Galileo Resources PLC Update on Afrimat Option regarding Glenover (4789D)

20 October 2022 - 5:00PM

UK Regulatory

TIDMGLR

RNS Number : 4789D

Galileo Resources PLC

20 October 2022

For immediate release

20 October 2022

Galileo Resources Plc

("Galileo" or "the Company")

Update on Afrimat Option to sell shares in Glenover

Galileo Resources plc ("Galileo "or the "Company") further to

its announcements on 9 December 2021 11 February 2022, and 30 March

2022 is pleased to announce that JSE listed Afrimat Limited (JSE :

AFT) ("Afrimat") has given notice to Glenover Phosphate Proprietary

Limited ("Glenover") in which Galileo now has a 30.7% direct and

4.99% indirect investment held via Galagen Proprietary Limited who

is the BEE partner in Glenover, that Afrimat wish to conditionally

acquire 100% of the shares in Glenover from the current

shareholders of Glenover for consideration of ZAR300 million

(approximately GBP14.6 million) (the "Glenover Consideration") (the

"Glenover Acquisition"). Capitalised terms defined in these

previous announcements have the same meaning in this announcement

unless indicated to the contrary.

Highlights:

-- The Company's wholly owned South African subsidiary Galileo

Resources SA (Pty) Ltd's share of the Glenover Consideration is

approximately ZAR 107 million (approximately GBP 5.2 million). The

Company has elected to receive its share of the Glenover

Consideration in cash rather than Afrimat shares.

-- The Glenover Acquisition is the second phase of the Glenover

Agreements whereby Afrimat has already acquired Glenover's

Phosphate Inventory Deposits and Vermiculite Mining Rights and is

now acquiring 100% of Glenover. The Company has already received

approximately GBP2.9M from the first phase being GBP2.4M from the

Glenover Unconditional Asset Sale (see 11 February 2021

announcement) and GBP523K from the Vermiculite Mining Right

Consideration (see 30 March 2022 announcement).

-- The remaining suspensive conditions of the Glenover

Acquisition are a) approval from the South African Department of

Mineral Resources and Energy ("DMRE") in terms of section 11 of the

South African Mineral and Petroleum Resource Development Act No. 28

of 2000 and b) South African Competition Commission approval.

Colin Bird Chairman & CEO said:

" We are very pleased that the Afrimat Board has decided to

proceed with the Glenover Acquisition. Upon completion of the

Glenover Acquisition the Company's share of the Glenover

Consideration will be approximately GBP 5.2 million which will be a

welcome addition to the Company's treasury in a market which is not

currently that favourable for fundraising for exploration

companies. On behalf of the Galileo Board, I would like to

recognise the professionalism and quality of the extensive test

work conducted by Afrimat and to wish Afrimat every success in the

future with the Glenover's Phosphate and rare earths business."

Further Information on the Glenover Acquisition:

In the event that either or both the suspensive conditions are

not fulfilled by 31st July 2023, interest at the South African

Reserve Bank Prime rate less 2% will be payable on the remaining

purchase consideration of ZAR 300 million from 1st August 2023

until the suspensive conditions are fulfilled or waived, as

applicable, prior to the longstop date of 30 April 2024.

Additional Information on Afrimat: Afrimat is a leading black

empowered Group with its main business and core competence in open

pit mining. It is listed on the 'Construction and Materials' sector

of the JSE Main Board since 2006. The group supplies a broad range

of products ranging from Construction Materials (aggregates,

bricks, blocks, pavers and readymix concrete), Industrial Minerals

(lime and lime products) and Bulk Commodities (iron ore and

anthracite). Afrimat's announcement in relation to the Asset Sale

Agreement and the Option Agreement can be found at their website

https://www.afrimat.co.za/

Further information on the Glenover Acquisition : The Company

has a 30.7% direct shareholding in Glenover and an indirect

investment of 4.99% in Glenover held through its shareholding in

Galagen. The investment in Glenover is treated in the Company's

accounts as a minority investment in a joint venture as such the

Company recognised in its accounts for the year ended 31 March 2022

(the "2022 Accounts") in the statement of Comprehensive Income the

net result of Glenover which was a profit of GBP3,433,034. The

carrying value of the Company's investment in Glenover in the 2022

Accounts after taking into account a dividend of GBP3,000,706 was

GBP2,936,125 and its loan to Glenover is GBP961,509. Accordingly,

Galileo anticipates that should the Glenover Acquisition proceed as

anticipated, it will record a profit on disposal in its accounts

for the relevant reporting period, which will be determined at that

time.

Use of funds: The Company intends to use the funds already

received from Glenover, and if received its share of the Glenover

Consideration, less any associated tax liabilities as working

capital of the Company to support expenditure on the Company's

existing projects, ongoing corporate costs and / or for further

acquisitions in the mining sector.

Transaction Incentive Award: As announced on 11 February 2022

Colin Bird the chairman of Galileo has waived in favour of the

Company the bonuses awarded to him by Glenover in his capacity as a

director of Glenover of 1.5% of the gross proceeds from the

Glenover Agreements and these amounts will as received be added to

the transaction awards previously announced that will, at the

determination of the Company's remuneration committee, be paid as

these transactions are successfully concluded.

You can also follow Galileo on Twitter: @GalileoResource

For further information, please contact: Galileo Resources

PLC

Colin Bird, Chairman Tel +44 (0) 20 7581

4477

================================== ======================

Beaumont Cornish Limited - Nomad Tel +44 (0) 20 7628

Roland Cornish/James Biddle 3396

================================== ======================

Novum Securities Limited - Joint

Broker

Colin Rowbury /Jon Belliss +44 (0) 20 7399 9400

================================== ======================

Shard Capital Partners LLP - Tel +44 (0) 20 7186

Joint Broker 9952

Damon Heath

================================== ======================

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDMLBPTMTTBBJT

(END) Dow Jones Newswires

October 20, 2022 02:00 ET (06:00 GMT)

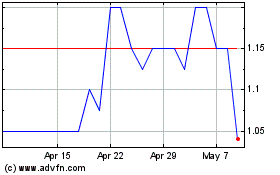

Galileo Resources (LSE:GLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

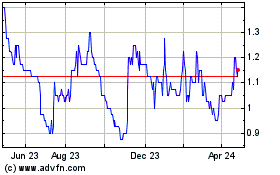

Galileo Resources (LSE:GLR)

Historical Stock Chart

From Apr 2023 to Apr 2024