TIDMGMS

RNS Number : 6915D

Gulf Marine Services PLC

30 June 2021

FOR IMMEDIATE RELEASE 30 June 2021

Gulf Marine Services PLC

('Gulf Marine Services', 'GMS', the 'Company' or the

'Group')

Results of Annual General Meeting ("AGM")

Results of the AGM

The AGM of Gulf Marine Services PLC was held on Wednesday, 30

June 2021. In the context of the continued restrictions on public

gatherings as a result of the COVID-19 pandemic, it was therefore

not possible for the AGM to be held in the same format as in

previous years, as a result of which shareholders were strongly

encouraged to submit a form of proxy in advance of this meeting

rather than seeking to vote in person.

Accordingly, all the resolutions were put to shareholders on a

poll. The results of the poll are shown in the

table below and will shortly be available on the Company's website, www.gmsplc.com.

Resolution Votes in % Votes % Total Votes

Favour (including Against Votes Withheld(2)

discretionary)(1) (excluding

votes withheld)

1. To receive the Annual

Report and Accounts for

the financial year ended

31 December 2020. 433,330,544 99.93% 313,235 0.07% 433,643,779 2,039

------------------- ------- ----------- ------ ----------------- -------------

2. To approve the Remuneration

Policy included in the

Annual Report and Accounts

for the financial year

ended 31 December 2020. 394,480,051 90.97% 39,151,228 9.03% 433,631,279 14,539

------------------- ------- ----------- ------ ----------------- -------------

3. To approve the Directors'

Remuneration Report included

in the Annual Report

and Accounts for the

financial year ended

31 December 2020. 431,901,063 99.60% 1,730,216 0.40% 433,631,279 14,539

------------------- ------- ----------- ------ ----------------- -------------

4. To reappoint Mansour

Al Alami as a Director. 433,316,509 99.93% 311,985 0.07% 433,628,494 17,324

------------------- ------- ----------- ------ ----------------- -------------

5. To reappoint Hassan

Heikal as a Director. 395,044,399 91.28% 37,729,920 8.72% 432,774,319 871,499

------------------- ------- ----------- ------ ----------------- -------------

6. To reappoint Rashed

Al Jarwan as a Director. 395,898,574 91.30% 37,729,920 8.70% 433,628,494 17,324

------------------- ------- ----------- ------ ----------------- -------------

7. To reappoint Jyrki

Koskelo as a Director. 433,026,759 99.86% 601,735 0.14% 433,628,494 17,324

------------------- ------- ----------- ------ ----------------- -------------

8. To reappoint Lord

Anthony St John of Bletso

as a Director. 431,918,759 99.61% 1,712,235 0.39% 433,630,994 14,824

------------------- ------- ----------- ------ ----------------- -------------

9. To reappoint Deloitte

LLP as Auditor. 431,943,735 99.61% 1,700,044 0.39% 433,643,779 2,039

------------------- ------- ----------- ------ ----------------- -------------

10. To authorise the

Audit and Risk Committee,

for and on behalf of

the Directors, to agree

the Auditor's remuneration. 431,920,073 99.60% 1,723,706 0.40% 433,643,779 2,039

------------------- ------- ----------- ------ ----------------- -------------

11. To authorise the

Directors to allot securities

(s.551 of the Companies

Act 2006). 433,298,432 99.92% 342,562 0.08% 433,640,994 4,824

------------------- ------- ----------- ------ ----------------- -------------

12. To approve the GMS

Deferred Bonus plan 431,615,201 99.53% 2,025,793 0.47% 433,640,994 4,824

------------------- ------- ----------- ------ ----------------- -------------

13. To approve the amendment

to the percentage of

total dilutive share

awards under the LTIP. 394,779,129 91.04% 38,861,865 8.96% 433,640,994 4,824

------------------- ------- ----------- ------ ----------------- -------------

14. To approve the amendment

to grant the Executive

Chairman share awards

under the LTIP. 394,768,879 91.04% 38,862,115 8.96% 433,630,994 14,824

------------------- ------- ----------- ------ ----------------- -------------

15. To disapply pre-emption

rights (s.570 and s.573

of the Companies Act

2006)(3) . 431,897,064 99.60% 1,733,930 0.40% 433,630,994 14,824

------------------- ------- ----------- ------ ----------------- -------------

16. To disapply pre-emption

rights (s.570 and s.573

of the Companies Act

2006) up to a further

5% for acquisitions or

specified capital investments.

(3) 431,895,316 99.60% 1,745,678 0.40% 433,640,994 4,824

------------------- ------- ----------- ------ ----------------- -------------

17. To authorise the

Company to make market

purchases of its own

shares (s.701 of the

Companies Act 2006).(3) 433,316,158 99.92% 327,621 0.08% 433,643,779 2,039

------------------- ------- ----------- ------ ----------------- -------------

18. To authorise the

Directors to call general

meetings of the Company

(other than an annual

general meeting) on not

less than 14 clear days'

notice.(3) 433,328,779 99.93% 315,000 0.07% 433,643,779 2,039

------------------- ------- ----------- ------ ----------------- -------------

Notes:

1) Any proxy appointments giving discretion to the Chairman of

the Meeting have been included in the "For" totals above.

2) A vote "Withheld" is not a vote in law and is not counted in

the calculation of the votes "For" or "Against" a resolution.

3) Indicates special resolutions requiring a 75% majority of

votes cast in favour to be passed.

The Company's total ordinary shares in issue (total voting

rights) as at 30 June 2021 was 1,016,414,582 ordinary shares of 2

pence each. Ordinary shareholders are entitled to one vote per

ordinary share held. No shares were held in treasury.

The full text of the resolutions may be found in the notice of

the AGM, copies of which are available on both the Company's

website at www.gmsplc.com and on the National Storage Mechanism at

https://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism

.

In accordance with LR 9.6.2R, copies of all resolutions passed

at the AGM concerning items other than ordinary business have been

submitted to the National Storage Mechanism and will shortly be

available for inspection at

https://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism

.

Enquiries: GMS

Mansour Al Alami, Executive

Chairman +44 (0) 207 603 1515

Celicourt Communications

Mark Antelme

Philip Dennis +44 (0)20 8434 2643

Gulf Marine Services PLC's Legal Entity Identifier is

213800IGS2QE89SAJF77

www.gmsplc.com

Disclaimer

The content of the Gulf Marine Services PLC website should not

be considered to form a part of or be incorporated into this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGSDSFESEFSELM

(END) Dow Jones Newswires

June 30, 2021 08:42 ET (12:42 GMT)

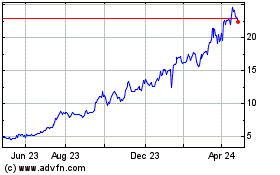

Gulf Marine Services (LSE:GMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

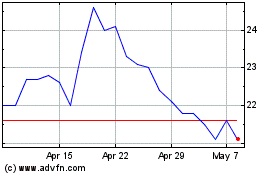

Gulf Marine Services (LSE:GMS)

Historical Stock Chart

From Apr 2023 to Apr 2024