TIDMGFIN

RNS Number : 5557G

Gfinity PLC

30 March 2022

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014. Upon the publication of

this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

30 March 2022

Gfinity plc

("Gfinity" or the "Company")

Half Year Results

Gfinity (AIM: GFIN), a world-leading esports solutions provider,

announces its unaudited results for the six-month period ended 31

December 2021.

Financial Highlights:

-- Continued improvement in financial performance through

sustained strategic focus on what the Company owns, with Gfinity

Digital Media ('GDM') driving growth in the business.

-- Revenue of GBP3.3m, an increase of 8% year on year (H1 21:

GBP3.0m) and 22% improvement on previous 6 months (H2 21:

GBP2.7m).

-- Adjusted operating loss([1]) of GBP0.4m, 53% improvement year

on year (H1 21: GBP0.9m loss) and 76% improvement on previous 6

months (H2 21: GBP1.8m loss) as the business continues on its path

towards profitability.

-- Reduction in Adjusted administrative expenses([2]) of 4% to GBP2.4m (H1 21: GBP2.5m).

-- Business well capitalised to continue to deliver on its

objectives following successful fundraising, underlining confidence

in the Company's long-term performance.

Operational Highlights:

Strategic focus on 'what we own' delivering improved financial

performance and growth

Gfinity Digital Media:

-- Continued growth of publishing platform, with revenues up 62%

year on year to GBP1.6m (H1 21: GBP1.0m) driven by increased

annualised revenue per user of 23.3p (up 31% year on year) and 23%

rise in Average Monthly Active Users to 13.9m.

-- 43% year on year improvement in Gross profit to GBP1.0m.

Clear profitable growth engine that is driving the continuation of

the Group's pathway to profitability.

-- Successful acquisitions of SiegeGG, including technology

behind leading statistical analysis of Rainbow Six Siege video

game, and Stock Informer which contributed GBP0.4m of revenue

between acquisition completion on 13 September 2021 and 31 December

2021.

-- Renewed agreement to extend Gfinity's partnership with global

advertising technology platform Venatus into its third year,

driving value per user growth.

-- Significant progress in optimising site infrastructure and

performance, utilising the Company's proprietary manifold content

management system (CMS), leading to strong user numbers in the

second half, with a record 16m monthly active users across GDM

platforms in February.

Technology and Esports Solutions:

-- Revenue from the delivery of esports solutions for third parties remained flat at GBP1.6m.

-- Gfinity continues to be selected by global brands to deliver

esports and gaming solutions, including Nintendo, Coca Cola

Hellenic Bottling Company.

-- Record F1 Esports 2021 Series breaking viewership and

engagement records with Gfinity retained as delivery partner of

choice for 2022 season.

-- In-person publisher esports events, however, have been slow

to return to pre-pandemic levels.

-- Within this segment, revenue directly relating to the

licensing of Gfinity's proprietary esports technology grew 75% to

GBP0.2m (H1 21: GBP0.1m).

o Platform deployed across in-app the competitive programmes for

three of the largest mobile game titles featuring more than 50,000

participants in multiple languages across a number of weekends

during the period

o Platform utilised for the ePremier League qualification for

fourth year running

-- The major strategic focus within this segment is the

productisation of this technology to allow it to be deployed at

scale, with clients benefitting from automated integration into

games and media owners' websites. This is expected to create a high

margin, recurring revenue stream through a SaaS licensing

model.

Co-Owned Esports Properties

-- Consolidation of the V10 R League, Gfinity's jointly owned

digital motorsport property in conjunction with Abu Dhabi

Motorsports Management, into a single season in the second half of

the year has impacted comparable revenue. H1 21 revenue included

GBP0.4m of revenue from this segment. Consolidation of the

programme in this way is intended to allow for the creation of a

live finals event, which will facilitate unlocking sponsorship

revenue from the region.

-- If revenues relating to this were eliminated from the

comparative period, the year on year revenue increase would be

24%.

Balance Sheet strengthened post-period end

As at 31 December 2021, Gfinity had cash reserves of GBP1.5m (30

June 2021: GBP1.4m). Post year end, the Directors took the decision

to secure additional funding, believing it to be in the best

interests of the Group.

On 14 March 2022, the Company successfully completed a fundraise

of GBP2.7 million, before expenses, via a placing and direct

subscription of new ordinary shares of 0.1p each in the Company at

a price of 1.25 pence per share. 50% of this fundraise was within

existing authorities and has completed, with the remaining 50%

subject to shareholder confirmation at the General Meeting to be

held on 1 April 2022. This provides the runway needed for the

Company to be profitable on a month by month basis in 2023.

Outlook

-- Continued delivery of strategy and focus on what we own, with

sustained GDM performance and good momentum heading into the second

half.

-- Slower than anticipated return to live esports events will

impact short term revenue and profits, but do not change the

long-term prospects or future pathway to profitability in 2023.

-- Investment in Gfinity Engage platform expected to create a

further owned, recurring and high margin revenue stream.

John Clarke, CEO, Gfinity said:

"We have continued to improve on financial performance during

the period, despite a slower than anticipated return to live events

and delays in certain revenue streams. The business remains on the

right path to profitability, with increased revenues, lower

operating losses and reduced operating expenditure.

We have strong momentum in our owned revenue streams, in

particular our GDM business, with record engagement numbers and

revenue per user up 270% since its launch. This business continues

to act as the growth engine for the Group, and our focus remains

firmly on building our capabilities and expertise to ensure more

brands choose Gfinity as their trusted partner.

Although the sector is still recovering from the impacts of

Covid-19, macro trends remain in our favour and following a

successful fundraise post-period, we now have the operating

liquidity we need to deliver on our target of reaching

profitability by 2023."

S

Enquiries :

Gfinity plc www.gfinityplc.com

John Clarke, CEO Via Teneo

Teneo (Media) Tel: +44 7880 715975

Anthony Di Natale Gfinity@teneo.com

Canaccord Genuity Limited (AIM Nominated Tel: +44 (0)207

Adviser & Broker) 523 8150

Bobbie Hilliam / Patrick Dolaghan

About Gfinity

Gfinity (AIM: GFIN) is a market-leading digital media publisher

and technology company in the rapidly growing esports and

competitive gaming sector. Created by gamers for the world's three

billion gamers, Gfinity has a unique understanding of this

fast-growing global community. It uses this expertise both to

provide advisory services and to design, develop and deliver

unparalleled experiences and winning strategies for game

publishers, sports rights holders, commercial partners and media

companies.

Gfinity connects its partners with the esports community in

authentic and innovative ways. This consists of on--and-off-line

competitions and industry--leading content production.

Relationships include Activision Blizzard, EA SPORTS, F1 Esports

Series Red Bull, Abu Dhabi Motorsport Management and Coca Cola.

Gfinity connects directly with tens of millions of gamers each

month through its digital media group, Gfinity Digital Media.

Gfinity Digital Media includes websites such as: Gfinityesports,

RealSport101, Epicstream, Stock Informer, StealthOptional,

RacingGames.gg, MTGRocks.com and their respective social

channels.

All Gfinity services are underpinned by the Company's

proprietary technology platform, delivering a level playing field

for all competitors and supporting scalable multi-format leagues,

ladders and knockout competitions.

Operational Review

The six months to 31 December 2021 saw Gfinity continue to make

significant progress against the key strategic pillars of the

business. This focus enabled a significant improvement in financial

performance. The a djusted operating loss([3]) for the period of

GBP0.4m represented a 53% improvement year on year (H1 21: GBP0.9m

loss), which built on a 71% improvement on the performance in H1

20.

Directors believe that building the future of the business

around owned, scalable, higher margin revenue streams relating to

the Gfinity Digital Media segment and the ability to deploy

Gfinity's proprietary esports technology at scale, represents the

right strategy to deliver long term value to investors.

Gfinity Digital Media:

In the six-month period to 31 December 2021, Gfinity continued

to drive growth in both the number of users engaging with written

and video content on its owned digital media platforms, as well as

the revenue derived from each user. As a result, revenue in the

period rose 62% to GBP1.6m.

Monthly Active Users

Unique monthly active users during the period were 13.9m, which

represented a year on year increase of 31%, peaking at over 15m

users in December 2021. Encouragingly, growth continued into H2,

which is traditionally a quieter period for gaming news and by

extension user numbers. In January 2022 monthly active users were

again over 15m, with growth continuing throughout February with a

new monthly record of 16m monthly active users achieved. Growth is

expected to be maintained with users in March expected to exceed 17

million. Including related social platforms, Gfinity's content is

now reaching more than 100m users every month.

The Company continues to target 50m monthly active users on its

owned channels in the short to medium term and 100m monthly active

users in the longer term, through a combination of both organic

growth and targeted acquisitions.

Revenue Per User

The annualised revenue per unique user during H1 grew 31% year

on year to 23p, reflecting a continued growth in advertising rates,

through enhanced scale, prestige and site performance. This was

complimented by a diversification of revenue streams, with an

increased emphasis on affiliate revenues, particularly driven by

the acquisition of the Stock Informer business in September

2021.

During the period, Gfinity extended its partnership with Venatus

into its third year, as its chosen partner for delivery of

advertising revenue. The extended partnership continues to

contribute to the acceleration of Gfinity's value per user across

its fast-growing websites under the GDM.

The Company is targeting annual revenue per user of 30p in the

short to medium term and 50p in the longer term, providing a

significant, recurring, high-margin revenue stream for the

business.

New Site Additions

Three new sites were added to the Gfinity Digital Media network

during the period. The largest of these was the Stock Informer

business, acquired through the acquisition of Megit Ltd, which

completed on 13 September 2021. Stock Informer has built up a

market leading position as an authority on hard-to-find items, with

a particular focus of bringing products of relevance to gamers. Its

proprietary technology enables real-time updates on availability

and pricing of items, from which consumers can click through to the

relevant retailers to make purchases, allowing the business to

drive revenue through affiliate commissions.

In the three-and-a-half-month period following the acquisition,

Stock Informer delivered GBP0.4m of high-margin revenue to the

business. Directors also believe that there is significant

potential for Stock Informer's technology to post relevant price

comparison offers to people viewing relevant content across the

whole GDM network, opening a new revenue stream for Gfinity from

FY23 onwards.

Also in September 2021, Gfinity completed the acquisition of

Siege.gg, a highly-engaged community for the Rainbow Six Siege game

and owner of the leading proprietary statistical dataset in respect

of the competitive following of the game.

The technology, team and methodology behind Siege.gg were

utilised in the period to launch the new site Forerunner.gg in

December 2021. This site focuses on the competitive community tied

to the highly popular Halo game.

Technology:

Throughout the period, Gfinity has continued to deploy its

proprietary esports technology for leading clients. Gfinity's

tournament management platform has been integrated directly into 3

leading mobile game titles, powering the competitive programme for

over 50,000 participants at any one time, enabling players to stay

in the game, rather than going to a third-party tournament play

site. The significant benefit to the game publisher is that it now

keeps its players data.

Gfinity's technology has been used for a fourth consecutive year

to deliver the online qualifying rounds for the ePremier League

programme. Gfinity's community building tools also continued to be

deployed on behalf of Nvidia.

Revenue from the direct deployment of Gfinity's technology,

outside of broader managed esports programmes, rose 75% year on

year to GBP0.2m.

A key strategic initiative is the productisation of this

technology suite, such that it can be quickly and easily deployed

directly into clients' games and media platforms, licensed under a

SaaS model, without the need for custom development work from

Gfinity's team. With those gamers who participate competitively,

spending longer in game and spending more money in-game, this

provides a valuable tool for clients to drive up both engagement

and revenue. The beta version of the "Engage" product that will

facilitate this, will launch during the second quarter of this

calendar year.

Esports Solutions:

Gfinity continues to be selected by global brands to deliver

esports and gaming solutions. In H1 22 Gfinity delivered the live

component of the fourth season of the Formula 1 Pro Series. In 2021

this programme delivered record levels of engagement, including

viewership up 103% year on year.

Other clients in the period included Nintendo, Amazon and Coca

Cola Hellenic Bottling Company.

Co-Owned Esports Properties

During FY21, Gfinity staged the first two seasons of V10 R

League, Gfinity's jointly owned digital motorsport property in

conjunction with Abu Dhabi Motorsports Management. The series has

created a strong basis for growth, with participation from leading

teams including Red Bull, Ford, BMW, Aston Martin and McLaren among

others, broadcast through distribution partners including ESPN and

BT Sport.

During FY22, the decision was taken to consolidate the V10 R

League into a single season in the second half of the year. This

allows for a more consolidated block of content, together with live

finals to be staged from Abu Dhabi, which it is believed will

create a more compelling proposition for sponsorship, particularly

from partners in the Middle East.

H1 21 revenue included GBP0.4m of revenue from this segment. If

revenues relating to this were eliminated from the comparative

period, the total year on year revenue increase for the period

would be 24%.

Outlook

Directors believe that Gfinity's focus on owned, high-margin,

scalable revenue streams is the right strategy to deliver

significant long-term value for shareholders. The 53% reduction in

operating loss, building on a 71% reduction in the prior year,

demonstrates this strategy is already delivering a significantly

improved financial performance. Directors expect both the audience

and monetisation of its owned Gfinity Digital Media business to

continue to grow, building on the 62% year on year uplift delivered

in the six-month period to 31 December 2021. It is also believed

that the productisation of Gfinity's esports platform will create a

further revenue stream of scale over future years.

Despite this, revenue growth is not always linear and the timing

of certain esports programmes cannot always be guaranteed. As a

result, in March 2022, Directors took the decision to raise a

further GBP2.7m before costs, accompanied by a one for one warrant

at the exercise price. This over-subscribed placing has secured the

business in a strong position from which to pursue its growth

objectives into the second half of FY22 and beyond, continuing its

path to delivering month on month profitability in 2023.

Financial Review

Revenue for the six-month period to 31 December 2021 was

GBP3.3m. This represented an increase of 8% year on year (H1 21:

GBP3.0m) and 22% improvement on the previous 6 months (H2 21:

GBP2.7m).

The proportion of revenue attached to owned assets, including

Gfinity's Digital Media network, jointly owned esports programmes

and the licensing of Gfinity's proprietary esports technology, rose

to 55% of total income (GBP1.8m). This compared to a figure of 49%

in H1 21, despite the prior year comparative period including

GBP0.4m from the first season of the V10 R League programme, now

condensed into a single season in the second half of FY22.

The sharpened focus on owned, higher margin revenue streams

delivered gross profit for the six-month period of GBP1.9m at a

gross margin of 60% (H1 21: GBP1.5m at 50%).

This growth was achieved with a reduction of 4% in adjusted

administrative expenses([4]) to GBP2.4m (H1 21: GBP2.5m). This

resulted in an adjusted operating loss([5]) , reduced by 53% to

GBP0.4m (FY21 H1: GBP0.9m loss).

In the period, Gfinity completed two acquisitions, supporting

the strategy to grow both the audience and monetisation of the

Gfinity Digital Media network.

In September 2021, Gfinity acquired the entire issued share

capital of Megit Ltd, the owner of the Stock Informer brand, for

consideration consisting of GBP2.5m in cash, GBP2.5m of equity in

Gfinity plc and an earn out calculated at 30% of revenue in each of

the first 3 years post-acquisition. The fair value of this

consideration has been estimated at GBP6.6m.

Also in September, Gfinity acquired the trade and assets of

Siege.gg, a leading digital community and owner of statistical

information in respect of the competitive following of the Rainbow

Six Siege game. Consideration for this acquisition comprised 9

million ordinary shares and an earn out amounting to 30% of revenue

in the first two years post-acquisition. The fair value of this

consideration has been estimated at GBP6.6m.

Directors consider the development of an easily deployed,

licensable version of Gfinity's proprietary esport technology

product to be a major strategic initiative, with the potential to

drive significant future SaaS revenues for the business. On that

basis GBP0.3m of costs invested directly in the development of this

product have been capitalised in the period.

Gfinity had cash of GBP1.5m at 31 December 2021. In March 2022,

the Directors announced their intention to raise a minimum of a

further GBP1.0m, accompanied by a one for one warrant at the

exercise price. This placing was heavily over-subscribed from a

combination of both existing and new shareholders. In the light of

current macro-economic conditions the Directors elected to take a

total of GBP2.7m, plus potential future funds from any warrant

exercises.

Group Statement of Profit or Loss

6 months 6 months Year to

to 31 December to 31 December 30 June

2021 2020 2021

Unaudited Unaudited Audited

GBP GBP GBP

CONTINUING OPERATIONS

Revenue 3,261,361 3,013,309 5,693,385

Cost of sales (1,320,260) (1,492,205) (3,085,409)

Gross profit/(loss) 1,941,101 1,521,104 2,607,976

Other Income 697 50,280 54,354

Administrative expenses (3,511,533) (2,863,226) (7,179,327)

Operating loss (1,569,735) (1,291,842) (4,516,997)

Disposal of Associate Gain

/ (Loss) 45,090 459,706 459,706

Finance income 2 - 4

Finance Costs - (8,988) (10,236)

Loss on ordinary activities

before tax (1,524,643) (841,124) (4,067,524)

Taxation 117,685 - 221,929

---------------- ---------------- ---------------------

Retained loss for the year (1,406,958) (841,124) (3,845,595)

Earnings per Share -GBP0.00 -GBP0.00 -GBP0.00

Group statement of comprehensive income

6 months 6 months Year to

to 31 December to 31 December 30 June

2021 2020 2021

Unaudited Unaudited Audited

Items that will not be reclassified

to profit or loss

Foreign exchange profit / (loss)

on retranslation of foreign

Subsidiaries (5,510) (4,763) (12,887)

---------------- ---------------- ------------

Other Comprehensive Income

for the period (5,510) (4,763) (12,887)

Loss and total comprehensive

income for the period (1,412,468) (845,887) (3,858,482)

Group Statement of Financial Position

As at 31 December As at 30 June

2021 2021

Unaudited Audited

GBP GBP

NON CURRENT ASSETS

Property, plant and equipment 200,110 187,366

Goodwill 5,259,307 1,903,790

Intangible fixed assets 5,240,418 704,481

10,699,835 2,795,637

CURRENT ASSETS

Trade and other receivables 2,096,066 1,586,850

Cash and cash equivalents 1,493,549 1,375,873

3,589,615 2,962,723

TOTAL ASSETS 14,289,450 5,758,360

EQUITY AND LIABILITIES

Equity

Ordinary shares 1,099,697 930,513

Share premium account 52,488,918 46,511,089

Other reserves 3,843,012 3,384,914

Retained earnings (48,709,655) (47,302,697)

Total equity 8,721,972 3,523,819

Non-current liabilities

Other Payables 1,316,801 254,986

Deferred Tax Liabilities 1,065,626 127,835

Current liabilities

Trade and other payables 3,185,051 1,851,720

Total liabilities 5,567,478 2,234,541

TOTAL EQUITY AND LIABILITIES 14,289,450 5,758,360

Group Cash Flow Statement

6 months 6 months Year to

to 31 December to 31 December 30 June

2021 2020 2021

Unaudited Unaudited Audited

GBP GBP GBP

Cash flow used in operating

activities

Net cash used in operating

activities (592,836) (439,160) (2,049,833)

Cash flow from/(used in)

investing activities

Interest received 2 - 4

Additions to property, plant

and equipment (68,850) (80,103) (106,642)

Additions to intangible

assets (351,103) - (16,030)

Payments to acquire trade (2,155,630) - -

& assets on business combination

Gain on disposal of associate 45,090 459,706 459,706

Net cash used in investing

activities (2,530,491) 379,603 337,038

Cash flow from/(used in)

financing activities

Issue of equity share capital 3,246,513 601,666 1,950,649

Repayment of leases - (306,486) (439,621)

Bank interest payable - (1,010) (10,236)

Net cash from financing

activities 3,246,513 294,170 1,500,792

Net increase in cash and

cash equivalents 123,186 234,613 (211,833)

Effect of currency translation

on cash (5,510) (4,763) (12,890)

Opening cash and cash equivalents 1,375,873 1,600,596 1,600,596

Closing cash and cash equivalents 1,493,549 1,830,446 1,375,873

Statement of Changes in Equity

Ordinary Share Share Retained Forex Total

shares premium option earnings equity

reserve

GBP GBP GBP GBP GBP GBP

At 30 June 2020 725,868 44,405,086 3,137,831 (43,457,102) (5,613) 4,806,070

Loss for the

period - - - (841,124) - (841,124)

Other Comprehensive

Income - - - - (4,763) (4,763)

Total comprehensive

income - - - (841,124) (4,763) (845,887)

---------- ----------- ---------- ------------- ---------- ------------

Proceeds of shares

issued 70,645 895,810 - - - 966,455

Share Issue Costs - (4,789) - - - (4,789)

Share options

expensed - - 81,744 - - 81,744

Total transactions

with owners,

recognised directly

in equity 70,645 891,021 81,744 - - 1,043,410

At 31 Dec 2020 796,513 45,296,106 3,219,575 (44,298,226) (10,376) 5,003,592

Loss for the

period - - - (3,004,471) - (3,004,471)

Other comprehensive

income - - - - (8,124) (8,124)

Total comprehensive

income - - - (3,004,471) (8,124) (3,012,595)

---------- ----------- ---------- ------------- ---------- ------------

Proceeds of shares

issued 134,000 1,214,983 - - - 1,348,983

Share Issue Costs - - - - - -

Share options

expensed - - 183,839 - - 183,839

Total transactions

with owners,

recognised directly

in equity 134,000 1,214,983 183,839 - - 1,532,822

At 30 June 2021 930,513 46,511,089 3,403,414 (47,302,697) (18,500) 3,523,819

Loss for the

period - - - (1,406,958) - (1,406,958)

Other comprehensive

income - - - - (5,510) (5,510)

Total comprehensive

income - - - (1,406,958) (5,510) (1,412,468)

---------- ----------- ---------- ------------- ---------- ------------

Proceeds of shares

issued 169,184 6,183,150 - - - 6,352,334

Share Issue Costs - (205,321) - - - (205,321)

Share options

expensed - - 463,608 - - 463,608

Total transactions

with owners,

recognised directly

in equity 169,184 5,977,829 463,608 - - 6,610,621

At 31 Dec 2021 1,099,697 52,488,918 3,867,022 (48,709,655) (24,010) 8,721,972

Notes to the interim financial statements

1. General Information

Gfinity plc is a company limited by shares, incorporated and

domiciled in the United Kingdom under the Companies Act 2006. Its

registered office is 16 Great Queen Street, London, England, WC2B

5AH. Its shares are quoted on the AIM market of London Stock

Exchange.

The functional and presentational currency is GBP sterling

because that is the currency of the primary economic environment in

which the group operates. Foreign operations are included in

accordance with the policies set out in note 2.

These condensed interim financial statements were approved for

issue on 29 March 2022.

The financial statements have been reviewed by the Group's

auditors but not audited.

2. Accounting Policies and Basis of Preparation

Basis of Preparation

The interim financial statements for the six months ended 31

December 2021 have been prepared using accounting policies that are

consistent with those of the audited financial statements for the

period ended 30 June 2021 and in accordance with IAS 34, "Interim

Financial Reporting" as adopted by the European Union. The interim

financial information should be read in conjunction with the

Group's Annual Report and Accounts for the year ended 30 June 2021,

which has been prepared in accordance with IFRS as adopted by the

European Union.

The interim financial information contained in this report has

been reviewed but not audited and does not constitute statutory

accounts within the meaning of section 434 of the Companies Act

2006.

The Annual Report and Accounts for the year ended 30 June 2021

has been filed with the Registrar of Companies. The auditors'

report on those accounts was unqualified, did not include a

reference to any matters to which the auditors drew attention by

way of emphasis without qualifying the report and did not contain

statements under s498(2) or s498(3) of the Companies Act 2006.

Significant Accounting Policies

The critical accounting policies and presentation followed in

the preparation of this interim report have been

consistently applied to all periods in these financial

statements and are the same as those applied in the company's

annual accounts for the year ended 30 June 2020.

A copy of the accounts to 30 June 2021 can be obtained from the

company's website: www.gfinityplc.com .

Critical Accounting Judgements

The preparation of financial statements in conforming with

adopted IFRS requires management to make judgements, estimates and

assumptions that affect the application of policies and reported

amounts of assets, liabilities, income and expenses. The estimates

and assumptions are based on historical experience and other

factors considered reasonable at the time, but actual results may

differ from those estimates. Revisions to these estimates are made

in the period in which they are recognised.

The critical accounting judgements made in preparing this

interim report are the same as those in preparing the annual

accounts for the Company for the year ended 30 June 2021 which can

be obtained from the company's website: www.gfinityplc.com .

Going Concern

Despite the significant reduction in operating loss delivered in

H1, revenue growth in such a new and rapidly evolving industry is

not always linear and certain initiatives, which were originally

anticipated for H2 of FY22, are now likely to take slightly longer

to materialise.

As a result, in March 2022 directors announced their intention

to raise a minimum of GBP1m, coupled with a one for one warrant at

the exercise price to support working capital requirements and

continue to support growth initiatives. The fundraise was heavily

over-subscribed, confirming continued investor support for the

business. As a result, in the context of an uncertain global

macro-economic situation, the directors opted to raise GBP2.7m,

coupled by a one for one warrant at the exercise price, to be

exercised within a 12-month period.

Management have prepared forecasts to 30 June 2023, under a

number of scenarios. Under each of these scenarios, following this

fundraise, the Company has sufficient cash reserves to continue to

operate for a further 12 months. As a result, directors believe

that the going concern basis for the preparation of these accounts

is appropriate.

3. Loss per share

Basic earnings per share is calculated by dividing the loss

attributable to shareholders by the weighted average number of

ordinary shares in issue during the period.

IAS 33 requires presentation of diluted EPS when a company could

be called upon to issue shares that would decrease earnings per

share or increase the loss per share. For a loss-making company

with outstanding share options, net loss per share would be

decreased by the exercise of options and therefore the effect of

options has been disregarded in the calculation of diluted EPS.

During the 6 month period to 31 December 2021, Gfinity issued

13,750,000 shares as the result of warrant exercises, 82,500,000

shares as the result of the fund raise, 1,433,331 as the results of

employee option exercises and 62,500,000 of new shares in relation

to the acquisition of Megit Ltd and 9,000,000 of new shares in

relation to the acquisition of Siege.gg.

6 months 6 months Year ended

ended 31 ended 31 30 Jun 2021

Dec 2021 Dec 2020

GBP GBP GBP

Loss attributable to shareholders

from continuing operations (1,412,468) (845,887) (3,858,482)

Number Number Number

000's 000's 000's

Weighted average number of

ordinary shares 963,463 767,286 809,795

Loss per ordinary share for

continuing operations -0.00 -0.00 -0.00

4. Notes to the Cash Flow Statement

6 months 6 months Year to

to 31 December to 31 December 30 June

2021 2020 2021

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows from

operating

activities

Loss for the

financial year (1,406,958) (841,124) (3,845,595)

Depreciation of

property, plant

and equipment 56,109 62,751 132,478

Depreciation on

right of use

assets - 293,515 428,305

Amortisation of

intangible fixed

assets 631,608 253,108 492,700

Goodwill

impairment - - 901,519

Interest Received (2) - (4)

Interest Payable - 8,988 10,236

Share based

payments 463,608 81,744 265,583

(Increase) in - - -

Inventories

(Increase)/

decrease in

trade

and other

receivables (509,217) 193,306 (280,359)

Increase/

(decrease) in

trade

and other

payables 334,791 (31,657) 300,020

Disposal of fixed

assets - (85) (85)

Gain on disposal

of Associate (45,090) (459,706) (459,706)

Corporation tax

charge - - 227,004

Corporation tax

(paid)/ R&D

credits

received (117,685) - (221,929)

------------------------------ ------------------------------ ------------------------------

Cash used by

operating

activities (592,836) (439,160) (2,049,833)

Net cash used by

operating

activities (592,836) (439,160) (2,049,833)

5. Segmental Information

The Group is managed on the basis of four segments:

- Gfinity Digital Media: monetisation of Gfinity's own network

of digital media sites, primarily through, advertising, sponsorship

and affiliate revenues

- Owned Content: The creation of esports programmes and content,

in which Gfinity owns or co-owns the output and hence shares in the

commercial revenue, including sponsorship and content rights that

come as a result

- Service Delivery: the delivery of esports solutions and

content for third parties, including high profile game publishers,

sports rights holders and brands, under a fee-based model

- Technology: Licensing and fees for the direct deployment of

Gfinity's proprietary esports technology, outside of a managed

esports programme.

6 months ended 6 months ended Year ended

31 Dec 2021 31 Dec 2020 30 June 2021

GBP GBP GBP

Gfinity digital media 1,647,899 1,006,309 1,623,497

Owned content - 382,235 728,065

Service delivery 1,479,697 1,530,333 3,118,975

Platform as a service 133,765 94,431 222,847

Total Revenue 3,261,361 3,013,309 5,693,385

=============== =============== ==============

Segmental information for the statement of financial position

has been presented as management do view this information on a

segmental basis. Intra-group recharges are not considered when

monitoring performance with central charges (such as senior

management costs) retained in Gfinity PLC rather than being

apportioned across segments.

6. Revenue

The Group's policy on revenue recognition is as outlined in note

2 of the financial statements for the year ending June 2021. The

period ending December 2021 included GBP153,643 in the contract

liability balance and at the beginning of the period (December

2020: GBP0.4m and year ending June 2021: GBP364,024).

The Group's revenue disaggregated by primary geographical

markets is as follows:

6 months ended 31 Dec 2021

Gfinity Cevo Megit Ltd Total

GBP GBP GBP GBP

United Kingdom 1,563,860 - 425,547 1,989,407

North America 699,011 166,797 - 865,808

ROW 512,668 - - 512,668

Total 2,775,538 166,797 425,547 3,367,882

========== ======== ========== ==========

6 months ended 31 Dec 2020

Gfinity Cevo Megit Ltd Total

GBP GBP GBP GBP

United Kingdom 2,079,447 - - 2,079,447

North America 530,306 58,465 - 588,771

ROW 345,090 - - 345,090

Total 2,954,843 58,465 - 3,013,309

========== ======= ========== ==========

Year ended 30 June 2021

Gfinity Cevo Megit Ltd Total

GBP GBP GBP GBP

United Kingdom 4,144,440 - - 4,144,440

North America 902,408 322,741 - 1,225,149

ROW 539,069 - - 539,069

Total 5,585,917 322,741 - 5,908,659

========== ======== ========== ==========

The Group's revenue disaggregated by pattern of revenue of

revenue recognition is as follows:

6 months ended 31 Dec 2021

Gfinity Cevo Megit Ltd Total

GBP GBP GBP GBP

Services transferred

at

a point in time 1,568,313 166,797 425,547 2,160,657

Services transferred

over time 1,207,226 - - 1,207,226

Total 2,775,538 166,797 425,547 3,367,882

========== ======== ========== ==========

6 months ended 31 Dec 2020

Gfinity Cevo Megit Ltd Total

GBP GBP GBP GBP

Services transferred

at

a point in time 1,922,827 58,465 - 1,981,292

Services transferred

over time 1,032,017 - - 1,032,017

Total 2,954,844 58,465 - 3,013,309

========== ======= ========== ==========

Year ended 30 June 2021

Gfinity Cevo Megit Ltd Total

GBP GBP GBP GBP

Services transferred

at

a point in time 3,432,959 322,741 - 3,755,700

Services transferred

over time 2,152,959 - - 2,152,959

Total 5,585,918 322,741 - 5,908,659

========== ======== ========== ==========

As at 31 December 2021 the Group had the amounts shown below

held on the consolidated statement of financial position in

relation to contracts either performed in full during the year or

ongoing as at the year end. All amounts were either due within one

year or, in the case of contract liabilities, the work was to be

performed within one year of the balance sheet date.

Dec-21 Jun-21

GBP GBP

Trade Receivables 1,363,845 1,024,696

Contract Assets 493,102 244,835

Contract Liabilities 153,643 364,024

Trade receivables are non-interest bearing and are generally on

30 day terms. Credit risk of customers is low with many being large

multinational corporations.

Contract assets are initially recognised for revenue earned

while the services are delivered over time or when billing is

subject to final agreement on completion of the milestone. Once the

amounts are billed the contract asset is transferred to trade

receivables.

Contract liabilities arise when amounts are paid in advance of

the delivery of the service. These are then transferred to the

statement of comprehensive income as either milestones are

completed or work is completed overtime.

7. Gain on Disposal of Associate

During the six month period to 31 December 2021, the process of

winding up Gfinity Esports Australia (PTY), in which Gfinity held a

30% shareholding, was completed. On completion of this process,

funds remaining in the business were re-distributed to

shareholders. With all amounts invested in this venture having

previously been expensed, his resulted in a one-off gain on

cessation of the business of GBP45,090.

8. BUSINESS COMBINATIONS

Megit Ltd

Acquisition of Megit Ltd

On 14 September 2021 Gfinity PLC acquired 100% shares of Megit

Ltd, owner of the Stock Informer brand. Stock Informer has built up

a market leading position as an authority on hard-to-find items,

with a particular focus to products of relevance to gamers. Its

proprietary technology enables real-time updates on availability

and pricing of items, from which consumers can click through to the

relevant retailers to make purchases, allowing the business to

drive revenue through affiliate commissions.

Purchase consideration

Initial consideration GBP

Shares (62,500,000 Ordinary shares at GBP0.04) 2,500,000

Cash 2,500,000

Acquisition cost 51,250

Total initial consideration 5,051,250

Deferred consideration

Contingent consideration at fair value 1,551,677

Total deferred consideration 1,551,677

Total consideration payable 6,602,927

==========

Contingent consideration

Contingent consideration is payable based on revenue generated

from the acquired entity. The amount payable is calculated at 30%

of relevant revenues received in the first, second and third 12

month periods after the acquisition date, up to a maximum of

GBP1,800,000 across the 3 year period. The fair value of the

contingent consideration is currently estimated to be GBP1,551,677

based on forecast revenues at the date of the acquisition.

Net assets acquired

The fair values of the assets and liabilities of the acquired of

Megit Ltd as at the date of acquisition are as follows:

GBP

Intangible assets: domain authority 3,944,713

Intangible assets: technology 715,741

Deferred tax liability (1,021,342)

Net identifiable assets acquired 3,639,112

Add: Goodwill 2,963,814

Net assets acquired 6,602,927

============

The goodwill that arises from the business combination reflects

the profitability of the acquired trade and assets and the enhanced

growth prospects for the combined business. None of the goodwill is

expected to be deductible for tax purposes.

Siege.gg

Acquisition of Siege.gg

On 8 September 2021 Gfinity PLC acquired trade and assets of

Siege.gg, a highly-engaged community for the Rainbow Six Siege game

and owner of the leading proprietary statistical dataset in respect

of the competitive scene around that game.

Purchase consideration

Initial consideration GBP

Shares (9,000,000 Ordinary shares at GBP0.0445) 400,500

Acquisition cost 4,380

Total initial consideration 404,880

Deferred consideration

Contingent consideration at fair value 108,678

Total deferred consideration 108,678

Total consideration payable 513,558

========

Contingent consideration

Contingent consideration is payable based on revenue generated

from the acquired assets. The amount payable is calculated at 30%

of relevant revenues received in the first and second 12 month

periods after the acquisition date, up to a maximum of 1,500,000

across the two-year period. The fair value of the contingent

consideration is currently estimated to be GBP108,678 based on

forecast revenues at the date of the acquisition.

Net assets acquired

The fair values of the assets and liabilities of the acquired of

Megit Ltd as at the date of acquisition are as follows:

GBP

Intangible assets: statistical data and domain

authority 155,989

Deferred tax liability (34,134)

Net identifiable assets acquired 121,855

Add: Goodwill 391,703

Net assets acquired 513,558

=========

The goodwill that arises from the business combination reflects

the profitability of the acquired trade and assets and the enhanced

growth prospects for the combined business. None of the goodwill is

expected to be deductible for tax purposes.

([1]) Adjusted operating loss is before interest, tax,

depreciation, amortisation, impairment and the share-based payment

expense.

([2]) Adjusted administrative expenses show the underlying

operating expenditure of the company, adjusting for the same items

as with the adjusted operating loss.

([3]) Adjusted operating loss is before interest, tax,

depreciation, amortisation, impairment and the share-based payment

expense.

([4]) Adjusted administrative expenses show the underlying

operating expenditure of the company, adjusting for the same items

as with the adjusted operating loss

([5]) Adjusted operating loss is before interest, tax,

depreciation, amortisation, impairment and the share-based payment

expense.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR WPUWAWUPPUCU

(END) Dow Jones Newswires

March 30, 2022 02:00 ET (06:00 GMT)

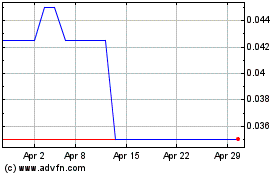

Gfinity (LSE:GFIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gfinity (LSE:GFIN)

Historical Stock Chart

From Apr 2023 to Apr 2024