TIDMGOOD

RNS Number : 3813U

Good Energy Group PLC

28 March 2023

Good Energy Group PLC

("Good Energy" or "the Company")

Un-audited results for the 12 months ended 31 December 2022

Executing our strategy by transitioning our business to a green

energy services model

Good Energy, the 100% renewable electricity supplier and

innovative energy services provider, today announces its

preliminary results for the twelve months ended 31 December

2022.

Financial highlights

-- Revenue increased 70.3% to GBP248.7m (2021: GBP146.0m) driven

by rising wholesale costs which have led price rises throughout the

year.

-- Government support for customers mitigated impact of very

high commodity driven price points across the industry in Q4

2022.

-- 10.7% increase in gross profit to GBP29.9m (2021: GBP27.0m)

with a gross profit margin of 12.0% (2021: 18.5%). T he decline in

underlying margins reflects that pricing, whilst rising, could not

keep pace with rapidly increasing wholesale costs through H1 2022

(price cap).

-- Profit before tax of GBP8.5m (2021: GBP1.8m) including net

GBP4.9m recognised value on the Zap Map investment. Underlying PBT

in the period was GBP3.1m with EBITDA of GBP4.4m.

-- Following the recent funding round, Zap-Map has been

deconsolidated from full year PBT figures, FY 2022 included a loss

of GBP2.0m for Zap-Map and a revaluation uplift of GBP 6.9m.

-- Reported profit after tax for the period of GBP9.2m (2021: GBP1.6m).

-- Reported earnings per share of 59.7p (2021: -20.7p).

-- Cash and cash equivalents at the end of Dec 2022 were

GBP24.5m, with a further GBP8.4m in restricted deposit accounts.

Within restricted deposits, GBP4.5m relates to Government support

scheme monies received in late December for application to business

and domestic customer accounts in January

-- Following a good operational performance in 2022 and

reflecting our confidence in the ongoing business, the Board

recommend a final dividend for 2022 of 2.0p per ordinary share,

taking our full year dividend to 2.75p (2021: 2.55p)

Operational highlights

-- Successful execution on our strategy to transition to a

leading green energy services company:

o Sale of 47.5MW generation portfolio in January 2022 for

GBP21.2m to facilitate future investment and M&A.

o Acquisition of heat pump and solar installation business,

Igloo Works, in December 2022, creating a new high margin revenue

stream.

o Completed Zap-Map GBP9m series A fundraise with Fleetcor,

valuing Zap-Map at GBP26.3m post money equity value.

o 63% increase in Zap-Map registered users to 550,000,

reflecting continued strong growth in electric vehicle uptake.

-- Renewable Supply business goals for 2022 achieved:

o New product launched for businesses, matching their supply

demands directly with generators. This reduces our exposure to

wholesale markets and gives our customers comfort as to the

provenance of their renewable electricity.

o Achieved target to install 13,000 smart meters during 2022,

increasing total number of smart meters installed to date to over

40,000 (47% of our customer's meter points).

Post period end and outlook highlights

-- Ambition to be the UK's leading provider of green energy

services, with the ability to install green energy infrastructure

and provide the best tariffs for the energy produced by our

customers :

o Launched a new market leading smart export tariff for

households with solar panels in March 2023.

o First domestic rooftop solar installation completed, following

Igloo acquisition.

-- We assess that energy services represents a GBP5 - GBP10 billion market opportunity . ([i])

-- Strategy is focused on driving high margin, low capital intensity sales growth .

-- Further M&A is a core near term focus, following recent buy and build acquisitions .

-- Our community of green-minded domestic customers provide a

strong initial pipeline for acquired businesses and enquiries to

date following the Igloo acquisition have been highly

encouraging.

-- Complemented through organic growth from product

diversification including new generation product development and

our ongoing relationship with Zap-Map and electric vehicle drivers

.

-- Trading in 2023 has started in line with management

expectations. Energy services continues to make good early

progress. Wholesale power prices are softening but remain elevated

and we anticipate the end of Government support schemes this

month.

Nigel Pocklington, Chief Executive Officer of Good Energy,

said:

"2022 was an enormously challenging year in energy. The knock-on

effects of the Ukraine conflict saw energy prices surge, driving

increased costs which we were forced to pass on to supply customers

in the form of price rises. Therefore, the vast majority of Good

Energy's positive performance came from areas other than energy

supply.

"We have made significant strides in delivering on our strategy

to become a leader in green energy services, and this momentum has

continued with strategic milestones already achieved in the first

quarter of 2023.

"As the UK's second biggest solar power payments company with

more generator customers than supply, and which paid out a record

amount to renewable generators in 2022, we are already the go-to

energy company for solar generators.

"There is a potential GBP5 to GBP10 billion growth market in

clean energy technology installations among climate conscious

customers. We are ideally positioned for this, and are kitting

homes out homes with solar panels and batteries now and plan to

install 12,000 heat pumps by 2026.

A video overview of the results from the Chief Executive

Officer, Nigel Pocklington, is available to watch here:

https://www.fmp-tv.co.uk/2023/03/28/good-energy-strong-momentum-in-year-end-results/

Enquiries

Good Energy Group PLC

Nigel Pocklington, Chief Executive

Charlie Parry, Director of Corporate Strategy

& Investor Relations

Ian McKee, Head of Communications Email: press@goodenergy.co.uk

SEC Newgate UK Email: GoodEnergy@secnewgate.co.uk

Elisabeth Cowell / Molly Gretton Tel: +44 (0)7900 248213

Investec Bank plc (Nominated Adviser

and Joint Broker)

Tel: +44 (0) 20 7597

Henry Reast / James Rudd 5970

Canaccord Genuity Limited (Joint Broker) Tel: +44 (0) 20 7523

Henry Fitzgerald - O'Connor / Harry Rees 4617

About Good Energy www.goodenergy.co.uk

Good Energy is a supplier of 100% renewable power and an

innovator in energy services. It has long term power purchase

agreements with a community of 1,700 independent UK generators.

Since it was founded 20 years ago, the Company has been at the

forefront of the charge towards a cleaner, distributed energy

system. Its mission is to power a cleaner, greener world and make

it simple to generate, share, store, use and travel by clean power.

Its ambition is to support one million homes and businesses to cut

carbon from their energy and transport used by 2025.

Good Energy is recognised as a leader in this market, through

green kite accreditation with the London Stock Exchange, Which? Eco

Provider status and Gold Standard Uswitch Green Tariff

Accreditation for all tariffs.

Chair's review

Overview

Setting out in 2022 we aimed to make progress on our strategy

across supply, generation and transport to deliver on our ambition

of helping one million homes and businesses cut their carbon by

2025. We made substantial strides in executing our strategy by

funding Zap-Map's growth, investing in generation services by

launching smart export and acquiring a clean technology

installation business, and maintaining a trusted truly green supply

business against a very volatile backdrop.

We have entered 2023 a very different business to the one we

were 12 months before, having taken these tangible steps in our

transition to become a green energy services business during the

year under review. This, together with the fact that we remain

substantially debt free and have a strong cash position for

continued investment, is of benefit to all our stakeholders.

For our customers, they have access to a trusted partner which

can now facilitate their ambition to generate green power for their

home, and which can also ensure they earn more from the power they

generate. For our investors, they have exposure to a highly

exciting growth market and are benefitting from the value creation

achieved through our investment into Zap-Map. Plus, this growth and

expansion is underpinned by a stable energy supply business.

I opened my statement last year noting the tumultuous prior year

we had witnessed. 2021 was dominated by the continuation of the

global pandemic and national lockdowns and 2022 saw this volatility

continue, driven by Russia's aggression in Ukraine and the ensuing

global supply chain issues.

Forward prices for electricity and gas hit extraordinary levels,

hitting highs of over 10 times the norms of recent years. [ii] As a

supplier which buys all of its power from renewable sources, due to

the mechanics of the UK market Good Energy was far from immune from

the knock-on effects. These increased costs drove a 70.7% increase

in revenues and forced multiple price increases upon customers.

The rising costs emphasised the need to shift away from fossil

fuels and encouraged people to insulate themselves from the high

prices by switching to solar power, with double the number of

rooftop installations taking place in the year versus 2021.

[iii]

Amidst this volatile backdrop, we exited the year in a strong

position. We have a robust balance sheet, continue to invest in

high growth markets and are helping more homes and businesses save

money and decarbonise.

Strategic developments

Despite the challenging market context, 2022 was a

transformational year for Good Energy. We are well positioned for

high margin sales growth from green energy services going forward.

We now have a strong platform from which to execute on an extremely

compelling opportunity, and we are excited to take this part of the

business to the next level in 2023.

In January, we completed the sale of our generation assets. This

provided us with a robust and substantially debt-free balance sheet

as well as funds to invest in our green energy services proposition

and in turn, the next wave of decarbonisation.

Not long after, we participated in a GBP9m Series A fundraise by

Zap-Map, the UK's leading electric vehicle mapping platform.

Fleetcor, one of the world's leading business payment firms took a

minority stake, as they look to build on their leading fuel card

offering and help businesses transition to electric vehicles. This

deal values Zap-Map at GBP26.3m post money and adds non-cash profit

to our balance sheet.

In December, we completed the acquisition of Igloo Works, an

established UK based heat pump installation business with

capability for solar installs too. The acquisition represents a

significant milestone in delivering on Good Energy's strategy to

accelerate its capability in decentralised energy services,

complementing its established energy supply business. It also

supports Good Energy's ambition to help one million customers cut

carbon by 2025, creating a new service in the crucial clean, green

heating space. We expect to see further acquisitions in the

domestic energy services space and we look forward to updating the

market on progress in due course.

Capital allocation

Our substantially debt free position and strong cash balance

allows us to continue to invest for sustainable growth, including

further acquisitions in energy services and our capital allocation

policy reflects this. However, we recognise the importance of a

dividend to many shareholders.

Following a good operational performance in 2022 and reflecting

our confidence in the ongoing business, the Board recommend a final

dividend for 2022 of 2.0p per ordinary share, taking our full year

dividend to 2.75p (2021: 2.55p).

Board

At the AGM in June, Juliet Davenport, founder, former CEO and

then Non-Executive Director stood down from the Good Energy Board.

I want to take this opportunity to thank Juliet for her enormous

contribution to the wider energy transition. On behalf of the

Board, I want to thank her deeply for her contribution and look

forward to seeing her continue to inspire and lead the way towards

a cleaner, greener future.

Looking ahead

We are seeing a softening in volatility of the energy market

currently. Good Energy remains well positioned both from a

shorter-term balance sheet perspective, but also from a longer-term

strategic growth perspective. The climate crisis already provided

urgency to transition to a clean energy system. The current

economic and political turmoil provides geopolitical urgency to

achieve greater energy independence too.

The opportunity ahead of us is a compelling one. We are focussed

on fast growth areas, with good margin and low working capital

intensity. We have identified a target addressable market of almost

900,000 households in the next two years, which equates to a c.

GBP5 billion target addressable market. Including the medium term

meaningful green actions households, this increases to a c. GBP10

billion opportunity. Our engaged customer base of green-minded

households provides us with a strong initial pipeline for our

energy services and the interest in our new services from this

community has been highly encouraging.

Good Energy has a more powerful role than ever to play in

accelerating the transition to renewables and we look forward to

providing updates during what we expect to be another busy year for

your company.

Will Whitehorn, Chair

CEO's review

Our future energy system will not be a handful of suppliers

billing customers for energy produced by a few generators. It will

be a decentralised, digitised, cleaner, greener grid where homes

and businesses play an active role. Generating, sharing, storing,

using and travelling with clean power.

This is a vision Good Energy has driven towards for years. And

its urgency was more apparent than ever in 2022 as the volatility

of our current centralised largely fossil fuel-based system was

abundantly clear by surging costs and rising bills for

customers.

This future energy system is one in which Good Energy is already

a major player and our goal is to become the leading green energy

services company in the UK. As the UK's largest voluntary Feed-in

Tariff (FiT) administrator, and second largest overall, we are the

only energy supplier today which has more customers generating

their own power than buying ours. With over 180,000 FiT customers

we have more than 20% market share of the biggest decentralised

energy scheme in the UK today.

Robust financial performance and strong cash balance

During the energy crisis, which took hold in late 2021 and did

not let up throughout 2022, Good Energy continued to show

robustness. We sold our two wind and six solar farm generation

assets early in the year, a departure from our past enabling us to

invest in our future strategy and the next wave of decarbonisation.

The cash, alongside our prudent approach to hedging throughout the

year, has resulted in a strong balance sheet.

Our supply business has been a steady ship in choppy waters.

After two years without a price change we implemented several

throughout 2022, moving our prices as the market required. We

called for government support on bills, seeing the onset of

extraordinary rises during the critical winter months. This came

through the Energy Bill Support Scheme and the later announced

Energy Price Guarantee, in addition to the Energy Bill Discount

Scheme for businesses. Implementing these schemes often at very

short notice was a not insignificant task and we are proud to have

done so efficiently and effectively. With clear communication to

customers, we maintained the trust we have built over years and

this will be essential as we evolve into a green energy services

business.

Post period end, we are pleased to have signed our largest ever

deal with renewable energy giant Ørsted to provide clean power to

UK homes and businesses. Utilising the power from one of the

world's largest offshore windfarms, Ørsted's Hornsea 1 offshore

windfarm in the North Sea, the three year deal will provide 110GWh

per annum, the most significant in terms of volume in Good Energy's

history - and enough for almost 38,000 homes. This is testament to

the strong working relationship we have built with Ørsted and

speaks to the strong partnership approach we have.

Green shoots for decentralised energy

Through the challenges of 2022 there were some green shoots for

a cleaner, decentralised energy system. 2022 saw a surge in rooftop

solar installations, more than doubling the year previous to hit

highs not seen since the peak of the FiT scheme in 2015. [iv] This

was largely driven by customers looking to curb their bills by

gaining energy independence and took place without an especially

competitive export tariff market. The rates offered under the

government's replacement to FiT, the Smart Export Guarantee, were

especially low in the context of high import prices.

The rapidly growing rooftop solar market is one Good Energy is

perfectly positioned for and we have launched new tariffs to ensure

more people are rewarded fairly for their switch to green energy

sources. We launched smart export for Feed-in Tariff customers

towards the end of 2022, meaning these customers could earn more

for their power than the deemed 50% rate for export under the

scheme. And now we have launched Power for Good, a leading variable

export tariff for households with solar power, offering a better

export rate than under FiT or the standard rates under the

government's Smart Export Guarantee.

Igloo Works' was established as an installer of heat pumps, a

crucial technology to get the UK off gas, the fuel which is not

only contributing to climate change but been the cause of

stratospheric energy prices over the past 12 to 18 months. This

represents another significant growth opportunity, considering the

government's stated target of 600,000 annual heat pump sales by

2028. [v] Following the December acquisition the company has been

fully incorporated into the Good Energy brand and we have also

built out this business' ability to install domestic solar panels.

Having set to work quickly, we have since completed our first solar

installation meaning that customers can now get a heat pump or

solar panels from Good Energy as well as the truly 100% renewable

electricity to power it, or payment for what they export. We have

an ambitious plan to ramp up sales from our current customer base -

which has already expressed strong interest in our new services -

as well as from new customers. Another significant growth

opportunity as we approach the government's stated target of

600,000 annual heat pump sales by 2028.

Travel with clean power

Another pillar of our strategy which saw growth through 2022 is

electrification of transport. Despite supply chain issues and

rising electricity prices, more than 265,000 electric cars were

registered in 2022, a growth of 40% on 2021 with a total on UK

roads now counting nearly 700,000 [vi] . Zap-Map continued to

maintain its strong market share in this rapidly growing

contingent, reaching 1,000,000 downloads and over 500,000

registered users.

In its Series A Zap-Map raised GBP9m, including a further

GBP3.7m from Good Energy in addition to GBP5.3m new strategic

investment from global fleet payments giant Fleetcor. The

transaction values the business at GBP26.3m with Good Energy's

shareholding at 49.9%.

Zap-Map's revenue channels are all growing. Subscriptions are

showing particular strength among new registered users. Zap-Pay,

Zap-Map's solution to a fragmented EV charging payments experience,

is now available for use on 25% of the UK's rapid chargers. Demand

for Zap-Map's unique data and insights is growing in lockstep with

the market, and a new dedicated insights business unit is

successfully fulfilling this as a strong commercial

proposition.

Outlook

Having established our goal to help one million homes and

businesses cut their carbon by 2025 last year, we are already well

on our way. We believe that our target customer opportunity in

energy services is a GBP5bn - GBP10bn market where we are focused

on driving high margin, low capital intensity sales growth.

Further M&A will be a core near term focus, following the

success of recent buy and build acquisitions and a way to

capitalise on the market opportunity. Our strong community of

green-minded domestic customers provide a strong initial pipeline

for acquired businesses and enquiries to date following the Igloo

acquisition have been highly encouraging. Wholesale energy prices

have eased into 2023, but we continue to take a prudent approach to

trading to maintain our robust position.

With a strong balance sheet, a strategy of investment in high

growth markets to help more to decarbonise, Good Energy's cleaner,

greener future as a services company looks very positive. Our

ambition is to be the UK's leading provider of green energy

services, with the ability to install green energy infrastructure

and provide the best tariffs for the energy produced by our

customers. The tangible steps made in 2022 have set the scene for

an exciting 2023.

Nigel Pocklington, CEO

Market review

The energy market saw unprecedented volatility in 2022.

Wholesale energy prices hit highs of over 10 times pre-2022 norms,

fluctuating throughout the year but remaining at extreme

levels.

These extreme highs and volatility were driven overwhelmingly by

global gas prices due to the conflict in Ukraine and sanctions on

Russia, and the UK was especially impacted due to its reliance on

gas for both heating and electricity generation. The mechanics of

the capacity market in the UK meant that even renewable electricity

prices were driven upwards, increasing Good Energy's costs.

In 2022, in a more consolidated supply market, these increased

costs impacted customers' bills. The energy price cap rose by 54%

in April 2022, and soon looked to be three times the year prior

from 1 October.

Government schemes

The government had announced it would be stepping in to support

through the Energy Bills Support Scheme (EBSS), but as October

approached it became clear that a greater level of intervention

would be required.

The Energy Price Guarantee (EPG) was announced in September. A

unit rate discount, it was applied from 1 October to reduce a

typical annual dual fuel bill on a price capped tariff to GBP2,500,

with the EBSS GBP400 payment made in monthly instalments over the

winter period reducing this further.

Support for businesses was also introduced in the form of the

Energy Bill Relief Scheme, operating similarly to the EPG by

discounting unit rates.

Regulatory environment

Following the widespread failure of energy suppliers in 2021 the

regulatory environment changed significantly, from a largely

liberal approach to one of greatly increased scrutiny.

Ofgem's Market Compliance Review process demanded a new level of

transparency from suppliers and has been applied with haste as the

regulator looks to reform the market. The reviews have looked in

detail at areas including Direct Debit processes, general standards

of performance, customer service and customers in payment

difficulty.

Vulnerable customers

Of greatest concern throughout this crisis has been the impact

of increasing bills on vulnerable customers and the growing number

in fuel poverty - defined as spending 10% or more of income on

energy.

Whilst the government schemes shielded millions from the very

worst of rising bills, the price cap of GBP2,500 in place from

October is still nearly double the level a year prior, meaning

significant bill shock for many. For those previously on cheaper

fixed deals which largely do not exist in the market any longer,

this increase will have been even sharper.

Particular focus has been given to prepayment customers, as the

method of payment more common for lower income households. Good

Energy has a very small proportion of customers which pay via this

method - just 1% compared to upwards of 15% across the industry

[vii] . We do not install traditional prepayment meters, as we

believe they are not a good solution for any customer. We offer

smart prepayment in conjunction with debt management plans as a way

for customers to take control of their usage.

Good Energy campaigned vocally not only for the government

support schemes to shield customers in the short term, but for

investment into energy efficiency and renewables to reduce bills

for the longer term. We joined Energy UK's Vulnerability Commitment

and began offering the Warm Home Discount. As part of the latter we

donated to the fuel poverty charity National Energy Action. We also

made a special donation to our long-term partners Friends of the

Earth in support of their United for Warm Homes campaign.

We are now reducing our smart prepayment prices, making our

smart prepay tariff the cheapest price capped tariff on the market

from 1 April - ahead of the government announcing its plans for all

suppliers to do this.

Good Energy has called for the implementation of a social tariff

available to lower income customers industry wide to make energy

bills fairer. Ultimately, we believe the most important aspect of

the pathway to a permanently fairer energy system is greater

investment in renewables, flexibility and energy efficiency to make

energy cheaper and greener for everyone.

Strategic update - Our transition to a green energy services

company

We have a clear strategic vision. To support one million homes

and businesses cut carbon from their energy and transport use by

2025. Our aim is to power a cleaner, greener, world by making it

simple to generate, share, store, use and travel by clean

power.

Aligning the business to our strategic vision

Our history has seen us evolve as the renewable energy industry

has gathered pace over the past twenty years. Whilst our purpose

and mission remains unchanged, how we are best placed to achieve

that mission is evolving. Where our recent past focused on large

scale generation and renewable supply, we now believe that we can

have a greater impact through the provision of energy services,

underpinned by renewable supply.

Energy services

Our definition of energy services focuses on three core

areas:

-- Solar and generation

-- Heat

-- Transport

Services and tariffs for domestic and small generators, the

installation of solar, battery storage and heat pumps and the

provision of electric vehicle services that help drivers search,

plan, route and pay.

These are high growth markets, typically requiring less working

capital. We will be deploying capital for both organic growth and

M&A in these markets to build on our existing capabilities.

Renewable supply

We serve both domestic and business customers, with fairly

priced, real 100% renewable electricity. This is what underpins our

energy services offering. We have proven operating capability and

stable growth in a highly regulated market.

Energy services - a GBP5 billion to GBP10 billion

opportunity

In the summer of 2022, we undertook a detailed assessment of UK

households to develop an extensive understanding of our target

customers. In the UK, there are approximately 29 million domestic

households. Our target customers want to go green, make a

difference and save money. Of the 29 million households, we view

4.1 million households as our target customers.

Of these 4.1 million, our immediate focus is on a 1.1 million

segment we label as 'green champions'. Typically older, wealthier,

own their own homes and willing to invest to save money and combat

climate change. A larger, but more medium-term focus of a further 3

million households are the 'meaningful green actions'. Typically

younger, wanting to make bold climate decisions, but require more

barriers of adoption removing.

This detailed analysis showed that 16% of these green champions

already had solar installed, 6% had a battery and 9% a heat pump.

This compares to the national average of 4% of households who have

solar installed. They are the early adopters. Of the remaining pool

of customers, 32% said they would consider solar in the next two

years, 35% a battery and 22% a heat pump. There were larger, albeit

potentially more aspirational, figures for our meaningful green

actions segment. We therefore see a target addressable market of

almost 900,000 households in the next two years, which equates to a

c. GBP5 billion target addressable market. Including the medium

term meaningful green actions households, this increases to a c.

GBP10 billion opportunity. Whilst we will be unable to serve all of

those customers, it identifies the scale of opportunity that exists

today. This is no longer an early adopter market for energy

enthusiasts.

Solar, heat pumps and EV markets are fast growth markets, with

good margin and low working capital intensity. In comparison, there

is unlikely to be growth in the domestic energy supply market in

the near term and business supply growth must be selective. Margins

are low, and working capital is higher as a result of elevated

energy costs and trading collateral requirements. Energy services

offers better returns than energy supply in both the short and long

term.

Solar and generation

The UK solar market has seen near record levels of growth

through 2022 as energy prices remained high. Installs increased

over 125% to 132,000 and are near the record highs of 2015 at the

peak of the feed in tariff administration. The vast majority of

this demand was domestic installs which accounted for 88% of the

volumes in 2022, as people looked to shield themselves from the

rising energy costs.

We anticipate cumulative capacity on the grid to be 7.5GWh by

2030 in order to be on track with net zero targets, which outlines

a 9.9% CAGR to 2030. [viii] However, from install levels seen in

2022, we calculate that this only requires a 2.9% annual growth in

install levels to c. 167k per year. With energy costs unlikely to

be falling quickly in the short term, we see this as the main

driver for install growth, which will continue to build

momentum.

Solar tariffs and innovation

In early 2023 we launched a new market leading smart export

tariff for households with solar panels. 'Power for Good' will pay

10p per kWh, a leading variable export tariff rate aligned to the

market and reviewed on a quarterly basis and better than the

standard rates offered under the Government's Smart Export

Guarantee.

The new tariff, which will require homes with solar panels to

have a compatible smart meter, means a typical solar powered home

could get paid around GBP150 per year for the energy they share.

That's in addition to saving around GBP500 off their annual energy

bills for what they use themselves.

We believe that people who have solar panels should be getting a

fair price for their power and our ambition is for Good Energy to

be known as the as the go-to supplier if you want the best tariffs

for the power you generate from the panels on your roof.

We are already the second biggest solar power payment company in

the UK through the Feed-in Tariff (FiT), with over 180,000

customers for whom we administrate hundreds of millions of pounds

in payments. We recently launched smart export for our FiT

customers, meaning these micro-generators could be paid more for

their export as it is based on what they actually share with the

grid rather than the deemed 50% normally paid.

Power for Good will be Good Energy's first smart export tariff

available to non-FiT customers including those who installed their

solar panels after the scheme closed in 2019.

Scaling solar and generation services

Following the acquisition of Igloo Works in December 2022, we

also recently announced that we will be installing solar panels.

The number of installations on rooftops surged in 2022 as people

looked to shield themselves from high energy bills and take control

of their power. The trend is set to continue as energy prices

remain high and demand for clean energy remains strong, and we are

looking to help customers with its install offer and the new market

leading tariff.

We will continue to be acquisitive in this space in order to

bolster our expertise in solar installation and increase our

installation capacity. Whilst we have significant national demand

from our own customer base, we will take a highly regionalised

approach to developing installation capability.

The solar installation market remains highly fragmented with

over 3,000 registered installers and the vast majority installing

less than 200 installs per year. Our growth strategy is focused on

a regional roll up of these companies to act as installation arms.

We anticipate a number of acquisitions, similar to our approach

with Igloo Works, in order to build a footprint to meet this

demand. From this acquired base, we will look to grow install

capacity organically and leverage the Good Energy credentials of a

strong brand and corporate functions to drive increased reach and

help customers cut carbon and save money.

We expect to complete further acquisitions throughout 2023,

whilst continuing to target our existing customer base.

Heat

Like solar installation the heat pump installation market has

seen significant growth throughout 2022 and a 35% CAGR over the two

years since 2020. [ix] , with air source heat pumps accounting for

over 85% of installations, as people looked to benefit from solar

generation and shield themselves from rising gas costs.

The boiler upgrade scheme was introduced in March 2022, offering

a GBP5,000 reduction from the total cost of installation. This

replaced the former renewable heat incentive, but uptake has been

slow. A combination of higher up-front costs and underwhelming

Government support.

Whilst growth in 2022 has been positive, a lot more needs to be

done to hit net zero targets. Our modelling outlines over 400,000

installs per year by 2030 targets, with a 20% CAGR growth in

installation volumes required to achieve this. This year has been a

tipping point for heat pump installations but more needs to be done

to reduce up front costs, promote awareness and debunk performance

myths.

To date, around 60% of people with heat pumps have had solar

installed first, [x] outlining the benefit of using excess solar

generation to power the electricity required for an air source heat

pump. We see this as a clear opportunity to market to our solar

installation customers and Feed-in Tariff customer base.

Heat pump installations underway and growing

Following the acquisition of Igloo Works, heat pump

installations have continued to grow and we are targeting 500

installations in 2023 and to build the capacity for 12,000 per year

by 2026. Whilst these targets are ambitious, we believe we have a

customer base and audience who are open to this. Initially our

focus is on serving our c. 60k domestic energy supply customers,

and selectively targeting both electric vehicle drivers and those

with solar generation. In time, we have a future ambition to target

the 1.5 million boiler replacement market, but this will take a

meaningful shift in volume to reduce the up front cost for

mainstream consumers.

In March 2023 we incorporated the business into the Good Energy

brand and have continued to develop a range of services to improve

overall user experience. This will include energy tariffs to

underpin the overall renewable offering and reduce the total cost

of ownership.

Transport

The electric vehicle market saw continued growth in 2022,

following impressive growth in recent years. Total EVs on the road

now totals over 1.1m, with over 60% of these being battery electric

vehicles in 2022. These battery electric vehicles are Zap-Map's

core market.

The Battery EV market grew 67% to over 700,000 in 2022 and has a

2-year CAGR of 80%. Cumulatively, Zap-Map now has over 1 million

downloads of the app and over 550,000 registered users, up 63% in

2022 and a 2 year CAGR of 83%. It continues to retain its position

as the market leader in the high growth electric vehicle market,

with registered user penetration at over 80% of all electric

vehicle drivers.

Zap-Map: Building scale and recurring revenue

In August 2022, Zap-Map closed a GBP9m series A funding round

including investment from Good Energy and Fleetcor:

-- GBP5.3m new investment from Fleetcor provided strategic

opportunities to leverage Fleetcor's global footprint and

partnerships with electric vehicle fleets and charging providers in

support of Zap-Map's international expansion plans.

-- Good Energy invested GBP3.7m in line with its strategy to

make it simple for people to generate, share, store, use and travel

with clean power.

Zap-Map's commercial goals include building on its

paid-subscription services and initiating international expansion.

The funds raised are being deployed to fuel the expansion of

Zap-Map's development team to deliver its product roadmap and could

pave the way for Zap-Map's international expansion, which began in

late 2022. Zap-Map registered users as a share of battery EV

drivers was stable around 80% and the first steps have been taken

in international expansion.

Zap-Map's share of EV market has continued to transfer into

revenue growth and they delivered over GBP1m in revenue in 2022 and

are on track to double this recurring revenue in 2023 growing

across its three core revenue streams.

-- Subscriptions

o Monthly or annual subscriptions for added-value features on

mobile and in-car.

o Active app users growing in line with BEV market growth.

Targeting 10% of registered users on paid subscription

services.

-- Pay

o 12 charging networks now signed covering 25% of the rapid

charger network.

o Zap-Pay utilisation continuing to increase. Higher charging

costs on the public network allowing for more flexible payment

offers.

o Integration with fleet Allstar Electric card for payment, with

Fleetcor.

-- Data and insights

o Dedicated insights business unit created to serve growing

demand.

o Increased need to understand the EV landscape for a growing

range of businesses and organisations.

o Zap-Map possesses the broadest and deepest data set, excellent

market knowledge and a wide range of recurring data services. High

growth potential.

Zap-Map growth

A major part of the Series A investment is to allow Zap-Map to

build on its market leading data and mapping, to develop its user

experience. This will allow for existing services to be improved

and new revenue streams to be developed. These include increasing

subscriptions through value-add services, improve Zap-Pay

functionality within the user journey and develop an API

(application programme interface) solution to allow the app

functionality to be utilised within partner apps and platforms.

The API solution is a single-entry point to enable third party

digital products. The Zap-Map platform is powered by scalable,

secure, and tested APIs. The first iteration of this has been

developed along Allstar, Fleetcor's UK fuel brand, as part of the

Allstar Electric fuel card. Further API capability will be rolled

out to a wide range of partners for search, payment, and planning.

This provides a range of other companies one integration to

leverage Zap-Map's unique applications.

Growth will be targeted across segments.

-- Free users will have the widest choice, best data, and the simplest way to pay.

-- Premium users can access added value charging features on mobile and in car.

-- Insights and data services use rich data to support required

growth in UK EV charging infrastructure.

-- Strategic partners can gain the ability to build their own digital EV product set.

Monetisation will focus on the development of recurring revenue

streams by growing subscriptions, data API sales, insights and

partner transaction fees. Payment transactions and advertising

revenue will enhance revenues further.

Renewable supply

We continue to operate in both the domestic and business UK

energy supply markets, but remain a premium provider for

green-minded customers. We provide a range of import and export

services, which underpin our overall offering. Our import services

provide 100% real renewable electricity to domestic, small

businesses and smaller half hourly business customers. We do not

focus on large scale industrial customers. Our export services

provide power purchase agreements (PPAs), Feed-in Tariff

administration services and smart generation offers for domestic

and business customers.

In domestic supply, we are witnessing a market with limited

growth potential with the introduction of the market stabilisation

charge, high wholesale costs and increased working capital

requirements for purchasing power. We have continued to make good

progress with our smart meter roll out and now have over 40,000

installed to date.

In Business supply, we have a clear size and sectoral targeting.

Small, medium sized enterprises (SMEs), and half hourly metered

business sites, with a focus on purpose driven businesses looking

for a truly green supply product. Recent customer renewals include

The Crown Estate, PriceWaterhouseCoopers, Rapanui and BNP

Paribas.

Our purchasing of PPA's is what sets us apart and allows us to

provide 100% renewable electricity. This is sourced from over 1,700

individual generators including a mix of wind, solar, hydro and

anaerobic digestion.

Near term growth pathway

Our strategic vision remains unchanged, in helping one million

homes and businesses cut carbon from their energy and transport use

by 2025. Our growth in 2023 will be achieved through.

-- Roll out of solar services to our existing client base.

-- Roll out of solar and heat pump installations.

-- Acquire more capacity to accelerate services strategy faster.

-- Drive uptake of new tariffs to maximise our customer base and potential customers.

For many, the purchase of an electric vehicle will be the

trigger into further energy services products. Initially this will

require the need to search, plan and pay for EV charging on the

road, and charge at home with cheaper, smarter off-peak tariffs.

Research by Zap-Map indicates that EV drivers are seven times more

likely to have solar PV installed than the national average, with

29% of respondents having solar panels on their home.

For those with EVs, solar PV allows you to reduce your overall

energy costs, support off grid consumption and increase value

through flexibility by exporting excess generation or storing it

for avoiding expensive on peak consumption. Our installation

partner data shows that on average 80% of solar PV installs are now

also selling a battery storage system to maximise this benefit.

MCS (Microgeneration Certification Scheme) data shows that on

average 60% of recent heat pump installations had solar PV

installed first. This allows consumers to minimise overall heating

costs by powering from solar, or replace increasingly expensive gas

and oil products.

What ties this all together are smart energy tariffs that

maximise the ability to save money and reduce carbon. These are

smart meter enabled, and bespoke recommendations will allow us to

remove complexity for consumers. In time, the technology potential

will allow much of this to be automated to increase cost savings

further. Smart charging, load shifting and further flexibility

services provide material upside.

We remain committed to building out these range of services

through our investments in Zap-Map, Igloo Works and further M&A

activity. Initially through the installation of solar, storage and

heat pump hardware, before wrapping appropriate tariffs to optimise

consumption. And finally monetising these assets as scale is

built.

OPERATING REVIEW

Wholesale energy market conditions

Power prices

The development of power prices in the last 24 months has been

significant, with COVID impacts and subsequent recovery before

geopolitical matters drove a dramatic, rapid, and fluctuating

upward trend in wholesale power and gas costs. Day ahead gas prices

started the year at GBP1.53/therm, peaked at GBP6.44/therm on 26

August, and had dropped/stabilised to GBP1.30/therm by mid-January

2023 driven by high European gas storage levels, LNG imports into

Europe, a warmer than seasonal normal winter and a general removal

of risk pricing as the industry adapted to the loss of Russian Oil

and Gas flows.

Weather conditions in 2022 have reflected a warmer year than

ever recorded before. The provisional UK mean temperature for 2022

was 10.0 degC, which is 0.9 degC above average, reaching 10 degC

for the first time and exceeding the UK's previous warmest year

(2014, 9.9 degC). Overall Good Energy gas supply volume was down

17% in 2022 (vs 2021) as the warm temperature combined with price

and political reasons to drive down usage.

Overall electricity supply volumes were up 2.5% (vs 2021)

reflecting continued COVID recovery and increased business supply

volumes.

Our renewable supply business

Cash collections

Significant rise in cash collections in 2022 driven by increased

tariffs (SVT's Price Cap and Commercial tariffs) and the recovery

from teething problems experienced in the implementation of our new

business billing platform (Ensek) which impacted collection during

Q2 and Q3 2021.

There is a continued focus on good quality business partners to

ensure future growth comes hand in hand with good collections

performance.

Cash collections continue to be a priority for the business,

with rising wholesale prices requiring tariff increases and

increased collections to continue to sustain the business.

Business

Total business supply customers fell by 30.6% to 8,000. Despite

this reduction in customer numbers, business supply volumes grew by

5% reflecting higher usage contracts. (2022: 457 GWh (Gigawatt

hours), 2021: 435 GWh).

Domestic

We remain committed to ensuring that we offer fair priced,

transparent 100% renewable electricity proposition. Elevated energy

prices will drive increasing awareness in the sector.

Feed in Tariff ("FIT")

FIT administration provides the foundation of our energy

services model. Despite the FIT scheme closing to new entrants in

March 2019, we continue to administer the scheme for domestic and

business customers. Customer numbers increased 0.1% to 180,300

versus 2021.

Generation performance

In January 2022 we announced the disposal of the renewable

generation asset portfolio (47.5MW) as part of an ongoing strategic

shift to energy and mobility services.

Smart metering

Following delays in 2020 and the first half 2021 due to COVID-19

restrictions, installations are now progressing well. In

2022,13,000 meters were installed in the year delivering on our

2022 target. Over 40,000 meters have been installed to date.

CFO REVIEW

Overview

The Group has had a resilient financial performance despite

continued and significant pressure from commodity markets impacting

on the year's performance.

Financial performance

Profit and loss

Revenue increased 70% in the period to GBP248.7m (2021:

GBP146.0m) driven by increased tariffs which have followed the

volatility seen in worldwide wholesale power and gas costs. Cost of

sales increased by 84% to GBP218.8m (2021 GBP119.0m) driven by

geopolitical impacts on wholesale costs.

Reported gross profit increased 10.7% to GBP29.9m (2021:

GBP27.0m). Gross margin decreased to 12.0% (2021 Reported: 18.5%,

2021 Underlying 14.5%). The 2.5% decline in underlying margins

reflects that pricing whilst rising could not keep pace with

rapidly increasing wholesale costs through H1 2022 (price cap).

Total administration costs increased 20% to GBP28.8m. This

increase relates to the booking of expected credit loss (ECL)

provisions at 2022 year-end rates, alongside the planned expansion

of Zap-Map, energy services investments, and inflationary pressures

experienced by all businesses during 2022.

Finance costs decreased by 40% to GBP0.4m due to a combination

of significant debt reduction over the past few years and the sale

of the generation asset portfolio.

Reported profit before tax of GBP8.5m includes GBP7m of profit

recognised on the deconsolidation of the Zap Map investment due to

relevant accounting treatment , alongside GBP(2.0)m of losses

related to the costs associated with the ZAPMAP business in 2022.

Underlying profit before tax is GBP3.1m which includes price,

weather, industry and the non-repeat of 2021 impairment. Adding

back GBP1.3m of depreciation and amortisation gives GBP4.4m EBITDA

for the period.

Reported tax credit at H1 2022 include the impact one-off

benefits related to generation business sale.

The reported profit for the period was GBP9.2m (2021: -GBP3.9m).

This reflects the increase in value of the Zap Map investment as

explained above and extraordinary market conditions seen since H2

2021 and continuing to this day.

*A profit bridge slide has been included in the Investor

presentation, which is available on the Company's website.

(https://group.goodenergy.co.uk/home/default.aspx)

Cash flow and cash generation

The increased tariffs alongside the recovery from 2021 business

billing migration issues has seen a significant improvement in

collections year on year. Collections in H1 were up 72% and in H2

were up 88% versus the same periods in 2021.

There was a net increase in cash of GBP17.8m, which includes the

proceeds from the sale of the Generation assets (GBP21.2m - gross

of fees) alongside the further strategic investment in Zap-Map of

GBP2.7m and the acquisition of Igloo Works for GBP1.8m.

Cash and cash equivalents at the end of Dec 2022 were GBP24.5m,

with a further GBP8.4m sat in restricted deposit accounts. GBP4.5m

of which relates to Government support scheme monies received in

late December for application to business and domestic customer

accounts in January.

Funding and debt

Our business is debt free on a net basis.

Substantial progress has been made against reducing Group

finance costs and reducing the gearing ratio. The remaining Good

Energy Bonds II outstanding (GBP4.9m) is split GBP10k short term

liabilities and GBP4.9m within long term liabilities. This is due

to an annual redemption request window for bondholders in December

of each year.

The Group continues to maintain capital flexibility, balancing

operating requirements, investments for growth and payment of

dividends. Our business remains mindful of the need to capitalise

on strategic business development and investment opportunities.

Prudent balance sheet management remains a key priority.

Earnings

Reported basic earnings per share increased to 59.7p (2021:

-20.7p).

Dividend

Following stable operational performance in 2022, the sale of

the generation portfolio and reflecting our confidence in the

ongoing business, the Board recommend a final dividend for 2022 of

2.0p per ordinary share.

Good Energy continues to operate a scrip dividend scheme and the

payment timetable of the final dividend will be announced in due

course.

Expected Credit Loss (ECL)

ECL charge in the year was GBP3.9m, this is an increase of

GBP1.0m (2021: GBP2.9m).

The main impact of the year is elevated tariffs. Revenues have

significantly increased but this has been partially offset by

Government support schemes reducing the impact of higher prices on

end customers.

Zap-Map investment

2022 saw a P&L loss related to Zap Map of GBP(2.0)m which

increased GBP(1.0)m from 2021, following a period of continued

investment. This was expected and related to Zap Map's growth plan.

From 8 August 2022 Good Energy decreased its stake to a 49.9%

minority shareholding and deconsolidated Zap Map which is now an

Associate .

Generation portfolio sale

On 25 November 2021, the Company appointed KPMG LLP to lead a

sale process for the Company's entire 47.5MW generation

portfolio.

On 20 January 2022 the Company announced, that following a

competitive process, the disposal of the 47.5MW generation

portfolio was complete with Bluefield Solar Income Fund. Total

consideration of GBP21.2m was received for the sale.

We are committed to delivering value to stakeholders and the

sale of our generation portfolio, at a significant premium to book

value, was a good deal. It is also a significant moment for Good

Energy - we are using the capital from our past to invest in our

future.

Events after the balance sheet

Good Energy will voluntarily withdraw the Company's ordinary

shares ("Ordinary Shares") from trading on the AQSE Growth Market.

Therefore, trading in the Ordinary Shares will cease at 4:30 p.m.

on 31 March 2023. Trading in the Ordinary Shares will continue on

the AIM market of the London Stock Exchange.

Consolidated Statement of Comprehensive Income (Unaudited)

For the year ended 31 December 2022 2022 2021

GBP'000 GBP'000

Notes Unaudited

REVENUE 2 248,682 146,045

Cost of sales (218,768) (119,019)

---------- ----------

GROSS PROFIT 29,914 27,026

Administrative expenses (28,805) (23,816)

Non-underlying costs - (806)

Other operating income 66 -

---------- ----------

OPERATING PROFIT 1,175 2,404

Finance income 4 633 14

Finance costs 4 (351) (584)

Gain arising on loss of control of 6,884 -

subsidiary

Share of loss of associate (712) -

---------- ----------

PROFIT BEFORE TAX 7,629 1,834

Taxation 737 (187)

---------- ----------

PROFIT FOR THE YEAR FROM CONTINUING

OPERATIONS 8,366 1,647

---------- ----------

DISCONTINUED OPERATIONS

Profit/(Loss) from discontinued operations,

after tax 858 (5,546)

---------- ----------

PROFIT/ (LOSS) FOR THE PERIOD 9,224 (3,899)

Attributable to

Good Energy Group PLC 9,816 (3,389)

Non-Controlling Interest (592) (510)

========== ==========

OTHER COMPREHENSIVE INCOME:

Other comprehensive income for the

year, net of tax - 677

TOTAL COMPREHENSIVE INCOME FOR THE

YEAR ATTRIBUTABLE TO OWNERS OF THE

PARENT COMPANY 9,224 (3,222)

========== ==========

Earnings per share for the year 5 Basic 59.7p (20.7) p

5 Diluted 59.7p (20.7) p

Earnings per share for the year (continuing

operations) 5 Basic 50.9p 13.2p

5 Diluted 50.9p 13.0p

Consolidated Statement of Financial Position (Unaudited)

As at 31 December 2022

2022 2021

GBP '000 GBP '000

Unaudited

ASSETS

Non-current assets

Property, plant and equipment 117 209

Intangible assets 3,507 3,891

Right of use assets 324 851

Deferred Tax asset 162 173

Equity investments in associate 12,578 -

Total non-current assets 16,688 5,124

Current assets

Inventories 9,211 7,682

Trade and other receivables 56,882 35,928

Restricted deposit accounts 8,462 2,414

Cash and cash equivalents 24,487 6,699

Total current assets 99,042 52,723

---------- ------------

Held for sale assets - 64,798

---------- ------------

TOTAL ASSETS 115,730 122,645

---------- ------------

EQUITY AND LIABILITIES

Capital and reserves

Called up share capital 844 840

Share premium account 12,915 12,790

Employee Benefit Trust shares (7) (444)

Retained earnings 25,231 4,774

Revaluation surplus - 11,693

Total equity attributable to members of

the parent company 38,983 29,653

Non-Controlling Interests - (325)

---------- ------------

Total equity 38,983 29,328

Non-current liabilities

Borrowings 4,927 5,066

Total non-current liabilities 4,927 5,066

Current liabilities

Borrowings 294 2,118

Trade and other payables 71,526 40,911

Total current liabilities 71,820 43,029

---------- ------------

Liabilities associated with held for sale

assets - 45,223

---------- ------------

Total liabilities 76,747 93,318

---------- ------------

TOTAL EQUITY AND LIABILITIES 115,730 122,646

---------- ------------

Consolidated Statement of Changes in Equity (Unaudited)

For the year ended 31 December 2022

Share Share EBT Retained Revaluation Total Non-controlling Total

capital premium shares earnings surplus equity interests

attributable

to members

of the

Parent

Company

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------- -------- ---------- --------- ------------ ---------------- ---------------- --------

At 1 January

2021 833 12,790 (502) 6,854 12,472 32,447 185 32,632

(Loss) for the

year - - - (3,389) - (3,389) (510) (3,899)

Other

comprehensive

income for

the

year - - - 677 - 677 - 677

----------- -------- ---------- --------- ------------ ---------------- ---------------- --------

Total

comprehensive

income for

the

year - - - (2,712) - (2,712) (510) (3,222)

----------- -------- ---------- --------- ------------ ---------------- ---------------- --------

Exercise of

options 7 58 (40) - 25 - 25

Dividends paid - - - (108) - (108) - (108)

Transfer of

revaluation

to retained

earnings - - - 779 (779) - - -

Total

contributions

by and

distributions

to owners of

the parent,

recognised

directly

in equity 7 - 58 631 (779) (83) - (83)

----------- -------- ---------- --------- ------------ ---------------- ---------------- --------

At 31 December

2021 840 12,790 (444) 4,773 11,693 29,652 (325) 29,327

=========== ======== ========== ========= ============ ================ ================ ========

At 1 January

2022 840 12,790 (444) 4,773 11,693 29,652 (325) 29,327

----------- -------- ---------- --------- ------------ ---------------- ---------------- --------

Profit for the

year - - - 9,816 - 9,816 (592) 9,224

Other - - - - - - - -

comprehensive

income for the

year

----------- -------- ---------- --------- ------------ ---------------- ---------------- --------

Total

comprehensive

income for

the

year - - - 9,816 - 9,816 (592) 9,224

Share based

payments - - - 198 - 198 - 198

Dividend Paid - - - (297) - (297) - (297)

Scrip

dividends

issued 3 125 - (128) - - - -

Transaction

arising from

loss of

control

of subsidiary - - - (592) - (592) 917 325

Exercise of

options 1 - 437 (232) - 206 - 206

Transfer of

revaluation

to retained

earnings - - - 11,693 (11,693) - - -

Total

contributions

by and

distributions

to owners of

the parent,

recognised

directly

in equity 4 125 437 10,642 (11,693) (485) 917 432

----------- -------- ---------- --------- ------------ ---------------- ---------------- --------

At 31 December

2022 844 12,915 (7) 25,231 - 38,983 - 38,983

=========== ======== ========== ========= ============ ================ ================ ========

Consolidated Statement of Cash Flows (Unaudited)

For the year ended 31 December 2022

2022 2021

GBP'000 GBP'000

Unaudited

Cash flows from operating activities

Cash generated from operations 5,763 3,900

Finance income 17 620

Finance cost (351) (2,902)

Income tax received - -

---------- ---------

Net cash flows generated from operating activities 5,429 1,618

---------- ---------

Cash flows from investing activities

Purchase of property, plant and equipment (9) (248)

Purchase of intangible fixed assets (125) (760)

Transfers (to)/from restricted deposit accounts (1,515) 1,971

Acquisition of subsidiary, net of cash held in (1,725) -

the subsidiary

Investment in associate (2,794) -

Proceeds from disposal of held for sale assets 20,351 -

Net cash flows used in investing activities 14,183 963

---------- ---------

Cash flows from financing activities

Payments of dividends (297) (108)

Proceeds from borrowings - 6,786

Repayment of borrowings (1,382) (18,076)

Capital repayments of leases (582) (616)

Proceeds from exercise of share options 437 26

---------- ---------

Net cash flows used in financing activities (1,824) (11,988)

---------- ---------

Net increase/(decrease) in cash and cash equivalents 17,788 (9,408)

Cash and cash equivalents at beginning of year 6,699 18,282

---------- ---------

Cash and cash equivalents at end of year

Represented by: 24,487 8,874

Cash and cash equivalents for discontinued operations - 2,175

Cash and cash equivalents for continuing operations 24,487 6,699

---------- ---------

Notes to the Financial Information (Unaudited)

For the year ended 31 December 2022

1. Basis of Preparation

Good Energy Group PLC is an AIM listed company, incorporated in

England and Wales and domiciled in the United Kingdom, under the

Companies Act 2006.

The principal activity of Good Energy Group PLC is that of a

holding and management company to the Group. More detailed

information on the Group's activities is set out in the Chairman's

statement, the Chief Executive's review and the Finance Director's

review.

The unaudited Preliminary Report has been prepared using

consistent accounting policies with those of the previous financial

year. It does not contain sufficient information to comply with the

disclosure requirements of UK-adopted international accounting

standards .

The Preliminary Report was approved by the Approvals Committee

and the Audit Committee and adopted by the Board of Directors. The

Preliminary Report does not constitute statutory financial

statements within the meaning of section 434 of the Companies Act

2006 and has not been audited.

On 24 November 2021, the Group publicly announced the decision

of its Board of Directors to sell the Good Energy Holding Company

No. 1 Limited group including its wholly owned subsidiaries

("GEGAN

group"). The sale of the GEGAN group was completed on 19 January

2022. At 31 December 2021 the GEGAN group was classified as a

disposal group held for sale and as a discontinued operation. The

business of GEGAN group represented the entirety of the Group's

Electricity Generation operating segment until 24 November 2021.

With GEGAN group being classified as discontinued operations, the

Electricity Generation segment is no longer presented in the

segment note.

On 8 August 2022, a subsidiary of the Group (Zap-Map Limited)

completed a GBP9m Series A fundraise. This included a further

GBP3.7m investment from Good Energy and a GBP5.3m investment from

new strategic investor Fleetcor UK Acquisition Limited

("Fleetcor"), the leading global fuel card and payment provider

with a US$17 billion market cap. From the date of the fundraise

Good Energy no longer includes Zap-Map as a subsidiary within the

financial statements. The results of Zap-Map are now recognised in

line with accounting for associates. A gain of GBP6.9m has been

recognised on disposal of the former subsidiary. Good Energy Group

PLC remains a significant investor in Zap-Map.

On 2 December 2022, the Group acquired the entire share capital

of Igloo Works Limited ("Igloo"), an established UK based heat pump

installation business (the "Acquisition"), for an initial

consideration of GBP1.75 million. The results of Igloo Works are

consolidated within the financial statements.

The accounting policies adopted, other than as documented above,

are consistent with those of the annual financial statements for

the year ended 31 December 2022 , as described in those financial

statements.

The Preliminary Report is presented in pounds sterling because

that is the currency of the primary economic environment in which

the Group operates.

The Preliminary Report will be announced to all shareholders on

the London Stock Exchange and published on the Group's website on

28 March 2023 . Copies will be available to members of the public

upon application to the Company Secretary at Good Energy, Monkton

Park Offices, Monkton Park, Chippenham, Wiltshire, United Kingdom,

SN15 1GH.

2. Segmental Analysis

The chief operating decision-maker has been identified as the

Board of Directors (the 'Board'). The Board reviews the Group's

internal reporting in order to assess performance and allocate

resources. Management has determined the operating segments based

on these reports. The Board considers the business from a business

class perspective, with each of the main trading subsidiaries

accounting for each of the business classes. The main segments

are:

-- Supply companies (including electricity supply, FiT administration and gas supply);

-- Energy as a service (including Igloo Works, Zap-Map and nextgreencar.com)

-- Holding companies, being the activity of Good Energy Group PLC.

The Board assesses the performance of the operating segments

based primarily on summary financial information, extracts of which

are reproduced below. An analysis of profit and loss, assets and

liabilities and additions to non-current assets, by class of

business, with a reconciliation of segmental analysis to reported

results follows:

Segmental analysis: 31 December 2022 - Unaudited

Electricity FIT Gas Total Energy Holding Total

Supply Administration Supply Supply as a Companies/Consoli-dation -

Companies service Adjustments Continuing

Operations

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

Revenue from

external

customers 205,942 5,588 36,500 248,030 652 - 248,682

Total revenue 205,942 5,588 36,500 248,030 652 - 248,682

------------ --------------- --------- ---------- -------- ------------------------- -----------

Expenditure

Cost of sales (190,391) (688) (27,516) (218,595) (196) 23 (218,768)

Gross Profit 15,551 4,900 8,984 29,435 456 23 29,914

Administrative

expenses (20,685) (2,041) (4,273) (26,999)

Net other

operating

income/

(costs) (156) 170 52 66

Depreciation

& amortisation (1,806) - - (1,806)

------------ --------------- --------- ---------- -------- ------------------------- -----------

Operating

profit/(loss) 6,788 (1,415) (4,198) 1,175

Net finance

costs (96) (3) 381 282

Gain arising

on loss of

control of

subsidiary - 6,884 6,884

Share of loss

of associate - - (712) (712)

------------ --------------- --------- ---------- -------- ------------------------- -----------

Profit/(loss)

before tax 6,692 (1,418) 2,355 7,629

Segments

assets &

liabilities

Segment assets 67,636 56 48,041 115,733

Segment

liabilities (59,544) (279) (16,924) (76,747)

---------------- ------------ --------------- --------- ---------- -------- ------------------------- -----------

Net asset/

(liabilities) 8,092 (223) 31,117 38,936

---------------- ------------ --------------- --------- ---------- -------- ------------------------- -----------

Additions

to non-current

assets - - 1,929 1,929

All turnover arose within the United Kingdom.

Segmental analysis: 31 December 2021

Electricity FIT Gas Total Energy Holding Total

Supply Admin-isration Supply Supply as a Companies/Consoli-dation -

Companies service Adjustments Continuing

Operations

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

Revenue from

external

customers 116,521 5,323 23,491 145,335 643 1 145,979

FiT/ROC subsidy

revenue 66 - - 66 - - 66

Total revenue 116,587 5,323 23,491 145,401 643 1 146,045

------------ --------------- --------- ---------- -------- ------------------------- -----------

Expenditure

Cost of sales (103,339) (647) (14,851) (118,837) (154) (28) (119,019)

Gross Profit 13,248 4,676 8,640 26,564 489 (27) 27,026

Administrative

expenses (17,849) (1,448) (3,612) (22,103)

Depreciation

& amortisation (1,578) (134) (1) (1,713)

------------ --------------- --------- ---------- -------- ------------------------- -----------

Operating

profit/(loss) 7,137 (1,093) (3,640) 3,210

Net finance

costs (67) (2) (501) (570)

Share of loss - - - -

of associate

------------ --------------- --------- ---------- -------- ------------------------- -----------

Profit/(loss)

before tax 7,070 (1,095) (4,141) 1,834

Segments

assets &

liabilities

Segment assets 63,415 633 (6,201) 57,847

Segment

liabilities (47,826) 1,549 (1,281) 48,094

---------------- ------------ --------------- --------- ---------- -------- ------------------------- -----------

Net asset/

(liabilities) 15,589 (916) (4,920) 9,753

---------------- ------------ --------------- --------- ---------- -------- ------------------------- -----------

Additions

to non-current

assets 1,746 3 - 1,749

All turnover arose within the United Kingdom.

4. Finance Income and Finance Costs

Finance income: 2022 2021

GBP'000 GBP'000

Unaudited

Bank and other interest receivables 17 14

Preference share dividends 187 -

Discount on purchase of preference shares 429 -

633 14

========== ========

Finance costs: 2022 2021

GBP000 GBP000

Unaudited

On bank loans and overdrafts - 3

On corporate bond 237 485

Other interest payable 70 27

Lease interest payable 44 69

351 584

========== =======

5. Earnings / (loss) per Ordinary Share

Basic

Basic earnings per share is calculated by dividing the profit

attributable to owners of the Company by the weighted average

number of ordinary shares during the year, after excluding 79,924

(2021: 250,880) shares held by Clarke Willmott Trust Corporation

Limited in trust for the Good Energy Group Employee Benefit

Trust.

2022 2021

Unaudited

Profit/ (Loss) attributable to owners of the Company

(GBP'000) 9,816 (3,389)

Basic weighted average number of ordinary shares

(000's) 16,440 16,399

---------- --------

Basic earnings per share 59.7p (20.7p)

Continuing operations 2022 2021

Unaudited

Profit attributable to owners of the Company (GBP'000) 8,366 2,157

Basic weighted average number of ordinary shares

(000's) 16,440 16,399

---------- -------

Basic earnings per share 50.9p 13.2p

Diluted

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares to assume conversion of

all potentially dilutive ordinary shares. Potentially dilutive

ordinary shares arise from awards made under the Group's

share-based incentive plans.

Where the vesting of these awards is contingent on satisfying a

service or performance condition, the number of potentially

dilutive ordinary shares is calculated based on the status of the

condition at the end of the period.

Potentially dilutive ordinary shares are dilutive only when the

average market price of the Company's ordinary shares during the

period exceeds their exercise price (options) or issue price (other

awards). The greater any such excess, the greater the dilutive

effect.

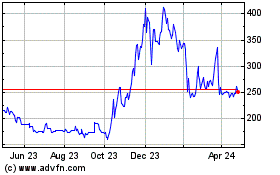

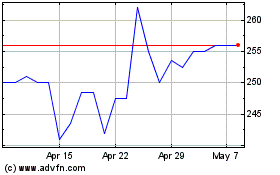

The average market price of the Company's ordinary shares during

the year was 242p (2021: 269p).

5. Earnings per Ordinary Share (continued)

The dilutive effect of share-based incentives was 10,497 shares

(2021: 145,752 shares). The dilutive effect of share-based

incentives for continuing operations was 10,497 shares (2021:

145,752 shares).

2022 2021

Unaudited

Profit/ (Loss) attributable to owners of the Company

(GBP'000) 9,816 (3,389)

Basic weighted average number of ordinary shares

(000's) 16,451 16,544

---------- --------

Diluted earnings per share 59.7p (20.7p)

Diluted (continuing operations) 2022 2021

Unaudited

Profit attributable to owners of the Company (GBP'000) 8,366 2,157

Weighted average number of diluted ordinary shares

(000's) 16,451 16,544

---------- -------

Diluted earnings per share 50.9p 13.0p

6. Borrowings

2022 2021

GBP'000 GBP'000

Current Unaudited

Bank and other borrowings - 1,007

Bond 10 557

Lease liabilities 284 555

---------- --------

Total 294 2,119

---------- --------

2022 2021

GBP'000 GBP'000

Unaudited

Non-current

Bond 4,921 4,749

Lease liabilities 6 317

---------- --------

Total 4,927 5,066

---------- --------

The current portion of the bond repayment represents the

interest accrued and the amount of principal repayments requested

prior to the end of the year. The latest redemption request

deadline was in December 2022, for repayment of the remaining bond

in June 2023.