Gresham House PLC Intended Purchase of Shares by EBT (5097S)

14 July 2022 - 9:02PM

UK Regulatory

TIDMGHE TIDMTTM

RNS Number : 5097S

Gresham House PLC

14 July 2022

14 July 2022

Gresham House plc

("Gresham House" or the "Company")

Intended Purchase of Shares by Employee Benefit Trust

The Company announces that Intertrust Employee Benefit Trustee

Limited, the trustee of the Gresham House Plc Employee Benefit

Trust (the "EBT"), has indicated its intention to make market

purchases in ordinary shares of the Company for the benefit of the

EBT up to a value of GBP2 million, to help meet future obligations

arising under the Company's long-term incentive plan (the "Market

Purchases").

The Market Purchases are subject to the EBT's discretion as to

the purchase price, in consultation with Canaccord Genuity, the

Company's broker, to be paid up to a pre-agreed maximum price per

ordinary share in the Company.

It is expected that the Market Purchases will be funded by

amounts advanced by the Company by way of loan, such funding having

been provided for within recent public announcements as to the

Company's outlook.

Further announcements will be made on completion of the Market

Purchases.

- Ends -

For more information contact:

Gresham House plc +44 (0)20 3837

Kevin Acton, Chief Financial Officer 6270

gh@houston.co.uk

Houston - media and analysts +44 (0) 20 4

Kay Larsen 529 0549

Joe Burgess

Canaccord Genuity Limited - Nominated Adviser

and Joint Broker

Bobbie Hilliam +44 (0)20 7523

Georgina McCooke 8000

Jefferies International Limited - Joint Broker

and Financial Adviser

Paul Nicholls +44 (0)20 7029

Max Jones 8000

About Gresham House

Gresham House plc is an AIM quoted specialist asset manager

providing funds, direct investments and tailored investment

solutions, including co-investment across a range of highly

differentiated alternative investment strategies. Our expertise

includes timber, renewable energy, housing and infrastructure,

strategic public and private equity (private assets). The group

aims to deliver sustainable financial returns and is committed to

building long-term partnerships with clients (institutions, family

offices, high-net-worth individuals, charities and endowments and

private individuals) to help them achieve their financial

goals.

Shareholder value creation will be driven by long-term growth in

earnings as a result of increasing AUM and returns from invested

capital.

www.greshamhouse.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUSRARURUBAAR

(END) Dow Jones Newswires

July 14, 2022 07:02 ET (11:02 GMT)

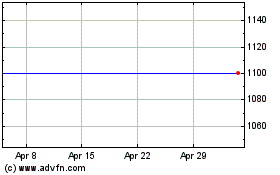

Gresham House (LSE:GHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

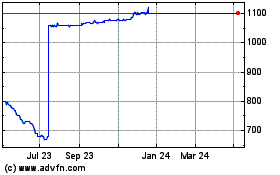

Gresham House (LSE:GHE)

Historical Stock Chart

From Apr 2023 to Apr 2024