TIDMGMS

RNS Number : 4144L

Gulf Marine Services PLC

13 May 2022

13 May 2022

Gulf Marine Services PLC

('Gulf Marine Services', 'GMS', 'the Company' or 'the

Group')

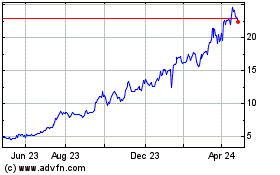

2021 Financial Results

Gulf Marine Services PLC ("GMS" or the "Company"), a leading

provider of advanced self-propelled, self-elevating support vessels

serving the offshore oil, gas and renewables industries, is pleased

to announce its full year financial results for the year to 31

December 2021.

Financial Overview

2021 2020 2019

US$m US$m US$m

--------------------------------- ----- ------- ------

Revenue 115.1 102.5 108.7

--------------------------------- ----- ------- ------

Gross profit/(loss) 60.6 (55.5) (25.0)

--------------------------------- ----- ------- ------

Adjusted EBITDA[1] 64.1 50.4 51.4

--------------------------------- ----- ------- ------

Impairment reversal/(impairment) 15.0 (87.2) (59.1)

--------------------------------- ----- ------- ------

Net profit/(loss) for the year 31.2 (124.3) (85.5)

--------------------------------- ----- ------- ------

Adjusted net profit/(loss)[2] 18.0 (15.3) (20.0)

--------------------------------- ----- ------- ------

2021 Financial Highlights

-- Revenue increased by 12.3% to US$ 115.1 million (2020: US$

102.5 million) driven by increased utilisation in higher earning E-

and S-Class vessels.

-- Adjusted EBITDA(1) increased to US$ 64.1 million (2020: US$

50.4 million) and adjusted EBITDA margin improved to 56% (2020:

49%).

-- Cost of sales excluding depreciation, amortisation and the

reversal of impairment/impairment charge was US$ 41.2 million

(2020: US$ 42.3 million) reflecting higher vessel utilisation and

saving initiatives.

-- General and administrative expenses decreased to US$ 12.3

million (2020: US$ 18.2 million) as a result of US$ 5.6 million of

non-recurring costs incurred in the prior year (2021: nil).

-- US$ 15.0 million reversal of prior years impairment compared

to an impairment charge of US$ 87.2 million in 2020, reflecting

Group's improved long-term outlook.

-- First reported net profit since 2016 at US$ 31.2 million

(2020: net loss of US$ 124.3 million). Adjusted net profit(2) of

US$ 18.0 million (2020: adjusted net loss of US$ 15.3 million).

-- Interest on bank borrowings reduced by 37% to US$ 17.5

million (2020: US$ 27.6 million) following refinancing of the

Group's debt facility and reduction in LIBOR with both margin and

average LIBOR decreasing to 3.0% and 0.2% (2020: 5.0% and

1.0%).

-- Net bank debt [3] reduced to US$ 371.2 million (2020: US$

406.3 million). Net leverage ratio [4] reduced to 5.8 times (2020:

8.0 times).

-- Successful issuance of equity by 30 June 2021 removed

potential event of default, which in turn removed material

uncertainty as to the Group's ability to continue as a Going

Concern reported in 2020.

2021 Operational Highlights

-- Average fleet utilisation increased by 4 percentage points to

85% (2020: 81%) with notable improvements in both S- and E-Class

vessels at 98% (2020: 92%) and 72% (2020: 65%) respectively.

Average utilisation for K-Class vessels remained flat at 86% (2020:

86%).

-- Average day rates marginally increased to US$ 25.7k (2020:

US$ 25.3k) with recent awards in the second half of the year

showing significant improvement.

-- New charters and extensions secured in year totalled 9.6 years (2020: 6.6 years).

-- Operational downtime remains low at 1.6% (2020: 1.5%).

-- Border restrictions and quarantine requirements in relation

to COVID-19 have shown signs of easing in latter part of 2021.

-- Strengthening of Board with the appointment of two

independent non-executive Directors in February 2021 and May 2021

and one non-executive Director in August 2021.

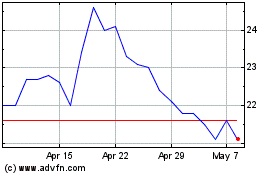

2022 Highlights and Outlook

-- Secured utilisation for 2022 currently stands at 88% against

actual utilisation of 81% in 2021.

-- Anticipate continued improvement on day rates as Middle East

vessel demand outstrips supply on the back of a strong pipeline of

opportunities.

-- Average secured day rates over 12% higher than 2021 actual levels.

-- Reversal of impairment recognised with a value of US$ 15.0

million indicative of improving long-term market conditions.

-- EBITDA guidance of between US$ 70-US$ 80 million maintained for the current financial year.

-- Group anticipates net leverage ratio to be below 4.0 times by the end of 2022.

Mansour Al Alami, Executive Chairman said:

"The primary aims of last year included reorganising the

Company, to regain the trust of stakeholders and to build a

business able to consistently provide value to its shareholders.

These aims have been delivered on and we are proud of having made

such significant progress in such a short period of time. GMS today

is back to profitability, it is back to being on a growth path and

continuing to deleverage. We look forward to continuing this

journey and we thank you all for your patience."

"On behalf of the Board, I would like to thank all our staff for

a year of hard work and for their continued commitment to GMS. I

would also like to thank our stakeholders, including customers,

suppliers, and lenders for their support during the past year".

This announcement contains inside information and is provided in

accordance with the requirements of Article 17 of the Market Abuse

Regulation (EU) No. 596/2014 (as it forms part of UK law by virtue

of the European Union (Withdrawal) Act 2018, as amended).

Enquiries:

Gulf Marine Services PLC Tel: +44 (0)20 7603

Mansour Al Alami 1515

Executive Chairman

Celicourt Communications Tel: +44 (0) 208 434

Mark Antelme 2643

Philip Dennis

Notes to Editors:

Gulf Marine Services PLC, a company listed on the London Stock

Exchange, was founded in Abu Dhabi in 1977 and has become a world

leading provider of advanced self-propelled self-elevating support

vessels (SESVs). The fleet serves the oil, gas and renewable energy

industries from its offices in the United Arab Emirates, Saudi

Arabia and Qatar. The Group's assets are capable of serving

clients' requirements across the globe, including those in the

Middle East, Southeast Asia, West Africa, North America, the Gulf

of Mexico and Europe.

The GMS fleet of 13 SESVs is amongst the youngest in the

industry, with an average age of 11 years. The vessels support

GMS's clients in a broad range of offshore oil and gas platform

refurbishment and maintenance activities, well intervention work

and offshore wind turbine maintenance work (which are opex-led

activities), as well as offshore oil and gas platform installation

and decommissioning and offshore wind turbine installation (which

are capex-led activities).

The SESVs are categorised by size - K-Class (Small), S-Class

(Mid) and E-Class (Large) - with these capable of operating in

water depths of 45m to 80m depending on leg length. The vessels are

four-legged and are self-propelled, which means they do not require

tugs or similar support vessels for moves between locations in the

field; this makes them significantly more cost-effective and

time-efficient than conventional offshore support vessels without

self-propulsion. They have a large deck space, crane capacity and

accommodation facilities (for up to 300 people) that can be adapted

to the requirements of the Group's clients.

Gulf Marine Services PLC's Legal Entity Identifier is

213800IGS2QE89SAJF77

www.gmsuae.com

Disclaimer

The content of the Gulf Marine Services PLC website should not

be considered to form a part of or be incorporated into this

announcement.

Cautionary Statement

This announcement includes statements that are forward-looking

in nature. All statements other than statements of historical fact

are capable of interpretation as forward-looking statements. These

statements may generally, but not always, be identified by the use

of words such as 'will', 'should', 'could', 'estimate', 'goals',

'outlook', 'probably', 'project', 'risks', 'schedule', 'seek',

'target', 'expects', 'is expected to', 'aims', 'may', 'objective',

'is likely to', 'intends', 'believes', 'anticipates', 'plans', 'we

see' or similar expressions. By their nature these forward-looking

statements involve numerous assumptions, risks and uncertainties,

both general and specific, as they relate to events and depend on

circumstances that might occur in the future.

Accordingly, the actual results, operations, performance or

achievements of the Company and its subsidiaries may be materially

different from any future results, operations, performance or

achievements expressed or implied by such forward-looking

statements, due to known and unknown risks, uncertainties and other

factors. Neither Gulf Marine Services PLC nor any of its

subsidiaries undertake any obligation to publicly update or revise

any forward-looking statement as a result of new information,

future events or other information. No part of this announcement

constitutes, or shall be taken to constitute, an invitation or

inducement to invest the Company or any other entity and must not

be relied upon in any way in connection with any investment

decision. All written and oral forward-looking statements

attributable to the Company or to persons acting on the Company's

behalf are expressly qualified in their entirety by the cautionary

statements referred to above.

Chairman's Review

TURNING THE CORNER

2021 saw a number of positive steps being made by the Group as

the business continues to turn around. A new bank deal and

subsequent equity raise helped stabilise the balance sheet,

removing a potential event of default with our banks. Improving

demand for our vessels led to utilisation being the highest in the

last six years, driving an increase in day rates for contracts

awarded in the second half of the year, which we will see the

benefit of in 2022. The Group reported improved margins driven by

increased revenues leading to its first reported net profit since

2016.

Group Performance

Revenue increased by 12.3% to US$ 115.1 million (2020: US$ 102.5

million) with an increase in utilisation of 3 percentage points to

84% (2020: 81%) and with notable improvements in both S- and

E-Class vessels at 98% (2020: 92%) and 72% (2020: 65%)

respectively. K- Class vessels remained flat at 86% (2020: 86%).

Average day rates across the fleet marginally increased to US$

25.7k (2020: US$ 25.3k). Certain contracts awarded in the latter

half of the year, which are due to commence in 2022, saw

significant day rate improvements on legacy contracts.

Vessel operating expenses decreased by 2.6% to US$ 41.2 million

(2020: $42.3 million), despite the increase in utilisation. General

and administrative expenses reduced by US$ 5.9 million to US$ 12.3

million, of which US$ 5.6 million related to non-recurring

adjusting items in 2020 and the balance reflecting savings from the

final phase of the Group's cost-cutting exercise.

Adjusted EBITDA was US$ 64.1 million, up 27.2% from the previous

year (2020: US$ 50.4 million) mainly driven by improved

utilisation, particularly in the Group's higher earning E- and

S-Class vessels.

During the year there was a reversal of previous impairment

charges of US$ 15.0 million, indicative of improvements to

long-term market conditions and non-operational finance expenses

totalling US$ 1.7 million following the extinguishment of the old

debt facility and recognition the new debt facility that completed

in the year, (refer to Note 9 in the consolidated financial

information).

The Group returned to profitability for the first time since

2016 with a net profit for the year of US$ 31.2 million (2020: loss

for the year of US$ 124.3 million) and an adjusted net profit of

US$ 18.0 million (2020: adjusted net loss of US$ 15.3 million).

Capital Structure and Liquidity

Net bank debt reduced to US$ 371.2 million (2020: US$ 406.3

million). A combination of reduced debt and improved adjusted

EBITDA led to a 28% reduction in the net leverage ratio reducing

from 8.0 times in 2020 to 5.8 times at the end of 2021. The Group

will continue its focus on organically reducing leverage going

forward.

The Group successfully concluded a US$ 27.8 million equity raise

in June 2021 which prevented an event of default on its loan

facilities. Under these facilities, the Group is required to raise

a further US$ 50 million of equity by the end of 2022 or issue 87.6

million warrants entitling the Group's banks to acquire 132 million

shares, or 11.5% of the share capital of the Company, for a total

consideration of GBP GBP7.9 million, or 6.0 pence per share.

The Group is exploring the various contractual options available

per the current bank terms to take place by the end of 2022. As

disclosed, the two options available are the raise of US$ 50

million equity or the issuance of 87.6 million warrants giving

potential rights to 132 million shares if exercised, which would

result in cash proceeds to the Company of GBP 7.9 million. As at 31

December 2021, neither of the two contractual scenarios had been

ruled out. The Board however consider the issuance of warrants to

have a slightly higher chance of occurrence.

Interest on bank borrowings reduced by 36.6% to US$ 17.5 million

(2020: US$ 27.6 million) following the renegotiation of the Group's

bank facility in March 2021, the reduction in net bank debt,

following the successful equity raise and a reduction in average

LIBOR to 0.2% (2020: 1.0%).

Commercial and Operations

The Group secured nine new contracts in the year, worth US$ 66.0

million (2020: seven contracts worth US$ 18.0 million). Tender and

bid activity increased, with 2.6 vessel years of projects that are

due to commence in 2022 currently in the pipeline. Evolution

commenced its first long-term contract utilising its cantilever

system.

Despite challenges brought by COVID the Group has achieved its

best year for financial performance for many years. Average

utilisation, particularly for K-Class vessels, has remained at its

highest since 2016. New charters and extensions secured in year

totalled 9.6 years. Operational downtime continued the trend of

recent years of being low at 1.5% (2020: 1.6%).

Governance

Three new non-executive Directors joined the Board during 2021,

with the appointment of Jyrki Koskelo, Anthony St John and Charbel

El Khoury in February, May, and August 2021 respectively.

I currently hold the position of Chairman and Chief Executive,

leading the business and the Board. Whilst holding the positions of

both Chairman and Chief Executive is not recommended by the 2018 UK

Corporate Governance Code (the Code), the Board has concluded that,

at this stage in the Group's turnaround process, this continues to

be appropriate. This recognises both the level and pace of change

necessary for the Group and its relatively small scale. This will

be regularly assessed by the Board as the Group progresses through

its turnaround process.

Removal of Material Uncertainty

The Group is currently operating as a Going Concern without any

material uncertainties. This is the first time the Group has been

operating as Going Concern without any material uncertainties since

2017.

Safety

There were two recordable injuries in the early part of 2021.

One Lost Time Injury and one Restricted Work Day Case. This led to

an increase in our Total Recordable Injury Rate from 0.0 (2020) to

0.2 (2021), and an increase in our Lost Time Injury rate from 0.0

(2020) to 0.1 (2021). These levels remain significantly below

industry average and in both cases have since returned to zero in

early 2022. Two vessels celebrated safety milestones in the year,

with both Evolution and Endeavour reaching five years without

incident.

We continue to develop our systems and processes to ensure that

our offshore operations are as safe as possible in line with the

expectations of our customers and stakeholders.

Taskforce on Climate-related Financial Disclosures

This year the Annual Report includes our first Task Force on

Climate-related Financial Disclosures (TCFD). This is a new

requirement for premium listed companies on the London Stock

Exchange. We welcome the introduction of this regulation, having

previously committed to adopting the TCFD recommendations by 2022.

GMS acknowledged climate change as an emerging risk in 2019, and in

December 2021, recognised it as a principal risk.

The Group has complied with the requirements of LR 9.8.6(8)R, by

reporting on a 'comply or explain' basis against the 11 recommended

TCFD disclosures. As of 31 December 2021, the Group was unable to

make disclosures that were consistent with those of the TCFD for

ten out of the eleven disclosures. The Group aims to be fully

compliant by 31st December 2022.

Outlook

Due to the strong pipeline of opportunities expected to come to

the market, the Group anticipates seeing continued improvements in

day rate and utilisation levels in 2022. Secured utilisation for

2022 currently stands at 88% (equivalent in 2021: 73%).

Secured backlog stands at US$ 179.2 million as at 1 April 2022

(US$ 207.3 million as at 1 April 2021) and average secured day

rates at $28.9k, 12.6% higher than 2021 actual average day rates.

Given the current high levels of utilisation secured, combined with

higher day rates, the Group expects the financial performance to

continue to improve and reiterates its EBITDA guidance of between

US$ 70-US$ 80 million for 2022.

Mansour Al Alami

Executive Chairman

Financial Review

2021 2020 2019

US$m US$m US$m

--------------------------------- ----- ------- ------

Revenue 115.1 102.5 108.7

--------------------------------- ----- ------- ------

Gross profit/(loss) 60.6 (55.5) (25.0)

--------------------------------- ----- ------- ------

Adjusted EBITDA[5] 64.1 50.4 51.4

--------------------------------- ----- ------- ------

Impairment reversal/(impairment) 15.0 (87.2) (59.1)

--------------------------------- ----- ------- ------

Net profit/(loss) for the year 31.2 (124.3) (85.5)

--------------------------------- ----- ------- ------

Adjusted net profit/(loss)[6] 18.0 (15.3) (20.0)

--------------------------------- ----- ------- ------

Introduction

Revenue increased by 12.3% to US$ 115.1 million (2020: US$ 102.5

million). Vessel utilisation increased to 84% (2020: 81%) mainly

driven by an easing of operational restrictions, and a more

positive outlook leading to increased demand and the re-activation

of delayed EPC project contract awards in GMS' core markets.

S-Class utilisation improved from 92% in 2020 to 98% in 2021, with

vessels benefiting from long-term contracts. Our E-Class

utilisation levels also increased to 72% (2020: 65%) whilst K-Class

utilisation remained flat at 86% (2020: 86%). Average day rates

increased to US$ 25.7k (2020: US$ 25.3k).

Adjusted EBITDA (1) increased to US$ 64.1 million (2020: US$

50.4 million) with an increase in adjusted EBITDA margin to 56%

(2020: 49%) mainly driven by the increase in utilisation

particularly in the Group's higher earning E- and S-Class vessels

described above.

Vessel operating expenses[7] decreased by 2.6% to US$ 41.2

million (2020: US$ 42.3 million), despite the increase in

utilisation and additional COVID-19 costs, as managing the Group's

cost base continues to be an area of focus.

During 2021, the Group encountered further COVID-related

logistical issues in relation to crew movement and delays in

mobilisations due to border closures and challenging quarantine

requirements. These requirements and the mobilisation delays

mentioned at H1 2021 have shown significant signs of easing in the

second half of 2021.

General and administrative expenses3 decreased by US$ 5.9

million (32%), to US$ 12.3 million mainly as a result of

exceptional restructuring costs and legal costs of US$ 2.5 million

and US$ 3.1 million incurred in the prior year which did not repeat

in the current year. Underlying G&A(4) remained broadly flat at

US$ 9.8 million (2020: US$ 9.7 million).

The Group reported a net profit for the year of US$ 31.2 million

(2020: net loss for the year of US$ 124.3 million). The significant

increase in profit was mainly driven by the increase in adjusted

EBITDA (1) described above, a reduction in finance costs to US$

14.5 million (2020: US$ 46.7 million) and a reversal of impairment

recognised at US$ 15.0 million compared to an impairment charge

booked in the previous year of US$ 87.2 million. Adjusted net

profit2 which excludes impairment charges, exceptional finance

costs and exceptional legal and restructuring costs in 2020 was US$

18.0 million (2020: adjusted net loss of US$ 15.3 million).

Included in the Company only financial statements is an

impairment against the carrying value of investments of US$ 16.8

million (2020: $327.7 million).

Finance expenses reduced mainly from a reduction in bank

interest to US$ 17.5 million (2020: US$ 27.6 million) following the

refinancing, which took place in March 2021, with both margin and

average LIBOR decreasing to 3.0% and 0.2% (2020: 5.0% and 1.0%) and

a reduction of costs to acquire the new debt facility in March 2021

of US$ 3.2 million, compared to US$ 15.8 million being expensed in

2020.

Net bank debt[8] reduced to US$ 371.2 million (2020: US$ 406.3

million). The net leverage ratio1 has significantly reduced to 5.8

times compared to 8.0 times in 2020 mainly as a result of the

improved adjusted EBITDA and raising US$ 27.8 million of new equity

in June 2021. The equity raise completed in June 2021removed a

potential event of default under the Groups' debt facilities as at

31 December 2021.

Adjusted Adjusted

gross profit gross profit

Revenue Revenue Gross profit/(loss) Gross profit/(loss) / (loss) / (loss)

US$'000 US$'000 US$'000 US$'000 US$'000* US$'000*

---------------- -------- -------- ------------------- ------------------- ------------- -------------

Vessel Class 2021 2020 2021 2020 2021 2020

---------------- -------- -------- ------------------- ------------------- ------------- -------------

E-Class vessels 38,680 29,407 21,277 (26,047) 11,170 (22)

---------------- -------- -------- ------------------- ------------------- ------------- -------------

S-Class vessels 33,420 32,136 15,897 15,797 15,897 15,797

---------------- -------- -------- ------------------- ------------------- ------------- -------------

K-Class vessels 43,027 40,947 23,568 (45,076) 18,716 16,055

---------------- -------- -------- ------------------- ------------------- ------------- -------------

Other vessels - 2 (116) (202) (116) (202)

---------------- -------- -------- ------------------- ------------------- ------------- -------------

Total 115,127 102,492 60,626 (55,528) 45,667 31,628

---------------- -------- -------- ------------------- ------------------- ------------- -------------

* See Glossary and note 9 of the consolidated financial

information.

Revenue and segmental profit/loss

The table above shows the contribution to revenue, and segment

gross profit or loss made by each vessel class during the year.

Utilisation in 2021 increased to 84% (2020: 81%). This is the

highest level of utilisation achieved since 2015 and was

facilitated by an easing of COVID-related operational restrictions

and a more positive outlook leading to increased demand and the

re-activation of delayed EPC project contract awards in GMS's core

markets. S-Class utilisation improved from 92% in 2020 to 98% in

2021 mainly from long-term contracts which continued throughout the

year. Our E-Class utilisation levels also saw an increase to 72%

(2020: 65%) and K-Class utilisation remained flat at 86% (2020:

86%).

Average day rates marginally increased to US$ 25.7k (2020: US$

25.3k). Vessel day rates for E-Class vessels increased by 7%,

offset by marginal decreases to S-Class and K-Class rates of 2% and

3% respectively. New contracts awarded in the latter half of the

year, which are due to commence in 2022, saw significant day rate

improvements on legacy contracts.

The MENA region continues to be the largest geographical market

representing 89% (2020: 88%) of total Group revenue. The remaining

11% (2020: 12%) of revenue was earned from Offshore Windfarms in

the renewables market in Europe. National Oil Companies (NOCs)

continue to be the Group's principal client representing 70% of

2021 total revenue (2020: 68%).

The UAE remains the largest revenue contributor in the MENA

region, generating 50% of total revenue (2020: 52%). The remainder

is split between Saudi Arabia and Qatar at 19% and 20% respectively

(2020: 17% and 19%).

Cost of sales, reversal of impairment and administrative

expenses

Cost of sales excluding impairment slightly decreased to US$

69.5 million (2020: US$ 70.9 million) with operating expenses and

depreciation decreasing by US$ 1.1 million and US$ 0.4 million

respectively. Despite achieving a 12.3% increase in revenue, cost

of sales excluding depreciation and amortisation fell by 2.6% to

US$ 41.2 million (2020: US$ 42.3 million). Total depreciation and

amortisation included in cost of sales amounted to US$ 28.2 million

in 2021 (2020: US$ 28.6 million).

Following an improvement to general market conditions,

stabilisation of the Group's capital structure and an increase in

market capitalisation, management performed a formal impairment

assessment of the Group's fleet, comparing the net book value to

the recoverable amount as at 31 December 2021. Based on the

assessment, the total recoverable amount of the fleet was computed

at US$ 631.9 million (2020: US$ 664.0 million) resulting in an

impairment reversal of US$ 15.0 million compared to an impairment

charge of US$ 87.2 million in 2020. Refer to note 4 in the

consolidated financial information for further details.

Overall general and administrative costs reduced from US$ 18.2

million in 2020 to US$ 12.3 million in 2021. There were no

restructuring costs incurred in the financial year (2020: US$ 2.5

million). In 2020, one-off legal costs of US$ 3.1 million were

incurred in relation to the Seafox proposed bid offer and

governance and management changes which did not repeat in the

current year. Underlying G&A remained broadly flat at US$ 9.8

million (2020: US$ 9.7 million).

Adjusted EBITDA

Adjusted EBITDA, which excludes the impact of reversal of

impairment in 2021 and an impairment charge and one-off

non-operational costs in 2020, increased to US$ 64.1 million (2020:

US$ 50.4 million), mainly driven by the increase in utilisation

particularly in the Group's higher earning E- and S-Class vessels

described above. Adjusted EBITDA is considered an appropriate,

comparable measure showing underlying performance, that management

are able to influence. Please refer to Note 9 and Glossary for

further details.

Finance costs

Finance costs reduced materially from US$ 46.7 million in 2020

to US$ 14.5 million in 2021, mainly as a result of a reduction in

bank interest to US$ 17.5 million (2020: US$ 27.6 million). Costs

to acquire the bank facility in 2021 were significantly lower than

costs to acquire the previous refinance in 2020 at US$ 3.2 million

(2020: US$ 15.8 million). A gain of US$ 6.3 million (2020: US$ 1.1

million) was recognised in the profit and loss in the current year,

reflecting the waiver of PIK interest otherwise payable during the

first quarter of 2021, the remeasurement of the debt to fair value

as at the date of the substantial modification and the impact of a

change in the forecast voluntary repayment of the debt. Refer to

note 7 for further details.

Earnings

The Group achieved a profit of US$ 31.2 million (2020: loss of

US$ 124.3 million), mainly driven by an increase in utilisation,

decrease in finance expenses and the reversal of impairment booked

in at US$ 15.0 million (2020: impairment charge of US$ 87.2

million) all described above.

After reflecting for adjusting items (impairment and finance

expenses) the Group incurred an adjusted profit of US$ 18.0 million

(2020: adjusted loss of US$ 15.3 million).

Capital expenditure

The Group's capital expenditure during the year reduced to US$

12.2 million (2020: US$ 14.2 million). Expenditure mainly relating

to upgrades made to vessels to meet client requirements. The

Company continues to maintain capital expenditure at a level that

ensures safe operations, in line with legal and regulatory

obligations, and that meets client requirements, as it focuses on

maximising its cash generation to continue reducing bank debt.

Cash flow and liquidity

During the year, the Group delivered operating cash flows of US$

40.5 million (2020: US$ 44.3 million). This reduction is primarily

as a result of the movement in trade and other receivables

described below offset by increased profit. The net cash outflow

from investing activities for 2021 decreased to US$ 11.5 million

(2020: US$ 12.4 million) as the Group continues to limit capital

expenditure to maintaining the fleet to a level that ensures safe

operations and meets client requirements.

The Group's net cash flow from financing activities was an

outflow of US$ 24.5 million during the year (2020: US$ 36.5

million) mainly comprising net repayments to the bank of US$ 31.0

million (2020: US$ 12.1 million) and interest paid of US$ 13.0

million (2020: US$ 27.9 million), offset by proceeds from shares

following the equity raise of US$ 27.8 million (2020: nil).

Balance sheet

Total non-current assets at 31 December 2021 were US$ 617.2

million (2020: US$ 618.8 million), following a US$ 15.0 million

reversal of impairment on some of the Group's vessels (2020:

impairment charge of US$ 87.2 million).

Total current assets at 31 December 2021 were US$ 57.2 million

(2020: US$ 35.6 million). Cash and cash equivalents increased to

US$ 8.3 million (2020: US$ 3.8 million). Trade and other

receivables increased to US$ 48.9 million (2020: US$ 31.8 million)

of which US$ 41.9 million (2020: US$ 24.1 million) related to net

trade receivables and US$ 7.0 million (2020: US$ 7.8 million) to

other receivables. The increase in trade receivables was mainly

driven by increased utilisation and client delays in processing

receipts. Trade receivables are primarily with NOC, IOC and

international EPC companies, with over 89% being aged between 0-60

days. Out of the year-end balance, over US$ 30 million has

subsequently been collected.

Total current liabilities reduced to US$ 53.3 million at 31

December 2021 (2020: US$ 61.0 million), Trade payables decreased to

US$ 10.5 million (2020: US$ 12.3 million) and other payables

decreased to US$ 8.9 million (2020: US$ 11.1 million). There was a

decrease in bank borrowings due within one year to US$ 26.1 million

(2020: US$ 31.0 million) as a result of the Group's working capital

facility (US$ 21.5 million) now being recognised as a non--current

liability as it is available for utilisation until the end of the

term debt facility offset by an increase in loan repayments for the

next 12 months compared to the previous year.

Net bank debt and borrowings

On 31 March 2021, the Group amended the terms of its loan

facility with its banking syndicate. The amended terms were

significantly different from the original loan. Management

determined that the Group's loan facility was substantially

modified and, accordingly, the old loan facility was extinguished

and the new facility recognised. Refer to note 7 for further

details.

Net bank debt as at 31 December 2021 reduced to US$ 371.2

million (2020: US$ 406.3 million) with US$ 20.0 million of the US$

31.0 million total loan repayments being made following the equity

raise in June 2021. The net leverage ratio has significantly

reduced and was 5.8 times as at 31 December 2021 compared to 8.0

times in 2020, as a result of improved adjusted EBITDA and the

equity raise in June 2021.

Going Concern

The successful issuance of equity by 30 June 2021 removed a

potential event of default on the Group's bank facilities which in

turn removed the material uncertainty as to the Group's ability to

continue as a Going Concern that was reported in the full year 2020

results.

The Group's forecasts indicate that its revised debt facility

will provide sufficient liquidity for its requirements for at least

the next 12 months and accordingly, the consolidated financial

information for the Group have been prepared on the Going Concern

basis. For further details please refer the Going Concern

disclosure in note 1 of the financial information. This is the

first time the Group have been operating as Going Concern without

any material uncertainties since 2017.

Related party transactions

During the year, there were related party transactions with our

partner in Saudi Arabia for leases of breathing equipment for some

of our vessels and office space totalling US$ 0.5 million (2020:

US$ 0.5 million). In addition, there were related party transaction

related to catering services for Vessel Pepper totalling to US$ 0.5

million (2020: US$ nil).

The Group has never had transactions with its largest

shareholder, Seafox International (29.9%) and has agreed with its

banks, in its latest agreement signed in March 2021, restrictions

on any future transactions with them or their affiliates. During

the year, the Group received catering services totalling US$ 0.5

million (2020: nil) on board one of its vessels provided by the

National Catering Company, an affiliate of Mazrui International

LLC, the Group's second largest shareholder (25.6%).

Adjusting items

The Group presents adjusted results, in addition to the

statutory results, as the Directors consider that they provide a

useful indication of underlying performance. A reconciliation

between the adjusted non-GAAP and statutory results is provided in

Note 9 of the consolidated financial information with further

information provided in the Glossary.

Consolidated statement of profit or loss and other comprehensive

income for the year ended 31 December

Notes 2021 2020

US$'000 US$'000

Revenue 8,11 115,127 102,492

Cost of sales (69,460) (70,864)

Reversal of impairment/(impairment

loss) 4 14,959 (87,156)

Gross profit/(loss) 60,626 (55,528)

Restructuring costs - (2,492)

Exceptional legal costs - (3,092)

Other general and administrative

expenses (12,272) (12,632)

--------- ----------

General and administrative expenses (12,272) (18,216)

Operating profit/(loss) 48,354 (73,744)

Finance income 9 15

Finance expense (14,463) (46,740)

Foreign exchange loss, net (1,002) (993)

Loss on disposal of property and

equipment - (2,073)

Gain on disposal of fixed assets

held for sale - 259

Other income 28 257

Profit/(loss) for the year before

taxation 32,926 (123,019)

Taxation charge for the year (1,707) (1,285)

Net profit/(loss) for the year 31,219 (124,304)

========= ==========

Other comprehensive income/(expense)

- items that may be reclassified

to profit or loss:

Net gain on changes in fair value

of hedging instruments 12 - 21

Net hedging gain reclassified to

the profit or loss 12 278 883

Exchange differences on translation

of foreign operations (91) 425

Total comprehensive gain/(loss)

for the year 31,406 (122,975)

========= ==========

Profit/(loss) attributable to:

Owners of the Company 31,001 (124,339)

Non-controlling interests 218 35

31,219 (124,304)

========= ==========

Total comprehensive profit/(loss)

attributable to:

Owners of the Company 31,188 (123,010)

Non-controlling interests 218 35

31,406 (122,975)

========= ==========

Earnings/(loss) per share:

Basic (cents per share) 10 4.48 (35.48)

Diluted (cents per share) 10 4.46 (35.48)

All results are derived from continuing operations in each year.

There are no discontinued operations in either years.

Consolidated statement of financial position as at 31

December

Notes 2021 2020

US$'000 US$'000

ASSETS

Non-current assets

Property and equipment 4 605,526 605,077

Dry docking expenditure 8,799 10,391

Right-of-use assets 2,884 3,340

Total non-current assets 617,209 618,808

Current assets

Trade and other receivables 48,917 31,834

Cash and cash equivalents 5 8,271 3,798

Total current assets 57,188 35,632

Total assets 674,397 654,440

========= =========

EQUITY AND LIABILITIES

Capital and reserves

Share capital - Ordinary 6 30,117 58,057

Share capital - Deferred 6 46,445 -

Share premium account 6 99,105 93,080

Restricted reserve 272 272

Group restructuring reserve (49,710) (49,710)

Share based payment reserve 3,648 3,740

Capital contribution 9,177 9,177

Cash flow hedge reserve (558) (836)

Translation reserve (2,086) (1,995)

Retained earnings 124,386 93,385

--------- ---------

Attributable to the owners of the

Company 260,796 205,170

Non-controlling interests 1,912 1,694

Total equity 262,708 206,864

--------- ---------

Current liabilities

Trade and other payables 19,455 23,395

Current tax liability 5,669 4,811

Bank borrowings - scheduled repayments

within one year 7 26,097 31,024

Lease liabilities 1,817 1,739

Total current liabilities 53,038 60,969

--------- ---------

Non-current liabilities

Provision for employees' end of service

benefits 2,322 2,190

Bank borrowings - scheduled repayments

more than one year 7 353,429 379,009

Lease liabilities 1,107 1,572

Derivative financial instruments 12 1,793 3,836

Total non-current liabilities 358,651 386,607

--------- ---------

Total liabilities 411,689 447,576

--------- ---------

Total equity and liabilities 674,397 654,440

--------- ---------

Consolidated statement of changes in equity for the year ended

31 December

Attributable

Share Share Share Cash Cost to the

capital capital Share Group based flow of Owners

- - premium Restricted restructuring payment Capital hedge hedging Translation Retained of the Non-controlling Total

Ordinary Deferred account reserve reserve reserve contribution reserve reserve reserve earnings Company interests equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

At 1 January

2020 58,057 - 93,080 272 (49,710) 3,572 9,177 520 (2,260) (2,420) 217,724 328,012 1,659 329,671

(Loss)/profit

for the year - - - - - - - - - - (124,339) (124,339) 35 (124,304)

Gain on fair

value changes

of hedging

instruments - - - - - - - - 21 - - 21 - 21

Net hedging

gain/(loss)

on interest

hedges

reclassified

to the profit

or loss - - - - - - - 901 (18) - - 883 - 883

Exchange

differences

on foreign

operations - - - - - - - - - 425 - 425 - 425

--------- --------- -------- ----------- -------------- -------- ------------- -------- -------- ------------ ---------- ------------- ---------------- ----------

Total

comprehensive

loss for

the year - - - - - - - 901 3 425 (124,339) (123,010) 35 (122,975)

--------- --------- -------- ----------- -------------- -------- ------------- -------- -------- ------------ ---------- ------------- ---------------- ----------

Gain/loss

on currency

hedges

reclassified

to profit

or loss - - - - - - - (2,257) 2,257 - - - - -

Share based

payment charge - - - - - 168 - - - - - 168 - 168

---------

At 31 December

2020 58,057 - 93,080 272 (49,710) 3,740 9,177 (836) - (1,995) 93,385 205,170 1,694 206,864

Profit for

the year - - - - - - - - - - 31,001 31,001 218 31,219

Net hedging

gain on

interest

hedges

reclassified

to the profit

or loss - - - - - - - 278 - - - 278 - 278

Exchange

differences

on foreign

operations - - - - - - - - - (91) - (91) - (91)

--------- --------- -------- ----------- -------------- -------- ------------- -------- -------- ------------ ---------- ------------- ---------------- ----------

Total

comprehensive

gain for

the year - - - - - - - 278 - (91) 31,001 31,188 218 31,406

--------- --------- -------- ----------- -------------- -------- ------------- -------- -------- ------------ ---------- ------------- ---------------- ----------

Share based

payment charge

(Note 12) - - - - - (18) - - - - - (18) - (18)

Capital

reorganisation (46,445) - - - - - - - - - - (46,445) - (46,445)

Issue of

share capital

(Note 6) 18,505 46,445 9,253 - - - - - - - - 74,203 - 74,203

Share issue

costs - - (3,228) - - - - - - - - (3,228) - (3,228)

Cash settlement

of share-

based payments - - - - - (74) - - - - - (74) - (74)

At 31 December

2021 30,117 46,445 99,105 272 (49,710) 3,648 9,177 (558) - (2,086) 124,386 260,796 1,912 262,708

========= ========= ======== =========== ============== ======== ============= ======== ======== ============ ========== ============= ================ ==========

Consolidated statement of cash flows for the year ended 31

December

Notes 2021 2020

US$'000 US$'000

Net cash generated from operating

activities 14 40,511 44,268

Investing activities

Payments for additions of property

and equipment (7,898) (5,623)

Dry docking expenditure incurred (3,609) (7,600)

Interest received 9 15

Proceeds from disposal of property

and equipment - 299

Proceeds from disposal of assets

held for sale - 559

Net cash used in investing activities (11,498) (12,350)

Financing activities

Proceeds from issue of shares 27,758 -

Bank borrowings received 2,000 21,500

Repayment of bank borrowings (30,983) (12,075)

Interest paid on bank borrowings (12,950) (27,903)

Payment of issue costs on bank borrowings (3,615) (14,449)

Share issue costs paid (3,228) -

Principal elements of lease payments (2,342) (1,871)

Settlement of derivatives (1,033) (883)

Interest paid on leases (147) (193)

Dividends paid - (650)

Net cash used in financing activities (24,540) (36,524)

Net increase/(decrease) in cash

and cash equivalents 4,473 (4,606)

Cash and cash equivalents at the

beginning of the year 3,798 8,404

Cash and cash equivalents at the

end of the year 5 8,271 3,798

========= =========

Non - cash transactions

Recognition of deferred shares 46,445 -

Recognition of right-of-use asset 1,955 3,239

Capital accruals 408 585

Drydock accruals 302 411

Notes to the consolidated financial information for the year

ended 31 December 2021

1 Basis of preparation

Gulf Marine Services PLC ("GMS" or "the Company") is a company

which is limited by shares and is registered and incorporated in

England and Wales on 24 January 2014. The Company is a public

limited company with operations mainly in the Middle East and North

Africa (MENA), and Europe. The address of the registered office of

the Company is 107 Hammersmith Road, London, United Kingdom, W14

0QH. The registered number of the Company is 08860816.

The principal activities of GMS and its subsidiaries (together

referred to as "the Group") are chartering and operating a fleet of

specially designed and built vessels. All information in the notes

relate to the Group, not the Company unless otherwise stated.

The Company and its subsidiaries are engaged in providing

self-propelled, self-elevating support vessels, which provide a

stable platform for delivery of a wide range of services throughout

the total lifecycle of offshore oil, gas and renewable energy

activities and which are capable of operations in the Middle East

and other regions.

The financial information for the year ended 31 December 2020

does not constitute statutory accounts as defined in section 434 of

the Companies Act 2006. A copy of the statutory accounts for that

year has been delivered to the Registrar of Companies. The

independent auditor's report on the full financial statements for

the year ended 31 December 2020 was unqualified, however included a

material uncertainty in relation to the Company's ability to

continue as a going concern. No other statement was made under

section 498 of the Companies Act 2006.

The preliminary announcement does not constitute the Group's

statutory accounts for the year ended 31 December 2021, but is

derived from those accounts. Statutory accounts for the year ended

31 December 2021 were approved by the Directors on 12 May 2022 and

will be delivered to the Registrar of Companies following the

Company's Annual General Meeting. The independent auditor's report

on those financial statements was unqualified, did not draw

attention to any matters by way of emphasis and did not include a

statement under Section s498 (2) or (3) of the 2006 Companies

Act.

The 2021 Annual Report will be posted to shareholders in advance

of the Annual General Meeting.

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards ("IFRSs"), this announcement does not itself contain

sufficient information to comply with the disclosure aspects of

IFRSs.

The consolidated preliminary announcement of the Group has been

prepared in accordance with IFRSs, IFRIC interpretations and the

Companies Act 2006 applicable to companies reporting under IFRSs.

The consolidated financial information has been prepared under the

historical cost convention, as modified by the revaluation of

certain financial assets and financial liabilities, including

derivative instruments, at fair value.

Going concern

The Group's Directors have assessed the Group's financial

position for a period through to June 2023 of not less than 12

months from the date of approval of the full year results and have

a reasonable expectation that the Group will be able to continue in

operational existence for the foreseeable future.

The material uncertainty over going concern that existed and was

previously disclosed as a significant judgment when the 31 December

2020 financial statements were approved on 21 May 2021 no longer

exists due to the successful issuance of equity in June 2021, which

removed the potential event of default on the Group's revised bank

facilities, as renegotiated in March 2021.

The renegotiation of bank facilities also resulted in a 40%

reduction in margin payable in 2021 and 2022, with the surplus cash

generated from these savings used to accelerate repayment of the

loan principal (refer to Note 7 for further details on the revised

terms of the bank facility).

As a result of the above refinancing in March 2021 and

subsequent equity raise in June 2021, the Directors no longer

consider going concern to be a critical accounting judgment as at

31 December 2021.

1 Basis of preparation (continued)

Going concern (continued)

The Group is exploring various contractual options available per

the current bank terms to take place by the end of 2022. There are

two options available which are either the raise of US$ 50 million

equity or the issuance of 87.6 million warrants giving potential

rights to 132 million shares if exercised. As at 31 December 2021,

the Board consider the more likely outcome will be the issuance of

warrants rather than the equity raise. PIK interest will

potentially accrue, only if the net leverage ratio is above 4.0

times. Based on the latest Board approved projections, the net

leverage ratio is expected to be below 4.0x and therefore no PIK

interest is expected.

The forecast used for Going Concern reflects management's key

assumptions including those around utilisation and vessel day rates

on a vessel-by-vessel basis. Specifically, these assumptions

are:

-- Average day rates across the fleet are assumed to be US$

28.6k for the 18-month period to 30 June 2023;

-- 90% forecast utilisation for the 18-month period to 30 June 2023;

-- Strong pipeline of tenders and opportunities for new

contracts that would commence during the forecast period.

As noted above the impact of COVID-19 has also been considered

in short-term forecasts approved by the Board which include

additional hotel and testing costs for offshore crew whilst in

quarantine. Terms and conditions of crew rotations have also been

amended and costs updated to reflect this. Rotations have been

extended for all crew to limit the number of times in quarantine

and the number of changeouts on the crew which increases the risk

of infection each time it occurs. All policies are in line with

Government and client guidelines for offshore activities.

Management note that the impact of COVID-19 has shown significant

signs of easing in Q1 2022 and therefore this is not expected to be

a long-term risk.

While the current situation regarding the war in Ukraine and

Russian sanctions described in note 15 remains uncertain, the

Directors believe the potential impact of the war, border closures

and resulting sanctions will not have a significant impact on

operations.

Brexit is not expected to have a significant effect on the

Group's operations as 12 of 13 vessels are in the MENA region.

The Group is expected to continue to generate positive operating

cash flows for the foreseeable future and has in place a committed

working capital facility of US$ 50.0 million, of which US$ 25.0

million can be utilised to support the issuance of performance

bonds and guarantees. The balance can be utilised to draw down

cash. US$ 21.5 million of this facility was utilised as at 31

December 2021, leaving US$ 3.5 million available for drawdown

(2020: US$ 3.5 million). There was a reduction to the cash element

of the working capital facility by US$ 5 million to US$ 20 million

on 31st March 2022. A payment of US$ 5 million was made by the

Group on the same day reducing the amount utilised to US$ 16.5

million, leaving US$ 3.5 million available for drawdown. The

working capital facility expires alongside the main debt facility

in June 2025.

The principal borrowing facilities are subject to covenants and

are measured bi-annually in June and December. Refer to note 7 for

further details.

The Group's forecasts, having taken into consideration

reasonable risks and downsides, indicate that its revised bank

facilities along with sufficient order book of contracted work

(currently secured 86% of revenue for FY 2022) and a strong

pipeline of near-term opportunities for additional work (a further

6% is at an advanced stages of negotiation captured in the Group's

backlog) will provide sufficient liquidity for its requirements for

the foreseeable future and accordingly the consolidated financial

information for the Group for the current period have been prepared

on a going concern basis.

A downside case was prepared using the following

assumptions:

-- no work-to-win in 2022;

-- a 22 percent reduction in work to win utilisation in H1 2023; and

-- a reduction in day-rates for an E-Class vessel assumed to

have the largest day rate, by 10% commencing from November 2022,

i.e. after expiry of the current secured period.

1 Basis of preparation (continued)

Going concern (continued)

Based on the above scenario, the Group would not be in breach of

its term loan facility, however, the net leverage ratio is forecast

to exceed 4.0 times as at 31 December 2022 for a period of 6 months

and therefore PIK interest of US$ 3.9 million would accrue in the

assessment period and has been included in the above forecast. Such

PIK would be settled as part of the bullet payment on expiry of the

Group's term loan facility in June 2025. The downside case is

considered to be severe but plausible and would still leave the

Group with $10m of liquidity and in compliance with the covenants

under the Group's banking facilities throughout the period until

the end of May 2023.

In addition to the above reasonably plausible downside

sensitivity, the Directors have also considered a reverse stress

test, where adjusted EBITDA has been sufficiently reduced to breach

the net leverage ratio as a result of a combination of reduced

utilisation and day rates, as noted below:

-- no work-to-win in 2022;

-- a 40 percent and 25 percent reduction in options utilisation

in 2022 and H1 2023 respectively;

-- a 48 percent reduction in work to win utilisation in H1 2023; and

-- a reduction in day-rates for an E-Class vessel assumed to

have the largest day rate, by 10% commencing from November 2022,

i.e. after expiry of the current secured period.

Based on the above scenario, net leverage ratio is forecast to

exceed 4.0 times at 31 December 2022 for a period of 6 months and

therefore PIK interest of US$ 3.9 million would accrue in the

assessment period and has been included in the above forecast. Such

PIK would be settled as part of the bullet payment on expiry of the

Group's term loan facility in June 2025. The net leverage ratio is

also breached at HY 2023.

Should circumstances arise that differ from the Group's

projections, the Directors believe that a number of mitigating

actions can be executed successfully in the necessary timeframe to

meet debt repayment obligations as they become due (refer note 7

for maturity profiles) and in order to maintain liquidity.

Potential mitigating actions include the following:

-- Reduction in client specific capex due to no mobilisation of

vessels of approximately US$ 4 million in 2022 and US$ 2.5 million

in H1 2023;

-- Vessels off hire for prolonged periods could be cold stacked

to minimise operating costs on these vessels at the rate of US$

35,000/month for K-Class and US$ 50,000/month for

S-Class/E-Class;

-- Reduction in overhead costs, particularly, bonus payments

estimated at US$ 125k per month; and

-- 2022 - H2 2024 voluntary payments could be deferred till H1

2025 when the bullet payment will be made as there would be less

cash available to help deleverage on a voluntary basis.

GMS remains cognisant of the wider context in which it operates

and the impact that climate change could have on the financial

statements of the Group.

2 Significant accounting policies

The significant accounting policies and methods of computation

adopted in the preparation of this financial information are

consistent with those followed in the preparation of the Group's

consolidated annual financial statements for the year ended 31

December 2020, except for the adoption of new standards and

interpretations effective as at 1 January 2021.

3 Key sources of estimation uncertainty and critical accounting judgements

In the application of the Group's accounting policies, the

Directors are required to make judgements, estimates and

assumptions about the carrying amounts of assets and liabilities

that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other

factors that are considered to be relevant. Actual results may

differ from these estimates.

In applying the Group's accounting policies during the year,

there are no critical judgements.

3 Key sources of estimation uncertainty and critical accounting judgements (continued)

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision affects

only that period, or in the period of the revision and future

periods if the revision affects both current and future

periods.

The key assumptions concerning the future, and other key sources

of estimation uncertainty that may have a significant risk of

causing a material adjustment to the carrying value of assets and

liabilities within the next financial year are outlined below.

Impairment and reversal of previous impairment of property and

equipment

Management carried out an impairment assessment of property and

equipment for year ended 31 December 2021. Following this

assessment management determined that the recoverable amounts of

the cash generating units to which items of property and equipment

were allocated, being vessels and related assets, were most

sensitive to future day rates, vessel utilisation and discount

rate. It is reasonably possible that changes to these assumptions

within the next financial year could require a material adjustment

of the carrying amount of the Group's vessels.

Whilst the Group has revised certain assumptions for certain

vessels by more than 10% relative to prior year the average

increase across all vessels was less than 10%. Management would not

expect an assumption change of more than 10% across all vessels

within the next financial year, and accordingly believes that a 10%

sensitivity to day rates and utilisation is appropriate.

As at 31 December 2021, the total carrying amount of the

property and equipment, drydocking expenditure, and right of use

assets subject to estimation uncertainty was US$ 602.3 million

(2020: US$ 706.0 million). Refer to Note 5 for further details

including sensitivity analysis.

4 Property and equipment

Vessel spares,

Capital Land, building fitting and

Vessels work-in-progress and improvements other equipment Others Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Cost

At 1 January 2020 884,497 4,857 10,488 60,743 3,670 964,255

Additions - 6,208 - - - 6,208

Transfers 5,695 (7,138) - 1,163 280 -

Disposals (180) - (5,387) - (1,660) (7,227)

Write offs - - (5,101) (2,004) (323) (7,428)

At 31 December

2020 890,012 3,927 - 59,902 1,967 955,808

Additions - 8,306 - - - 8,306

Transfers 6,859 (7,191) - 332 - -

At 31 December

2021 896,871 5,042 - 60,234 1,967 964,114

-------- ------------------ ------------------ ----------------- -------- --------

4 Property and equipment (continued)

Vessel spares,

Capital Land, building fitting and

Vessels work-in-progress and improvements other equipment Others Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Accumulated

depreciation

At 1 January 2020 221,805 2,845 8,014 13,823 3,534 250,021

Eliminated on

disposal of

assets - - (3,269) - (1,586) (4,855)

Write off - - (5,101) (2,004) (323) (7,428)

Depreciation

expense 22,444 - 356 2,955 82 25,837

Impairment 87,156 - - - - 87,156

At 31 December

2020 331,405 2,845 - 14,774 1,707 350,731

Depreciation

expense 19,492 - - 3,244 80 22,816

Reversal of

impairment (14,959) - - - - (14,959)

At 31 December

2021 335,938 2,845 - 18,018 1,787 358,588

--------- ----------------- ------------------ ----------------- -------- ---------

Carrying amount

At 31 December

2021 560,933 2,197 - 42,216 180 605,526

--------- ----------------- ------------------ ----------------- -------- ---------

At 31 December

2020 558,607 1,082 - 45,128 260 605,077

--------- ----------------- ------------------ ----------------- -------- ---------

Depreciation amounting to US$ 22.8 million (2020: US$ 25.8

million) has been charged to the profit and loss, of which US$ 22.7

million (2020: US$ 25.5 million) was allocated to cost of sales.

The remaining balance of the depreciation charge is included in

general and administrative expenses.

Vessels with a total net book value of US$ 560.9 million (2020:

US$ 558.6 million), have been mortgaged as security for the loans

extended by the Group's banking syndicate (Note 7).

4 Property and equipment (continued)

Impairment

In accordance with the requirements of IAS 36 - Impairment of

Assets, the Group assesses at each reporting period if there is any

indication an additional impairment would need to be recognised for

its vessels and related assets, or if the impairment loss

recognised in prior periods no longer exist or had decreased in

quantum. Such indicators can be from either internal or external

sources. In circumstances in which any indicators of impairment or

impairment reversal are identified, the Group performs a formal

impairment assessment to evaluate the carrying amounts of the

Group's vessels and their related assets, by comparing against the

recoverable amount to identify any impairments or reversals. The

recoverable amount is the higher of the vessels and related assets'

fair value less costs to sell and value in use.

During the years ended 31 December 2019 and 31 December 2020,

the market capitalisation of the Group continued to be lower than

the net asset value as the Group had been unable to achieve the

recovery previously anticipated following ongoing challenging

market conditions and uncertainty in respect of the Group's capital

structure. These conditions and specifically the continued low

share price were identified as indicators of potential impairment

of the Group's vessels and their related assets. As such a full

impairment review of each vessel and their related assets was

undertaken in both those years. Based on such review, management

had recognised an impairment loss of US$ 59.1 million and US$ 87.2

million on certain of the Group's vessels during the years ended

2019 and 2020 respectively. Of the 13 vessels in existence as at 31

December 2021, impairment losses had been recognised on 9 vessels

while no impairment loss had been recognised on the remaining 4

vessels. The recoverable values in both the years were measured

using value in use computations. As permitted under IAS 36.105,

none of the above impairment losses were allocated to the assets

related to the vessels as management concluded that doing so would

have reduced their carrying values to an amount below their

respective recoverable values on a standalone basis.

During the year ended 31 December 2021, external factors, such

as the improvement in general market conditions and the sustained

increase in oil prices/related activity; and internal factors,

specifically, the further increase in management's assumptions in

relation to long-term day rates beyond that previously assumed in

the prior year impairment assessments, suggested that there were

indications that the value of assets may have increased as at 31

December 2021 leading to potential reversals of historic impairment

losses. Management's view of the further improvement in the

long-term market outlook was supported by a recent independent

market and fleet valuation report that management obtained from a

leading consultant with extensive experience of the subsea

equipment support vessel markets in which the Group operates.

Additionally, management identified certain indicators of

possible additional impairment, such as a higher discount rate

assumption, a market capitalisation that remains below the Group's

net assets, and lower actual revenues than prior year forecasts for

some vessels.

As a result of the above factors and as required by IAS 36,

management performed a formal impairment assessment as at 31

December 2021 for all vessels.

Management has again obtained an independent broker valuation of

its vessels as at 2 February 2022 for the purpose of its banking

covenant compliance requirements. However, consistent with prior

years, management does not consider these broker valuations to

represent a reliable estimate of the fair value for the purpose of

assessing the recoverable value of the Group's vessels, noting that

there have been limited "willing buyer and willing seller"

transactions in the current offshore vessel market on which such

values could reliably be based. Due to these inherent limitations,

management has again concluded that recoverable amount should be

based on value in use.

The impairment review was performed for each cash-generating

unit, by identifying the value in use of each vessel and associated

spares fittings, capitalised dry-docking expenditure and

right-of-use assets relating to operating equipment used on the

fleet, based on management's projections of future utilisation, day

rates and associated cash flows.

4 Property and equipment (continued)

Impairment (continued)

The projection of cash flows related to vessels and their

related assets is complex and requires the use of a number of

estimates, the primary ones being future day rates, vessel

utilisation and discount rate.

In estimating the value in use, management estimated the future

cash inflows and outflows to be derived from continuing use of each

vessel and its related assets for the first four years based on its

approved budgets and forecasts. The terminal value cash flows

(i.e., those beyond the 4-year period) were estimated based on

terminal value mid-cycle day rates and utilisation levels

calculated by looking back as far as 2014, when the market was at

the top of the cycle through to current levels as the industry

starts to emerge out of the bottom of the cycle, adjusted for

anomalies. Such long-term forecasts also took account of the

outlook for each vessel having regard to their specifications

relative to expected customer requirements, as well as new

information obtained from recent external publications and reports

and about broader long-term trends including climate change.

The near-term assumptions used to derive future cash flows

reflect contracted rates where applicable and thereafter the market

recovery from the COVID-19 pandemic and current oil price

environment. Though the Group also operates in the North Sea, its

core market in the long term is expected to remain in the Middle

East which, in turn, is expected to continue to benefit from the

low production costs for oil and gas in the region, the current

appetite of NOCs to increase production and the reliance the local

governments have on revenues derived from oil and gas.

At the same time, as an operator of state-of-the-art Subsea

Equipment Support Vessels in both the oil and gas and renewables

industries (offshore wind market) with experience in multiple

geographical areas, the Group's fleet offers significant

operational flexibility. Any increased demand in offshore

renewables in the long-term as a result of climate change concerns

will present the Group future opportunities to deploy more of its

fleet into this market without any major additional capital

expenditure on the vessels. Hence, the Group believes that it will

not face any significant impact on the demand for its vessels due

to climate change implications beyond the extent reflected in

management's assumptions and sensitivities.

In assessing value in use, the estimated future cash flows are

discounted to their present value using a pre-tax discount rate.

The discount rate of 12.6% (2020: 10.56%) is computed on the basis

of the Group's weighted average cost of capital. The cost of equity

incorporated in the computation of the discount rate is based on

risk-free rate, equity risk premium and industry sector average

betas, and reflects specific adjustments for country risk in the

countries the Group operates in, the Group's relatively small size

and a Group specific risk premium reflecting any additional risk

factors relevant to the Group. The cost of debt is based on the

Group's actual cost of debt. The weighted average is computed based

on the industry capital structure. In concurrence with external

advisors, management reviewed and narrowed down the peer companies

used to compute the discount rate and measured the overall impact

of existing and additional risks related to the Group, resulting in

an increase of the WACC to 12.6% as noted above. Whilst this

exceeded the reasonably possible sensitivity disclosed in the prior

year, for the reasons disclosed in the key assumptions sensitivity

section on page 25 onwards, management still consider a 1%

sensitivity on discount rate to be appropriate.

The impairment review led to the recognition of an aggregate

impairment reversal of US$ 14.96 million. The key reason for the

reversal is an increase in management's long-term assumptions for

day rates compared to prior year. This increase is partially offset

by an overall decrease in long-term utilisation assumptions and an

increase in discount rate from 10.56% to 12.6%, which is computed

on the basis explained in earlier paragraph.

In accordance with the Companies Act 2006, section 841(4), the

following has been considered:

a) the directors have considered the value of some/all of the

fixed assets of the Group without revaluing them; and

b) the Directors are satisfied that the aggregate value of those

assets are not less than the aggregate amount at which they were

stated in the Group's accounts.

4 Property and equipment (continued)

Impairment (continued)

Details of the impairment reversal by cash-generating unit,

along with the associated recoverable amount reflecting its value

in use, are provided below:

Impairment Recoverable Impairment Recoverable

Reversal Amount Amount Amount

Cash Generating Vessel 2021 2021 2020 2020

Unit (CGUs) class US$'000 US$'000 US$'000 US$'000

------------------- ---------- ----------- ------------ ----------- ------------

Endurance E-Class 9,013 66,289 25,472 56,605

Endeavour E-Class 558 73,144 - 74,771

Enterprise E-Class 536 78,007 554 77,322

Evolution E-Class - 83,481 - 88,012

------------------- ---------- ----------- ------------ ----------- ------------

E-class 10,107 300,921 26,026 296,710

------------------------------- ----------- ------------ ----------- ------------

Shamal S-Class - 62,614 - 70,214

Scirocco S-Class - 65,140 - 71,545

Sharqi S-Class - 68,431 - 79,276

------------------- ---------- ----------- ------------ ----------- ------------

S-class - 196,185 - 221,035

------------------------------- ----------- ------------ ----------- ------------

Kamikaze K-Class 244 21,193 258 19,124

Kikuyu K-Class 910 14,735 13,401 12,050

Kawawa K-Class 1,373 13,597 9,009 12,891

Kudeta K-Class 409 13,967 13,722 14,230

Keloa K-Class 1,916 13,225 24,740 12,463

Pepper K-Class - 58,084 - 75,518

------------------- ---------- ----------- ------------ ----------- ------------

K-class 4,852 134,801 61,130 146,276

------------------------------- ----------- ------------ ----------- ------------

Total 14,959 631,907 87,156 664,021

------------------------------- ----------- ------------ ----------- ------------

The below table compares the long-term day rate and utilisation

assumptions used to forecast future cash flows from 2026 for the

remainder of each vessel's useful economic life against those

secured for 2022:

Day rate change Utilisation

Vessels class % on 2022 levels change %

on 2022 levels

----------------- ------------------ ----------------

E-Class CGUs 48% (10%)

S-Class CGUs 23% (3%)

K-Class CGUs 7% (15%)

----------------- ------------------ ----------------

The below table compares the long-term day rate and utilisation

assumptions used to forecast future cash flows during the year

ended 31 December 2021 against the Group's long-term assumptions in

the impairment assessment performed as at 31 December 2020:

Long term Long term utilisation

day rate change change % on 2020

Vessels class % on 2020 assumptions assumptions

----------------- ----------------------- ----------------------

E-Class CGUs 29% (6%)

S-Class CGUs 2% (4%)

K-Class CGUs (5%) (2%)

----------------- ----------------------- ----------------------

4 Property and equipment (continued)

Impairment (continued)

The impairment reversals recognised on the Group's K-Class fleet

(excluding Pepper which was never impaired) primarily reflect a

modest increase in short-term forecast day rates and utilisation

for these vessels as the market begins to recover and the Group

experiences increased demand. The NOCs have indicated a preference

for vessels that are larger, and in some cases, particularly in

Qatar and Saudi Arabia, able to work in deeper water than the

K-Class are capable of. As a result, the main use of these vessels

is now expected to be on contracts for engineering, procurement and

construction ("EPC") clients, which are typically shorter in

duration which is likely to impact utilisation with short gaps

expected between contracts and only modest improvements, if any, in

day rates due to a smaller pipeline of future opportunities. These

factors are reflected in the long-term forecasts of day rates and

utilisation for these vessels, similar to prior year.

The impairment reversals recognised on three E-Class vessels

reflect further increases primarily in long-term assumptions on day

rates relative to the Group's previous forecasts, informed by the

recent independent market and fleet valuation report obtained by

the Group, as described above. The forecast 48% increase in rates

relative to 2022 reflects improving long-term market conditions

coupled with a lack of supply of vessels with the capabilities of

the E-Class such as their large crane capacities and superior leg

length. As these vessels are the most capable of all the vessels in