TIDMGHE

RNS Number : 3862L

Gresham House PLC

10 September 2021

Gresham House plc

("Gresham House," "the Group" or "the Company")

Interim results for the six months ended 30 June 2021

Strong AUM growth driven by international expansion and demand

for ESG-focused strategies

Gresham House plc, (AIM: GHE) the specialist alternative asset

manager, reports strong growth in assets under management (AUM) in

the first half of the year, driven by international expansion and

continued demand for its Environment, Social and Governance (ESG)

focused investment strategies, underpinned by organic and

acquisition-based growth.

HIGHLIGHTS

As at As at Change

30 Jun 2021 31 Dec 2020

(GBPm) (GBPm) (%)

-------------------------------- ---------------- ---------------- ---------

Assets under management

(AUM) 4,722 3,970 +19

Cash and liquid assets(1) 45.0 45.1 -

Six months to Six months to

30 Jun 2021 30 Jun 2020

(GBPm) (GBPm) (%)

-------------------------------- ---------------- ---------------- ---------

Total net core income 23.0 17.5 +31

Adjusted operating profit(2) 6.9 5.2 +32

Total comprehensive net

profit/(loss) 5.2 (2.2) n/a

(1) Cash and liquid assets includes cash and investments in

tangible and realisable assets

(2) Adjusted operating profit is defined as the net trading

profit of the Group after charging interest but before

depreciation, amortisation, share-based payments relating to

acquisitions, profits and losses on disposal of tangible fixed

assets, net performance fees, net development gains and exceptional

items

FINANCIAL HIGHLIGHTS

-- AUM up 19% in H1 to GBP4.7 billion

-- Organic growth of 12% (GBP453 million)

-- Net core income up 31% to GBP23.0 million (H1 2020: GBP17.5 million)

-- Adjusted operating profit up 32% to GBP6.9 million (H1 2020: GBP5.2 million)

-- Utilising balance sheet to grow the asset management business

with cash and liquid assets at 30 June 2021 of GBP45.0 million (31

December 2020: GBP45.1 million)

-- Strong post period AUM growth with fund inflows of over

GBP350 million, and the announced acquisition of the Venture

Capital Trust business of Mobeus Equity Partners LLP (Mobeus VCT

business) increasing pro forma AUM to GBP5.4 billion

-- Delivery against GH25 financial and strategic targets ahead of management expectations

STRATEGIC HIGHLIGHTS

-- Achieving international expansion through the completion of

the acquisition of Appian Asset Management in Ireland and the

expected completion of a further international forestry mandate in

Australia, subject to regulatory approval

-- Recognised for leadership in sustainable investment through fund performance and award wins

-- Increased client diversification and AUM through additional

organic fundraises post period end of over GBP350 million

-- Acquisition of the Mobeus VCT business brings additional AUM

of GBP369 million ( see today's separate RNS announcement )

SUSTAINABLE INVESTMENT HIGHLIGHTS

-- Gresham House Asset Management Limited has met the FRC's

expected standard of reporting in 2021 and been listed as a

signatory to the 2020 UK Stewardship Code

-- Sustainability Committee established by the Board which will be chaired by Gareth Davis

-- Commenced a large project this year to better understand our

climate impact as a business and as investors, ahead of planned

reporting against the TCFD recommendations in 2022

Commenting on the results, Tony Dalwood, Chief Executive Officer

said:

"Our first half performance has been very strong, with robust

AUM growth driven by organic progress and international expansion.

In addition, the acquisition of the Mobeus VCT business, announced

today, will create further shareholder value.

"We continue to see strong demand for our ESG-focused investment

strategies, underpinned by our compelling investment performance. A

number of our sustainability-focused funds have held successful

closes since the half-year end and the acquisition of the Mobeus

VCT business also brings significant scale to create a leading

player in the VCT segment.

"The Group has built an effective platform to grow AUM further

by providing outstanding products in attractive asset classes. We

are extremely well positioned for further growth in second half of

2021 and beyond."

Ends

Gresham House will be hosting a Capital Markets Day on Thursday

4 November 2021 - details to be announced in due course.

This announcement contains inside information for the purposes

of the Market Abuse Regulation (596/2014/EU)("MAR")

For more information contact:

Gresham House plc

Tony Dalwood, Chief Executive Officer

Kevin Acton, Chief Financial Officer +44 (0)20 3837 6270

Houston - PR advisors

Alexander Clelland gh@houston.co.uk

Kay Larsen +44 (0)20 4529 0549

Canaccord Genuity Limited - Nominated Adviser and Joint Broker

Bobbie Hilliam

Georgina McCooke +44 (0)20 7523 8000

Jefferies International Limited - Joint Broker and Financial Adviser

Paul Nicholls

Max Jones +44 (0)20 7029 8000

About Gresham House

Gresham House is a specialist alternative asset management

group, dedicated to sustainable investments across a range of

strategies, with expertise across forestry, housing,

infrastructure, renewable energy and battery storage, public and

private equity.

Our origins stretch back to 1857, while our focus is on the

future and the long term. Quoted on the London Stock Exchange

(GHE:LN) we actively manage c.GBP4.7 billion of assets (as at 30

June 2021) on behalf of institutions, family offices, charities and

endowments, private individuals and their advisers. We act

responsibly within a culture of empowerment that encourages

individual flair and entrepreneurial thinking.

As a signatory to the UN-supported Principles for Responsible

Investment (PRI), our vision is to always make a positive social or

environmental impact, while delivering on our commitments to

shareholders, employees and investors.

www.greshamhouse.com

CHAIRMAN'S STATEMENT

It has been very pleasing to see the ongoing momentum of Gresham

House in the first half of 2021, with strong progress against the

financial and strategic targets of the five-year plan, 'GH25'.

Growth in AUM has proceeded apace towards the GH25 target of GBP6.0

billion. AUM was up 19% to GBP4.7 billion in the half through

organic and acquisition activity, reflecting our commitment to

creating shareholder value through growth and performance on

various metrics.

Moreover, our plan to establish a platform for international

growth is now evident in both Europe and Asia Pacific.

We were pleased to complete the acquisition of Appian Asset

Management (Appian), now Gresham House Ireland, on 29 June

following regulatory approval from the Central Bank of Ireland,

cementing the Group's international expansion plans with the

addition of a regulated EU-based platform post-Brexit, alongside

our intention to scale our activities in Ireland.

In addition, post period end, we were appointed as asset manager

for a 24,800-hectare Australian forestry investment, Green Triangle

Forest Products (GTFP), for AXA IM Alts, expanding our presence

outside Europe and growing our relationship with AXA IM Alts

following our appointment to manage a 4,074-hectare portfolio of

forests in Ireland in 2019. This is pending regulatory approval,

which we hope to provide an update on by the end of the year.

Our leadership in sustainable investing continues to be

underpinned by our broad product range and growth across all areas,

from renewable energy and sustainable infrastructure to housing and

forestry. We are increasingly recognised across the industry as

being at the forefront of sustainable investment, investing in

people and areas of opportunity which are evolving rapidly, whilst

demonstrating innovation and resilience in performance across our

product set.

Climate change is at the top of most investors' agendas and we

have worked with a number of clients to meet their increasing

climate reporting requirements. In addition, we provide our clients

with a range of solutions that take advantage of climate related

opportunities and positively influence environmental outcomes.

The Taskforce on Climate-Related Financial Disclosures (TCFD)

has become the widely recognised standard for climate reporting,

and we commenced a large project this year to better understand our

climate impact as a business and as investors. We are planning to

report against the TCFD recommendations in 2022 and will be

starting work with an external expert to provide our first climate

footprint as well as forward looking climate analysis.

Our investment expertise has been recognised in awards,

including Alternatives Manager of the Year from Pensions Age, and

more widely across our business with our UK Multi Cap Income Fund

winning awards from both Investment Week and Citywire. We are proud

to be finalists for many awards due to be judged in the second half

of 2021 and will be delighted to add to this roster.

Clearly clients are the focus for a long term, sustainable,

profitable and growing business like Gresham House, and as such, we

are pleased that the investment performance of our funds remains

strong and continues to attract new investors.

Activity in the period

The robust rise in AUM growth in the period reflects this strong

performance at a fund and strategic level across the business, as

well as net inflows and the completion of the Appian acquisition

(EUR396 million at 30 June 2021).

We expect this growth to continue with the fund launches

highlighted in the 2020 annual report which are on track. This

includes the Gresham House Forest Growth & Sustainability LP

securing GBP25 million by the end of the period and Gresham House

Residential Secure Income LP (ReSI LP) achieving commitments of

GBP70 million, with GBP16 million deployed by the end of the

period.

Our commitment to investing in people to support growth remains,

with senior hires across the business, including James Lindsay as

Head of Institutional Business to complement Heather Fleming and

our existing senior expertise in this area.

Results

I am also pleased to report continuing progress towards the

financial goals of GH25, with Net Core Income up 31% in the first

half of 2021 to GBP23.0 million (H1 2020: GBP17.5 million), and the

Adjusted Operating Profit up 32% in the same period to GBP6.9

million (H1 2020: GBP5.2 million).

We continue to invest in the business, with an operating margin

of 30% in the first half of 2021 (H1 2020: 30%), as we focus on

growing the business in areas of high-growth potential and where we

have sector/technical expertise to outperform versus the

market.

Board

As highlighted previously, Richard Chadwick will be standing

down as Audit Committee Chairman and Non-Executive Director at the

conclusion of the 2022 AGM.

We have completed the recruitment process for Richard's

replacement and I am pleased to welcome Richard's successor, Sarah

Ing as the Audit Committee Chair Designate, taking on full

responsibility on Richard's retirement at the conclusion of the

2022 AGM. Sarah will act as Richard's alternate from 15 September

2021 until Richard's retirement.

Sarah is a chartered accountant, with listed company experience

as a Non-Executive Director on XPS Pensions Group plc and CMC

Markets plc boards. Richard will handover through the 2021 year-end

process to ensure a smooth transition. I look forward to working

with Sarah as we continue the Company's growth story.

Outlook

Assets with a focus on ESG factors are on track to exceed $53

trillion by 2025, representing more than a third of the $140.5

trillion in projected total global assets under management,

according to Bloomberg.[1]

Gresham House is well positioned to take advantage of this

growth as many of our investment solutions contribute positively to

environmental and social outcomes, whilst offering investors strong

investment returns.

To that end, I am pleased to note that Gresham House Energy

Storage Fund plc (GRID), Gresham House Forest Growth &

Sustainability LP, and BSIF II LP, and ReSI LP have all held

successful closes since 30 June, adding over GBP350 million to AUM

and setting the Group in great stead for the second half of 2021

and beyond.

In addition, the acquisition of the Mobeus VCT business and the

associated equity raise will boost our AUM and significantly

enhance our profitability, marking substantial progress towards

achieving the targets laid out in our GH25 five-year plan. Pro

forma AUM increases to GBP5.4 billion after adding post period AUM

raised of over GBP350 million and GBP369 million from the Mobeus

VCT business acquisition.

As the VCT segment continues to consolidate, this latest

acquisition provides substantial scale to compete effectively amid

rising demand for early-stage growth capital from a range of

emerging disruptive businesses. The benefits to both the Baronsmead

and Mobeus VCT shareholders are clear from the increased resources

and platform that Gresham House can provide, including ESG

leadership.

We approach the second half of 2021 with real optimism having

laid down a solid platform to grow AUM we are ahead of management

expectations for 2021, and remain on track to deliver GH25 and

create further shareholder value.

Anthony Townsend

Chairman

9 September 2021

CHIEF EXECUTIVE'S REPORT

It has been 18 months since we set out our five-year strategy

'GH25' to target long-term shareholder value and I am delighted to

say we have been making strong progress against all our strategic

and financial objectives despite the challenges presented by the

global macro environment as a result of the pandemic.

We are increasingly recognised as leaders in ESG and sustainable

investing: the vast majority of our investment products are

outperforming their benchmarks; we are building significant market

share in specialist products; building on our international

presence and increasing client diversification and depth. All of

the above are enhancing our brand value and reputation and this has

been reflected in various industry awards alongside new investors

approaching us to become clients or work on a partnership

basis.

Whilst the environment has been challenging, with the UK in

lockdown for much of the first half of this year, we have seized

the opportunities across the business to improve our position in a

number of key areas.

Our culture is strong and contributes significantly to our

success. In our employee survey, 94% of respondents would recommend

Gresham House as a place to work. The Management Committee view

this as significant and important for the long-term growth

ambitions of the Group. We want people to enjoy their work and we

know this is a key ingredient in delivering for our clients.

We will continue to invest in growth areas, recruiting

high-calibre talent, while remaining focused on maintaining and

improving operating margins in line with the target in GH25.

Achieving AUM growth of 19%, taking us to GBP4.7 billion at the

half-way point of the year, is testament to the success of our

strategy to grow organically supported by acquisition, and we are

pleased to have already made such good progress against our target

of GBP6.0 billion by 2025.

We welcome our new colleagues in Ireland, where the Appian

acquisition builds on our existing presence managing forestry

assets for AXA IM Alts, and we foresee further growth under the new

name Gresham House Ireland, both in Ireland and across the EU from

this important platform.

We committed significant time to launching new funds and to

fundraising in the first half of 2021, which means we approach the

rest of the year with confidence.

Progress on 2021 priorities - Financial

Our significant AUM growth to date in 2021 and a series of

successful fundraises across our product set reflect the sustained

interest in ESG investing and the breadth of our offering.

In Housing, ReSI LP, a closed-ended limited partnership aiming

to deliver secure income returns by investing in portfolios of

shared ownership and rental homes, had a successful first close

with commitments of GBP70 million and we expect this vehicle to

scale over time. We are delighted that ReSI Homes, the registered

provider within ReSI LP, has been selected as a strategic partner

of the Greater London Authority to deliver affordable housing over

the next five years. Nationally ReSI Homes is one of only three

institutional investors to have been selected.

We continue to develop utility scale battery storage projects to

support the growth of Gresham House Energy Storage Fund plc (GRID)

and have GBP11 million invested in projects at the end of the

period and also completed the sale of 30MW to GRID in H1, deploying

balance sheet capital to support growth.

AUM growth has continued since 30 June 2021, with new fund

inflows of over GBP350 million. A further GBP100 million was raised

for GRID in early July and the launch of the Gresham House Forest

Growth & Sustainability LP, with a first close in August, added

a further GBP102 million to close at GBP127 million. In addition,

in sustainable infrastructure - BSIF II (British Sustainable

Infrastructure Fund II), reached a first close in August of GBP100

million. We also achieved a follow-on close for ReSI LP in August

for a further GBP50 million.

We expect this growth to continue through the second half of the

year, with further international expansion in Asia Pacific as we

pursue Carbon Credit opportunities in forestry and the anticipated

close of our new Australian forestry mandate with AXA IM Alts by

the end of 2021.

In Public Equity, we have seen continued inflows into our UK

Micro Cap and UK Multi Cap Income funds managed by the

award-winning Ken Wotton, Brendan Gulston and team. In line with

the specialist nature of Gresham House products, these funds focus

on small, mid-cap companies and micro-cap companies using a

fundamentals-based approach and a private equity philosophy,

designed to deliver attractive returns with a low correlation to

their peer group.

Our disciplined process leverages the fundamentals-driven

attributes of private equity, and our highly-resourced team has

access to specialist expertise via an extensive network derived

from their private equity heritage, alongside investment committees

with broad experience and successful track records. This is evident

in the growth in NAVs at Strategic Equity Capital (SEC) and Gresham

House Strategic (GHS), which grew by 24% and 22% respectively in

the first half. Importantly, the long-term track records of the

teams managing these investment funds are clearly very strong and

we are proud of the platform Gresham House provides for these teams

to flourish and add value to portfolio investments.

There was also successful fundraising in Private Equity, with a

successful close for the last fundraising round by the Baronsmead

VCTs, raising a total of GBP65 million, the highest amount raised

by these two VCTs to date (GBP32 million in 2021).

We remain focused on our other financial targets and have

achieved an operating profit margin of 30% in the period, and

alongside this an operating profit of GBP6.9 million. We have

continued to invest in the business for the long term, while

focused on productivity and efficiency throughout and the timing of

AUM delivery in 2021 will provide greater benefit to the second

half of 2021 and profitability in future years.

As part of GH25 we target a ROIC of 15%+ and we have continued

to use our balance sheet to invest, with the ultimate goal of

growing AUM while delivering 15%+ returns.

Progress on 2021 priorities - Strategic

In line with our ambition for Gresham House to be a leader in

sustainable investment, including ESG, we conducted a corporate ESG

gap analysis to identify where there are opportunities to develop

our business practices to reflect our ambition for leadership more

closely. From this analysis, we have identified several priorities

for the business:

1. Evolve our management and measurement of climate related

risks and opportunities at a corporate and investment level

2. Further enhance Diversity and Inclusion across the business

3. Evaluate sustainability factors across material supply chains

that our investments are a part of

To support the development of these priorities, we have further

invested in our Sustainable Investment Team by increasing the team

from one to three individuals. This will significantly bolster our

capacity to enhance our sustainable investment processes across all

divisions as well as at a corporate level.

In addition, the Board have established a Sustainability

Committee to provide oversight and accountability for our

sustainability related practices across the business. This

Committee will work closely with our Managing Director, Rupert

Robinson and Director of Sustainable Investment, Rebecca

Craddock-Taylor to progress the various priorities we have set

ourselves in relation to becoming a leader in this area. Further

details on our progress and plans can be found in the Sustainable

Investment overview.

Our plans for international expansion are advancing, and the

completion of our acquisition of Appian Asset Management, now

Gresham House Ireland, and the Australian forestry mandate, subject

to regulatory approval, are enabling us to operate in carefully

identified areas of the world where we see a business and cultural

fit.

We continue to maintain market share in specialist areas and

have seen further growth in our Forestry and New Energy businesses,

and we expect to grow in other areas with the close of additional

fundraises over the course of the year.

We are working to increase our client diversification and depth

and have had success with fund launches attracting new

institutional and long-term clients. We have also further invested

in our distribution team.

People

The Covid-19 pandemic has been a test of the culture of

organisations across the world. I am proud to say that my

colleagues across Gresham House responded in exemplary fashion to

the challenges it presented and our culture has remained strong

throughout these difficult times, including the periods of lockdown

we experienced earlier this year.

We have followed government guidelines closely to maintain the

safety of our teams, enabling our people to work remotely and

managing logistics around office work effectively. Following

consultation with the teams, our return to the office more

permanently will continue to focus on the wellbeing of our

employees and we will be adopting a hybrid working model,

recognising the benefits of this way of working for both the

Company and our people. We will be moving into a new office in

London, which has been designed to accommodate hybrid working

alongside improved facilities to support sustainability and the

growth of the business.

We continue to invest in talent across the business, including

notable senior hires in James Lindsay as Head of Institutional

Business, and Fernando Casas Garcia as Head of Operations for New

Energy, where increasing scale in areas such as battery storage has

driven the need for greater expertise in this area. This is also

the case with our Sustainable Investment team - it is an important

and growing part of the business and we are committed to working

with the highest quality talent.

Delivering top-quality service is our priority and we will

continue to invest in teams across the business to ensure this is

the case.

Outlook

We have enjoyed an encouraging H1 2021 and the outlook for the

rest of the year and beyond indicates a continuation of this

positive momentum. Whilst macroeconomic challenges are clear, the

structural growth in our areas of investment remains evident with

increasing asset allocation to real assets and specialist or

strategic equity.

In the first half, we have made good progress in many areas

against our GH25 objectives and our business has the opportunity to

grow further across the board, with our client base broadening and

deepening, and as we venture further into international

geographies.

I am also pleased to welcome the Mobeus VCT business to the

Gresham House family following the announced acquisition and equity

fund raise today. Together this adds scale to our expertise in

venture investing, while adding scale and enhancing earnings for

shareholders.

With Gresham House's positive reputation growing across the

spectrum of investment performance, product innovation, a focus on

appropriate governance, social benefits and environmental

awareness, we have completed the groundwork for a number of our

planned funds. We have held first closes in H1 and have a strong

pipeline of new investors lined up for closes in H2 having already

closed funds with AUM of over GBP350 million since the end of June,

bringing pro forma AUM to GBP5.1 billion. After the acquisition of

the Mobeus VCT business, pro forma AUM increases to GBP5.4 billion.

We are therefore confident that we will outperform the current

market expectations for the end of 2021.

Tony Dalwood

Chief Executive

9 September 2021

SUSTAINABILITY AT GRESHAM HOUSE

Progress on our corporate sustainability plan

Environmental awareness, understanding and action

In the past few months, we have been working to appoint an

external expert to help us measure our current carbon emissions

across our operations and our investments. The purpose of this

exercise will be to understand our baseline, so we can then set

targets and actions to reduce the impact we have on the environment

as a business and as investors.

Diversity and Inclusion (D&I) awareness, understanding and

action

In 2020 we published our first D&I policy setting out our

commitments to enhance D&I at Gresham House. This year we have

established a D&I Committee with representatives from across

the business who are tasked with implementing our D&I strategy

to set out the internal behaviours and actions to be rolled out to

improve diversity and inclusion across the Company and meet our

policy commitments. The D&I strategy will also establish a

range of objectives we want to achieve to support our company

strategy. The D&I strategy provides a shared direction,

commitment and set of goals and work streams for us over the next

four years. It outlines the key roles and responsibilities and how

we will track progress and measure success and is an integral part

of the financial and strategic targets of the GH25 plan.

In addition, we signed up to the #100blackinterns last year and

subsequently hired two individuals to work in our Sustainable

Infrastructure and Housing strategies and within our Sustainable

Investment team throughout the summer of 2021. We are building on

this and will be developing a formal internship programme to ensure

interns that work with us are able to gain valuable skills that can

be translated into their future careers.

People and community

Our people are our greatest asset and we have worked extremely

hard throughout the Covid-19 pandemic to ensure staff satisfaction

remains high. We will be completing our second employee engagement

survey in October, which will provide useful insights for the

Gresham House leadership team to understand where improvements have

been made relative to the results in 2020, and what areas need to

be prioritised in the remainder of 2021 and into 2022.

Communication and transparency

We published our first Sustainable Investment Report earlier

this year which includes case studies, measurements of what we have

achieved and key Group milestones. The report demonstrated what has

been achieved over the last year and the contribution that our

business and investments are having on the environment and

society.

Accreditations and commitments

We have maintained our London Stock Exchange Green Economy Mark

for Gresham House plc as well as for our listed battery storage

fund Gresham House Energy Storage Fund plc (GRID). Gresham House

Asset Management Limited has also met the expected standard of

reporting in 2021 and has been listed as a signatory to the 2020 UK

Stewardship Code. Earlier this year we reported for the second time

for the PRI and await the 2021 rating outcomes. We have also been

shortlisted for Best Sustainable & ESG Fund Management Group of

the Year (AUM under GBP20 billion), as well as Best Sustainable

& ESG Alternative Assets Fund for GRID at the 2021 Investment

Week Sustainable & ESG Investment Awards.

Policies, processes and systems

The Board has established a Sustainability Committee which will

be chaired by Gareth Davis. This Committee will provide oversight

and accountability for Gresham House plc's sustainability strategy

across our business operations and investment practices. The

Committee met for the first time in August 2021 where a range of

sustainability factors were discussed, including how we will

advance our management of climate change risks and

opportunities.

In addition, we also have our Sustainable Investing Committee

(SIC), which operates at the divisional level. This forum focuses

on sharing best practice between different divisions, whilst also

working as a unit to drive sustainability related deliverables

applicable to all divisions. The SIC's objective for the remainder

of 2021 is to build on existing processes and systems to enhance

our monitoring of sustainability factors during the holding period

of our investments.

Measurable investment actions

1. Planted 7 million trees in 2021 (versus 9 million for the calendar year 2020)*

2. Our existing forestry captured the equivalent CO2 generated

by 266,000 people in the UK annually (versus 270,000 in 2020)**

3. Invested in two businesses that plan to connect 5,000+ homes to the internet in 2021

4. Solar and wind projects generated enough energy to power over

131,000 homes in the last year (versus 117,000 homes in 2020)

5. Invested in a further 733 shared ownership homes (166 homes

in 2020) with a total shared ownership portfolio of 936 homes (205

homes in 2020)

6. Improved portfolio company engagement in 2020. We voted 97%

for management recommendations, 3% against, and had 0% abstentions.

(2019, we voted 94% for management recommendations, 6% against, and

had 0% abstentions)

* As at 7 September 2021. Based on 1,100 trees per hectare for

broadleaves and, 2,700 trees per hectare for conifers

** Existing forestry is captured in the UK national account, so

no direct offsetting claims can be made. Calculated using the

Woodland Carbon Code and based on the managed area decreasing from

141,000 hectares to 136,000 hectares

FINANCIAL REVIEW

We set out our priorities for 2021 and it is pleasing to see

that during the first half of the year we have made good

progress.

The Group's AUM increased to GBP4.7 billion at the end of the

first half, up 19% on the beginning of the year (GBP4.0 billion)

and we have since achieved a number of fund closes, which sets the

Group up well to deliver ahead of expectations in the second half

of the year.

Gresham House has seen net core income grow in the period by 31%

to GBP23.0 million compared to GBP17.5 million in the first half of

2020 and this has driven the adjusted operating profits of the

Group up by 32% to GBP6.9 million (H1 2020: GBP5.2 million). We

have continued our focus on the long-term scalable areas of the

business and continued to invest in people and systems and as such

the Group's operating margin has remained at 30% (H1 2020:

30%).

The Group also delivered total comprehensive income of GBP5.2

million (H1 2020: total comprehensive loss of GBP2.2 million),

reflecting the strong performance of the Group's balance sheet

investments in the period.

We have continued to use the Group's balance sheet to invest in

areas which will lead to increasing AUM and the generation of

long-term management fees.

Assets under management

AUM grew by 19% in the first six months of the year to GBP4.7

billion (Dec 2020: GBP4.0 billion). In line with our strategy this

was achieved through both organic growth of GBP453 million (12%)

and acquisition growth of GBP299 million (7%).

GBP millions AUM Net Fund Performance Funds Acquired/Won AUM Total

Dec-20 Flows(1) Jun-21 Growth

%

Strategic Equity

Public Equity 508 53 149 255 965 90.0%

Private Equity 412 11 54 - 477 15.8%

Subtotal 920 64 203 255 1,442 56.7%

Real Assets

Forestry 1,811 25 149 - 1,985 9.6%

New Energy &

Sustainable Infrastructure 932 - (4) - 928 (0.4)%

Housing 307 16 - 44 367 19.5%

Subtotal 3,050 41 145 44 3,280 7.5%

Total AUM 3,970 105 348 299 4,722 19.0%

1. Including funds raised, redemptions and distributions

Net fund inflows of GBP105 million across Strategic Equity,

Forestry and Housing highlighted the demand for the Group's

offering in these asset classes. We set out the key funds that we

were focused on raising in 2021 and these have shown good progress

with a first close for Gresham House Residential Secured Income LP

(ReSI LP), our shared ownership housing fund with committed capital

of GBP70 million, and deployed capital of GBP16 million by the end

of June 2021.

The performance of the Strategic Equity division in the period

was strong with GBP203 million growth in AUM, reflecting the high

performing nature of the funds managed by Ken Wotton and his

team.

We also completed the acquisition of Appian Asset Management

Limited (Appian), which has since been rebranded as Gresham House

Ireland and is an exciting platform to pursue our international

growth plans. The acquired AUM of GBP299 million (EUR350 million)

reflects the AUM at exchange in December 2020 and it is pleasing to

see that the AUM has since grown to GBP340 million (EUR396 million)

across the equities and property funds managed by Gresham House

Ireland.

Adjusted operating profit

The adjusted operating profit for the Group grew in the first

half of 2021 by 32% to GBP6.9 million (H1 2020: GBP5.2 million). We

use the non-GAAP measure of adjusted operating profit as a key

performance indicator for Gresham House as an alternative asset

manager and have separated out net performance fees and net gains

on investments. As set out in the 2020 Annual Report, the adjusted

operating profit is defined as the net trading profit of the Group

before deducting amortisation, depreciation and exceptional items

relating to acquisition and restructuring costs and share-based

payments relating to acquisitions.

Six months Six months

to 30 June to

2021 30 June 2020

GBP'000 GBP'000

Gross core income 23,648 17,803

Rebates, distribution costs and fundraising

costs (611) (254)

---------------- -----------------

Net core income 23,037 17,549

---------------- -----------------

Administration overheads (excluding amortisation,

depreciation, exceptional items and acquisition

related share-based payments) (16,041) (12,307)

Finance costs (102) (5)

Adjusted operating profit 6,894 5,237

---------------- -----------------

Adjusted operating margin 30% 30%

Performance fees (gross) 1,912 -

Variable compensation attributable to performance (1,497) -

fees

---------------- -----------------

Performance fees net of costs 415 -

---------------- -----------------

Realised gains on development projects 818 -

Variable compensation attributable to realised (511) -

gains

Development project costs (219) -

---------------- -----------------

Realised gains on development projects net 88 -

of costs

---------------- -----------------

Adjusted operating profit including performance

fees and net realised gains on development

projects 7,397 5,237

---------------- -----------------

Amortisation and depreciation (4,191) (4,482)

Acquisition related share-based payments

charges (253) (296)

Exceptional items (102) (1,170)

Net gains/(losses) on investments and other

fair value movements 3,305 (898)

Tax (908) (623)

---------------- -----------------

Operating profit/(loss) after tax 5,248 (2,232)

---------------- -----------------

Loss from discontinued operations (5) (6)

---------------- -----------------

Total comprehensive net income 5,243 (2,238)

---------------- -----------------

Income

Net core income in the period increased by 31% to GBP23.0

million (H1 2020: GBP17.5 million). This increase reflects the

organic growth in AUM across the business alongside AUM activity in

the second half of 2020 which is now coming through fully in the

first half of 2021.

The long-term nature of the Group's Real Asset management

contracts highlight the stable revenue streams for the business

with over GBP1.4 billion of AUM in Limited Partnership management

contracts with a weighted average contract length of 14 years. The

underlying assets within these funds of forests, infrastructure,

renewable energy and housing continue to provide a stable platform

to grow the business.

Administration expenses

Administration expenses, (excluding amortisation, depreciation,

share-based payments relating to acquisitions and exceptional

items) have increased in the period by 30% to GBP16.0 million (H1

2020: GBP12.3 million). We continue to manage costs diligently

while ensuring that we invest in critical areas of the business.

This includes a focused investment in our distribution and

investment teams as the key drivers of growth, as well as in

critical support functions such as compliance and legal. Headcount

for the Group increased to 138 at the end of June (H1 2020: 129

people), and a further 23 joined from Appian.

Performance fees

The Group received a performance fee of GBP1.9 million (H1 2020:

GBPnil) from Gresham House Strategic plc (GHS) in recognition of

the performance of GHS exceeding the NAV growth hurdle as set out

in the investment management agreement. This is a key tool to

incentivise the entire team that work on GHS and as such this is

allocated to the team, with the Group retaining GBP415,000.

Realised gains on investments

The Group sold one of the battery storage development projects,

Byers Brae, in the period to Gresham House Energy Storage Fund plc

(GRID), realising a gain of GBP818,000. The development of these

sites is also used to incentivise the team and as such a proportion

of the gain is paid to the team as a variable incentive. Other

costs associated with battery storage development projects were

GBP219,000 in the period.

Exceptional items in the first half of the year of GBP0.1

million (H1 2020: GBP1.2 million) reflect the fact that there were

lower acquisition related costs or restructuring in the first half

of the year. The majority of costs relating to the Appian

acquisition were recognised at the point of exchange in December

2020.

Gains and losses on investments

Gains on investments in the period of GBP3.3 million reflect the

recognition of the Group's investments in associates as well as the

fair value movements other investments and contingent consideration

relating to previous acquisitions. The treatment of GHS as an

associate requires the Group to recognise its share of profits or

losses in the period last reported by GHS. GHS has announced its

annual results for the period to 31 March 2021 and under associate

accounting the Group's share of the profits of GHS over this time

frame is GBP2.5 million. Other notable gains were Gresham House

Energy Storage Fund plc of GBP0.1 million, Strategic Equity Capital

plc of GBP0.2 million and Strategic Public Equity (SPE)

co-investments of GBP0.4 million.

Contingent consideration payable to the sellers of acquired

businesses is fair valued at each period end, with the movement

reflecting assessments of the expected final payment as well as the

discount over time. The fair value movement in the period of GBP0.4

million was primarily driven by the unwind of the discount (H1

2020: GBP0.7 million).

Financial position

The Group's focus on using its balance sheet to grow was key in

the first half of the year as investments grew from GBP23.3 million

to GBP34.9 million. Cash has reduced as a result of this from

GBP21.9 million to GBP10.1 million and we have drawn GBP5.0 million

of the Revolving Credit Facility (RCF).

The Group received proceeds of GBP5.0 million from the sale of

battery storage projects and some of the other smaller holdings in

the Group. This has been used alongside the RCF funds and operating

cash flows to fund a number of activities. These include c.GBP11.0

million investment into battery storage development projects,

commitments to new funds launched by the Group, the investment in

SEC plc following winning the mandate in 2020 and an investment in

a new sustainable infrastructure asset to develop land banks to

establish new biodiversity, Environment Bank Limited.

The remaining cash movement reflects the dividend paid in May

2021 of GBP1.9 million and the completion of the acquisition of

Appian for GBP0.8 million.

Outlook

Since the period end the Group has increased its AUM in ESG

attractive asset classes. In July GRID raised a further GBP100

million, the Gresham House Forest Growth & Sustainability Fund

LP added a further GBP102 million, BSIF II LP, the Group's second

sustainable infrastructure fund held a first close for GBP100

million and ReSI LP added a further GBP50 million of commitments.

This increases pro forma AUM to GBP5.1 billion and post the

acquisition of the Mobeus VCT business to GBP5.4 billion, setting

the Group up well for the rest of 2021 to achieve it's 2021

priorities and continue to deliver shareholder value.

Kevin Acton

Chief Financial Officer

9 September 2021

UNAUDITED CONDENSED GROUP STATEMENT OF COMPREHENSIVE INCOME

Six months Six months

ended ended Year ended

31 December

2020

30 June 2021 30 June 2020

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Income

Asset management income 22,960 17,583 40,304

Dividend and interest income 139 200 554

Other operating income 389 20 1,078

Performance fees 1,912 - -

------------- ------------- ------------

Total income 5 25,400 17,803 41,936

Operating costs

Administrative overheads (23,323) (17,339) (42,052)

------------- ------------- ------------

Net operating profit/(loss)

before exceptional items 2,077 464 (116)

Finance costs (102) (5) (25)

Exceptional items 7 (102) (1,170) (1,775)

Net operating profit/(loss)

after exceptional items 1,873 (711) (1,916)

Gains and losses on investments

Share of associates' profits/(losses) 2,700 (177) 158

Profit on disposal of associate 413 - -

Gains and losses on investments

held at fair value 1,520 (64) 4,599

Movement in fair value of contingent

consideration (350) (657) (1,163)

Movement in value of deferred

receivable - - 224

Operating profit/(loss) before

taxation 6,156 (1,609) 1,902

Taxation (908) (623) (1,084)

------------- ------------- ------------

Operating profit/(loss) from

continuing operations 5,248 (2,232) 818

Loss from discontinued operations (5) (6) (12)

Total comprehensive income 5,243 (2,238) 806

============= ============= ============

Attributable to:

Equity holders of the parent 5,220 (2,237) 577

Non-controlling interest 23 (1) 229

------------- ------------- ------------

5,243 (2,238) 806

============= ============= ============

Basic profit/(loss) per ordinary

share (pence) 8 16.2 (7.7) 1.9

Diluted profit/(loss) per ordinary

share (pence) 8 15.3 (7.7) 1.8

Basic adjusted profit per ordinary

share (pence) 8 17.8 15.1 34.5

Diluted adjusted profit per

ordinary share (pence) 8 16.8 13.6 32.9

UNAUDITED CONDENSED GROUP STATEMENTS OF CHANGES IN EQUITY

Six months ended 30 June 2021 (unaudited)

Equity

Ordinary attributable Non-

Share Share Retained to equity controlling Total

Capital premium reserves shareholders interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December 2020 8,023 80,042 8,402 96,467 811 97,278

Profit and total comprehensive

income for the period - - 5,220 5,220 23 5,243

Contributions by and distributions

to owners

Share-based payments - - 445 445 - 445

Issue of shares 213 953 - 1,166 - 1,166

Dividends paid - - (1,881) (1,881) - (1,881)

--------- -------- --------- ------------- ------------ --------

Total contributions by and

distributions to owners 213 953 (1,436) (270) - (270)

--------- -------- --------- ------------- ------------ --------

Balance at 30 June 2021 8,236 80,995 12,186 101,417 834 102,251

========= ======== ========= ============= ============ ========

Six months ended 30 June 2020 (unaudited)

Equity

Ordinary attributable Non-

Share Share Retained to equity controlling Total

Capital premium reserves shareholders interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December 2019 6,956 69,242 14,039 90,237 582 90,819

Loss and total comprehensive

income for the period - - (2,237) (2,237) (1) (2,238)

Contributions by and distributions

to owners

Share-based payments 2 38 (1,715) (1,715) - (1,715)

Issue of shares 545 10,762 - 11,307 - 11,307

Dividends paid - - (1,351) (1,351) - (1,351)

--------- -------- --------- ------------- ------------ --------

Total contributions by and

distributions to owners 547 10,800 (3,106) 8,241 - 8,241

--------- -------- --------- ------------- ------------ --------

Balance at 30 June 2020 7,503 80,042 8,696 96,241 581 96,822

========= ======== ========= ============= ============ ========

Year ended 31 December 2020 (audited)

Equity

Ordinary attributable Non-

Share Share Retained to equity controlling Total

Capital premium reserves shareholders interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December 2019 6,956 69,242 14,039 90,237 582 90,819

Profit and total comprehensive

income for the year - - 577 577 229 806

Contributions by and distributions

to owners

Share-based payments 2 38 (4,863) (4,823) - (4,823)

Issue of shares 1,065 10,762 - 11,827 - 11,827

Dividends paid - - (1,351) (1,351) - (1,351)

--------- -------- --------- ------------- ------------ --------

Total contributions by and

distributions to owners 1,067 10,800 (6,214) 5,653 - 5,653

--------- -------- --------- ------------- ------------ --------

Balance at 31 December

2020 8,023 80,042 8,402 96,467 811 97,278

========= ======== ========= ============= ============ ========

UNAUDITED CONDENSED GROUP STATEMENT OF FINANCIAL POSITION

30 June 30 June 31 December

2021 2020 2020

Notes (unaudited) (unaudited) (audited)

Assets GBP'000 GBP'000 GBP'000

Non-current assets

Investments 10 13,443 9,872 9,086

Tangible fixed assets 1,432 743 1,090

Investment in associates 11,012 9,009 9,142

Intangible assets 63,133 63,779 59,970

Total non-current assets 89,020 83,403 79,288

-------------- ------------- --------------------

Current assets

Trade receivables 11,067 6,092 3,184

Accrued income and prepaid expenses 16,129 6,196 13,783

Other current assets 1,955 1,071 551

Deferred tax 895 613 1,051

Cash and cash equivalents 10,144 21,864 21,886

Non-current assets held for sale

Assets of a disposal group held

for sale 15,689 35,407 7,363

-------------- ------------- --------------------

Total current & non-current assets

held for sale 55,879 71,243 47,818

-------------- ------------- --------------------

Total assets 144,899 154,646 127,106

-------------- ------------- --------------------

Current liabilities

Trade and other payables 21,315 19,618 18,780

Liabilities of a disposal group

held for sale

Liabilities of a disposal group

held for sale 6,403 31,255 2,072

-------------- ------------- --------------------

27,718 50,873 20,852

-------------- ------------- --------------------

Total assets less current liabilities 117,181 103,773 106,254

Non-current liabilities

Deferred taxation 3,784 3,037 3,227

Long-term borrowings 5,822 - -

Other creditors 5,324 3,914 5,749

-------------- ------------- --------------------

14,930 6,951 8,976

-------------- ------------- --------------------

Net assets 102,251 96,822 97,278

============== ============= ====================

Capital and reserves

Ordinary share capital 11 8,236 7,503 8,023

Share premium 80,995 80,042 80,042

Retained reserves 12,186 8,696 8,402

-------------- ------------- --------------------

Equity attributable to equity shareholders 101,417 96,241 96,467

Non-controlling interest 834 581 811

-------------- ------------- --------------------

Total equity 102,251 96,822 97,278

============== ============= ====================

Basic net asset value per ordinary

share (pence) 12 307.8 320.7 300.6

============== ============= ====================

Diluted net asset value per ordinary

share (pence) 12 291.7 288.9 287.4

============== ============= ====================

UNAUDITED CONDENSED GROUP STATEMENT OF CASH FLOWS

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

Notes (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Net cash generated from operations 13 (6,097) 6,225 17,592

Corporation tax paid (447) (98) (1,856)

Interest paid on loans (51) (5) (25)

Net cash flow from operating

activities (6,595) 6,122 15,711

============= ============= ================

Cash flow from investing activities

Acquisition of Appian Asset Management

Limited (841) - -

Acquisition of TradeRisks Limited - (8,045) (8,045)

Deferred consideration paid (794) - (9,842)

Investment in associates (15) - -

Dividends received from associates 258 82 186

Sale of associate 855 - -

Purchase of investments (6,013) (269) (1,007)

Sale of investments 1,422 187 3,032

Investment in DevCo projects (3,156) (2,021) (1,271)

DevCo loans repaid - 1,096 1,096

Proceeds received on sale of

DevCo projects 2,281 2,334 4,581

Purchase of fixed assets (87) (103) (152)

Purchase of intangible assets (371) (286) (584)

(6,461) (7,025) (12,006)

============= ============= ================

Cash flow from financing activities

New loans in period 5,000 - -

Share issue proceeds - 8,010 8,010

Share issue costs - (347) (347)

Share warrants exercised - 182 182

Share-based payments settled (1,529) (2,860) (7,125)

Dividends paid (1,881) (1,351) (1,351)

Capital element of lease payments (276) (299) (620)

------------- ------------- ----------------

1,314 3,335 (1,251)

============= ============= ================

(Decrease)/increase in cash and

cash equivalents (11,742) 2,432 2,454

Cash and cash equivalents at

start of period 21,886 19,432 19,432

Cash and cash equivalents at

end of period 10,144 21,864 21,886

============= ============= ================

NOTES TO THE ACCOUNTS

1 REPORTING ENTITY

Gresham House plc (the Company) is a public limited company

limited by shares incorporated in the United Kingdom under the

Companies Act and registered in England. The unaudited condensed

group interim financial statements of the Company as at and for the

six months ended 30 June 2021 comprise the Company and its

subsidiary undertakings (together referred to as the Group). All

intra-group transactions, balances, income and expenses are

eliminated on consolidation.

2 STATEMENT OF COMPLIANCE AND BASIS OF PREPARATION

The financial information presented in these interim results has

been prepared in accordance with international accounting standards

in conformity with the requirements of the Companies Act 2006. The

principal accounting policies adopted in the preparation of the

financial information in these interim results are primarily

unchanged from those used in the Company's financial statements for

the year ended 31 December 2020 and are consistent with those that

the Company expects to apply in its financial statements for the

year ended 31 December 2021.

The financial information for the year ended 31 December 2020

presented in this Interim Report does not constitute the Company's

statutory accounts for that period but has been derived from them.

The Report and Accounts for the year ended 31 December 2020 were

audited and have been filed with the Registrar of Companies. The

Independent Auditor's Report on the Report and Accounts for the

year ended 31 December 2020 was unqualified and did not draw

attention to any matters by way of emphasis and did not contain

statements under s498(2) or (3) of the Companies Act 2006. The

financial information for the periods ended 30 June 2020 and 30

June 2021 are unaudited and have not been reviewed by the Company's

auditors.

3 ESTIMATES AND MANAGEMENT JUDGEMENTS

The preparation of the unaudited condensed group interim

financial statements requires management to make judgements,

estimates and assumptions that affect the application of accounting

policies and the reported amounts of assets and liabilities, income

and expense. Actual results may differ from these estimates.

In preparing these unaudited condensed group interim financial

statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation were the same as those that applied to the group

financial statements as at and for the year ended 31 December

2020.

4 FINANCIAL RISK MANAGEMENT

The Group's financial risk management objectives and policy are

consistent with those disclosed in the group financial statements

as at and for the year ended 31 December 2020.

5 INCOME

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Asset management income

Asset management income 22,960 17,583 40,304

22,960 17,583 40,304

----------- ----------- -------------

Income from investments

Dividend income - Listed UK 106 138 316

LP Distributions 4 - -

Interest receivable - Banks 2 51 69

- Other 27 11 169

----------- ----------- -------------

139 200 554

----------- ----------- -------------

Other operating income

Other income 1 20 51

DevCo income * 388 - 1,027

----------- ----------- -------------

389 20 1,078

----------- ----------- -------------

Performance fees

Performance fees 1,912 - -

----------- ----------- -------------

1,912 - -

----------- ----------- -------------

Total income 25,400 17,803 41,936

=========== =========== =============

* DevCo income represents the net operating income in the period

from battery storage projects prior to the projects being sold to

Gresham House Energy Storage Fund plc (GRID)

NOTES TO THE ACCOUNTS

6 BUSINESS COMBINATIONS

On 29 June 2021 the Group acquired 100% of the issued share

capital of Appian Asset Management Limited (Appian), a company

registered in Ireland. Appian is an active asset manager with

around EUR350 million in Assets Under Management (AUM) as at 31

December 2020. The Acquisition enhances the Group's capabilities to

develop existing strategies in Ireland and Europe, particularly

those with a sustainability focus including Forestry, Sustainable

Infrastructure, and Housing.

The provisional fair value of the identifiable net assets

acquired, and the consideration paid under IFRS 3 are as

follows:

Net book

value Adjustments Fair value

GBP'000 GBP'000 GBP'000

Tangible fixed assets 54 616 670

Cash 2,305 - 2,305

Trade and other receivables 604 - 604

Trade and other payables (1,464) (825) (2,289)

Intangible fixed assets (including goodwill) - 6,568 6,568

Deferred tax liability - (962) (962)

Total identifiable net assets 1,499 5,397 6,896

========= ============ ===========

Under the terms of the acquisition agreement, the fair value of

the consideration paid to the vendors of Appian was:

GBP'000

Cash 3,146

Shares - 104,168 shares in Gresham House plc valued at 940.0p

per share on 29 June 2021 979

--------

Total initial consideration 4,125

Contingent consideration 2,771

Total consideration 6,896

========

The consideration shares were admitted to trading on AIM on 5

July 2021.

Contingent consideration

Contingent consideration with an expected fair value of EUR4.5

million will be payable in cash to the sellers based on the

following:

-- 1.4 times year 2 earnings, payable in 2 years. The expected

fair value at acquisition is GBP1.0 million;

-- 1.4 times year 3 earnings, payable in 3 years. The expected

fair value at acquisition is GBP1.4 million; and

-- Up to EUR0.75 million payable in 3 years based on certain AUM

and earnings targets. The expected fair value at acquisition is

GBP0.3 million

The fair value of the contingent consideration has been

estimated at the date of acquisition using estimated outcomes, the

probability of those outcomes and discounting this at 13.0%. Up to

50% of the contingent consideration may be settled in Gresham House

plc shares at the Company's discretion. As such this will be

recognised as a liability on the balance sheet and the fair value

assessed each reporting period. The fair value at the time of

acquisition was calculated as GBP2.8 million.

Revenue and profits of Appian

Appian was acquired on 29 June 2021. The Group has therefore not

recognised any revenues or costs in respect of Appian for the

period ended 30 June 2021.

Prior to acquisition by the Group, Appian had a 31 December year

end. The results for the most recent audited reporting period prior

to acquisition were to 31 December 2020. Had Appian been part of

the Group for the entire reporting period the following sums would

have been consolidated:

EUR'000

Revenue 3,403

Profit before tax 284

Goodwill

Goodwill arises due to the excess of the fair value of the

consideration payable over the fair value of the net assets

acquired. It is mainly attributable to the skills of the team

acquired, the synergies expected to be achieved from the

acquisition and the business development potential. Goodwill

arising on the Appian acquisition is not deductible for tax

purposes.

Fair value

The fair value of the management contracts and customer

relationships have been estimated using a discounted cash flow

model. The estimated cash flows have been valued at a discount of

13.0%.

NOTES TO THE ACCOUNTS

7 EXCEPTIONAL ITEMS

Six months

Six months ended Year ended

ended 30 30 June 31 December

June 2021 2020 2020

GBP'000 GBP'000 GBP'000

Acquisition costs

TradeRisks Limited - 847 868

Appian Asset Management Limited 8 - 328

Joint Venture establishment - 210 219

Other 54 30 30

----------- ----------- -------------

62 1,087 1,445

Restructuring costs 40 83 330

102 1,170 1,775

=========== =========== =============

Acquisition and associated restructuring costs are considered

exceptional and not part of the normal course of asset management

activity.

8 EARNINGS PER SHARE

Basic and diluted profit/(loss) per share

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

Total net profit/(loss) attributable to equity

holders of the parent (GBP'000) 5,220 (2,237) 577

Weighted average number of ordinary shares

in issue during the period 32,291,046 29,099,750 30,479,015

Basic profit/(loss) per share to equity holders

of the parent (pence) 16.2 (7.7) 1.9

=========== =========== =============

Diluted profit/(loss) per share to equity

holders of the parent (pence) 15.3 (7.7) 1.8

=========== =========== =============

1,818,884 (30 June 2020: 3,301,297; 31 December 2020: 1,475,509)

shares were deemed to have been issued at nil consideration as a

result of the shareholder and supporter warrants granted (in prior

periods) and shares which could be issued under the bonus share

matching plan and long-term incentive plans which, as required

under IAS 33, Earnings per Share, were not recognised for the six

months ended 30 June 2020 as they would reduce the loss per

share.

Adjusted earnings per share

Adjusted earnings per share is based on adjusted operating

profit after tax, which is stated after charging interest but

before depreciation, amortisation, share-based payments relating to

acquisitions, profits and losses on disposal of tangible fixed

assets, net performance fees, net development gains and exceptional

items, to provide the non-GAAP measure of the performance as an

asset manager. This includes dividend and interest income received

from investment in associates.

Adjusted profit for calculating adjusted earnings per share:

Six months

Six months ended Year ended

ended 30 30 June 31 December

June 2021 2020 2020

GBP'000 GBP'000 GBP'000

Net operating profit/(loss) after exceptional

items 1,873 (711) (1,916)

Add back:

Exceptional operating expenses 102 1,170 1,775

Depreciation and amortisation 4,188 4,482 8,904

Loss on disposal of tangible fixed assets 3 - 27

Dividend income received from associates 160 - 202

Net performance fees (415) - -

Variable compensation attributable to realised

gains on development projects 511 - 2,474

Development project costs 219 - -

Share-based payments relating to acquisitions 253 296 593

----------- ----------- -------------

Adjusted operating profit attributable to

equity holders of the parent before tax 6,894 5,237 12,059

Corporation tax attributable to adjusted

operating profit (1,157) (832) (1,541)

Adjusted operating profit attributable to

equity holders of the parent after tax 5,737 4,405 10,518

Adjusted profit per share (pence) - basic 17.8 15.1 34.5

=========== =========== =============

Adjusted profit per share (pence) - diluted 16.8 13.6 32.9

=========== =========== =============

NOTES TO THE ACCOUNTS

9 DIVIDENDS

The Company paid GBP1,881,000 during the period which represents

a final dividend for the year ended 31 December 2020 of 6.0 pence

per share. A final dividend for the year ended 31 December 2019 of

4.5 pence per share totalling GBP1,351,000 was paid in May

2020.

10 INVESTMENTS - SECURITIES

Investments have been classified as follows:

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Non-current assets 13,443 9,872 9,086

Other debtors due within one year - Investment

in development projects 1,955 752 551

15,398 10,624 9,637

======== ======== ============

A further analysis of total investments is as follows:

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Listed securities - on the London Stock Exchange 6,521 6,318 3,991

Securities dealt in under AIM 1,222 395 950

Securities dealt in under Aquis Stock Exchange 6 13 7

Unlisted securities 7,649 3,898 4,689

Closing value 15,398 10,624 9,637

======== ======== ============

Investments valued at fair value through profit

or loss 13,443 9,605 8,874

Loans and receivables carried at amortised cost 1,955 1,019 763

15,398 10,624 9,637

======== ======== ============

Unlisted securities primarily include the Group's investment in

the Gresham House Forestry Fund LP (GBP3.0 million, including

non-controlling interests), investment in battery storage projects

(GBP2.0 million) included within other debtors due within one year,

an investment in Environment Bank Limited (GBP1.2 million),

co-investments into funds managed by the Group (GBP0.6 million) and

an investment of GBP0.7 million in LF GH Equity Funds.

11 SHARE CAPITAL

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Allotted: Ordinary - 32,945,875 (30 June 2020:

30,012,401; 31 December 2020: 32,091,707) fully

paid shares of 25p each 8,236 7,503 8,023

======== ======== ============

During the six months to 30 June 2021 the Company issued the

following new ordinary shares:

-- 750,000 shares on 26 March 2021 at par into the Gresham House Employee Benefit Trust; and

-- 104,168 shares on 29 June 2021 at a price of 940.0p per share

to the vendors of Appian Asset Management Limited.

NOTES TO THE ACCOUNTS

12 NET ASSET VALUE PER SHARE

Basic

30 June 30 June 31 December

2021 2020 2020

Equity attributable to holders of the parent

(GBP'000) 101,417 96,241 96,467

Number of ordinary shares in issue at the end

of the period 32,945,875 30,012,401 32,091,707

Basic net asset value (pence) 307.8 320.7 300.6

=========== =========== ============

Diluted

30 June 30 June 31 December

2021 2020 2020

Equity attributable to holders of the parent

(GBP'000) 101,417 96,241 96,467

Number of ordinary shares in issue at the end

of the period 34,764,759 33,313,698 33,567,216

Diluted net asset value (pence) 291.7 288.1 287.4

=========== =========== ============

Diluted net asset value per share is based on the number of

shares in issue at the period end together with 1,818,884 (30 June

2020: 3,301,297; 31 December 2020: 1,475,509) shares deemed to have

been issued at nil consideration as a result of the shareholder and

supporter warrants (in prior periods) and shares which could be

issued under the bonus share matching plan and long-term incentive

plans.

13 RECONCILIATION OF NET OPERATING LOSS TO OPERATING CASH

FLOWS

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Net operating profit/(loss) after exceptional

items 1,873 (711) (1,916)

Loss from discontinued operations (5) (6) (12)

Interest payable 54 5 25

Depreciation 413 529 871

Loss on disposal of tangible fixed assets 3 - 27

Amortisation 3,776 3,953 8,033

Share-based payments 1,972 1,105 2,262

8,086 4,875 9,290

(Increase)/decrease in current assets (11,284) 3,851 1,777

(Decrease)/increase in current liabilities (2,899) (2,501) 6,525

(6,097) 6,225 17,592

========= =========== ============

14 POST BALANCE SHEET EVENTS

On 29 June 2021 the proposed cancellation of part of the share

premium account of the Company totalling GBP60.0 million was

approved by the High Court of Justice in England and Wales. The

capital reduction became effective on 23 July 2021 following the

registration of the order of the Court by the Registrar of

Companies.

On 10 September 2021 the Company announced the acquisition of

the Venture Capital Trust (VCT) business of Mobeus Equity Partners

LLP, through the acquisition of the management contracts of the

VCTs and the hiring of the team. The Company will pay initial

consideration on completion of GBP20.0 million cash and GBP4.0

million in ordinary shares of the Company, with a further GBP12.1

million in deferred consideration which is subject to conditions

and performance.

[1]

https://www.bloomberg.com/professional/blog/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKKBQPBKKCCD

(END) Dow Jones Newswires

September 10, 2021 02:00 ET (06:00 GMT)

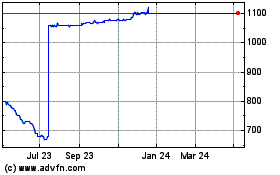

Gresham House (LSE:GHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gresham House (LSE:GHE)

Historical Stock Chart

From Apr 2023 to Apr 2024