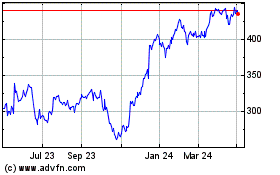

TIDMGEN

RNS Number : 8140I

Genuit Group PLC

17 August 2021

Genuit Group plc

Interim condensed set of consolidated financial

statements for the six months ended 30 June 2021

17 August 2021

Genuit Group plc

Interim results for the six months ended 30 June 2021

"H1 performance above 2019 - upgrade to full year

expectations"

Genuit Group plc ("Genuit", the "Company" or the "Group"), a

leading provider of sustainable water and climate management

solutions for the built environment , today announces its unaudited

interim results for the six months ended 30 June 2021.

Martin Payne, Chief Executive Officer, said

"I am delighted with the Group's performance in the first half

with strong revenue and profit growth in recovering markets,

despite cost headwinds. This reflects good organic trading as well

as the contribution from our three recent acquisitions, which are

performing well. I would like to thank all our people for their

continued hard work in the face of ongoing challenges from the

pandemic as well as significant increases in demand. The alignment

of our Group strategy around sustainability and environmental

drivers as well as strong market demand has seen momentum continue

into the second half and the Board expects full year performance to

be ahead of previous management expectations."

Financial Results

H1 2021 H1 2020 H1 2019 Change

Statutory measures vs H1 2019

Revenue GBP295.6m GBP173.6m GBP223.3m 32.4%

Operating profit GBP36.3m GBP6.2m GBP35.2m 3.1%

Profit before tax GBP33.8m GBP2.3m GBP31.4m 7.6%

Earnings per share (basic) 7.9p 0.7p 12.9p (38.8%)

Cash generated from operations GBP23.6m GBP(15.7)m GBP21.7m 8.8%

Dividend per share 4.0p - 4.0p -

Alternative performance

measures

Underlying operating

profit (1) GBP48.6m GBP10.5m GBP39.3m 23.7%

Underlying cash generated

from operations(2) GBP15.0m GBP(22.7)m GBP13.5m 11.1%

Underlying operating

margin (1) 16.4% 6.0% 17.6% (120)bps

Underlying profit before

tax (1) GBP46.5m GBP6.6m GBP35.6m 30.6%

Underlying earnings per

share (basic) (1) 15.8p 2.6p 14.7p 7.5%

Leverage(3) (times pro

forma EBITDA(4) ) 1.5 1.1 1.8 0.3

Summary

-- We continue to prioritise the health, safety and wellbeing of

our colleagues as circumstances around the pandemic evolve.

-- Financial performance has been achieved by driving higher

volumes despite some supply constraints and considerable cost

inflation, particularly in relation to raw materials. Management

expects full year operating margins to be broadly in line with the

first half.

-- Revenue 32.4% higher than H1 2019, reflecting continued

strong trading and the benefit of acquisitions. On a like-for-like

basis, revenue 13.8% higher than H1 2019.

-- Strong cashflow generation with net debt(3) of 1.5 times pro

forma EBITDA(4) in line with expectations. Net debt leverage for

the year end is forecast to be lower than this.

-- The three acquisitions made during the period (Adey, Nu-Heat

and Plura) have performed well to date with Adey exceeding

expectations and integration of these businesses into the Group is

proceeding well.

-- Statutory financial measures have a number of non-underlying

adjustments including recognition of a deferred tax liability as a

result of tax rate changes and enhanced amortisation of intangible

assets as a result of the acquisitions.

-- Continued investment in new products in both Residential

Systems and Commercial and Infrastructure Systems in line with our

strategic growth drivers.

-- The Group is making progress against its 2025 ESG targets and

senior management's incentive programmes are now aligned to

these.

-- The Group intends to pay an interim dividend of 4.0 pence per share (2019: 4.0 pence).

Outlook

-- UK market outlook for the second half is generally

encouraging, with strong demand levels in most parts of the UK

construction market, particularly in residential.

-- Fundamentals in Residential Systems continue to be strong,

driven by the new housebuild sector and private RMI, which

performed relatively well throughout the pandemic.

-- Despite buoyant demand, structural labour supply constraints

and cost inflation primarily affecting raw materials and transport

costs, will provide some risk to financial performance for the

remainder of the year, although the Group is taking action to help

mitigate this.

-- Trading has started well in the second half, and the Board

now expects that underlying operating profit for the full year will

be ahead of previous management expectations.

(1) Underlying profit and earnings measures exclude certain

non-underlying items and, where relevant, the tax effect of these

items. The Directors consider that these measures provide a better

and more consistent indication of the Group's underlying financial

performance and more meaningful comparison with prior and future

periods to assess trends in our financial performance.

(2) Underlying cash generated from operations is defined as cash

generated from operations, adjusted for non-underlying cash items,

after movement in net working capital and capital expenditure net

of proceeds from disposals of property, plant and equipment.

(3) Leverage is defined as net debt divided by pro forma EBITDA.

Net debt within the leverage calculation is defined as loans and

borrowings net of unamortised issue costs less cash and cash

equivalents, excluding the effects of IFRS 16.

(4) Pro forma EBITDA is defined as underlying operating profit

before depreciation for the 12 months preceding the balance sheet

date, adjusted, where relevant, to include a full year of EBITDA

from acquisitions made during those 12 months.

Enquiries:

Genuit

Martin Payne, Chief Executive

Officer

Paul James, Chief Financial

Officer +44 (0) 1709 772 204

Brunswick

Nina Coad

Sophia Lazarus +44 (0) 20 7404 5959

A copy of this report will be available on our website

www.genuitgroup.com today from 0700hrs (BST).

There will be webcast presentation for analysts and investors at

0830hrs (BST) on Tuesday 17 August 2021 via web-conference. Please

access the presentation on the following link; :

https://www.investis-live.com/genuit-group/60ed96532527a9160049e54a/ir2021

We recommend you register by 0815hrs (BST). Details of the

conference call dial-in numbers for questions and answers will be

given at the end of the webcast presentation.

The presentation is also available on the Reports, Results and

Presentations page on our website at

https://www.genuitgroup.com/investors/

Notes to Editors:

Genuit Group plc ("Genuit", the "Company" or the "Group"), a

leading provider of sustainable water and climate management

solutions for the built environment, is the largest manufacturer in

the UK, and among the ten largest manufacturers in Europe, of

piping systems for the residential, commercial, civils and

infrastructure sectors by revenue. It is also a leading designer

and manufacturer of energy efficient ventilation systems,

sustainable underfloor heating solutions and energy efficiency

solutions in water-based heating systems in the UK.

The Group operates from 28 facilities in total and manufactures

the UK's widest range of solutions for heating, plumbing, drainage

and ventilation. The Group primarily targets the UK and European

building and construction markets with a presence in Italy, the

Netherlands, Ireland and the Middle East and sales to specific

niches in the rest of the world.

Genuit Group plc changed its name from Polypipe Group plc on 6

April 2021. The Group was established in 1980 and has been listed

on the premium segment of the London Stock Exchange since 2014.

Group Results

Revenue for the six months ended 30 June 2021 was 70.3% higher

than the prior year at GBP295.6m (2020: GBP173.6m) and 32.4% above

2019 (GBP223.3m). On a like-for-like basis, excluding the impact of

acquisitions, revenue was 50.0% higher than prior year and 13.8%

above the same period in 2019. The Group successfully implemented

price increases in the period after the extent of the raw material

cost inflation became apparent which, together with operational

efficiencies, is mitigating this inflation. The Group continued to

focus on its medium-term demand drivers - a structural UK housing

shortage, the regulatory and environmental drivers around water and

climate management, and increasingly indoor air quality. The three

acquisitions made during the period (Adey, Nu-Heat and Plura) have

performed well to date, with Adey exceeding expectations, and the

integration of these businesses into the Group is progressing

well.

Underlying operating profit was 362.9% higher than the prior

year at GBP48.6m (2020: GBP10.5m) and 23.7% higher than the same

period in 2019 (GBP39.3m). This represents an underlying operating

margin of 16.4%, a significant improvement on the prior year level

of 6.0% but 120 basis points lower than 2019 due to the normal lag

in effecting price increases to recover inflation and Covid-19

related costs.

Underlying finance costs of GBP2.1m (2020: GBP3.9m) were broadly

in line with expectations due to the lower levels of debt. The

prior year included a cost related to the full draw down of the

Group's GBP300.0m Revolving Credit Facility (RCF), a GBP50.0m

Covid-19 facility and a GBP100.0m Covid Corporate Financing

Facility, which was repaid in full in September 2020.

Non-underlying operating costs of GBP12.3m (2020: GBP4.3m, 2019:

GBP4.1m) are driven by acquisition costs, amortisation of

intangible assets arising from acquisitions and the unwind of

inventory fair value adjustment.

The total tax charge for the period was GBP14.7m (2020: GBP0.9m,

2019: GBP5.7m). The underlying tax charge of GBP8.2m (2020:

GBP1.1m, 2019: GBP6.3m) represents an effective underlying tax rate

of 17.6% (2020: 16.7%). The effective underlying tax rate for the

same period in 2019 was 17.7%.

Underlying profit after tax was significantly higher than prior

year at GBP38.3m (2020: GBP5.5m) and 30.7% above the same period in

2019 (2019 GBP29.3m). Underlying basic earnings per share increased

to 15.8 pence (2020: 2.6 pence), 7.5% higher than the same period

in 2019 (14.7 pence).

Including non-underlying items, profit after tax increased to

GBP19.1m (2020: GBP1.4m), 25.7% lower than the same period in 2019

(GBP25.7m). Basic earnings per share increased to 7.9 pence (2020:

0.7 pence).

The Board recognises the importance of dividends to shareholders

and has declared an interim dividend of 4.0 pence per share. This

dividend will be paid on 24 September 2021 to shareholders on the

register at the close of business on 3 September 2021.

Business Review

Revenue 2021 2020 Change LFL Change 2019 Change LFL Change

GBPm GBPm % % GBPm % %

------------------------------- ------ ------ ------- ----------- ------ ------- -----------

Residential Systems 183.8 92.8 98.1 63.7 129.0 42.5 17.8

Commercial and Infrastructure

Systems 111.8 80.8 38.4 34.2 94.3 18.6 8.3

------------------------------- ------ ------ ------- ----------- ------ ------- -----------

295.6 173.6 70.3 50.0 223.3 32.4 13.8

------------------------------- ------ ------ ------- ----------- ------ ------- -----------

Underlying operating 2021 ROS 2020 ROS Change 2019 ROS Change

profit GBPm % GBPm % % GBPm % %

------------------------------- ------ ----- ------ ---- ------- ------ ----- -------

Residential Systems 35.8 19.5 7.4 8.0 383.8 26.6 20.6 34.6

Commercial and Infrastructure

Systems 12.8 11.4 3.1 3.8 312.9 12.7 13.5 0.8

------------------------------- ------ ----- ------ ---- ------- ------ ----- -------

48.6 16.4 10.5 6.0 362.9 39.3 17.6 23.7

------------------------------- ------ ----- ------ ---- ------- ------ ----- -------

The Group has experienced a strong performance in the first half

of the year despite the challenges associated with the continued

Covid-19 pandemic, the cost and supply of raw materials and

increasing transport costs. We were able to maintain manufacturing

output due to the scale and flexibility of our operations.

During the period we focused on integrating our newly acquired

businesses of Adey, the UK's leading provider of magnetic filters,

chemicals and related products, which protect against magnetite and

other performance issues in water-based heating systems and improve

energy efficiency; Nu-Heat, the leading supplier of sustainable

underfloor heating solutions, air and ground source heat pumps, and

other renewable heating systems; and Plura, a manufacturer of a

range of products for utility companies, road and rail operators,

network builders and designers in the construction and maintenance

of their networks. All businesses are performing well, with Adey

continuing to exceed expectations.

We are pleased to report that revenue for the six months ended

30 June 2021 was 70.3% higher than the prior year at GBP295.6m

(2020: GBP173.6m) and 32.4% above 2019 (2019: GBP223.3m). On a

like-for-like basis, excluding the impact of acquisitions, revenue

was 50.0% higher than prior year and 13.8% above the same period in

2019.

On a like-for-like basis, revenue in Residential Systems was

63.7% ahead of prior year and 17.8% above 2019 levels. In

Commercial and Infrastructure Systems, revenue was 34.2% ahead of

prior year and 8.3% above 2019 levels. Despite the challenges of

the pandemic, we retain a strong pipeline of new products. We have

launched several new ranges in the first half of the year,

including the Squrbo 2 extractor range from Nuaire, and newly

acquired Adey launched the Magnaclean CMX filter, and a new range

of cleaning chemicals specifically targeting growth in the

commercial sector. Our Civils & Green Urbanisation business su

ccessfully launched Permatreat, a new range of low maintenance

linear surface water collection and treatment systems.

RESIDENTIAL SYSTEMS

Trading in the Residential Systems segment performed strongly,

with revenue of GBP183.8m 42.5% ahead 2019, and 17.8% ahead on a

like-for-like basis. The residential sector has continued its

fast-paced recovery, due to a combination of pent-up demand, and

government stimulus. The second quarter of 2020 was the most

impacted by Covid-19, however, the strength of the housing recovery

is highlighted by the first quarter of 2021 seeing private starts

and completions at 36% and 21% higher than prior year respectively

(source: CPA Summer Forecast/MHCLG). Revenue in the Residential

Systems segment was ahead of 2019 by 42.5%, (17.8% on a

like-for-like basis). The CPA full year 2021 estimation is that

total housing output will be slightly below 2019, as the gradient

of recovery begins to shallow out, partly reflecting possible

constraining factors on the supply side, including some key

construction materials as well as labour. These supply side issues

have had an impact on input inflation in the first half, which was

offset by our ability to pass on cost increases.

Our acquisitions, Adey and Nu-Heat have performed strongly, and

increased our mix toward RMI activity, which has generally been

less volatile than new housing in recent months. The growth drivers

around low carbon heating, which support both of these businesses,

continue to provide confidence in their ability to deliver against

their plans.

Margin recovery continued through the first half of the year

reaching 19.5%, close to levels achieved in the same period in

2019, despite the cost headwinds experienced.

COMMERCIAL AND INFRASTRUCTURE SYSTEMS

Revenue of GBP111.8m in Commercial and Infrastructure Systems

improved by 18.6% vs 2019 (8.3% on a like-for-like basis). Sales of

ventilation products have benefitted from the increased focus on

the importance of fresh air in the workspace, and suitability for

retrofitting has minimised the impact of the low level of new build

activity. We have also seen strong demand for our water management

systems with the expansion of larger housing development sites,

which has been necessary due to the rapid build out rates and

completions which occurred in the second half of 2020. Plura

continues to perform in line with expectations and is well

positioned to benefit from the near-term growth in infrastructure

activity highlighted above.

Commercial and Infrastructure Systems showed some resilience

during the pandemic, with the larger sites and open spaces making

continued operation easier than the housing sector. However,

differing trends are developing as we emerge from the pandemic, as

the impact from wider structural issues starts to be seen.

The commercial sector remains subdued, with moves toward home

working, and online shopping, dampening new projects in particular.

This has been particularly evident in London, which has accounted

for over a third of commercial new build activity (source: CPA).

Even with projected growth in 2021 of 5.8%, 3.5% in 2022, and 2.7%

in 2023, the new build construction segment would still be 10%

below 2019.

Infrastructure, in contrast, continues to be the strongest

performing segment with continued growth in the regulated sectors

such as roads. Although some project delays have caused a slight

movement of work from 2021 to 2022, the CPA outlook for 2021

remains 23.4% ahead of prior year, and 17.3% ahead of 2019.

The margin continued to improve through the first half of the

year reaching 11.4% (2019: 13.5%), despite the cost headwinds.

ENVIRONMENTAL, SOCIAL & GOVERNANCE

At our Capital Markets Event in November 2020, we explained how

our focus on addressing growth drivers relating to the

sustainability agenda, would be matched by our commitment to

operating sustainably. We have continued to make strong progress

against the various ESG targets we announced in November 2020. Our

like-for-like carbon intensity has reduced by some 53% in the first

half of the year, with a significant contribution from our move to

renewable energy sources. We have also signed the Pledge to Net

Zero initiative, committing to be carbon neutral by 2050, giving us

a long-term goal, which will continue our improvement trajectory

beyond 2025.

Our commitment to employee development and social mobility is

reflected in our membership of The 5% Club, and we have grown our

proportion of qualifying colleagues to 3.5%, earning us "silver"

status. Our use of recycled material in the first half was 47.6% of

our total tonnage. Although it has been challenging in a market

with strong housing starts and a resulting product mix biased

toward those governed by standards limiting use of recyclate, it is

pleasing to report that our Q2 performance was marginally above 50%

of our consumption derived from recyclate. By 2025, r ecycled

materials should represent 62% of our total polymer consumption. We

continue to place innovation at the heart of our business, ensuring

we have the solutions for the emerging challenges faced by the

construction sector.

OUTLOOK

The robust start to the year continued into May and June with

revenues for the half year up 13.8% compared to the first half of

2019, on a like-for-like basis. Within this, there was strong

like-for-like volume growth at circa 6%, ahead of 2019 and the

overall performance of a recovering construction market, with good

drop through on this volume. Profitability has been impacted during

the period by the normal lag in price increases compensating for

considerable levels of cost inflation in the period as well as some

costs associated with Covid-19. The three acquisitions completed in

February 2021 are all performing well, with Adey continuing to

exceed expectations. As for the year ahead, we are monitoring how

the recovering market develops with supply constraints in some

areas as well as labour shortages affecting the overall market

performance. The ongoing pandemic continues to provide challenges,

but the Group is well-placed to address them.

We believe the Group has a balanced exposure to the different

elements of the UK construction market, which provides resilience,

and a clear strategy underpinned by strong medium-term growth

drivers. The Board now expects that underlying operating profit for

the full year will be ahead of previous management expectations

.

Financial Review

Finance Costs

Net underlying finance costs for the six months ended 30 June

2021 decreased to GBP2.1m (2020: GBP3.9m, 2019: GBP3.7m) due to the

lower interest rates on a lower level of borrowing through the

first half of the year. Interest is payable on the Group's RCF at

LIBOR plus an interest rate margin ranging from 0.90% to 2.75%

depending on leverage. The interest rate margin at 30 June 2021 was

1.65% (2020: 1.65%, 2019: 1.65%).

Taxation

The Group's tax charge for the six months ended 30 June 2021

increased to GBP14.7m (2020: GBP0.9m, 2019: GBP5.7m) due to the

much stronger profitability. The underlying tax rate (underlying

tax: underlying profit) has been provided at the estimated full

year rate of 17.6% (2020 full year: 17.6%, 2019 full year

16.8%).

Dividend

Our dividend policy is normally to pay a minimum of 40% of the

Group's annual underlying profit after tax. The Directors intend

that the Group will pay the total annual dividend in two tranches,

an interim dividend and a final dividend, to be announced at the

time of announcement of the interim and preliminary results

respectively with the interim dividend being approximately one half

of the prior year's final dividend.

Cash Flow and Net Debt

Cash generated from operations during the period amounted to an

inflow of GBP23.6m (2020: GBP15.7m outflow, 2019: GBP21.7m inflow).

This result includes a working capital outflow of GBP31.1m (2020:

GBP35.2m, 2019: GBP27.8m). A first half working capital outflow is

a normal feature of the Group's annual working capital cycle and

arises primarily from rebate settlements.

Capital expenditure increased to GBP15.1m (2020: GBP8.5m, 2019:

GBP9.0m) as expenditure in the prior year was severely curtailed

following the Covid-19 outbreak. The full year 2021 expected spend

is some GBP35.0m with a primary focus on key commercial and

innovation lead projects.

During February the Group successfully raised GBP96.3m through

an equity placing of its shares, funds which were used along with a

drawdown on its Revolving Credit Facility to acquire Adey for a

cash consideration of GBP210.0m on a cash-free, debt-free

basis.

Following the acquisitions in February 2021, net debt (including

unamortised debt issue costs but excluding the effects of IFRS 16

capitalisation) increased to GBP169.6m at 30 June 2021 (2020:

GBP71.2m, 2019: GBP178.5m). Leverage was 1.5 times pro forma EBITDA

compared to 1.1 times pro forma EBITDA at 30 June 2020, 0.3 times

pro forma EBITDA at 31 December 2020 and 1.8 times pro forma EBITDA

at 30 June 2019.

Going Concern

The Group continues to meet its day-to-day working capital and

other funding requirements through a combination of long-term

funding and cash deposits. The Group's bank financing facilities

consist of a GBP300.0m RCF. The extended committed Covid-19

facility of GBP50.0m expired in May 2021. GBP102.0m of the RCF was

undrawn at 30 June 2021. At 30 June 2021, liquidity headroom (cash

and undrawn committed banking facilities) was GBP129.6m (2020:

GBP376.9m, 2019: GBP120.0m). Our focus is to continue to be on

deleveraging and our net debt to EBITDA ratio stood at 1.5 times

pro forma EBITDA at 30 June 2021 (2020: 1.1 times pro forma

EBITDA), increasing to 1.6 times pro forma EBITDA including the

effects of IFRS 16. This headroom means the Group is

well-positioned with a strong balance sheet.

As a result, the Directors have satisfied themselves that the

Group has adequate financial resources to continue in operational

existence for a period of at least the next 17 months. Accordingly,

they continue to adopt the going concern basis in preparing the

condensed set of consolidated financial statements.

Principal Risks and Uncertainties

The Board continually assesses and monitors the key risks of the

business and Genuit has developed a risk management framework to

identify, report, and manage its principal risks and uncertainties

. The principal risks and uncertainties that could have a material

impact on the Group's performance and prospects, and the mitigating

activities which are aimed at reducing the impact or likelihood of

a major risk materialising , have not changed from those which are

set out in detail in the principal risks and uncertainties section

of our 2020 Annual Report and Accounts.

These principal risks and uncertainties include macro-economic

and political conditions; the weather; raw materials supply and

pricing; information systems disruption; reliance on key customers

and recruitment and retention of key personnel.

A copy of the 2020 Annual Report and Accounts is available on

the Company's website www.genuitgroup.com .

Forward-Looking Statements

This report contains various forward-looking statements that

reflect management's current views with respect to future events

and financial and operational performance. These forward-looking

statements involve known and unknown risks, uncertainties,

assumptions, estimates and other factors, which may be beyond the

Group's control and which may cause actual results or performance

to differ materially from those expressed or implied from such

forward-looking statements. All statements (including

forward-looking statements) contained herein are made and reflect

knowledge and information available as of the date of preparation

of this report and the Group disclaims any obligation to update any

forward-looking statements, whether as a result of new information,

future events or results or otherwise. There can be no assurance

that forward-looking statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements due to the

inherent uncertainty therein. Nothing in this report should be

construed as a profit forecast .

Directors' Responsibility Statement

We confirm that to the best of our knowledge:

-- The condensed set of consolidated financial statements has

been prepared in accordance with UK adopted International

Accounting Standard (IAS) 34, Interim Financial Reporting; and

-- The Interim Management Report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of consolidated financial statements; and a

description of the principal risks and uncertainties for the

remaining six months of the financial year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

entity during that period; and any changes in the related party

transactions described in the last Annual Report and Accounts that

could do so.

This report was approved by the Board of Directors on 17 August

2021 and is available on the Company's website www.genuitgroup.com

.

The Directors of the Company are:

Ron Marsh Chairman

Martin Payne Chief Executive Officer

Paul James Chief Financial Officer

Glen Sabin Chief Operating Officer

Mark Hammond Non-executive Director and Senior Independent Director

Louise Hardy Non-executive Director

Lisa Scenna Non-executive Director

Louise Brooke-Smith Non-executive Director

Kevin Boyd Non-executive Director

By order of the Board:

M K Payne P A James

Chief Executive Officer Chief Financial Officer

INTERIM GROUP INCOME STATEMENT

for the six months ended 30 June 2021 (unaudited)

Notes Six months ended 30 Six months ended 30

June 2021 June 2020

------------------ ------ -------------------------------------- --------------------------------------

Underlying Non-Underlying Total Underlying Non-Underlying Total

GBPm GBPm GBPm GBPm GBPm GBPm

Revenue 3 295.6 - 295.6 173.6 - 173.6

Cost of sales (173.6) (1.7) (175.3) (110.3) - (110.3)

------------------ ------ ----------- --------------- -------- ----------- --------------- --------

Gross profit 122.0 (1.7) 120.3 63.3 - 63.3

Selling and

distribution

costs (40.0) - (40.0) (31.0) - (31.0)

Administration

expenses (33.4) (4.0) (37.4) (21.8) (0.3) (22.1)

------------------ ------ ----------- --------------- -------- ----------- --------------- --------

Trading profit 48.6 (5.7) 42.9 10.5 (0.3) 10.2

Amortisation

of intangible

assets - (6.6) (6.6) - (4.0) (4.0)

------------------ ------ ----------- --------------- -------- ----------- --------------- --------

Operating

profit 3 48.6 (12.3) 36.3 10.5 (4.3) 6.2

3,

Finance costs 5 (2.1) (0.4) (2.5) (3.9) - (3.9)

------------------ ------ ----------- --------------- -------- ----------- --------------- --------

Profit before

tax 46.5 (12.7) 33.8 6.6 (4.3) 2.3

Income tax 6 (8.2) (6.5) (14.7) (1.1) 0.2 (0.9)

------------------ ------ ----------- --------------- -------- ----------- --------------- --------

Profit for

the period

attributable

to the owners

of the parent

company 38.3 (19.2) 19.1 5.5 (4.1) 1.4

------------------ ------ ----------- --------------- -------- ----------- --------------- --------

Basic earnings

per share

(pence) 7 7.9 0.7

------------------ ------ ----------- --------------- -------- ----------- --------------- --------

Diluted earnings

per share

(pence) 7 7.8 0.7

------------------ ------ ----------- --------------- -------- ----------- --------------- --------

Dividend

per share

(pence) -

interim 8 4.0 -

------------------ ------ ----------- --------------- -------- ----------- --------------- --------

Non-underlying items are presented separately and are detailed

in Note 4.

INTERIM GROUP STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 June 2021 (unaudited)

Six months Six months

ended 30 ended 30

June 2021 June 2020

GBPm GBPm

------------------------------------------------- ----------- -----------

Profit for the period attributable to the

owners of the parent company 19.1 1.4

------------------------------------------------- ----------- -----------

Other comprehensive income:

Items which may be reclassified subsequently

to the income statement:

Exchange differences on translation of foreign

operations - 0.5

Effective portion of changes in fair value

of interest rate swaps - 0.4

Tax relating to items which may be reclassified

subsequently to the income statement - (0.1)

------------------------------------------------- ----------- -----------

Other comprehensive income for the period

net of tax - 0.8

------------------------------------------------- ----------- -----------

Total comprehensive income for the period

attributable to the owners of the parent

company 19.1 2.2

------------------------------------------------- ----------- -----------

INTERIM GROUP BALANCE SHEET

at 30 June 2021 (unaudited)

30 June 2021 30 June 2020 31 December

Notes 2020

GBPm GBPm GBPm

-------------------------------- -------- -------------- -------------- ------------

Non-current assets

Property, plant and

equipment 145.1 126.9 134.2

Right-of-use assets 21.7 13.5 12.9

Intangible assets 9 644.4 397.8 393.8

-------------------------------- -------- -------------- -------------- ------------

Total non-current assets 811.2 538.2 540.9

-------------------------------- -------- -------------- -------------- ------------

Current assets

Inventories 64.4 55.8 52.6

Trade and other receivables 99.4 60.2 61.6

Income tax receivable 1.2 2.5 0.6

Cash and cash equivalents 10 27.6 201.7 44.1

-------------------------------- -------- -------------- -------------- ------------

Total current assets 192.6 320.2 158.9

-------------------------------- -------- -------------- -------------- ------------

Total assets 1,003.8 858.4 699.8

-------------------------------- -------- -------------- -------------- ------------

Current liabilities

Trade and other payables (129.0) (78.1) (112.2)

Loans and borrowings 10 - (99.5) -

Lease liabilities 10 (4.3) (3.3) (3.5)

Deferred and contingent

consideration 11 (0.9) (1.5) (3.4)

Derivative financial

instruments (0.8) (0.1) -

Total current liabilities (135.0) (182.5) (119.1)

-------------------------------- -------- -------------- -------------- ------------

Non-current liabilities

Loans and borrowings 10 (197.2) (173.4) (58.9)

Lease liabilities 10 (17.5) (10.2) (9.4)

Deferred and contingent

consideration 11 (2.6) - -

Other liabilities (1.4) (0.9) (0.7)

Deferred income tax

liabilities (46.9) (11.0) (10.8)

-------------------------------- -------- -------------- -------------- ------------

Total non-current liabilities (265.6) (195.5) (79.8)

-------------------------------- -------- -------------- -------------- ------------

Total liabilities (400.6) (378.0) (198.9)

-------------------------------- -------- -------------- -------------- ------------

Net assets 603.2 480.4 500.9

-------------------------------- -------- -------------- -------------- ------------

Capital and reserves

Equity share capital 0.2 0.2 0.2

Share premium 93.6 - -

Capital redemption reserve 1.1 1.1 1.1

Hedging reserve - (0.1) -

Foreign currency retranslation

reserve 0.4 0.6 0.4

Other reserves 116.5 116.5 116.5

Retained earnings 391.4 362.1 382.7

-------------------------------- -------- -------------- -------------- ------------

Total equity 603.2 480.4 500.9

-------------------------------- -------- -------------- -------------- ------------

INTERIM GROUP STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 June 2021 (unaudited)

Equity Capital Foreign

share Share redemption Hedging currency Other Retained Total

capital premium reserve reserve retranslation reserves earnings equity

reserve

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

--------------- --------- --------- ------------ --------- --------------- ---------- ---------- --------

Six months

ended

30 June 2021

Opening

balance 0.2 - 1.1 - 0.4 116.5 382.7 500.9

--------------- --------- --------- ------------ --------- --------------- ---------- ---------- --------

Profit for the

period - - - - - - 19.1 19.1

Total

comprehensive

income for

the period - - - - - - 19.1 19.1

Dividends paid - - - - - - (11.9) (11.9)

Issue of share

capital - 96.3 - - - - - 96.3

Transaction

costs

on issue of

share

capital - (2.7) - - - - - (2.7)

Share-based

payments

charge - - - - - - 1.0 1.0

Share-based

payments

settled - - - - - - 0.4 0.4

Share-based

payments

excess tax

benefit - - - - - - 0.1 0.1

--------------- --------- --------- ------------ --------- --------------- ---------- ---------- --------

Closing

balance 0.2 93.6 1.1 - 0.4 116.5 391.4 603.2

--------------- --------- --------- ------------ --------- --------------- ---------- ---------- --------

Six months

ended

30 June 2020

Opening

balance 0.2 - 1.1 (0.4) 0.1 - 360.4 361.4

--------------- --------- --------- ------------ --------- --------------- ---------- ---------- --------

Profit for the

period - - - - - - 1.4 1.4

Other

comprehensive

income - - - 0.3 0.5 - - 0.8

--------------- --------- --------- ------------ --------- --------------- ---------- ---------- --------

Total

comprehensive

income for

the period - - - 0.3 0.5 - 1.4 2.2

Issue of share

capital - - - - - 120.0 - 120.0

Transaction

costs

on issue of

share

capital - - - - - (3.5) - (3.5)

Share-based

payments

charge - - - - - - 0.6 0.6

Share-based

payments

settled - - - - - - 0.1 0.1

Share-based

payments

excess tax

benefit - - - - - - (0.4) (0.4)

--------------- --------- --------- ------------ --------- --------------- ---------- ---------- --------

Closing

balance 0.2 - 1.1 (0.1) 0.6 116.5 362.1 480.4

--------------- --------- --------- ------------ --------- --------------- ---------- ---------- --------

INTERIM GROUP CASH FLOW STATEMENT

for the six months ended 30 June 2021

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

GBPm GBPm GBPm

-------------------------------------- ----------- ----------- -------------

Operating activities

Profit before tax 33.8 2.3 23.8

Finance costs 2.5 3.9 6.6

-------------------------------------- ----------- ----------- -------------

Operating profit 36.3 6.2 30.4

Non-cash items:

Profit on disposal of property,

plant and equipment - (0.1) (0.2)

Transaction costs on issue

of share capital 0.1 0.1 0.1

Research and development expenditure

credit - - (1.0)

Non-underlying items:

- amortisation of intangible

assets 6.6 4.0 7.8

- provision for acquisition

costs 4.0 0.3 2.9

-unwind of inventory fair value 1.7 - -

adjustment

- provision for restructuring

costs - - 1.1

Depreciation of property, plant

and equipment 9.3 7.9 16.3

Depreciation of right-of-use

assets 2.1 1.8 3.5

Share-based payments 1.0 0.6 1.4

Cash items:

- settlement of acquisition

costs (6.4) (1.3) (1.2)

- settlement of restructuring

costs - - (1.1)

-------------------------------------- ----------- ----------- -------------

Operating cash flows before

movement in working capital 54.7 19.5 60.0

Movement in working capital:

Receivables (22.3) (19.2) (21.3)

Payables (8.5) (20.1) 15.6

Inventories (0.3) 4.1 7.2

-------------------------------------- ----------- ----------- -------------

Cash generated from operations 23.6 (15.7) 61.5

Income tax paid (5.3) (7.3) (8.2)

-------------------------------------- ----------- ----------- -------------

Net cash flows from operating

activities 18.3 (23.0) 53.3

-------------------------------------- ----------- ----------- -------------

Investing activities

Settlement of deferred and

contingent consideration - (1.8) (1.8)

Acquisition of businesses net

of cash at acquisition (236.2) - -

Proceeds from disposal of property,

plant and equipment 0.1 0.2 0.6

Purchase of property, plant

and equipment (15.1) (8.5) (25.1)

-------------------------------------- ----------- ----------- -------------

Net cash flows from investing

activities (251.2) (10.1) (26.3)

-------------------------------------- ----------- ----------- -------------

Financing activities

Issue of share capital 96.3 120.0 120.0

Transaction costs on issue

of share capital (2.8) (3.6) (3.6)

Debt issue costs - (0.3) (0.4)

Issue of Euro-Commercial Paper - 99.4 99.4

Buyback of Euro-Commercial

Paper - - (99.7)

Net drawdown / (repayment)

of bank loan 138.0 (24.2) (139.0)

Interest paid (1.2) (2.6) (5.4)

Dividends paid (11.9) - -

Proceeds from exercise of share

options 0.6 0.1 2.1

Settlement of lease liabilities (2.5) (1.9) (4.0)

-------------------------------------- ----------- ----------- -------------

Net cash flows from financing

activities 216.5 186.9 (30.6)

-------------------------------------- ----------- ----------- -------------

Net change in cash and cash

equivalents (16.4) 153.8 (3.6)

Cash and cash equivalents -

opening balance 44.1 47.7 47.7

Net foreign exchange difference (0.1) 0.2 -

-------------------------------------- ----------- ----------- -------------

Cash and cash equivalents -

closing balance 27.6 201.7 44.1

-------------------------------------- ----------- ----------- -------------

NOTES TO THE INTERIM FINANCIAL STATEMENTS

for the six months ended 30 June 2021

1. Basis of preparation

Genuit Group plc (previously known as Polypipe Group plc) is

incorporated in the UK. The condensed set of consolidated financial

statements have been prepared in accordance with the Disclosure

Guidance and Transparency Rules of the Financial Conduct Authority

and UK adopted IAS 34, Interim Financial Reporting.

The annual financial statements will be prepared under

UK-adopted IAS (UK-adopted IFRSs).

As required by the Disclosure Guidance and Transparency Rules of

the Financial Conduct Authority, the condensed set of consolidated

financial statements have been prepared applying the accounting

policies and presentation that were applied in the preparation of

the Group's published consolidated financial statements for the

year ended 31 December 2020, except for the definition of

non-underlying items that now includes the unwind of inventory fair

value adjustment as a result of the Adey acquisition. These

statements do not include all the information required for full

annual consolidated financial statements and should be read in

conjunction with the full Annual Report and Accounts for the year

ended 31 December 2020.

The comparative figures for the financial year ended 31 December

2020, where reported, are not the Group's statutory accounts for

that financial year. Those accounts have been reported on by the

Group's auditors and delivered to the Registrar of Companies. The

report of the auditors was (i) unqualified, (ii) did not include a

reference to any matters to which the auditors drew attention by

way of emphasis without qualifying their report, and (iii) did not

contain a statement under Section 498 (2) or (3) of the Companies

Act 2006.

There were no accounting standards or interpretations that have

become effective in the current reporting period which had an

impact on disclosures, financial position or performance.

The condensed set of consolidated financial statements are

prepared on a going concern basis. The Directors have made

enquiries into the adequacy of the Group's financial resources,

through a review of the Group's budget and medium-term financial

plan, including cash flow forecasts. The Group has modelled a

scenario with the base forecast being one in which, over the 17

months ending 31 December 2022, sales volumes continue to recover

to pre-Covid-19 pandemic levels and then grow in line with external

construction industry forecasts. In addition, reverse stress

testing has been performed to identify the necessary reduction in

profitability or growth in net debt required to result in a breach

of the Group's banking covenants. The reverse stress test showed

significant headroom existed throughout the assessment period.

At 30 June 2021, the Group had available GBP102.0m of undrawn

committed borrowing facilities in respect of which all conditions

precedent had been met. These borrowing facilities are available

until at least November 2023, subject to covenant headroom. In

addition, on 11 February 2021, the Company conducted a

non-pre-emptive placing of new ordinary shares generating gross

proceeds of GBP96.3m and drew down GBP120.0m net from the RCF as

part of the post year end acquisition funding. The Directors are

satisfied that the Group has sufficient liquidity and covenant

headroom to withstand reasonable variances to the base forecast. In

addition, the Directors have noted the range of possible additional

liquidity options available to the Group, should they be

required.

As a result, the Directors have satisfied themselves that the

Group has adequate financial resources to continue in operational

existence for a period of at least the next 17 months. Accordingly,

they continue to adopt the going concern basis in preparing the

condensed set of consolidated financial statements.

There have been no related party transactions in the period to

30 June 2021.

Four non-statutory measures have been used in preparing the

condensed set of consolidated financial statements:

-- Underlying profit and earnings measures exclude certain

non-underlying items (which are detailed in Note 4) and, where

relevant, the tax effect of these items. The Directors consider

that these measures provide a better and more consistent indication

of the Group's underlying financial performance and more meaningful

comparison with prior and future periods to assess trends in our

financial performance.

-- Underlying cash generated from operations is defined as cash

generated from operations, adjusted for non-underlying cash items,

after movement in net working capital and capital expenditure net

of proceeds from disposals of property, plant and equipment.

-- Leverage is defined as net debt divided by pro forma EBITDA.

Net debt within the leverage calculation is defined as loans and

borrowings net of unamortised issue costs less cash and cash

equivalents, excluding the effects of IFRS 16.

-- Pro forma EBITDA is defined as underlying operating profit

before depreciation, for the 12 months preceding the balance sheet

date, adjusted where relevant, to include a full year of EBITDA

from acquisitions made during those 12 months.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

for the six months ended 30 June 2021

2. Financial risks, estimates, assumptions and judgements

The preparation of the condensed set of consolidated financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and

expenses. Actual results may differ from estimates.

In preparing the condensed set of consolidated financial

statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements as at and for the year ended 31

December 2020.

3. Segment information

The Group has two reporting segments - Residential Systems and

Commercial and Infrastructure Systems. The reporting segments are

organised based on the nature of the end markets served. There are

no significant judgements in aggregating operating segments to

arrive at the reporting segments. Inter-segment sales are on an

arm's length basis in a manner similar to transactions with third

parties.

Six months ended 30 June Six months ended 30 June

2021 2020

-------------------------------------- -------------------------------------

Commercial Commercial

Residential & Infrastructure Residential & Infrastructure

Systems Systems Total Systems Systems Total

GBPm GBPm GBPm GBPm GBPm GBPm

---------------------- ----------- ----------------- ------ ----------- ----------------- -----

Segmental revenue 186.7 116.4 303.1 95.1 84.4 179.5

Inter-segment revenue (2.9) (4.6) (7.5) (2.3) (3.6) (5.9)

---------------------- ----------- ----------------- ------ ----------- ----------------- -----

Revenue 183.8 111.8 295.6 92.8 80.8 173.6

---------------------- ----------- ----------------- ------ ----------- ----------------- -----

Underlying operating

profit * 35.8 12.8 48.6 7.4 3.1 10.5

Non-underlying

items - segmental (9.7) (2.6) (12.3) (1.9) (2.4) (4.3)

---------------------- ----------- ----------------- ------ ----------- ----------------- -----

Segmental operating

profit 26.1 10.2 36.3 5.5 0.7 6.2

Non-underlying

items - finance

costs (0.4) -

Finance costs (2.1) (3.9)

---------------------- ----------- ----------------- ------ ----------- ----------------- -----

Profit before tax 33.8 2.3

---------------------- ----------- ----------------- ------ ----------- ----------------- -----

* Underlying operating profit is stated before non-underlying

items as defined in the Group Accounting Policies in the Annual

Report and Accounts and is the measure of segment profit used by

the Group's CODM. Details of the non-underlying items of GBP12.7m

(2020: GBP4.3m) are detailed in Note 4 .

Geographical analysis

Six months Six months

ended 30 ended 30

June 2021 June 2020

Revenue by destination GBPm GBPm

----------------------- ---------- ----------

UK 266.3 151.7

Rest of Europe 18.4 12.5

Rest of World 10.9 9.4

----------------------- ---------- ----------

Total - Group 295.6 173.6

----------------------- ---------- ----------

NOTES TO THE INTERIM FINANCIAL STATEMENTS

for the six months ended 30 June 2021

4. Non-underlying items

Non-underlying items comprised:

Six months ended 30 June Six months ended 30 June

2021 2020

---------------------------- ----------------------------

Gross Tax Net Gross Tax Net

GBPm GBPm GBPm GBPm GBPm GBPm

--------------------------- -------- -------- -------- -------- -------- --------

Cost of sales:

Unwind of inventory

fair value adjustment 1.7 (0.3) 1.4 - - -

Administration expenses:

Acquisition costs

- acquisition and

other M&A activity 4.0 (0.2) 3.8 0.3 - 0.3

Amortisation of intangible

assets 6.6 7.1 13.7 4.0 (0.2) 3.8

Finance costs: Unwind

of discount on contingent

consideration 0.4 (0.1) 0.3 - - -

Total non-underlying

items 12.7 6.5 19.2 4.3 (0.2) 4.1

--------------------------- -------- -------- -------- -------- -------- --------

The unwind of the inventory fair value adjustment relates to the

fair value uplift of the inventory acquired as part of the Adey

acquisition that has subsequently been sold. Acquisition costs in

2021 relate to the acquisitions of Adey, Nu-Heat and Plura and also

include an accrual for the earn out associated with the Plura

acquisition (see Note 9). The non-underlying tax charge includes

GBP8.5m in respect of restating the deferred income tax liability

on intangible assets as a result of the change in the main UK

corporation tax rate (see Note 6).

5. Finance costs

Six months Six months

ended 30 ended 30

June 2021 June 2020

GBPm GBPm

----------------------------------------------- ---------- ----------

Interest on bank loan 1.2 3.1

Interest on Euro-Commercial Paper - 0.1

Debt issue cost amortisation 0.3 0.2

Unwind of discount on lease liabilities 0.3 0.2

Other finance costs 0.3 0.3

Unwind of discount on contingent consideration 0.4 -

----------------------------------------------- ---------- ----------

2.5 3.9

----------------------------------------------- ---------- ----------

6. Income tax

Tax has been provided on the profit before tax at the estimated

effective rate for the full year of 31.7% (2020 full year: 22.3%).

Tax on underlying profit before tax was 17.6% (2020 full year:

17.6%).

Six months Six months

ended 30 ended 30

June 2021 June 2020

GBPm GBPm

--------------------------------------------------- ---------- ----------

Current income tax:

UK income tax 5.1 0.9

Overseas income tax 0.1 0.1

--------------------------------------------------- ---------- ----------

Total current income tax 5.2 1.0

Deferred income tax:

Origination and reversal of timing differences (1.2) (0.8)

Adjustment in respect of changes in income

tax rate 10.7 0.7

--------------------------------------------------- ---------- ----------

Total deferred income tax 9.5 (0.1)

--------------------------------------------------- ---------- ----------

Total tax expense reported in the income statement 14.7 0.9

--------------------------------------------------- ---------- ----------

NOTES TO THE INTERIM FINANCIAL STATEMENTS

for the six months ended 30 June 2021

6. Income tax (continued)

The Finance (No.2) Act 2015 reduced the main UK corporation tax

rate to 19%, effective from 1 April 2017. A further reduction in

the main UK corporation tax rate to 17% was expected to come into

effect from 1 April 2020 (as enacted by the Finance Act 2016 on 15

September 2016). However, legislation introduced in the Finance Act

2020 (enacted on 22 July 2020) repealed the reduction of the rate,

thereby maintaining the current rate of 19%. Deferred income tax on

the balance sheet at 30 June 2020 was therefore measured at 19%

(2019: 17%).

The Finance Act 2021 (enacted on 10 June 2021) included an

increase to the main UK corporation tax rate to 25% effective from

1 April 2023. Deferred income tax on the balance sheet at 30 June

2021 was therefore measured at 19% or 25% (2020: 19%) depending on

when the deferred income tax asset or liability is expected to

reverse.

7. Earnings per share

Basic earnings per share amounts are calculated by dividing

profit for the period attributable to the owners of the parent

company by the weighted average number of ordinary shares

outstanding during the period. The diluted earnings per share

amounts are calculated by dividing profit for the period

attributable to the owners of the parent company by the weighted

average number of ordinary shares outstanding during the period

plus the weighted average number of potential ordinary shares that

would be issued on the conversion of all the dilutive share options

into ordinary shares.

The calculation of basic and diluted earnings per share is based

on the following:

Six months Six months

ended 30 ended 30

June 2021 June 2020

----------------------------------------------- ----------- -----------

Weighted average number of ordinary shares

for the purpose of basic earnings per share 242,745,684 208,398,693

Effect of dilutive potential ordinary shares 3,311,655 2,648,081

----------------------------------------------- ----------- -----------

Weighted average number of ordinary shares

for the purpose of diluted earnings per share 246,057,339 211,046,774

----------------------------------------------- ----------- -----------

Underlying earnings per share is based on the result for the

period after tax excluding the impact of non-underlying items of

GBP7.1m (2020: GBP4.1m). The Directors consider that this measure

provides a better and more consistent indication of the Group's

underlying financial performance and more meaningful comparison

with prior and future periods to assess trends in our financial

performance. The underlying earnings per share is calculated as

follows:

Six months Six months

ended 30 ended 30

June 2021 June 2020

---------------------------------------------- ---------- ----------

Underlying profit for the period attributable

to the owners of the parent company (GBPm) 38.3 5.5

---------------------------------------------- ---------- ----------

Underlying basic earnings per share (pence) 15.8 2.6

---------------------------------------------- ---------- ----------

Underlying diluted earnings per share (pence) 15.6 2.6

---------------------------------------------- ---------- ----------

8. Dividends

The Directors have proposed an interim dividend for the current

year of GBP9.9m which equates to 4.0 pence per share.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

for the six months ended 30 June 2021

9. Acquisitions

Acquisition-related deferred and contingent consideration

comprised:

30 June 30 June 31 December

2021 2020 2020

GBPm GBPm GBPm

-------------------------------------- ------- ------- -----------

Deferred and contingent consideration

on Permavoid acquisition 0.9 1.5 3.4

Deferred and contingent consideration

on Plura acquisition 2.6 - -

-------------------------------------- ------- ------- -----------

3.5 1.5 3.4

-------------------------------------- ------- ------- -----------

Acquisition-related cash flows comprised:

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

GBPm GBPm GBPm

---------------------------------- ---------- ---------- ------------

Operating cash flows - settlement

of acquisition costs

Permavoid 2.5 - -

Nu-Heat 0.6 - -

Plura 0.3 - -

Adey 3.0 - -

Other - aborted acquisition costs - 1.3 1.2

---------------------------------- ---------- ---------- ------------

6.4 1.3 1.2

---------------------------------- ---------- ---------- ------------

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

GBPm GBPm GBPm

------------- ------------ ----------- --------------

Investing cash flows - settlement of deferred and

contingent consideration

Permavoid - 1.5 1.5

Alderburgh - 0.3 0.3

- 1.8 1.8

------------- ------------ ----------- --------------

NOTES TO THE INTERIM FINANCIAL STATEMENTS

for the six months ended 30 June 2021

9. Acquisitions (continued)

Six months Six months Year ended

ended 30 ended 30 December

June 2021 June 2020 31 2020

GBPm GBPm GBPm

------------------------------ ------------- ------------- ----------

Investing cash flows - acquisition of businesses net of

cash at acquisition

Nu-Heat 25.8 - -

Plura 1.8 - -

Adey 208.4 - -

Tree Ground Solutions 0.2 - -

------------------------------ ------------- ------------- ----------

236.2 - -

------------------------------ ------------- ------------- ----------

Nu-Heat

On 2 February 2021, the Group acquired 100% of the voting rights

and shares of Nu-Heat (Holdings) Limited (Nu-Heat), the leading

supplier of sustainable underfloor heating solutions, air and

ground source heat pumps, and other renewable heating systems, for

a cash consideration of GBP27.0m on a cash-free, debt-free basis.

The total cash consideration of GBP24.8m included a payment of

GBP5.7m for net cash on completion and was net of loans and

borrowings at acquisition of GBP6.7m. Additional debt and debt like

items amounted to GBP1.2m.

Details of the acquisition, including provisional fair value

adjustments, were as follows:

Fair

value

GBPm

-------------------------------- ------

Property, plant and equipment 0.5

Right-of-use assets 0.3

Intangible assets 11.7

Inventories 1.4

Trade and other receivables 0.7

Cash and cash equivalents 5.7

Trade and other payables (3.3)

Loans and borrowings (6.7)

Lease liabilities (0.3)

Income tax payable (0.2)

Deferred income tax liabilities (2.3)

Net identifiable assets 7.5

Goodwill on acquisition 17.3

Total cash consideration 24.8

---------------------------------- ------

The 'Nu-Heat' brand, order book and customer relationships have

been recognised as specific intangible assets as a result of this

acquisition. Fair value adjustments principally relate to the

recognition of intangible assets and deferred income tax arising on

these adjustments and are provisional. The goodwill arising on the

acquisition primarily represented the assembled workforce,

technical expertise and market share. The goodwill is allocated

entirely to the Residential Systems segment.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

for the six months ended 30 June 2021

9. Acquisitions (continued)

The fair value of trade and other receivables was GBP0.7m. The

gross amount of trade and other receivables was GBP0.7m and it is

expected that the full contractual amounts will be collected.

Post-acquisition Nu-Heat contributed GBP6.6m revenue and GBP1.0m

underlying operating profit which were included in the Group income

statement. If Nu-Heat had been acquired on 1 January 2021, the

Group's results for the six months ended 30 June 2021 would have

shown revenue of GBP296.8m and underlying operating profit of

GBP48.5m.

Acquisition costs of GBP0.4m were expensed and are included in

non-underlying items in administration expenses. Acquisition costs

of GBP0.6m were fully cash settled in the period, including GBP0.2m

that was included in trade and other payables at 31 December

2020.

Plura

On 5 February 2021, the Group acquired 51% of the voting rights

and shares of Plura Composites Ltd (Plura) for an initial cash

consideration of GBP1.25m, and a further payment in respect of the

remaining 49% of between GBP6.0m and GBP16.4m depending on the

EBITDA performance of Plura in the 12 month period ending no

earlier than 5 February 2024 and no later than 31 July 2024. Plura

provides a range of products for utility companies, road and rail

operators, network builders and designers in the construction and

maintenance of their networks. Plura's manufacturing expertise lies

in pultrusion, compression moulding, injection moulding and

fabrications.

Details of the acquisition, including provisional fair value

adjustments, were as follows:

Fair

value

GBPm

----------------------------------------- ------

Property, plant and equipment 0.7

Right-of-use assets 1.7

Intangible assets 2.5

Inventories 0.9

Trade and other receivables 1.7

Cash and cash equivalents 0.2

Trade and other payables (2.2)

Loans and borrowings (0.7)

Lease liabilities (1.7)

Income tax receivable 0.1

Deferred income tax liabilities (0.4)

------------------------------------------- ------

Net identifiable assets 2.8

Goodwill on acquisition -

Less: estimated contingent consideration (1.5)

Initial cash consideration 1.3

------------------------------------------- ------

Customer relationships is the only material intangible asset

that has been recognised as a result of this acquisition. Fair

value adjustments principally relate to the recognition of

intangible assets and deferred income tax arising on these

adjustments and are provisional. The goodwill arising on the

acquisition is immaterial.

The fair value of trade and other receivables was GBP1.7m. The

gross amount of trade and other receivables was GBP1.7m and it is

expected that the full contractual amounts will be collected.

Post-acquisition Plura contributed GBP3.2m revenue and GBP0.2m

underlying operating profit which were included in the Group income

statement. If Plura had been acquired on 1 January 2021, the

Group's results for the six months ended 30 June 2021 would have

shown revenue of GBP296.0m and underlying operating profit of

GBP48.5m.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

for the six months ended 30 June 2021

9. Acquisitions (continued)

Acquisition costs of GBP0.3m were included in trade and other

payables at 31 December 2020 and have been fully cash settled in

the period. No further acquisition costs have been charged to the

income statement in the period.

Contingent consideration at fair value of GBP2.6m has been

recognised at 30 June 2021. Of this, GBP1.5m is contingent on

EBITDA performance in the third year of trading following

acquisition and has been included in the purchase consideration.

The balance of GBP1.1m has been included in non-underlying items

and is contingent on EBITDA performance in the third year of

trading following acquisition as well as the continued employment

of key personnel. This second payment is being accrued over the

three-year period. Of the GBP1.1m, GBP0.8m was included in

administration expenses and GBP0.3m included in finance costs.

Contingent consideration was determined using the Directors'

assessment of the likelihood that financial targets will be

achieved. The fair value of the consideration has been derived by

discounting the estimated cash consideration at 10.0% (being the

Group's estimated risk adjusted cost of capital). The estimated

cash consideration is derived from the budgets and forecasts for

Plura.

Adey

On 10 February 2021, the Group acquired 100% of the voting

rights and shares of London Topco Limited (Adey) for a cash

consideration of GBP210.0m on a cash-free, debt-free basis. Adey is

the UK's leading provider of magnetic filters, chemicals and

related products, which protect against magnetite and other

performance issues in water-based heating systems and improve

energy efficiency, operating in predominantly residential end

markets. The cash consideration of GBP86.6m included a payment of

GBP7.5m for net cash on completion and was net of loans and

borrowings at acquisition of GBP129.3m. Additional debt and debt

like items amounted to GBP1.6m.

Details of the acquisition, including provisional fair value

adjustments, were as follows:

Fair

value

GBPm

--------------------------------- -------

Property, plant and equipment 3.4

Right-of-use assets 4.9

Intangible assets 124.0

Inventories 10.9

Trade and other receivables 12.8

Cash and cash equivalents 7.5

Trade and other payables (20.0)

Loans and borrowings (129.3)

Lease liabilities (4.9)

Derivative financial instruments (0.8)

Income tax payable 0.8

Deferred income tax liabilities (24.0)

----------------------------------- -------

Net identifiable liabilities (14.7)

Goodwill on acquisition 101.3

Total cash consideration 86.6

----------------------------------- -------

Customer relationships, the 'Adey' brand and patents have been

recognised as specific intangible assets as a result of this

acquisition. Fair value adjustments principally relate to the

recognition of intangible assets and deferred income tax arising on

these adjustments and are provisional. The goodwill arising on the

acquisition primarily represented the assembled workforce,

technical expertise and market share. The goodwill is allocated

entirely to the Residential Systems segment.

The fair value of trade and other receivables was GBP12.8m. The

gross amount of trade and other receivables was GBP13.1m and it is

expected that the full contractual amounts will be collected.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

for the six months ended 30 June 2021

9. Acquisitions (continued)

Post-acquisition Adey contributed GBP25.3m revenue and GBP8.0m

underlying operating profit which were included in the Group income

statement. If Adey had been acquired on 1 January 2021, the Group's

results for the six months ended 30 June 2021 would have shown

revenue of GBP307.0m and underlying operating profit of

GBP50.5m.

Acquisition costs of GBP2.8m were expensed and are included in

non-underlying items in administration expenses. Of the GBP2.8m

acquisition costs, GBP2.6m were fully cash settled in the period in

addition to GBP0.4m that were included in trade and other payables

at 31 December 2020. A further GBP0.2m is included in trade and

other payables at 30 June 2021.

Tree Ground Solutions

On 3 May 2021, the Group acquired the remaining 50% of the share

capital of Tree Ground Solutions BV, taking the total shareholding

to 100%, for a cash consideration of GBP0.2m (EUR0.25m). The cash

consideration of GBP0.2m included an immaterial payment for net

cash on completion.

Details of the acquisition were as follows:

Fair

value

GBPm

---------------------------- -------

Inventories 0.1

Trade and other receivables 0.4

Trade and other payables (0.4)

------------------------------ -------

Net identifiable assets 0.1

Less: initial investment (0.1)

Goodwill on acquisition 0.2

Total cash consideration 0.2

------------------------------ -------

There have been no fair value adjustments following the

acquisition. The goodwill arising on the acquisition primarily

represented the assembled workforce, technical expertise and market

share. The goodwill is allocated entirely to the Commercial and

Infrastructure Systems segment.

The fair value of trade and other receivables was GBP0.4m. The

gross amount of trade and other receivables was GBP0.4m and it is

expected that the full contractual amounts will be collected.

Due to the timing of the acquisition, TGS contributed an

immaterial amount to the revenue and underlying operating profit of

the Group.

Acquisition costs were negligible and have been expensed and

included in non-underlying items in administration expenses.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

for the six months ended 30 June 2021

9. Acquisitions (continued)

Following these acquisitions, the carrying amount of goodwill

and other intangible assets is as follows:

Brand Customer Customer Development

Goodwill Patents names relationships Licences order book costs Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------- -------- ------- ------ -------------- -------- ----------- ----------- -----

Cost

At 1 January 2021 345.4 34.4 30.3 17.4 0.8 - - 428.3

Additions - - - - - - 0.2 0.2

Acquisition of

businesses 118.8 4.9 36.2 96.2 - 0.9 - 257.0

------------------- -------- ------- ------ -------------- -------- ----------- ----------- -----

At 30 June 2021 464.2 39.3 66.5 113.6 0.8 0.9 0.2 685.5

------------------- -------- ------- ------ -------------- -------- ----------- ----------- -----

Amortisation and

impairment losses

At 1 January 2021 - 12.1 14.3 7.9 0.2 - - 34.5

Charge for the

period - 1.6 2.3 2.4 0.1 0.2 - 6.6

------------------- -------- ------- ------ -------------- -------- ----------- ----------- -----

At 30 June 2021 - 13.7 16.6 10.3 0.3 0.2 - 41.1

------------------- -------- ------- ------ -------------- -------- ----------- ----------- -----

Net book value

At 30 June 2021 464.2 25.6 49.9 103.3 0.5 0.7 0.2 644.4

------------------- -------- ------- ------ -------------- -------- ----------- ----------- -----

At 31 December

2020 345.4 22.3 16.0 9.5 0.6 - - 393.8

------------------- -------- ------- ------ -------------- -------- ----------- ----------- -----

Impairment testing of goodwill

Goodwill is not amortised but is subject to annual impairment

testing (at 31 December). Goodwill has been allocated for

impairment testing purposes to a number of cash-generating units

(CGUs) which represent the lowest level in the Group at which

goodwill is monitored for internal management purposes.

Impairment tests on the carrying amounts of goodwill were

performed by analysing the carrying amount allocated to each CGU

against its value-in-use. Value-in-use was calculated for each CGU

as the net present value of that CGU's discounted future pre-tax

cash flows. These pre-tax cash flows are based on budgeted cash

flows information for a period of one year, construction industry

forecasts of growth for the following year and growth of between

2.68% to 2.80% thereafter. A pre-tax discount rate of 10.0% was

applied in determining the recoverable amounts of CGUs. The pre-tax

discount rate was estimated based on the Group's risk adjusted cost

of capital. The Group applied sensitivities to assess whether any

reasonably possible changes in assumptions could cause an

impairment that would be material to these consolidated financial

statements. The application of these sensitivities did not cause an

impairment of goodwill.

However, the headroom resulting from the value-in-use

calculations at 31 December 2020 indicated that the Alderburgh CGU

was sensitive to changes in the key assumptions. Accordingly,

whilst not identifying any further specific indicators of

impairment at 30 June 2021, management reperformed these

calculations at 30 June 2021. Management considers that a

reasonably possible change in any single assumption could give rise

to an impairment of the corresponding carrying amount of goodwill

and other intangible assets of GBP2.5m (2020: GBP2.5m) and GBP4.1m

(2020: GBP4.3m), respectively. The achievement, or otherwise, of

the key assumptions is dependent on maintaining the continued

recovery in Alderburgh's chosen markets. The detailed sensitivity

analysis indicates that the following changes in each of these key

assumptions would result in the headroom being eliminated and thus

an impairment recognised:

-- Operating margins declining to 7.9% (2020: 7.7%) per annum

from that used in the value-in-use calculations of 10.2% (2020:

10.3%) per annum.

-- The pre-tax discount rate increasing to 12.1% (2020: 12.5%)

from that used in the value-in-use calculations of 10.0% (2020:

10.0%).

-- A reduction of 22% (2020: 25%) in the overall forecast

operating cash flows used in the value-in-use calculations.

It should be noted that a deterioration in a combination of

these key assumptions could result in a larger reduction in

assessed headroom.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

for the six months ended 30 June 2021

10. Analysis of net debt

30 June 30 June 31 December

2021 2020 2020

GBPm GBPm GBPm

---------------------------------------------- ------- ------- -----------

Cash and cash equivalents 27.6 201.7 44.1

---------------------------------------------- ------- ------- -----------

Current loans and borrowings

Euro-Commercial Paper - 99.5 -

Lease liabilities 4.3 3.3 3.5

---------------------------------------------- ------- ------- -----------

4.3 102.8 3.5