TIDMGMR

RNS Number : 4817L

Gaming Realms PLC

13 September 2021

Gaming Realms plc

(the "Company" or the "Group")

Interim Results

Revenue growth of 50% generates adjusted EBITDA [1] of GBP3.1m

[2] , up 144%

Continued U.S. expansion post period end with content launched

in Pennsylvania

Gaming Realms plc (AIM: GMR), the developer and licensor of

mobile focused gaming content, is pleased to announce its interim

results for the six months to 30 June 2021 (the "Period" or

"H1'21").

Financial highlights:

H1 2021 H1 2020 Change

GBPm GBPm %

------------------------------------- -------- -------- --------

Revenue (Licensing) 5.8 3.4 +73%

Revenue (Social) 1.9 1.8 +7%

-------- -------- --------

Total revenue 7.7 5.2 +50%

-------- -------- --------

Adjusted EBITDA before share option

and related charges 3.1 1.28 +144%

Adjusted EBITDA 2.7 1.2 +116%

Profit / (loss) before tax 0.8 (0.7)

Cash or cash equivalents 3.92 0.85 +363.3%

-- Total revenue grew 50% from GBP5.2m in H1'20 to GBP7.7m in

H1'21. The Group's revenues generate high margins, and in

combination with a stable fixed cost base, resulted in adjusted

EBITDA growing from GBP1.28m to GBP3.1m, a rise of 144% over the

previous Period.

-- Licensing revenue grew 73% to GBP5.8m (H1'20: GBP3.4m)

o This included content licensing revenue growing 39% to GBP4.1m

(H1'20: GBP2.9m) due to an increase in distribution from an

expanded games portfolio

o Brand licensing reflected a significant deal which positively

impacted revenues, resulting in a 298% increase to GBP1.7m (H1'20:

GBP0.4m)

-- Social revenue increased 7% to GBP1.9m (H1'20: GBP1.8m) from

an increase in new Slingo content, as well as improved player

management and new player engagement features.

-- Cash or cash equivalents grew from GBP0.85m to GBP3.92m due

to strong cash conversion of operating profits.

Operational highlights:

-- Granted provisional iGaming supplier license in Michigan

where we went live with BetMGM with a direct- integration

agreement.

-- Granted Interactive Gaming Manufacture Licence in Pennsylvania.

-- Launched Slingo content in the Italian regulated market with Goldbet and Sisal.

-- Signed several distribution deals including with GAN.

-- Signed content licensing agreement with IGT.

-- Released four new games into the market, including Slingo

Starburst and Slingo Lobstermania. The Group now has 48 games in

its portfolio (Dec'20: 44 games, Jun'20: 40 games).

Post period-end:

-- Licensing revenue increased 28% in the two months post

period-end compared to the same period in 2020 (with the

significant deal reflected in the first half numbers not repeating

in the second half) .

-- Launched in Pennsylvania with BetMGM and Rush Street Interactive.

-- Launched further operators in Michigan with Draftkings and Rush Street Interactive.

-- Released two new Slingo games: Slingo Big Wheel and Redhot Slingo.

Outlook for FY21:

Gaming Realms made exceptional progress during the first half of

the year in developing and licensing games to market-leading brands

and operators globally, expanding its footprint and delivering high

margin revenues.

Momentum is set to continue into the second half of the

financial year, with revenues from the Group's content launches in

Michigan and Pennsylvania (in June and September, respectively)

expected to grow substantially in H2'21. Despite being live with

just three operators to date in Michigan, early appetite for Gaming

Realms' full Slingo portfolio has been promising, and the Group

will be launching imminently with additional operators across all

its U.S. territories to fulfil strong market demand.

Whilst the European market continues to grow and be the largest

contributor to Group results, we are excited about the growth

prospects of the nascent U.S. market. The Company has direct

integrations and multi-State deals with the majority of the U.S.

iGaming market. These include multi-State deals with BetMGM,

Draftkings, Fanduel, Rush Street Interactive, Golden Nugget, Poker

Stars, Barstool/PNG, Kindred, Wynn Interactive, Twinspires, Parx,

Tropicana/Gamesys and Caesars Entertainment. The Company also has

direct integrations with BetMGM, Draftkings, Rush Street

Interactive, Fanduel, Golden Nugget, Gamesys, Twinspires, Wynn

Interactive and 888, with more in the pipeline.

Following the Group's successful launch in the Italian regulated

market earlier this year, Gaming Realms has evaluated further

European expansion opportunities and is preparing for launches in

additional regulated markets in the second half of the year.

With a strong game development pipeline, a clear strategy to

continue expanding its distribution internationally and with demand

from the Group's customers expected to continue, the Board expects

trading for FY21 to be in line with market expectations and remains

confident in the strategic outlook for the business.

Commenting on the first half performance, Michael Buckley,

Executive Chairman, said:

"The Group has delivered an excellent first half both in terms

of significant earnings growth and new licensing and distribution

agreements. Having recently launched in Michigan and Pennsylvania,

the Group is now working to capitalise on the significant

opportunities in these markets. We are also looking to strengthen

our position in Europe through launches in other regulated markets

following the encouraging response we have seen from players in

Italy for our Slingo content.

"Looking further ahead, we are about to start the process for

obtaining a license in Ontario, Canada. Ontario has announced its

intention to regulate iGaming and has the potential to be a bigger

market for Gaming Realms than any one of the U.S. states that have

regulated so far. In addition, we will also pursue further

licensing opportunities within the U.S. as new States announce

their intention to regulate iGaming.

"This is an exciting time for the Company and we intend to

continue to deliver further value by scaling our platform and

bringing innovative content to new audiences worldwide. With more

material impact expected from Michigan and Pennsylvania in the

second half of this year, the Board is confident in the future

performance of the business."

An analyst briefing will be held virtually at 9:30am today. To

attend, please email gamingrealms@yellowjerseypr.com .

[1] EBITDA is profit before interest, tax, depreciation,

amortisation and impairment expenses and is a non-GAAP measure.

Adjusted EBITDA is EBITDA excluding non-recurring material items

which are outside the normal scope of the Group's ordinary

activities. The Group uses EBITDA and Adjusted EBITDA to comment on

its financial performance. Adjusting items include costs arising

from a fundamental restructuring of the Group's operations and

redundancy costs. See Note 4 for further details.

[2] Adjusted EBITDA before share option and related charges.

Enquiries

Gaming Realms plc 0845 123 3773

Michael Buckley, Executive

Chairman

Mark Segal, CFO

Peel Hunt LLP - NOMAD and broker 020 7418 8900

George Sellar

Andrew Clark

Will Bell

Yellow Jersey 07747 788 221

Charles Goodwin

Annabel Atkins

Annabelle Wills

Business review

Overall Group revenues increased 50% from the previous Period,

while total expenses (excluding share option and related charges)

increased 19%. As a result, the Group delivered adjusted EBITDA for

the Period of GBP2.7m (H1'20: GBP1.2m), while also reporting a

pre-tax profit of GBP0.8m compared with a pre-tax loss of GBP0.7m

for the comparative Period.

The high revenue growth from the previous Period was driven by

the 73% growth in licensing revenues, supplemented by the continued

modest growth in social publishing revenues.

Licensing

The licensing business continued to deliver strong growth, with

revenue for the Period increasing 73% to GBP5.8m (H1'20: GBP3.4m).

The 26 partners that went live through 2020 and further 11 partners

going live in H1'21 helped drive this revenue growth, along with

the release of four new Slingo games (H1'20: four games) to the

market.

The overall GBP2.4m increase in licensing revenues was achieved

through a mixture of a GBP0.5m organic increase in content license

revenues from existing partners, a GBP0.6m increase in content

license revenues from partners that went live after 30 June 2020

and a GBP1.3m increase in brand license revenue compared to the

previous Period.

Social

The Group's social publishing business continued to deliver

strong results in the Period, with revenue increasing 7% to GBP1.9m

(H1'20: GBP1.8m).

Marketing costs of GBP0.2m (H1'20: GBP0.03m) were incurred in

order to drive player activity and revenues.

Cash

The Company's cash position at 30 June 2021 was GBP3.9m,

increasing GBP1.8m from the GBP2.1m reported at 31 December

2020.

The increase in cash during the period was largely driven

through the GBP2.3m cash inflow from operating activities and

GBP1.0m of deferred consideration received, offset by the GBP1.6m

of development costs capitalised in the Period.

During the period, on 1 April 2021 the Group received GBP1.0m

from River Tech plc for full and final settlement of deferred

consideration receivable, certain other receivable balances and

various legal proceedings and out of court disputes between the

parties.

The Company has a convertible loan of GBP3.5m owed to Gamesys

Group plc (see Note 14), due for repayment on 31 December 2022.

Consolidated statement of comprehensive income

for the 6 months ended 30 June 2021

6M 6M

30 June 2021 30 June 2020

Unaudited Unaudited

Note GBP GBP

------------------------------------------ ----- --------------------------------- -------------------------------

Revenue 2 7,745,982 5,180,058

Marketing expenses (207,428) (101,408)

Operating expenses (1,185,859) (1,043,235)

Administrative expenses (3,256,425) (3,007,154)

Share option and related charges 13 (442,571) (40,075)

Adjusted EBITDA 2 2,678,699 1,239,067

Restructuring expenses 4 (25,000) (250,881)

EBITDA 2 2,653,699 988,186

----- ---------------------------------

Amortisation of intangible assets 7 (1,461,832) (1,393,651)

Depreciation of property, plant

and equipment 6 (97,282) (108,464)

Finance expense 3 (302,221) (287,335)

Finance income 3 11,564 108,686

------------------------------------------ ----- --------------------------------- -------------------------------

Profit / (loss) before tax 803,928 (692,578)

Tax credit 38,347 62,881

------------------------------------------ ----- --------------------------------- -------------------------------

Profit / (loss) for the period 842,275 (629,697)

------------------------------------------ ----- --------------------------------- -------------------------------

Other comprehensive income

Items that will or may be reclassified

to profit or loss:

Exchange (loss) / gain arising

on translation of foreign operations (84,998) 489,466

------------------------------------------ ----- --------------------------------- -------------------------------

Total other comprehensive income (84,998) 489,466

------------------------------------------ ----- --------------------------------- -------------------------------

Total comprehensive income 757,277 (140,231)

------------------------------------------ ----- --------------------------------- -------------------------------

Profit / (loss) attributable to:

Owners of the parent 843,833 (627,692)

Non-controlling interest (1,558) (2,005)

--------------------------------- -------------------------------

842,275 (629,697)

------------------------------------------ ----- --------------------------------- -------------------------------

Total comprehensive income attributable

to:

Owners of the parent 758,835 (138,226)

Non-controlling interest (1,558) (2,005)

------------------------------------------ ----- --------------------------------- -------------------------------

757,277 (140,231)

------------------------------------------ ----- --------------------------------- -------------------------------

Profit / (loss) per share Pence Pence

Basic 5 0.29 (0.22)

Diluted 5 0.28 (0.22)

------------------------------------------ ----- --------------------------------- -------------------------------

Consolidated statement of financial position

as at 30 June 2021

30 June 31 December

2021 2020

Unaudited Audited

Note GBP GBP

-------------------------------------- ----- ------------- -------------

Non-current assets

Intangible assets 7 11,495,250 11,137,123

Other investments 8 - 401,291

Property, plant and equipment 6 583,722 560,793

Other assets 150,387 150,528

-------------------------------------- ----- ------------- -------------

12,229,359 12,249,735

-------------------------------------- ----- ------------- -------------

Current assets

Trade and other receivables 9 3,015,377 2,343,739

Deferred consideration - 972,554

Finance lease asset 64,469 140,058

Cash and cash equivalents 10 3,923,635 2,105,167

-------------------------------------- ----- ------------- -------------

7,003,481 5,561,518

-------------------------------------- ----- ------------- -------------

Total assets 19,232,840 17,811,253

-------------------------------------- ----- ------------- -------------

Current liabilities

Trade and other payables 11 2,159,335 1,943,714

Lease liabilities 257,979 343,859

-------------------------------------- ----- ------------- -------------

2,417,314 2,287,573

-------------------------------------- ----- ------------- -------------

Non-current liabilities

Deferred tax liability 256,287 320,913

Other Creditors 14 3,406,970 3,304,870

Derivative liabilities 14 627,000 627,000

Lease liabilities 247,190 340,175

-------------------------------------- ----- ------------- -------------

4,537,447 4,592,958

-------------------------------------- ----- ------------- -------------

Total liabilities 6,954,761 6,880,531

-------------------------------------- ----- ------------- -------------

Net assets 12,278,079 10,930,722

-------------------------------------- ----- ------------- -------------

Equity

Share capital 12 28,870,262 28,664,731

Share premium 87,370,856 87,258,166

Merger reserve (67,673,657) (67,673,657)

Foreign exchange reserve 1,294,118 1,379,116

Retained earnings (37,652,565) (38,768,257)

-------------------------------------- ----- ------------- -------------

Total equity attributable to owners

of the parent 12,209,014 10,860,099

-------------------------------------- ----- ------------- -------------

Non-controlling interest 69,065 70,623

-------------------------------------- ----- ------------- -------------

Total equity 12,278,079 10,930,722

-------------------------------------- ----- ------------- -------------

Consolidated statement of cash flows

for the 6 months ended 30 June 2021

30 June 30 June

2021 2020

Unaudited Unaudited

Note GBP GBP

------------------------------------------------- ------ ------------ ------------

Cash flows from operating activities

Profit / (loss) for the period 842,275 (629,697)

Adjustments for:

Depreciation of property, plant and equipment 6 97,282 108,464

Amortisation of intangible fixed assets 7 1,461,832 1,393,651

Finance income 3 (11,564) (108,686)

Finance expense 3 302,221 287,335

Loss on disposal of property, plant and

equipment 6 578 -

Income tax credit (38,347) (62,881)

Exchange differences 29,803 (127,423)

Share option and related charges 13 442,571 40,075

Increase in trade and other receivables (877,939) (1,152,422)

Decrease in trade and other payables 14,909 (293,848)

Increase in other assets - (840)

------------------------------------------------- ------ ------------ ------------

Net cash flows from / (used in) operating

activities 2,263,621 (546,272)

------------------------------------------------- ------ ------------ ------------

Investing activities

Acquisition of property, plant and equipment 6 (119,847) (18,891)

Acquisition of intangible assets (98,473) -

Capitalised development costs 7 (1,614,370) (1,099,406)

Proceeds from the sale of other investments 8 362,435 -

Interest received - 1

Finance lease asset - sublease receipts 78,840 83,700

------------------------------------------------- ------ ------------ ------------

Net cash used in investing activities (1,391,415) (1,034,596)

------------------------------------------------- ------ ------------ ------------

Financing activities

Receipt of deferred consideration 972,554 -

IFRS 16 lease payments (203,878) (167,193)

Issue of share capital on exercise of

options 12 318,221 -

Interest paid (105,218) (116,669)

------------------------------------------------- ------ ------------ ------------

Net cash from / (used in) financing activities 981,679 (283,862)

------------------------------------------------- ------ ------------ ------------

Net increase / (decrease) in cash and

cash equivalents 1,853,885 (1,864,730)

Cash and cash equivalents at beginning

of period 2,105,167 2,608,455

Exchange (loss) / gain on cash and cash

equivalents (35,417) 84,686

------------------------------------------------- ------ ------------ ------------

Cash and cash equivalents at end of period 3,923,635 828,411

------------------------------------------------- ------ ------------ ------------

Consolidated statement of changes in equity

for the 6 months ended 30 June 2021

Total

to equity

Foreign holders

Share Share Merger Exchange Retained of Non-controlling Total

capital premium reserve Reserve earnings parents interest equity

GBP GBP GBP GBP GBP GBP GBP GBP

---------------- ----------- ----------- ------------- ---------- ------------- ----------- ----------------- -----------

1 January 2020 28,442,874 87,198,410 (67,673,657) 1,605,782 (37,570,601) 12,002,808 76,716 12,079,524

---------------- ----------- ----------- ------------- ---------- ------------- ----------- ----------------- -----------

Loss for the

period - - - - (627,692) (627,692) (2,005) (629,697)

Other

comprehensive

income - - - 489,466 - 489,466 - 489,466

---------------- ----------- ----------- ------------- ---------- ------------- ----------- ----------------- -----------

Total

comprehensive

income

for the

period - - - 489,466 (627,692) (138,226) (2,005) (140,231)

---------------- ----------- ----------- ------------- ---------- ------------- ----------- ----------------- -----------

Contributions

by and

distributions

to owners

Share-based

payment on

share

options (Note

13) - - - - 40,075 40,075 - 40,075

30 June 2020

(unaudited) 28,442,874 87,198,410 (67,673,657) 2,095,248 (38,158,218) 11,904,657 74,711 11,979,368

---------------- ----------- ----------- ------------- ---------- ------------- ----------- ----------------- -----------

1 January 2021 28,664,731 87,258,166 (67,673,657) 1,379,116 (38,768,257) 10,860,099 70,623 10,930,722

---------------- ----------- ----------- ------------- ---------- ------------- ----------- ----------------- -----------

Profit for the

period - - - - 843,833 843,833 (1,558) 842,275

Other

comprehensive

income - - - (84,998) - (84,998) - (84,998)

---------------- ----------- ----------- ------------- ---------- ------------- ----------- ----------------- -----------

Total

comprehensive

income

for the

period - - - (84,998) 843,833 758,835 (1,558) 757,277

---------------- ----------- ----------- ------------- ---------- ------------- ----------- ----------------- -----------

Contributions

by and

distributions

to owners

Share-based

payment on

share

options (Note

13) - - - - 271,859 271,859 - 271,859

Exercise of

options (Note

12) 205,531 112,690 - - - 318,221 - 318,221

30 June 2021

(unaudited) 28,870,262 87,370,856 (67,673,657) 1,294,118 (37,652,565) 12,209,014 69,065 12,278,079

---------------- ----------- ----------- ------------- ---------- ------------- ----------- ----------------- -----------

Notes forming part of the consolidated financial statements

For the 6 months ended 30 June 2021

1. Accounting policies

General Information

Gaming Realms plc ("the Company") and its subsidiaries (together

"the Group").

The Company is admitted to trading on AIM of the London Stock

Exchange. It is incorporated and domiciled in the UK. The address

of its registered office is Two Valentine Place, London,

SE18QH.

The results for the six months ended 30 June 2021 and 30 June

2020 are unaudited.

Basis of preparation

The financial information for the year ended 31 December 2020

included in these financial statements does not constitute the full

statutory accounts for that year. The Annual Report and Financial

Statements for 2020 have been filed with the Registrar of

Companies. The Independent Auditors' Report on the Annual Report

and Financial Statement for 2020 was unqualified, did not draw

attention to any matters by way of emphasis, and did not contain a

statement under 498(2) or 498(3) of the Companies Act 2006.

This interim report, which has neither been audited nor reviewed

by independent auditors, was approved by the board of directors on

10 September 2021. The financial information in this interim report

has been prepared in accordance with UK adopted international

accounting standards. The accounting policies applied by the Group

in this financial information are the same as those applied by the

Group in its financial statements for the year ended 31 December

2020 and which will form the basis of the 2021 financial

statements.

The consolidated financial statements are presented in

Sterling.

Going concern

The Group meets its day-to-day working capital requirements from

the cash flows generated by its trading activities and its

available cash resources.

The Group prepares cash flow forecasts and re-forecasts at least

bi-annually as part of the business planning process. A

re-forecasting process has been completed for H2 2021 to 2023 in

light of the economic uncertainty resulting from the ongoing

COVID-19 pandemic. These forecasts have been reviewed by the

Directors and show that the Group will continue to have sufficient

cash resources available to meet its liabilities as they fall

due.

Accordingly, these financial statements have been prepared on

the basis of accounting principles applicable to a going concern,

which assumes that the Group will realise its assets and discharge

its liabilities in the normal course of business.

Adjusted EBITDA

EBITDA is a non-GAAP company specific measure defined as profit

or loss before tax adjusted for finance income and expense,

depreciation and amortisation.

Adjusted EBITDA excludes non-recurring material items which are

outside the normal scope of the Group's ordinary activities.

Adjusted EBITDA is considered to be a key performance measure by

the Directors as it serves as an indicator of financial

performance. The adjusting items are separately disclosed in order

to enhance the reader's understanding of the Group's profitability

and cash flow generation. Adjusting items include costs arising

from a fundamental restructuring of the Group's operations and

redundancy costs.

2. Segment information

The Board is the Group's chief operating decision-maker.

Management has determined the operating segments based on the

information reviewed by the Board for the purposes of allocating

resources and assessing performance.

The Group has two reportable segments.

-- Licensing - B2B brand and content licensing to partners in the US and Europe; and

-- Social publishing - provides B2C freemium games to the US and Europe.

Revenue

The Group has disaggregated revenue into various categories in

the following table which is intended to:

-- Depict how the nature, amount, timing and uncertainty of

revenue and cash flows are affected by economic date; and

-- Enable users to understand the relationship with revenue segment information provided below.

Social

Licensing publishing Other Total

H1 2021 revenue GBP GBP GBP GBP

-------------------------- ----------- ------------- ------- ----------

Primary geographical

markets

UK, including Channel

Islands 381,898 - - 381,898

USA 1,228,086 1,930,171 - 3,158,257

Isle of Man 2,533,481 - - 2,533,481

Rest of the World 1,672,346 - - 1,672,346

-------------------------- ----------- ------------- ------- ----------

5,815,811 1,930,171 - 7,745,982

-------------------------- ----------- ------------- ------- ----------

Contract counterparties

Direct to consumers

(B2C) - 1,930,171 - 1,930,171

B2B 5,815,811 - - 5,815,811

-------------------------- ----------- ------------- ------- ----------

5,815,811 1,930,171 - 7,745,982

-------------------------- ----------- ------------- ------- ----------

Timing of transfer of goods

and services

Point in time 5,735,657 1,930,171 - 7,665,828

Over time 80,154 - - 80,154

-------------------------- ----------- ------------- ------- ----------

5,815,811 1,930,171 - 7,745,982

-------------------------- ----------- ------------- ------- ----------

Social

Licensing publishing Other Total

H1 2020 revenue GBP GBP GBP GBP

-------------------------- ----------- ------------- ------- ----------

Primary geographical

markets

UK, including Channel

Islands 226,376 - - 226,376

USA 1,092,749 1,809,774 2,400 2,904,923

Isle of Man 1,295,490 - - 1,295,490

Rest of the World 753,269 - - 753,269

-------------------------- ----------- ------------- ------- ----------

3,367,884 1,809,774 2,400 5,180,058

-------------------------- ----------- ------------- ------- ----------

Contract counterparties

Direct to consumers

(B2C) - 1,809,774 - 1,809,774

B2B 3,367,884 - 2,400 3,370,284

-------------------------- ----------- ------------- ------- ----------

3,367,884 1,809,774 2,400 5,180,058

-------------------------- ----------- ------------- ------- ----------

Timing of transfer of goods

and services

Point in time 3,207,576 1,809,774 2,400 5,019,750

Over time 160,308 - - 160,308

-------------------------- ----------- ------------- ------- ----------

3,367,884 1,809,774 2,400 5,180,058

-------------------------- ----------- ------------- ------- ----------

Adjusted EBITDA

Social

Licensing publishing Head Office Total

H1 2021 GBP GBP GBP GBP

----------------- -------------------------- -------------------------- -------------------------- --------------------------

Revenue 5,815,811 1,930,171 - 7,745,982

Marketing

expense (12,389) (157,862) (37,177) (207,428)

Operating

expense (606,247) (579,612) - (1,185,859)

Administrative

expense (1,741,832) (583,265) (906,328) (3,231,425)

Share option

and

related

charges (85,401) (4,745) (352,425) (442,571)

----------------- -------------------------- -------------------------- -------------------------- --------------------------

Adjusted EBITDA

-

continuing 3,369,942 604,687 (1,295,930) 2,678,699

----------------- -------------------------- -------------------------- -------------------------- --------------------------

Restructuring

expenses (25,000)

EBITDA -

continuing 2,653,699

----------------- -------------------------- -------------------------- -------------------------- --------------------------

Social

Licensing publishing Head Office Total

H1 2020 GBP GBP GBP GBP

----------------- -------------------------- -------------------------- -------------------------- --------------------------

Revenue 3,367,884 1,809,774 2,400 5,180,058

Marketing

expense (8,608) (34,051) (58,749) (101,408)

Operating

expense (515,894) (529,567) 2,226 (1,043,235)

Administrative

expense (1,112,048) (413,001) (1,231,224) (2,756,273)

Share option

and

related

charges - - (40,075) (40,075)

----------------- -------------------------- -------------------------- -------------------------- --------------------------

Adjusted EBITDA

-

continuing 1,731,334 833,155 (1,325,422) 1,239,067

----------------- -------------------------- -------------------------- -------------------------- --------------------------

Restructuring

expenses (250,881)

EBITDA -

continuing 988,186

----------------- -------------------------- -------------------------- -------------------------- --------------------------

3. Finance income and expense

6M 6M

30 June 30 June

2021 2020

GBP GBP

---------------------------------------- ---------------------------- ------------------------------

Finance income

Interest received 6,306 1

Interest income on finance lease

asset 5,258 11,642

Interest income on unwind of deferred

consideration receivable - 97,043

----------------------------------------- ---------------------------- ------------------------------

Total finance income 11,564 108,686

----------------------------------------- ---------------------------- ------------------------------

Finance expense

Bank interest paid 8,743 8,722

Fair value loss on other investments 38,856 26,575

Effective interest on other creditor 228,575 213,304

Interest expense on lease liability 26,047 38,734

----------------------------------------- ---------------------------- ------------------------------

Total finance expense 302,221 287,335

----------------------------------------- ---------------------------- ------------------------------

4. Adjusted EBITDA

EBITDA and Adjusted EBITDA are non-GAAP measures and exclude

exceptional items, depreciation, and amortisation. Exceptional

items are those items the Group considers to be non-recurring or

material in nature that may distort an understanding of financial

performance or impair comparability.

Adjusted EBITDA is stated before exceptional items as

follows:

6M 6M

30 June 30 June

2021 2020

GBP GBP

------------------------- --------- ----------

Restructuring expenses (25,000) (250,881)

------------------------- --------- ----------

Adjusting items (25,000) (250,881)

------------------------- --------- ----------

Restructuring expenses

Restructuring costs of GBP25k (H1 2020: GBP251k) were incurred

relating to restructuring and redundancy costs.

5 . Earnings per share

Basic earnings per share is calculated by dividing the result

attributable to ordinary shareholders by the weighted average

number of shares in issue during the period. The calculation of

diluted EPS is based on the result attributable to ordinary

shareholders and weighted average number of ordinary shares

outstanding after adjustment for the effects of all dilutive

potential ordinary shares. The Group's potentially dilutive

securities consist of share options and a convertible loan (see

Note 14). The convertible loan is anti-dilutive and so is ignored

in calculating diluted EPS.

6M 6M

30 June 30 June

2021 2020

GBP GBP

------------------------------------------- ------------ ------------

Profit / (loss) after tax attributable

to the owners of the parent Company 843,833 (627,692)

Number Number

------------------------------------------- ------------ ------------

Denominator - basic

Weighted average number of ordinary

shares 288,157,560 284,428,747

Denominator - diluted

Weighted average number of ordinary

shares 288,157,560 284,428,747

Weighted average number of option shares 12,332,327 -

------------------------------------------- ------------ ------------

Weighted average number of shares 300,489,887 284,428,747

------------------------------------------- ------------ ------------

Pence Pence

------------------------------------------- ------------ ------------

Basic earnings per share 0.29 (0.22)

Diluted earnings per share 0.28 (0.22)

------------------------------------------- ------------ ------------

6. Property, plant and equipment

Computers Office

ROU lease Leasehold and related furniture

assets improvements equipment and equipment Total

GBP GBP GBP GBP GBP

----------------------- ----------- --------------- -------------- ---------------- ----------

Cost

At 1 January 2021 769,613 76,059 206,367 77,209 1,129,248

Additions - - 119,189 658 119,847

Disposals - - (28,763) - (28,763)

Exchange differences 1,736 (63) 1,056 435 3,164

At 30 June 201 771,349 75,996 297,849 78,302 1,223,496

----------------------- ----------- --------------- -------------- ---------------- ----------

Accumulated deprecation

and impairment

At 1 January 2021 304,667 29,717 172,932 61,139 568,455

Depreciation charge 75,105 7,968 10,221 3,988 97,282

Disposals - - (28,185) - (28,185)

Exchange differences 1,037 (62) 717 530 2,222

At 30 June 2021 380,809 37,623 155,685 65,657 639,774

----------------------- ----------- --------------- -------------- ---------------- ----------

Net book value

At 31 December

2020 464,946 46,342 33,435 16,070 560,793

----------------------- ----------- --------------- -------------- ---------------- ----------

At 30 June 2021 390,540 38,373 142,164 12,645 583,722

----------------------- ----------- --------------- -------------- ---------------- ----------

7. Intangible assets

Customer Development Domain Intellectual

Goodwill database Software costs Licenses names Property Total

GBP GBP GBP GBP GBP GBP GBP GBP

---------- ----------- ---------- ------------- ---------- -------- -------------- -----------

Cost

At 1 January

2021 6,697,219 1,475,650 1,384,223 14,232,892 - 8,785 5,786,179 29,584,948

Additions - - 76,286 1,614,370 212,515 - - 1,903,171

Exchange

differences (59,611) (17,612) (14,194) (2,371) - (105) (69,333) (163,226)

At 30 June

2021 6,637,608 1,458,038 1,446,315 15,844,891 212,515 8,680 5,716,846 31,324,893

--------------- ---------- ----------- ---------- ------------- ---------- -------- -------------- -----------

Accumulated amortisation

and impairment

At 1 January

2021 1,650,000 1,475,650 1,384,223 10,030,745 - 8,785 3,898,422 18,447,825

Amortisation

charge - - 12,749 1,076,512 15,945 - 356,626 1,461,832

Exchange

differences - (17,612) (14,194) (2,295) - (105) (45,808) (80,014)

At 30 June

2021 1,650,000 1,458,038 1,382,778 11,104,962 15,945 8,680 4,209,240 19,829,643

--------------- ---------- ----------- ---------- ------------- ---------- -------- -------------- -----------

Net book

value

At 31

December

2020 5,047,219 - - 4,202,147 - - 1,887,757 11,137,123

--------------- ---------- ----------- ---------- ------------- ---------- -------- -------------- -----------

At 30 June

2021 4,987,608 - 63,537 4,739,929 196,570 - 1,507,606 11,495,250

--------------- ---------- ----------- ---------- ------------- ---------- -------- -------------- -----------

8. Other investments

The other investment balance comprises a 6.6% interest in Ayima

Group AB ("Ayima"). The shares of Ayima are quoted on AktieTorget,

a Nordic stock exchange (www.aktietorget.se). The investment is

remeasured each reporting period to fair value based on the quoted

share price.

During the period the Group disposed of its entire shareholding

in Ayima, generating cash proceeds on disposal of GBP0.4m bringing

the investment balance to GBPNil (31 December 2020:

GBP401,291).

9. Trade and other receivables

30 June 31 December

2021 2020

GBP GBP

Trade receivables 1,383,856 1,319,769

Other receivables 35,337 216,207

Tax and social

security 179,507 5,288

Prepayments and

accrued income 1,416,677 802,475

3,015,377 2,343,739

All amounts shown fall due for payment within one year.

10. Cash and cash equivalents

30 June 31 December 30 June

2021 2020 2020

GBP GBP GBP

-------------------------------- ---------- ------------ ---------

Cash and cash equivalents 3,923,635 2,105,167 846,793

Restricted cash - (18,382) (18,382)

--------------------------------- ---------- ------------ ---------

Cash and cash equivalents for

Statement of Cash Flows 3,923,635 2,086,785 828,411

--------------------------------- ---------- ------------ ---------

Restricted cash in previous periods relates to funds held in

Swiss subsidiaries which are currently undergoing liquidation. The

funds are restricted and are not included in the consolidated

statement of cash flows.

11. Trade and other payables

30 June 31 December

2021 2020

GBP GBP

----------------- ---------- ------------

Trade payables 592,895 368,402

Other payables 139,605 290,543

Tax and social

security 175,259 122,533

Accruals 1,251,576 1,162,236

------------------ ---------- ------------

2,159,335 1,943,714

----------------- ---------- ------------

The carrying value of trade and other payables classified as

financial liabilities measured at amortised cost approximates fair

value.

12. Share capital

30 June 30 June 31 December 31 December

2021 2021 2020 2020

Ordinary shares Number GBP Number GBP

Ordinary shares

of 288,702,626 28,870,262 286,647,315 28,664,731

------------ ----------- ------------ ------------

10 pence each

------------------ ------------ ----------- ------------ ------------

The increase of 2,055,311 ordinary shares relates to the

exercise of share options during the period. The total amount

received by the Company for the exercise price settlement was

GBP318,221, which has been recorded as an increase in share capital

and share premium as follows:

GBP

Share capital 205,531

Share premium 112,690

---------------- --------

318,221

---------------- --------

13. Share based payments

The share option and related charges income statement expense

comprises:

6M 6M

30 June 30 June

2021 2020

GBP GBP

----------------------------- --------- ---------

IFRS 2 share-based payment

charge 271,859 40,075

Direct taxes related 170,712 -

to share options

----------------------------- --------- ---------

442,571 40,075

----------------------------- --------- ---------

IFRS 2 (Share-based payments) requires that the fair value of

equity settled transactions are calculated and systematically

charged to the statement of comprehensive income over the vesting

period. The total fair value that was charged to the income

statement in the period in relation to equity-settled share-based

payments was GBP271,859 (H1 2020: GBP40,075).

Where individual EMI thresholds are exceeded or when unapproved

share options are exercised by overseas employees, the Group is

subject to employer taxes payable on the taxable gain on exercise.

Since these taxes are directly related to outstanding share

options, the income statement charge has been included within share

option and related charges. The Group uses its closing share price

at the reporting date to calculate such taxes to accrue. The tax

related income statement charge for the period was GBP170,712 (H1

2020: GBPNil).

On 5 January 2021, certain employees of the Group were granted a

total of 350,000 share options, which vest in three equal tranches

on 1 January 2022, 1 January 2023 and 1 January 2024. The options

have an exercise price of 22.4 pence per share.

14. Arrangement with Gamesys Group plc

In December 2017 the Group entered into a complex transaction

with Gamesys Group plc and Group companies (together 'Gamesys

Group'). The transaction includes a GBP3.5m secured convertible

loan agreement alongside a 10-year framework services agreement for

the supply of various real money services. Under the framework

services agreement the first GBP3.5m of services are provided free

of charge within the first 5 years.

The convertible loan has a duration of 5 years and carried

interest at 3-month LIBOR plus 5.5%. It is secured over the Group's

Slingo assets and business. At any time after the first year,

Gamesys Group plc may elect to convert all or part of the principal

amount into ordinary shares of Gaming Realms plc at a discount of

20% to the share price prevailing at the time of conversion. To the

extent that the price per share at conversion is lower than 10p

(nominal value), then the shares can be converted at nominal value

with a cash payment equal to the aggregate value of the convertible

loan outstanding multiplied by the shortfall on nominal value

payable to Gamesys Group plc. Under this arrangement the maximum

dilution to Gaming Realms shareholders will be approximately 11%

assuming the convertible loan is converted in full.

The option violates the fixed-for-fixed criteria for equity

classification as the number of shares is variable and as a result

is classified as a liability.

The fair value of the conversion feature is determined each

reporting date with changes recognised in profit or loss. The

initial fair value was GBP0.6m based on a probability assessment of

conversion and future share price. This is a level 3 valuation as

defined by IFRS 13. The fair value as at 30 June 2021 was GBP0.6m

(31 December 2020: GBP0.6m) based on revised probabilities of when

and if the option will be exercised. The key inputs into the

valuation model included timing of exercise by the counterparty

(based on a probability assessment) and the share price.

The initial fair value of the host debt was calculated as

GBP2.7m, being the present value of expected future cash outflows.

The initial rate used to discount future cash flows was 14.1%,

being the Group's incremental borrowing rate. The rate was

calculated by reference to the Group's cost of equity in the

absence of reliable alternative evidence of the Group's cost of

borrowing given it is predominantly equity funded. Expected cash

flows are based on the directors' judgement that a change in

control event would not occur. Subsequently the loan is carried at

amortised cost.

The residual GBP0.2m of proceeds were allocated to the

obligation of provide free services.

Fair Fair

value Obligation value

of debt to provide of derivative

host free services Liability Total

GBP GBP GBP GBP

---------------------- ---------- ---------------- ---------------- ----------

At 1 January 2021 3,155,870 149,000 627,000 3,931,870

Utilisation of free

services - (30,000) - (30,000)

Effective interest 228,575 - - 228,575

Interest paid (96,475) - - (96,475)

---------------------- ---------- ---------------- ---------------- ----------

At 30 June 2021 3,287,970 119,000 627,000 4,033,970

---------------------- ---------- ---------------- ---------------- ----------

15. Related party transactions

Jim Ryan is a Non-Executive Director of the Company and the CEO

of Pala Interactive, which has a real-money online casino and bingo

site in New Jersey. During the period, total license fees earned by

the Group were $24,862 (H1 2020: $22,592) with $12,668 due at 30

June 2021 (30 June 2020: $7,599).

Jim Ryan is a Non-Executive Director of Gamesys Group plc. In

December 2017 the Group entered into a 10-year framework services

agreement and a 5-year convertible loan agreement for GBP3.5m with

Gamesys Group plc (see Note 14).

During the period GBP75,000 (H1 2020: GBP48,333) of consulting

fees were paid to Dawnglen Finance Limited, a company controlled by

Michael Buckley. No amounts were owed at 30 June 2021 (30 June

2020: GBPNil).

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKBBKKBKDQCD

(END) Dow Jones Newswires

September 13, 2021 02:00 ET (06:00 GMT)

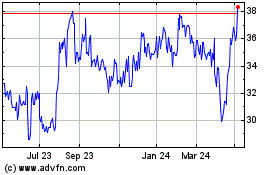

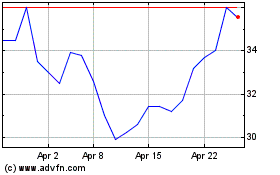

Gaming Realms (LSE:GMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gaming Realms (LSE:GMR)

Historical Stock Chart

From Apr 2023 to Apr 2024