TIDMGDP

RNS Number : 3615Q

Goldplat plc

20 February 2023

G ol dp lat plc / Ti cker: GDP / Index: AIM / Secto r: M in i ng

& E x p l o rati on

20 February 2023

Goldplat plc

('Goldplat', the 'Group' or 'the Company')

2nd Quarter operating results update

for the period ended 31 December 2022 ("Q2")

G ol dp lat, the AIM li sted Mining Services Group, w ith

internati onal g o ld reco very o perati ons l o cated in South Afr

i ca and Ghana, servicing the African and South American Mining

Industry, is p leased to announce an operational update for Q2.

The two recovery operations continued to produce good combined

operating profit during Q2, albeit down 41% on a strong Q2 period

during the previous financial period, of GBP1,382,000 (Q2 2021:

GBP2,356,000) (excluding listing and head office costs and foreign

exchange losses).

The Ghanaian operation continues to perform well as a result of

the steady supply of material and achieved an operating profit for

Q2 of GBP1,026,000 (Q2 2021: GBP1,012,000), however the South

African operations have been impacted during the last two months of

Q2 by electricity cuts by the electricity provider in the country.

Notwithstanding the electricity cuts, the South African operation

achieved an operating profit for Q2 of GBP356,000 (Q2 2021:

GBP1,344,000).

The electricity cuts we referred to in the quarterly update

announced on 8 November 2022 have continued into Q3 and are

expected to continue to some extent at least until the end of

calendar year 2023. We have been evaluating our options to manage

the situation. Generating our own electricity through the use of

diesel generators or renewable energy sources currently does not

prove to be feasible and we will instead focus on easing the

bottlenecks created as a result of the reduction in electricity

supply and increase output during periods of electricity

availability through focussed management and initial capital outlay

of less than GBP50,000. We will also adjust processing methods on

some material to increase capacity through our plant to limit the

impact that this has on production through our incineration

units.

Not all of our production circuits have been impacted to the

same extent, with our by-product's circuits having more capacity to

deal with supply of material. Regarding the by-products, we

received a large supply of material during December 2022, which has

been processed during December 2022 and January 2023 and we will

see the sales of this material coming through during Q3.

Goldplat processes an assortment of material throughout the

Group from different clients and on different contracts making use

of a wide range of plant and equipment. The Group has been

delivering profitability for the last 12 quarters, which is in line

with management's focus on ensuring sustainable cashflow and

profitability.

Whilst we cannot predict the level of electricity supply for the

rest of the year, should the electricity cuts in South Africa

continue at the current level, although we still expect to generate

operating profits over Q3 and Q4, we believe it is unlikely that we

will be able to meet market expectations for the current financial

year. We will keep the market updated with regard to the impact of

the electricity supply and on the progress of our business

generally.

The application for a pipeline to the DRD Gold premises is still

being evaluated by the authorities and although we have indicated

before that it will be by no later than June 2023, the timelines

for when approval will be received are not that clear and we will

update the market once we have more clarity. The pipeline will

provide Goldplat Recovery Limited with the ability to process the

existing Tailings Storage Facility ("TSF") which contains a JORC

resource of circa 82,000 ounces of gold (Table 1) at a DRD Gold

processing facility. The negotiations of the terms and conditions

of processing our existing TSF at a DRD Gold processing facility

still need to be finalised.

Goldplat has identified, and to an extent secured, material in

ECOWAS ("The Economic Community of West African States"); however,

the export and processing of these materials remains dependent on

approval from government officials. We continue our engagement with

the governments and mines in the ECOWAS to agree processes and

controls on the export of gold bearing products and remain

encouraged by the value we have identified that we can offer in

these countries.

The majority of material processed in Ghana during Q2 was from

clients inside the country, however we secured a larger consignment

out of South America during December and we should see the returns

from this during the last two quarters of the current financial

period.

We continue with our expansion into South America on a measured

basis, and we have identified a location and property which we are

negotiating to procure for less than GBP100,000.

The construction of the new TSF started in Q2 (to 31 December

2022) and while we aim to have this completed by the end of Q4 (to

30 June 2023), some delays may result due to the rainy season in

South Africa and additional preparation work required.

During the period we made a strategic investment of GBP 150,000

to obtain the usage of a small spiral plant for our gold operations

in South Africa and acquire a 15% shareholding in a fine coal

recovery technology company. Goldplat has an option to invest an

additional GBP 1.5m, which will increase our shareholding in that

business to above 50%. This investment would be used to

operationalize the technology through the construction of a fine

coal washing plant in Mpumalanga, South Africa. Management is still

evaluating this option which would provide us diversification in

our recovery operations into a different commodity, namely coal, of

which significant resources are available in South Africa, with

opportunities not just for processing but also for environmental

rehabilitation.

During Q2 the Group incurred capital cost of GBP253 ,000 and we

are estimating that we will require a further GBP1,500,000 during

the next 12 to 18 months to be spent on repairing and maintaining

current operations, and on improved lining of the new TSF and

improving the environmental impacts of our current processes.

Cash balances in the group remained strong at GBP2,920,000 at

the end of Q2 ( Q2 2021: GBP1,452,000). We still have significant

balances invested in inventory and debtors with main exposures to

smelters in Europe and South Africa.

Werner Klingenberg, CEO of Goldplat commented: "I am pleased to

announce continued profitability in the Group, particularly

considering some of the challenges we are facing. Our solutions

have always been flexible and unique and I believe that the team

will find a way to handle the impact of electricity cuts in South

Africa, whilst reducing their impact on our results.

We still see opportunity for supply in West Africa and we

continue to increase our supplier base in South America, supporting

further investment in the region.

Our aim remains to increase visibility of earnings through,

becoming a partner to the mining industry, by maintaining and

increasing our value offering to clients, improving our

environmental management and processes and expanding our processes

to increase the types of by-products and waste we can beneficiate

and also through identifying and securing previously mined

resources."

For further information visit www.g o ld p l at.com, f o l l ow

on Twitter @GoldPlatPlc or contact:

Werner Klingenberg Goldplat plc Tel: +27 (0) 82 051 1071

(CEO)

Colin Aaronson / George Grant Thornton UK LLP Tel: +44 (0) 20 7383

Grainger / Samuel Littler (Nominated Adviser) 5100

James Bavister / Andrew WH Ireland Limited Tel: +44 (0) 207 220

de Andrade (Broker) 1666

Tim Thompson / Mark Edwards Flagstaff Strategic and Tel: +44 (0) 207 129

/ Fergus Mellon Investor Communications 1474

goldplat@flagstaffcomms.com

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

Table 1

Mineral Resource Estimate of the TSF, South Africa

Total Resource

Domain Class Tonnes Density Au (g/t) Au (Oz) U(3) O(8) U(3) O(8) Ag (g/t) Ag (Oz)

(Mil) (g/t) (lbs)

----------- ------------ -------- --------- -------- ----------- ----------- --------- --------

TOTAL

RESOURCE Measured 0.87 1.32 1.82 50,907 61.41 117,754 4.85 135,573

----------- ------------ -------- --------- -------- ----------- ----------- --------- --------

Indicated 0.49 1.37 1.77 27,897 59.73 64,506 4.71 74,165

------------------------- ------------ -------- --------- -------- ----------- ----------- --------- --------

Inferred 0.07 1.30 1.4 3,154 71.40 11,016 2.82 6,356

------------------------- ------------ -------- --------- -------- ----------- ----------- --------- --------

Grand Total 1.43 1.34 1.78 81,959 61.32 193,276 4.70 216,094

------------ -------- --------- -------- ----------- ----------- --------- --------

The Tailings Mineral Resource Estimate was announced in

accordance with the JORC Code (2012) in a press release on 29

January 2016. Mark Austin of Applied Geology & Mining (Pty) Ltd

was the Competent Person responsible for that announcement. The

Company confirms that all material assumptions and technical

parameters underpinning the Resource Estimate continue to apply and

have not materially changed.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPUCWPUPWGRB

(END) Dow Jones Newswires

February 20, 2023 02:00 ET (07:00 GMT)

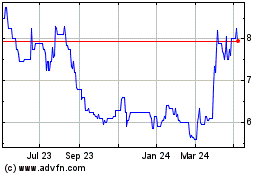

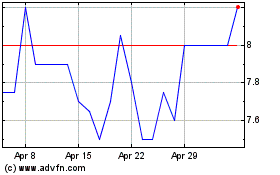

Goldplat (LSE:GDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Goldplat (LSE:GDP)

Historical Stock Chart

From Apr 2023 to Apr 2024