Gresham House PLC Trading Update - H1 AUM growth of +19% to GBP4.7bn (2816F)

15 July 2021 - 4:00PM

UK Regulatory

TIDMGHE

RNS Number : 2816F

Gresham House PLC

15 July 2021

15 July 2021

Gresham House plc

("Gresham House" or the "Company" or the "Group")

Trading Update - H1 AUM growth of +19% to GBP4.7bn

Gresham House (AIM: GHE), the specialist alternative asset

manager, is pleased to announce a trading update for the six-month

period to 30 June 2021.

Highlights

* AUM growth of GBP761m in H1 (+19%) to GBP4.7bn,

including organic growth of GBP457m (+12%)

* Completion of Appian Asset Management acquisition, to

form Gresham House Ireland and international platform

* Cost synergies captured from Housing acquisition of

c.GBP0.9m

* Advanced product progress within the Real Asset

division including Forestry, New Energy, Sustainable

Infrastructure and Housing to support AUM ambitions

* Continued strong progress against five-year financial,

strategic and sustainability plan, 'GH25', including

product development, AUM growth, client expansion and

fund investment performance

Trading review

The Group has delivered a strong first half performance in line

with market expectations and continues to make good progress

towards delivery of its GH25 commitments to achieve GBP6bn+ in

Assets Under Management (AUM), gain market share in specialist

products and build an international presence. Demand for the

Group's Environmental, Social and Governance (ESG) focused

strategies continues to gain momentum and AUM grew 19% to GBP4.7bn,

with organic growth of GBP457m (+12%).

The acquisition of Appian Asset Management, announced on 17

December 2020 (AUM EUR350m, or GBP303m), was completed on 29 June

2021 with AUM of EUR396m (GBP340m). Appian will be known as Gresham

House Ireland going forward, and it provides a strong international

platform for Gresham House in Ireland and across the EU.

Gresham House has continued to invest in the business during the

period, with several key hires in high-growth opportunities aligned

with the Group's investment strategies and products.

The Group has also continued to drive synergies from the

TradeRisks Limited acquisition, with c.GBP0.9m of cost synergies

captured to date.

The Group has continued to focus on using its balance sheet to

develop the business, including: further investment of GBP5.7m in

the development of battery energy storage projects; GBP4.8m in

funds that the Group has launched and manages; including an

investment which supports the creation of a pioneering new

sustainable infrastructure asset class seeking to develop dedicated

areas of land to establish new biodiversity.

Funds raised

Strong progress has been achieved against the Group's 2021

fundraising targets during H1 2021, which contributed to the AUM

increase to GBP4.7bn as at 30 June 2021 (31 December 2020:

GBP4.0bn).

ReSI LP, the shared ownership housing fund, held a first close

in May 2021 with commitments of GBP70m and deployment by 30 June

2021 of GBP16m. The Housing team's strong pipeline is anticipated

to support further fundraising in H2 2021. ReSI plc has also

delivered excellent performance in the period and is now operating

at a premium to NAV as at 30 June 2021.

Within the Group's BSIF strategy, the BSI Infrastructure LP is

now fully committed, and the Group is on track to raise its second

sustainable infrastructure fund, the British Sustainable

Infrastructure Fund II or 'BSIF II', in H2 2021.

Post 30 June 2021 update

Following the period-end, in July 2021 the Gresham House Energy

Storage Fund plc (GRID) launched and closed a fundraise of GBP100m,

underlining the growth potential and market leading nature of

GRID's battery energy storage projects, and further demonstrating

the attractiveness of the Group's investment strategies. The

fundraise was significantly oversubscribed and a scaling back

exercise was undertaken.

Tony Dalwood, Chief Executive Officer, said :

"We have delivered strong progress in the first half, with

growth in AUM from both organic initiatives and acquisition

activity. The depth and breadth of our investor base continues to

increase, driven by appetite for our ESG-focused investment

strategies and strong investment performance, and we are well on

track to achieve our GH25 objectives. We continue to invest in

building our specialist teams with a focus on scalable or

differentiated products and see good momentum across the business

as we enter the second half."

Ends

"This announcement contains inside information for the purposes

of the Market Abuse Regulation (596/2014/EU)("MAR")"

For more information contact:

Gresham House plc

Tony Dalwood, Chief Executive Officer

Kevin Acton, Chief Financial Officer +44 (0)20 3837 6270

Houston - PR advisors

Alexander Clelland gh@houston.co.uk

Kay Larsen +44 (0)20 4529 0549

Canaccord Genuity Limited - Nominated Adviser

and Joint Broker

Bobbie Hilliam

Georgina McCooke +44 (0)20 7523 8000

Jefferies International Limited - Joint

Broker and Financial Adviser

Paul Nicholls

Max Jones +44 (0)20 7029 8000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTQZLFFFDLZBBF

(END) Dow Jones Newswires

July 15, 2021 02:00 ET (06:00 GMT)

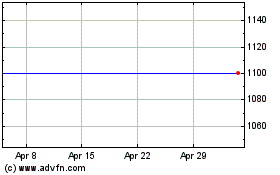

Gresham House (LSE:GHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

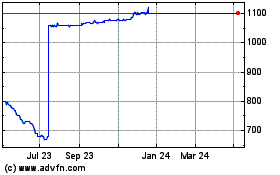

Gresham House (LSE:GHE)

Historical Stock Chart

From Apr 2023 to Apr 2024