TIDMGEMD

RNS Number : 2439W

Gem Diamonds Limited

17 August 2022

17 August 2022

GEM DIAMONDS LIMITED

H1 2022 Trading Update

Gem Diamonds Limited (LSE: GEMD) ("Gem Diamonds" or the

"Company" or the "Group") provides the following Trading Update

detailing the Group's operational and sales performance from 1

January 2022 to 30 June 2022 ("H1 2022" or the "Period").

Highlights:

-- 57 075 carats were sold during the Period (H2 2021: 54 573

carats), generating revenue of US$99.6 million (H2 2021: US$97.3

million) and achieving an average price of US$1 745 per carat (H2

2021: US$1 783 per carat).

-- The highest price achieved in the Period was US$66 059 per

carat for an 8.41 carat pink diamond.

-- 15 diamonds sold for more than US$1.0 million each,

generating revenue of US$25.8 million during the Period.

-- Three diamonds greater than 100 carats (244.34, 127.58 and

124.65 carats) were recovered during the Period, which were sold in

the first tender after Period end for US$13.9 million.

-- Carats recovered during the Period were 55 157 (H2 2021: 56 504).

Corporate and Financial:

-- The Group ended the Period with US$24.2 million cash on hand.

-- Drawn down facilities amounted to US$12.1 million resulting

in a net cash position of US$12.1 million at Period end (Q4 2021:

net cash of US$20.9 million).

-- The Group had undrawn and available facilities of US$69.9 million at Period end.

-- The 2021 dividend of 2.7 US cents per share (US$3.8 million)

proposed by the Board in March 2022 was approved at the Annual

General Meeting on 8 June 2022 and has been paid.

-- During the Period, the Company purchased 1 520 170 of its

shares at a weighted average purchase price of 60.05 GB pence

(78.07 US cents) per share under its share buyback programme. The

shares are currently held as treasury shares.

-- The purchaser for the Ghaghoo diamond mine did not meet the

extended long stop date of 10 May 2022 resulting in the agreement

lapsing on that date. The Group continues to pursue potential sales

opportunities while other disposal or closure alternatives are also

being considered.

Gem Diamonds' CEO, Clifford Elphick, commented:

"We continue to see a firm diamond market for the high quality

Letšeng diamonds in 2022. We are managing the economic impact of

global events which are contributing significantly to the slowing

down of global economic growth and which are materially impacting

energy and commodity prices and disrupting supply chains

worldwide.

The sanctions imposed on the Russian diamond producer Alrosa

have exacerbated a shortage of rough diamonds in the market,

supporting continued strong demand and robust prices for Letšeng's

high-quality rough diamonds"

1. Diamond Market

Strong demand and robust prices achieved for Letšeng's diamonds

reflected the continued positive sentiment in the diamond market.

The Group hosted another Dubai tender viewing in March 2022 which

was well-attended and contributed positively to the firm prices

achieved during the Period.

2. Letšeng

2.1. Rough diamond sales

H1 2022 Q2 2022 Q1 2022 H2 2021 H1 2022 vs H2 2021 % Change

Carats sold 57 075 28 614 28 461 54 573 5%

-------- -------- -------- -------- ----------------------------

Total value (US$ millions) 99.6 47.5 52.1 97.3 2%

-------- -------- -------- -------- ----------------------------

US$/carat 1 745 1 660 1 831 1 783 -2%

-------- -------- -------- -------- ----------------------------

2.2. Production

H1 2022 Q2 2022 Q1 2022 H2 2021 H1 2022 vs H2 2021 % Change

Waste tonnes stripped 6 289 380 2 436 654 3 852 726 8 495 967 -26%

---------- ---------- ---------- ---------- ----------------------------

Ore tonnes treated 3 017 664 1 453 010 1 564 654 3 032 710 -

---------- ---------- ---------- ---------- ----------------------------

Satellite pipe contribution (tonnes) 1 378 404 744 039 634 365 1 654 169 -17%

---------- ---------- ---------- ---------- ----------------------------

Carats recovered (1) 55 157 26 727 28 430 56 504 -2%

---------- ---------- ---------- ---------- ----------------------------

Grade recovered (cpht) (1) 1.83 1.84 1.82 1.86 -2%

---------- ---------- ---------- ---------- ----------------------------

(1) Includes carats produced from the Letšeng Plants, the

Alluvial Ventures (AV) plant and the recovery tailings treatment

facility.

The 26% reduction in waste tonnes mined and the 17% reduction in

Satellite pipe contribution to tonnes treated in H1 2022 is in line

with plan. Satellite pipe contribution increases in H2 2022 and is

on track to meet guidance as set out below.

Letšeng's Plants treated a total of 2.58 million tonnes of ore

during the Period, 53% of which was sourced from the Satellite pipe

and 47% from the Main pipe. In addition, 0.44 million tonnes of

Main pipe material were treated through the third-party processing

contractor, Alluvial Ventures. This contract ended on 30 June 2022

as planned.

2.3. G uidance for 2022

During the Period, Letšeng experienced excessive rain, increased

power disruptions on the energy supply network and negative impacts

on the supply of critical parts and spares of equipment which

impacted production. However, the 2022 production metrics remain on

track to be achieved, albeit at the lower end of original guidance

published in March 2022. The related cost impact of disruptions to

the supply chain, combined with significant increases in fuel,

explosives and other consumables prices were experienced in the

Period, exacerbated by the Russian invasion of Ukraine. This is

expected to continue into H2 2022, resulting in a revision to the

full year cost guidance as set out in the table below. A review of

capital projects for 2022 has resulted in a significant reduction

of capex for 2022.

FY 2022 FY 2022

Revised Guidance Original Guidance

June 2022 March 2022

---------------- -------------------

Waste tonnes mined (Mt) No change 10 - 12

---------------- -----------------

Ore treated (Mt) No change 5.6 - 5.8

---------------- -----------------

Satellite pipe ore contribution (Mt) No change 2.8 - 3.0

---------------- -----------------

Carats recovered (Kct) No change 112 - 116

---------------- -----------------

Carats sold (Kct) No change 110 - 114

---------------- -----------------

Direct cash costs, (before waste) per

tonne treated (Maloti) 250 - 270 220 - 230

---------------- -----------------

Operating costs per tonne treated (Maloti) 330 - 350 275 - 285

---------------- -----------------

Mining waste cash costs per tonne of

waste mined (Maloti) 62 - 65 51 - 53

---------------- -----------------

Total capex (US$ million) 19 - 23 25 - 30

---------------- -----------------

3. Sustainability

The Group won three awards at the Investing in African Mining

Indaba Junior ESG Awards in May 2022, in the categories of Health

and Safety, Responsible Water and Protection of Biodiversity.

In addition, Gem Diamonds' Sustainability and Climate Change

Reports have been nominated as finalists by the influential

investor media platform ESG Investing in two reporting categories,

namely (i) Best Sustainability Report: Metals and Mining and (ii)

Best Climate-Related Reporting: Small Cap.

During the Period, two LTI's occurred at Letšeng , and the

Group-wide All Injury Frequency Rate was 0.82. Letšeng continued to

advance its Critical Control Management programme, aimed at

eliminating work-related risk to employee health and safety. No

major or significant community or environmental incidents occurred

across the Group during the Period.

FOR FURTHER INFORMATION:

Gem Diamonds Limited

Susan Wallace, Company Secretarial department

ir@gemdiamonds.com

Celicourt Communications

Mark Antelme / Felicity Winkles

Tel: +44 (0) 208 434 2643

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014.

The Gem Diamonds Limited LEI number is 213800RC2PGGMZQG8L67.

ABOUT GEM DIAMONDS:

Gem Diamonds is a leading global diamond producer of large high

value diamonds. The Company owns 70% of the Letšeng mine in Lesotho

and is currently in the process of selling its 100% share of the

Ghaghoo mine in Botswana. The Letšeng mine is famous for the

production of large, exceptional white diamonds, making it the

highest dollar per carat kimberlite diamond mine in the world.

www.gemdiamonds.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBKABBDBKBDFD

(END) Dow Jones Newswires

August 17, 2022 02:00 ET (06:00 GMT)

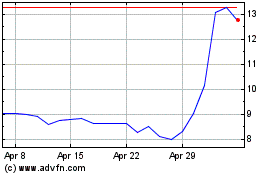

Gem Diamonds (LSE:GEMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gem Diamonds (LSE:GEMD)

Historical Stock Chart

From Apr 2023 to Apr 2024