TIDMGEMD

RNS Number : 4722O

Gem Diamonds Limited

01 February 2023

1 February 2023

GEM DIAMONDS LIMITED

Q4 2022 Trading Update

Gem Diamonds Limited (LSE: GEMD) ("Gem Diamonds" or the

"Company" or the "Group") provides the following Trading Update

detailing the Group's operational and sales performance from 1

October 2022 to 31 December 2022 ("Q4 2022" or the "Period").

Highlights:

-- All operational metrics achieved for FY 2022 were within or better than guidance.

-- 26 530 carats were recovered during the Period, resulting in

106 704 carats recovered for the year (FY 2021: 115 335

carats).

-- 107 498 carats were sold in 2022, achieving an average price

of US$1 755 per carat (FY 2021: 109 697 carats sold for US$1 835

per carat).

-- The highest price achieved in the Period was US$34 170 per

carat for a 42.98 carat white diamond for a total price of US$1 469

000.

-- Four diamonds sold for more than US$1.0 million each,

generating revenue of US$5.3 million during the Period.

Corporate and Financial:

-- The Group ended the Period with US$8.7 million cash on hand

and utilised project facilities of US$5.5 million (under the

project debt facility for the replacement of the Primary Crushing

Area (PCA)), resulting in a net cash position of US$3.2 million at

Period end (Q3 2022: US$5.4 million).

-- The Group had undrawn and available facilities of US$82.6

million at Period end including the remaining US$2,6 million

project debt facility for the replacement of the PCA.

Gem Diamonds' CEO, Clifford Elphick, commented:

"Despite Letšeng continuing to be impacted by Eskom-driven power

outages which not only interrupt the production cycle but also

impact costs significantly due to the increased alternative power

generation costs, it was pleasing to meet planned operational

metrics in 2022. Long-term alternative power supply options are

being actively investigated.

Pleasingly, the implementation of initiatives aimed at energy

efficiency and carbon reduction resulted in a year-on-year

reduction in the Group's carbon footprint of 10% ".

1. Diamond Market

Letšeng's tenders were well-attended which contributed

positively to the prices achieved for Letšeng's large high-value

diamonds during the Period.

2. Letšeng

2.1. Rough Diamond Sales

H1 2022 Q3 2022 Q4 2022 FY 2022 FY 2021 FY 2022 vs FY 2021 % Change

Carats sold 57 076 27 913 22 509 107 498 109 697 -2%

-------- -------- -------- -------- -------- ----------------------------

Total value (US$ millions) 99.6 56.6 32.4 188.6 201.3 -6%

-------- -------- -------- -------- -------- ----------------------------

US$/carat 1 745 2 028 1 438 1 755 1 835 -4%

-------- -------- -------- -------- -------- ----------------------------

2.2. Production

H1 2022 Q3 2022 Q4 2022 FY 2022 FY 2021 FY 2022 vs FY 2021 %

Change

Waste tonnes stripped 6 289 380 2 116 761 1 747 704 10 153 845 18 663 492 -46%

---------- ---------- ---------- ----------- ----------- ---------------------------

Ore tonnes treated 3 017 664 1 246 209 1 242 703 5 506 576 6 172 429 -11%

---------- ---------- ---------- ----------- ----------- ---------------------------

Satellite pipe

contribution (tonnes) 1 378 404 713 239 946 323 3 037 966 3 326 458 -9%

---------- ---------- ---------- ----------- ----------- ---------------------------

Carats recovered (1) 55 156 25 018 26 530 106 704 115 335 -7%

---------- ---------- ---------- ----------- ----------- ---------------------------

Grade recovered (cpht) (1) 1.83 2.01 2.13 1.94 1.87 4%

---------- ---------- ---------- ----------- ----------- ---------------------------

(1) Includes carats produced from the Letšeng Plants, the

recovery tailings treatment facility and the Alluvial Ventures (AV)

plant (Until 30 June 2022)

The 46% reduction in waste tonnes mined in 2022 compared to 2021

was in line with the mine plan. The reduced waste profile from

slope steepening of the active cutbacks in Main pipe contributed to

this reduction. The Satellite pipe contribution of 3.0 million

tonnes treated in 2022 was in line with the planned annual

Satellite ore contribution.

Letšeng's Plants treated a total of 1.2 million tonnes of ore

during the Period. The 11% reduction in total ore tonnes treated in

2022 compared to 2021 was mainly driven by the expiry of Alluvial

Ventures' processing contract on 30 June 2022 as planned to allow

for the waste stripping of the new cutback in the Main pipe to

commence.

The reduction in ore tonnes treated for the Period was, as

previously reported, due to the Lesotho general election requiring

a compulsory two-day site wide shutdown at Letšeng to allow the

workforce to vote in their respective constituencies, a secondary

crusher breakdown in Plant 2 and continued power disruption on the

energy supply network. The reduction in ore tonnes treated for 2022

consequently impacted the carats recovered for the year

negatively.

Frequency of recovery of large diamonds

2022 2021 FY Average

2008 - 2021

Number of diamonds

---- ---- ------------

>100 carats 4 6 8

---- ---- ------------

60-100 carats 18 16 19

---- ---- ------------

30-60 carats 69 81 77

---- ---- ------------

20-30 carats 108 122 114

---- ---- ------------

Total diamonds > 20 carats 199 225 218

---- ---- ------------

The recovery of four >100 carat diamonds during the year

which was lower than the 14-year average of eight, impacted overall

revenue generated during the year. Demand for Letšeng's high

quality goods however remained high and the prices achieved for

these high quality >100 carat diamonds remained strong.

2.3. FY 2022 Guidance

2.3.1. Production

Mine Plan FY 2022 Guidance issued

Waste tonnes mined (Mt) 10.2 10 - 12

------- ---------------

Ore treated (Mt) 5.5 5.45

------- ---------------

Satellite pipe ore contribution (Mt) 3.0 2.8 - 3.0

------- ---------------

Carats recovered (Kct) 106 104

------- ---------------

Carats sold (Kct) 107 105

------- ---------------

2.3.2. Cost

Letšeng maintained its direct cash and operating costs per tonne

treated within expected targets and capex under the full year 2022

guidance. All costs were however impacted by the increased diesel

usage due to the Eskom-driven power outages and increased costs of

diesel and other consumables. Waste cash costs per waste tonne were

slightly above guidance further impacted by the lower waste tonnes

(on the lower end of guidance) during the year.

Costs FY 2022 Guidance issued

Direct cash costs (before waste) per

tonne treated (Maloti) 264 250 - 270

------- ---------------

Operating costs per tonne treated(1)

(Maloti) 340 330 - 350

------- ---------------

Mining waste cash costs per tonne of

waste mined (Maloti) 67 62 - 65

------- ---------------

Total capex(2) (US$ million) 11.5 19 - 23

------- ---------------

(1) Operating costs per tonne excludes royalty, selling costs,

depreciation and mine amortisation, but includes inventory, waste

and ore stockpile adjustments.

(2) The 2022 guidance for capital included the full costs of the

PCA capital. This was not fully incurred in 2022 and will be

carried over to 2023.

3. Sustainability

Energy efficiency and carbon reduction initiatives contributed

to a year-on-year reduction in the Group's carbon footprint of

10%

During the Period, one LTI occurred at Letšeng , and the

Group-wide All Injury Frequency Rate was 0.72 for 2022. No major or

significant community or environmental incidents occurred across

the Group during the Period.

FOR FURTHER INFORMATION:

Gem Diamonds Limited

Susan Wallace, Company Secretarial department

ir@gemdiamonds.com

Celicourt Communications

Mark Antelme / Felicity Winkles

Tel: +44 (0) 208 434 2643

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014.

The Gem Diamonds Limited LEI number is 213800RC2PGGMZQG8L67.

ABOUT GEM DIAMONDS:

Gem Diamonds is a leading global diamond producer of large high

value diamonds. The Company owns 70% of the Letšeng mine in Lesotho

and is currently in the process of selling its 100% share of the

Ghaghoo mine in Botswana. The Letšeng mine is famous for the

production of large, exceptional white diamonds, making it the

highest dollar per carat kimberlite diamond mine in the world.

www.gemdiamonds.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKDBNABKDCDN

(END) Dow Jones Newswires

February 01, 2023 02:00 ET (07:00 GMT)

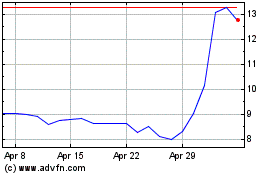

Gem Diamonds (LSE:GEMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gem Diamonds (LSE:GEMD)

Historical Stock Chart

From Apr 2023 to Apr 2024