TIDMGOOD

RNS Number : 9259Z

Good Energy Group PLC

20 September 2022

Good Energy Group PLC ("Good Energy" or "the Company")

Un-audited interim results for the 6 months ended 30 June

2022

Resilient financial performance and investing in growth

strategy

Good Energy, the 100% renewable electricity supplier and

innovative energy services provider, today announces its interim

results for the six months ended 30 June 2022.

Highlights

-- A resilient financial performance, despite ongoing and

significant pressures from commodity markets

-- The Company remains substantially debt free with a strong

cash and cash equivalents position of GBP22.2m at the end of August

2022.

-- Supply business well hedged for winter 2022 having

incrementally hedged throughout the year, a strategy that will

continue into 2023.

-- Continued investment in strategic vision including new

generation product development, innovative business supply products

and further investment into Zap-Map through a successful GBP9m

series A fundraise with Fleetcor, valuing Zap - Map at GBP26.3m on

a post money equity value.

-- As previously announced, the Company has shifted its capital

allocation towards growth and investment, whilst maintaining a

strong balance sheet as a buffer to the ongoing volatile wholesale

energy markets. An interim dividend of 0.75p has been declared for

the period.

Financial performance for the six months to 30 June 2022

Period ended H1 2022 HY 2022 H1 2022 H1 2021

GBPm* Underlying Non underlying Reported Reported

continued

operations

Revenue GBP107.6m GBP107.6m GBP68.4m

------------ ---------------- ----------- -----------

Gross Profit GBP12.2m GBP12.2m GBP17.7m

------------ ---------------- ----------- -----------

Administration costs GBP(12.7)m GBP(12.7)m GBP(11.8)m

------------ ---------------- ----------- -----------

Operating profit GBP(0.5)m GBP(0.6)m GBP5.9m

------------ ---------------- ----------- -----------

Net finance costs GBP(0.2)m GBP(0.2)m GBP( 1.2

)m

------------ ---------------- ----------- -----------

Profit before tax GBP(0.7)m GBP(0.7)m GBP4.8m

------------ ---------------- ----------- -----------

Taxation GBP1.0m GBP1.0m GBP(1.6)m

------------ ---------------- ----------- -----------

Profit from continuing GBP0.3m GBP0.3m GBP3.2m

operations

------------ ---------------- ----------- -----------

Profit from discontinued GBP0.0m GBP0.0m

operations, before

tax

------------ ---------------- ----------- -----------

Tax on discontinued GBP0.4m GBP0.4m

operations

------------ ---------------- ----------- -----------

Profit for the GBP0.8m GBP0.8m

period

------------ ---------------- ----------- -----------

Cash and cash equivalents GBP21.7m GBP21.7m GBP9.0m

------------ ---------------- ----------- -----------

Basic (loss) / earnings

per share (p) 7.4p 7.4p 20.5p

------------ ---------------- ----------- -----------

Half Year dividend

per share (p) 0.75p 0.75p 0.75p

------------ ---------------- ----------- -----------

Financial highlights - continuing operations

-- Revenue increased 57.4% to GBP107.6m (HY 21: GBP68.4m) driven

by significant price rises throughout the year in response to

rising wholesale costs. As price rises lag commodity price

increases, this is expected to be a phasing impact in the medium

term.

-- Gross profit decreased by 31.1% to GBP12.2m (HY 2021:

GBP17.7m) with a gross profit margin of 11.4% (HY 2021: 25.9%) . H1

2021 benefited from commodity procurement during COVID.

-- Underlying loss before tax of GBP0.7m (HY 2021: profit

GBP4.8m) includes a loss of GBP0.8m in relation to Zap-Map's

financial performance. Following the recent funding round, Zap-Map

will be deconsolidated from full year PBT figures, H1 2022 included

a loss of GBP0.8m for Zap-Map.

-- Reported profit after tax for the period of GBP0.8m (HY 2021: GBP3.2m),

-- Reported earnings per share of 7.4p (HY 2021: 20.5p).

-- Sale of generation assets completed in January 2022 for total

consideration of GBP21.2m. The company is now debt free on a net

basis.

-- Sale proceeds continue to provide a balance of growth capital

and buffer against continued volatile wholesale energy prices. Cash

and cash equivalents at the end of August 2022 was GBP22.2m.

Operational highlights

-- Good Energy has delivered a resilient performance in the

first half of 2022 with continued investment across the business

supporting the journey to a zero-carbon Britain.

o Smart meter rollout progressing well, with over 36,800 and 43%

of customer smart meters installed to date, with over 10,000

installed in 2022. We remain on target to install over 13,000 this

year, increasing the total to 40,000 and 47% of our customer base

by the end of 2022.

o New product launched for businesses, matching their supply

demands directly with generators. This reduces our exposure to

wholesale markets and allows our customers to know the exact

provenance of the renewable energy.

o Two market leading billing platforms integrated. Kraken and

Ensek offering an enhanced digital service for customers.

Delivering an 'Excellent' 4.6* rating on Trust Pilot.

o Resilient business practices offering stability in the face of

wholesale market pressures.

-- Zap-Map successfully completed a GBP9m Series A fundraising,

valuing Zap-Map at GBP26.3m post money equity value, including

investment from Fleetcor and Good Energy.

o The funds raised are expected to fuel the expansion of

Zap-Map's development team to deliver its product roadmap and could

pave the way for Zap-Map's international expansion.

o Zap-Map registered users increased 105% to 455,000, reflecting

continued strong growth in electric vehicle uptake. Mapping data

includes 95% of the UK's public charging points on its network.

Over 75% of the UK's EV drivers have downloaded Zap-Map.

o Zap-Pay rollout continuing at pace, with nine charge point

operators and 25% of the rapid charging market signed to date.

o Subscription service launched in June 2021. Good levels of

customer conversion experienced particularly from new EV drivers,

particularly for annual subscriptions.

o Fleet service EV fuel card with Fleetcor UK (Allstar Business

solutions) launched in March 2022.

o Good Energy made an initial GBP1.08m investment in Zap - Map

in 2019 for a 50.1% equity stake. Subsequent investment of GBP1m

via a convertible loan was made in 2021, followed by a further

GBP3.7m in the recent Series A round. Total investment made by Good

Energy to date of GBP5.7m. Good Energy now hold a 49% stake in Zap

- Map. Following the GBP9m series A investment, including GBP5.3m

from Fleetcor, Zap - Map is now valued at GBP26.3m on a post money

equity value.

-- Customer numbers increased marginally in 2022, with a focus

on collections and long-term relationships.

o Overall Good Energy customer numbers increased by 0.8% to

276.9 k.

o Domestic customers increased 2.6% to 86.6k.

o Business customers decreased 10.0% to 9.8k

o Feed in tariff (FiT) customers increased 0.7% to 180.5k

o Zap-Map total registered users increased 105% to 455,000 (June

21: 221k users).

Outlook Highlights

-- Robust platform for future growth and resilience.

Substantially debt free with a strong cash and cash equivalents

position of GBP22.2m as at the end of August 2022. Enables

continued investment across the business and provides sufficient

working capital to support our continued resilience to

industry-wide headwinds.

-- We expect the introduction of the Energy Bill Support Scheme

to minimise the impact of the rising forward prices over the medium

term for customers.

-- Innovative new payments product for generators remains on

track to launch in Q4 2022. A key step for generators combatting

the ongoing energy crisis.

-- Whilst there will inevitably be pain for customers, we are

well positioned to help those customers wishing to go green and

have the services to generate, consume, share and store fully

renewable power.

-- The Company will invest across energy services through a clear buy and build strategy.

-- We see returns being driven primarily from a combination of

organic growth and acquisitions. M&A will be targeted primarily

on accelerating our capability in decentralised energy services and

we look forward to updating the market on this as we are in a

position to execute.

Nigel Pocklington, Chief Executive Officer of Good Energy,

said:

"The global energy crisis is escalating further. Russia's

stranglehold on gas supplies to Europe has been magnified by

further shortages and uncertainty, driving energy prices in the UK

to fresh highs. We have been vocal in stating that the only

solution in the short term is Government support and demand

reduction, with an accelerated roll out of renewables in the medium

to longer term. We are now pleased to see the Government take

meaningful steps to help customers through winter and beyond.

"Over the past 12 months, the rising cost of energy, multiple

supplier failures and everyday consumers having to pick up the bill

only serves to highlight a greater need for renewables to play a

vital role in our long-term energy strategy. Not only will a shift

to cleaner, local electricity sources cut the UK's carbon, it will

cut the UK's ties to fossil fuel driven global markets. As a

trusted leader in local, decentralised clean power, Good Energy's

core purpose has never been more relevant.

"Despite the pressures of the wider market, I am pleased with

the resilient performance and continued delivery on our growth

strategy during the period. We remain a substantially debt free

business with a strong balance sheet, which is of benefit to all

our stakeholders, and have taken tangible steps to invest in our

future, in both new products for solar customers and supporting

Zap-Map's growth by powering electric vehicle drivers.

Demand for clean energy products like solar, storage and

electric vehicles is soaring as customers look to cut costs and

gain control of their energy. Our mission to help one million homes

and businesses cut carbon from their energy and transport use by

2025, and supporting the growth of renewable generation, has never

been more needed."

Enquiries

Good Energy Group PLC

Nigel Pocklington, Chief Executive

Charlie Parry, Director of Corporate Strategy

& Investor Relations

Ian McKee, Head of Communications Email: press@goodenergy.co.uk

SEC Newgate UK Email: GoodEnergy@secnewgate.co.uk

Elisabeth Cowell / Molly Gretton Tel: +44 (0)7900 248213

Investec Bank plc (Nominated Adviser

and Joint Broker)

Tel: +44 (0) 20 7597

Jeremy Ellis 5970

Canaccord Genuity Limited (Joint Broker) Tel: +44 (0) 20 7523

Henry Fitzgerald - O'Connor / Harry Rees 4617

About Good Energy www.goodenergy.co.uk

Good Energy is a supplier of 100% renewable power and an

innovator in energy services. It has long term power purchase

agreements with a community of 1,700 independent UK generators.

Since it was founded 20 years ago, the Company has been at the

forefront of the charge towards a cleaner, distributed energy

system. Its mission is to power a cleaner, greener world and make

it simple to generate, share, store, use and travel by clean power.

Its ambition is to support one million homes and businesses to cut

carbon from their energy and transport used by 2025.

Good Energy is recognised as a leader in this market, through

green kite accreditation with the London Stock Exchange, Which? Eco

Provider status and Gold Standard Uswitch Green Tariff

Accreditation for all tariffs.

About Zap-Map www.zap-map.com

Launched in June 2014, with a mission to accelerate the shift to

electric vehicles (EV) and help the drive towards zero carbon

mobility, Zap-Map is the UK's leading EV mapping service. The

charging point map, available on desktop and iOS/Android apps,

helps EV drivers to search for available charge points, plan longer

journeys, pay for charging on participating networks and share

updates with other drivers.

Zap-Map currently has more than 420,000 registered users and

over 95% of the UK's public points on its network, with around 70%

being updated with live availability status data. More than 220,000

EV drivers use Zap-Map each month out of an EV parc of 520,000,000

(SMMT June 2022).

CEO review

Overview

Good Energy's mission to help combat the climate crisis is now

intertwined with combatting the energy crisis. I wrote in March

that in the second half of 2021 we had begun to see largely

unprecedented and structural changes to the UK energy landscape.

Throughout 2022 we have seen this trend continue, exacerbated by

Russia's attack on Ukraine. Since then, the energy crisis in the UK

and across Europe has deepened and brought energy to the forefront

of the national conversation. Energy security, energy independence,

inflation and the cost-of-living are driving headlines daily.

We are now experiencing one of the most exceptional financial

periods in post war history, with surging energy prices driving

near record levels of inflation. Coupled with global post pandemic

supply chain issues, it is creating the conditions to send us

towards the nadir of stagflation. Wholesale energy prices have

increased significantly and are now 120% higher than this time 12

months ago.

The need for strong Government support to avoid a deeper, longer

lasting impact of this cost-of-living crisis has never been more

important. It should not be down to the UK's consumers and

businesses to pay the cost of a war on energy. On 8 September the

government announced substantial further package of measures to

combat consumer energy prices alongside plans to do the same for

businesses. The Energy Price Guarantee is a unit rate discount that

supersedes the existing energy price cap, applicable to all

households from 1 October which will in addition to the GBP400

Energy Bill Support Scheme retain prices at a similar level to

current over the winter period.

These unprecedented times are likely to drive accelerated

systemic changes, both in macro support and energy policies and we

anticipate that these actions will accelerate an acceptance of

green technologies. We believe that now is the time to invest. Now

is the time to take bold action.

Navigating the energy crisis with resilience and investing for

growth

Despite rising wholesale prices, a raft of suppliers exiting the

market and significant operational changes, we have continued to

operate successfully. I remain proud of the way our business has

reacted to these unprecedented events. We are trading in line with

our expectations and the activities undertaken during the period

mean that we remain in good financial health, being substantially

debt free with a strong cash balance.

Throughout the crisis we have used our flexibility to set

appropriate prices and improved cash collection capabilities and

systems, leading to a significant year-on-year improvement in

collections to mitigate the impact on our business and our

management of working capital. We have implemented price rises

across domestic and business portfolios in line with increasing

costs and carefully managed debt and direct debit collection

rates.

Alongside our focus on operational performance, we have

continued to invest across our business, to deliver our strategic

vision of helping one million homes and businesses cut carbon. To

fund this strategy, we completed the transformational sale of our

generation portfolio in January, at a premium to book value, which

was a landmark moment for Good Energy. The total consideration of

GBP21.4m is being used to accelerate and support further

investments across both transport and decentralised energy to

deliver Good Energy's strategic plan, as well as to provide

sufficient working capital to support our continued resilience to

industry-wide headwinds.

We have been developing a new platform for our decentralised

energy service business which will be the key to unlocking a more

digital services led offering. We believe this new product will be

a market leading, innovative solution for solar customers. As the

only UK energy supplier with more customers exporting their energy

through us (via the Feed-in Tariff) than importing it, we are

uniquely positioned in this growing market. It will enable Good

Energy to pay actual as opposed to deemed rates for exported

electricity, providing material benefits to customers. It also acts

as a new source of power to match with our supply customers. This

is a first in the market which is not currently possible under the

Feed-in Tariff.

We also participated in Zap-Map's Series A funding round, in

line with our strategy to accelerate the transition to electric

vehicles and to provide investors with exposure to this exciting

growth market.

Navigating the crisis and making progress on our strategy has

only been possible with the support of Good Energy's dedicated and

professional team, and the patience of our customers, many of whom

have been with the business for several years. I remain acutely

aware of the impact of high energy costs on society and for our

customers. The longer term needs these events have exposed - for a

resilient, renewable and secure energy strategy for the UK, is of

course, at the very heart of our mission as a company.

Purpose and strategic vision

Earlier this year we launched our bold vision for the coming

years. Our ambition is to support one million homes and businesses

cut carbon from their energy and transport use by 2025.

Our mission remains as it always has. To power a cleaner,

greener world, by making it simple to generate, share, store, use

and travel by clean power.

In order to deliver this bold vision, we will be laser focused

on our target markets and service offerings.

Renewable supply business

-- Fairly priced, transparent, 100% renewable electricity.

Decentralised energy

-- Services to help homes and businesses generate, store, consume and share their own power.

Mobility

-- Make it easier to own, drive, fuel and pay for an electric vehicle.

Throughout 2022 we have continued to make good progress on

delivering this vision, despite the backdrop of the energy

crisis.

Renewable Supply

Our focus is to provide fair priced, transparent, genuine 100%

renewable electricity. We are clear that we are not everything for

everybody. We offer a premium product and are a trusted provider to

help customers choose the right services and feel like they are

making an impact on climate change by going green and saving money

in the process.

We see this market as one of potential steady and incremental

growth over the coming years. It remains the foundation of a green

energy services business.

Our 2022 goals for this part of our business are very much

focused on stability:

-- retention of our customer base

-- launching new products for our business customers

-- continued improvement of our overall customer service

As a result of the ongoing volatility in the wholesale markets,

very little switching has taken place across the domestic market.

Suppliers have taken lower cost tariffs off the market while

commentators and the regulator have continued to urge caution. Our

focus in the first half of the year, which we expect to continue

into early 2023, has been on operational stability and financial

prudence.

Electricity increased 472% and gas increased 752% year on year

(March 2022 vs March 2021). This has continued to rise throughout

the year.

As a result, in February 2022 we saw the price cap increase by a

significant 54% to GBP1,971. In August, it was announced this would

rise a further 80% to GBP3,549, a staggering 177% rise on 12 months

ago. With further rises planned for the updated price cap in

January 2023, the Government has announced plans to take

substantial action, applying a universal discount rate to all

domestic tariffs to keep the prices customers will pay at a similar

level to pre-October.

Although we are not immune from this energy crisis, which has

affected everyone from consumers to suppliers, regulators, and

government, we have worked hard to insulate ourselves as much as

possible. Earlier in the year, we highlighted the impact of

incurring additional commodity costs from a higher number of

business and domestic customers than expected. We saw this continue

over the first months of the year.

Despite the highly volatile wholesale energy prices, we have

continued to mitigate against further risks where possible:

-- Our electricity purchasing model, which backs all supply with

power sourced via direct agreements with renewable generators,

brings additional complexity and provides support for renewables

above and beyond that offered by other suppliers. But for the same

reasons it is the basis for our exemption for the price cap and

creates price flexibility.

-- We expect this to minimise the impact of the rising forward

prices over the medium term. We will continue to monitor the need

to increase prices further.

-- We expect prices to stabilise, albeit it at a significantly

higher level, throughout 2022 and 2023.

-- We are 90 per cent hedged for winter 2022 (based on seasonal

normal weather patterns), despite the continued market volatility.

Our energy trading capabilities remain a core strength. We have a

robust hedging policy implemented via dedicated trading function.

This has helped us navigate the energy crisis whilst many suppliers

have gone out of business.

-- We have a clear trading plan and have taken steps going into

Winter 2022 including risk of PPA under delivery built into

tariffs. We had a clear plan to incrementally purchase power for

winter 2022 and are now 90 per cent hedged heading into that

period. We are following a similar approach and plan to

incrementally increase hedging for Summer 2023.

-- Following a record low wind period in Winter 2021, we have

adjusted our trading mix to lower exposure to wind. Risk of under

delivery is now built into tariffs.

-- However, c hanging regulations continue to make access to

trading difficult across the industry

In the business supply market, the rising cost of energy has

also forced us to assess the most effective way to serve our

customers.

Historically Good Energy, and some other suppliers, have

purchased volume from smaller generators via power purchase

agreements (PPAs) while at the same time selling volume to

customers via supply contracts. The generator volume was either

added into the overall hedge position or sold back to the market.

The supply contracts volume would have been purchased from the

marketplace.

This year we have shifted our business proposition to net

generators with supply customers. This means when a generator

offers us an amount of power, we try and find a supply customer

that wants to buy that volume of power. This provides two

benefits:

-- It provides customers certainty about the provenance of their

renewable supply - they can pinpoint the site(s) where their volume

is coming from - whether that's a wind turbine in Suffolk, a solar

panel in Cornwall or an anaerobic digestion plant in Scotland.

-- It enables Good Energy to diversify where we source our

customer's power from, reducing our exposure to purchasing via the

marketplace and enabling us to optimise our trading credit lines

better.

So far we have matched over 24GWh across 48 of our larger

customers.

In summary, we have made good operational progress during the

period, which has positioned us well for future growth:

-- Green proposition enhanced through accreditations including

Which? Eco Provider and Uswitch Green Tariff Gold Standard.

-- Our leading customer platforms are delivering improving

customer service. All our domestic and business customers are now

on Kraken and Ensek. Delivering an 'Excellent' 4.6* rating on Trust

Pilot.

-- Our smart meter rollout remains on track with 10k installed

in 2022 and over 36k, or 43% of our customer base, installed to

date. These are key to unlocking energy services products.

-- We are also well placed for further trading optimisation and smart tariffs.

The longer-term impact on the UK and European energy markets

remains unknown, but a reduction on reliance on Russian gas

inevitable. This structural shift in the source of UK energy supply

provides a material opportunity to further accelerate our

development and deployment of renewable generation.

We are now clear that the days of low prices and aggressive

price competition in the energy retail market are unlikely to

return in the short or medium term. Whilst there will inevitably be

pain for customers, we are well positioned to help those customers

wishing to go green and have the services to generate, consume,

share and store fully renewable power. We see this market evolving

to be increasingly focused less on price competition, but more on

trust, purpose and high-quality products and services. We are well

aligned with this change in market focus and are well placed to

prosper.

Decentralised energy

This strategic focus provides services to allow people and

businesses to generate, store, consume and share their own

power.

We see this side of our business as a way of gaining market

share through innovation and renewed market growth. Home and

small-scale generation is growing rapidly as a result of the rising

price of energy, with triple the capacity of rooftop solar

installed in Q2 2022 compared to the same period in the previous

year and UK Google searches for 'solar panels' reaching an all-time

high in August 2022.

A key goal for 2022 has been to deliver a smart export product

for solar users. This has been progressing well and we expect to

launch a first-of-its-kind service in Q4 2022.

This service will reward customers for making the grid greener

and is a step towards a more decentralised energy grid. Customers

will get paid for what they export, which is an evolution from the

current deemed export payment, which is capped at 50% of all

generation. This is ideal for homes which generate more than

they're able to use, or who can shift load effectively.

As the second largest feed in tariff (FIT) provider, we believe

this product will help grow market share as generators look to earn

more for what they generate. It also rewards those customers with

smart enabled services who can shift load and export at appropriate

times, and we earn revenue on each MWh our customers export. It has

significant potential to unlock new services and recurring revenue

streams to power growth for the future.

We are also focused on securing partnerships and potential

acquisitions for solar, storage and clean electrified heating

installations, and look forward to updating the market on

developments in this area.

Mobility

Our ambition is to make it easier to own, drive, charge and pay

for an electric vehicle. We have solutions for all areas an

electric vehicle driver needs. We will continue to focus on

investing in software and services and look to partner for asset

and hardware solutions.

We see this area undergoing rapid growth in the coming years and

will be building services for all electric vehicle drivers. Our

investment in Zap-Map allows us to have a material impact in this

space as they build out a market leading offering.

Zap-Map

Zap-Map delivered a strong 2021 performance and built on that

throughout 2022. The Zap-Map team is now focused on scaling up to

capitalise on this market leading position.

Zap-Map's product vision is to be the go-to app for electric

vehicle drivers, offering the simplest way to find and pay for

charging, in the UK and abroad.

Growth will come from being the best place to find bundled

charging and aiming to lead the market on payments. Over the medium

term, expansion will come from building an as a service business

model, enhancing the fleet proposition, expanding data insights

further and going international.

Post-period end, in August, we announced the successful

completion of a series A fundraise, with Zap-Map raising GBP9m from

Fleetcor and Good Energy at a post money equity value of GBP26.3m.

Our contribution of GBP3.7m was enabled by the proceeds raised from

the sale of our generation assets and is in line with our strategy

to build a platform which makes it simple for people to travel with

clean power. Zap-Map has a strong role in our three-pronged

strategy across clean energy supply, energy services and

transport.

Zap-Map is focused on leading the market in terms of EV charging

payments and therefore, the involvement of Fleetcor is highly

exciting and a strong endorsement of Zap-Map. Fleetcor processes

billions of electronic transactions a year, recording annual

revenue of $2.8 billion in 2021.

Its strategic investment builds on an existing partnership which

sees Fleetcor's Allstar Business Solutions integrated into

Zap-Map's Zap-Pay product, which is designed to make EV charging

payment simple. Zap-Pay continues to expand quickly, experiencing

good levels of customer conversion, particularly from new EV

drivers, and is already integrated with nine charging networks,

covering 25% of the UK rapid networks.

A significant proportion of the funds raised will be used for

the product development but the involvement of Fleetcor will also

be beneficial to Zap-Map as it progresses its international

expansion strategy.

Zap-Map is well positioned to benefit from future growth in EV

ownership. The electric vehicle (EV) market continues to experience

a seismic shift with growing demand. EVs are expected to grow from

10% of new car sales in 2020 to 100% by 2030. This would represent

over 27% of all UK cars. Throughout this period, we expect a 92%

compound annual growth rate (CAGR), with 47% growth expected until

2026.

Zap-Map currently has over 450,000 registered users, and over

95% of the UK's public points on its network. Over 75% of UK EV

drivers have downloaded Zap-Map, with growth in Zap-Map downloads

more than keeping pace with the rapid growth in the EV market.

Growth in users has tracked the growth of the wider electric

vehicle market with user numbers up 105% vs June 2021.

Engagement is one of the key metrics for growth. Zap-Map has

historically had an early adopter, highly engaged user base. Over

50% of users are monthly active users, a leading indicator of

repeat usage. The breadth and depth of the data available to EV

drivers is what defines Zap-Map as the market leader in this

category.

Another pillar of its expansion strategy is subscriptions

services delivering recurring revenues to the group. Zap-Map has

already rolled out a subscription model to provide high usage

drivers with improved services and uptake of the annual

subscription has continued to rise. Alongside direct to registered

users conversion, we see bundling as an effective route to

market.

In September 2021, Good Energy and Zap-Map launched the first

electric vehicle driver tariff with Zap-Map subscriptions bundled

in. Bundled services will be a key part of our growth strategy

going forward and we will continue to seek out partnerships with

car manufacturers and parking operators providing another revenue

growth channel. Our ambition is to leverage our relationship with

Zap-Map to drive additional value add services for customers and

maintain longer lasting relationships.

Capital allocation and outlook

We continue to invest for sustainable growth and our capital

allocation policy will reflect this. We are maintaining our

dividend while also delivering on our growth strategy.

We see returns being driven primarily from a combination of

organic growth and acquisitions. M&A will be targeted primarily

on accelerating our capability in decentralised energy services and

we look forward to updating the market on this as we are in a

position to execute.

Naturally, we will also be focused on ensuring stability in

existing business, driving sustainable growth to withstand external

shocks. While growth is expected through our new decentralised

energy services platform, due to go live in Q4 2022, we are well

prepared for ongoing volatility, being 90 per cent hedged for

seasonal normal weather conditions for winter 2022 and our trading

mix has been adjusted to lower our exposure to wind. Also, while

changing regulations continue to make access to trading difficult

across the industry, we have a clear trading plan and have already

taken steps going into Winter 2022.

I am pleased with our resilient financial performance in the

period and would like to thank the team for their hard work in

managing unprecedented challenges while also laying strong

foundations for growth. I would also like to thank our customers,

who continue to support both our business and the rise of renewable

generation in the UK during this challenging period.

OPERATING REVIEW

Wholesale energy market conditions

Power prices

The development of power prices in the last 18 months has been

significant, starting with COVID impacts and subsequent recovery

before geopolitical matters drove a dramatic, rapid and fluctuating

upward trend in wholesale power and gas costs. Day ahead gas prices

started the year at GBP1.53/therm, peaked at GBP6.44/therm on

August 26(th) , and had dropped to GBP3.94/therm by September 7(th)

.

Weather conditions in H1 2022 and through to August have

reflected a warmer year than ever recorded before. The average

temperature for January to August for the UK in 2022 has been

10.5degC, making this year so far warmer than the previous record

of 10.2degC in 2014. This has impacted gas usage with H1 2022 being

17.8% lower than H1 2021.

Overall electricity supply volumes were up 20.6% reflecting

continued COVID recovery, increased business supply volumes and an

increase in domestic customer numbers.

Our renewable supply business

Cash collections

Significant rise in cash collections in Q1 driven by increased

tariffs (SVT's Price Cap and Commercial tariffs) and the recovery

from teething problems experienced in the implementation of our new

business billing platform (Ensek) which impacted collection during

Q2 and Q3 2021.

There is a continued focus on good quality business partners to

ensure future growth comes hand in hand with good collections

performance.

Cash collections continue to be a priority for the business,

with rising wholesale prices requiring tariff increases and

increased collections to continue to sustain the business.

Business

Total business supply customers fell by 10% to 10k. Whilst this

fall was seen evenly across SME and HH customers, business supply

volumes grew materially (30%) reflecting higher usage contracts.

(2022: 248 GWh, 2021: 191 GWh).

Domestic

In the domestic supply market, 29 suppliers have exited the

market since 2021. This reinforced our stance that a race to bottom

on price was not a viable long-term business model. We remain

committed to ensuring that we offer fair priced, transparent 100%

renewable electricity proposition. Elevated energy prices will

drive increasing awareness in the sector.

Feed in Tariff ("FIT")

FIT administration provides the foundation of our energy

services model. Despite the FIT scheme closing to new entrants in

March 2019, we continue to administer the scheme for domestic and

business customers. Customer numbers increased 0.7% to 180.5k

versus June 2021.

Generation performance

In January 2022 we announced the disposal of the renewable

generation asset portfolio (47.5MW) as part of an ongoing strategic

shift to energy and mobility services.

Smart metering

Following delays in 2020 and the first half 2021 due to COVID-19

restrictions, installations are now progressing well. By 7 January

2022, we had installed 22,00 meters delivering on our 2021 target.

Total installed meters to date are close to 37,000 meters.

CFO REVIEW

Overview

The Group has had a resilient financial performance despite

continued and significant pressure from commodity markets impacting

on the year's performance.

The first half of 2021 saw significant benefits from power and

gas hedged during 2020. The second half of 2021 saw rapidly

escalating wholesale prices combined with significant periods of

low wind, which combined to hit margins materially. This escalation

of prices has continued throughout the first half of 2022 and

whilst tariffs have been increasing, wholesale prices has risen

quicker putting pressure on margins in the short term.

In September 2022, the UK government announced a significant

extension of its energy market support packages. This support will

cap domestic bills, offer business users significant support, and

will add additional collateral into the wholesale commodity market.

All the interventions are designed to support consumers through an

exceedingly difficult period.

Financial performance

Profit and loss

Revenue increased 57% in the period to GBP107.6m (202: GBP68.3m)

driven by increased tariffs.

Cost of sales increased by 88% to GBP95.4m (20201 GBP50.6m)

driven by geopolitical impacts on wholesale costs.

Gross profit decreased 31% to GBP12.2m (2021: GBP17.7m). Gross

margin decreased to 11.3% (2021: 25.9%). The decline in margins

reflects that Pricing whilst rising could not keep pace through H1

(price cap) although this is primarily a phasing impact over the

medium term.

Total administration costs increased 8% to GBP12.7m. This

increase primarily relates to the booking of expected credit loss

(ECL) provisions at 2021 year end rates.

Net finance costs decreased by 79% to GBP0.2m driven by a

combination of significant debt reduction and sale of the

generation asset portfolio.

Loss before tax of GBP0.7m includes a breakeven performance for

the traditional good energy business and a loss of GBP0.7m in the

ZAPMAP business.

Reported tax credit at H1 2022 include the impact one-off

benefits related to Generation business sale.

The profit for the period was GBP0.8m (2020: GBP3.2m). This

reflects the extraordinary market conditions seen since H2 2021 and

continuing to this day.

Financial bridge 2021 to 2022*

2022 saw the impact of some higher volume business contracts

secured in 2021 and a small growth in domestic customer numbers.

This generated a GBP0.8m positive volume impact compared to H1

2021

The current geopolitical energy crisis - affecting everyone from

consumers to suppliers, regulators and government - means we are

experiencing ongoing global uncertainty and have not been immune

from the impacts from the wholesale market. In H1 2022 our recorded

wholesale prices increased 87% whilst supply revenue increased 60%.

On the commodity costs side this also reflects that H1 2021

benefited from commodity procurement during COVID, whilst H2 2022

saw the impacts of the rapidly rising commodity costs. Due to the

price cap calculation mechanics, prices whilst rising through the

same period, couldn't keep pace. Although this is primarily a

phasing impact over the medium term. The net negative financial

impact of all this is GBP5.6m.

ECL provisioning for H1 2022 has been done at revised rates but

using the same methodology as 2021 year-end. Compared to the H1

2021 we see a negative PBT impact of GBP1.6m

Substantially offsetting this ECL change are the reducing costs

of interest and financing within the business that have resulted

from the sales of the generation portfolio and the reduction in

bond debt within the business.

Finally, there are some smaller PBT movements with a GBP0.3m

increase in Zap-Map losses being offset by GBP0.2m of small other

PBT changes within the group.

*A profit bridge slide has been included in the Investor

presentation, which is available on the Company's website.

(https://group.goodenergy.co.uk/home/default.aspx)

Cash flow and cash generation

Our business model remains cash generative and once wholesale

prices stabilise we expect to see a working capital improvement

within the business as tariffs catchup to wholesale positions.

The increased tariffs alongside the recovery from 2021 business

billing migration issues has seen a significant improvement in

collections year on year. Collections in Q1 were up 57% and in Q2

were up 91% versus the same periods in 2021.

There was a net increase in cash of GBP15.0m, which includes the

proceeds from the sale of the Generation assets (GBP21.2m - gross

of fees) alongside the further strategic investment in Zap-Map of

GBP3.7m.

Cash and cash equivalents at the end of August 2022 were

GBP22.2m.

Funding and debt

Our business is substantially debt free on a net basis. In the

period, gross debts have reduced by 86.6% compared with June

2021.

Substantial progress has been made against reducing Group

finance costs and reducing the gearing ratio. The remaining Good

Energy Bonds II outstanding (GBP4.7m) is reported within current

liabilities. This is due to an annual redemption request window for

bondholders in December of each year and a one-off redemption

window that closed in August with payment of GBP0.3m due in

December 2022.

The Group continues to maintain capital flexibility, balancing

operating requirements, investments for growth and payment of

dividends. Our business remains mindful of the need to capitalise

on strategic business development and investment opportunities.

Prudent balance sheet management remains a key priority.

Earnings

Reported basic earnings per share decreased to 7.4 (2021:

20.5p).

Dividend

Following stable operational performance in 2022, the sale of

the generation portfolio and reflecting our confidence in the

ongoing business, the Board recommend an interim dividend for 2022

of 0.75p per ordinary share.

Good Energy continues to operate a scrip dividend scheme and the

payment timetable of the interim dividend will be announced in due

course.

Expected Credit Loss (ECL)

Versus H1 2021 ECL provision has increased by GBP1.6m taking the

overall provision to GBP11.2m (2021: GBP9.6m).

The main impact is updating H1 2022 to the methodology applied

in FY 2021. Revenues have substantially increased but this has been

substantially offset by improved commercial collection rates.

Zap-Map investment

2022 H1 saw a P&L loss related to Zap-Map of GBP(0.7m) which

increased GBP0.3m from 2021, following a period of continued

investment. This was expected and related to Zap-Map's growth plan.

At an earnings level the group retains a GBP0.4m loss reflecting

Good Energy's 50.1% stake in Zap-Map.

Generation portfolio sale

On 25 November 2021, the Company appointed KPMG LLP to lead a

sale process for the Company's entire 47.5MW generation

portfolio.

On 20 January 2022 the Company announced, that following a

competitive process, the disposal of the 47.5MW generation

portfolio was complete with Bluefield Solar Income Fund ("BSIF").

Total consideration of GBP21.2m was received for the sale.

We are committed to delivering value to stakeholders and the

sale of our generation portfolio, at a significant premium to book

value, was a good deal. It is also a significant moment for Good

Energy - we are using the capital from our past to invest in our

future.

Events after the balance sheet

Zap - Map Series A investment.

https://www.londonstockexchange.com/news-article/GOOD/zap-map-raises-ps9m/15574433

Consolidated Statement of profit or loss (Un-audited)

For the 6 months ended 30 June 2022

Notes Unaudited Unaudited Audited

6 months 6 months 12 months

to 30/06/2022 to 30/06/2021 to 31/12/2021

GBP000's GBP000's GBP000's

REVENUE 107,600 68,374 146,045

Cost of Sales (95,379) (50,646) (119,019)

----------------- ------------------ -----------------

GROSS PROFIT 12,221 17,728 27,026

Administrative Expenses (12,725) (11,789) (24,622)

----------------- ------------------ -----------------

OPERATING PROFIT (504) 5,939 2,404

Finance Income 6 1 1,447 14

Finance Costs 6 (247) (2,627) (584)

Share of loss of - - -

associate

----------------- ------------------ -----------------

PROFIT BEFORE TAX (750) 4,759 1,834

Taxation 1,044 (1,609) (187)

----------------- ------------------ -----------------

PROFIT FOR THE PERIOD 294 3,150 1,647

Profit from discontinued

operations before

tax 82 - (6,752)

Tax on discontinued

operations 440 - 1,206

----------------- ------------------ -----------------

PROFIT/(LOSS) FOR

THE PERIOD 816 3150 (3,899)

Attributable to:

Equity holders of

the parent 1,217 3,362 (3,389)

Non-controlling

interest (401) (212) (510)

Earnings per

share - Basic 9 7.4p 20.5p -20.7p

- Diluted 9 7.4p 20.0p -20.7p

Earnings per

share (continuing

operations) - Basic 9 4.2p 20.5p 13.2p

- Diluted 9 4.2p 20.0p 13.0p

Consolidated Statement of profit or loss (Un-audited)

For the 6 months ended 30 June 2022

Unaudited Unaudited Audited

6 months 6 months 12 months

to 30/06/2022 to 30/06/2021 to 31/12/2021

GBP000's GBP000's GBP000's

Profit/(Loss) for the

period 816 3,150 (3,899)

Other comprehensive income

Other comprehensive

income that will not

be reclassified to profit

or loss in subsequent

periods (net of tax):

Deferred tax charge on - (924) -

rate change

TOTAL COMPREHENSIVE

INCOME FOR THE PERIOD

ATTRIBUTABLE TO OWNERS

OF THE PARENT COMPANY 816 2,226 (3,899)

Attributable to:

Equity holders of the

parent 1,217 2,438 (3,899)

Non-controlling interest (401) (212) -

Consolidated Statement of Financial Position (Un-audited)

As at 30 June 2022

Notes Un-audited Un-audited Audited

30/06/2022 30/06/2021 31/12/2021

GBP000's GBP000's GBP000's

ASSETS

Non-current assets

Property, plant and equipment 171 56,848 209

Right-of-use assets 850 6,279 851

Intangible assets 4,233 4,392 3,891

Deferred tax asset 1,280 - 173

Restricted deposit assets - 866 -

Total non-current assets 6,534 68,385 5,124

Current assets

Inventories 17,893 19,914 7,682

Trade and other receivables 7 38,262 30,413 35,928

Current Tax receivable - - -

Restricted deposit assets 2,816 476 2,414

Cash and cash equivalents 21,690 9,035 6,699

Total current assets 80,661 59,838 52,723

------ ------------ ------------ ------------

Held for sale assets - - 64,798

------ ------------ ------------ ------------

TOTAL ASSETS 87,195 128,223 122,645

------ ------------ ------------ ------------

EQUITY AND LIABILITIES

Capital and reserves

Called up share capital 842 833 840

Share premium account 12,790 12,790 12,790

EBT shares (444) (502) (444)

Revaluation surplus - 11,003 11,693

Retained earnings 17,281 10,541 4,774

------ ------------ ------------ ------------

Total equity attributable

to members of the parent company 30,469 34,665 29,653

Non-controlling Interest (726) (27) (325)

------ ------------ ------------ ------------

Total equity 29,743 34,638 29,328

Non-current liabilities

Deferred taxation - 6,077 -

Borrowings 8 276 39,855 5,066

Provision for liabilities - 1,316 -

Long term financial liabilities - 13 -

Total non-current liabilities 276 47,261 5,066

Current liabilities

Borrowings 8 5,436 6,874 2,118

Trade and other payables 51,683 39,450 40,910

Current tax payable 59 - -

Short term financial liabilities - - -

Total current liabilities 57,176 46,324 43,029

------ ------------ ------------ ------------

Liabilities associated with

HFS asset - - 45,223

------ ------------ ------------ ------------

Total liabilities 57,452 93,585 93,318

------ ------------ ------------ ------------

TOTAL EQUITY AND LIABILITIES 87,195 128,223 122,645

------ ------------ ------------ ------------

Consolidated Statement of Changes in Equity (Un-audited)

For the 6 months ended 30 June 2022

Share Share Other Retained Revaluation Non-controlling Total

Capital Premium Reserves Earnings surplus interest

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

--------- --------- ---------- ---------- ------------ ---------------- ---------

At 1 January 2021 833 12,790 (502) 6,854 12,472 185 32,632

--------- --------- ---------- ---------- ------------ ---------------- ---------

Loss for the year - - - 3,362 - (212) 3,150

Other comprehensive income

for the year - - - - (924) - (924)

--------- --------- ---------- ---------- ------------ ---------------- ---------

Total comprehensive income

for the year - - - 3,362 (924) (212) 2,226

Transfer of revaluation

to retained earnings - - - 545 (545) - -

--------- --------- ---------- ---------- ------------ ---------------- ---------

Total contributions by and

distributions to owners

of the parent, recognised

directly in equity - - - 545 (545) - -

At 1 July 2021 833 12,790 (502) 10,761 11,003 (27) 34,858

--------- --------- ---------- ---------- ------------ ---------------- ---------

Profit / (Loss) for the

period - - - (6,751) - (298) 7,049

Other comprehensive income

for the period - - - 677 - - 677

--------- --------- ---------- ---------- ------------ ---------------- ---------

Total comprehensive income

for the period - - - (6,074) - (298) 6,372

Share based payments - - - - - - -

Exercise of options 7 - 58 (40) - - 25

Dividend paid - - - (108) (108)

Acquisition of Subsidiary - - - - - - -

Transfer of revaluation

to retained earnings - - - 234 690 - 924

--------- --------- ---------- ---------- ------------ ---------------- ---------

Total contributions by and

distributions to owners

of the parent, recognised

directly in equity 7 - 58 86 690 - 841

--------- --------- ---------- ---------- ------------ ---------------- ---------

At 31 December 2021 840 12,790 (444) 4,773 11,693 (325) 29,327

--------- --------- ---------- ---------- ------------ ---------------- ---------

At 1 January 2022 840 12,790 (444) 4,773 11,693 (325) 29,327

--------- --------- ---------- ---------- ------------ ---------------- ---------

Profit/(Loss) for the

period - - - 816 - (401) 415

Other comprehensive income - - - - - - -

for the period

--------- --------- ---------- ---------- ------------ ---------------- ---------

Total comprehensive income

for the period 816 - (401) 415

Transfer of revaluation

to retained earnings - - - 11,693 (11,693) - -

Total contributions by and

distributions to owners

of the parent, recognised

directly in equity - - - 11,693 (11,693) - -

--------- --------- ---------- ---------- ------------ ---------------- ---------

At 30 June 2022 840 12,790 (444) 17,281 - (726) 29,743

Consolidated Statement of Cash Flows (Un-audited)

For the 6 months ended 30 June 2022

Notes Un-audited Un-audited Audited

30/06/2022 30/06/2021 31/12/2021

GBP000's GBP000's GBP000's

Cash flows from operating

activities

Cash inflow from continuing

operations (2,173) 351 3,901

Finance income (1) 9 620

Finance cost (348) (2,139) (2,902)

Net cash flows from operating

activities 10 (2,522) (1,779) 1,619

Cash flows from investing

activities

Purchase of property, plant

and equipment - (11) (248)

Purchase of intangible fixed

assets (342) (198) (760)

Deposit into restricted accounts (401) 3,908 1,791

Proceeds from disposal of -

subsidiaries 19,575 -

Net cash flows used in investing

activities 18,832 3,699 963

Cash flows from financing

activities

Payments of dividends - - (108)

Proceeds from borrowings - 7,026 6,786

Repayment of borrowings (1,000) (17,917) (18,076)

Capital repayment of leases (321) (276) (616)

Proceeds from issue of shares - - -

Proceeds from sale of share

options 2 - 26

------------ ------------ ------------

Net cash flows from financing

activities (1,319) (11,167) (11,988)

Net increase/(decrease) in

cash and cash equivalents 14,991 (9,247) (9,406)

Cash and cash equivalents

at beginning of period 6,699 18,282 18,282

Cash and cash equivalents

at end of period 21,690 9,035 6,699

Cash and cash equivalents

for discontinued operations

at end of period - - 2,175

Notes to the Interim Accounts

For the 6 months ended 30 June 2022

1. General information and basis of preparation

Good Energy Group PLC is an AIM listed company incorporated and

domiciled in the United Kingdom under the Companies Act 2006. The

Company's registered office and its principal place of business is

Monkton Park Offices, Monkton Park, Chippenham, Wiltshire, United

Kingdom, SN15 1GH.

The Interim Financial Statements were prepared by the Directors

and approved for issue on 20(th) September 2022. These Interim

Financial Statements do not comprise statutory accounts within the

meaning of section 434 of the Companies Act 2006. Statutory

accounts for the year ended 31 December 2021 were approved by the

Board of Directors on 27 April 2022 and delivered to the Registrar

of Companies . The report of the auditors on those accounts was

unqualified and did not contain statements under 498 (2) or (3) of

the Companies Act 2006 and did not contain any emphasis of

matter.

As permitted these Interim Financial Statements have been

prepared in accordance with UK AIM rules and the IAS 34, 'Interim

financial reporting' as adopted by the United Kingdom. They should

be read in conjunction with the Annual Financial Statements for the

year ended 31 December 2021 which have been prepared in accordance

with IFRS as adopted by the European Union.

In accordance with IAS 34, the tax charge is estimated on the

weighted average annual income tax rate expected for the full

financial year. The accounting policies applied are consistent with

those of the Annual Financial Statements for the year ended 31

December 2021, as described in those Annual Financial

Statements.

The Interim Financial Statements have not been audited.

2. Going concern basis

The Group has had a resilient financial performance despite

significant pressure from commodity markets and low wind levels.

The Group has performed a going concern review, going out until

September 2023, considering both an internal base case, and various

externally provided scenarios. The scenarios were provided by Ofgem

in July 2022 as part of their review into the financial stability

of UK Energy suppliers. Having reviewed this forecast, and having

applied a reverse stress test, the possibly that financial headroom

could be exhausted is remote.

All modelling work was performed before the announcement of the

announcement of the Governments Energy Price Guarantee on Sept

8(th) , 2022. The impact of this announcement is only positive for

the company. It reduces collections and expected loss risk, by

providing direct funding from industry bodies to replace customer

contributions (for all domestic dual fuel customer tariffs above

GBP2,500 per annum - standard TDCV usage assumed). In addition, the

Government funding will be provided within 11 days after the week

of supplying power/gas to consumers which reduces working capital

extremes. The Government has also announced business customer will

receive an equivalent level of support although details are still

being confirmed, but any support will a positive for the business.

Finally, the Bank of England will also be supporting liquidity in

the wholesale power and gas trading markets with a GBP40bn facility

with the aim of a return to a more normal trading environment.

The Directors are confident in the ongoing stability of the

Group, and its ability to continue operation and meet commitments

as they fall due over the going concern period. The Group therefore

continues to adopt the going concern basis in preparing its

consolidated financial statements.

3. Estimates

The preparation of Interim Financial Statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing this set of condensed Interim Financial Statements,

the significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the Annual

Financial Statements for the year ended 31 December 2021.

4. Financial risk factors

The Group's activities expose it to a variety of financial

risks: market risk, currency risk, credit risk and liquidity risk.

The condensed Interim Financial Statements do not include all

financial risk management information and disclosures required in

the Annual Financial Statements. They should be read in conjunction

with the Annual Financial Statements as at 31 December 2021.

5.Segmental analysis

H1 2022 Electricity FIT Gas Total Electricity Energy Holding Total

Supply Administration Supply Supply Generation as a Company/

Companies (Discontinued service Consolidated

operations) Adjustments

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

------------ --------------- --------- ---------- -------------- -------- ------------- ---------

Revenue 88,510 2,849 15,638 106,997 - 603 - 107,600

Cost of sales (84,282) (325) (10,573) (95,180) - (155) (45) (95,380)

Gross

profit/(loss) 4,228 2,524 5,065 11,817 - 448 (45) 12,220

Gross margin 5% 89% 32% 11% - 74% 0% 11%

Admin costs (9,716) - (1,227) (1,779) (12,725)

---------- -------------- -------- ------------- ---------

Operating

profit/(loss) 2,098 - (779) (1,824) (505)

Net finance

costs (5) - (24) (216) (245)

Share of - - - - -

loss of

associate

---------- -------------- -------- ------------- ---------

Profit/(loss)

before tax 2,093 - (803) (2,040) (750)

H1 2021 Electricity FIT Gas Total Electricity Energy Holding Total

Supply Administration Supply Supply Generation as a Company/

Companies service Consolidated

Adjustments

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

------------ --------------- -------- ---------- ------------ -------- ------------- ---------

Revenue 50,412 2,582 13,780 66,774 3,864 268 (2,532) 68,374

Cost of sales (41,619) (306) (8,432) (50,357) (2,7839) (54) 2,504 (50,646)

Gross

profit/(loss) 8,793 2,276 5,348 16,417 1,125 214 (28) 17,728

Gross margin 17% 88% 39% 25% 29% 80% 1% 26%

Admin costs (9,665) (188) (700) (1,236) (11,789)

---------- ------------ -------- ------------- ---------

Operating

profit/(loss) 6,752 937 (486) (1,264) 5,939

Net finance

costs (34) (752) (2) (392) (1,180)

Share of - - - - -

loss of

associate

---------- ------------ -------- ------------- ---------

Profit/(loss)

before tax 6,718 185 (488) (1,656) 4,759

6. Finance income and expense

Unaudited Unaudited

As at 30/06/2022 As at 30/06/2021

Finance income GBP000s GBP000s

Bank and other interest receivable 2 -

FV gains & losses (1) (1) 1,447

Total 1 81

Unaudited Unaudited

As at 30/06/2022 As at 30/06/2021

Finance expense GBP000s GBP000s

On bank loans and overdrafts 123 1,298

On corporate bond 120 363

Other interest payable 6 1

Fees on repayment of borrowings(1) - 620

Interest on lease liabilities 1 194

Amortisation of debt issue costs - 151

------------------------------------ ------------------ ------------------

Total 250 2,627

(1) Included within Finance income and Finance expenses in the

prior year are amounts classified as non-underlying income and

expenses relating to the debt restructuring taken place during

2020. As a result of the debt restructuring a fair value gain of

GBP1,447,000 was recognised. However, a GBP620,000 fee was incurred

for the early settlement of the Delabole loan arrangement.

7. Trade Receivables

Unaudited Audited

As at 30/06/2022 As at 31/12/2021

GBP000s GBP000s

Gross trade receivables 49,110 47,686

Provision for impairment/non-payment

of trade receivables (11,184) (11,792)

------------------ ------------------

Net trade receivables 37,926 35,894

Other taxation 337 35

------------------ ------------------

Total 38,263 35,929

The movements on the provision for impairment and non-payment of

trade receivables is shown below:

Movement on the provision for impairment Unaudited Audited

and non-payment of trade receivables As at 30/06/2022 As at 31/12/2021

GBP000's GBP000's

Balance at 1 January 11,792 8,882

Increase in allowance for impairment/non-payment 586 3,134

Impairment/non-payment losses recognised (1,194) (224)

Balance at 31 December 11,184 11,792

Days past due

Unaudited Contract <30 30-60 61-90 >91

As at 30/06/2022 assets Current days days days days Total

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

Expected credit loss

rate - 4.5% 9.7% 17.2% 26.1% 80.5%

Estimated total gross

carrying amount at

default - 30,260 4,198 2,377 1,640 10,633 49,110

Expected credit loss - 1,376 409 410 428 8,561 11,184

Days past due

Audited Contract Current <30 30-60 61-90 >91 Total

As at 31/12/2021 assets days days days days

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

Expected credit loss

rate - 3.3% 7.9% 17.0% 31.2% 90.1%

Estimated total gross

carrying amount at

default - 30,070 4,294 1,488 804 11,030 47,686

Expected credit loss - 1,015 340 253 251 9,931 11,792

8. Borrowings

Unaudited Audited

As at 30/06/2022 As at 31/12/2021

Current: GBP000s GBP000s

Bank and other borrowings - 1,007

Bond 5,160 557

Lease liabilities 276 555

--------------------------- ------------------ ------------------

Total 5,436 2,119

Unaudited Audited

As at 30/06/2022 As at 31/12/2021

Non-current: GBP000s GBP000s

Bank and other borrowings - -

Bond - 4,749

Lease liabilities 275 317

--------------------------- ------------------ ------------------

Total 275 5,066

On the 30 June 2021, the Group partially repaid GBP11,450,000 of

the Good Energy Bonds II. This represented 70% of the un-redeemed

amount at the date of payment. On the same day the group also

repaid GBP400,000 in redemption requests. On 30 June 2022, the

Group repaid GBP200,000 in redemption requests. The outstanding

capital after these combined payments is GBP4,700,000. The bond is

classified as a current liability as the remaining value is

repayable within 12 months, subject to the request of individual

bondholders.

The fair values of borrowings have been calculated taking into

account the interest rate risk inherent in the bond. The fair value

estimates and carrying values of borrowings (excluding issue costs)

in place are:

Unaudited Unaudited Audited Audited

As at 30/06/2022 As at 30/06/2022 As at 31/12/2021 As at 31/12/2021

Fair value Carrying Fair value Carrying

GBP000s value GBP000s value

GBP000s GBP000s

Good Energy Generation

Assets No.1 Ltd - - 39,513 38,310

Corporate bond 5,104 4,735 5,189 4,902

9. Earnings per share

The calculation of basic earnings per share at 30 June 2022 was

based on a weighted average number of ordinary shares outstanding

for the six months to 30 June 2022 of 16,528,000 (for the six

months to 30 June 2021: 16,375,000 and for the full year 2021:

16,399,000 after excluding the shares held by Clarke Willmott Trust

Corporation Limited in trust for the Good Energy Group Employee

Benefit Trust.

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares to assume conversion of

all potentially dilutive ordinary shares. Potentially dilutive

ordinary shares arise from awards made under the Group's

share-based incentive plans. When the vesting of these awards is

contingent on satisfying a service or performance condition, the

number of the potentially dilutive ordinary shares is calculated

based on the status of the condition at the end of the period.

Potentially dilutive ordinary shares are actually dilutive only

when the Company's ordinary shares during the period exceeds their

exercise price (options) or issue price (other awards). The greater

any such excess, the greater the dilutive effect. The average

market price of the Company's ordinary shares over the six month

period to 30 June 2022 was 258p (for the six months to 30 June

2021: 189p and for the full year 2021: 269p). The dilutive effect

of share-based incentives was 208,252 shares (for the six months to

30 June 2021: 440,432 shares and for the full year 2021:

145,752).

10. Net cash flows from operating activities

The operating cashflow for the six months to 30 June 2022 is an

outflow of GBP2.5m (for the six months to 30 June 2021: GBP1.8m

outflow and for the full year 2021: GBP1.6m inflow). The difference

in the cashflow between the half year 2022 and its comparative for

the same period is primarily due to timing of working capital

related items and a loss before tax in the current year compared

with a profit before tax in 2021.

11. Post balance sheet events

Zap Map fundraise

On 8 August 2022, Zap-Map successfully completed a GBP9m Series

A funding round with a GBP5.3m investment from Fleetcor UK

Acquisition Limited ("Fleetcor") and a GBP3.7m investment from Good

Energy. Following the transaction, Good Energy have a significant

minority 49.9% shareholding and Fleetcor have a shareholding of

19.9%. Zap Map has therefore been deconsolidated from the Good

Energy group from 8 August 2022, resulting in a non-adjusting post

balance sheet event. Good Energy originally invested GBP1.08m for a

50.1% stake in March 2019, with a further GBP1m strategic

investment via a convertible loan note in April 2021. The GBP1m

convertible loan note issued in April 2021 by Good Energy has now

converted into shares.

Government Energy Price Guarantee

On 8 September 2022, the UK government announced details of

domestic financial support available through the Energy Price

Guarantee. This has been factored into the going concern disclosure

in note 2 and is treated as a non-adjusting post balance sheet

event in relation to expected credit losses (ECL).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFEEAIIALIF

(END) Dow Jones Newswires

September 20, 2022 02:00 ET (06:00 GMT)

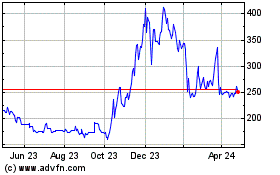

Good Energy (LSE:GOOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

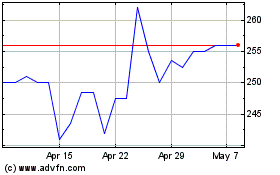

Good Energy (LSE:GOOD)

Historical Stock Chart

From Apr 2023 to Apr 2024