - - - - 1,187,334 - 1,187,334

Foreign

exchange

adjustment 55,743 215,044 5,467 5,347 525,221 - 806,822

------------- --------- --------- -------- --------- ----------- ------------ -----------

Balance,

March 31,

2023 $2,307,796 $8,936,842 $ 226,333 $ 221,376 $ 23,114,595 $ - $ 34,806,942

------------- --------- --------- -------- --------- ----------- ------------ -----------

Accumulated

depreciation

------------- --------- --------- -------- --------- ----------- ------------ -----------

Balance,

December 31,

2021 $1,964,309 $6,067,698 $ 147,888 $ 137,888 $ - $ - $ 8,317,783

Depreciation 4,734 587,131 20,676 12,510 - - 625,051

Disposals - - (3,268) - - - (3,268)

Foreign

exchange

adjustment (92,801) (276,816) (6,681) (6,331) - - (382,629)

------------- --------- --------- -------- --------- ----------- ------------ -----------

Balance,

December 31,

2022 1,876,242 6,378,013 158,615 144,067 - - 8,556,937

Depreciation 968 118,046 4,374 2,717 - - 126,105

Foreign

exchange

adjustment 46,457 159,121 4,002 3,613 - - 213,193

------------- --------- --------- -------- --------- ----------- ------------ -----------

Balance,

March 31,

2023 $1,923,667 $6,655,180 $ 166,991 $ 150,397 $ - $ - $ 8,896,235

------------- --------- --------- -------- --------- ----------- ------------ -----------

Carrying

value

------------- --------- --------- -------- --------- ----------- ------------ -----------

Balance,

December 31,

2022 $ 375,811 $2,343,785 $ 62,251 $ 71,962 $ 21,402,040 $ - $ 24,255,849

------------- --------- --------- -------- --------- ----------- ------------ -----------

Balance,

March 31,

2023 $ 384,129 $2,281,662 $ 59,342 $ 70,979 $ 23,114,595 $ - $ 25,910,707

------------- --------- --------- -------- --------- ----------- ------------ -----------

(i) Right-of-use assets of $282,041 is included in additions of

the plant and machinery for the year ended December 31, 2022.

(ii) Development assets are expenditures for the underground

mining operations in Omagh.

7. Exploration and Evaluation Assets

Exploration

and

evaluation

Cost assets

---------------------------- -----------

Balance, December 31, 2021 $ 1,574,183

Additions 1,165,561

Foreign exchange adjustment (74,431)

---------------------------- -----------

Balance, December 31, 2022 2,665,313

Additions 921,853

Foreign exchange adjustment 73,498

---------------------------- -----------

Balance, March 31, 2023 $ 3,660,664

---------------------------- -----------

Carrying value

---------------------------- -----------

Balance, December 31, 2022 $ 2,665,313

---------------------------- -----------

Balance, March 31, 2023 $ 3,660,664

---------------------------- -----------

(i) On January 26, 2023, the Company announced that it entered

into an agreement to acquire a 100% interest and the exclusive

rights to explore and develop the Gairloch Project from the owners

of the Gairloch Estate lands. The Company has acquired exploration

and developments rights for an initial payment of GBP 347,000 and

annual payments of GBP 69,000 beginning in year 6.

The lease agreement will continue for 30 years and will be

renewable at the election of Galantas, upon 90 days' prior written

notice and upon the approval of the lessor, not to be unreasonably

withheld, for a further 20-year period, assuming all conditions of

this agreement have been met satisfactorily according to the

Lessor, acting reasonably, in respect of the Galantas' conduct and

operations. Galantas may terminate the agreement with 18 months'

notice.

Galantas made a payment of $580,392 (GBP 347,000) representing

payment for the first five years of the lease. If the exploration

phase continues past the fifth anniversary of the effective date of

the agreement, Galantas will pay the lessor GBP 69,400 index linked

per lease year for each such lease year following the fifth

anniversary of the effective date, with such payment to be made at

the commencement of each such lease year.

During any mining phase, Galantas will pay the lessor GBP 50,000

index linked per lease year, with such payment to be made at the

commencement of each such lease year. Galantas will grant a 5% net

profits interest royalty (the "NPI"), calculated according to

standard industry terms and practices with the option by the Lessor

to convert the NPI to a 2% net smelter returns royalty, calculated

according to standard industry terms and practices.

8. Decommissioning Liability

The Company's decommissioning liability is a result of mining

activities at the Omagh mine in Northern Ireland. The Company

estimated its decommissioning liability at March 31, 2023 based on

a risk-free discount rate of 1% (December 31, 2022 - 1%) and an

inflation rate of 1.50% (December 31, 2022 - 1.50%). The expected

undiscounted future obligations allowing for inflation are GBP

330,000 and based on management's best estimate the decommissioning

is expected to occur over the next 5 to 10 years. On March 31,

2023, the estimated fair value of the liability is $599,498

(December 31, 2022 - $582,441). Changes in the provision during the

three months ended March 31, 2023 are as follows:

As at As at

March 31, December 31,

2023 2022

-------------------------------------------------- --------- ------------

Decommissioning liability, beginning of period $ 582,441 $ 600,525

Accretion 2,596 10,154

Foreign exchange 14,461 (28,238)

--------------------------------------------------- --------- ------------

Decommissioning liability, end of period $ 599,498 $ 582,441

----------------------------------------------- --------- ------------

As required by the Crown in Northern Ireland, the Company is

required to provide a bond for reclamation related to the Omagh

mine in the amount of GBP 300,000 (December 31, 2022 - GBP

300,000), of which GBP 300,000 was funded as of March 31, 2023 (GBP

300,000 was funded as of December 31, 2022) and reported as

long-term deposit of $501,780 (December 31, 2022 - $489,660).

9. Accounts Payable and Other Liabilities

Accounts payable and other liabilities of the Company are

principally comprised of amounts outstanding for purchases relating

to exploration costs on exploration and evaluation assets, general

operating activities and professional fees activities.

As at As at

March 31, December 31,

2023 2022

------------------------------------------------ --------- ------------

Accounts payable $ 3,292,487 $ 2,528,245

Accrued liabilities 1,316,264 1,523,796

------------------------------------------------- --------- ------------

Total accounts payable and other liabilities $ 4,608,751 $ 4,052,041

--------------------------------------------- --------- ------------

The following is an aged analysis of the accounts payable and

other liabilities:

As at As at

March 31, December 31,

2023 2022

------------------------------------------------ --------- ------------

Less than 3 months $ 3,084,128 $ 2,939,972

3 to 12 months 712,969 412,168

12 to 24 months 157,196 61,247

More than 24 months (see also note 16) 654,458 638,654

------------------------------------------------- --------- ------------

Total accounts payable and other liabilities $ 4,608,751 $ 4,052,041

--------------------------------------------- --------- ------------

10. Financing Facilities

Amounts payable on the Company's financial facilities are as

follow:

As at As at

March 31, December 31,

2023 2022

---------------------------------------------- ---------- ------------

Melquart Limited

Financing facilities, beginning of period $ - $ -

Financing facility received (i) 580,392 -

Less bonus warrants issued (i) (16,984) -

Interest 8,502 -

----------------------------------------------- ---------- ------------

571,910 -

---------------------------------------------- ---------- ------------

G&F Phelps

Financing facility, beginning of period 4,836,267 4,247,488

Accretion 64,839 269,512

Interest 221,389 618,903

Repayment - (24,120)

Foreign exchange adjustment 130,004 (275,516)

----------------------------------------------- ---------- ------------

5,252,499 4,836,267

---------------------------------------------- ---------- ------------

Less current portion (5,252,499) (4,836,267)

----------------------------------------------- ---------- ------------

Financing facilities - non-current portion $ 571,910 $ -

------------------------------------------- ---------- ------------

(i) On February 13, 2023, the Company announced that it entered

into a loan agreement for $580,392 (GBP 347,000) with London-based

family office Melquart Limited ("Melquart"). The loan is to be used

for the initial lease payment for the Gairloch Project in Scotland.

The loan is payable 24 months from the date of the loan agreement

and will bear interest at an annual rate of 12% payable upon

repayment of the loan. As at March 31, 2023, the amount of interest

accrued is $8,502 (GBP 5,083).

As consideration for providing the loan, Melquart received

100,000 warrants of Galantas. Each bonus warrant are exercisable

into one common share of Galantas at an exercise price of $0.41,

with said warrants expiring on February 13, 2025. The fair value of

the 100,000 warrants was estimated at $16,984 using the following

Black-Scholes option pricing model with the following assumptions:

expected dividend yield - 0%, expected volatility - 97.54%,

risk-free interest rate - 3.47% and an expected average life of

1.90 years.

11. Share Capital and Reserves

a) Authorized share capital

At March 31, 2023, the authorized share capital consisted of an

unlimited number of common and preference shares issuable in

Series.

The common shares do not have a par value. All issued shares are

fully paid.

No preference shares have been issued. The preference shares do

not have a par value.

b) Common shares issued

At March 31, 2023, the issued share capital amounted to

$71,104,535. The continuity of issued share capital for the periods

presented is as follows:

Number of

common

shares Amount

--------------------------------------- ----------- ----------

Balance, December 31, 2021 74,683,801 $57,783,570

Exercise of warrants 7,838,000 4,093,100

---------------------------------------- ----------- ----------

Balance, March 31, 2022 82,521,801 $61,876,670

---------------------------------------- ----------- ----------

Balance, December 31, 2022 103,518,509 $69,664,056

Shares issued in private placement (i) 8,230,951 2,963,142

Warrants issued (i) - (1,284,806)

Share issue costs (i) - (245,168)

Exercise of warrants 14,000 7,311

---------------------------------------- ----------- ----------

Balance, March 31, 2023 111,763,460 $71,104,535

---------------------------------------- ----------- ----------

(i) On March 27, 2023, the Company closed a non-brokered private

placement of 8,230,951 units at a price of $0.36 per unit for gross

proceeds of $2,963,142. Each unit consists of one common share of

the Company and one common share purchase warrant, with each

warrant entitling the holder to purchase an additional common share

at a price of $0.55 per share until March 27, 2028. The fair value

of the 8,230,951 warrants was estimated at $1,284,806 using the

Black-Scholes option pricing model with the following assumptions:

expected dividend yield - 0%, expected volatility - 126.22%,

risk-free interest rate - 2.96% and an expected average life of 5

years.

The Company paid the agents a cash commission equal to $130,966

and issued 237,162 non-transferable broker warrants of the Company.

Each broker warrant is exercisable to acquire one common share at

an exercise price of $0.36 until March 27, 2025. The fair value of

the 237,162 warrants was estimated at $40,175 using the

Black-Scholes option pricing model with the following assumptions:

expected dividend yield - 0%, expected volatility - 99.18%,

risk-free interest rate - 3.61% and an expected average life of 2

years.

There is a 4-month hold period on the trading of securities

issued in connection with this offering.

Ocean Partners acquired 691,666 units for consideration of

$249,000 and Brendan Morris, and officer of the Company, acquired

468,416 units for consideration of $168,630.

c) Warrant reserve

The following table shows the continuity of warrants for the

periods presented:

Weighted

average

Number of exercise

warrants price

--------------------------------------------- ---------- --------

Balance, December 31, 2021 28,691,598 $ 0.39

Issued 250,000 0.50

Exercised (7,838,000) 0.40

---------------------------------------------- ---------- --------

Balance, March 31, 2022 21,103,598 $ 0.39

---------------------------------------------- ---------- --------

Balance, December 31, 2022 24,051,900 $ 0.45

Issued (notes 10(i), 11(b)(i) and 14(a)(iv)) 9,068,113 0.54

Exercised (14,000) 0.40

Expired (250,000) 0.50

---------------------------------------------- ---------- --------

Balance, March 31, 2023 32,856,013 $ 0.47

---------------------------------------------- ---------- --------

The following table reflects the actual warrants issued and

outstanding as of March 31, 2023:

Grant date Exercise

Number fair value price

Expiry date of warrants ($) ($)

------------------ ----------- ---------- --------

May 14, 2023 14,396,231 1,763,087 0.40

July 25, 2023 125,000 23,000 0.48

December 31, 2023 780,000 274,883 0.33

August 30, 2024 820,000 144,464 0.45

January 31, 2025 500,000 65,527 0.55

February 13, 2025 100,000 16,984 0.41

February 28, 2025 7,666,669 1,644,859 0.55

March 27, 2025 237,162 40,175 0.36

March 27, 2028 8,230,951 1,284,806 0.55

------------------- ----------- ---------- --------

32,856,013 5,257,785 0.47

------------------ ----------- ---------- --------

11. Share Capital and Reserves (Continued)

d) Stock options

The following table shows the continuity of stock options for

the periods presented:

Weighted

average

Number of exercise

options price

--------------------------- --------- --------

Balance, December 31, 2021 4,885,000 $ 0.88

Expired (255,000) 1.35

Cancelled (205,000) 0.96

---------------------------- --------- --------

Balance, March 31, 2022 4,425,000 $ 0.85

---------------------------- --------- --------

Balance, December 31, 2022 6,152,500 $ 0.78

Cancelled (i) (177,500) 0.71

---------------------------- --------- --------

Balance, March 31, 2023 5,975,000 $ 0.78

---------------------------- --------- --------

(i) The portion of the estimated fair value of options granted

in the current and prior years and vested during the three months

ended March 31, 2023, amounted to $183,723 (three months ended

March 31, 2022 - $350,539). In addition, during the three months

ended March 31, 2023, 177,500 options granted in the prior years

were cancelled (three months ended March 31, 2022 - 205,000 options

cancelled).

The following table reflects the actual stock options issued and

outstanding as of March 31, 2023:

Weighted average Number of

remaining Number of options Number of

Exercise contractual options vested options

Expiry date price ($) life (years) outstanding (exercisable) unvested

------------------ --------- ---------------- ----------- ------------- ---------

April 19, 2023 1.10 0.05 25,000 25,000 -

February 13, 2024 0.90 0.87 85,000 85,000 -

June 27, 2024 0.90 1.24 100,000 100,000 -

May 19, 2026 0.86 3.14 3,685,000 2,456,667 1,228,333

June 21, 2026 0.73 3.23 425,000 283,333 141,667

August 27, 2026 0.86 3.41 20,000 13,333 6,667

May 3, 2027 0.60 4.09 1,635,000 545,000 1,090,000

------------------ --------- ---------------- ----------- ------------- ---------

0.78 3.33 5,975,000 3,508,333 2,466,667

------------------ --------- ---------------- ----------- ------------- ---------

12. Net Loss per Common Share

The calculation of basic and diluted loss per share for the

three months ended March 31, 2023 was based on the loss

attributable to common shareholders of $1,393,614 (three months

ended March 31, 2022 - $1,415,812) and the weighted average number

of common shares outstanding of 103,893,399 (three months ended

March 31, 2022 - 78,556,743) for basic and diluted loss per share.

Diluted loss did not include the effect of 32,856,013 warrants

(three months ended March 31, 2022 - 21,103,598) and 5,975,000

options (three months ended March 31, 2022 - 4,425,000) for the

three months ended March 31, 2023, as they are anti-dilutive.

13. Revenues

Shipments of concentrate under the off-take arrangements

commenced during the second quarter of 2019. Concentrate sales

provisional revenues during the three months ended March 31, 2023

totalled approximately US$255,000 (CAD$419,169) (three months ended

March 31, 2022 - US$219,000). However, until the mine reaches the

commencement of commercial production, the net proceeds from

concentrate sales will be offset against Development assets.

14. Related Party Disclosures

Related parties pursuant to IFRS include the Board of Directors,

close family members, other key management individuals and

enterprises that are controlled by these individuals as well as

certain persons performing similar functions.

Related party transactions conducted in the normal course of

operations are measured at the exchange amount and approved by the

Board of Directors in strict adherence to conflict of interest laws

and regulations.

(a) The Company entered into the following transactions with

related parties:

Three Months Ended

March 31,

2023 2022

---------------------------------------- ---------- -------

Interest on related party loans (i) $ 173,665 $ 74,695

-------------------------------- ---- ---------- -------

(i) Refer to note 14(a)(iii).

(ii) Refer to note 11(b).

(a) The Company entered into the following transactions with

related parties (continued):

(iii) As at March 31, 2023, the Company owes Ocean Partners

$5,189,693 (December 31, 2022 - $4,978,069) which is recorded as

due to related parties on the unaudited condensed interim

consolidated statement of financial position.

March 31, December 31,

2023 2022

------------------------------------------------ ---------- ------------

Balance, beginning of period $ 4,978,069 $ 2,444,376

Loan received - 2,062,693

Less bonus warrants - (74,000)

Share issue costs - (93,444)

Advance - 93,284

Repayment (6,500) (524,255)

Accretion 43,697 391,128

Interest 173,665 554,073

Foreign exchange adjustment 762 124,214

------------------------------------------------- ---------- ------------

Balance, end of period 5,189,693 4,978,069

Less current balance (5,189,693) (4,978,069)

------------------------------------------------- ---------- ------------

Due to related parties - non-current balance $ - $ -

--------------------------------------------- ---------- ------------

(iv) In December 2022, the Company entered into an agreement

(the "Trading Agreement") with Ocean Partners, whereby Ocean

Partners has sold on behalf of Galantas call options on 6,000

ounces of gold at 500 ounces per month from February 2024 to

January 2025 at a strike price of US$1,775 per ounce for proceeds

of US$804,000 to Galantas (an option premium of US$134 per gold

ounce). Proceeds from the sale will be used to fund development of

the underground mining operations at the Omagh Gold Project in

Northern Ireland and working capital.

If the gold price during February 2024 to January 2025 is at or

below US$1,775 per ounce, Galantas will receive the price of gold

at the time for the sale of its gold produced. If the gold price is

above US$1,775 per ounce, Galantas will receive US$1,775 per ounce

in revenue for the sale of its gold.

Pursuant to the Trading Agreement, and in return for Ocean

Partners facilitating the call option sale and agreeing to maintain

all margin requirements on Galantas' behalf, which Galantas has

determined has a value of at least $150,000, Galantas has agreed to

grant 500,000 warrants to Ocean Partners at an exercise price of

$0.55 expiring on January 31, 2025. The warrants are subject to a

hold period under applicable securities laws and the rules of the

TSXV. The fair value of the 500,000 warrants was valued at $65,527

using the following Black-Scholes option pricing model with the

following assumptions: expected dividend yield - 0%, expected

volatility - 97.85%, risk-free interest rate - 3.73% and an

expected average life of 1.9 year.

As at March 31, 2023, balance related to the Trading Agreement

is recorded as other liability on the unaudited condensed interim

consolidated statement of financial position is $1,021,819

(December 31, 2022 - $1,085,426).

(b) Remuneration of officer and directors of the Company was as

follows:

Three Months Ended

March 31,

2023 2022

----------------------------- --------- --------

Salaries and benefits (1) $ 113,334 $ 107,583

Stock-based compensation 141,231 250,310

------------------------------ --------- --------

$ 254,565 $ 357,893

----------------------------- --------- --------

(1) Salaries and benefits include director fees. As at March 31,

2023, due to directors for fees amounted to $105,000 (December 31,

2022 - $70,000) and due to officers, mainly for salaries and

benefits accrued amounted to $86,672 (December 31, 2022 - $24,465),

and is included with due to related parties.

(c) As at March 31, 2023, Ross Beaty owns 3,744,748 common

shares of the Company or approximately 3.4% of the outstanding

common shares. Premier Miton owns 4,848,243 common shares of the

Company or approximately 4.3%. Melquart owns, directly and

indirectly, 28,140,195 common shares of the Company or

approximately 25.2% of the outstanding common shares of the

Company. G&F Phelps owns 5,353,818 common shares of the Company

or approximately 4.8%. Eric Sprott owns 10,166,667 common shares of

the Company or approximately 9.1%. Mike Gentile owns 6,217,222

common shares of the Company or approximately 5.6%. The remaining

47.6% of the shares are widely held, which includes various small

holdings which are owned by directors of the Company. These

holdings can change at anytime at the discretion of the owner.

The Company is not aware of any arrangements that may at a

subsequent date result in a change in control of the Company.

15. Segment Disclosure

The Company has determined that it has one reportable segment.

The Company's operations are substantially all related to its

investment in Cavanacaw and its subsidiaries, Omagh and Flintridge.

Substantially all of the Company's revenues, costs and assets of

the business that support these operations are derived or located

in Northern Ireland. Segmented information on a geographic basis is

as follows:

March 31, 2023 United Kingdom Canada Total

------------------- -------------- --------- ----------

Current assets $ 853,269 $3,314,356 $ 4,167,625

Non-current assets $ 29,189,571 $ 883,580 $30,073,151

Revenues $ - $ - $ -

------------------- -------------- --------- ----------

December 31, 2022 United Kingdom Canada Total

------------------- -------------- --------- ----------

Current assets $ 1,659,045 $1,273,833 $ 2,932,878

Non-current assets $ 27,271,081 $ 139,741 $27,410,822

Revenues $ - $ - $ -

------------------- -------------- --------- ----------

16. Contingency

During the year ended December 31, 2010, the Company's

subsidiary Omagh received a payment demand from Her Majesty's

Revenue and Customs ("HMRC") in the amount of $508,955 (GBP

304,290) in connection with an aggregate levy arising from the

removal of waste rock from the mine site during 2008 and early

2009. Omagh believed this claim to be without merit. An appeal was

lodged with the Tax Tribunals Service and the hearing started at

the beginning of March 2017 and following a number of adjournments

was completed in August 2018. During the year ended December 31,

2019, the Tax Tribunals Service issued their judgement dismissing

the appeal by Omagh in respect of the assessments. A provision has

now been included in the unaudited condensed interim consolidated

financial statements in respect of the aggregates levy plus

interest and penalty.

There is a contingent liability in respect of potential

additional interest which may be applied in respect of the

aggregates levy dispute. Omagh is unable to make a reliable

estimate of the amount of the potential additional interest that

may be applied by HMRC.

17. Events After the Reporting Period

(i) The Company has entered into an agreement to acquire the

historical Gairloch drill and exploration database for (i) a

payment of $420,000 (approximately GBP 252,153), to be satisfied

through the issuance of common shares of the Company based on the

5-day volume weighted average price at the time of signing (subject

to the approval of the TSXV) and (ii) GBP 50,000 in cash. On April

13, 2023, the Company issued 933,334 common shares per terms of the

agreement.

(ii) On April 19, 2023, 25,000 stock options with exercise price

of $1.10 expired unexercised.

(iii) On April 26, 2023, the Company agreed to the terms of a

proposed shares-for-debt transaction with several additional arm's

length creditors of the Company and agreed to settle a total of

approximately $749,020 of indebtedness through the issuance of an

aggregate of 2,080,609 units a deemed price of $0.36 per unit. Each

unit consists of one common share of the Company and one common

share purchase warrant, with each warrant entitling the holder to

purchase an additional common share at a price of $0.55 per share

until April 26, 2028. The securities pursuant to the debt

settlement will be subject to a four-month hold period under

applicable Canadian securities laws.

(iv) On May 14, 2023, 14,332,231 warrants with an exercise price

of $0.40 expired unexercised.

(v) Subsequent to March 31, 2023, 64,000 warrants were exercised

for gross proceeds of $25,600.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFNKCBQFBKDOPB

(END) Dow Jones Newswires

May 30, 2023 02:00 ET (06:00 GMT)

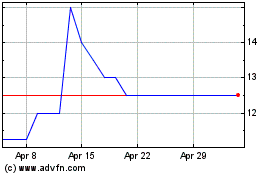

Galantas Gold (LSE:GAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Galantas Gold (LSE:GAL)

Historical Stock Chart

From Apr 2023 to Apr 2024