TIDMGNC

RNS Number : 8985N

Greencore Group PLC

26 January 2023

26 January 2023

Greencore Group plc

Soft start to the year. Accelerating delivery on inflation

recovery, cost reduction and profit conversion.

Greencore Group plc ("Greencore" or the "Group"), a leading

manufacturer of convenience foods in the UK, today issues a trading

update covering the 13 weeks to 30 December 2022 ("Q1" or "the

quarter").

Q1 Trading(1)

PERFORMANCE(1)

-- Q1 23 Group reported revenue increased by 19.0% year on year

to GBP463.0m, driven by inflationary effects, with overall

manufactured volumes modestly behind year on year. Q1 23 Pro forma

revenue increased by 18.9% year on year.

-- Q1 23 Reported and pro forma revenue in Food to Go categories

increased by 14.5% year on year to GBP291.1m driven by inflationary

effects. The impact of Omicron on comparative figures in the prior

year was offset by the disruption impact of railway strikes in the

period. Food to Go volumes were slightly behind Q1 22 with

increased sandwich volumes being offset by lower demand in sushi

and salads. Revenue from distribution of third- party products was

also impacted by lower volumes which were approximately 10% behind

last year.

-- Q1 23 Reported revenue in Other Convenience increased by

27.6% year on year to GBP171.9m driven by inflationary effects and

the onboarding of new business in ready meals. Overall growth in

Other Convenience volumes was driven by strong volumes from our

ready meals business due to the new business win, in addition to a

strong performance across ambient sauces.

-- Profit conversion in the quarter was behind management

expectations due to a combination of lower volumes and a lag in

recovery of inflation over the calendar year end. To mitigate this

shortfall, we are immediately implementing further measures through

Better Greencore, accelerating, and broadening the scope of the

programme. The first phase is targeted to deliver annual recurring

benefits of approximately GBP30m in FY24. The second phase is now

focused on (a) contract margin enhancement following the dilutive

effect of new business onboarded and contract extensions agreed in

the last two years and (b) delivery of our operational excellence

programme.

-- While some raw materials and packaging inflation is easing,

labour cost and energy inflation remains relatively high. The Group

continues to focus on recovery of inflation from customers, and

while we expect to recover the significant majority of inflation,

we now anticipate a lag in that recovery.

-- On 29 November 2022, the Group announced the commencement of

a second share buyback programme whereby it will repurchase

ordinary shares of the Group for up to a maximum aggregate

consideration of GBP15m.

OUTLOOK(2)

-- The Board is cognisant of the short term potential impact of

the volatile recessionary environment and the cost-of-living

factors on consumer spending throughout the remainder of the year.

However, remains confident that a continued focus on the strengths

of the business combined with an accelerated delivery of

efficiency, cost reduction and productivity gains related to our

Better Greencore programme will support the further successful

progress of the Group in the years ahead.

-- Given the lower than expected volumes due to the disruptive

impact of continued industrial action on demand and operations and

the expected lag on inflation recovery the Group now expects to

generate an FY23 outturn at the lower end of current market

expectations.

-- The Group's balance sheet remains strong with substantial headroom in debt facilities.

-- Greencore will report its H1 23 results on 30 May 2023.

Commenting on the performance, Dalton Philips, CEO, said:

" It's a difficult, volatile market, and the business has got

off to a slower start to the year than envisaged. Given this, we

are doubling down on our initiatives on inflation recovery, and in

parallel, driving harder and faster to get our cost base to the

right level.

After just four months in the business, and notwithstanding the

obvious challenges, I remain highly enthusiastic about the

longer-term future of Greencore. Strategically we are well

positioned for the future growth given our customer base, the

categories in which we operate, our operational capabilities and

critically the people behind all of this. However, the immediate

focus is to tackle the shorter-term self-help actions which set the

foundations for margin recovery ."

For further information, please contact:

Dalton Philips Chief Executive Tel: +353 (0)

Officer 1 486 3326

Emma Hynes Chief Financial Tel: +353 (0)

Officer 1 486 3307

Rob Greening/ Nick Hayns/ Powerscourt Tel: +44 (0)

Sam Austrums 20 7250 1446

Billy Murphy/ Claire Rowley Drury Communications Tel: +353 (0)

1 260 5000

(1) Pro forma revenue presents the revenue on a constant

currency basis utilising Q1 23 FX rates on Q1 22 reported

revenue.

(2) Consensus market expectations as compiled by Greencore from

available analyst estimates on 25 January 2023 and as reported in

the Investor Relations section of the Group website.

About Greencore

We are a leading manufacturer of convenience food in the UK and

our purpose is to make every day taste better. We supply all of the

major supermarkets in the UK. We also supply convenience and travel

retail outlets, discounters, coffee shops, foodservice and other

retailers. We have strong market positions in a range of categories

including sandwiches, salads, sushi, chilled snacking, chilled

ready meals, chilled soups and sauces, chilled quiche, ambient

sauces and pickles, and frozen Yorkshire Puddings.

In FY22 we manufactured 795m sandwiches and other food to go

products, 127m chilled prepared meals, 249m bottles of cooking

sauces, pickles and condiments, and 47m of chilled soups and

sauces. We carry out more than 10,600 direct to store deliveries

each day. We have 16 world-class manufacturing sites and 18

distribution centres in the UK, with industry-leading technology

and supply chain capabilities. We generated revenues of GBP1.7bn in

FY22 and employ more than 14,000 people. We are headquartered in

Dublin, Ireland.

For further information go to www.greencore.com or follow

Greencore on social media.

Forward--looking statements

This announcement is based on information sourced from unaudited

management accounts.

Certain statements made in this document are forward--looking.

These represent expectations for the Group's business, and involve

known and unknown risks and uncertainties, many of which are beyond

the Group's control. The Group has based these forward--looking

statements on current expectations and projections about future

events based on information currently available to the Group. These

forward-looking statements include all statements that are not

historical facts and may generally, but not always, be identified

by the use of words such as 'will', 'aims', achieves',

'anticipates', 'continue', 'could', 'develop', 'should', 'expects',

'is expected to', 'may', maintain', 'grow', 'estimates', 'ensure',

'believes', 'intends', 'projects', 'sustain', 'targets', or the

negative thereof, or similar future or conditional expressions.

By their nature, forward-looking statements involve risk and

uncertainty because they relate to events and depend on

circumstances that may or may not occur in the future and reflect

the Group's current expectations and assumptions as to such future

events and circumstances that may not prove accurate. A number of

material factors could cause actual results and developments to

differ materially from those expressed or implied by

forward-looking statements. There may be risks and uncertainties

that the Group is unable to predict at this time or that the Group

currently does not expect to have a material adverse effect on its

business. You should not place undue reliance on any

forward-looking statements. These forward-looking statements are

made as of the date of this announcement. The Group expressly

disclaims any obligation to publicly update or review these

forward-looking statements other than as required by law.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDDGDBLDDDGXU

(END) Dow Jones Newswires

January 26, 2023 02:01 ET (07:01 GMT)

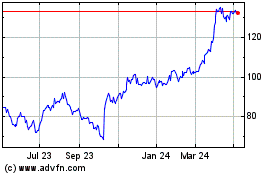

Greencore (LSE:GNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

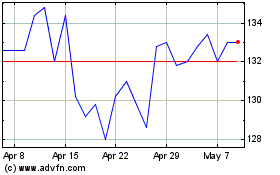

Greencore (LSE:GNC)

Historical Stock Chart

From Apr 2023 to Apr 2024