TIDMGDP

RNS Number : 1237R

Goldplat plc

03 November 2021

G ol dp lat plc / Ti cker: GDP / Index: AIM / Secto r: M in i ng

& E x p l o rati on

3 November 2021

Goldplat plc

( 'Goldplat', t he 'Group' or 'the Company ')

Quarterly Update to 30 September 2021

G ol dp lat pl c, the AIM li sted g o ld p r o ducer, w ith

internati onal g o ld reco very o perati ons l o cated in South Afr

i ca and Ghana, is p leased to announce an operational update for

the first quarter of the current financial year ("Q1") ended 30

September 2021.

The recovery operations achieved the same combined operating

profit for Q1 2021 as for Q1 2020 of GBP1,403,000 (Q1, 30 September

2020: GBP1,403,000), although the average gold price in USD

decreased 6.7% for Q1 2021.

The Ghana operations continue to perform well as a result of the

steady supply of material and achieved an operating profit for Q1

of GBP839,000 (Q1, 30 September 2020: GBP280,000). The South

African operation achieved an operating profit for Q1 of GBP564,000

(Q1, 30 September 2020: GBP1,123,000), reflecting a significantly

lower gold price in Rand terms in the period.

The following events have contributed to the Q1 operating

results:

Ghana

-- The continued supply from current clients in Ghana and Mali

was further supported by batches of material received from South

America.

-- Our engagement with mine management and government officials

on different levels has continued, with the aim of increasing our

footprint to ensure regular supply. Specific progress in this

regard has been made during the quarter in Cote d'Ivoire.

-- To build on our market strategy in South America over the

last 5 years, a decision has been made to expand the opportunities

by establishing a processing and storage site in Brazil, at an

initial cost of USD300,000, to capture part of the lower-grade

material market which is not feasible to export to our other

operations and also to improve services we can provide in

country.

-- We continue to evaluate our options for processing of

artisanal tailings material, including the possibility of finding a

partner in country.

South Africa

-- Although the gold produced and sold year-on-year was similar,

the average gold price in South African Rands ('ZAR') for Q1 was

19.3% lower year-on-year, resulting in operating profits being

lower by 50%.

-- The Carbon-in-Leach ('CIL') circuits' production improved

year-on-year by 9%, on the back of capital investment in the

previous financial period in a jigging plant and a further

GBP50,000 (less than the planned GBP75,000) incurred on a gravity

circuit during Q1 on our largest milling and CIL plant.

-- Gold produced from our by-products operations decreased by

16% as a result in variability of supply from the mines.

-- As part our strategy to build partnerships in industry and to

create longer term visibility of supply of materials and associated

earnings, we have agreed with West Wits Mining Limited (ASX: WWI),

as announced on 12 October 2021, to process material from their

early mine programme through our plant on a toll treatment basis.

The initial programme will last approximately 6 months with

material processed through our largest CIL circuit, with the option

to extend.

-- During Q1 we have built our strategic precious metals ('PGM')

material to a level to warrant capital expenditure of USD 300,000

on a plant to extract its value. This new plant will also enable us

to further develop our PGM recovery business.

-- Unrealised profits contained in material remains high at

GBP900,000 (30 June 2021 - GBP1,100,000) and is partly due to the

increase in gravity gold production and the longer sales cycle it

takes to realise the profit. We are focussed on reducing the

turnover time and the figure should return to normal levels, circa

GBP500,000 within the next two quarters.

-- Our application for the water use license was submitted in

the last week of October 2021 and we should get feedback before the

end of Q2. We continue to manage and extend the deposit of material

within the Group's current tailings storage facility with the help

of consulting engineers.

-- Towards the end of October 2021 an application was made to

get environmental approval for the installation of a pipeline to a

process facility in the area. This pipeline could provide us with

an avenue to pump and process our current tailings facility which

contains circa 82,000 ounces of gold ('See the announcement dated

29 January 2016'). The approval process will take approximately 12

months.

Our cash balances remain strong at GBP2,340,000 at end of

Q1.

The buy-back of the shares in Goldplat Recovery held by certain

minority shareholders, as announced on 18 June 2021, was completed

in October 2021, with the full lending facility of ZAR 60 million

(approximately GBP3.1 million) drawn from Nedbank and all payments

made to the respective minorities.

We have agreed with Caracal Gold to take up the remainder of the

initial share consideration on the sale of Kilimapesa at the

initial listing price of Caracal Gold and as a result, Caracal Gold

has allotted an additional circa 32 878 000 shares in lieu of a

cash payment of US$450,000, increasing the Group's shareholding in

Caracal to 9.2%.

Werner Klingenberg, CEO of Goldplat commented: "I am pleased to

see us continue to consolidate our interests in West Africa and

look forward to build on this in South America. This, together with

improvements in our production units in South Africa, is providing

us with a platform to build longer term profitable recovery

streams. I am encouraged by the progress made on the PGM front.

With initial consideration on the sale of Kilimapesa and majority

of the restructuring within the Group completed, we will evaluate

our options to return value to shareholders."

For further i n fo rmat i on v i s it www .g o ld p lat.com, f o

l l ow on Twitter @GoldPlatPlc or contact:

Werner Klingenberg Goldplat plc Tel: +27 (0) 82 051 1071

(CEO)

Colin Aaronson / George Grant Thornton UK LLP Tel: +44 (0) 20 7383

Grainger (Nominated Adviser) 5100

Jessica Cave / Andrew WH Ireland Limited Tel: +44 (0) 207 220

de Andrade (Broker) 1666

Tim Thompson / Mark Edwards Flagstaff Strategic and Tel: +44 (0) 207 129

/ Fergus Mellon Investor Communications 1474

goldplat@flagstaffcomms.com

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAXFAEFDFFFA

(END) Dow Jones Newswires

November 03, 2021 02:59 ET (06:59 GMT)

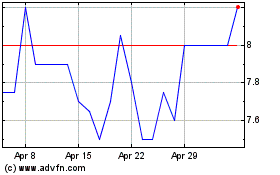

Goldplat (LSE:GDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

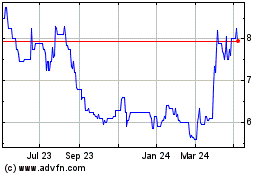

Goldplat (LSE:GDP)

Historical Stock Chart

From Apr 2023 to Apr 2024