TIDMGMR

RNS Number : 6483W

Gaming Realms PLC

27 April 2021

Gaming Realms plc

(the "Company" or the "Group")

Annual Results 2020

Transformational year with strong momentum continuing into 2021

underpinned by growing U.S. footprint

Revenue grows by 66% and Licensing strategy delivers adjusted

EBITDA 1 profit GBP3.3m 2

Gaming Realms plc (AIM: GMR), the developer and licensor of

mobile focused gaming content, announces its annual results for the

year ended 31 December 2020 and Q1 highlights for 2021.

Gaming Realms' licensing strategy enabled the Group to deliver

profitable growth during FY20, as it distributed its extensive

games portfolio to an increasing number of operators in key global

markets.

2020 Financial Highlights:

-- Revenue increased by 66% to GBP11.4m (2019: GBP6.9m) for the year

o Licensing revenue increased 81% to GBP7.5m (2019: GBP4.1m)

o Social publishing revenue increased 41% to GBP3.9m (2019:

GBP2.8m)

-- Adjusted EBITDA before share option and related charges of GBP3.3m (2019: loss of GBP0.2m)

-- Adjusted EBITDA from continuing operations of GBP2.9m (2019: loss of GBP0.3m)

o Licensing segment generated GBP3.7m adjusted EBITDA (2019:

GBP1.4m)

o Social publishing segment generated GBP1.4m adjusted EBITDA

(2019: GBP0.8m)

o Head office costs reduced to GBP2.2m (2019: GBP2.4m) through

ongoing cost control

-- Loss for the year significantly reduced to GBP1.5m (2019: GBP5.4m)

2020 Operational Highlights:

-- Portfolio grew to 44 proprietary games on the Group's Remote Game Server ("RGS") (2019: 34)

-- Launched with 26 new partners for Slingo Originals content,

including 888casino.com, DraftKings, Paddy Power Betfair and Sky

Betting & Gaming

-- Signed licensing deals with NetEnt, Playtech, Inspired

Entertainment and King Show Games to build new innovative Slingo

games

-- Unique players in licensing business increased by 140%

-- Submitted licence applications in order to enter the

Pennsylvania and Michigan iGaming markets

-- Prepared for launch in the Italian market

Q1 2021 Highlights:

-- Licensing revenues increased 60% in Q1 2021 to GBP2.1m (Q1 2020: GBP1.3m)

-- Entered the Italian gaming market with Goldbet and Sisal Group

-- Obtained provisional supplier licence in Michigan and expect to launch imminently

-- Signed multi-State deals with BetMGM, Golden Nugget and

Betfair/Fanduel, as well as two distribution deals with GAN for the

U.S. and European market

1 EBITDA is profit before interest, tax, amortisation and

impairment expenses and is a non-GAAP measure. The Group uses

EBITDA and adjusted EBITDA to comment on its financial performance.

Adjusted EBITDA is EBITDA excluding non-recurring material items

which are outside the normal scope of the Group's ordinary

activities. Adjusting items include costs arising from a

fundamental restructuring of the Group's operations, management

restructuring costs, relocation costs, impairment of financial

assets and sales proceeds on business asset disposals.

2 Adjusted EBITDA before share option and related charges.

Outlook

The strong momentum seen in FY20 has continued into 2021, with

the Group continuing to focus on expanding internationally,

securing additional partnerships and creating new games to drive

growth. Gaming Realms successfully launched its Slingo content in

the Italian regulated market, and will launch in Michigan, its

second U.S. State in May. The Company expects to be granted a

supplier licence in Pennsylvania and launch in the first half of

the year. With 9 new partners secured to date in 2021, together

with the recent launch of Slingo Starburst in collaboration with

NetEnt, the Board has every confidence in the strategy being

pursued and in the Group's prospects for the year ahead. The

Company is trading marginally ahead of Board expectations.

Commenting on the results, Michael Buckley, Executive Chairman,

said:

"The Group made excellent progress in FY20, producing a maiden

adjusted EBITDA profit of GBP3.3m and increasing revenue by 66%.

This underscores the success of the Company's strategy to focus on

its core licensing business segment, as well as its social

publishing division.

"By securing 26 new licensing and distribution partners

throughout the year, of which many were Tier 1 operators, and

adding 10 new games to our hugely popular Slingo portfolio, we

successfully increased the number of unique players playing our

games by 140% and saw increased international demand for our

content.

"We remain committed to the expansion of our global footprint,

particularly in the U.S. and European regulated markets, through

increasing and strengthening our network of distributors, operators

and licensors. With further planned launches in the USA, Denmark,

Spain, Canada and Portugal, and a strong pipeline of new and

exciting branded Slingo games, the Board is confident in the future

prospects of the business and looks forward to keeping its

shareholders updated on progress."

Enquiries

Gaming Realms plc 0845 123 3773

Michael Buckley, Executive

Chairman

Mark Segal, CFO

Peel Hunt LLP - NOMAD and broker 020 7418 8900

George Sellar

Andrew Clark

Will Bell

Yellow Jersey 020 3004 9512

Charles Goodwin

Annabel Atkins

About Gaming Realms

Gaming Realms creates and licenses innovative games for mobile,

with operations in the UK, U.S. and Canada. Through its unique IP

and brands, Gaming Realms is bringing together media, entertainment

and gaming assets in new game formats. The Gaming Realms management

team includes accomplished entrepreneurs and experienced executives

from a wide range of leading gaming and media companies.

Executive Chairman's Statement

The Group made excellent progress during the year, increasing

revenues by 66% to GBP11.4m (2019: GBP6.9m) and producing a maiden

adjusted EBITDA profit before share option and related charges of

GBP3.3m (2019: loss of GBP0.2m). This underscores the success of

the revised strategy we set out at the beginning of 2020 to focus

on our core licensing business segment, as well as delivering

growth in our social publishing division.

Our focus on content licensing resulted in 81% revenue growth in

our licensing business to GBP7.5m (2019: GBP4.1m). We are seeing

strong momentum within this business, with increased international

demand for our Slingo Originals portfolio. With growing

distribution via our proprietary Remote Game Server ("RGS"), we

have been able to increase our EBITDA margin within the licensing

segment to 50% (2019: 34%), resulting in EBITDA of GBP3.7m (2019:

GBP1.4m).

Licensing business highlights:

-- Increased our library of proprietary games by 10 to 44 games at year-end.

-- Went live with 26 new partners during the year, all of which

have licensed our Slingo Originals content.

-- Went live with a number of "Tier 1" partners through our

Scientific Games distribution channel.

-- Increased our unique players in the year by 140% to 2.28m (2019: 0.95m)

-- Signed deals with NetEnt, King Show Games and Inspired

Entertainment for new branded Slingo games.

-- Maintained in excess of a 3.5% market share of sales in New

Jersey, USA, from online slot products throughout the year. During

2020, the New Jersey online casino market grew by 102%.

We grew our social publishing business in the year, reversing

the trends of previous years. Revenues grew 41% to GBP3.9m (2019:

GBP2.8m), the result of both publishing our Slingo Originals

portfolio, as well as the development of new tournament and

promotional features on the platform. With increasing margins,

EBITDA has grown to GBP1.4m (2019: GBP0.8m). As a result, the

division produced a cash contribution to the Group.

2020 was a challenging year with the difficulties imposed by

COVID-19 restrictions. The highly pleasing financial results and

groundwork for the future years would not have been achieved

without management and staff showing excellent dedication and

adaptability in the challenging circumstances. I should like to

thank them all for their efforts which are reflected in these

Financial Statements.

Outlook for 2021

We are continuing our focus on the following areas:

-- International expansion - particularly in the US and European regulated markets

-- Adding new distributors, operators and licensors

-- Further penetration with existing distributors and operators driven by new games

The Group has made encouraging progress so far in 2021,

obtaining a supplier licence in Michigan and expecting to be live

imminently. We are committing a lot of resources to growing the

U.S. iGaming market and expect to obtain a supplier license and go

live in Pennsylvania in the first half of the year. As a result, we

are well prepared to take advantage of the growth of iGaming within

the U.S., and have signed several multi-State deals and direct

integration agreements with the largest operators, including Rush

Street Interactive, DraftKings and BetMGM. We have also signed a

distribution agreement with GAN for the U.S. and European markets.

In January of this year, we had a successful launch in the Italian

regulated market and are encouraged by early trading. We have

further launches planned in the regulated markets of Denmark,

Spain, Canada and Portugal.

We have also recently launched Slingo Starburst, through our

licencing agreement with NetEnt, which has proven extremely popular

with our players and partners internationally. It has been our most

successful launch to date in both unique player numbers and revenue

generated in its first month.

With regards to this year's trading, I am pleased to inform

shareholders that our licensing revenues for the first quarter of

this year are 60% ahead of the same period in 2020, and we are

operating slightly ahead of Board expectations. With these early

results, and the imminent launches in both Michigan and

Pennsylvania, the Board has every confidence in the strategy being

pursued and its expectations for this year and beyond.

COVID-19

Our top priority in response to the pandemic has been the health

and welfare of our employees and partners as mentioned above. Our

team has demonstrated incredible commitment and focus to maintain

complete business continuity and we will continue to support them

as we move to a more flexible model post COVID-19.

Michael Buckley

Executive Chairman

Financial Review

Overview

In 2020 the Group was able to focus on successfully executing

its core strategy of scaling the licensing business.

For the year, the Group delivered adjusted EBITDA on a

continuing basis of GBP2.9m (2019: GBP0.3m adjusted EBTIDA loss).

This has resulted in a significant reduction in the pre-tax loss of

GBP1.6m compared with the previous year (2019: GBP4.7m loss from

continuing operations).

In the prior year, the Group completed its disposal of the real

money B2C assets and realised a GBP0.8m profit on disposal. The B2C

RMG segment is presented as a discontinued operation in the

comparative 2019 results. There were no such asset disposals during

2020.

The table below sets out the split of revenue and adjusted

EBITDA on a continuing and discontinued operations basis:

Continuing operations Discontinued

---------------------- ----------------------------------------------------

Social Total Real money Total

Licensing Publishing Head office continuing gaming 2020

2020 GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

---------------------- ---------- ------------ ------------ ------------ ------------- ---------

Revenue 7,515 3,886 2 11,403 - 11,403

Marketing expense (18) (243) (94) (355) - (355)

Operating expense (1,071) (1,161) - (2,232) - (2,232)

Administrative

expense (2,610) (1,090) (1,804) (5,504) - (5,504)

Share option

and related charges (71) (7) (294) (372) - (372)

---------------------- ---------- ------------ ------------ ------------ ------------- ---------

Adjusted EBITDA 3,745 1,385 (2,190) 2,940 - 2,940

---------------------- ---------- ------------ ------------ ------------ ------------- ---------

Discontinued

Continuing operations operations

---------------------- ----------------------------------------------------

Social Total Real money Total

Licensing Publishing Head office continuing gaming 2019

2019 GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

---------------------- ---------- ------------ ------------ ------------ ------------- ---------

Revenue 4,147 2,758 106 7,011 6,002 13,013

Marketing expense - (130) (82) (212) (706) (918)

Operating expense (773) (855) 1 (1,627) (4,908) (6,535)

Administrative

expense (1,970) (1,001) (2,446) (5,417) (1,965) (7,382)

Share option

and related charges - - (10) (10) - (10)

---------------------- ---------- ------------ ------------ ------------ ------------- ---------

Adjusted EBITDA 1,404 772 (2,431) (255) (1,577) (1,832)

---------------------- ---------- ------------ ------------ ------------ ------------- ---------

Continuing operations

Year-on-year continuing revenue increased 66% to GBP11.4m

(GBP2019: GBP6.9m) due to the strong performance of both the

licensing and social publishing segments in the year.

Continuing operations generated adjusted EBITDA of GBP2.9m

(2019: GBP0.3m loss) and GBP3.3m before share option and related

charges (2019: GBP0.2m loss).

EBITDA generated from continuing operations was GBP2.0m (2019:

GBP0.8m loss) including restructuring costs of GBP0.5m (2019:

GBP0.3m) and impairment of assets of GBP0.4m (2019: GBP0.2m).

Operating expenses for the year increased to GBP2.2m (2019:

GBP1.5m) principally as a result of costs directly associated with

the revenue growth in both the licensing and social publishing

segments.

Adjusted administrative expenses increased slightly to GBP5.5m

(2019: GBP5.4m) due to increased staff costs in the licensing

segment in order to drive the revenue growth, offset by head office

cost savings compared to 2019.

Licensing

Licensing segment revenues increased 81% to GBP7.5m (2019:

GBP4.1m) due to the successful implementation of the Group's

strategy of growing both the games content and distribution to an

increased number of operators in Europe and the US.

During 2020, the Group went live with an additional 26 partners

in Europe, New Jersey and Latin America. After the year-end, the

Group went live with a further 9 new operators, including Sisal and

Goldbet in Italy, which represents a new regulated market for the

Group.

10 new Slingo games were launched to the market during 2020,

including Slingo Fluffy Favorites and Slingo Reel King.

Revenues from the U.S. market continue to be a focus for the

segment, and in 2020 increased to GBP2.4m (2019: GBP1.7m),

representing 32% of total licensing revenues (2019: 40%). This

market is expected to gain further prominence for the Group given

the recently announced successful license application in Michigan

and pending application in Pennsylvania.

Social publishing

The Group's social publishing business delivered strong growth

in 2020, with revenues increasing to GBP3.9m (2019: 2.8m). With

continued cost controls in place, this resulted in the segment

delivering GBP1.4m adjusted EBITDA for the year (2019:

GBP0.8m).

Marketing expenses of GBP0.2m were incurred (2019: GBP0.1m) in

order to drive player activity and revenues.

Discontinued operations

Discontinued operations in the prior year relate only to B2C

RMG.

In July 2019 the Group concluded its transaction with River Tech

plc ("River"), which finalised the Group's strategy of withdrawing

from the UK real money B2C market to focus on game development and

licensing activities. The Group recorded a profit on disposal of

these assets of GBP0.8m in the prior year.

The Group recorded a loss after tax from discontinued operations

of GBP0.8m in the prior year, comprising GBP0.7m profit on disposal

of assets, GBP0.2m share of loss of associate prior to disposal,

and incurred trading losses until disposal of GBP1.3m.

Cashflow, Balance Sheet and Going Concern

Net cash decreased by GBP0.5m in 2020 (2019: increased by

GBP1.0m) to GBP2.1m at 31 December 2020 (2019: GBP2.6m). The

current year reduction in net cash was largely driven through the

GBP2.4m of development costs capitalised in the year (2019:

GBP2.7m) offset by the GBP2.0m cash inflow from operating

activities (2019: GBP1.5m outflow).

After the year-end, on 1 April 2021 the Group received GBP1.0m

from River for full and final settlement of the deferred

consideration receivable, certain other receivable balances, and

various legal proceedings and out of court disputes between the

parties.

Net assets totaled GBP10.9m (2019: GBP12.1m).

The prolonged COVID-19 pandemic has brought significant

uncertainty to global markets and economies, including the real

money gambling sector. The Directors have performed qualitative and

quantitative assessments of the associated risks facing the

business and its ability to meet its short and medium-term

forecasts. The forecasts were subject to stress testing to analyse

the reduction in forecast revenues required to bring about

insolvency of the Company unless capital was raised. In such cases

it is anticipated that mitigation actions, such as reduction in

overheads could be implemented to stall such an outcome.

The Directors confirm their view that they have carried out a

robust assessment of the emerging and principal risks facing the

business. As a result of the assessment performed, the Directors

consider that the Group has adequate resources to continue its

normal course of operations for the foreseeable future.

Dividend

During the year, Gaming Realms did not pay an interim or final

dividend. The Board of Directors are not proposing a final dividend

for the current year.

Corporation and deferred taxation

The Group received GBP0.05m (2019: GBP0.1m) in research and

development credits in Canada. A current year tax charge of GBP0.1m

(2019: GBP0.1m) principally relates to taxation in overseas

jurisdictions in which the Group operates. The Group also

recognised an unwind of deferred tax of GBP0.1m (2019: GBP0.1m)

which arose on prior year business combinations.

Mark Segal

Chief Financial Officer

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2020

2020 2019

Continuing GBP GBP

----------------------------------------- ------------------------------------ ----------------------------------

Revenue 11,403,486 6,882,741

Marketing expenses (355,394) (212,473)

Operating expenses (2,232,032) (1,498,294)

Administrative expenses (5,971,970) (5,743,747)

Impairment of financial asset (449,422) (200,000)

Share option and related charges (372,344) (9,972)

Adjusted EBITDA - continuing 2,939,522 (255,116)

Impairment of financial asset (449,422) (200,000)

Restructuring expenses (467,776) (326,629)

EBITDA - continuing 2,022,324 (781,745)

------------------------------------

Amortisation of intangible assets (2,817,043) (2,982,845)

Depreciation of property, plant

and equipment (216,323) (204,714)

Impairment of property, plant (22,876) -

and equipment

Finance expense (882,032) (842,518)

Finance income 333,664 146,661

------------------------------------------ ------------------------------------ ----------------------------------

Loss before tax (1,582,286) (4,665,161)

Tax credit 48,229 31,335

------------------------------------------ ------------------------------------ ----------------------------------

Loss for the financial year

- continuing (1,534,057) (4,633,826)

Loss for the financial year

- discontinued - (783,451)

------------------------------------------ ------------------------------------ ----------------------------------

Loss for the financial year

- total (1,534,057) (5,417,277)

------------------------------------------ ------------------------------------ ----------------------------------

Other comprehensive income

Items that will or may be reclassified

to profit or loss:

Exchange loss arising on translation

of foreign operations (226,666) (305,671)

------------------------------------------ ------------------------------------ ----------------------------------

Total other comprehensive income (226,666) (305,671)

------------------------------------------ ------------------------------------ ----------------------------------

Total comprehensive income (1,760,723) (5,722,948)

------------------------------------------ ------------------------------------ ----------------------------------

Loss attributable to:

Owners of the parent (1,527,964) (5,341,669)

Non-controlling interest (6,093) (75,608)

------------------------------------ ----------------------------------

(1,534,057) (5,417,277)

----------------------------------------- ------------------------------------ ----------------------------------

Total comprehensive income attributable

to:

Owners of the parent (1,754,630) (5,647,340)

Non-controlling interest (6,093) (75,608)

------------------------------------------ ------------------------------------ ----------------------------------

(1,760,723) (5,722,948)

----------------------------------------- ------------------------------------ ----------------------------------

Loss per share Pence Pence

Basic and diluted - continuing (0.54) (1.60)

Basic and diluted - discontinued - (0.28)

------------------------------------------ ------------------------------------ ----------------------------------

Basic and diluted - total (0.54) (1.88)

------------------------------------------ ------------------------------------ ----------------------------------

Consolidated Statement of Financial Position

As at 31 December 2020

31 December 31 December

2020 2019

GBP GBP

-------------------------------- ------------- -------------

Non-current assets

Intangible assets 11,137,123 11,702,553

Other investments 401,291 289,511

Property, plant and equipment 560,793 760,763

Finance lease asset - 157,166

Other assets 150,528 150,885

--------------------------------- ------------- -------------

12,249,735 13,060,878

-------------------------------- ------------- -------------

Current assets

Trade and other receivables 2,343,739 1,850,863

Deferred consideration 972,554 1,298,663

Finance lease asset 140,058 126,354

Cash and cash equivalents 2,105,167 2,626,837

--------------------------------- ------------- -------------

5,561,518 5,902,717

Total assets 17,811,253 18,963,595

--------------------------------- ------------- -------------

Current liabilities

Trade and other payables 1,943,714 2,125,257

Lease liabilities 343,859 256,527

--------------------------------- ------------- -------------

2,287,573 2,381,784

-------------------------------- ------------- -------------

Non-current liabilities

Deferred tax liability 320,913 457,492

Other Creditors 3,304,870 3,126,673

Derivative liabilities 627,000 272,000

Lease liabilities 340,175 646,122

--------------------------------- ------------- -------------

4,592,958 4,502,287

-------------------------------- ------------- -------------

Total liabilities 6,880,531 6,884,071

--------------------------------- ------------- -------------

Net assets 10,930,722 12,079,524

--------------------------------- ------------- -------------

Equity

Share capital 28,664,731 28,442,874

Share premium 87,258,166 87,198,410

Merger reserve (67,673,657) (67,673,657)

Foreign exchange reserve 1,379,116 1,605,782

Retained earnings (38,768,257) (37,570,601)

--------------------------------- ------------- -------------

Total equity attributable to

owners of the parent 10,860,099 12,002,808

--------------------------------- ------------- -------------

Non-controlling interest 70,623 76,716

--------------------------------- ------------- -------------

Total equity 10,930,722 12,079,524

--------------------------------- ------------- -------------

Consolidated Statement of Cash Flows

For the year ended 31 December 2020

2020 2019

GBP GBP

--------------------------------------------- ------------ ------------

Cash flows from operating activities

Loss for the financial year (1,534,057) (5,417,277)

Adjustments for:

Depreciation of property, plant and

equipment 216,323 211,055

Impairment of property, plant and 22,876 -

equipment

Amortisation of intangible fixed assets 2,817,043 2,982,845

Impairment 449,422 200,000

Finance income (333,664) (420,512)

Finance expense 882,032 842,518

Income tax credit (48,229) (31,335)

Exchange differences (54,940) 41,336

(Profit) / loss on disposal of property,

plant and equipment (1,000) 28,081

Profit on disposal of assets - (683,323)

Share of loss of associate - 157,307

Share based payment expense 330,308 9,972

(Increase) / decrease in trade and

other receivables (463,237) 1,330,674

Decrease in trade and other payables (233,543) (803,124)

Increase in other assets - (18,308)

Net cash flows from / (used in) operating

activities before taxation 2,049,334 (1,570,091)

---------------------------------------------- ------------ ------------

Net tax (paid) / received in the year (33,717) 73,424

---------------------------------------------- ------------ ------------

Net cash flows from / (used in) operating

activities 2,015,617 (1,496,667)

---------------------------------------------- ------------ ------------

Investing activities

Acquisition of property, plant and

equipment (30,143) (106,583)

Capitalised development costs (2,440,559) (2,680,289)

Proceeds from disposal of assets,

net of cash disposed of - 6,135,529

Costs related to asset disposal - (765,867)

Proceeds from disposal of property, 1,000 -

plant and equipment

Interest received 47 3,705

Finance lease asset - sublease receipts 163,324 120,507

---------------------------------------------- ------------ ------------

Net cash (used in) / from investing

activities (2,306,331) 2,707,002

---------------------------------------------- ------------ ------------

Financing activities

Receipt of deferred consideration - 385,000

Principal paid on lease liability (300,086) (252,376)

Issue of share capital on exercise 281,613 -

of options

Interest paid (225,516) (322,772)

---------------------------------------------- ------------ ------------

Net cash used in financing activities (243,989) (190,148)

---------------------------------------------- ------------ ------------

Net (decrease) / increase in cash

and cash equivalents (534,703) 1,020,187

Cash and cash equivalents at beginning

of year 2,608,455 1,550,141

Exchange gain on cash and cash equivalents 13,033 38,127

---------------------------------------------- ------------ ------------

Cash and cash equivalents at end of

year 2,086,785 2,608,455

---------------------------------------------- ------------ ------------

Consolidated Statement of Changes in Equity

For the year ended 31 December 2020

Total

Foreign to equity

Share Share Merger Exchange Retained holders Non-controlling Total

capital premium reserve Reserve earnings of parents interest equity

GBP GBP GBP GBP GBP GBP GBP GBP

---------------- ----------- ----------- ------------- ---------- ------------- ------------ ----------------- ------------

1 January 2019 28,442,874 87,198,410 (67,673,657) 1,911,453 (32,238,904) 17,640,176 152,324 17,792,500

---------------- ----------- ----------- ------------- ---------- ------------- ------------ ----------------- ------------

Loss for the

year - - - - (5,341,669) (5,341,669) (75,608) (5,417,277)

Other

comprehensive

income - - - (305,671) - (305,671) - (305,671)

---------------- ----------- ----------- ------------- ---------- ------------- ------------ ----------------- ------------

Total

comprehensive

income

for the year - - - (305,671) (5,341,669) (5,647,340) (75,608) (5,722,948)

---------------- ----------- ----------- ------------- ---------- ------------- ------------ ----------------- ------------

Contributions

by and

distributions

to owners

Share-based

payment on

share

options - - - - 9,972 9,972 - 9,972

31 December

2019 28,442,874 87,198,410 (67,673,657) 1,605,782 (37,570,601) 12,002,808 76,716 12,079,524

---------------- ----------- ----------- ------------- ---------- ------------- ------------ ----------------- ------------

1 January 2020 28,442,874 87,198,410 (67,673,657) 1,605,782 (37,570,601) 12,002,808 76,716 12,079,524

---------------- ----------- ----------- ------------- ---------- ------------- ------------ ----------------- ------------

Loss for the

year - - - - (1,527,964) (1,527,964) (6,093) (1,534,057)

Other

comprehensive

income - - - (226,666) - (226,666) - (226,666)

---------------- ----------- ----------- ------------- ---------- ------------- ------------ ----------------- ------------

Total

comprehensive

income

for the year - - - (226,666) (1,527,964) (1,754,630) (6,093) (1,760,723)

---------------- ----------- ----------- ------------- ---------- ------------- ------------ ----------------- ------------

Contributions

by and

distributions

to owners

Share-based

payment on

share

options - - - - 330,308 330,308 - 330,308

Exercise of

options 221,857 59,756 - - - 281,613 - 281,613

31 December

2020 28,664,731 87,258,166 (67,673,657) 1,379,116 (38,768,257) 10,860,099 70,623 10,930,722

---------------- ----------- ----------- ------------- ---------- ------------- ------------ ----------------- ------------

Notes to the Consolidated Financial Statements

For the year ended 31 December 2020

1. Accounting policies

General information

Gaming Realms Plc (the "Company") and its subsidiaries (together

the "Group").

The Company is admitted to trading on the Alternative Investment

Market (AIM) of the London Stock Exchange. It is incorporated and

domiciled in the UK. The address of its registered office is Two

Valentine Place, London, SE1 8QH.

The consolidated financial statements are presented in British

Pounds Sterling.

Basis of preparation

The Group financial statements have been prepared in accordance

with international accounting standards in conformity with the

requirements of the Companies Act 2006 and on a basis consistent

with those policies set out in our audited financial statements for

the year ended 31 December 2019.

The financial information set out in this document does not

constitute the Group's statutory accounts for the year ended 31

December 2020 or 31 December 2019.

Statutory accounts for the year ended 31 December 2019 have been

filed with the Registrar of Companies and those for the year ended

31 December 2020 will be delivered to the Registrar in due course;

both have been reported on by independent auditors. The independent

auditor's report for the year ended 31 December 2020 is

unmodified.

The independent auditor's reports on the Annual Report and

Accounts for the year ended 31 December 2020 and 31 December 2019

were unqualified and did not contain a statement under 498(2) or

498(3) of the Companies Act 2006.

Basis of consolidation

The Group financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(subsidiaries). Control is achieved when the Company is exposed, or

has rights, to variable returns from its involvement with the

investee and has the ability to affect those returns through its

power over the investee.

The results of subsidiaries acquired or disposed of during the

period are included in the Consolidated Statement of Comprehensive

Income from the effective date of acquisition up to the effective

date of disposal. Where necessary, adjustments are made to the

financial statements of subsidiaries to bring the accounting

policies used in line with those used by the Group.

All intra-Group transactions, balances, income and expenses are

eliminated on consolidation.

Going concern

The Group meets its day-to-day working capital requirements from

the cash flows generated by its trading activities and its

available cash resources.

The Group prepares cash flow forecasts and re-forecasts at least

bi-annually as part of the business planning process. The Directors

have reviewed forecast cash flows for the period to December 2023

and consider that the Group will have sufficient cash resources

available to meet its liabilities as they fall due for at least the

forthcoming 12 months from the date of the approval of the

financial statements. Given the economic uncertainty resulting from

the ongoing COVID-19 pandemic, these cash flow forecasts have been

subject to short- and medium-term stress testing, scenario

modelling and sensitivity analysis through to June 2022, which the

Directors consider sufficiently robust. Scenarios considered

include but are not limited to; failure to expand into new US

states during the forecast period, non-receipt of deferred

consideration due to the Group at the year-end and a significant

reduction in trading cash flows compared to Group forecasts. The

Directors note that in an extreme scenario, the Group also has the

option to rationalise its cost base including cuts to discretionary

capital, marketing and overhead expenditure. The Directors consider

that the required level of change to the Group's forecast cash

flows to give a rise to a material risk over going concern are

sufficiently remote.

Subsequent to the year-end, on 1 April 2021 the Group received

GBP1.0m from River in respect of the deferred consideration

receivable, certain other receivable balances and full and final

settlement of all legal proceedings and out of court disputes

between the parties. The Directors note that aside from ongoing

lease liabilities, the Group has no debt contractually repayable

before 31 December 2022.

Accordingly, these financial statements have been prepared on

the basis of accounting principles applicable to a going concern,

which assumes that the Group and the Company will realise its

assets and discharge its liabilities in the normal course of

business. Management has carried out an assessment of the going

concern assumption and has concluded that the Group and the Company

will generate sufficient cash and cash equivalents to continue

operating for the next 12 months.

Adoption of new and revised standards

New standards that have been adopted by the Group for the year

ended 31 December 2020, but have not had a significant impact on

the Group are:

-- Definition of a Business (Amendments to IFRS 3);

-- Interest Rate Benchmark Reform - IBOR 'phase 2' (Amendments

to IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16);

-- COVID-19-Related Rent Concessions (Amendments to IFRS 16);

-- IAS 1 Presentation of Financial Statements and IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors

(Amendment - Disclosure Initiative - Definition of Material);

and

-- Revisions to the Conceptual Framework for Financial Reporting.

There are a number of standards, amendments to standards, and

interpretations which have been issued by the IASB that are

effective in future accounting periods that the Group has decided

not to adopt early.

The following amendments are effective for the period beginning

1 January 2022:

-- Onerous Contracts - Cost of Fulfilling a Contract (Amendments to IAS 37);

-- Property, Plant and Equipment: Proceeds before Intended Use (Amendments to IAS 16);

-- Annual Improvements to IFRS Standards 2018-2020 (Amendments

to IFRS 1, IFRS 9, IFRS 16 and IAS 41); and

-- References to Conceptual Framework (Amendments to IFRS 3).

The Group is currently assessing the impact of these new

accounting standards and amendments.

Business combinations

On acquisition, the assets, liabilities and contingent

liabilities of a subsidiary are measured at their fair values at

the date of acquisition. Any excess of the cost of acquisition over

the fair values of the identifiable net assets acquired, including

separately identifiable intangible assets, is recognised as

goodwill. Any discount on acquisition, i.e. where the cost of

acquisition is below the fair value of the identifiable net assets

acquired, is credited to the Statement of Comprehensive Income in

the period of acquisition.

2. Adjusted EBITDA

EBITDA and adjusted EBITDA are non-GAAP measures and exclude

exceptional items, depreciation, and amortisation. Exceptional

items are those items the Group considers to be non-recurring or

material in nature that may distort an understanding of financial

performance or impair comparability.

Adjusted EBITDA is stated before exceptional items as

follows:

2020 2019

GBP GBP

Impairment of

financial asset (449,422) (200,000)

Restructuring

costs (467,776) (326,629)

Adjusting items (917,198) (526,629)

--------------------- ---------- ----------

Restructuring costs

Restructuring costs of GBP0.5m in 2020 relate to a management

restructure during the year, following the change in focus to the

licensing business. Restructuring costs of GBP0.3m in 2019 related

to redundancy and relocation costs.

Impairment of financial asset

In accordance with IFRS 9, management have performed an expected

credit loss review over its deferred consideration and trade and

other receivable balances. As a result of this review, an

impairment provision of GBP449,422 (2019: GBP200,000) has been

recorded in the income statement. The current year provision is

split between deferred consideration (GBP527,446) and other

receivables (credit of GBP78,024).

3. Segment information

The Board is the Group's chief operating decision-maker.

Management has determined the operating segments based on the

information reviewed by the Board for the purposes of allocating

resources and assessing performance.

The Group has 2 continuing reportable operating segments:

-- Licensing - brand and content licensing to partners in Europe and the US

-- Social Publishing - providing freemium games to the US

Management do not report segmental assets and liabilities

internally and as such an analysis is not reported.

Social

Licensing publishing Head Office Total

2020 GBP GBP GBP GBP

--------------------- --------------------------- ---------------------------- ------------------------------ --------------------------

Revenue 7,515,114 3,885,971 2,401 11,403,486

Marketing expense (18,528) (242,667) (94,199) (355,394)

Operating expense (1,070,766) (1,161,266) - (2,232,032)

Administrative

expense (2,610,275) (1,090,014) (1,803,905) (5,504,194)

Share option and

related

charges (70,764) (6,906) (294,674) (372,344)

--------------------- --------------------------- ---------------------------- ------------------------------ --------------------------

Adjusted EBITDA -

continuing 3,744,781 1,385,118 (2,190,377) 2,939,522

--------------------- --------------------------- ---------------------------- ------------------------------ --------------------------

Impairment of

financial

asset (449,422)

Restructuring

expenses (467,776)

-------------------- --------------------------- ---------------------------- ------------------------------ ----------------------------

EBITDA - continuing 2,022,324

--------------------- --------------------------- ---------------------------- ------------------------------ --------------------------

Amortisation of

intangible

assets (2,817,043)

Depreciation of

property,

plant and

equipment (216,323)

Impairment of

property,

plant and

equipment (22,876)

Finance expense (882,032)

Finance income 333,664

-------------------- --------------------------- ---------------------------- ------------------------------ ----------------------------

Loss before tax -

continuing (1,582,286)

-------------------- --------------------------- ---------------------------- ------------------------------ ----------------------------

Social

Licensing publishing Head Office Total

2019 GBP GBP GBP GBP

-------------------- ------------------------------ ------------------------------ ----------------------------- ----------------------------

Revenue 4,146,857 2,758,475 106,164 7,011,496

Marketing expense - (130,505) (81,968) (212,473)

Operating expense (772,827) (854,984) 762 (1,627,049)

Administrative

expense (1,970,455) (1,001,103) (2,445,560) (5,417,118)

Share option and

related

charges - - (9,972) (9,972)

-------------------- ------------------------------ ------------------------------ ----------------------------- ----------------------------

Adjusted EBITDA -

continuing 1,403,575 771,883 (2,430,574) (255,116)

-------------------- ------------------------------ ------------------------------ ----------------------------- ----------------------------

Impairment of

financial

asset (200,000)

Restructuring

expenses (326,629)

------------------- ------------------------------ ------------------------------ ----------------------------- ------------------------------

EBITDA -

continuing (781,745)

-------------------- ------------------------------ ------------------------------ ----------------------------- ----------------------------

Amortisation of

intangible

assets (2,982,845)

Depreciation of

property,

plant and

equipment (204,714)

Finance expense (842,518)

Finance income 146,661

------------------- ------------------------------ ------------------------------ ----------------------------- ------------------------------

Loss before tax -

continuing (4,665,161)

------------------- ------------------------------ ------------------------------ ----------------------------- ------------------------------

Segmental revenue includes GBPnil (2019 : GBP128,755) of

inter-segment Licensing revenue. This is shown as an Operating

Expense under the real money gaming discontinued operations and

eliminates on consolidation.

4. finance income and expense

2020 2019

GBP GBP

--------------------------------------- ------------------------------- -------------------------------

Finance income

Interest received 47 3,705

Fair value gain on other investments 111,780 -

Interest income on unwind of

finance lease asset 20,500 30,625

Interest income on unwind of

deferred consideration receivable 201,337 112,331

---------------------------------------- ------------------------------- -------------------------------

Total finance income 333,664 146,661

---------------------------------------- ------------------------------- -------------------------------

Finance expense

Bank interest paid 18,663 45,931

Fair value loss on other investments - 245,619

Fair value movement on derivative

liability 355,000 72,000

Effective interest on other

creditor 437,050 406,912

Interest expense on lease liability 71,319 72,056

---------------------------------------- ------------------------------- -------------------------------

Total finance expense 882,032 842,518

---------------------------------------- ------------------------------- -------------------------------

5. tax credit

2020 2019

GBP GBP

Current tax

Current tax expense (93,997) (62,784)

Adjustment for current tax of prior periods (34,232) (134,631)

R&D tax credit for the year 46,127 97,007

Total current tax (82,102) (100,408)

---------------------------------------------- --------- ----------

Deferred tax

Unwind of deferred tax 130,331 131,743

---------------------------------------------- --------- ----------

Total deferred tax credit 130,331 131,743

Total tax credit 48,229 31,335

---------------------------------------------- --------- ----------

The reasons for the difference between the actual tax credit for

the period and the standard rate of corporation tax in the UK

applied to profits for the year are as follows:

2020 2019

GBP GBP

------------------------------------------------ ------------ ------------

Loss before tax for the year - continuing (1,582,286) (4,665,161)

Loss before tax for the year - discontinued - (783,451)

------------------------------------------------ ------------ ------------

Loss before tax for the year (1,582,286) (5,448,612)

------------------------------------------------ ------------ ------------

Expected tax at effective rate of corporation

tax in the UK of 19.0% (2019: 19.0%) (300,634) (1,035,236)

Expenses not deductible for tax purposes 3,369 36,755

Income not chargeable for tax purposes - (129,831)

Effects of overseas taxation 93,997 62,785

Adjustment for under-provision in prior

years 34,233 134,631

Research and development tax credit (46,127) (97,007)

Timing difference 12,745 29,959

Tax losses for which no deferred tax

assets have been recognised 284,519 1,098,352

Unwind of deferred taxes recognised on

business acquisitions (130,331) (131,743)

------------------------------------------------ ------------ ------------

(48,229) (31,335)

------------------------------------------------ ------------ ------------

6. Profit/(Loss) per share

Basic profit/(loss) per share is calculated by dividing the

result attributable to ordinary shareholders by the weighted

average number of shares in issue during the year. For fully

diluted loss per share, the weighted average number of ordinary

shares in issue is adjusted to assume conversion of dilutive

potential ordinary shares. The Group's potentially dilutive

securities consist of share options, performance shares and a

convertible bond. As the continuing operations of the Group are

loss-making, none of the potentially dilutive securities are

currently dilutive.

2020 2019

GBP GBP

--------------------------------------- ------------ ------------

Loss after tax - continuing (1,527,964) (4,558,218)

Loss after tax - discontinued - (783,451)

---------------------------------------- ------------ ------------

Loss after tax - total (1,527,964) (5,341,669)

---------------------------------------- ------------ ------------

Number Number

--------------------------------------- ------------ ------------

Weighted average number of ordinary

shares used in calculating basic

loss per share 285,165,652 284,428,747

---------------------------------------- ------------ ------------

Weighted average number of ordinary

shares used in calculating dilutive

loss per share 285,165,652 284,428,747

---------------------------------------- ------------ ------------

Pence Pence

--------------------------------------- ------------ ------------

Basic and diluted loss per share

- continuing (0.54) (1.60)

Basic and diluted loss per share

- discontinued - (0.28)

---------------------------------------- ------------ ------------

Basic and diluted loss per share

- total (0.54) (1.88)

---------------------------------------- ------------ ------------

7. Intangible assets

Customer Development Domain Intellectual

Goodwill database Software costs names Property Total

GBP GBP GBP GBP GBP GBP GBP

---------- ----------- ---------- ------------- --------- -------------- -----------

Cost

At 1 January

2019 7,056,768 1,582,190 1,488,600 9,708,137 29,418 6,194,372 26,059,485

Additions - - - 2,680,289 - - 2,680,289

Disposals - - - (144,766) (20,000) - (164,766)

Reclassified

as held for sale - - - (437,023) - - (437,023)

Exchange differences (207,720) (61,681) (68,226) (8,264) (365) (231,600) (577,856)

----------------------- ---------- ----------- ---------- ------------- --------- -------------- -----------

At 31 December

2019 6,849,048 1,520,509 1,420,374 11,798,373 9,053 5,962,772 27,560,129

----------------------- ---------- ----------- ---------- ------------- --------- -------------- -----------

Additions - - - 2,440,559 - - 2,440,559

Disposals - - - - - - -

Exchange differences (151,829) (44,859) (36,151) (6,040) (268) (176,593) (415,740)

At 31 December

2020 6,697,219 1,475,650 1,384,223 14,232,892 8,785 5,786,179 29,584,948

----------------------- ---------- ----------- ---------- ------------- --------- -------------- -----------

Accumulated amortisation and

impairment

At 1 January

2019 1,650,000 1,582,190 1,407,255 5,923,789 29,418 2,618,210 13,210,862

Amortisation

charge - - 79,731 2,128,156 - 774,958 2,982,845

Disposals - - - (60,389) (20,000) - (80,389)

Exchange differences - (61,681) (66,612) (5,521) (365) (121,563) (255,742)

----------------------- ---------- ----------- ---------- ------------- --------- -------------- -----------

At 31 December

2019 1,650,000 1,520,509 1,420,374 7,986,035 9,053 3,271,605 15,857,576

----------------------- ---------- ----------- ---------- ------------- --------- -------------- -----------

Amortisation

charge - - - 2,050,390 - 766,653 2,817,043

Disposals - - - - - - -

Exchange differences - (44,859) (36,151) (5,680) (268) (139,836) (226,794)

At 31 December

2020 1,650,000 1,475,650 1,384,223 10,030,745 8,785 3,898,422 18,447,825

----------------------- ---------- ----------- ---------- ------------- --------- -------------- -----------

Net book value

At 31 December

2019 5,199,048 - - 3,812,338 - 2,691,167 11,702,553

----------------------- ---------- ----------- ---------- ------------- --------- -------------- -----------

At 31 December

2020 5,047,219 - - 4,202,147 - 1,887,757 11,137,123

----------------------- ---------- ----------- ---------- ------------- --------- -------------- -----------

8. Deferred consideration

Affiliate

Marketing RMG* Total RMG*

Continuing Continuing Continuing Discontinued Total

GBP GBP GBP GBP GBP

------------------------- ----------- ----------- ----------- ------------- ------------

At 1 January 2019 385,000 280,690 665,690 3,623,425 4,289,115

Deferred consideration

received in the

year (385,000) - (385,000) - (385,000)

Interest recognised

as finance income

on b/fwd balance - 22,034 22,034 273,851 295,885

Eliminated on

2019 RMG disposal - (302,724) (302,724) (3,897,276) (4,200,000)

Deferred consideration

on 2019 RMG disposal - 1,208,366 1,208,366 - 1,208,366

Interest recognised

as finance income

on 2019 disposal - 90,297 90,297 - 90,297

At 31 December

2019 - 1,298,663 1,298,663 - 1,298,663

-------------------------- ----------- ----------- ----------- ------------- ------------

At 1 January 2020 - 1,298,663 1,298,663 - 1,298,663

Interest recognised

as finance income

on 2019 disposal - 201,337 201,337 - 201,337

Impairment recognised - (527,446) (527,446) - (527,446)

At 31 December

2020 - 972,554 972,554 - 972,554

-------------------------- ----------- ----------- ----------- ------------- ------------

* RMG refers to Real Money Gaming which is classified as

discontinued.

9. Arrangement with GAMESYS GROUP PLC

In December 2017 the Group entered into a complex transaction

with Gamesys Group plc and group companies (together "Gamesys

Group"). The transaction includes a GBP3.5m secured convertible

loan agreement alongside a 10-year framework services agreement for

the supply of various real money services. Under the framework

services agreement the first GBP3.5m of services are provided

free-of-charge within the first 5 years.

The convertible loan has a duration of 5 years and carries

interest at 3-month LIBOR plus 5.5%. It is secured over the Group's

Slingo assets and business. At any time after the first year,

Gamesys Group plc may elect to convert all or part of the principal

amount into ordinary shares of Gaming Realms plc at a discount of

20% to the share price prevailing at the time of conversion. To the

extent that the price per share at conversion is lower than 10p

(nominal value), then the shares can be converted at nominal value

with a cash payment equal to the aggregate value of the convertible

loan outstanding multiplied by the shortfall on nominal value

payable to Gamesys Group plc. Under this arrangement, the maximum

dilution to Gaming Realms shareholders will be approximately 11%,

assuming the convertible loan is converted in full.

The option violates the fixed-for-fixed criteria for equity

classification as the number of shares is variable and as a result

is classified as a liability.

The fair value of the conversion feature is determined at each

reporting date with changes recognised in profit or loss. The

initial fair value was GBP0.6m based on a probability assessment of

conversion and future share price. This is a level 3 valuation as

defined by IFRS 13. The fair value as at 31 December 2020 was

GBP0.6m (2019: GBP0.3m) based on revised probabilities of when and

if the option will be exercised. The key inputs into the valuation

model included timing of exercise by the counterparty (based on a

probability assessment) and the share price.

The initial fair value of the host debt was calculated as

GBP2.7m, being the present value of expected future cash outflows.

The initial rate used to discount future cashflows was 14.1%, being

the Group's incremental borrowing rate. This rate was calculated by

reference to the Group's cost of equity in the absence of reliable

alternative evidence of the Group's cost of borrowing given it is

predominantly equity funded. Expected cashflows are based on

directors' judgement that a change in control event would not

occur. Subsequently the loan is carried at amortised cost. The

residual GBP0.2m of proceeds were allocated to the obligation to

provide free services.

Fair Fair

value Obligation value

of debt to provide of derivative

host free services Liability Total

GBP GBP GBP GBP

----------------------- ---------- ---------------- ---------------- ----------

At 1 January 2019 2,795,602 209,000 200,000 3,204,602

Utilisation of free

services - (8,000) - (8,000)

Effective interest 406,912 - - 406,912

Interest paid (276,841) - - (276,841)

Change in fair value - - 72,000 72,000

----------------------- ---------- ---------------- ---------------- ----------

At 31 January 2019 2,925,673 201,000 272,000 3,398,673

----------------------- ---------- ---------------- ---------------- ----------

At 1 January 2020 2,925,673 201,000 272,000 3,398,673

Utilisation of free

services - (52,000) - (52,000)

Effective interest 437,050 - - 437,050

Interest paid (206,853) - - (206,853)

Change in fair value - - 355,000 355,000

----------------------- ---------- ---------------- ---------------- ----------

At 31 December 2020 3,155,870 149,000 627,000 3,931,870

----------------------- ---------- ---------------- ---------------- ----------

10. Share capital

Ordinary shares

2020 2020 2019 2019

Number GBP Number GBP

Ordinary shares of 286,647,315 28,664,731 284,428,747 28,442,874

------------ ----------- ------------ -----------

10 pence each

--------------------- ------------ ----------- ------------ -----------

The increase of 2,218,568 ordinary shares relates to the

exercise of share options during the year. The total amount

received by the Company for the exercise price settlement was

GBP281,613, which has been recorded as an increase in share capital

and share premium as follows:

GBP

---------------- --------

Share capital 221,857

Share premium 59,756

---------------- --------

281,613

---------------- --------

11. POST BALANCE SHEET EVENTS

On 6 January 2021, the Group was awarded a provisional iGaming

supplier license by the Michigan Gaming Control Board to allow the

Group to provide its Slingo Originals game content to Michigan's

licensed online casino operators.

On 1 April 2021, the Group received GBP1.0m from River for full

and final settlement of the deferred consideration receivable,

certain other receivable balances, and various legal proceedings

and other out of court disputes between the parties.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BCGDSLBDDGBL

(END) Dow Jones Newswires

April 27, 2021 02:00 ET (06:00 GMT)

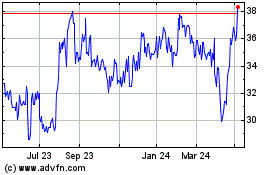

Gaming Realms (LSE:GMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

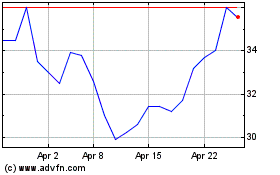

Gaming Realms (LSE:GMR)

Historical Stock Chart

From Apr 2023 to Apr 2024