TIDMGDP

RNS Number : 2061F

Goldplat plc

18 March 2022

18 March 2022

Goldplat plc / Ticker: GDP / Index: AIM / Sector: Mining &

Exploration

Goldplat plc ('Goldplat' or 'the Company')

Interim results for the six-month period ended 31 December

2021

Goldplat plc, the AIM listed gold producer, with international

gold recovery operations located in South Africa and Ghana, is

pleased to announce its unaudited interim results for the six

months ended 31 December 2021.

Goldplat achieved an excellent result for the six months ended

31 December 2021 including:

-- Increasing operating profit, against the six months ended 31

December 2020, by 28% to GBP3,334,000 (31 December 2020:

GBP2,600,000);

-- Doubling of net profit from continued operations attributable

to owners of the company to GBP2,071,000 (31 December 2020:

GBP1,013,000);

-- As a result of increased performance, the fully diluted

earnings per share for the six-month period doubled to 1.19 pence

per share (31 December 2020: 0.59 pence per share), and;

-- The group cash balance (net of overdraft) remained strong at

GBP1,640,000 (30 June 2021: GBP3,459,000).

Werner Klingenberg, CEO of Goldplat commented: "I am pleased

with the continued strong operating results achieved by the group,

but even more so, how this is translating into increased profits

and earnings for the owners of Goldplat Plc.

For further information visit www.goldplat.com, follow on

Twitter @GoldPlatGDP or contact:

Werner Klingenberg Goldplat plc (CEO) Tel: +27 (0) 82 051

1071

Colin Aaronson / George Grainger / Grant Thornton UK Tel: +44 (0) 20 7383

Samuel Littler LLP (Nominated Adviser) 5100

---------------------------- ----------------------------

Jessica Cave / Andrew de Andrade WH Ireland Limited Tel: +44 (0) 207 220

(Broker) 1666

---------------------------- ----------------------------

Tim Thompson / Mark Edwards / Fergus Flagstaff Strategic Tel: +44 (0) 207 129

Mellon and Investor Communications 1474

goldplat@flagstaffcomms.com

---------------------------- ----------------------------

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

Chairman's Statement

I am pleased to share continued strong results from our gold

recovery operations, with profit for the half year from continuing

operations increasing to GBP2,217,000 (H1 2020: GBP1,500,000) and

an all-in, fully diluted EPS for the half year of 1.19 pence (H1

2020: 0.59 pence).

Our portfolio of core assets consists of two gold recovery

operations, in South Africa and Ghana, with plans to extend this to

Brazil and these recover gold and platinum group metals ('PGM')

from by-products of current and historical mining processing,

thereby providing mines with an environmentally-friendly and

cost-efficient way of removing waste material.

The Revenues from continued operations increased by 69% to

GBP21,326,000 (H1 2020: GBP12,602,000), with the Ghanaian and South

African recovery operations achieving revenue increases of 146% and

29%, respectively, as a result of good and steady supply of

material in Ghana and result of continuous research and investments

made in South Africa.

The increase in revenue drove the increase in operating profit

from continued operations of GBP3,334,000 (H1 2020:

GBP2,600,000).

The net financing cost tend to fluctuate from period to period

due to the fluctuation in the intergroup unrealised foreign

exchange losses or gains, which is driven by the movement of Ghana

Cedi ('GHS'), the South African Rand ('ZAR') and Great British

Pound ('GBP') against the United State Dollar ('USD') in which

intergroup balances are denominated. As set out in the summary

table below, the intergroup foreign exchanges losses reduced to

GBP30,000 (H1 2020: GBP357,000).

Detail H1 2021 H1 2020

Intergroup foreign exchange movements (30,000) (357,000)

--------- ---------

Third party foreign exchange movements 1,000 (72,000)

--------- ---------

Net interest paid (299,000) (149,000)

--------- ---------

Total (328,000) (578,000)

--------- ---------

The net finance interest increased from GBP149,000 to GBP299,000

as a result of the increase in the volume of material sourced and

processed in Ghana and the delays we are starting to experience as

a result of the global supply chain crisis. This increased the

amount of working capital finance required and the time over which

it is required. The interest on working capital finance increased

from GBP36,000 to GBP225,000. With the increase in cash available,

we are starting to finance more of this out of our own cash

resources.

Interest paid on financing for the repurchase of shares at

Goldplat Recovery (Pty) Ltd, secured in August 2021, as discussed

below, was GBP41,000, whilst the remainder relates to financing on

lease assets.

The profit after taxation before discontinued operations of

GBP2,217,000 (H1 2020: GBP1,500,000) resulted in the GBP229,000

increase in the taxation paid. Furthermore, the withholding tax

expense year-on-year was higher due to more dividends declared by

both Goldplat Recovery Pty Limited ('GPL') and Goldplat Recovery

Ghana Limited ('GRG') during the period. By restructuring GPL as a

subsidiary of Goldplat Plc, as recently announced, there will not

only be a saving of General and Administrative expenses but also a

reduction in the withholding tax rate on dividends declared to

Goldplat Plc.

Share repurchase of minority shareholding in GPL

During the period the Group increased its interest in GPL, its

principal operating subsidiary, from 74% to 90.63% through the

buy-back by GPL of 22.33% of GPL shares from its minority

shareholders and issuing shares, amounting to 4.90% of GPL to

Aurelian Capital Proprietary Limited ('The Transaction'). The net

cost to Goldplat of acquiring an additional 16.63% of GPL was ZAR

66.52 million (approximately GBP3.55m)

The Transaction was financed in part through a South African

Rand denominated bank facility of ZAR 60 million (approximately

GBP3.02 million) provided by Nedbank.

Additional detail with regards to the Transaction and the

financing thereof are set out in note 19.

Other shareholdings

After the period end, the group sold 32,878,000 of our shares in

Caracal Gold PLC ('Caracal') for 0.95 pence per share. The shares

sold represent the remainder of the initial share consideration of

USD450,000 that was payable in cash by Caracal in relation to the

sale of Kilimapesa Gold Pty Ltd, which the Group agreed to take up

in shares at the initial listing price of Caracal, as announced on

3 November 2021.

The Group retains 103,846,153 shares representing a 5.69%

interest in Caracal.

Working capital

Cash and cash equivalents at the end of the period decreased to

GBP1,640,000 (30 June 2021: GBP3,459,000). The decrease from

GBP3,459,000 at end of 30 June 2021 is as a result of investment

in working capital as noted below.

Inventories increased from 30 June 2021, by GBP2,601,000 as

result of an increase in precious metals on hand of GBP3,080,000

set- off by a decrease in raw materials of GBP720,000. The increase

in precious metals on hand and in process was driven by high

turnover volumes in Ghana as well as delays we are experiencing on

some of the shipping routes, whilst the decrease in raw material

was as a result of higher cost per ton material processed in South

Africa during the period.

Trade and other receivable balances also increased from 30 June

2021 by GBP3,590,000 again driven by increases in turnover,

specifically in Ghana.

During the period the long-term liabilities increased to

GBP3,332,000 as a result of the repurchase of shares from minority

shareholders in GPL on the terms indicated above.

Goldplat Recovery (Pty) Ltd ('GPL')

Revenues in South Africa increased by 29% to GBP10,616,000 (H1

2020: GBP8,243,000). The 29% increase in revenue is attributable to

improved production in our largest milling circuit, after the

construction of a JIG and gravity concentrator (at a capital cost

of

GBP55,000), in March 2021 and October 2022 respectively. The

increase in revenue resulted in a profit of GBP1,552,000 (H1

2020:

GBP940,000).

The production of Platinum Group Metals (PGMs) is making a

contribution to results and as indicated in the Q1 operational

update, we have built our strategic PGM material to a level to

warrant capital expenditure of USD 300,000 on a plant to extract

its value. This new plant will also enable us to further develop

our PGM recovery business and should be completed by the 4th

quarter.

We continue to experience increase in operating costs, These

included the increase in refinery charges, treatment charges,

electricity costs, machinery hire, and security costs.

Our application for the water use license was submitted in

October 2021 and we are still expecting feedback by the end of Q3

2022. We continue to manage and extend the deposit of material

within the Group's current tailings storage facility ('TSF') with

the help of consulting engineers and have spent 203,000 of capital

on establishing of new tailings facility during the period.

The establishment of a new tailings storage facility remains the

first step towards the reprocessing of our existing TSF which

contains a JORC resource of approximately 82,000 ounces of gold

(see announcement of 29 January 2016 for further information). The

second step being the approval of pipeline application to a third

party processor, which is ongoing and we expect results towards the

end of this calendar year.

Gold Recovery Ghana ('GRG')

We experienced a steady and reliable supply of materials from

our regular clients during the period and this significantly

contributed to the 146% increase in revenue year on year to

GBP10,710,000 (H1 2020: GBP4,359,000). The increase in volume of

material processed, combined with the higher gold price resulted in

the operating margins increasing by 153% to GBP1,828,000 (H1 2020:

GBP724,000) and a net profit of GBP1,217,000 (H1 2020: GBP139,000),

a 776% improvement from that of the comparative period.

Our engagement with mine management and government officials on

different levels has continued, with the aim of increasing our

footprint to ensure regular supply. By achieving a larger

geographical spread with more clients, our objective is to have a

steady supply from the mines current production, rather than ad hoc

supplies from stockpiles.

We continue to evaluate our options for the processing of

artisanal tailings material in Ghana, including the possibility of

finding a partner in country.

To increase our ability to capture lower-grade material market

which is not feasible to export to our other operations and also to

improve services we can provide in South America, we aim to

establish a processing and storage site in Brazil, at an initial

cost of USD300,000. We are currently ensuring we secure all

licenses required, specifically environmental, and will keep the

market updated on progress.

Post-period end

Subsequent to 31 December 2021 we sold 32,878,000 of our shares

in Caracal as reported above.

Outlook

We remain committed to our strategy of increasing long term

visibility of earnings in the recovery businesses through key

initiatives. These key initiatives include:

-- improving our gold recoveries from lower grade contaminated

material, effectively reducing the grade of the material we will be

able to source economically. Reserves of lower grade materials are

more readily available and help to alleviate the sourcing risk;

-- Building strategic partnerships within the mining

industry;

-- Evaluating the investment into larger tailings storage

facility and additional mill and leaching capacity to enable us to

reprocess our current TSF; and

-- Increased investment into sourcing initiatives and test work

on a wider range of materials, including PGM discards.

Whilst the Group's trading expectation for the remainder of the

year is currently unchanged, it is worth noting that the impact of

the Russian invasion of Ukraine is posing a significant challenge

to the global supply chain industry. Whilst Goldplat has no

activities directly connected with Russia or Ukraine, the long-term

effect of the conflict on the Group is uncertain.

Matthew Robinson Chairman

18-Mar-22

Statements of Financial Position

Group

31 December Group Group 31

Figures in GBP `000 Notes 2021 30 June December

2021 2020

-------------------------------------- ---------- ------------ --------- ----------

Assets

Non-current assets

Property, plant and equipment 4 4 353 4 568 4 132

Right-of-use assets 465 574 375

Intangible assets 5 4 664 4 664 4 664

Investments in subsidiaries, joint

ventures and associates 6 1 1 1

Receivable on Kilimapesa sale 7 519 606 -

Other loans and receivables 8 511 636 750

------------ --------- ----------

Total non-current assets 10 513 11 049 9 922

Current assets

Inventories 9 11 034 8 433 11 568

Trade and other receivables 10 16 593 13 003 6 580

Receivable on Kilimapesa sale 7 87 58 -

Cash and cash equivalents 11 1 640 3 459 1 394

------------ --------- ----------

Total current assets 29 354 24 953 19 542

Non-current assets or disposal groups

classified as held for sale - - 3 380

------------ --------- ----------

Total current assets 29 354 24 953 22 922

------------ --------- ----------

Total assets 39 867 36 002 32 844

------------ --------- ----------

Equity and liabilities Equity

Share capital 12 1 715 1 698 1 698

Share premium 12 11 546 11 491 11 491

Retained income / (accumulated loss) 7 578 6 846 6 180

Foreign exchange reserve (5 806) (5 258) (5 406)

------------ --------- ----------

Total equity attributable to owners

of the parent 15 033 14 777 13 963

Non-controlling interests 1 314 3 637 3 379

------------ --------- ----------

Total equity 16 347 18 414 17 342

Liabilities

Non-current liabilities

Provisions 13 724 787 586

Deferred tax liabilities 808 792 727

Long-term borrowings 15 1 758 - -

Lease liabilities 42 110 77

------------ --------- ----------

Total non-current liabilities 3 332 1 689 1 390

Group

31 December Group Group 31

Figures in GBP `000 Notes 2021 30 June December

2021 2020

---------------------------------------- ---------- ------------ --------- ----------

Current liabilities

Trade and other payables 14 18 754 15 445 10 724

Current tax liabilities 399 128 532

Current portion of long-term borrowings 15 866 33 723

Lease liabilities 169 293 200

Bank overdraft 11 - - 484

------------ --------- ----------

Total current liabilities 20 188 15 899 12 663

Liabilities included in disposal groups

classified as held for sale - - 1 449

------------ --------- ----------

Total current liabilities 20 188 15 899 14 112

------------ --------- ----------

Total liabilities 23 520 17 588 15 502

------------ --------- ----------

Total equity and liabilities 39 867 36 002 32 844

------------ --------- ----------

The notes below are an integral part of this condensed

consolidated interim financial report.

Statements of Profit or Loss and Other Comprehensive Income

Group Group Group 6 month

6 month period 12 month period ended

ended 31 period ended 31 December

Figures in GBP `000 Notes December 2021 30 June 2020

2021

------------------------------------------- ----- ---------------- ------------- --------------

Revenue 21 326 35 400 12 602

Cost of sales (17 172) (29 201) (9 323)

-------------

Gross profit 4 154 6 199 3 279

Other income 2 56 -

Administrative expenses (822) (1 694) (679)

-------------

Profit from operating activities 3 334 4 561 2 600

Finance income 1 - 45

Finance costs (329) (909) (623)

Sundry income - - 38

-------------

Profit before tax 3 006 3 652 2 060

Income tax expense - continuing operations 16 (789) (903) (560)

-------------

Profit from continuing operations 2 217 2 749 1 500

Loss from discontinued operations - (570) (243)

-------------

Profit for the period 2 217 2 179 1 257

-------------

Profit for the period attributable to:

Owners of Parent 2 071 1 679 1 013

Non-controlling interest 146 500 244

-------------

2 217 2 179 1 257

-------------

Other comprehensive income net of tax

Components of other comprehensive income

that will be reclassified to profit

or loss

Exchange differences on translation

relating to the parent

(Losses) / gains on exchange differences

on translation (548) 719 818

Exchange reserve reclassified on loss

of control of Kilimapesa - 247 -

-------------

Total Exchange differences on translation (548) 966 818

Exchange differences relating to the

non-controlling interest

(Losses)/Gains on exchange differences

on translation (124) 256 213

-------------

Total other comprehensive income that

will be reclassified to profit or loss (672) 1 222 1 031

-------------

Total other comprehensive (expense)/income

net of tax (672) 1 222 1 031

-------------

Total comprehensive income 1 545 3 401 2 288

-------------

Comprehensive income attributable to:

Comprehensive income, attributable to

owners of parent 1 523 2 645 1 826

Comprehensive income, attributable to

non-controlling interests 22 756 462

-------------

1 545 3 401 2 288

-------------

Group Group Group 6 month

6 month period 12 month period ended

ended 31 period ended 31 December

Figures in GBP `000 Notes December 30 June 2020

2021 2021

-------------------------------------------- ----- ---------------- -------------- --------------

Earnings per share from continuing and

discontinuing operations attributable

to owners of the parent during the period

Basic earnings per share

Basic earnings per share from continuing

operations 17 1.20 1.32 0.74

Basic loss per share from discontinuing

operations - (0.34) (0.14)

--------------

Total basic earnings per share 1.20 0.98 0.60

--------------

Diluted earnings per share

Diluted earnings per share from continuing

operations 17 1.19 1.32 0.73

Diluted loss per share from discontinued

operations - (0.33) (0.14)

--------------

Total diluted earnings per share 1.19 0.99 0.59

The notes below are an integral part of this condensed

consolidated interim financial report.

Goldplat PLC

Condensed consolidated interim financial report for the 6 month

period ended 31 December 2021

Statements of Changes in Equity - Group

Foreign Retained

currency income / Attributable

to

translation (accumulated owners of Non-controlling

Figures in GBP `000 Share Capital Share premium reserve loss) the interests Total

parent

--------------------------------------------------------------------------------------------------- ------------ ------------ ------------- --------------- ---------

Balance at 1 July 2020 1 675 11 441 (6 224) 5 167 12 059 3 057 15 116

Changes in equity

Profit for the year - - - 1 679 1 679 500 2 179

Other comprehensive income - - 966 - 966 256 1 222

--------------------------------------------------------------------------------------------------- ------------ ------------ ------------- --------------- ---------

Total comprehensive income for the period - - 966 1 679 2 645 756 3 401

Non-controlling interests in

subsidiary dividend - - - - - (176) (176)

Shares issued from options exercised 23 50 - - 73 - 73

--------------------------------------------------------------------------------------------------- ------------ ------------ ------------- --------------- ---------

Balance at 30 June 2021 1 698 11 491 (5 258) 6 846 14 777 3 637 18 414

--------------------------------------------------------------------------------------------------- ------------ ------------ ------------- --------------- ---------

Balance at 1 July 2021 1 698 11 491 (5 258) 6 846 14 777 3 637 18 414

Changes in equity

Profit for the period - - - 2 071 2 071 146 2 217

Other comprehensive income - - (548) - (548) (124) (672)

Exchange reserve released through profit and loss on sale of - - - -

Kilimapesa - -

--------------------------------------------------------------------------------------------------- ------------ ------------ ------------- --------------- ---------

Total comprehensive income for the period - - (548) 2 071 1 523 22 1 545

Non-controlling interests in

subsidiary dividend - - - - - (22) (22)

Shares issued from options exercised 17 55 - - 72 - 72

Adjustments arising from change in non-controlling interest

- - - (1 339) (1 339) (2 323) (3 662)

--------------------------------------------------------------------------------------------------- ------------ ------------ ------------- --------------- ---------

Balance at 31 December 2021 1 715 11 546 (5 806) 7 578 15 033 1 314 16 347

--------------------------------------------------------------------------------------------------- ------------ ------------ ------------- --------------- ---------

Notes

12 12

The notes below are an integral part of this condensed

consolidated interim financial report.

9

Statements of Cash Flows

Group Group 12 Group 6

6 month month month period

period period ended ended 31

Figures in GBP `000 Notes ended 31 30 June December

December 2021 2020

2021

------------------------------------------------- --------- --------- -------------- -------------

Net cash flows from / (used in) operations 225 4 277 (704)

Finance cost (329) (909) (623)

Finance income 1 - 46

Income taxes paid (502) (1 059) (159)

--------- -------------- -------------

Net cash flows (used in) / from operating

activities (605) 2 309 (1 440)

--------- -------------- -------------

Cash flows used in investing activities

Proceeds from sales of property, plant

and equipment 29 18 2

Purchase of property, plant and equipment (313) (979) (458)

Decrease in cash from disposal of non-current

assets held for sale - (6) -

(Payment)/Receipt from long term receivable 125 74 (89)

--------- -------------- -------------

Cash flows used in investing activities (159) (893) (545)

--------- -------------- -------------

Cash flows used in financing activities

Net proceeds from issuing of shares/options

exercised 72 73 73

Repayment of capital portion of interest-bearing

borrowings (203) (872) (142)

Interest paid on interest-bearing borrowings (63) (99) (66)

Increase in shareholding of subsidiary (3 787) - -

Increase in interest bearing borrowings 2 927 - (88)

Principal paid on lease liabilities (155) (186) -

Interest paid on lease liabilities (37) (21) (36)

Payment of dividend to non-controlling

interest (22) (176) (135)

--------- -------------- -------------

Cash flows used in financing activities (1 268) (1 281) (394)

-------------

Net (decrease) / increase in cash and

cash equivalents (2 032) 135 (2 379)

Cash and cash equivalents at beginning

of the period 3 459 3 146 3 140

Foreign exchange movement on opening

balance 213 178 149

--------- -------------- -------------

Cash and cash equivalents at end of

the period 11 1 640 3 459 910

--------- -------------- -------------

Cashflows from discontinued operations 6 113

The notes below are an integral part of this condensed

consolidated interim financial report.

Notes to the Consolidated Financial Statements

Figures in GBP `000 31

December 2021 Group 30 June 2021 Group 31 December 2020

1. General information

This condensed consolidated interim financial information does

not comprise statutory accounts within the meaning of section 434

of the Companies Act 2006. Statutory accounts for the year ended 30

June 2021 were approved by the Board of Directors and have been

delivered to the Registrar of Companies. The audit report on those

accounts: their report was unqualified, did not draw attention to

any matters by way of emphasis and did not contain a statement

under section 498(2) or (3) of the Companies Act 2006.

2. Basis of preparation

Statement of compliance

The annual financial statements of Goldplat plc (the 'Company')

are prepared in accordance with IFRSs as adopted by the European

Union.

Going concern

The directors assessed that the group is able to continue in

business for the foreseeable future with neither the intention nor

the necessity of liquidation, ceasing trading or seeking protection

from creditors pursuant to laws or regulations and thus adopted the

going concern basis in preparing these financial statements.

The assessment of the going concern assumption involves

judgement, at a particular point in time, about the future outcome

of events or conditions which are inherently uncertain. The

judgement made by the directors included the availability of and

the ability to secure material for processing at its plants in

South Africa and Ghana, the impact of loss of key management,

outlook of commodity prices and exchange rates in the short to

medium term and changes to regulatory and licensing conditions.

3. Significant accounting policies

The accounting policies applied in this condensed consolidated

interim financial report are the same as those applied in the

Group's consolidated financial statements as at and for the year

ended 30 June 2021.

4. Property, plant and equipment

During the six months ended 31 December 2021, the Group acquired

assets with a cost, excluding capitalised borrowing costs of

GBP313,000 (six months ended 31 December 2020: GBP458,000; twelve

months ended 30 June 2021: GBP1,132,000).

5. Intangible assets

Intangible assets at the end of the period relate only to

goodwill which relate to the investment held in Gold Minerals

Resources Limited. The balance is supported by the combined ongoing

gold recovery operations in South Africa and Ghana. During the six

months ended 31 December 2021 the goodwill balance has not been

impaired (six months ended 31 December 2020: GBPnil; twelve months

ended 30 June 2021: GBPnil).

6. Investments in subsidiaries, joint ventures and

associates

The amounts included on the statements of financial position

comprise the following:

Investment in joint ventures 1 1 1

7. Receivable on Kilimapesa sale

Receivable on Kilimapesa sale incorporates the following

balances:

The receivable relate to the 1% net smelter royalty on

production of Kilimapesa to the maximum of USD1,500,000.

Non-current assets 519 606 -

Current assets 87 58 -

--- ---

606 664 -

--- ---

Other financial assets are recognised initially at the fair

value, including transaction costs. The asset will subsequently be

measured at fair value and are grouped into levels 1 to 3 based on

the significance of the inputs used in the valuation. The financial

assets from the Kilimapesa sale has significant inputs and is

therefore included in level 3.

8. Other loans and receivables

Other loans and receivables comprise the

following balances

Amabubesi (Pty) Ltd 636 750

Aurelian Capital Proprietary Limited - 511 - -

------------------------- --- ---

511 636 750

------------------------- --- ---

The loan receivable in Goldplat Recovery (Pty) Limited, in

compliance with Black Economic Empowerment legislation in South

Africa, are recoverable from future dividends. They have been

included at historical cost due to the uncertainty surrounding the

variables required to calculate this asset at amortised cost. The

directors consider that the carrying amount represents the fair

value of the assets.

9. Inventories

Inventories comprise:

Raw materials 2 704 3 424 3 439

Consumable stores 947 706 538

Precious metals on hand and in process 7 383 4 303 7 591

------ ----- ------

11 034 8 433 11 568

------ ----- ------

Inventories are initially recognised at cost, and subsequently

at the lower of cost and net realisable value. Cost comprises all

costs of purchase, costs of conversion and other costs incurred in

bringing the inventories to their present location and condition.

Weighted average cost is used to determine the cost of ordinarily

interchangeable items.

10. Trade and other receivables

Trade and other receivables comprise:

Trade receivables 14 377 11 986 5 808

Sundry debtors 1 414 12 22

Prepaid expenses 110 157 128

Deposits 12 - 12

Other receivables 485 618 394

Value added tax 195 230 216

------- ------- -------

16 593 13 003 6 580

11. Cash and cash equivalents

11.1 Cash and cash equivalents included in

current assets:

Cash

Balances with banks 1 640 3 459 1 394

------- ------- -------

11.2 Overdrawn cash and cash equivalents included

in current liabilities

Bank overdrafts - - (484)

------- ------- -------

12. Share capital

Authorised and issued share capital

Issued

Ordinary shares 1 715 1 698 1 698

------- ------- -------

1 715 1 698 1 698

Share premium 11 546 11 491 11 491

------- ------- -------

13 261 13 189 13 189

------- ------- -------

During the current year, share options were exercised that

resulted in an increased in share capital and share premium.

13. Provisions

Provisions comprise:

Environmental obligation 724 787 586

In terms of section 54 of the regulations of the Minerals

Resource and Petroleum Act of 2002, in South Africa, a Quantum of

Financial Provisioning is required for activities performed under

mining lease. Quantum of Financial Provisioning requires a detailed

itemization of actual costs relating to the premature closure,

decommissioning and final closure and post closure management. The

Company makes use of an independent consultant to calculate the

detail itemized actual current costs for rehabilitation and to

evaluate any critical estimates and assumptions. The Quantum of

Financial Provisioning has been approved by Department of Minerals

Resources in South Africa. The Company has insured the obligation

and has ceded the proceeds from the policy to the Department of

Minerals Resources. During the prior financial year, the provision

held in GPR was reassessed by using an external expert and it was

concluded that due to the additional capital expenditure that has

taken place over the financial period, the provision had to be

increased to account for the additional capital incurred.

14. Trade and other payables

Trade and other payables comprise:

Trade creditors 1 610 9 200 4 055

Accrued liabilities 9 306 5 260 5 665

Invoice financing creditor 7 838 985 1 004

Total trade and other payables 18 754 15 445 10 724

15. Long term borrowings

The principal on the bank facility is repayable monthly over 36

months. The interest payable on the facility will be the South

African Prime Rate plus 1.75%.

Further to above, GPL did grant security over its debtors as

well as a negative pledge over its moveable and any immovable

property and a general notarial bond over all movable assets of GPL

will be registered. The Group entered into a limited suretyship for

ZAR 60 million (approximately GBP3.02 million), in favour of

Nedbank.

Long term borrowings comprise:

2 624

Nedbank Scipion - - 33 - 723

------- ------------------------- -------------------------

2 624 33 723

------- ------------------------- -------------------------

Non-current portion of long term borrowings 1 758 - -

Current portion of long term borrowings 866 33 723

------- ------------------------- -------------------------

2 624 33 723

------- ------------------------- -------------------------

16. Income tax expense - continuing operations

Income tax expense is recognised based on management's best

estimate of the weighted average annual income tax rate expected

for the full financial year applied to the pre-tax income of the

interim period. The tax charges for the period arises in South

Africa, Ghana and on declaration of dividends from South Africa.

The effective income tax rate in GPL was 24% (six months ended 31

December 2020: 26%), GRG was 15% (six months ended 31 December

2020: 15%) and the withholding tax

rate on dividends declared was 5% (six months ended 31 December

2020: 20%).

17. Earnings per share

Basic earnings per share

The earnings and weighted average number of

ordinary shares used in the calculation of

basic earnings per share are as follows:

Profit for the period attributable to owners

of the company 2 071 1 679 1 013

Loss for the year from discontinued operations - 570 243

--------- --------- ---------------

Earnings used in the calculation of basic

earnings per share for continuing operations 2 071 2 249 1 256

--------- --------- ---------------

Weighted average number of ordinary shares

used in the calculation of basic earnings

per share ('000s) 171 954 169 774 169 774

Weighted average number of ordinary shares

used in the calculation of diluted earnings

per share ('000s) 174 201 170 561 173 312

18. Segment information

18.1 Segment revenues

Total segment

revenue

---------------

Period ended 31 December 2021

South African Recovery Operations 10 616

West African Recovery Operations 10 710

---------------

Group revenue 21 326

---------------

Period ended 30 June 2021

South African Recovery Operations 17 622

West African Recovery Operations 17 778

---------------

Group revenue 35 400

---------------

Period ended 31 December 2020

South African Recovery Operations 8 243

West African Recovery Operations 4 359

---------------

12 602

---------------

Segment

information

continued...

18.2 Other incomes

and expenses

Segment

profit/(loss)

Depreciation Finance cost Finance before tax

for for income for

continued continued for continued Discontinued

operations operations continued opeations Taxation operations

operations

Period ended 31

December 2021

South African

Recovery Operations (172) (140) 370 2 141 (589) -

West African Recovery

Operations (76) (418) - 1 409 (193) -

Administration - (152) - (405) (7) -

Reconciliation to

group figures - 100 (88) (139) - -

-------------- -------------- ------------ --------------- -------------- ----------------

Total other incomes

and expenses (248) (610) 282 3 006 (789) -

-------------- -------------- ------------ --------------- -------------- ----------------

Period ended

30 June 2021

South African

Recovery Operations (379) (991) 125 2 358 (435) -

West African Recovery

Operations (140) (223) - 2 092 (383) -

Mining and

Exploration - - - - - (570)

Administration - 144 41 (3 957) (85) -

Reconciliation to

group figures - 161 (166) 3 159 - -

-------------- -------------- ------------ --------------- -------------- ----------------

Total other incomes

and expenses (519) (909) - 3 652 (903) (570)

-------------- -------------- ------------ --------------- -------------- ----------------

Segment

information

continued...

Segment

profit/(loss)

Depreciation Finance cost Finance before tax

for for income for

continued continued for continued Discontinued

operations operations continued opeations Taxation operations

operations

Period ended 31

December 2020

South African

Recovery

Operations (210) (876) 65 1 297 (357) -

West African

Recovery

Operations (68) (68) - 846 (122) -

Mining and

Exploration - - - - - (243)

Administration - (133) 389 (109) (80) -

Reconciliation

to group

figures - - 45 44 - -

-------------- -------------- ------------ --------------- -------------- ----------------

Total other

incomes and

expenses (278) (1 077) 499 2 078 (559) (243)

-------------- -------------- ------------ --------------- -------------- ----------------

Goldplat PLC

Condensed consolidated interim financial report for the 6 month

period ended 31 December 2021

Notes to the Consolidated Financial Statements

Figures in GBP `000

19. Major events

Share repurchase from and issue of new shares to the minority

shareholders of GPL

During the period the Group increased its interest in GPL, its

principal operating subsidiary, from 74% to 90.63% through the

buy-back by GPL of 22.33% of GPL shares, for ZAR 89.3 million

(approximately GBP4.5 million), from its minority shareholders and

issuing shares, amounting to 4.90% of GPL to Aurelian Capital

Proprietary Limited, a related party, at the same valuation as the

share repurchase, for ZAR 16 million (approximately GBP807,000).

The Transaction valued GPL at ZAR 400 million (approximately

GBP20.2 million) ("The Transaction"). The net cost to Goldplat

of acquiring an additional 16.63% of GPL was ZAR 66.52 million

(approximately GBP3.55 million).

The Transaction was financed in part through a South African

Rand denominated bank facility of ZAR 60 million (approximately

GBP3.02 million) provided by Nedbank. The remainder of the

consideration was settled through a set-off against the existing

Amabubesi vendor loan of ZAR 12.6 million (approximately

GBP635,000) outstanding to the Group with the balance paid in cash.

The principal on the bank facility is repayable monthly over 36

months. The interest payable on the facility will be the South

African Prime Rate plus 1.75%.

Of the ZAR 16 million (approximately GBP807,000) consideration

for the 4.90% worth of shares, Aurelian has paid ZAR 5 million

(approximately GBP252,000) in cash; a further ZAR 5 million cash

(approximately GBP252,000) is due by April 2022; and the ZAR 6

million balance (approximately GBP302,000) is a vendor loan and is

payable from distributions to be declared by GPL. Following

dividends declared to date of this report by GPL, the balance of

this vendor loan is now ZAR 4.2 million (approximately

GBP212,000).

After the completion of above transactions and cancellation of

the repurchased shares, the Group held 90.63% of GPL (an increase

of 16.63%), Amabubesi held 4.47% and Aurelian 4.90%. Subsequent to

above, Amabubesi's remaining shares were repurchased and shares to

the same amount and value issued to Aurelian. Aurelian is therefore

the only minority partner in South Africa and holds 9.37% of

GPL.

18

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UBOWRURUOAAR

(END) Dow Jones Newswires

March 18, 2022 03:01 ET (07:01 GMT)

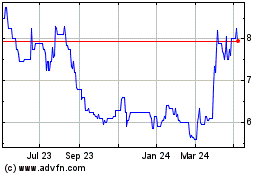

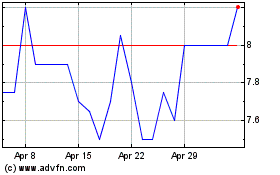

Goldplat (LSE:GDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Goldplat (LSE:GDP)

Historical Stock Chart

From Apr 2023 to Apr 2024