Genel Energy PLC (GENL) Genel Energy PLC: Trading and operations

update 04-Nov-2021 / 07:00 GMT/BST Dissemination of a Regulatory

Announcement that contains inside information according to

REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group. The

issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

4 November 2021

Genel Energy plc

Trading and operations update

Genel Energy plc ('Genel' or 'the Company') issues the following

trading and operations update in respect of the third quarter and

first nine months of 2021.

Bill Higgs, Chief Executive of Genel, said:

"Genel's low-cost and high-margin production continues to

generate material positive cash flow which, coupled with our

confidence in predictable payments going forward, allows us to

further invest in our growth assets with sufficient surplus to

support our competitive and progressive dividend, with the interim

dividend increased by 20%.

I am pleased that drilling is back underway at Tawke, and

drilling operations at Peshkabir, Sarta, and Qara Dagh are ongoing.

We continue to work hard to deliver results from the appraisal

programmes at Sarta and Qara Dagh, and remain excited about their

potential, although disappointed that the testing programme will be

later than we had forecast due to a combination of geological and

operational challenges, supply chain issues, and well approval

delays."

FINANCIAL PERFORMANCE

-- USD187 million of cash proceeds received in the first nine

months of 2021 (USD142 million in the first ninemonths of 2020)

-- Free cash flow before investment in growth was USD99 million

in the first nine months of 2021 (USD36 millionin first nine months

of 2020), despite the expected industry-wide reversion to payments

three months in arrears bythe Kurdistan Regional Government ('KRG')

meaning seven payments have been received in the nine-month

period

-- Total capital expenditure of USD106 million, with USD71

million spent in the first nine months of 2021 onprogressing Sarta

and Qara Dagh

-- Free cash flow of USD33 million in the first nine months of

2021 (outflow of USD5 million in the first ninemonths of 2020)

-- Cash of USD277 million at 30 September 2021 (USD266 million

at 30 June 2021)? Net cash of USD8 million at 30 September 2021

(net debt of USD2 million at 30 June 2021)

-- Interim dividend of 6¢ per share (2020: 5¢ per share), a

distribution of c.USD18 million, to be paid toshareholders on the

register as of 12 November 2021

OPERATING UPDATE

-- Net production averaged 32,005 bopd in the first nine months

of 2021, with net production in Q3 averaging30,520 bopd (Q2 2021:

32,475 bopd)

-- Production by field was as follows:

Gross production Net production

(bopd)

Q3 2021 Q3 2021

Tawke 45,260 11,310

Peshkabir 59,920 14,980

Sarta 5,960 1,790

Taq Taq 5,530 2,430

Total 116,670 30,520

PRODUCTION ASSETS

-- Tawke PSC (25% working interest)? Gross production at the

Tawke PSC averaged 109,150 bopd in the first nine months of 2021,

of whichPeshkabir contributed 61,430 bopd, and 105,180 bopd in Q3,

of which Peshkabir contributed 59,920 bopd whilebeing impacted for

shut-ins and maintenance ? The Peshkabir-Tawke gas project, which

was commissioned in mid-2020, has injected eight billion cubicfeet

of otherwise flared gas as of the end of the third quarter,

capturing 480,000 tonnes of CO2 equivalent. InSeptember, a second

phase of the gas capture project to reinject and retain gas in the

Tawke reservoir andavoid flaring was initiated ? Drilling at the

Tawke field resumed in Q3 2021 after an 18-month pause during which

naturalproduction decline was slowed through pressure support from

gas injection and workovers

Sarta (30% working interest) ? Gross production averaged 6,680

bopd in the first nine months of 2021, and 5,960 bopd in Q3 ?

Production in Q3 has come predominantly from the Sarta-2 well,

after the Sarta-3 well was taken offlineat the end of Q2 in order

to monitor and manage reservoir pressure in the thinner,

volumetrically smaller Musreservoir and water ingress from part of

the deeper Adaiyah reservoir, both of which are informing the

long-termproduction strategy for the field ? This strategy includes

plans to convert the legacy Sarta-4 well into a water disposal well

in Q1 2022 tooptimise Sarta oil production ? Q3 production has been

in line with expectations for the Mus only reservoir accessible

with the Sarta-2well ? The Sarta-1D well is drilling ahead in the

reservoir section with testing expected early in the new year,now

via the production flowline, in order to accommodate the recent

industry-wide directive from the Ministry ofNatural Resources

('MNR') prohibiting the burning of oil during well test operations.

Sarta-1D addition to theproduction stream is expected in Q1 2022 ?

The Sarta-5 well is set to enter the primary reservoir objectives

imminently and testing will take placein Q1 2022 once the

appropriate equipment is in place to comply with the MNR's well

testing directive ? The Sarta-6 well will spud once the Sarta-5

well has been drilled and completed ? In line with the farm-in

agreement Chevron is set to transfer operatorship of the field to

Genel on 1January 2022

-- Taq Taq PSC (44% working interest and joint operator)? Gross

production averaged 6,170 bopd in the first nine months of 2021,

and 5,530 bopd in Q3 ? Additional activity at the field is set to

resume in 2022, with a view to increasing cash generationfrom the

licence, with returns boosted by the improved oil price

PRE-PRODUCTION ASSETS

-- Qara Dagh (40% working interest and operator)? The QD-2 well,

appraising the crest of a 50 km long structure at Qara Dagh, spud

in April 2021 ? Drilling is ongoing, with the well having been

side-tracked in response to encountering more complexgeology above

the target reservoir than expected by the joint venture ? Given the

current challenging drilling conditions, Genel is evaluating

options to optimally deliverthe primary well objectives ? Genel is

now targeting the completion of drilling and testing at QD-2 in Q1

2022

-- Bina Bawi and Miran (100% working interest and operator)? In

August, Genel received notice from the Ministry of Natural

Resources of the KRG of its intentionto terminate the Bina Bawi and

Miran PSCs ? Genel subsequently issued notices of dispute to the

KRG under each PSC contesting the right of theKRG to issue any such

termination notice. Genel will take steps to protect its rights

under the PSCs and, ifnecessary, seek compensation ? Genel will

update the market on future developments

-- African exploration assets? A farm-out process relating to

the highly prospective SL10B13 block (100% working interest

andoperator) in Somaliland is continuing, and active engagement

with respect to the opportunity is ongoing ? Genel continues to

work towards a farm-out campaign aimed at bringing a partner onto

the Lagziralicence offshore Morocco (75% working interest and

operator).

ESG

-- Our sustainability report in accordance with Global Reporting

Initiative standards was issued in August2021, giving a

comprehensive overview of our ESG activities and positions

-- Following 14 million work hours since a lost time injury

('LTI') at Genel and TTOPCO operations, a memberof the contractor

drilling team regrettably sustained a foot injury during drilling

operations at Sarta-5. Actionhas been taken to prevent a recurrence

of such an incident, as we strive to repeat the performance of the

previoussix years of LTI free operations

-- Following the Annual General Meeting ('AGM') on 6 May 2021

the Company announced that all the resolutionsput forward to the

meeting had passed with the requisite majority of votes and

acknowledged that resolutions 3, 4,6, 18 and 19, had a c.40% of

votes cast against them. In accordance with Provision 4 of the UK

Corporate GovernanceCode 2018, the Company wishes to provide an

update on the views received from shareholders and actions taken

inrespect of these resolutions? In light of the votes received

against the resolutions, the Company has engaged with

majorshareholders to understand their views. Noting that proxy

agencies were all in favour of the above resolutions,and following

discussions with shareholders, the Board considers the votes cast

against the resolutions toprimarily reflect differing opinions held

by the Company's major shareholders in relation to a number

ofmatters. As a consequence, the Company does not believe it is

necessary or appropriate to take any additionalaction

OUTLOOK

-- Following the strength of the oil price, Genel expects to

generate free cash flow in 2021 despitematerial investment in

growth? At a Brent oil price of USD85/bbl, our barrels generate

USD28/bbl of cash flow, sufficient to deliver amaterial surplus

after funding growth expenditure, corporate costs, and interest ?

USD132 million still outstanding from the KRG for oil sales from

November 2019 to February 2020 and thesuspended override from March

to December 2020 ? The inclusion of Sarta production in our

receivable recovery payments is a positive step andincreases the

pace of recovery of monies owed

-- Following the production performance of Sarta in 2021 being

below expectations, and delays in drilling atTawke, Genel now

expects production in the year to be slightly below the 2020

average of 31,980 bopd

-- 2021 capital expenditure expected to be c.USD165 million

(guidance USD150 million to USD200 million), followingdelays in

approvals from the KRG and ongoing supply chain challenges caused

by COVID-19 leading to some plannedactivity moving to Q1 2022

(MORE TO FOLLOW) Dow Jones Newswires

November 04, 2021 03:00 ET (07:00 GMT)

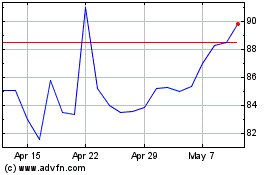

Genel Energy (LSE:GENL)

Historical Stock Chart

From Mar 2024 to Apr 2024

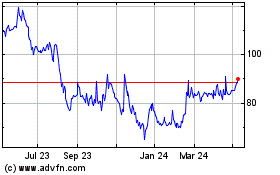

Genel Energy (LSE:GENL)

Historical Stock Chart

From Apr 2023 to Apr 2024