TIDMGAMA

RNS Number : 3446Y

Gamma Communications PLC

06 September 2022

6 September 2022

Gamma Communications plc

Unaudited results for the six months ended 30 June 2022

Strong first half performance, continued cash generation and

positive business momentum

Expectations for the full year unchanged

Gamma Communications plc ("Gamma" or "the Group"), a leading

provider of Unified Communications as a Service ("UCaaS") into the

UK and European business markets, is pleased to announce its

unaudited results for the six months ended 30 June 2022.

Six months ended

30 June

----------------------

Change

2022 2021 (%)

---------- ---------- -------

Revenue GBP234.7m GBP217.4m +8%

---------- ---------- -------

Gross profit GBP120.4m GBP111.7m +8%

---------- ---------- -------

Gross margin 51% 51%

---------- ---------- -------

Profit from operations GBP38.7m GBP32.9m +18%

---------- ---------- -------

Adjusted EBITDA* GBP51.9m GBP46.0m +13%

---------- ---------- -------

Profit before tax ("PBT") GBP38.4m GBP32.4m +19%

---------- ---------- -------

Adjusted PBT* GBP43.1m GBP37.0m +16%

---------- ---------- -------

EPS (Fully Diluted, "FD") 31.9p 27.0p +18%

---------- ---------- -------

Adjusted EPS (FD)* 35.6p 30.6p +16%

---------- ---------- -------

Interim dividend per share 5.0p 4.4p +14%

---------- ---------- -------

Cash generated by operations GBP49.5m GBP43.1m +15%

---------- ---------- -------

Cash generated by operations /

Adjusted EBITDA 95% 94%

---------- ---------- -------

Cash and cash equivalents less borrowings

("Net Cash") GBP72.6m GBP25.6m +184%

---------- ---------- -------

* All adjusted measures set out above and throughout this

document which are described as "adjusted" represent Alternative

Performance Measures ("APMs") and are separately presented within

the statement of profit or loss or reconciled in the Financial

Review section or segment note and are applied consistently. Where

reference is made to adjusted EPS this is stated on a fully diluted

basis. Definitions of APMs are included in the Financial Review.

Our policy on the use of APMs is included in note 2. Constant

currency movements for the income statement are calculated by

restating the results for the period ended 30 June 2022 at the

prior period average exchange rates.

Key Highlights

The Group continued to perform strongly in the first six months

of the year with good gross profit growth flowing through to

Adjusted EBITDA and significant cash generation.

Financial highlights

The UK business units continued to perform well. In Europe,

Germany's strong growth out performed the more subdued performance

in the smaller Spanish and Dutch businesses:

-- Revenue and gross profit grew by 8% to GBP234.7m and

GBP120.4m respectively (H1 2021: GBP217.4m and GBP111.7m), with

gross margin being maintained and Adjusted EBITDA growing by 13% to

GBP51.9m (H1 2021: GBP46.0m).

-- Recurring revenue (being revenue which is recognised "over

time" as per note 3) in the year grew to GBP208.7m (H1 2021:

GBP194.3m) being maintained at 89% of total revenue.

-- UK Indirect Business continued to grow strongly with a focus

on the existing partner base. Gross profit increased by 10% to

GBP76.3m (H1 2021: GBP69.2m) with a stable gross margin.

-- UK Direct Business returned to growth, with gross profit

increasing 6% to GBP27.9m (H1 2021: GBP26.4m). A strong contracted

pipeline, significantly ahead when compared to this time last year,

supports the growth we anticipate for the full year. As expected

gross margin decreased slightly as a result of higher installations

and hardware sales which are lower margin.

-- European Business, in local currency, delivered gross profit

growth of 4%, seeing strong growth in UCaaS users and a good

performance from our German business being tempered by some

headwinds in our smaller Spanish business. After foreign exchange

("FX") translation, the European business gross profit was stable

at GBP16.2m (H1 2021 GBP16.1m).

Product highlights

There continues to be strong volume growth across the major

product groups:

-- The number of installed SIP Trunks increased, driven by voice

enablement of the Microsoft ("MS") Teams via Direct Routing and

Operator Connect.

-- The number of Horizon (Cloud PBX) users increased by 6% to

716,000 from 676,000 as at 31 December 2021; sales of the

Collaborate module grew faster than the core module, increasing by

10% to 69,000 from 63,000.

-- The number of Cloud PBX seats in our European business

increased by 7% to 137,000 from 128,000 at 31 December 2021 - a

slightly higher rate of growth than we are experiencing in the UK

and in line with the growth in the European market.

Andrew Belshaw, Interim Chief Executive Officer, commented:

"I am pleased to be presenting the first set of results since I

took on my new role. Gamma has had a strong first half. Our Direct

business in the UK has returned to growth as we had indicated it

would once the effects of COVID had worked through. The UK Indirect

business continues to be strong with good growth in the new

variants of SIP which support MS Teams users. Our European business

has increased the number of Cloud seats by 7% despite a challenging

economic environment."

"We are seeing some effects of inflation in connectivity and

hardware costs which we are generally able to pass on to customers.

We expect this to continue to increase in the second half and into

2023. We are also seeing salary inflation, which we continue to

actively manage whilst focussing on retention and ensuring that we

support our lower paid staff seeing unprecedented rises in the cost

of living. Gamma is well placed to navigate the publicised

macro-economic headwinds. We are a leader in a market with

long-term structural growth, have a high degree of recurring

revenue and have been and will continue to be strongly cash

generative. We have a robust balance sheet that will allow us to

continue to invest in the business as well as support organic

growth with selected acquisitions."

Enquiries:

Gamma Communications plc Tel: +44 (0)333 006 5972

Andrew Belshaw, Interim Chief Executive Officer

Bill Castell, Chief Financial Officer

Investec Bank plc (NOMAD & Broker) Tel: +44 (0)207 597 5970

Patrick Robb / Virginia Bull

Tulchan Communications LLP (PR Adviser) Tel: +44 (0)207 353 4200

James Macey White / Matt Low

Chair's statement

I am pleased to present the unaudited results for the six months

ended 30 June 2022.

Overview of results

Group revenue for the six months ended 30 June 2022 increased by

GBP17.3m to GBP234.7m (H1 2021: GBP217.4m) an increase of 8% on the

prior year. Profit before tax for the period was GBP38.4m, an

increase of 19% (H1 2021: GBP32.4m). Adjusted EBITDA for the Group

increased by GBP5.9m or 13% to GBP51.9m (H1 2021: GBP46.0m).

Adjusted items are explained and reconciled in the Financial Review

and note 2. Fully diluted earnings per share for the half increased

by 18% to 31.9p (H1 2021: 27.0p). Adjusted earnings per share

(fully diluted) for the year increased by 16% to 35.6p (H1 2021:

30.6p).

The cash generated by operations for the half year was GBP49.5m

compared to GBP43.1m in H1 2021. The closing net cash balance for

the period was GBP72.6m compared to GBP49.5m at the end of December

2021. The cash balance has increased despite investing GBP7.8m on

capital expenditure, GBP1.6m of contingent consideration for

acquisitions and paying GBP8.5m in dividends.

The first half of 2022 saw the positive impact from the lifting

of COVID restrictions offset by the increasing global macroeconomic

headwinds we all face going into 2023. Although not totally immune

to these headwinds, Gamma's commercial model with its high

recurring revenue stream and cash conversion leaves us well placed

to both navigate those challenges ourselves and continue to support

our customers through the challenging times ahead.

Our markets

As we approach the UK PSTN switch off in 2025 many businesses

still need to migrate their ISDN lines to SIP meaning there is

still growth in the SIP market. Cloud Communications is a growing

market across Europe, with short, medium and long-term

opportunities. The European market is under-penetrated with these

technologies which presents us with an opportunity to grow our

European revenues and profits as those markets evolve.

Board and governance

On 3 May 2022, Andrew Belshaw was promoted from Chief Financial

Officer to Deputy Chief Executive Officer as part of a structured

plan to strengthen and broaden the scope and capacity of Gamma's

management team. To fill the role of Chief Financial Officer, Bill

Castell joined the Company and the Board on 1 May 2022 having

previously been Chief Financial Officer at Ovo Energy. Prior to

this Bill has held senior finance roles at Virgin Media, Barclays

Corporate Bank and Barclaycard Europe, and he also serves as a

Non-Executive Director for the Financial Ombudsman Service.

On 4 July 2022, Andrew Belshaw took on the role of Interim Chief

Executive Officer after Andrew Taylor notified the Board of his

intention to retire from his role as Chief Executive Officer and

the Board. I would like to take the opportunity to thank Andrew

Taylor formally for his leadership over the past four years. He has

played a key role in shaping Gamma's strategy and he leaves the

business in an excellent position to further develop and grow.

At the AGM on 19 May 2022, Wu Long Peng retired from the Board

as a Non-Independent Non-Executive Director. I am grateful to Wu

Long Peng for his substantial input and support, particularly since

the IPO almost eight years ago.

I was delighted to welcome Shaun Gregory to the Board on 1 July

2022 as an Independent Non-Executive Director. Shaun has had an

extensive career across media and advertising spanning over 30

years. More recently, he has been the Chief Executive Officer of

Exterion Media and IYUNO Media Group and is currently the Chief

Executive Officer of EMG Group.

Employees

At 30 June 2022, we had 1,783 employees in the Group based in

seven countries (30 June 2021: 1,686). We encourage all employees

to own shares in the Company. For our UK based employees, we

offered a Sharesave scheme for the sixth year in a row. Once again,

it was pleasing to see the high take-up, with 360 staff choosing to

participate in the scheme (2021: 402). This brought the total

number of employees in the SAYE scheme to 711. We also have 174

employees who are buying shares monthly through our Share Incentive

Plan and 703 in total who hold shares through the Share Incentive

Plan Trust.

Environmental

Gamma remains committed to developing from a Carbon Neutral

business to a Carbon Net-Zero business by 2042. Gamma expects to

reduce Scope 1 and 2 emissions (those made directly and indirectly)

by 90% by 2030 from a baseline year of 2021. In H1 2022 we

committed to set near and long-term Company-wide emission

reductions in line with the Science-Based Target initiative (SBTi)

and we will seek validation of our target within the 24-month SBTi

timeframe.

Dividend

Gamma remains committed to a progressive dividend policy which

has seen the dividend increase by between 10 - 15% every year since

our IPO in 2014. Gamma has paid one third of the dividend as an

interim dividend with the final two thirds paid as a final dividend

once the results for the full year are known.

The Board is pleased to declare an interim dividend, in respect

of the six months ended 30 June 2022, of 5.0 pence per share (2021:

4.4 pence). This is an increase of 14%. It will be payable on

Thursday 20 October 2022 to shareholders on the register on Friday

23 September 2022.

Current Trading and Outlook

The Board remains positive about the prospects for Gamma. Having

successfully navigated and continued to grow through the COVID

pandemic, we now face increasing global economic and geopolitical

headwinds. The Group continues to deliver against its long-term

growth strategy. Gamma will continue to concentrate its efforts and

investment to develop a product and solution set which facilitates

flexible working for businesses of all sizes, building on an

already strong reputation for operational excellence and service

quality. The business is in a strong financial position, which

enables it to continue to invest in its product portfolio across

its European footprint.

As we said in our trading update on 2 August 2022, the Board

expects Adjusted EBITDA and Adjusted EPS for the year ending 31

December 2022 to be in the upper half of the range of market

forecasts at that time. Company compiled analyst market

expectations based on known sell side analyst estimates have not

changed since 2 August with an Adjusted EBITDA range of GBP102.3m -

GBP106.8m and Adjusted range of EPS of 67.1p - 74.6p.

Richard Last

Chair

Interim Chief Executive Review

I am pleased to have taken on the role of Gamma's Interim CEO. I

must start by thanking Andrew Taylor for the platform he has

established that will enable us to continue to grow.

As the Chair has already explained, the first half of 2022 was

strong and Gamma is in a good position to maximise the

opportunities which exist in our market. Our new CFO, Bill Castell,

will explain the drivers for the first half's growth in his

report.

The evolution of communications presents many opportunities for

Gamma and we have the strength to be able to take on each of these

opportunities. I set out below the changing market characteristics

which we expect to help continue to drive our growth over the

coming years.

Areas of historical strength remain healthy and growing; outlook

for long term growth exciting

-- Cloud Communications remains a growing market in the UK.

The majority of businesses in the UK still have a physical

hardware PBX rather than a Cloud based software PBX solution.

Therefore, the UK market for our products will continue to expand

and we are well positioned to capture this significant opportunity.

We believe that we not only have a product set which can satisfy

that market today but we also have the technology development

capabilities and resources to continue to build new software

modules which will meet customer requirements in the future.

-- The European market is under-penetrated which presents us

with an opportunity to grow our European revenues and profits as

the market evolves.

Through our targeted European acquisition strategy, we have

developed a network capability and channel relationships in Spain,

the Netherlands and Germany. Between them, these countries have

more than twice as many UCaaS business users as the UK. The average

penetration rate for Cloud PBX across those three countries is much

lower than the UK which means there is scope for higher growth in

future.

Despite the low market penetration, the growth rate of Cloud PBX

adoption in our European markets is stubbornly lower than we would

like but we are pleased to report that we continue to grow our

UCaaS products in line with those markets, with 7% growth in this

period.

Over the coming periods, Gamma's strategy is to take our product

developed for the UK market into those European territories where

we have a competitive advantage in a fuller feature set than any

local competition.

We have already begun to assemble cross-border teams who are

working together to successfully launch products developed in the

UK overseas (for example MS Operator Connect in the Netherlands)

and I am confident we will be able to launch additional products

across Europe in the second half of this year.

We continue to evaluate opportunities to grow by acquisition

either into new geographies or to augment the sales channels and

scale we have in the countries in which we already operate. In late

August we agreed to acquire NeoTel, another UCaaS / CCaaS business,

in Spain for a maximum of EUR5.5m in cash with potentially a

further EUR3.5m of contingent cash consideration depending on the

performance of NeoTel in 2023; the growth targets required for the

vendor to receive the additional consideration are challenging.

Completion of the acquisition is still subject to regulatory

approval and closing conditions being met which we expect to follow

shortly. We believe that our existing Spanish business will be in a

much better position to focus on the growing UCaaS and CCaaS

markets in Spain following this acquisition.

The growth of our Spanish business had historically been held

back by the performance of ComyMedia, its subsidiary which

specialised in IT solutions and had little fit with the rest of our

European business. ComyMedia had been contributing around GBP1.6m

in yearly revenues but generated a negligible Adjusted EBITDA

contribution. We disposed of ComyMedia in August 2022.

-- Favourable customer trends and behaviours present us with an

opportunity to improve Average Revenue Per User ("ARPU").

Since 2006, Gamma has sold a core Cloud PBX solution called

Horizon - a product which now has 716,000 users in the UK. Over the

course of the last three years our in-house team has developed a

number of additional modules that are fully integrated with that

core Cloud PBX. These are -

-- Call recording - launched in 2019 using our own technology, it now has 83,000 users.

-- Horizon Collaborate - was originally launched in 2020 but has

now been re-architected using software which we have developed

ourselves - it has 69,000 users.

-- MS Teams integration - some users prefer to use MS Teams as a

Collaboration product (as opposed to Horizon Collaborate) and hence

we launched an option to integrate our Cloud PBX (Horizon) with

Teams (for an additional charge) in July 2021. We now have 5,000

users who take this option.

-- Multi-Channel Communications (Contact Centre functionality) -

was launched in April 2021 (using technology obtained through our

Telsis acquisition). It now has 8,000 users.

Each of the above modules were built by our own in-house

development team; each is sold on a "per month / per seat" basis

and provides us with a recurring revenue stream.

When we are able to sell these additional modules alongside the

core Horizon product, it increases the ARPU of a Horizon seat.

-- Technology changes also present an opportunity for growth.

For example, SIP continues to evolve and improve as a product and

that gives us an opportunity to improve our ARPUs as customers move

to higher value solutions or new variants.

SIP is a substitution product for ISDN that Gamma has been

selling in the UK and Germany for over fifteen years; in both

markets we are a market leader.

As we approach the UK PSTN switch off in 2025 there is still

growth in the UK SIP market. There are still ISDN users who will

convert to SIP over the next three years and we are well placed to

win our share of that business. As we have not been a provider of

ISDN historically this migration generates new revenue for

Gamma.

The SIP market has evolved and we now sell different variants of

SIP.

We had a UK base of 1.60m of SIP trunks as at 30 June 2022 (31

December 2021: 1.43m). We are seeing users beginning to change how

they use SIP as a product. Because we have been planning for this

evolution of the market for some time, Gamma already has a strong

product set to meet the changing demand.

-- 1.01m trunks are being used by owners of traditional hardware

PBX products (31 December 2021: 1.01m). Our units of traditional

SIP are static. We continue to win new business but long time SIP

customers are now moving to other solutions such as Cloud PBX. As

customers move from a combination of SIP (which we sell) plus a

hardware PBX (which we don't sell) to Gamma's own Cloud PBX

solution we have an opportunity to take the share of spend which

was originally taken by the hardware provider. This can see our

ARPUs increase by up to five-fold.

-- 0.32m trunks are being used by users of a Cloud PBX product

other than Gamma's Horizon product (31 December 2021: 0.30m). Some

end users move to other providers of Cloud PBX and many of these

(unlike Gamma) do not have their own carrier capability. Because

Gamma is a traditional telecoms carrier in each country in which we

operate we are able to support other providers of Cloud PBX who

provide only an "over the top" software service. Our preference is

clearly always for our customers to buy our own Horizon Cloud PBX

product but where they choose not to and prefer to buy from a

competitor who does not have their own carrier capability then

Gamma can provide that service. In this instance, the alternative

provider buys SIP capability from Gamma.

-- 0.27m are being used to support users of Microsoft Teams (31

December 2021: 0.12m). Some customers are migrating from a hardware

PBX to a solution which includes MS Teams and this is our fastest

growing driver of SIP sales. Microsoft does not have any carrier

capability but Gamma is able to provide connectivity into the

servers that run MS Teams - this is explained in more detail below.

This additional technical capability typically allows us to double

ARPU compared to the SIP product which is being replaced. We

therefore see the rise of Teams as a generator of additional

revenue for Gamma.

Collectively, this variety of offer means that Gamma continues

to have a revenue opportunity on whatever route businesses take on

their forced migration from ISDN.

-- MS Teams adoption is growing in the Enterprise space, as more

organisations "voice enable" their solution, we have the

opportunity to gain revenue.

MS Teams is a software tool which facilitates collaborative

working. It allows users to contact others in their own network and

to schedule video calls but without support from a carrier such as

Gamma it does not allow users to make and receive external calls

from the PSTN and nor does it have normal PBX functionality (for

example, voicemail, hunt groups, call forwarding etc).

The growth of deployment of MS Teams provides Gamma with a

number of opportunities to grow revenue.

Currently we believe that fewer than 5% of MS Teams users have

their Teams instance "voice enabled" but that percentage will

increase and Teams voice usage is predicted to rise by more than

3.5m users in the UK by 2026. Gamma can provide a range of services

to support and benefit from this opportunity to sell a number of

complementary services -

-- As mentioned above, we are able to provide a SIP service to

Teams users to enable them to make and receive calls to and from

the PSTN. We call this service Microsoft Teams Direct Routing or

"Operator Connect" when it is sold through Microsoft's accredited

portal. We include sales of these products within our SIP volumes

as explained above.

-- Through our acquisition of Exactive we are able to perform

complex integrations of Teams with other platforms.

-- Where customers want Teams with a fully integrated PBX

capability we are able to integrate our Horizon Cloud PBX product

with Teams. At present we find relatively few customers taking this

capability as we find that Teams appeals more to Enterprise

customers and our Horizon product is primarily aimed at the SME

market.

Outlook

I look forward to working with our customers, partners and staff

as we continue to grow the business through both our existing

portfolio of products and the development of more products and

solutions in the future. Our products are designed to meet the

communications challenges which businesses are facing today and in

the future.

Most commentators expect a tightening of the UK and European

economies in the remainder of this year and into 2023 but we have a

robust business model based on recurring revenue from products and

solutions that are critical to the businesses which use them.

Whilst economic headwinds may slow the rate of our revenue growth

if the markets in which operate enter a recession, we would still

expect to deliver growth (but perhaps more slowly) and revenues

from our existing business to remain robust due to our monthly

recurring revenue model. We have seen that historically businesses

do not cut back on communication spend in a recession. Our

continued profitability, strength in cash generation and healthy

net cash balance leave us competitively placed to maximise the

opportunity even in challenging macro-economic times.

Like every other business we have challenges around salary

inflation which we do not expect to materially impact 2022 but

these may slow the growth in our Adjusted EBITDA for a short

time.

Irrespective of these short-term challenges we continue to

invest in organic growth, new product development and acquisitions

to further build scale and capability. I believe that the business

is in a good position to continue to grow.

Andrew Belshaw

Interim Chief Executive Officer

Financial review

Revenue and gross profit

Gamma has performed well during the six months ended 30 June

2022, increasing revenue by 8% to GBP234.7m (H1 2021: GBP217.4m)

and gross profit by 8% to GBP120.4m (H1 2021: GBP111.7m). The UK

businesses have seen growth in revenue of GBP17.1m (+9%) and gross

profit of GBP8.6m (+9%). Adjusted EBITDA increased by 13% to

GBP51.9m (H1 2021: GBP46.0m). Adjusted EPS (FD) increased by 16% to

35.6p (H1 2021: 30.6p).

UK Indirect

H1 2022 H1 2021 Change

GBPm GBPm

-------- -------- -------

Revenue 143.7 130.1 +10%

-------- -------- -------

Gross Profit 76.3 69.2 +10%

-------- -------- -------

Gross Margin 53.1% 53.2%

-------- -------- -------

Overall, the growth in the UK Indirect Business unit has been

strong. The growth has been driven by UCaaS and data product

growth. ARPU has been supported through the successful up-sell of

additional modules to UCaaS customers. Gross Margin has been

broadly consistent with previous periods, which is in line with

expectations, as the mix of UCaaS and connectivity products is now

reasonably constant.

UK Direct

H1 2022 H1 2021 Change

GBPm GBPm

Revenue 55.4 51.9 +7%

Gross Profit 27.9 26.4 +6%

-------- -------- -------

Gross Margin 50.4% 50.9%

-------- -------- -------

The significant levels of sales activity in late 2021 has

started to flow through in H1 2022 leading to a 7% growth in

revenue and 6% growth in gross profit. The UK Direct business has

seen a number of significant MS Teams user contract wins, including

the Home Office and the Department for Work and Pensions in the

public sector. The strong contracted pipeline, significantly ahead

when compared to this time last year, across the Direct channel

gives comfort on the growth we expect for the full year. Minimal

impact from the well-publicised supply chain shortage has been seen

in H1 2022 but we are seeing supply squeezes for some items of

hardware begin to increase in H2. The gross margin decrease is due

to mix as a result of higher installations and hardware sales which

are lower margin as previously expected.

Europe

H1 2022 H1 2021 Change

GBPm GBPm

-------- -------- -------

Revenue 35.6 35.4 +1%

-------- -------- -------

Gross Profit 16.2 16.1 +1%

-------- -------- -------

Gross Margin 45.5% 45.5%

-------- -------- -------

The revenue and gross profit growth have been negatively

impacted by exchange rates (GBP1.3m and GBP0.6m respectively). In

local currency, the growth was 4% on both revenue and gross profit.

Growth in UCaaS supported a good first half financial performance

from our German business which counterbalanced some headwinds in

our smaller Spanish business. The growth of our Spanish business

has historically been impacted by a small subsidiary, ComyMedia,

which generated a negligible Adjusted EBITDA contribution. We

disposed of ComyMedia in August 2022.

Europe gross margins have remained consistent with the prior

year. The gross margin is lower than for the UK business as a

result of "high revenue/low margin" business within the Epsilon

business which offers mobile connections in Germany.

Operating expenses

Operating expenses grew from GBP78.8m in H1 2021 to GBP81.7m. We

break these down as follows:

H1 2022 H1 2021 Change

GBPm GBPm

Expenses included within cash

generated from operations 68.5 65.7 +4%

Depreciation and amortisation 13.2 13.1 +1%

-------- -------- -------

Total Operating Expenses 81.7 78.8 +4%

-------- -------- -------

Movements in expenses were driven by:

-- The UK Businesses' operating expenses grew by 5% (compared to

gross profit growth of 9%). This growth has been tightly managed

whilst inflationary pressures have been monitored.

-- Drivers of the increase in the overhead include increased

staff costs offset in part by lower share-based payments costs

driven by the lower share price which has made the costs of

employers NI for share grants lower than in previous years.

-- The decrease in European costs is as a result of exchange

rate movements giving a GBP0.4m benefit. In local currency the cost

growth was 2%, reflecting tight cost control.

-- Central costs have increased from the prior period which is

due to continued growth in the Group function required to support

the businesses we have acquired around Europe as well as an

increase in governance costs.

Depreciation and amortisation on tangible and intangible assets

remained constant at GBP7.2m. This level has been maintained as the

increase in capitalised labour has not resulted in current period

amortisation. The annual depreciation and amortisation charge is

below the annual capital expenditure spend but is expected to

increase in future.

Exceptional Items

There were no exceptional items in the period or in H1 2021.

Alternative performance measures

Our policy for alternative performance measures is set out in

note 2. The tables below reconcile the alternative performance

measures used in this document:

Depreciation

and amortisation

Statutory on business Adjusting Adjusted

Measure basis combinations tax items basis

2022

PBT (GBPm) 38.4 4.7 - 43.1

PAT* (GBPm) 31.0 4.7 (1.1) 34.6

EPS (FD) (p) 31.9 4.8 (1.1) 35.6

------------- ---------- ------------------ ----------- ---------

2021

PBT (GBPm) 32.4 4.6 - 37.0

PAT (GBPm) 26.2 4.6 (1.1) 29.7

EPS (FD) (p) 27.0 4.7 (1.1) 30.6

------------- ---------- ------------------ ----------- ---------

* PAT is the amount attributable to the ordinary equity holders

of the Company

We believe that these measures provide a user of the accounts

with important additional information by providing the following

alternative performance metrics:

-- Profit before tax is adjusted for the amortisation of

intangibles which were created on acquisition. This enables a user

of the accounts to compare performance irrespective of whether the

Group has grown by acquisition or organically.

-- Profit after tax is adjusted in the same way as Profit before

tax but it also considers the tax impact of these items. To exclude

the items without excluding the tax impact would not give a

complete picture.

-- Adjusted earnings per share takes into account all of the

factors above and gives users of the accounts information on the

performance of the business that management is more directly able

to influence and on a basis comparable from year to year.

In addition to the above we add back the depreciation and

amortisation charged in the period to Profit from Operations (H1

2022: GBP38.7m; 2021: GBP32.9m) to calculate a figure for Adjusted

EBITDA (H1 2022: GBP51.9m; 2021: GBP46.0m) which is commonly quoted

by our peer group internationally and allows users of the accounts

to compare our performance with those of our peers.

EBITDA (being also "Adjusted EBITDA")

Adjusted EBITDA grew from GBP46.0m to GBP51.9m (13%).

Taxation

The effective tax rate for the first half of 2022 was 19% (2021:

19%). The rate in the current year is consistent with the statutory

UK rate of 19%. The tax rate in future years will increase as a

result of the UK tax rate increasing to 25% and the higher rates in

the main European countries that we operate.

Net cash and cash flows

The Group has net cash of GBP72.6m. The gross cash balance at

the end of the period was GBP75.6m and the Group had borrowings of

GBP3.0m which are held by trading subsidiaries outside of the UK

and pre-date their acquisition by Gamma.

In addition, we estimate that we will have to pay an additional

GBP10.0m in the future in relation to acquisitions made (this is a

mix of contingent consideration and the exercise of options over

shares not yet acquired); these payments will be between 2022 and

2024. We do not class contingent consideration as debt for the

purposes of quoting a net cash figure.

Cash conversion from trading during the year increased from

previous years. The ratio of Adjusted EBITDA to cash generated from

operations was 95% (2021: 94%).

Items which are not directly related to trading were:

-- Capital spend (including intangible assets) was GBP7.8m (H1

2021: GBP6.1m). The increase was driven by capitalised development

costs, as the Group continues to invest in its product set, but in

part offset by lower tangible asset purchases and software licence

purchases.

-- GBP1.6m was paid in contingent consideration relating to

Mission Labs. In H1 2021 GBP6.5m was paid in deferred consideration

and option exercises of which GBP1.5m was for Exactive and GBP5.0m

was for Gamma Holding GmbH (formerly HFO Holding AG).

-- There were no acquisitions in H1 2022 (2021: GBP40.8m - Mission Labs).

-- GBP0.3m was received from the issue of shares (2021:

GBP4.6m). The high prior year number was as a result of

reinvestment in Gamma by former shareholders of Missions Labs

(GBP2.8m) and Gamma Holding GmbH (GBP0.7m) as well as part payment

of deferred consideration for Exactive in shares (GBP0.3m). The

other shares issues relate to exercise of options held by

employees.

-- GBP8.5m was paid as dividends (2021: GBP7.5m).

Adjusted EPS (FD) and Statutory EPS (FD)

Adjusted EPS (FD) increased from 30.6p to 35.6p (16%). Adjusted

EPS is EPS as adjusted for exceptional items (if any, there are

none in the current and prior period) and other items as defined in

note 2 and a reconciliation to the statutory measure is shown in

the table above.

EPS (FD) grew from 27.0p to 31.9p (18%). The growth is higher

than the adjusted metric because, in the current period, the

amortisation relating to business combinations has grown at a

slower rate.

Going Concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position,

are consistent with those set out in the Annual Report for the year

ended 31 December 2021. In assessing going concern management and

the Board has considered:

-- The principal risks faced by the Group are set out in note 1

to the interim financial statements

and are consistent with those found in the Annual Report for the

year ended 31 December 2021.

-- The macroeconomic environment.

-- The financial position of the Group including budgets and financial plans.

-- The strong cash position - at 30 June 2022 the Group had cash

and cash equivalents of GBP75.6m. Net cash (being cash and cash

equivalents less borrowings) was GBP72.6m. All borrowings were

acquired with acquisitions made in previous years.

-- Future cashflows including committed M&A cash outflows, liquidity and borrowings.

-- Sensitivity analysis, which has shown that Adjusted EBITDA

would need to be nil for the Group to need additional borrowing

(assuming no mitigating actions had been taken). Possible

mitigating actions would include a review of capital expenditure,

variable and semi-fixed overheads. We consider this to be highly

unlikely.

The Directors are satisfied that the Group has adequate

financial resources to continue in operational existence for the

foreseeable future, a period of at least twelve months from the

date of this report. Accordingly, the going concern basis of

accounting continues to be used in the preparation of the condensed

consolidated financial statements.

Dividends

The Board has declared an interim dividend of 5.0p (2021: 4.4p).

This is an increase of 14% and is in line with our progressive

dividend policy. The interim dividend is payable on Thursday 20

October 2022 to shareholders on the register as at Friday 23

September 2022.

Bill Castell

Chief Financial Officer

MANAGEMENT STATEMENT

This Interim Management Report (IMR) has been prepared solely to

provide additional information to shareholders to assess the

Group's strategies and the potential for those strategies to

succeed. The IMR should not be relied on by any other party or for

any other purpose.

The IMR contains certain forward-looking statements. These

statements are made by the Directors in good faith based on the

information available to them up to the time of their approval of

this report but such statements should be treated with caution due

to the inherent uncertainties, including both economic and business

risk factors, underlying any such forward-looking information.

RESPONSIBILITY STATEMENT

We confirm that to the best of our knowledge:

-- the condensed set of interim financial statements has been

prepared in accordance with IAS 34 "Interim Financial

Reporting";

-- the Interim Management Report includes a fair review of the

information required by DTR 4.27R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

-- the Interim Management Report includes a fair review of the

information required by DTR 4.28R (disclosure of related party

transactions and changes therein).

By the order of the board

5 September 2022

INDEPENT REVIEW REPORT TO GAMMA COMMUNICATIONS PLC

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2022 which comprises the condensed

consolidated statement of profit or loss, the condensed

consolidated statement of comprehensive income, the condensed

consolidated statement of financial position, the condensed

consolidated statement of cash flows, the condensed consolidated

statement of changes in equity and related notes 1 to 11.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2022 is not prepared, in all material respects, in accordance

with United Kingdom adopted International Accounting Standard 34

and the AIM Rules of the London Stock Exchange.

Basis for Conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410 "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" issued by the Financial Reporting Council for use in the

United Kingdom (ISRE (UK) 2410). A review of interim financial

information consists of making inquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with United Kingdom adopted

international accounting standards. The condensed set of financial

statements included in this half-yearly financial report has been

prepared in accordance with United Kingdom adopted International

Accounting Standard 34, "Interim Financial Reporting".

Conclusion Relating to Going Concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

Conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This Conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410; however future events or conditions

may cause the entity to cease to continue as a going concern.

Responsibilities of the directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the AIM rules of the London

Stock Exchange.

In preparing the half-yearly financial report, the directors are

responsible for assessing the group's ability to continue as a

going concern, disclosing as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's Responsibilities for the review of the financial

information

In reviewing the half-yearly financial report, we are

responsible for expressing to the group a conclusion on the

condensed set of financial statement in the half-yearly financial

report. Our Conclusion, including our Conclusion Relating to Going

Concern, are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

This report is made solely to the company in accordance with

ISRE (UK) 2410. Our work has been undertaken so that we might state

to the company those matters we are required to state to it in an

independent review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the company, for our review work, for this

report, or for the conclusions we have formed.

Deloitte LLP

Statutory Auditor

Reading, United Kingdom

5 September 2022

Condensed consolidated statement of profit or loss

For the six months ended 30 June 2022

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

GBPm GBPm GBPm

Note Unaudited Unaudited Audited

Revenue 3 234.7 217.4 447.7

Cost of sales (114.3) (105.7) (219.2)

----------- ----------- -------------

Gross profit 120.4 111.7 228.5

Operating expenses (81.7) (78.8) (160.2)

Earnings before depreciation and

amortisation (Adjusted EBITDA) 51.9 46.0 95.4

Depreciation and amortisation (excluding

business combinations) (8.5) (8.5) (17.6)

Depreciation and amortisation arising

due to business combinations (4.7) (4.6) (9.5)

------------------------------------------------ ----------- ----------- -------------

Profit from operations 38.7 32.9 68.3

Finance income 0.2 - 0.1

Finance expense (0.5) (0.5) (1.2)

Profit before tax 38.4 32.4 67.2

Tax expense 4 (7.3) (6.0) (13.2)

----------- ----------- -------------

Profit after tax 31.1 26.4 54.0

Profit is attributable to:

Equity holders of Gamma Communications

plc 31.0 26.2 53.6

Non-controlling interests 0.1 0.2 0.4

31.1 26.4 54.0

=========== =========== =============

Earnings per share attributable

to the ordinary equity holders of

the Company:

Basic per ordinary share (pence) 5 32.2 27.4 55.9

Diluted per ordinary share (pence) 5 31.9 27.0 55.2

----------- ----------- -------------

Adjusted earnings per share is

shown in note 5

Condensed consolidated statement of comprehensive income

For the six months ended 30 June 2022

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

GBPm GBPm GBPm

Unaudited Unaudited Audited

Profit for the period after tax 31.1 26.4 54.0

Other comprehensive income

Items that may be reclassified

subsequently to the income statement

(net of tax effect)

Exchange difference on translation

of foreign operations 1.3 (2.2) (3.5)

----------- ----------- -------------

Total comprehensive income 32.4 24.2 50.5

=========== =========== =============

Total comprehensive income for

the period attributable to:

Equity holders of Gamma Communications

plc 32.3 24.0 50.1

Non-controlling interests 0.1 0.2 0.4

32.4 24.2 50.5

=========== =========== =============

Condensed consolidated statement of fi nancial position

As at 30 June 2022

30 June 30 June 31 December

2022 2021 2021

GBPm GBPm GBPm

Note Unaudited Unaudited Audited

Assets

Non-current assets

Property, plant and equipment 7 34.4 35.7 36.8

Right of use assets 9.9 11.4 10.2

Intangible assets 8 129.0 133.5 129.3

Deferred tax asset 5.6 5.9 7.0

Trade and other receivables 12.8 18.6 14.3

---------- ---------- ------------

191.7 205.1 197.6

Current assets

Inventories 8.5 7.2 7.9

Trade and other receivables 110.8 99.7 98.4

Cash and cash equivalents 75.6 30.8 52.8

Current tax asset 3.5 2.7 5.1

---------- ---------- ------------

198.4 140.4 164.2

---------- ---------- ------------

Total assets 390.1 345.5 361.8

---------- ---------- ------------

Liabilities

Non-current liabilities

Other payables 2.2 1.7 2.0

Borrowings 2.2 3.9 2.5

Lease Liabilities 9.5 10.6 9.8

Provisions 1.0 1.0 1.1

Contract Liabilities 7.9 7.9 10.0

Contingent consideration 1.6 3.6 3.7

Put option liability - 1.0 2.3

Deferred tax 7.5 9.2 10.0

31.9 38.9 41.4

Current liabilities

Trade and other payables 56.2 59.0 48.1

Borrowings 0.8 1.3 0.8

Lease Liabilities 2.2 2.4 2.1

Provisions 0.7 1.1 0.9

Contract Liabilities 9.0 7.4 7.4

Contingent consideration 3.0 2.5 2.6

Put option liability 5.4 4.8 3.4

Current tax liability 0.3 0.2 0.9

77.6 78.7 66.2

---------- ---------- ------------

Total liabilities 109.5 117.6 107.6

---------- ---------- ------------

Net assets 280.6 227.9 254.2

========== ========== ============

Equity

Share capital 9 0.2 0.2 0.2

Share premium reserve 15.2 13.6 14.9

Other reserves 10 7.8 4.5 4.5

Retained earnings 261.8 214.3 239.1

Equity attributable to owners of Gamma

Communications plc 285.0 232.6 258.7

---------- ---------- ------------

Non-controlling interests 2.3 2.0 2.2

Written put options over non-controlling

interests (6.7) (6.7) (6.7)

---------- ---------- ------------

Total equity 280.6 227.9 254.2

========== ========== ============

Condensed consolidated statement of cash fl ows

For the six months ended 30 June 2022

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

GBPm GBPm GBPm

Note Unaudited Unaudited Audited

Cash flows from operating activities

Profit for the period before tax 38.4 32.4 67.2

Adjustments for:

Depreciation of property, plant

and equipment 7 4.5 4.0 8.3

Depreciation of right of use assets 1.3 1.3 2.7

Amortisation and reduction in value

of intangible assets 8 7.4 7.8 16.1

Share based payment expense 1.8 2.6 4.8

Interest income (0.2) - (0.1)

Finance cost 0.5 0.5 1.2

----------- ----------- -------------

53.7 48.6 100.2

Increase in trade and other receivables (12.7) (8.2) (5.4)

(Increase)/decrease in inventories (0.6) 0.9 0.2

Increase/(decrease) in trade and

other payables 8.2 2.8 (6.2)

Increase/(decrease) in contract

liabilities 1.2 (0.6) 1.5

Decrease in provisions and employee

benefits (0.3) (0.4) (0.5)

----------- ----------- -------------

Cash generated by operations 49.5 43.1 89.8

Taxes paid (7.4) (7.6) (13.3)

Net cash flows from operating

activities 42.1 35.5 76.5

----------- ----------- -------------

Investing activities

Proceeds on disposal of property,

plant and equipment 7 0.1 - 0.1

Purchase of property, plant and

equipment 7 (2.2) (3.6) (9.1)

Purchase of intangible assets 8 (5.6) (2.5) (7.7)

Interest received 0.2 - 0.1

Acquisition of subsidiaries net

of cash acquired (inc. contingent

consideration) (1.6) (47.3) (49.3)

Net cash used in investing activities (9.1) (53.4) (65.9)

----------- ----------- -------------

Financing activities

Lease liability repayments (1.3) (1.7) (3.1)

Repayment of borrowings (0.4) (0.5) (2.3)

Interest paid (0.3) (0.1) (0.5)

Share issues 0.3 4.6 5.9

Dividends (8.5) (7.5) (11.7)

----------- ----------- -------------

Net cash used in financing activities (10.2) (5.2) (11.7)

----------- ----------- -------------

Net increase/(decrease) in cash

and cash equivalents 22.8 (23.1) (1.1)

Cash and cash equivalents at beginning

of period 52.8 53.9 53.9

----------- ----------- -------------

Cash and cash equivalents at end

of period 75.6 30.8 52.8

=========== =========== =============

Condensed consolidated statement of changes in equity

For the six months ended 30 June 2022

Share Share Other Retained Total Non-controlling Written Total

capital premium reserves earnings interests put equity

reserve options

over

non-controlling

interests

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

1 January 2021 0.2 9.0 6.1 197.5 212.8 3.0 (11.4) 204.4

--------- --------- ---------- ---------- ------ ---------------- ----------------- --------

Issue of shares - 4.6 (1.7) 1.6 4.5 - - 4.5

Share-based

payment

expense - - 2.3 - 2.3 - - 2.3

Non-controlling

interest - - - 1.2 1.2 (1.2) - -

Equity put

rights - - - (4.7) (4.7) - 4.7 -

Dividends paid - - - (7.5) (7.5) - - (7.5)

------ ---------------- ----------------- --------

Transactions

with

owners - 4.6 0.6 (9.4) (4.2) (1.2) 4.7 (0.7)

--------- --------- ---------- ---------- ------ ---------------- ----------------- --------

Profit for the

half year - - - 26.2 26.2 0.2 - 26.4

Other

comprehensive

income - - (2.2) - (2.2) - - (2.2)

--------- --------- ---------- ---------- ------ ---------------- ----------------- --------

Total

comprehensive

income - - (2.2) 26.2 24.0 0.2 - 24.2

30 June 2021 0.2 13.6 4.5 214.3 232.6 2.0 (6.7) 227.9

========= ========= ========== ========== ====== ================ ================= ========

1 January 2022 0.2 14.9 4.5 239.1 258.7 2.2 (6.7) 254.2

--------- --------- ---------- ---------- ------ ---------------- ----------------- --------

Issue of shares - 0.3 (0.2) 0.2 0.3 - - 0.3

Share-based

payment

expense - - 2.2 - 2.2 - - 2.2

Dividends paid - - - (8.5) (8.5) - - (8.5)

------ ---------------- ----------------- --------

Transactions

with

owners - 0.3 2.0 (8.3) (6.0) - - (6.0)

--------- --------- ---------- ---------- ------ ---------------- ----------------- --------

Profit for the

half year - - - 31.0 31.0 0.1 - 31.1

Other

comprehensive

income - - 1.3 - 1.3 - - 1.3

--------- --------- ---------- ---------- ------ ---------------- ----------------- --------

Total

comprehensive

income - - 1.3 31.0 32.3 0.1 - 32.4

30 June 2022 0.2 15.2 7.8 261.8 285.0 2.3 (6.7) 280.6

========= ========= ========== ========== ====== ================ ================= ========

Notes to the interim financial information

For the six months ended 30 June 2022

1. Basis of preparation

The condensed consolidated interim financial information

(interim financial information) included in this half -- yearly

financial report has been prepared in accordance with International

Accounting Standard 34 'Interim Financial Reporting', as adopted by

the United Kingdom. The interim financial statements do not

constitute statutory accounts within the meaning of the Companies

Act 2006 and should be read in conjunction with the Group's Annual

Report and Accounts for the year ended 31 December 2021, which was

prepared in accordance with IFRS as adopted by the United

Kingdom.

There are no additional standards or interpretations requiring

adoption that are applicable to the Group for the accounting period

commencing 1 January 2022.

Principal risks and uncertainties

The principal risks faced by the Group continue to be unplanned

service disruption, data loss and cyber-attacks, over-reliance on

key suppliers, inability to attract and retain top talent,

uncertain competitive landscape, price erosion, legal and

regulatory non-compliance and unsuccessful M&A strategies.

Further details can be found in the Annual Report for the year

ended 31 December 2021. There were emerging risks identified in the

prior year of the macroeconomic impacts of the Russian/Ukraine

conflict and climate change that the Company continues to

monitor.

2. Accounting policies, judgements and estimates

The accounting policies adopted are consistent with those

followed in the preparation of the audited statutory financial

statements for the year ended 31 December 2021.

Preparation of the interim financial information requires the

Group to make certain estimations, assumptions and judgements

regarding the future. Estimates and judgements are continually

evaluated based on historical experience and other factors,

including best estimates of future events. In the future, actual

experience may differ from these estimates and assumptions. The key

judgements and sources of estimation uncertainty reported in the

financial statements for the year ended 31 December 2021 are still

relevant.

Alternative Performance Measures

Adjustments to the income statement have been presented because

the Group believes that adjusted performance measures (APMs)

provide valuable additional information for users of the financial

statements in assessing the Group's performance. These are one of

the metrics used by the Board and management as KPIs to understand

how the business is performing. Moreover, they provide information

on the performance of the business that Management is more directly

able to influence and on a comparable basis from year to year.

The measures are adjusted for the following items:

(a) Depreciation and amortisation

Depreciation and amortisation relate to the assets which were

acquired by the Group. These are omitted from adjusted operating

expenses to allow users of the accounts to compare against other

external data sources.

(b) Depreciation and amortisation arising due to business

combinations

This adjustment is made to improve the comparability between

acquired and organically grown operations, as the latter cannot

recognise internally generated intangible assets. Adjusting for

amortisation provides a more consistent basis for comparison

between the two.

(c) Adjusting tax items

Where movements to tax balances arise and these do not relate to

the underlying trading current year tax charge, these are adjusted

in determining certain APMs as they do not reflect the underlying

performance in that year.

The tables below reconcile the alternative performance measures

used in this document:

Depreciation

and amortisation

Statutory on business Adjusting Adjusted

Measure basis combinations tax items basis

2022

PBT (GBPm) 38.4 4.7 - 43.1

PAT* (GBPm) 31.0 4.7 (1.1) 34.6

EPS (FD) (p) 31.9 4.8 (1.1) 35.6

------------- ---------- ------------------ ----------- ---------

2021

PBT (GBPm) 32.4 4.6 - 37.0

PAT* (GBPm) 26.2 4.6 (1.1) 29.7

EPS (FD) (p) 27.0 4.7 (1.1) 30.6

------------- ---------- ------------------ ----------- ---------

*PAT is the amount attributable to the ordinary equity holders

of the Company.

In addition to the above we add back the depreciation and

amortisation charged in the period to Profit from Operations (H1

2022: GBP38.7m; H1 2021: GBP32.9m) to calculate a figure for

Adjusted EBITDA (H1 2022: GBP51.9m; H1 2021: GBP46.0m) which is

commonly quoted by our peer group internationally and allows users

of the accounts to compare our performance with those of our

peers.

3. Segment information

The Group's main operating segments are outlined below:

(R) UK Indirect - This division sells Gamma's products and

services to channel partners and contributed 61% (2021: 60%) of the

Group's external revenue.

(R) UK Direct - This division combines Gamma's products with

those of third parties to provide communications solutions directly

to end users (who tend to be Enterprise size). It contributed 24%

(2021: 24%) of the Group's external revenue.

(R) European - This division consists of sales made in Europe by

local subsidiaries in the Netherlands, Spain and Germany,

contributing 15% (2021: 16%) of the Group's external revenue.

(R) Central functions - This is not a revenue generating segment

but is made up of the central management team and wider Group

costs.

Factors that management used to identify the Group's reportable

segments

The Group's reportable segments are strategic business units

that offer products and services into different markets. They are

managed separately because each business requires different

marketing strategies and are reported separately to the Board and

management team. Management are in the process of reviewing the go

to market segments.

Measurement of operating segment profit or loss, assets and

liabilities

The accounting policies of the reporting segments are the same

as those described in the summary of significant accounting

policies. The Group evaluates performance on the basis of profit or

loss from operations but excludes non-recurring losses, such as

goodwill impairment. Inter-segment sales are priced in line with

sales to external customers, with an appropriate discount being

applied to encourage use of Group resources at a rate acceptable to

local tax authorities. This policy was applied consistently

throughout the current and prior period.

Central

UK Indirect UK Direct European functions Total

Period to 30 June 2022 GBPm GBPm GBPm GBPm GBPm

------------------------------------- ------------ ---------- --------- ----------- -------

Segment revenue 156.8 56.1 35.6 - 248.5

Inter-segment revenue (13.1) (0.7) - - (13.8)

------------ ---------- --------- ----------- -------

Revenue from external customers 143.7 55.4 35.6 - 234.7

------------ ---------- --------- ----------- -------

Timing of revenue recognition

At a point in time 7.9 2.9 15.2 - 26.0

Over time 135.8 52.5 20.4 - 208.7

------------ ---------- --------- ----------- -------

143.7 55.4 35.6 - 234.7

Total gross profit 76.3 27.9 16.2 - 120.4

Operating expenses (45.4) (14.9) (17.2) (4.2) (81.7)

Adjusted Earnings before

depreciation and amortisation 37.3 14.5 4.3 (4.2) 51.9

Depreciation and amortisation

(excluding business combinations) (5.9) (0.7) (1.9) - (8.5)

Depreciation and amortisation

arising due to business

combinations (0.5) (0.8) (3.4) - (4.7)

------------------------------------- ------------ ---------- --------- ----------- -------

Profit/(loss) from operations 30.9 13.0 (1.0) (4.2) 38.7

------------ ---------- --------- ----------- -------

External customer revenue has been derived principally in the

geographical area of the operating segment and no single customer

contributes more than 10% of revenue.

Central

UK Indirect UK Direct European functions Total

Period to 30 June 2022 GBPm GBPm GBPm GBPm GBPm

----------------------------- ------------ ---------- --------- ----------- ------

Additions to non-current

assets 7.0 0.6 1.1 - 8.7

------------ ---------- --------- ----------- ------

Reportable segment assets 265.6 43.1 81.4 - 390.1

------------ ---------- --------- ----------- ------

Reportable segment liabilities 58.0 20.9 30.6 - 109.5

----- ----- ----- ------

Central

UK Indirect UK Direct European functions Total

Period to 30 June 2021 GBPm GBPm GBPm GBPm GBPm

------------------------------------- ------------ ---------- --------- ----------- -------

Segment revenue 141.8 51.9 35.4 - 229.1

Inter-segment revenue (11.7) - - - (11.7)

------------ ---------- --------- ----------- -------

Revenue from external customers 130.1 51.9 35.4 - 217.4

------------ ---------- --------- ----------- -------

Timing of revenue recognition

At a point in time 7.6 2.1 13.4 - 23.1

Over time 122.5 49.8 22.0 - 194.3

------------ ---------- --------- ----------- -------

130.1 51.9 35.4 - 217.4

Total gross profit 69.2 26.4 16.1 - 111.7

Operating expenses (43.7) (13.7) (17.4) (4.0) (78.8)

Adjusted Earnings before

depreciation and amortisation 32.2 13.7 4.1 (4.0) 46.0

Depreciation and amortisation

(excluding business combinations) (6.1) (0.4) (2.0) - (8.5)

Depreciation and amortisation

arising due to business

combinations (0.6) (0.6) (3.4) - (4.6)

------------------------------------- ------------ ---------- --------- ----------- -------

Profit/(loss) from operations 25.5 12.7 (1.3) (4.0) 32.9

------------ ---------- --------- ----------- -------

External customer revenue has been derived principally in the

geographical area of the operating segment and no single customer

contributes more than 10% of revenue.

Central

UK Indirect UK Direct European functions Total

Period to 30 June 2021 GBPm GBPm GBPm GBPm GBPm

---------------------------------- ------------ ---------- --------- ----------- ------

Additions to non-current

assets 5.4 0.8 1.1 - 7.3

------------ ---------- --------- ----------- ------

Reportable segment assets 217.0 44.4 84.1 - 345.5

------------ ---------- --------- ----------- ------

Reportable segment liabilities 60.9 22.2 34.5 - 117.6

------------ ---------- --------- ----------- ------

4. Taxation on profit on ordinary activities

Tax expense is recognised based on management's best estimate of

the weighted average effective annual tax rate expected for the

full financial year. The estimated average annual tax rate used for

the period to 30 June 2022 is 19%, compared to 19% for the six

months ended 30 June 2021.

5. Earnings per share

Six months Six months

ended ended

30 June 30 June

22 21

Earnings per Ordinary Share - basic (pence) 32.2 27.4

Earnings per Ordinary Share - diluted (pence) 31.9 27.0

The calculation of the basic and diluted earnings per share is

based on the following data:

Six months Six months

ended ended

30 June 30 June

22 21

GBPm GBPm

Earnings

Profit after tax attributable to equity

holders of the Company 31.0 26.2

=========== ===========

Shares Number Number

Basic weighted average number of Ordinary

Shares 96,341,184 95,522,758

Effect of dilution resulting from share

options 836,273 1,406,872

-----------

Diluted weighted average number of Ordinary

Shares 97,177,457 96,929,630

=========== ===========

Adjusted earnings per share is detailed below:

Six months Six months

ended ended

30 June 30 June

22 21

Adjusted earnings per Ordinary Share - basic

(pence) 35.9 31.1

Adjusted earnings per Ordinary Share - diluted

(pence) 35.6 30.6

Adjusted profit used in the calculation of adjusted earnings per

share is detailed below:

Six months Six months

ended ended

30 June 30 June

22 21

Earnings GBPm GBPm

Profit for the period attributable to equity

holders of the Company 31.0 26.2

Amortisation arising on business combinations 4.7 4.6

Adjusting tax items (1.1) (1.1)

Adjusted profit after tax for the period 34.6 29.7

=========== ===========

6. Dividends

A final dividend of 8.8p was paid on the 23 June 2022 (2021:

7.8p). The Board has declared an interim dividend of 5.0p per share

payable on Thursday 20 October 2022 to shareholders on the register

as at Friday 23 September 2022. In the prior year an interim

dividend of 4.4p was paid.

7. Property, plant and equipment

Land and Network Computer Fixtures

building assets equipment and fittings Total

GBPm GBPm GBPm GBPm GBPm

2022

Cost

At 1 January 2022 4.5 78.7 12.3 2.4 97.9

Additions - 1.2 1.0 - 2.2

Disposals - (6.4) - - (6.4)

Exchange differences 0.1 (0.1) (0.1) 0.5 0.4

At 30 June 2022 4.6 73.4 13.2 2.9 94.1

---------- -------- ----------- -------------- ------

Depreciation

At 1 January 2022 0.3 50.3 9.0 1.5 61.1

Charge for the period - 3.5 0.8 0.2 4.5

Disposals - (6.3) - - (6.3)

Exchange differences - 0.4 0.2 (0.2) 0.4

At 30 June 2022 0.3 47.9 10.0 1.5 59.7

---------- -------- ----------- -------------- ------

Net book value

At 1 January 2022 4.2 28.4 3.3 0.9 36.8

At 30 June 2022 4.3 25.5 3.2 1.4 34.4

---------- -------- ----------- -------------- ------

Land and Network Computer Fixtures

building assets equipment and fittings Total

GBPm GBPm GBPm GBPm GBPm

2021

Cost

At 1 January 2021 4.8 71.9 11.6 2.0 90.3

Additions - 3.0 0.5 0.1 3.6

Acquisition of subsidiary - - 0.1 - 0.1

Disposals - (0.1) - - (0.1)

Exchange differences (0.2) - (0.1) (0.1) (0.4)

At 30 June 2021 4.6 74.8 12.1 2.0 93.5

---------- -------- ----------- -------------- ------

Depreciation

At 1 January 2021 0.1 44.7 7.9 1.3 54.0

Charge for the period 0.1 3.1 0.5 0.3 4.0

Exchange differences - (0.2) - - (0.2)

At 30 June 2021 0.2 47.6 8.4 1.6 57.8

---------- -------- ----------- -------------- ------

Net book value

At 1 January 2021 4.7 27.2 3.7 0.7 36.3

At 30 June 2021 4.4 27.2 3.7 0.4 35.7

---------- -------- ----------- -------------- ------

8. Intangible assets

Customer Development

Goodwill contracts Brand costs Software Total

GBPm GBPm GBPm GBPm GBPm GBPm

2022

Cost

At 1 January

2022 91.8 47.6 2.2 28.1 18.5 188.2

Additions - - - 5.6 - 5.6

Disposals - - - (0.1) - (0.1)

Exchange differences 0.6 0.9 - 0.2 - 1.7

At 30 June 2022 92.4 48.5 2.2 33.8 18.5 195.4

--------- ----------- ------ ------------ --------- ------

Amortisation

At 1 January

2022 8.7 20.2 0.9 14.8 14.3 58.9

Charge for the

period - 3.7 0.5 2.2 1.0 7.4

Disposals - - - (0.1) - (0.1)

Exchange Differences (0.1) 0.4 - (0.1) - 0.2

At 30 June 2022 8.6 24.3 1.4 16.8 15.3 66.4

--------- ----------- ------ ------------ --------- ------

Net book value

At 1 January

2022 83.1 27.4 1.3 13.3 4.2 129.3

At 30 June 2022 83.8 24.2 0.8 17.0 3.2 129.0

--------- ----------- ------ ------------ --------- ------

Customer Development

Goodwill contracts Brand costs Software Total

GBPm GBPm GBPm GBPm GBPm GBPm

2021

Cost

At 1 January

2021 55.0 48.6 2.4 17.6 16.6 140.2

Additions - - - 0.9 1.6 2.5

Acquisition of

subsidiary 38.7 1.5 0.9 5.2 - 46.3

Exchange differences (1.5) (1.8) - (0.2) - (3.5)

Reclassifications - - - 0.8 (0.8) -

At 30 June 2021 92.2 48.3 3.3 24.3 17.4 185.5

--------- ----------- ------ ------------ --------- ------

Amortisation

At 1 January

2021 8.8 13.5 0.7 10.1 11.8 44.9

Charge for the

period - 3.9 0.6 1.9 1.4 7.8

Exchange Differences (0.1) (0.6) - - - (0.7)

Reclassifications - - - 0.4 (0.4) -

At 30 June 2021 8.7 16.8 1.3 12.4 12.8 52.0

--------- ----------- ------ ------------ --------- ------

Net book value

At 1 January

2021 46.2 35.1 1.7 7.5 4.8 95.3

At 30 June 2021 83.5 31.5 2.0 11.9 4.6 133.5

--------- ----------- ------ ------------ --------- ------

Amortisation on intangible assets is charged to the consolidated

statement of profit or loss and included in operating expenses.

Our annual goodwill impairment test of our Spanish business

performed in September 2021 showed that the headroom between the

recoverable amount (determined based on a value in use model) and

the carrying value of the Spain cash generating unit ("CGU") was

modest at GBP12m at the measurement date. As part of our 2021

goodwill impairment test, we considered reasonably possible changes

in key assumptions that could cause an impairment, and identified

two key assumptions relating to the cash flows in years 1 to 5,

being:

1. The Group's value in use cash flows assumes a double-digit

revenue CAGR over the five-year period. A decrease in the forecast

revenue CAGR by 4% (H1 2021: 4%) over this period, would see the

headroom reduced to nil.

2. To breakeven, the Adjusted EBITDA margin percentage achieved

in year 5 and terminal years would need to reduce by 9% (H1 2021:

6%).

9. Share capital

Number GBPm

1 January 2022

Ordinary Shares of GBP0.0025 each 96,323,054 0.2

------------- -----

Number

At 1 January 2022 96,323,054

Movement:

January 5,291 (a)

March 10,516 (a)

April 14,401 (a)

June 13,591 (a)

At 30 June 2022 96,366,853

=============

(a) Ordinary shares were issued to satisfy options which

have been exercised.

Number GBPm

30 June 2022

Ordinary Shares of GBP0.0025 each 96,366,853 0.2

------------- -----

10. Other reserves

Merger Share Foreign Own shares Total

reserve option exchange other

reserve reserve reserves

GBPm GBPm GBPm GBPm GBPm

1 January 2021 2.3 5.2 (0.7) (0.7) 6.1

--------- --------- ---------- ----------- ----------

Issue of shares - (1.7) - - (1.7)

Share-based payment expense - 2.3 - - 2.3

Other comprehensive income - - (2.2) - (2.2)

--------- --------- ---------- ----------- ----------

30 June 2021 2.3 5.8 (2.9) (0.7) 4.5

========= ========= ========== =========== ==========

1 January 2022 2.3 7.1 (4.2) (0.7) 4.5

--------- --------- ---------- ----------- ----------

Issue of shares - (0.2) - - (0.2)

Share-based payment expense - 2.2 - - 2.2

Other comprehensive income - - 1.3 - 1.3

--------- --------- ---------- ----------- ----------

30 June 2022 2.3 9.1 (2.9) (0.7) 7.8

========= ========= ========== =========== ==========

11. Events after the reporting date

On 5 August 2022 the Group disposed of a small Spanish

subsidiary ComyMedia Proyectos Y Sevicios S.L.U. The business

contributed around GBP1.6m of yearly revenue but was negligible at

Adjusted EBITDA level.

On the 12 August 2022 the Group signed an agreement to acquire

100% of the share capital of NeoTel 2000 S.L.U. ("NeoTel"). The

agreement is subject to regulatory approval and closing conditions

being met which is expected to follow shortly. NeoTel provides a

cloud PBX and call centre solution focused on the Spanish SME

market. The initial consideration is a maximum of EUR5.5m with

potentially a further EUR3.5m of contingent consideration depending

on performance to June 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRGDCCUGDGDU

(END) Dow Jones Newswires

September 06, 2022 02:00 ET (06:00 GMT)

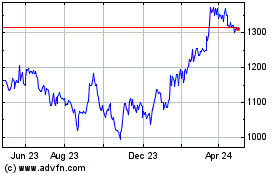

Gamma Communications (LSE:GAMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

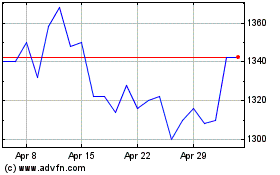

Gamma Communications (LSE:GAMA)

Historical Stock Chart

From Apr 2023 to Apr 2024