TIDMGLB

RNS Number : 3848K

Glanbia PLC

05 May 2022

FIRST QUARTER 2022 INTERIM MANAGEMENT STATEMENT

Glanbia reports a strong Q1, FY 22 guidance raised

05 May 2022 - Glanbia plc, the global nutrition group

("Glanbia", the 'Group', "plc" or the 'Company'), is issuing this

Interim Management Statement for the three month period ended 2

April 2022 ("first quarter" or "Q1 2022" or "Q1"). This statement

is issued in conjunction with the plc's Annual General Meeting

("AGM") which is being held today.

Summary

-- Q1 2022 wholly-owned revenues up 25.0% on a constant currency

basis (up 33.5% reported) versus prior year due to good demand

across both Glanbia Performance Nutrition ("GPN") and Glanbia

Nutritionals ("GN");

-- Significant action taken across the Group to mitigate

inflation with pricing increased by 17.0% and volume growth

sustained at 6.9%;

-- Q1 like-for-like(1) ("LFL") wholly-owned revenue growth of 23.9% versus prior year;

-- GPN delivered LFL revenue growth in Q1 2022 of 14.7% on a

constant currency basis driven by pricing actions and strong demand

in sports nutrition, healthy snacking and plant based products;

-- GN Nutritional Solutions ("NS") delivered LFL revenue growth

in Q1 2022 of 19.0% on a constant currency basis driven by pricing

and strong customer demand in micro-nutrients;

-- NS acquired Sterling Technology, a US bioactive ingredient

company focused on immunity solutions, for $60 million plus

deferred consideration;

-- Glanbia Ireland disposal closed during Q1;

-- Net debt at the end of Q1 2022 of EUR552.3 million, (Q1 2021,

EUR498.5 million) with significant borrowing capacity on balance

sheet; and

-- Following a strong first quarter, Glanbia is raising guidance

and now expects to deliver 5% to 10% growth in adjusted EPS on a

constant currency basis.

Commenting today, Siobhán Talbot, Group Managing Director

said:

"I am pleased to announce a strong 2022 first quarter

performance for Glanbia. Glanbia continues to grow as a focused,

purpose-led global nutrition company serving powerful consumer

health and wellness trends. This strategy underpins our growth,

which continued in first quarter of 2022 with revenues up 25.0%, on

a constant currency basis, versus prior year. Inflation remains a

key dynamic for Glanbia and we have taken significant mitigating

actions across the Group by increasing prices by 17.0% in the first

quarter and delivering volume growth of 6.9% while managing our

cost base prudently. The GPN consumer branded business has

performed well delivering volume growth across performance

nutrition, healthy snacking and plant based brands as consumer

demand for our brands remains robust. Our NS ingredients business

delivered an excellent quarter as customer demand across

micro-nutrients in particular remains strong.

We have maintained momentum on our strategic agenda in the

period by completing the disposal of our interest in the Glanbia

Ireland joint venture as well as acquiring Sterling Technology, a

bioactive ingredient company, which builds on our offering in

immunity solutions in NS. To-date in 2022 we have also invested

EUR123.4 million in share buybacks.

The strong first quarter gives us confidence for the remainder

of the year and we have raised our expectations for full year 2022,

and now expect to deliver between 5% to 10% growth in adjusted EPS

on a constant currency basis."

Summary revenue progression

Summary of Q1 2022 revenue progression

versus Q1 2021

Reported

Constant currency movement movement

=========================================================

Total

constant Total

Volume Price Like-for-like Acquisition currency reported

======= ==========

Glanbia Performance

Nutrition 1.7% 13.0% 14.7% 1.0% 15.7% 22.8%

----------------------- ------- ------ -------------- ------------ ---------- ----------

Glanbia Nutritionals 9.4% 18.8% 28.2% 1.1% 29.3% 38.3%

----------------------- ------- ------ -------------- ------------ ---------- ----------

Nutritional Solutions 4.2% 14.8% 19.0% 3.4% 22.4% 29.9%

US Cheese 11.7% 20.7% 32.4% - 32.4% 42.2%

----------------------- ------- ------ -------------- ------------ ---------- ----------

Total wholly-owned

businesses 6.9% 17.0% 23.9% 1.1% 25.0% 33.5%

======================= ======= ====== ============== ============ ========== ==========

In the three months ended 2 April 2022 compared to the same

period in 2021, wholly-owned revenue increased 25.0%, constant

currency. On a reported basis, reflecting the stronger Euro US

Dollar foreign exchange rate(2) , revenue increased 33.5%. The

drivers of the revenue increase, on a constant currency basis was

volume growth of 6.9%, price increase of 17.0% and acquisitions

representing 1.1%. Volume was positive across all segments as

demand in the Group's end markets remains robust. The Group has

been proactively raising prices materially across its portfolio of

brands and ingredients to counteract cost inflation in raw

materials in particular. Acquisitions remain a core strategy for

the Group with the PacMoore and LevlUp acquisitions in GN and GPN

respectively contributing to growth in the period.

Outlook

Glanbia is successfully growing revenue year to-date despite a

number of significant risks including inflation, geopolitical

tensions and continued Covid related supply chain disruption,

particularly in Asia.

In the absence of any further major market disruption, the

strong start to 2022 provides increasing confidence in the Group's

ability to stay close to the nutrition needs of consumers and

navigate external challenges. Glanbia is now confident to raise its

outlook and for full year 2022, GPN expects to deliver double digit

revenue growth while GN NS expects strong double digit revenue

growth. Revenue growth in both platforms will be primarily driven

by pricing as previously noted.

EBITA growth is expected to be delivered in both GPN and GN NS

for FY 2022.

Full year expectations for US Cheese and JVs are unchanged from

prior views.

As previously outlined, some full year margin contraction is

expected in GPN, due to the lag effect of inflation and pricing

action. In GN NS full year margin contraction will be driven by the

mathematical dilution of significant top line pricing changes

particularly in dairy ingredients.

From a Group perspective, the strong focus on cash generation is

expected to deliver an operating cash flow conversion rate of over

80% in 2022.

The Group now expects to deliver 5% to 10% growth in adjusted

EPS on a constant currency basis. Based on current foreign exchange

rates the reported adjusted EPS result is expected to be 10% higher

than the constant currency basis.

Glanbia Performance Nutrition (all commentary is on a constant

currency basis(2) )

GPN delivered revenue growth of 15.7% in the first quarter of

2022 compared to the prior year. This was a strong performance in

the context of the prior year comparative and was driven by a price

increase of 13.0%, a volume increase of 1.7% and the LevlUp

acquisition adding 1.0%. Branded revenue for the first quarter grew

on a like-for-like basis by 16.7% with 13.4% growth in pricing and

volume growth of 3.3%.

Volume performance was driven by good growth in performance

nutrition, healthy snacking and plant based categories offset by

declines in the diet category. Price improvement was driven by the

impact of price increases which were implemented in the third

quarter of 2021 and in the first quarter of 2022.

Americas

GPN Americas delivered 13.8% revenue growth in the first quarter

of 2022. This was driven by a good performance in sports nutrition,

healthy snacking and plant based categories with key brands in

these categories delivering good volume growth. The majority of

price increase was focused on these categories and the consumer

response has been positive with strong consumption trends

continuing into the second quarter.

Consumers remain focused on returning to healthy lifestyles as

well as making healthy choices in their everyday nutrition and this

continues to be a powerful driver of demand across the portfolio

and in particular for the ON, think!, Isopure and Amazing Grass

brands.

The diet category continued to experience headwinds during the

key first quarter and this impacted consumption trends and revenue

performance for the SlimFast brand. Informed by consumer research,

GPN is in the process of broadening the brand appeal of SlimFast

from diet into weight management, a refresh that will be supported

by new brand and pack design, new creative content and new

innovation in the second half of the year.

International

GPN International delivered 20.1% revenue growth in the first

quarter with both volume and price growth as well as the LevlUp

acquisition.

Demand and consumption trends in the first quarter across key

international markets has remained robust across performance

nutrition categories. Pricing action to mitigate inflation has been

taken globally across the portfolio.

The European direct-to-consumer ("DTC") business has performed

well in the period delivering revenue growth as consumer demand for

performance nutrition remained robust in its core markets.

Glanbia Nutritionals (all commentary is on a constant currency

basis(2) )

GN delivered strong revenue growth in the first quarter of 2022

versus prior year. Revenue increased by 29.3% versus prior year

driven by a volume increase of 9.4%, a price increase of 18.8% and

acquisitions delivering 1.1% revenue growth.

Nutritional Solutions

NS revenue increased by 22.4% in the period. Volume growth was

good at 4.2%, pricing increased by 14.8% and acquisitions delivered

3.4% revenue growth.

Volume growth in Q1 2022 was driven primarily by a strong

performance in micro-nutrients due to strong end market demand in

immunity and mainstream food and beverage. NS has taken pricing

action across the portfolio to mitigate inflation including

pass-through pricing of dairy market inflation in the period.

Throughout Q1 there has been strong global demand from customers

oriented to health, wellbeing and immune enhancing trends as well

as mainstream food and beverage in a range of product formats. NS

expects these trends to continue in the second quarter. The

PacMoore acquisition, completed in September 2021, is performing

well. NS completed the acquisition of Sterling Technology in March

2022.

Sterling Technology acquisition

On 11 March 2022 Glanbia acquired Sterling Technology

("Sterling"), a bioactive ingredient company based in South Dakota,

USA for a purchase price of $60 million plus deferred

consideration. Sterling will complement the existing ingredient

technology portfolio of NS providing bioactive ingredients which

are mainly used in the growing immunity and gut-heath segments as

well as in pet nutrition. Sterling 2021 revenue was $23.6 million

and the acquisition is expected to be marginally accretive to

earnings in FY 2022.

US Cheese

US Cheese revenue increased by 32.4% in the period. This was

driven by volume growth of 11.7% and pricing growth of 20.7%.

Volume growth was driven by US Cheese sales from the new

large-scale joint venture plant in Michigan which was commissioned

during 2021. Overall end market demand has remained robust during

the quarter. Pricing reflects the higher year-on-year market

pricing. US Cheese operates a robust business model which largely

provides margin protection against dairy price fluctuations.

Joint ventures - continuing operations

The Group's joint ventures have performed in line with

expectations with share of profit after tax lower versus prior year

due to strong comparatives.

Glanbia Ireland disposal

On 1 April 2022, Glanbia completed the disposal of its 40%

interest in the Glanbia Ireland joint venture ("Glanbia Ireland")

to Glanbia Co-operative Society Limited for EUR307 million. Up to

date of disposal, Glanbia Ireland will continue to be presented as

a discontinued operation, separate to the other joint venture

operations which remain part of the Group and are unaffected by

this transaction.

The Group expects a net exceptional gain related to this

transaction.

Share Buyback

Glanbia maintained share buyback activity through the first

quarter deploying EUR91.5 million in the period. Buyback activity

has continued and to-date in 2022 Glanbia has deployed a total of

EUR123.4 million on share buybacks. Glanbia is proposing to renew

its authority to complete share buybacks at the Company's annual

general meeting ("AGM") today. Following the AGM, the Board will

keep the option for further share buybacks under consideration as a

capital allocation tool.

Financing

The Group's balance sheet remains in a strong position.

Glanbia's net debt at 2 April 2022 was EUR552.3 million which

represents an increase of EUR53.8 million versus the net debt

position at the end of the first quarter of 2021. Net Debt

increased due to increased investment in working capital, share

buybacks and the Sterling Technology acquisition net of the receipt

of the proceeds of the sale of the Group's stake in Glanbia

Ireland. Working capital investment was driven by increased

inventory valuations and business activity as well as strategic

sourcing of key ingredients to ensure availability throughout the

year and manage input price changes. Working capital levels are

expected to reduce during the remainder of the year and the Group

is confident of delivering its 80%+ operating cash conversion

target for the full year.

At the end of Q1 2022 the Group had EUR1.2 billion in committed

debt facilities. Glanbia has access to considerable resources from

unutilised debt facilities for further investment in the

business.

AGM

Glanbia is holding its AGM in person at 11.00 a.m. (Irish time)

today at Hotel Kilkenny, College Road, Kilkenny, R95 XD74, Ireland.

Shareholders who alternatively wish to participate remotely in the

AGM can do so and will find details on how to do this on the

Company's website: www.glanbia.com/agm

Ends (1) Like-for-like revenue represents the sales

increase/(decrease) year-on-year, excluding acquisitions made in

the prior 12 months, on a constant currency basis. (2) To arrive at

the Constant Currency change, the average FX rate for the current

period is applied to the relevant reported result from the same

period in the prior year. The average Euro US Dollar FX rate for Q1

2022 was EUR1 = $1.122 (Q1 2021 was EUR1 = $1.204).

Cautionary statement

This announcement contains forward-looking statements. These

statements have been made by the Directors in good faith based on

the information available to them up to the time of their approval

of this report. Due to the inherent uncertainties, including both

economic and business risk factors underlying such forward-looking

information, actual results may differ materially from those

expressed or implied by these forward-looking statements. The

Directors undertake no obligation to update any forward-looking

statements contained in this announcement, whether as a result of

new information, future events, or otherwise.

IMS conference call and webcast details

There will be an analysts' conference call and webcast

presentation to accompany this Interim Management Statement at 8.00

a.m. (BST) today. Please access the webcast from the Glanbia

website at https://www.glanbia.com/investors/results-and-events,

where the presentation can also be viewed or downloaded.

To listen to the call, please dial-in using the following

numbers:

Ireland +353 (0)1 246 5682

UK +44 (0)330 165 4012

Netherlands +31 (0)20 703 8218

France +33 (0)1 70 7 303 39

Italy +39 02 3602 6066

Europe +44 (0)330 165 4012

USA +1 323 701 0160

Pass code 2526909

A replay of the call will be available for 30 days from this

afternoon. Please see the link below to the Investor Relations

section of the Glanbia plc website for details:

https://www.glanbia.com/investors/results-centre

For further information contact

Glanbia plc +353 (0)56 777 2200

Mark Garvey, Group Finance Director

Liam Hennigan, Group Secretary & Head of Investor Relations: +353 (0)86 046 8375

Martha Kavanagh, Head of Corporate Communications: +353 (0)87 646 2006

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBKQBBNBKBDPK

(END) Dow Jones Newswires

May 05, 2022 02:01 ET (06:01 GMT)

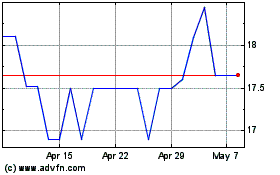

Glanbia (LSE:GLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Glanbia (LSE:GLB)

Historical Stock Chart

From Apr 2023 to Apr 2024