Global Ports Holding PLC (GPH)

Trading Statement for the three months to 31 March 2021

09-Jun-2021 / 07:03 GMT/BST

Dissemination of a Regulatory Announcement that contains inside information according to REGULATION (EU) No 596/2014

(MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

=----------------------------------------------------------------------------------------------------------------------

Global Ports Holding Plc

Trading Statement for the three months to 31 March 2021

Global Ports Holding Plc ("GPH Plc" or "Group"), the world's largest independent cruise port operator, today issues a

trading update for the period from 1 January to 31 March 2021.

GPH Plc has changed its financial year-end to 31 March. The next audited financial statement will cover the 15-month

period from 1 January 2020 to 31 March 2021 and will be released in July 2021. All figures included in this trading

update for the calendar quarter Q1-2021 only are unaudited management accounts.

3 months 3 months

Key Financials & KPI Highlights3 31 March 2021

31 March 2020

Like-for-like1

Passengers (m PAX) 2 0.01 1.3

General & Bulk Cargo ('000 tons) 12.7 18.6

Container Throughput ('000 TEU) 12.2 11.8

Total Revenue (USDm) 13.9 12.7

Cruise Revenue (USDm) 4 12.0 11.0

Ex-IFRIC 12 Cruise Revenue (USDm) 5 2.0 11.0

Commercial Revenue (USDm) 6 1.9 1.7

Segmental EBITDA (USDm) 7 (1.0) 6.0

Cruise EBITDA (USDm) 8 (1.6) 5.7

Commercial EBITDA (USDm) 6 0.6 0.3

Adjusted EBITDA (USDm) 9 (2.6) 4.0

31.03.2021 31.12.20201

Gross Debt (IFRS) 552.5 556.0

Gross Debt ex IFRS 16 Finance Lease 486.7 487.4

Net Debt 381.9 456.5

Net Debt ex IFRS 16 Finance Lease 316.0 387.9

Cash and Cash Equivalents 170.7 99.5

Notes 1. Presented excluding Port Akdeniz to ensure

comparability to Q1-2021 data. 2. Passenger numbers refer to

consolidated and managed portfolio consolidation perimeter, hence

it excludes equity

accounted associate ports La Goulette, Lisbon, Singapore and

Venice. 3. All USD refers to United States Dollar unless otherwise

stated. Where applicable, non-USD figures are converted using

the average exchange rate of the period 1 January to 31 March

2021. 4. Revenue allocated to the Cruise segment is the sum of

revenues of consolidated ports and from management contracts. 5.

Revenue Ex IFRIC 12 refers to the exclusion of the impact of IFRIC

12 construction revenue accounting at Nassau

Cruise Port. 6. Commercial Revenue and EBITDA reflects the

contribution of Port of Adria, excluding Port Akdeniz, which was

sold

during the period. 7. Segmental EBITDA is calculated as

income/(loss) before tax after adding back: interest; depreciation;

amortisation;

unallocated expenses; and specific adjusting items, including

Nassau IFRIC-12 construction margin. 8. EBITDA allocated to the

Cruise segment is the sum of EBITDA of consolidated cruise ports

and pro-rata Net Profit of

equity accounted associate ports La Goulette, Lisbon, Singapore

and Venice, and the contribution from management

agreements. 9. Adjusted EBITDA calculated as Segmental EBITDA

less unallocated (holding company) expenses.

Key Financials and KPIs ? Cruise passenger volumes for the 3M

period fell by -99% YoY, driven by the shutdown of the cruise

industry as a

result of the Covid-19 pandemic. However, cruise activities have

now restarted in some of our Mediterranean ports

and Singapore. ? Total container volumes (TEUs) grew by 3.2%,

and General & Bulk volumes fell 31.8% in certain low margin

cargo

items. ? Total consolidated revenues were USD13.9m for the 3M

period; excluding the impact of IFRIC-12 Construction revenues

at Nassau Cruise Port, total consolidated revenues were USD3.9m.

? Segmental EBITDA for the three months to end March 2021 was a

loss of USD1.0m.

? Adjusted EBITDA was a loss of USD2.6m.

Cruise

3 months 3 months

Passengers ('000 PAX)

31 March 2021 31 March 2020

Creuers (Barcelona/Malaga) 0 119

Valletta 8 40

Ege Port 0 2

Nassau 0 834

Antigua 0 256

Other Cruise Ports 2 2

Total Cruise Ports 10 1,253 ? Total cruise revenue of USD12.0m for the three months to end March 2021.

? Excluding the impact of IFRIC-12 Construction revenues at

Nassau Cruise Port, Cruise revenue was USD2.0m. ? Passenger volumes

fell 99% to 10k, compared to 1.3m in the three months to end March

2020. ? Cruise EBITDA was a loss of USD1.6m. ? The limited return

to cruise activity drove the declines in passenger volumes, revenue

and EBITDA.

Commercial

3 months 3 months

Volumes

31 March 2021 31 March 2020

Port Adria

General & Bulk Cargo ('000) 12.7 18.6

Throughput ('000 TEU) 12.2 11.8

? Total commercial revenues rose by 13% to USD1.9m for the period vs USD1.7m for the three months to end March 2020. ? Commercial EBITDA was USD0.6m. ? The most significant development in the period was the completion of the sale of the Group's largest commercial

port, Port Akdeniz, for an enterprise value of USD140m to

QTerminals W.L.L. The equity value of Port Akdeniz after

deducting net debt and debt-like items of Port Akdeniz at

closing was USD115m, with the buyer withholding USD11.5m,

which will be released in Q4-2021. The Group has paid

transaction-related expenses and costs from the net proceeds

at closing, including costs related to the satisfaction of

condition precedents to closing.

? The Key Financials & KPI Highlights included in this

trading update exclude the contribution from Port Akdeniz.

Other developments

During the period, GPH's wholly-owned subsidiary, Port Finance

Investment Limited, launched a Scheme of Arrangement in connection

with the refinancing of the USD250,000,000 8.125% Senior Unsecured

Notes due 2021 issued by Global Liman Isletmeleri A.S. Shortly

after the period end, after a period of extensive engagement with

noteholders, including certain key noteholders who formed an ad-hoc

group, GPH withdrew from the Scheme process on 6 April 2021.

On 7 April 2021, Global Liman Isletmeleri A.S. launched a tender

offer, which resulted in USD44.7m excluding accrued interest, being

spent on purchasing its own Eurobonds at an average price of

USD899.4 for each USD1,000 of principal, thereby reducing the

outstanding nominal Eurobond of Global Liman Isletmeleri A.S. to

USD200.3m.

On 17 May 2021 and 24 May 2021, GPH announced that it had

entered a five-year senior secured loan agreement for up to USD261

million with the leading global investment firm, Sixth Street.

The loan agreement remains conditional on a number of factors,

which are expected to be satisfied shortly. As part of the

financing arrangements, the Company intends to issue warrants over

its shares to the lender, which will become exercisable subject to

certain events. GPH is holding a general meeting today, 9 June

2021, related to the issuing of the warrants. More details can be

found at the investor relations section of the company website

www.globalportsholding.com.

The net proceeds from the loan will be used, inter alia, to

refinance the outstanding Eurobond of Global Liman Isletmeleri A.S.

The loan agreement also provides for potential additional growth

funding to provide flexible financing solutions for GPH's strategic

objective of growing the number of cruise ports in its network.

Balance Sheet

At 31 March 2021 IFRS gross debt was USD552.5m (Ex IFRS16 Gross

Debt: USD486.7m), compared to gross debt at 31 December 2021 of

USD556.0m (Ex IFRS16 Gross Debt: USD487.4m) and net debt was

USD381.9m (Ex IFRS16 Net Debt: USD316.0m) compared to net debt at

31 December 2020 of USD456.5m (Ex IFRS16: USD387.9m). At the end of

March 2020, GPH had cash and cash equivalents of USD170.7m,

compared to USD99.5m at 31 December 2020.

Outlook

Global Ports Holding will provide a detailed update on current

trading and outlook when it reports audited financial results for

the 15 months to end March 2021 in July 2021.

CONTACT

For investor, analyst and financial media enquiries: For trade media enquiries:

Global Ports Holding, Investor Relations Global Ports Holding

Martin Brown, Investor Relations Director Ceylan Erzi

Telephone: +44 (0) 7947 163 687 Telephone: +90 212 244 44 40

Email: martinb@globalportsholding.com Email: ceylane@globalportsholding.com -----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BD2ZT390

Category Code: MSCH

TIDM: GPH

LEI Code: 213800BMNG6351VR5X06

Sequence No.: 110087

EQS News ID: 1205764

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1205764&application_name=news

(END) Dow Jones Newswires

June 09, 2021 02:03 ET (06:03 GMT)

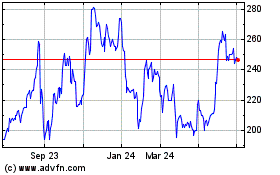

Global Ports (LSE:GPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

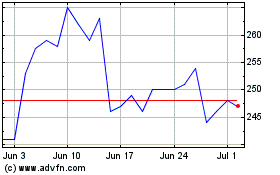

Global Ports (LSE:GPH)

Historical Stock Chart

From Apr 2023 to Apr 2024